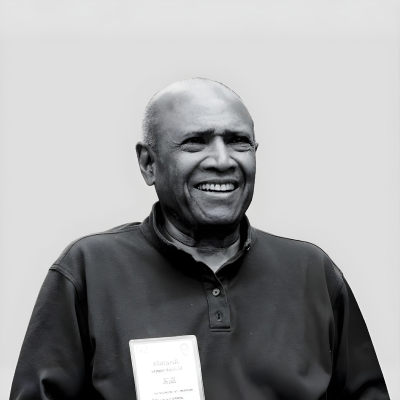

Ananda Krishnan Biography, Career, Net Worth, and Key Insight

Ananda Krishnan’s Profile Summary

|

Company

|

Astro |

|---|---|

|

Position

|

Founder and Chairman of Usaha Tegas , leading force behind Astro Malaysia Holdings, founder of Yu Cai Foundation |

|

Source of wealth

|

Telecommunications via Maxis Communications Media and broadcasting through Astro Malaysia Oil and gas services with Bumi Armada |

|

Also known as

|

Philanthropist Media and telecom magnate |

|

Years of life

|

01.04.1938 - 28.11.2024 |

|

Education

|

University of Melbourne – Bachelor's degree in Political Science Harvard Business School – Master of Business Administration (MBA) |

|

Citizenship

|

Malaysian |

|

Residence

|

Kuala Lumpur, Malaysia |

|

Family

|

Spouse: Sreelekha Mitra (Shrilekha) Children: Three children |

|

Website, Social Media

|

https://corporate.astro.com.my/ |

Ananda Krishnan’s biography

Ananda Krishnan, born on April 1, 1938, in Brickfields, Kuala Lumpur, is a Malaysian billionaire and business magnate. Coming from a Tamil Malaysian family, Krishnan earned a Bachelor’s degree in Political Science from the University of Melbourne and later obtained an MBA from Harvard Business School in 1964. He began his career in the oil trading business, establishing MAI Holdings and eventually transitioning into media, telecommunications, and satellite services.In the 1990s, Krishnan made a significant impact by founding Maxis Communications, Malaysia's largest telecommunications company, and Astro Malaysia, which dominates satellite television in the region. His business empire further expanded to include ventures in oil and gas (via Bumi Armada) and property development (Maxis Tower). Krishnan is known for his quiet and private lifestyle, maintaining a low profile despite his substantial influence across multiple industries

-

How did Ananda Krishnan make money?

Ananda Krishnan makes money in the following areas:

Telecommunications via Maxis Communications Media and broadcasting through Astro Malaysia Oil and gas services with Bumi Armada

-

What is Ananda Krishnan net worth?

As of 2025, Ananda Krishnan’s net worth is estimated to be $5.7B.

What is Ananda Krishnan also known as?

Krishnan is recognized for his significant contributions to education and philanthropy. Through the Usaha Tegas Foundation, he has launched multiple initiatives, including the Harapan Nusantara and Yu Cai Education Foundations, which provide scholarships and grants for educational institutions. He also sponsored orphaned and underprivileged girls through the Montfort Girls Centre and has supported various charitable and educational programsProminent achievements of Ananda Krishnan

Founder of Maxis Communications and Astro Malaysia, leading telecommunications and media companies in Malaysia.Named one of Forbes' 48 Heroes of Philanthropy in 2010.

Played a major role in organizing the Live Aid concert alongside Bob Geldof in the mid-1980s

What are Ananda Krishnan’s key insights?

Krishnan’s business philosophy focuses on diversification and strategic investment in industries with high growth potential, including telecommunications, media, and energy. His approach has been characterized by long-term sustainability and regional influence, with a focus on expanding services across Asia

Ananda Krishnan’s personal life

Spouse: Sreelekha Mitra (Shrilekha)

Children: Three children, including son Ven Ajahn Siripanyo (a Theravada Buddhist monk)

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

733,000 license cards delayed, South Africa plans fresh tender

South Africa invests $27M in AI, blockchain research infrastructure