Best Forex Brokers With FCA regulation In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, the best FCA (UK) regulated broker is Plus500. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- A wide range of tools

- Fast execution speed

Best FCA (UK) regulated brokers are:

- Plus500 - Best premium client support (personal manager, exclusive analysis, webinars)

- Pepperstone - Best for scalping strategies (spread from 0 pips)

- OANDA - Best for trading with advanced technical analysis tools (TradingView charts support)

- FOREX.com - Diverse range of tradable assets (80+ currency pairs)

- Interactive Brokers - Best broker for international investors (assets from 33 countries, 150+ markets)

The Financial Conduct Authority (FCA) is an agency that regulates Forex brokers by authorizing and registering those that meet particular requirements. This article will explore the best FCA (UK) Forex brokers, brokers' fees, trading platforms, limitations, and supported assets.

Best FCA regulated brokers

We have selected a list of FCA-regulated Forex brokers to provide a secure and trustworthy trading experience. These brokers follow strict regulatory standards for transparency and reliability.

| FCA | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | MAX Spread GBP/USD, pips | Investor protection | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:300 | 0,5 | 1,0 | €20,000 £85,000 SGD 75,000 | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | 0,5 | 1,4 | £85,000 €20,000 €100,000 (DE) | Open an account Your capital is at risk.

|

|

| Yes | No | 1:200 | 0,1 | 0,5 | £85,000 SGD 75,000 $500,000 | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:50 | 0,7 | 1,4 | £85,000 | Study review | |

| Yes | No | 1:30 | 0,2 | 1,5 | $500,000 £85,000 | Open an account Your capital is at risk. |

How to choose a FCA (UK) regulated broker

When choosing a FCA-regulated Forex broker, it is crucial to consider the following:

Reliability

Ensure that you do your due diligence before settling for a Forex broker. Reading reviews and additional information from past clients will paint a picture of what you may experience while trading with that particular broker.

Human beings tend to have an emotional attachment to their money. So in a situation where a trader feels like the security of their funds isn't assured, it will affect their decisions. Trading requires concentration, but how would you be able to trade if you aren’t confident that your finances are safe?

Trading fees

When looking for a Forex broker to work with, you must consider the profit margins you will make from your trades. There may be additional costs on your broker’s part that will affect the amount of money you receive per trade.

Some brokers charge both a commission and spread, while others claim to facilitate commission-free trading. However, the broker not charging a commission may have higher spreads than their counterparts. Therefore, it is essential to make a detailed comparison before assuming that one broker is cheaper than the next.

Trading platforms

The two leading trading platforms Forex brokers use are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The more popular version is MT5 because it allows access to a more expansive scope of markets than MT4, which translates to more brokers and traders.

In addition, the greater reach increases Forex traders’ capacity in the markets, making MT5 a more profitable platform than the others.

Customer service

Because the global markets run 24 hours straight on weekdays, it is essential to use a Forex broker that offers customer service around the clock. If you need assistance from your broker while trading at odd hours, conversing with an actual person beats any automated responses.

An added advantage will be if your choice of Forex broker has a physical office accessible to their clients. This factor would increase trust levels and accountability between the broker and their traders.

Training

One of the most vital aspects of successfully trading Forex is proper training. This skill takes work, and with the dynamic shift in the global markets, there is always more to learn. Some FCA-regulated Forex brokers offer free training to their clients, which is a bonus.

You may be a novice in Forex trading with a keen interest in the trade but need to gain knowledge of market analysis. Rather than breaking the bank to receive training to equip you, find a trusted FCA-regulated broker who can get you started with the basics.

Rules and regulation in the UK

Licensing in the UK

To operate legally in the UK, Forex brokers must be authorized by the Financial Conduct Authority (FCA). The FCA ensures that brokers adhere to strict financial and operational standards, providing a secure environment for traders. For Forex traders, this licensing guarantees that their funds are segregated and protected, and that the broker operates transparently. Always verify a broker's FCA registration through the Financial Services Register to avoid unregulated or fraudulent platforms.

Investor protection in the UK

Forex traders in the UK benefit from robust investor protection under the Financial Services Compensation Scheme (FSCS). If an FCA-regulated broker becomes insolvent, traders are eligible for compensation of up to £85,000 per individual. Additionally, FCA regulations mandate client fund segregation, ensuring that traders' funds are not used for broker operations. This legal framework minimizes risks, giving traders peace of mind when trading in the volatile Forex market.

Taxation in the UK for Forex traders

Forex traders in the UK are taxed differently depending on the type of trading they engage in and their trading status. For retail traders engaging in spread betting, profits are generally tax-free, as spread betting is classified as gambling under UK tax laws. However, losses from spread betting cannot be offset against other taxable income or gains.

