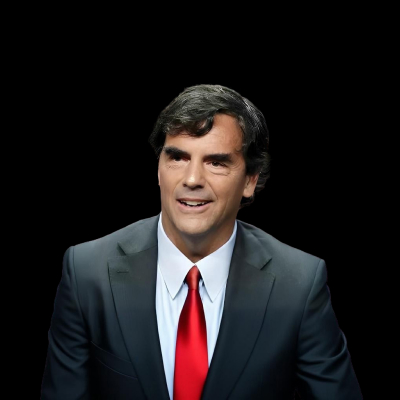

Tim Draper Biography, Career, Net Worth, and Key Insight

Tim Draper’s Profile Summary

|

Company

|

Draper Associates |

|---|---|

|

Position

|

Founding partner of Draper Associates, a venture capital firm that he established in 1985 |

|

Source of wealth

|

Venture capital investments, management fees from Draper Associates, early-stage investments in technology startups, and cryptocurrency investments. |

|

Also known as

|

Cryptocurrency advocate, author, entrepreneur educator. |

|

Age

|

67 |

|

Education

|

Stanford University - Bachelor of Science in Electrical Engineering |

|

Citizenship

|

United States |

|

Residence

|

San Mateo, California, USA |

|

Family

|

Tim Draper's family includes his wife, three children, and prominent family members such as his father, William H. Draper III, and his grandfather, William H. Draper Jr., both of whom were influential figures in venture capital. |

|

Website, Social Media

|

Tim Draper’s biography

Tim Draper is a prominent American venture capitalist, entrepreneur, and advocate for blockchain technology, born on June 11, 1958, in California. He graduated from Stanford University with a Bachelor of Science in Electrical Engineering and later earned an MBA from Harvard Business School. Draper gained notoriety for his early investments in technology companies, including Skype, Tesla, and Hotmail, significantly impacting the Silicon Valley startup ecosystem. He is known for his unconventional investment strategies and has been a vocal proponent of cryptocurrency and blockchain technology, famously purchasing a substantial amount of Bitcoin from a U.S. government auction in 2014. Draper's commitment to fostering innovation extends beyond his investment activities; he has launched various initiatives, such as the Draper University, an educational program for aspiring entrepreneurs. Throughout his career, Draper has been involved in several philanthropic endeavors, focusing on education and economic development, demonstrating a passion for supporting the next generation of innovators.-

How did Tim Draper make money?

Tim Draper makes money in the following areas:

Venture capital investments, management fees from Draper Associates, early-stage investments in technology startups, and cryptocurrency investments.

-

What is Tim Draper net worth?

As of 2025, Tim Draper’s net worth is estimated to be $3.1B.

What is Tim Draper also known as?

Tim Draper is widely recognized as a cryptocurrency advocate, having publicly endorsed Bitcoin and blockchain technology through various platforms, including conferences and social media. He authored the book "How to Be the Startup Hero," where he shares insights on entrepreneurship and venture capital. Additionally, he is known for his role as an entrepreneur educator through Draper University, where he teaches aspiring entrepreneurs about business development and innovation.Prominent achievements of Tim Draper

Tim Draper has been recognized as a pioneer in venture capital, with notable investments in companies like Skype, Tesla, and Hotmail. He was named a “Top 100 Venture Capitalist” by Forbes and has received accolades for his contributions to the startup ecosystem. Draper University has gained acclaim as a leading institution for entrepreneurial education. Additionally, he is known for his early and significant investment in Bitcoin, which has further solidified his status as a visionary in the cryptocurrency space.What are Tim Draper’s key insights?

Tim Draper’s business philosophy centers on the belief that innovation drives economic growth. He advocates for a hands-off investment approach, allowing entrepreneurs the freedom to develop their ideas. Draper emphasizes the importance of embracing failure as a learning experience and encourages bold thinking to disrupt traditional markets. He also strongly supports the decentralization of power through blockchain technology, viewing it as a means to enhance individual freedom and economic opportunity.

Tim Draper’s personal life

Tim Draper is married to his wife, an active participant in various philanthropic initiatives. They have three children, who have also engaged in entrepreneurial ventures. His father, William H. Draper III, is a notable venture capitalist and co-founder of Draper Richards, while his grandfather, William H. Draper Jr., was a pioneer in the venture capital industry. The Draper family has a longstanding legacy in entrepreneurship and innovation, contributing significantly to Silicon Valley.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

South Africa unveils digital visas to attract film and events

South Africa invests R710 million to expand free Internet access