Best Brokers with No-Deposit Bonus in South Africa - TU Expert review

A No-Deposit Bonus is a popular special offer for traders. Clients can use it to discover the products of a broker, the account, instruments, etc. This kind of offer enjoys great popularity among traders from South Africa. Traders Union analysts have prepared a list of the Best Brokers with No-Deposit Bonus in South Africa. Traders will learn about the brokers that offer this kind of bonus and will be able to compare conditions offered by different companies.

Brief introduction of InstaForex

InstaForex is a leading broker with over 7,000,000 clients. The company provides access to 2,500+ trading instruments, including Forex pairs, stocks, indices, commodities, and cryptocurrencies. Clients can benefit from competitive spreads starting from 0 pips, leverage up to 1:1000, and access to non-standard technological solutions like synthetic securities. The average execution speed is 0.1 sec.

The broker offers a wide range of cryptocurrency CFDs, with over 70 instruments available and zero spreads on major cryptocurrencies. Additionally, it supports passive investment options including PAMM accounts, copy trading services, and unique offering - OYS portfolios.

The company provides responsive client support and insurance coverage up to €20,000 under European regulation.

| 💰 Account currency: | FSC - USD, EUR, RUB. CySEC - EUR, USD, PLN, CZK, GBP (GBP -only for accounts on МТ5). |

| 🚀 Minimum deposit: | FSC - $1. CySEC - €200/€1 |

| ⚖️ Leverage: | FSC - up to 1:1000. CySEC: leverage is up to 1:30 for retail traders and up to 1:500 for professionals. |

| 💱 Spread: | FSC - from 0-0.3 pips subject to the account type. CySEC - from 0 pips subject to the asset type. |

| 🔧 Instruments: | FSC - currency pairs, stocks, indices, metals, oil and gas, commodity futures, cryptocurrencies, and InstaFutures. CySEC - currency pairs, commodities, stocks, indices, cryptocurrencies, synthetic stocks and ETFs, and stocks at the moment of IPO. |

| 💹 Margin Call / Stop Out: | FSA - 30%/10%. CySEC - 100%/50% |

InstaForex Pros and Cons

👍 InstaForex Pros:

•2,500+ trading instruments, including non-standard assets, such as InstaFutures and synthetic securities.

•Passive investment products, including PAMM accounts and a copy trading service.

•Non-standard technological solutions such as InstaSpot (P2P spot trading), OYS account, Stock Basket, etc.

•European regulation and IFC compensation fund with guaranteed insurance coverage up to €20,000.

•Comfortable trading conditions, such as a $1 minimum deposit and leverage up to 1:1000, for clients of the FSC-regulated broker.

👎 InstaForex Cons:

•Tough conditions for retail European traders due to regulations.

•The time gap between a trade executed by a trader and the one copied to the investor’s account in the social trading service can be up to 15 seconds.

What do you need to know about a No-Deposit Bonus?

A No-Deposit Bonus is a special offer made to attract new clients. These bonuses have several features, including the following:

-

A new client can receive a no-deposit bonus. In order to do that, the client needs to fulfill certain conditions: as a rule, register and verify his account and identity.

-

A no-deposit bonus can be used for trading. It allows you to test the platform using a live account.

-

A no-deposit bonus cannot be withdrawn. However, brokers can have certain conditions for such a bonus becoming available for withdrawal, for example after funding the account or upon reaching a specific trading volume.

The amount and conditions of a no-deposit bonus differ depending on the broker. Also, traders can refuse to accept a no-deposit bonus.

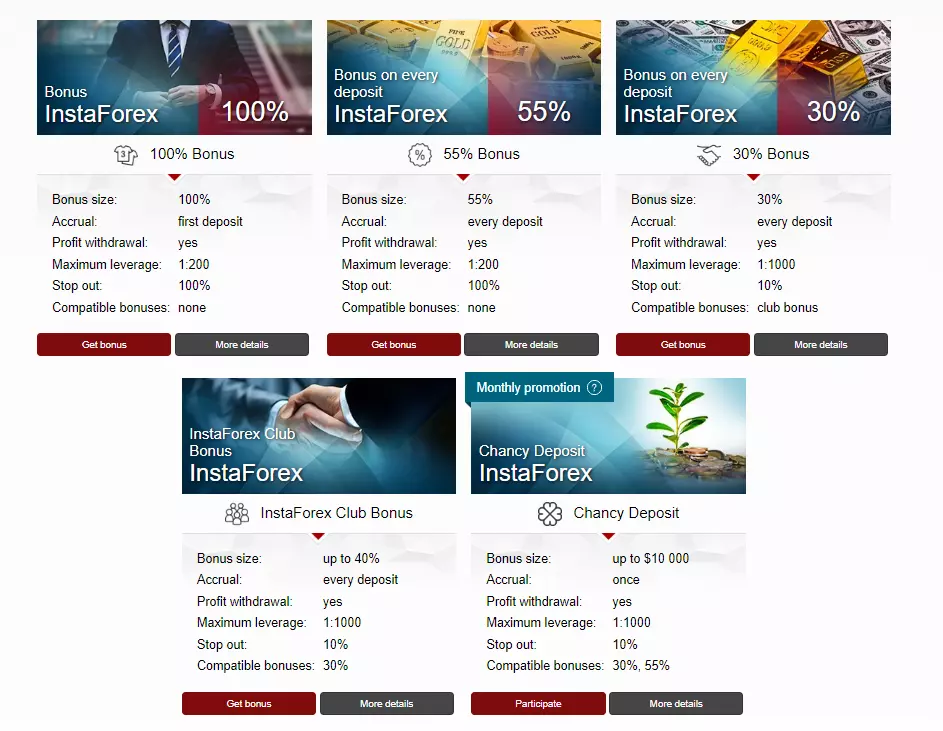

InstaForex Bonuses

Bonuses Paid by the Broker

Bonus programs are available only for traders working with the FSC-regulated broker.