For those trading through contracts for difference (CFDs) or directly in the Forex market, profits are subject to Capital Gains Tax (CGT). The CGT rates for the 2024/25 tax year are 10% for basic rate taxpayers and 20% for higher rate taxpayers. Traders also benefit from an annual tax-free CGT allowance of £3,000, meaning gains up to this amount are exempt from tax. Losses incurred can be offset against gains, and any unused losses can be carried forward to reduce future taxable gains.

Professional traders, for whom Forex trading is the primary source of income, are treated differently. Their profits are subject to Income Tax rather than CGT. For the 2024/25 tax year, income up to £12,570 is tax-free under the personal allowance. Income between £12,571 and £50,270 is taxed at 20%, between £50,271 and £125,140 at 40%, and income over £125,140 at 45%.

| Trading Type | Tax Type | Tax Rate | Key Points |

|---|---|---|---|

| Spread Betting | None | Tax-Free | Profits are tax-free; losses cannot be offset. |

| CFDs and Forex Trading | Capital Gains Tax (CGT) | 10% (Basic Rate) / 20% (Higher Rate) | £3,000 tax-free allowance; losses can offset gains. |

| Professional Trading | Income Tax | 20%-45% based on income brackets | Treated as earned income; personal allowance applies. |

Forex traders should maintain accurate records of all trades, including dates, profits, and losses, to ensure compliance with HMRC regulations. Consulting a tax professional is recommended to optimize tax strategies and adhere to legal requirements.

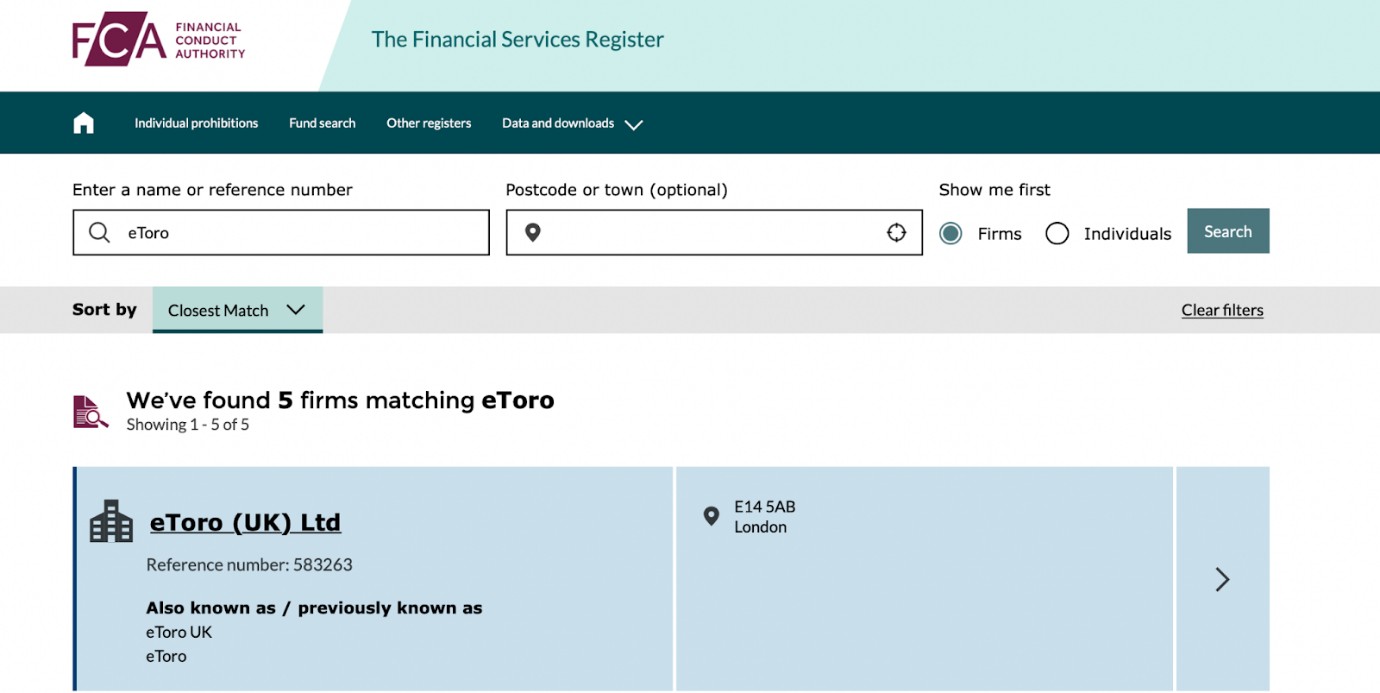

How to check FCA regulation

Visit the FCA's official website.

