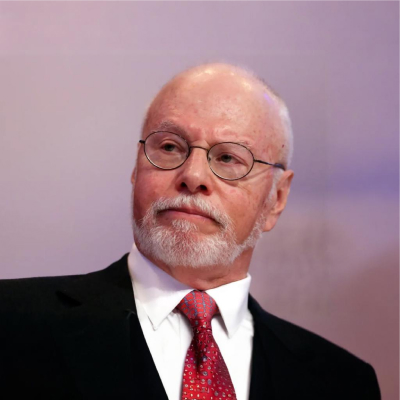

Paul Singer Biography, Career, Net Worth, and Key Insight

Paul Singer’s Profile Summary

|

Company

|

Elliott Management |

|---|---|

|

Position

|

Founder and Chief Executive Officer (CEO) of Elliott Management Corporation. |

|

Source of wealth

|

Singer's wealth primarily comes from management and performance fees generated by Elliott Management's investment strategies, including hedge fund investments |

|

Also known as

|

Philanthropist, activist investor, and political donor. |

|

Age

|

80 |

|

Education

|

University of Chicago - Bachelor's degree in Economics. |

|

Citizenship

|

United States |

|

Residence

|

New York City, USA |

|

Family

|

Paul Singer's family includes his wife, Alexandra Singer, and their children. |

|

Website, Social Media

|

https://www.elliottmgmt.com/ |

Paul Singer’s biography

Paul Singer was born on August 22, 1944, in New York City, New York. He attended the University of Chicago, where he earned a degree in economics in 1966. After graduating, he began his career in finance at the investment bank Donaldson, Lufkin & Jenrette. In 1977, he founded Elliott Management Corporation, a global investment firm known for its activist investment strategies and distressed debt investing. Under Singer's leadership, Elliott Management has become one of the most prominent hedge funds in the world, with assets under management exceeding $48 billion as of 2023. Singer is known for his aggressive tactics in negotiating with companies and governments, often advocating for corporate governance reforms. He has been involved in high-profile disputes with various entities, including countries and corporations, and has built a reputation as a formidable activist investor. In addition to his investment activities, Singer is a philanthropist, contributing to various causes, including education, arts, and medical research.-

How did Paul Singer make money?

Paul Singer makes money in the following areas:

Singer's wealth primarily comes from management and performance fees generated by Elliott Management's investment strategies, including hedge fund investments

-

What is Paul Singer net worth?

As of 2025, Paul Singer’s net worth is estimated to be $3B.

What is Paul Singer also known as?

As a philanthropist, Paul Singer has donated significantly to various causes, focusing on education, medical research, and arts organizations. He is known for supporting initiatives that promote free markets and conservative policies. Additionally, Singer is an influential political donor, contributing to various campaigns and organizations that align with his economic and social views. His activism extends beyond investments; he often engages in public discussions about corporate governance, economic policy, and financial regulations.Prominent achievements of Paul Singer

Paul Singer has received numerous accolades throughout his career, including being named to Forbes' list of "The World's Billionaires" and "America's 400 Richest People." He has been recognized as one of the most influential investors in the hedge fund industry. Under his leadership, Elliott Management has achieved significant returns, with the fund reportedly delivering over 15% annualized returns since its inception. Singer has also been involved in landmark cases that have reshaped corporate governance standards.What are Paul Singer’s key insights?

Paul Singer's business philosophy emphasizes value investing, activist strategies, and a focus on long-term returns rather than short-term gains. He believes in holding management accountable and advocating for changes that enhance shareholder value. His insights often highlight the importance of strong corporate governance and the need for transparency in business operations. He also values intellectual rigor and thorough analysis when making investment decisions.

Paul Singer’s personal life

Paul Singer is married to Alexandra Singer, and they have three children together. The family maintains a relatively private life, although Singer has been known to involve his family in philanthropic activities.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

South Africa invests R710 million to expand free Internet access

WTI crude oil price slips near $66 as trendline rejection and tariff risk dampen outlook