Best Skrill Forex Brokers In 2025

Uwaga redakcyjna: Chociaż przestrzegamy ścisłej integralności redakcyjnej, ten post może zawierać odniesienia do produktów naszych partnerów. Oto wyjaśnienie, w jaki sposób zarabiamy pieniądze. Żadne dane ani informacje na tej stronie nie stanowią porady inwestycyjnej zgodnie z naszym Zastrzeżeniem.

Jeśli jesteś zbyt zajęty, aby przeczytać cały artykuł i chcesz uzyskać szybką odpowiedź, najlepszy broker Skrill Forex w 2025 roku Eightcap. Dlaczego? Oto jego najważniejsze zalety:

- Jest legalny w Twoim kraju (to jest Polska

)

- Uzyskał dobry wynik zadowolenia użytkowników

- Niskie prowizje

- Duża szybkość wykonywania

Najlepsi brokerzy Skrill Forex w 2025 roku:

- Eightcap - Najlepszy broker do handlu bezpośrednio z wykresów TradingView (ponad 15 konfigurowalnych typów wykresów, ponad 90 narzędzi do rysowania)

- XM Group - Najlepsza realizacja zleceń (99,35% zleceń jest realizowanych niemal natychmiast)

- TeleTrade - Najlepszy wybór do nauki podstaw handlu (dużo materiałów edukacyjnych i analitycznych)

- FxPro - Największy wybór par walutowych (ponad 70 kontraktów CFD na FX)

- VT Markets - Atrakcyjne bonusy Forex (50% bonus powitalny, 20% bonus depozytowy)

Skrill, a widely used digital wallet, has become a favored payment method for many Forex traders due to its speed, security, and ease of use. This article aims to guide you through the best Forex brokers that accept Skrill, helping you make an informed choice to enhance your trading experience.

Best Skrill Forex brokers in 2025

Below is a comparison table of the top Skrill Forex brokers in 2025, highlighting their key features to help you make an informed decision.

| Skrill | Demo | Min. depozyt, $ | Min. spread EUR/USD, pips | Max. spread EUR/USD, pips | Opłata za depozyt, % | Opłata za wypłatę, $ | Opłata za wypłatę, % | Otwórz konto | |

|---|---|---|---|---|---|---|---|---|---|

| Tak | Tak | 100 | 0,4 | 1,5 | Nie | Nie | Nie | OTWÓRZ KONTO Twój kapitał jest zagrożony.

|

|

| Tak | Tak | 5 | 0,7 | 1,2 | Nie | Nie | Nie | OTWÓRZ KONTO Twój kapitał jest zagrożony.

|

|

| Tak | Tak | 10 | 0,8 | 1,4 | Nie | Nie | Nie | OTWÓRZ KONTO Twój kapitał jest zagrożony.

|

|

| Tak | Tak | 100 | 0,9 | 1,7 | Nie | Nie | Nie | OTWÓRZ KONTO Twój kapitał jest zagrożony.

|

|

| Tak | Tak | 100 | 0,4 | 1,2 | Nie | Nie | 1-3 | OTWÓRZ KONTO Twój kapitał jest zagrożony.

|

When selecting a Forex broker that accepts Skrill, there are several critical factors to consider. Understanding these factors can help you choose a broker that aligns with your trading needs and preferences.

Fees and spreads. Low fees and tight spreads are essential for maximizing your trading profits. Brokers with competitive pricing structures are preferable as they reduce the cost of each trade, allowing you to keep more of your earnings.

Regulation and security. Ensuring that your chosen broker is regulated by a reputable financial authority is crucial. Regulation provides a layer of security and accountability, protecting your investments from potential fraud and malpractice.

Platform features and usability: A user-friendly and feature-rich trading platform enhances your trading experience. Look for brokers that offer advanced charting tools, technical analysis indicators, and seamless navigation.

Deposit and withdrawal options. The ease of depositing and withdrawing funds can significantly impact your trading efficiency. Brokers that support fast and hassle-free transactions via Skrill are advantageous.

Customer support. Responsive and knowledgeable customer support is vital, especially if you encounter issues or need assistance with your trading account.

Account types and minimum deposits. Different brokers offer various account types to cater to different levels of traders. Consider brokers that provide account options with low minimum deposits to start trading with minimal capital.

Additional features. Some brokers offer additional features such as educational resources, demo accounts, and trading tools that can enhance your trading skills and knowledge.

What is Skrill and why should I use it?

Skrill is a digital wallet that allows users to make online payments, transfer money, and store funds securely. Launched in 2001, Skrill has become a popular payment solution due to its convenience and wide acceptance across various online platforms, including Forex brokers.

Using Skrill for Forex trading offers several advantages:

Speed. Skrill transactions are processed instantly, allowing traders to deposit and withdraw funds quickly without waiting for traditional bank transfers.

Security. Skrill employs advanced security measures, including encryption and two-factor authentication, to protect users' financial information.

Convenience. Skrill is widely accepted by many Forex brokers, making it easy to transfer funds between your trading account and Skrill wallet.

