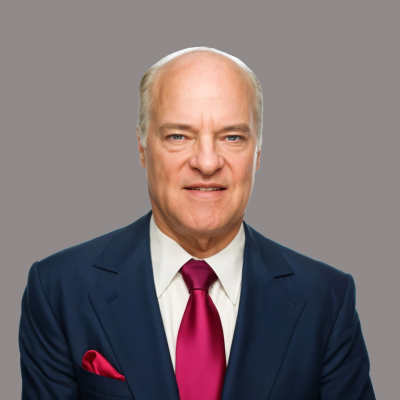

Henry Kravis Net Worth, Biography and Key Insights

Henry Kravis’s Profile Summary

|

Company

|

KKR & Co. |

|---|---|

|

Position

|

Co-Founder and Co-Executive Chairman of KKR & Co. |

|

Source of wealth

|

Management and performance fees from KKR's investment strategies, personal investments, dividends from KKR’s holdings, capital gains from leveraged buyouts. |

|

Also known as

|

Philanthropist, Art Collector. |

|

Age

|

81 |

|

Education

|

Claremont McKenna College - Bachelor's in Economics, Columbia Business School - MBA |

|

Citizenship

|

United States |

|

Residence

|

New York City, United States |

|

Family

|

Henry Kravis is married to Marie-Josée Kravis, and they have three children. |

|

Website, Social Media

|

https://www.kkr.com/ |

Henry Kravis’s biography

Henry Kravis, born on January 6, 1944, in Tulsa, Oklahoma, is a prominent American financier and co-founder of Kohlberg Kravis Roberts & Co. (KKR), one of the most influential private equity firms in the world. After earning a degree in economics from Claremont McKenna College and an MBA from Columbia Business School, Kravis began his career at Bear Stearns, where he worked with Jerome Kohlberg and his cousin, George Roberts. In 1976, the three of them founded KKR, pioneering the use of leveraged buyouts (LBOs) to acquire companies using a combination of debt and equity. One of the most famous LBOs was the acquisition of RJR Nabisco in 1988 for $31.4 billion, a transaction that became legendary in financial circles and was chronicled in the book Barbarians at the Gate. Kravis's influence extends beyond finance into philanthropy, where he has made significant donations to educational and medical institutions. He is also known as an art collector and serves on several cultural boards, including the Metropolitan Museum of Art. Kravis's legacy in finance, philanthropy, and the arts has made him a highly influential figure in multiple spheres.-

How did Henry Kravis make money?

Henry Kravis, one of the pioneers of private equity, co-founded Kohlberg Kravis Roberts & Co. (now KKR), a firm that changed the way businesses were done in the leveraged buyout (LBO). His entrepreneurial journey began in 1976, when he left investment bank Bear Stearns with George Roberts and Jere Kohlberg to form his own firm.

KKR quickly gained a reputation for identifying profitable investment opportunities. In its early years, KKR successfully executed industrial buyouts and restructurings. One of its first major deals was the purchase of Houdaille Industries in 1979, which generated significant profits. The breakthrough was the legendary $25 billion acquisition of RJR Nabisco in 1988, the largest LBO to date, which cemented KKR’s status as a leader in private equity.

Today, Henry Kravis's capitalization is based on income from managing KKR's assets, which exceed $500 billion. The company earns billions of dollars annually in management fees and investment income. KKR is also actively developing alternative investment areas, including real estate, infrastructure, and credit products. Henry Kravis's fortune is estimated at more than $12 billion, a significant portion of which is associated with his stake in KKR. Kravis' business remains one of the most influential in the global private equity industry. -

What is Henry Kravis net worth?

As of 2025, Henry Kravis’s net worth is estimated to be $14.0 B.

What is Henry Kravis also known as?

Beyond his career in finance, Henry Kravis is widely known for his philanthropic efforts, particularly in education and medical research. He has donated significant sums to institutions such as Columbia University, Mount Sinai Hospital, and other causes, often focusing on advancing medical research and education. Additionally, Kravis is an avid art collector and supporter of the arts, serving on various cultural boards, including the Metropolitan Museum of Art. His contributions to these fields have cemented his reputation as a leading figure in philanthropy and the arts.Prominent achievements of Henry Kravis

Henry Kravis is recognized for revolutionizing the private equity industry through KKR’s leveraged buyout strategies, notably the RJR Nabisco acquisition. He has been listed among Forbes’ wealthiest individuals multiple times and has received various honors for his philanthropy, including significant recognition from institutions like Columbia University. He also serves on boards of several prestigious cultural institutions, including the Metropolitan Museum of Art, reflecting his influence in both business and the arts.What are Henry Kravis’s key insights?

Henry Kravis emphasizes the importance of partnership and shared ownership in business, advocating for a collaborative approach with management teams of acquired companies. He believes in the power of leverage when properly managed and focuses on long-term value creation over short-term gains. Kravis also champions philanthropy, viewing wealth as a tool for broader societal impact, particularly in education and healthcare.

Henry Kravis’s personal life

Henry Kravis's current wife, Marie-Josée Kravis, is a prominent economist and philanthropist. Together, they are active in charitable endeavors and serve on various boards. Kravis has three children, though much of his family life remains private. His first marriage was to Helene Diane "Hedi" Shulman, with whom he had his children before their divorce.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

South Africa unveils digital visas to attract film and events

South Africa invests R710 million to expand free Internet access