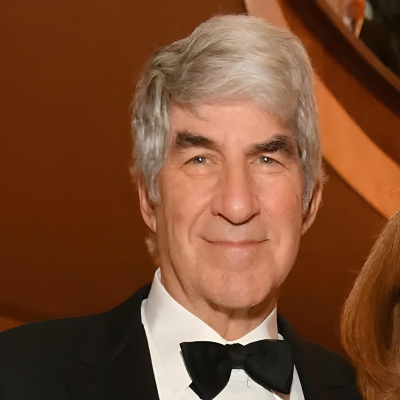

Bruce Kovner Net Worth, Biography and Key Insights

Bruce Kovner’s Profile Summary

|

Company

|

Caxton Associates |

|---|---|

|

Position

|

Bruce Kovner is the founder and former chairman of Caxton Associates, a global macro hedge fund. He served as the chief investment officer of the firm until 2011. |

|

Source of wealth

|

Management and performance fees from Caxton Associates, personal trading profits, investments in various asset classes. |

|

Also known as

|

Philanthropist. Art collector. Former amateur violinist |

|

Age

|

79 |

|

Education

|

Harvard University - Bachelor of Arts in Government |

|

Citizenship

|

United States |

|

Residence

|

New York City, United States |

|

Family

|

Bruce Kovner is married and has children, though specific details about his family members are generally kept private. |

|

Website, Social Media

|

https://www.caxton.com/ |

Bruce Kovner’s biography

Bruce Kovner was born on December 25, 1945, in New York City. He graduated from Harvard University in 1967 with a degree in government. Before entering the financial sector, Kovner initially pursued a career in academia, earning a scholarship to attend the Harvard Graduate School of Arts and Sciences. However, he shifted his focus to trading in the late 1970s, eventually founding Caxton Associates in 1983. Under his leadership, the firm gained a reputation for its global macro trading strategies, achieving impressive returns and attracting a substantial client base. Kovner is known not only for his financial acumen but also for his philanthropic efforts, particularly in education and the arts. He has supported various institutions, including the Metropolitan Opera and the American Academy in Rome. Kovner's legacy in the finance world is marked by his innovative approach to investment and his commitment to social causes.-

How did Bruce Kovner make money?

Bruce Kovner made his fortune as a global macro trader and the founder of the hedge fund Caxton Associates, which he launched in 1983. He began trading in the late 1970s, making a profit of $22,000 on his first trade in soybean futures using just $3,000 in borrowed money. This early success led him to develop a deep interest in financial markets. At Caxton, Kovner focused on large-scale bets in currencies, commodities, and interest rates, capitalizing on macroeconomic trends and central bank policies. Under his leadership, the fund delivered consistently high returns for nearly two decades, managing over $14 billion at its peak.

Kovner was known for his disciplined risk management and strategic thinking, earning him a reputation as one of the most successful hedge fund managers of his time. After retiring from trading in 2011, he turned to philanthropy, supporting education, the arts, and conservative political causes. His wealth, built on decades of disciplined global speculation, has made him a prominent figure not only in finance but also in cultural and academic circles. -

What is Bruce Kovner net worth?

As of 2025, Bruce Kovner’s net worth is estimated to be $8.6 B.

What is Bruce Kovner also known as?

Bruce Kovner is recognized for his philanthropic contributions, particularly in the fields of education and the arts. He has made significant donations to institutions like the Metropolitan Opera, where he has been a major supporter. Additionally, Kovner is known for his extensive art collection, which includes works by prominent artists. His passion for music also extends to his background as a former amateur violinist, highlighting his diverse interests beyond finance.Prominent achievements of Bruce Kovner

Founded Caxton Associates, which became one of the world's leading hedge funds.Significant philanthropic contributions, particularly to education and the arts. Recognized for his contributions to the financial industry and for his commitment to charitable causes.

What are Bruce Kovner’s key insights?

Bruce Kovner's business philosophy centers on rigorous research, disciplined risk management, and the importance of adapting to changing market conditions. He emphasizes the value of lifelong learning and believes in making decisions based on a deep understanding of macroeconomic factors. Kovner also advocates for a thoughtful and patient approach to investing, often highlighting the importance of emotional discipline in trading.

Bruce Kovner’s personal life

Bruce Kovner is married to his wife, who is involved in philanthropy and the arts. Together, they have several children, though their names and details about them are not widely publicized. The Kovner family is known for its commitment to various charitable endeavors, particularly in education and the arts.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

South Africa unveils digital visas to attract film and events

South Africa invests R710 million to expand free Internet access