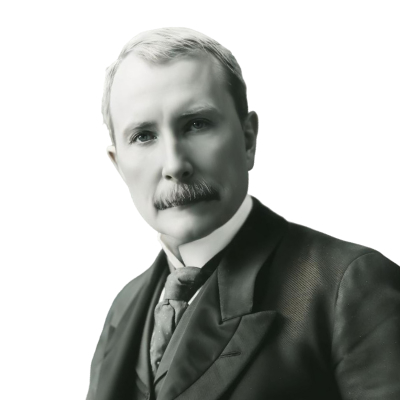

John D. Rockefeller Biography, Career, Net Worth, and Key Insight

John D. Rockefeller’s Profile Summary

|

Company

|

Standard Oil |

|---|---|

|

Position

|

John D. Rockefeller was the co-founder and chairman of Standard Oil. He played a central role in the company's development, leading it to become one of the most powerful and influential corporations in the oil industry. |

|

Source of wealth

|

Oil refining and distribution, investments in railroad and banking industries, dividends from the breakup of Standard Oil into multiple companies. |

|

Also known as

|

Philanthropist, Founder of educational institutions, Health care advocate. |

|

Years of life

|

08.07.1839 - 23.05.1937 |

|

Education

|

Cleveland's Central High School - completed high school. No higher education degree. |

|

Citizenship

|

United States |

|

Residence

|

New York City, USA |

|

Family

|

John D. Rockefeller’s immediate family includes his wife, Laura Spelman Rockefeller, and their five children: John D. Rockefeller Jr., Edith Rockefeller, Alta Rockefeller, Elizabeth Rockefeller, and Alice Rockefeller. |

|

Website, Social Media

|

John D. Rockefeller’s biography

John D. Rockefeller, born on July 8, 1839, in Richford, New York, was an American industrialist and philanthropist, most known for founding Standard Oil in 1870. Rockefeller revolutionized the petroleum industry, employing innovative strategies such as vertical integration and aggressive pricing to dominate the oil market. His company's influence was so vast that it controlled around 90% of the U.S. oil refineries and pipelines by the early 1880s. In 1911, Standard Oil was broken up by the U.S. Supreme Court due to antitrust violations, but Rockefeller's wealth continued to grow from the shares he held in the resulting companies. Besides his oil ventures, Rockefeller was a significant philanthropist, establishing the University of Chicago, Rockefeller University, and the Rockefeller Foundation. He was a devout Baptist and believed in the "Gospel of Wealth," giving away over $500 million during his lifetime to causes related to education, public health, and science. Rockefeller passed away on May 23, 1937, at the age of 97, leaving behind a legacy as one of the wealthiest individuals in modern history.-

How did John D. Rockefeller make money?

John D. Rockefeller makes money in the following areas:

Oil refining and distribution, investments in railroad and banking industries, dividends from the breakup of Standard Oil into multiple companies.

-

What is John D. Rockefeller net worth?

As of 2025, John D. Rockefeller’s net worth is estimated to be $418B.

What is John D. Rockefeller also known as?

John D. Rockefeller was a pioneering philanthropist. He is renowned for his substantial contributions to education and medical research. He founded the University of Chicago and Rockefeller University, as well as the Rockefeller Foundation, which has supported advancements in public health, scientific research, and education worldwide. His philanthropic efforts helped to eradicate diseases like hookworm and yellow fever, and he is regarded as one of the first major global health care advocates in history.Prominent achievements of John D. Rockefeller

Founder of Standard Oil, revolutionized the petroleum industry, became the world’s richest man and the first modern billionaire, founded the University of Chicago and Rockefeller University, established the Rockefeller Foundation, supported medical breakthroughs that eradicated diseases like hookworm and yellow fever, considered the world’s most significant philanthropist of his time.What are John D. Rockefeller’s key insights?

John D. Rockefeller’s business philosophy was rooted in efficiency, innovation, and long-term planning. He believed in minimizing waste and maximizing productivity through vertical integration, controlling all aspects of production and distribution. Rockefeller was known for his focus on cost-cutting and efficiency, aiming to provide the best product at the lowest price. He also advocated for reinvesting profits to grow his business, and he emphasized strong ethics in business, although his competitive tactics were often considered ruthless. Rockefeller was deeply religious, and his charitable activities reflected his belief in using wealth for the greater good.

John D. Rockefeller’s personal life

John D. Rockefeller married Laura Spelman in 1864, and they had five children. His eldest son, John D. Rockefeller Jr., carried on the family’s philanthropic legacy and played a key role in the expansion of Rockefeller-related charities and foundations. Edith Rockefeller married Harold Fowler McCormick, a prominent industrialist. Alta Rockefeller married E. Parmalee Prentice, and Elizabeth Rockefeller married Charles Augustus Strong, a philosopher. His daughter Alice died in infancy.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

South Africa unveils digital visas to attract film and events

South Africa invests R710 million to expand free Internet access