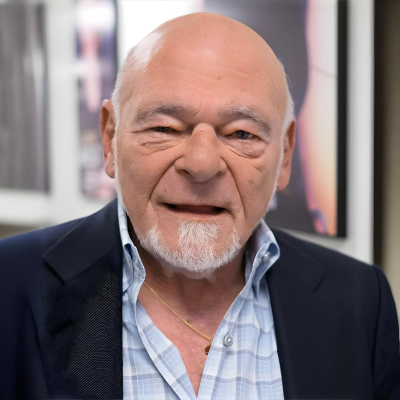

Sam Zell Biography, Career, Net Worth, and Key Insight

Sam Zell’s Profile Summary

|

Company

|

Equity Group Investments |

|---|---|

|

Position

|

Founder and Chairman of Equity Group Investments. |

|

Source of wealth

|

Zell's wealth primarily stems from his investments in real estate, particularly through Equity Group Investments, as well as management fees from various investment ventures and funds |

|

Also known as

|

Philanthropist, Author, Real Estate Mogul |

|

Years of life

|

28.09.1941 - 18.05.2023 |

|

Education

|

University of Michigan - Bachelor of Arts (B.A.) in Economics |

|

Citizenship

|

United States |

|

Residence

|

Chicago, Illinois, United States |

|

Family

|

Sam Zell's family includes his wife, Helen Zell, and his three children: Paul, Robert, and Lisa Zell. |

|

Website, Social Media

|

https://www.equityinvestmentgroup.com/ |

Sam Zell’s biography

Sam Zell, born on September 28, 1941, in Chicago, Illinois, is a prominent American businessman and investor known for his role in the real estate and investment industries. He founded Equity Group Investments in 1968, a private investment firm that specializes in various sectors, including real estate, energy, and transportation. Zell gained notoriety for pioneering the concept of Real Estate Investment Trusts (REITs), significantly shaping the U.S. real estate market. Throughout his career, he has been involved in various ventures, including the acquisition of the Tribune Company, where he famously led the company into bankruptcy in 2008, highlighting the risks associated with leveraged buyouts. Zell's investment philosophy emphasizes opportunistic buying and selling, particularly during market downturns. He is often referred to as the "Grave Dancer" for his ability to invest in distressed assets and has been recognized for his philanthropic efforts, particularly in education and the arts. His entrepreneurial spirit and innovative approach have made him a significant figure in American finance.-

How did Sam Zell make money?

Sam Zell makes money in the following areas:

Zell's wealth primarily stems from his investments in real estate, particularly through Equity Group Investments, as well as management fees from various investment ventures and funds

-

What is Sam Zell net worth?

As of 2025, Sam Zell’s net worth is estimated to be $5.6B.

What is Sam Zell also known as?

Sam Zell is recognized not only for his success in real estate investments but also for his philanthropic endeavors. He has made significant contributions to educational institutions, including the University of Michigan and the University of Chicago, reflecting his commitment to advancing education. Additionally, Zell authored a book titled "Am I Being Too Subtle?" in which he shares insights from his career, offering advice on entrepreneurship and investment strategies. His reputation as a "Grave Dancer" is well known, as he often invests in distressed assets, further solidifying his image in the investment community.Prominent achievements of Sam Zell

Sam Zell has received numerous accolades throughout his career, including being named a "Real Estate Icon" by the Wall Street Journal. He was recognized as the "Businessman of the Year" by the National Association of Real Estate Investment Trusts (NAREIT). His firm, Equity Group Investments, has consistently achieved significant returns on investment, and Zell is noted for his strategic leadership in various high-profile acquisitions and developments. His book, "Am I Being Too Subtle?", has also gained recognition in the business community for its practical insights.What are Sam Zell’s key insights?

Sam Zell's business philosophy centers on opportunism and value investing, particularly in distressed assets. He believes in taking calculated risks and seizing market opportunities, especially during downturns. Zell emphasizes the importance of being adaptable and resilient, often advocating for a hands-on approach to management. His insights reflect a deep understanding of market cycles and a belief in the potential for recovery and growth even in challenging circumstances.

Sam Zell’s personal life

Sam Zell's wife, Helen Zell, is known for her philanthropic activities, particularly in the arts and education. His son, Paul Zell, works in the family business, while Robert Zell is involved in various entrepreneurial ventures. Lisa Zell has pursued a career in finance. The family is known for their involvement in charitable activities, often focusing on education, the arts, and community development.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

Nvidia stock jumps 4% after China sales reboot approved

Tesla stock falls 1.9% as sales slide and exec exits deepen uncertainty