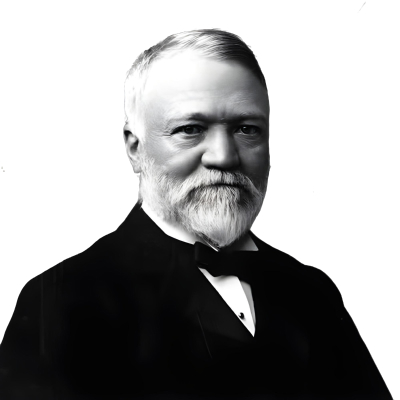

Andrew Carnegie Biography, Career, Net Worth, and Key Insight

Andrew Carnegie’s Profile Summary

|

Company

|

Carnegie Steel |

|---|---|

|

Position

|

Andrew Carnegie was the founder and chairman of Carnegie Steel Company. Under his leadership, the company became the largest and most profitable steel company in the United States during the late 19th century. |

|

Source of wealth

|

Founding and leadership of Carnegie Steel Company, Investments in various industries, Philanthropic endeavors that generated public goodwill. |

|

Also known as

|

Philanthropist. Author of "The Gospel of Wealth". Advocate for peace and education |

|

Years of life

|

25.11.1835 - 01.01.1970 |

|

Education

|

Local schools in Pittsburgh - Attended for a few years, no formal degree. |

|

Citizenship

|

United States |

|

Residence

|

New York City, USA |

|

Family

|

Wife: Louise Whitfield Carnegie. Children: Margaret Carnegie (daughter), Helen Carnegie (daughter) |

|

Website, Social Media

|

https://www.ussteel.com/ |

Andrew Carnegie’s biography

Andrew Carnegie (1835-1919) was a Scottish-American industrialist and philanthropist who played a pivotal role in the expansion of the American steel industry. Born in Dunfermline, Scotland, he emigrated to the United States with his family in 1848, settling in Pittsburgh, Pennsylvania. Carnegie started his career as a bobbin boy in a cotton factory, but he quickly ascended the ranks, working in various jobs including as a telegraph operator and a railroad assistant. By the 1870s, he had founded Carnegie Steel Company, which revolutionized steel production through the introduction of the Bessemer process, making steel manufacturing more efficient and cost-effective. Carnegie's company dominated the U.S. steel market, leading to significant economic growth in the region. In 1901, he sold Carnegie Steel to J.P. Morgan for $480 million, a record sum at the time, making him one of the richest men in the world. Despite his immense wealth, Carnegie is perhaps best known for his philanthropic efforts, establishing institutions such as Carnegie Mellon University and donating over $350 million to libraries, educational institutions, and peace initiatives. His life exemplifies the American Dream, transitioning from humble beginnings to becoming a titan of industry and a generous benefactor.-

How did Andrew Carnegie make money?

Andrew Carnegie makes money in the following areas:

Founding and leadership of Carnegie Steel Company, Investments in various industries, Philanthropic endeavors that generated public goodwill.

-

What is Andrew Carnegie net worth?

As of 2025, Andrew Carnegie’s net worth is estimated to be $310B (inflation-adjusted to 2025).

What is Andrew Carnegie also known as?

Andrew Carnegie is widely recognized as a philanthropist, having donated significant portions of his fortune to various causes. He believed in the "Gospel of Wealth," which posited that the wealthy had a moral obligation to distribute their surplus wealth for the benefit of society. He authored a book of the same name, advocating for philanthropy and the establishment of libraries, schools, and cultural institutions. Additionally, Carnegie was a strong advocate for peace, supporting international arbitration and the establishment of the Carnegie Endowment for International Peace. His contributions to education included founding Carnegie Mellon University and establishing over 2,500 public libraries across the United States and around the world.Prominent achievements of Andrew Carnegie

Founded Carnegie Steel Company, which became the largest steel producer in the U.S. Authored "The Gospel of Wealth," influencing philanthropic practices. Established over 2,500 public libraries and various educational institutions, including Carnegie Mellon University. Inducted into the American Academy of Arts and Letters.Contributed over $350 million to charitable causes during his lifetime. Received honorary degrees from multiple universities for his contributions to education and philanthropy.What are Andrew Carnegie’s key insights?

Andrew Carnegie's business philosophy emphasized the importance of efficiency and innovation. He was a proponent of the "Gospel of Wealth," advocating for the wealthy to use their riches for the greater good of society. He believed in continuous improvement and often implemented new technologies in his steel mills to enhance productivity. Carnegie also valued hard work, dedication, and education, insisting that these principles were essential for both personal success and societal progress.

Andrew Carnegie’s personal life

Andrew Carnegie married Louise Whitfield in 1887, and together they had one daughter, Margaret, born in 1897. They also had another daughter, Helen, who was born in 1900. The Carnegies were known for their close-knit family life. After Carnegie's retirement from business, he devoted significant time to his family, and he often involved them in his philanthropic pursuits. Louise was also a philanthropist, actively participating in various charitable endeavors alongside her husband.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

South Africa invests R710 million to expand free Internet access

WTI crude oil price slips near $66 as trendline rejection and tariff risk dampen outlook