Use the FCA register and search for the broker. Enter the name or registration number of the broker you want to check. The register provides information about authorized firms and individuals.

3. Verify the details. Review the information provided by the FCA (regulatory status, business address, and any additional information relevant to their authorization).

4. Check for warnings or alerts. The FCA may issue warnings about firms engaging in unauthorized activities or scams.

UK-regulated brokers trading limitations

In the UK, Forex brokers regulated by the Financial Conduct Authority (FCA) must follow specific rules designed to protect retail traders and promote market transparency. Key limitations include:

Leverage restrictions

The FCA caps leverage to reduce the risk of excessive losses:

30:1 for major currency pairs.

20:1 for non-major pairs, gold, and major indices.

10:1 for commodities other than gold and non-major indices.

5:1 for individual equities.

2:1 for cryptocurrencies.

These caps aim to prevent retail traders from taking on unsustainable risks that can amplify losses.

Negative balance protection

Brokers must ensure that traders cannot lose more money than they have in their accounts. This rule protects clients from incurring debts beyond their initial deposits.

Margin close-out rule

If a trader’s account equity falls below 50% of the required margin, the broker must close one or more positions to limit further losses. This helps safeguard traders from complete account depletion.

Ban on incentives

Brokers are prohibited from offering bonuses, gifts, or other incentives to encourage trading. This rule is intended to prevent clients from being lured into risky or frequent trading.

Risk warnings

Brokers must display clear risk warnings that disclose the percentage of retail accounts that lose money when trading. This ensures traders understand the potential risks involved.

Choosing a broker with an NDD might give you more dependable trades

When you're picking an FCA-regulated Forex broker, it's a good idea to look at how they handle order execution. Some brokers use a “No Dealing Desk” (NDD) setup, which can lead to quicker trades and fewer chances of price changes after you've placed an order. This is especially helpful during big economic news releases when markets can be unpredictable. Choosing a broker with an NDD model might give you more dependable trades, which is important if you're working with strategies that rely on precise timing.

Also, check out the broker's rules on margin calls. Some brokers have a “tiered margining” system, meaning the amount of money you need to keep in your account can change based on how big your trades are. As your trades get larger, you might need to have more funds available, which could lower your leverage.

Knowing these details can help you handle your risks better and avoid surprises that could mess up your trading plans. It's always a good move to read through the broker's policies on margin requirements to make sure they fit with how you want to trade and how much risk you're comfortable taking.

Methodology for compiling our ratings of Forex brokers

Traders Union applies a rigorous methodology to evaluate brokers using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

-

Regulation and safety. Brokers are evaluated based on the level/reputation of licenses and regulations they operate under.

-

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

-

Trading instruments. Brokers are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

-

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

-

Trading platforms. Brokers are assessed based on the variety, quality, and features of platforms offered to clients.

-

Other factors like brand popularity, client support, and educational resources are also evaluated.

Find out more about the unique broker assessment methodology developed by Traders Union specialists.

Conclusion

Forex trading offers significant opportunities to enhance your financial position, but choosing the right broker is essential. The Financial Conduct Authority (FCA) plays a key role in ensuring that brokers operate transparently and safeguard traders' interests.

Not all brokers are regulated by reputable bodies like the FCA, which can expose traders to unnecessary risks. For a secure trading experience, it is vital to research thoroughly and select FCA-regulated Forex brokers that adhere to strict industry standards. Prioritizing regulated brokers helps protect your investments and builds trust in your trading journey.

FAQs

What platform do Forex brokers use for trading?

MetaTrader is one of the most popular Forex trading platforms, with two versions: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). This platform is available for download or online use.

When is the Forex market open, and how does it work?

The Forex market is open for the five weekdays, where world currencies are traded in pairs. Forex traders study these pairs to predict the direction that the market will move next. They can close a trade and earn a profit if their prediction is correct.

Do all Forex brokers charge the same rates?

No, they do not. Instead, Forex brokers’ rates vary depending on their commission fees and spreads. The spreads refer to the difference between their sell rate and buy rate when trading pairs.

What risk do I face by trading with a Forex broker who is not FCA regulated?

Since no regulating authority holds them accountable, the broker can scam you out of your money.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

A margin call is a demand made by a broker or a financial institution to a trader or investor who is using margin (borrowed funds) to cover potential losses in a trading account. It occurs when the value of the securities or assets held in the account falls below a certain threshold, known as the maintenance margin or margin requirement, as specified by the broker.

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.