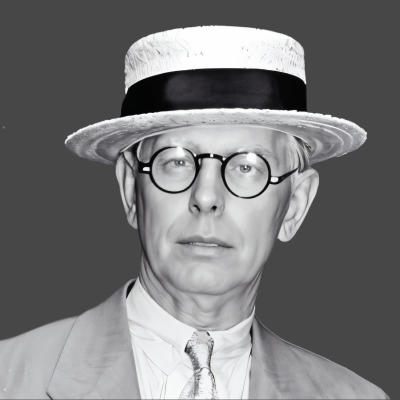

Jesse Livermore Biography, Career, Net Worth, and Key Insight

Jesse Livermore’s Profile Summary

|

Company

|

Self-employed |

|---|---|

|

Position

|

Jesse Livermore was a self-employed stock trader and speculator. He was known for his independent trading strategies |

|

Source of wealth

|

Trading profits from stock market speculation, short-selling during market crashes, authoring financial strategies. |

|

Also known as

|

Author, Market analyst, Trading mentor. |

|

Years of life

|

26.07.1877 - 20.11.1940 |

|

Education

|

No formal higher education; Jesse Livermore learned trading and financial markets through practical experience as a stock quotation board boy and self-study. |

|

Citizenship

|

United States |

|

Residence

|

New York City, United States |

|

Family

|

Jesse Livermore's family included his three wives (not simultaneously), two sons, and one daughter. |

|

Website, Social Media

|

https://jesse-livermore.com/ |

Jesse Livermore’s biography

Jesse Livermore was born on July 26, 1877, in Shrewsbury, Massachusetts, and became one of the most famous stock market traders of the early 20th century. He started trading in stocks at a young age, working initially as a quotation board boy in stockbrokerage offices. Over time, he became known for his ability to predict market trends and made his fortune by short-selling during market crashes, including the Panic of 1907 and the 1929 stock market crash. Livermore's life was marked by both extraordinary gains and devastating losses, which earned him a reputation as a "Boy Plunger" or "Great Bear of Wall Street." Despite his financial brilliance, his personal life was tumultuous, and his career experienced several bankruptcies. Livermore authored a book titled "How to Trade in Stocks," which shared his trading insights. He passed away in 1940, leaving behind a complex legacy as one of Wall Street's most enigmatic figures.-

How did Jesse Livermore make money?

Jesse Livermore makes money in the following areas:

Trading profits from stock market speculation, short-selling during market crashes, authoring financial strategies.

-

What is Jesse Livermore net worth?

As of 2025, there is no publicly available and reliable information regarding Jesse Livermore’s net worth.

What is Jesse Livermore also known as?

Jesse Livermore was also known as an author, having written the book "How to Trade in Stocks" in 1940, which offered insights into his trading strategies and market philosophy. He was a market analyst, recognized for his ability to predict major market movements, including the crashes of 1907 and 1929, which solidified his reputation as a significant figure in stock market history. Additionally, he became a trading mentor, as many modern-day traders and investors study his principles and strategies, especially his risk management techniques, despite his personal financial downfalls.Prominent achievements of Jesse Livermore

Jesse Livermore is most famous for his remarkable profits made during the Panic of 1907 and the 1929 stock market crash, where he reportedly made over $100 million. His book "How to Trade in Stocks" became a classic in the trading community. Though his financial life ended in tragedy, his achievements in trading set a foundation for modern market analysis and risk management strategies.What are Jesse Livermore’s key insights?

Jesse Livermore believed in the importance of market timing and psychological discipline in trading. His famous principles included cutting losses early, letting profits run, and the necessity of patience and waiting for the right market conditions before making trades. He emphasized learning from failures and consistently stressed the importance of managing risk above all else.

Jesse Livermore’s personal life

Jesse Livermore was married three times. His first wife was Nettie Jordan, followed by Dorothy Wendt, with whom he had two sons, Jesse Jr. and Paul. His third wife was Harriet Metz Noble. Livermore’s family life was tumultuous, with significant strains due to his financial ups and downs. His son, Jesse Livermore Jr., also pursued a career in finance but faced similar difficulties as his father.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

South Africa unveils digital visas to attract film and events

South Africa invests R710 million to expand free Internet access