Cost-effective. Skrill often has lower transaction fees compared to traditional banking methods, making it a cost-effective choice for traders.

Flexibility. Skrill supports multiple currencies and can be used globally, providing flexibility for traders operating in different regions.

How to deposit and withdraw from Skrill

Depositing and withdrawing funds using Skrill is straightforward and user-friendly. Here’s how you can do it:

Depositing funds:

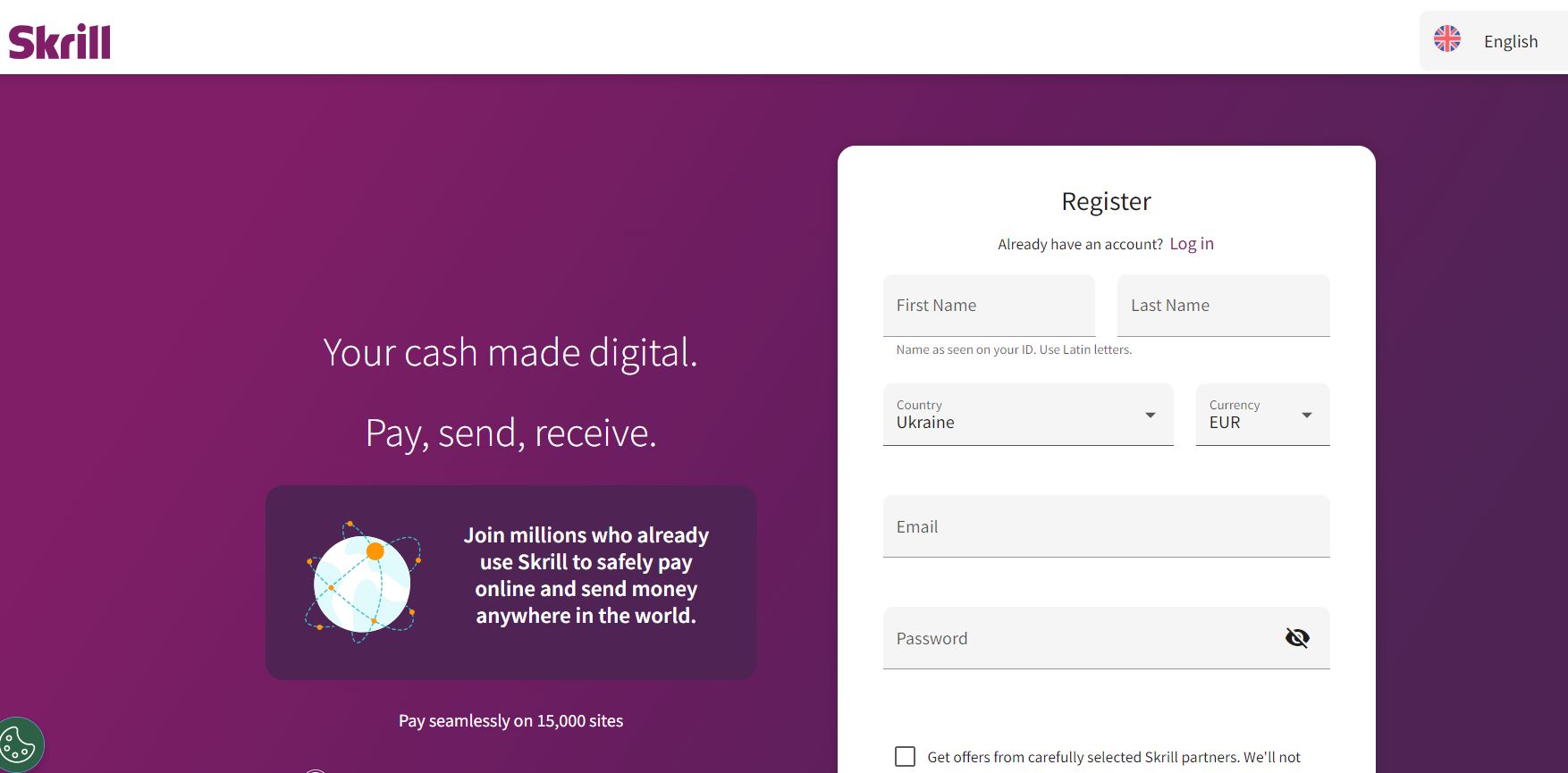

Create a Skrill account. Sign up for a Skrill account on their website and complete the verification process.

Link your bank account or card. Add your bank account or credit/debit card to your Skrill account.

Deposit funds into Skrill. Transfer money from your bank account or card to your Skrill wallet.

Transfer to Forex broker. Log in to your Forex trading account, go to the deposit section, select Skrill as your payment method, and enter the amount you wish to deposit.

Withdrawing funds:

Log in to a Forex account. Access your Forex trading account and navigate to the withdrawal section.

Select Skrill. Choose Skrill as your withdrawal method and specify the amount you want to withdraw.

Transfer to Skrill wallet. The funds will be transferred from your trading account to your Skrill wallet.