"100% bonus"

The opportunity to get a bonus of 100% for the first replenishment.

"55% bonus"

Bonus of 55% for each replenishment.

"30% bonus"

A bonus of 30% on every deposit enrollment.

"Club Bonus"

A bonus of up to 40% for each account replenishment is awarded to the members of InstaForex Club.

"Happy deposit"

Brokers similar to InstaForex

In addition to bonuses, traders also need to familiarize themselves with trading conditions. It is important to compare trading conditions of several brokers offering no-deposit bonuses. The important factors of choice include the minimum deposit, trading fees, leverage, available trading platforms, etc.

Comparison of InstaForex with other Brokers

| InstaForex | Tickmill | FBS | FXOpen | FreshForex | |

|---|---|---|---|---|---|

|

Trading platform |

MT4, MultiTerminal, Mobile Trading, MT5, WebTrader |

MT4, MT5, Tickmill Mobile App |

MT4, Mobile Trading |

TickTrader, TradingView, MT4, MT5 |

MT4, Mobile Trading |

|

Min deposit |

$1 |

$100 |

$1 |

$300 |

No |

|

Leverage |

From 1:1 |

From 1:1 |

From 1:1 |

From 1:1 |

From 1:1 |

|

Trust management |

Yes |

Yes |

No |

No |

No |

|

Accrual of % on the balance |

No |

No |

No |

No |

No |

|

Spread |

From 0 points |

From 0 points |

From 0.2 points |

From 0.9 points |

From 0 points |

|

Level of margin call / stop out |

30% / 10% |

100% / 30% |

40% / 20% |

20% / 100% |

40% / 20% |

|

Execution of orders |

Instant Execution |

Market Execution |

Market Execution |

Market Execution |

Market Execution, Instant Execution |

|

No deposit bonus |

No |

$30 |

$5 |

No |

$30 |

|

Cent accounts |

Yes |

No |

Yes |

Yes |

Yes |

InstaForex is the best option for traders with any level of experience. For active professional traders, there is a large pool of non-standard technological solutions for more accurate analysis. For novice traders, there are comfortable starting conditions, such as a $1 minimum deposit under the regulation of FSC and a $200 minimum deposit with the broker regulated by CySEC. There are PAMM accounts and social trading for investors.

Tickmill is a suitable broker for both professional traders and novices. The company is good for robotic trading as well as for short-term strategies.

FBS is a broker for those who appreciate a variety of trading instruments and prompt support. The company is suitable for both beginners and experienced traders working on PCs and smartphones.

FXOpen is a reliable broker with years of experience in financial markets, and adjusting trading conditions for its clients based on the regulatory requirements of their jurisdiction.

FreshForex is a reliable Forex broker providing a standard set of trading tools. The company is a good option for traders of all levels, from beginner to professional traders. It is mid-range in terms of size and number of registered traders and they are reliable based on our research and analysis.

Comparison of no-deposit bonus programs of brokers similar to InstaForex

Many brokers offer a no-deposit bonus. Therefore, before choosing a company to work with, it is important to compare it with its competitors. In the table below, you can review and compare conditions for a no-deposit bonus.

| Bonus type | InstaForex | Tickmill | FBS | FXOpen | FreshForex |

|---|---|---|---|---|---|

Bonuses |

$1000 no deposit bonus |

$30 welcome bonus |

$140 no deposit bonus, up to 100% deposit bonus (Bonuses are not available for EU and UK clients) |

A $10 bonus is credited after opening a personal account (eWallet) and passing the 2nd level of verification. (for STP-type accounts); A welcome bonus of $1 is credited when opening a Micro account. |

Bonus offers: +10% for each cryptocurrency deposit, stop-out insurance, 101% for drawdown, etc. Bonus programs are updated |

Affiliate Program |

Yes |

Yes |

No |

There is a flexible system of remunerations and coefficients depending on these indicators. 1st level — 100% of the standard commission, 2nd level — 35% of the standard commission, 3rd level — 10% of the standard commission. |

Types of affiliate programs: organization of a training center, official representation, promotion of SMM. Reward - up to 20 USD for each referral's trading lot |

Other |

No |

Trading contests |

By activating the option in the personal account, a trader can receive a cashback of up to $15 per lot |

Forex Cup - A bonus in the amount of 1% of the profit is credited for participating in contests for traders on a virtual account, FXOpen Cashback - The broker refunds a part of the funds for the trading operations conducted, including unprofitable ones. The amount depends on the margin involved in all accounts and ranges from $5 to $1,000. |

No |

Conclusions

A no deposit bonus is one of the promos offered by the broker. The company’s conditions can be generally considered rather attractive. It is a good option for traders from South Africa who are starting to work with the platform. The conditions are competitive, although other brokers operating in South Africa offer more attractive options.

FAQs

Who can use the no deposit bonus?

Traders who open a new account with a broker can receive the no deposit bonus.

What are the conditions for receiving the no deposit bonus?

As a rule, they include registration and verification. However, additional conditions are also possible.

Is providing the no deposit bonus legal in South Africa?

Yes, the financial law of South Africa does not prohibit awarding bonuses, including the no deposit bonus.

Is it possible to withdraw the no deposit bonus?

It depends on the conditions of the broker. Some brokers allow withdrawal of the no deposit bonus subject to certain conditions, while others don’t allow at all.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.