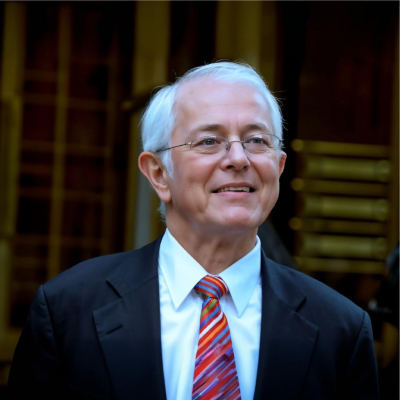

Bruce Bent Biography, Career, Net Worth, and Key Insight

Bruce Bent’s Profile Summary

|

Company

|

The Reserve |

|---|---|

|

Position

|

Was the co-founder and CEO of The Reserve, the company that created the world's first money market fund in 1970, known as the Reserve Fund. |

|

Source of wealth

|

Co-inventor of the money market mutual fund, fees from managing The Reserve Fund, and investment in financial products. |

|

Also known as

|

Political candidate, philanthropist, guest lecturer. |

|

Age

|

88 |

|

Education

|

St. John’s University - Bachelor's degree in Economics (1961). |

|

Citizenship

|

United States |

|

Residence

|

Great Neck, New York, USA |

|

Family

|

Bruce Bent's immediate family includes his wife, Nancy, and two sons. |

|

Website, Social Media

|

https://www.federalreserve.gov/ |

Bruce Bent’s biography

Bruce R. Bent is an American financial pioneer best known for co-creating the world’s first money market mutual fund, the Reserve Fund, in 1970 alongside his business partner, Henry B. R. Brown. Born in 1937, Bent grew up in Great Neck, New York, and later graduated with a degree in economics from St. John’s University in 1961. His early career included positions at LF Rothschild and TIAA-CREF before he ventured into entrepreneurship by co-founding Brown & Bent in 1968. The Reserve Fund revolutionized short-term investing by offering safety and liquidity with a return slightly above traditional savings accounts. The fund was highly successful, growing to manage over $60 billion at its peak. Despite these successes, the Reserve Fund faced challenges during the 2008 financial crisis when it "broke the buck" following Lehman Brothers' collapse. Bent continued to be recognized for his contributions to financial innovation, despite the eventual closure of the Reserve Fund in 2015. Bent also has a strong connection to education, serving as a Trustee Emeritus of St. John’s University and a member of its Founders Society.-

How did Bruce Bent make money?

Bruce Bent makes money in the following areas:

Co-inventor of the money market mutual fund, fees from managing The Reserve Fund, and investment in financial products.

-

What is Bruce Bent net worth?

As of 2025, there is no publicly available and reliable information regarding Bruce Bent’s net worth.

What is Bruce Bent also known as?

Bruce Bent is also known for his involvement in politics and philanthropy. In 2001, he ran for Nassau County Executive as the Republican candidate, focusing on improving the county’s finances. He has been a major donor to educational institutions and served as a Trustee Emeritus at St. John’s University, where he endowed Bent Hall. Furthermore, Bent is a guest lecturer, sharing his insights on finance at prestigious institutions such as NYU, The Wharton School, and Harvard University.Prominent achievements of Bruce Bent

Bruce Bent co-invented the first money market mutual fund, which grew to manage over $60 billion at its peak. He was recognized by the American Museum of Financial History for his contribution to financial innovation, served as a Trustee Emeritus at St. John’s University, and was a guest lecturer at prestigious institutions. His Reserve Fund was one of the 10 largest cash management complexes in the world, and he held over 60 financial patents during his careerWhat are Bruce Bent’s key insights?

Bruce Bent’s business philosophy centers around innovation, risk management, and providing investors with security. He is credited with revolutionizing short-term investing by creating a product that provided safety and liquidity. His approach to business is characterized by the belief that every financial product should offer value without exposing investors to unnecessary risk, a principle that shaped the money market fund industry. Bent also emphasizes integrity and transparency in managing client assets, focusing on ensuring investors get their full investment value with minimal market risk.

Bruce Bent’s personal life

Bruce Bent is married to Nancy Bent, and they have two sons, Bruce Bent II and another son whose name is less commonly referenced in public sources. Bruce Bent II has followed in his father's footsteps in the financial world, playing a significant role in the management of the Bent family businesses, particularly in the financial services and innovation space

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

Nvidia stock jumps 4% after China sales reboot approved

Tesla stock falls 1.9% as sales slide and exec exits deepen uncertainty