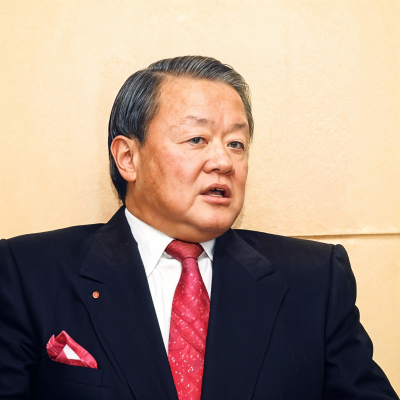

Oei Hong Leong Biography, Career, Net Worth, and Key Insight

Oei Hong Leong’s Profile Summary

|

Company

|

Oei Hong Leong Group |

|---|---|

|

Position

|

Chairman and founder of Oei Hong Leong Group. |

|

Source of wealth

|

Real estate investments, financial services, technology investments, strategic asset management. |

|

Also known as

|

Philanthropist, art collector, investor in Chinese markets. |

|

Age

|

77 |

|

Education

|

No verified information regarding his formal education is publicly available. |

|

Citizenship

|

Singapore |

|

Residence

|

Singapore |

|

Family

|

Oei Hong Leong is married and has children, though specific family details are not widely publicized. |

|

Website, Social Media

|

https://hongleong.com/ |

Oei Hong Leong’s biography

Oei Hong Leong, born in Indonesia, is a prominent Singaporean businessman and investor. He is the son of Oei Ek Tjong, a successful tycoon from Indonesia. After moving to Singapore, Oei Hong Leong diversified his business interests, making significant investments in various industries such as real estate, finance, and technology. Oei's influence expanded globally, with ventures in North America, Europe, and China. Known for his strategic thinking, he successfully built Oei Hong Leong Group, focusing on real estate development and investments. Beyond his business activities, Oei has been involved in philanthropy, particularly in education and healthcare. His leadership has helped him become one of Singapore's wealthiest individuals, and he remains an influential figure in Asian business circles. His decision-making style is often described as bold and forward-thinking, allowing him to capitalize on market trends effectively.-

How did Oei Hong Leong make money?

Oei Hong Leong makes money in the following areas:

Real estate investments, financial services, technology investments, strategic asset management.

-

What is Oei Hong Leong net worth?

As of 2025, Oei Hong Leong’s net worth is estimated to be $2.3 B.

What is Oei Hong Leong also known as?

Oei Hong Leong is known for his philanthropic efforts, particularly in supporting education and healthcare initiatives in Singapore and China. He has also gained recognition as an avid art collector, with a significant private collection of contemporary and classical pieces. Additionally, Oei has been a notable investor in Chinese markets, leveraging his deep connections and understanding of the region's economic landscape to expand his business portfolio, particularly in real estate and technology sectors.Prominent achievements of Oei Hong Leong

Oei Hong Leong has been recognized for his business success, being consistently ranked among Singapore's wealthiest individuals. His business empire expanded into real estate, finance, and technology, with notable investments in China. He is also recognized for his contributions to philanthropy and has made significant donations to healthcare and educational causes in Singapore and China.What are Oei Hong Leong’s key insights?

Oei Hong Leong emphasizes strategic diversification, long-term investments, and leveraging regional knowledge, particularly in the Chinese market. His business philosophy is rooted in adaptability, seizing opportunities, and bold decision-making. He also stresses the importance of maintaining strong connections and relationships in both business and personal life.

Oei Hong Leong’s personal life

Oei Hong Leong is married to Irene Oei, and together they have children, but the names and personal details of his family members remain largely private. He is known to maintain a close relationship with his family, who are involved in some of his business activities.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

South Africa unveils digital visas to attract film and events

South Africa invests R710 million to expand free Internet access