Louis Bacon Biography, Career, Net Worth, and Key Insight

Louis Bacon’s Profile Summary

|

Company

|

Moore Capital Management |

|---|---|

|

Position

|

Founder, Chief Executive Officer (CEO), Principal Investment Manager, and Chairman of Moore Capital Management, LLC. He founded the hedge fund in 1989 and continues to hold these leadership roles |

|

Source of wealth

|

Bacon's wealth primarily stems from management and performance fees from Moore Capital Management's investment strategies in global macro trading, real estate investments |

|

Also known as

|

Environmental philanthropist, real estate investor. |

|

Age

|

68 |

|

Education

|

Middlebury College – BA in American Literature, Columbia Business School – MBA in Finance |

|

Citizenship

|

United States, Austria |

|

Residence

|

Oyster Bay, New York, USA |

|

Family

|

Louis Bacon has been married twice. He has a total of seven children—four from his first marriage to Cynthia Pigott and three from his second marriage to Gabrielle Sacconaghi. |

|

Website, Social Media

|

https://www.moorecap.com/ |

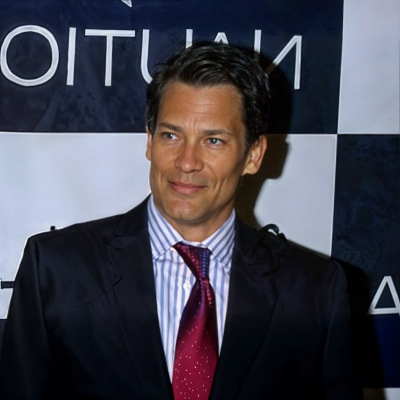

Louis Bacon’s biography

Louis Bacon, born on July 25, 1956, is an American hedge fund manager and philanthropist. He grew up in North Carolina and earned a BA in American Literature from Middlebury College, followed by an MBA in Finance from Columbia Business School. In 1989, he founded Moore Capital Management, a hedge fund that became known for its global macro trading strategies. Prior to this, Bacon had roles at Shearson Lehman Brothers and other financial firms, gaining valuable experience in futures trading. Under his leadership, Moore Capital became one of the most successful hedge funds, managing billions in assets at its peak. Bacon is also a committed philanthropist, particularly in the field of environmental conservation. Through his Moore Charitable Foundation, founded in 1992, he has supported numerous initiatives focused on preserving natural resources and wildlife habitats. Additionally, Bacon is known for his investments in real estate, including large conservation land purchases such as the Trinchera Blanca Ranch in Colorado. His career and contributions to both finance and environmentalism have earned him widespread recognition-

How did Louis Bacon make money?

Louis Bacon makes money in the following areas:

Bacon's wealth primarily stems from management and performance fees from Moore Capital Management's investment strategies in global macro trading, real estate investments

-

What is Louis Bacon net worth?

As of 2025, Louis Bacon’s net worth is estimated to be $1.0 B.

What is Louis Bacon also known as?

Louis Bacon is widely known for his environmental philanthropy. He established the Moore Charitable Foundation in 1992, which focuses on land and water conservation. Bacon has donated large tracts of land, including significant conservation easements in Colorado and Long Island. His commitment to environmental causes has earned him multiple awards, including the Audubon Medal and a Lifetime Conservation Achievement Award. In addition to his philanthropic efforts, Bacon is a notable real estate investor, owning properties such as the Trinchera Blanca Ranch in Colorado and Robins Island in New York, both protected through conservation effortsProminent achievements of Louis Bacon

Bacon has received several notable awards, including induction into Institutional Investors Alpha's Hedge Fund Manager Hall of Fame (2008). He won the Audubon Medal in 2013 and the Theodore Roosevelt Conservation Partnership’s Lifetime Conservation Achievement Award in 2016 for his contributions to environmental protection, particularly through the donation of conservation easementsWhat are Louis Bacon’s key insights?

Louis Bacon’s business philosophy revolves around global macro trading, where he takes positions based on macroeconomic trends. He emphasizes risk management and adapts quickly to changing market conditions. His approach also includes a strong commitment to philanthropy, particularly in environmental conservation, integrating business success with social responsibility

Louis Bacon’s personal life

Louis Bacon’s first wife, Cynthia Pigott, is a former Newsweek reporter. They married in 1986 and had four children together before divorcing in 2002. His second wife, Gabrielle Sacconaghi, whom he married in 2007, is a Canadian socialite and art adviser. They have three children together, and they divorced in 2022. One of his children, Louis Dillon Ingraham Bacon, works as an analyst at Goldman Sachs

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

South Africa unveils digital visas to attract film and events

South Africa invests R710 million to expand free Internet access