Withdraw from Skrill. From your Skrill account, you can transfer the funds to your linked bank account or card, or use the Skrill Prepaid Mastercard to withdraw cash from an ATM.

Risks and warnings

Forex trading carries inherent risks, and it's essential to understand these risks to make informed trading decisions:

Understanding the risks of Forex trading. Forex trading involves high volatility and leverage, which can lead to significant gains or losses.

The Importance of regulatory compliance. Trading with a regulated broker ensures your funds are protected and reduces the risk of fraud.

Potential issues with unregulated brokers. Unregulated brokers may not adhere to industry standards, posing a higher risk to your investments.

Managing financial risks. Implementing risk management strategies, such as setting stop-loss orders and limiting leverage, can help mitigate potential losses.

When choosing a Skrill broker, don’t just look at the basic fees

As someone who has been trading Forex for many years, I can tell you that choosing the right broker can be a game-changer. When I started, I didn’t pay much attention to things like regulation or fees, and I learned the hard way how important these factors are.

When choosing a Skrill broker, don’t just look at the basic fees — dig deeper into how they handle currency conversions. Some brokers automatically convert your funds into their default currency, which might not be in your favor. To keep more of what you earn, find a broker that either lets you hold multiple currencies or offers fair conversion rates based on real market data. This way, you’re not losing money on every trade without even realizing it.

Another tip is to really check how quickly you can withdraw your money using Skrill and whether there are any fees attached. While many brokers claim they offer fast withdrawals, the reality can vary a lot. Some may process your request immediately, but others might take days, which can be frustrating if you need quick access to your cash. It’s a good idea to test the withdrawal process with a small amount first to see how it works. This small step can help you avoid surprises later and ensure you’re with a broker that fits your needs.

Metodologia tworzenia naszych rankingów brokerów Forex

Traders Union stosuje rygorystyczną metodologię do oceny brokerów, wykorzystując ponad 100 kryteriów ilościowych i jakościowych. Wiele parametrów otrzymuje indywidualne oceny, które są uwzględniane w rankingu ogólnym.

Kluczowe aspekty oceny obejmują:

-

Regulacje i bezpieczeństwo. Brokerzy są oceniani na podstawie poziomu/reputacji licencji i przepisów, na podstawie których działają.

-

Opinie użytkowników. Opinie klientów są analizowane w celu określenia poziomu satysfakcji z usług. Opinie są weryfikowane pod kątem autentyczności.

-

Instrumenty handlowe. Brokerzy są oceniani na podstawie zakresu oferowanych aktywów oraz głębokości i szerokości dostępnych rynków.

-

Opłaty i prowizje. Wszystkie opłaty handlowe i prowizje są szczegółowo analizowane, aby określić całkowite koszty dla klientów.

-

Platformy handlowe. Brokerzy są oceniani pod kątem różnorodności, jakości i funkcjonalności oferowanych platform.

-

Inne czynniki. Popularność marki, wsparcie klienta i zasoby edukacyjne.

Dowiedz się więcej o metodologii oceny brokerów, opracowanej przez ekspertów Traders Union.

Summary

Picking the right Skrill Forex broker is key to successful trading. Skrill is fast, easy, and safe, which makes it a great choice for managing your funds. In this article, we looked at what Skrill is, why it’s useful, and how to use it for deposits and withdrawals. We also compared the best brokers for using Skrill, focusing on important things like fees, regulation, and platform features. Remember, Forex trading comes with risks, so it’s crucial to choose a broker that fits your needs and helps you manage those risks effectively.

FAQs

Can I use Skrill to trade Forex if I live in the United States?

Yes, you can use Skrill for Forex trading in the United States, but you need to ensure that the Forex broker you choose accepts Skrill and is also compliant with U.S. regulations.

Are there any fees for using Skrill for Forex trading?

Yes, Skrill charges fees for transactions, including deposits and withdrawals. These fees can vary based on your location and the broker's policies, so it's important to check the specific fee structure on both Skrill's website and your broker's site.

How long does it take to withdraw funds from my Forex account to Skrill?

Withdrawals from your Forex account to your Skrill wallet typically take a few hours to a couple of business days, depending on the broker’s processing times.

Is Skrill safe for depositing large amounts of money into my Forex account?

Yes, Skrill is considered safe for large transactions as it uses advanced encryption and two-factor authentication. However, it's essential to ensure your Forex broker is reputable and regulated.

Powiązane artykuły

Zespół, który pracował nad tym artykułem

Parshwa jest ekspertem ds. treści i specjalistą ds. finansów posiadającym głęboką wiedzę na temat handlu akcjami i opcjami, analizy technicznej i fundamentalnej oraz badań kapitałowych. Jako finalista Chartered Accountant, Parshwa ma również doświadczenie w Forex, handlu kryptowalutami i podatkach osobistych. Jego doświadczenie jest widoczne w ponad 100 artykułach na temat Forex, kryptowalut, akcji i finansów osobistych, a także w spersonalizowanych rolach doradczych w zakresie konsultacji podatkowych.