Your capital is at risk.

Tier1FX Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1000

- MT4

- JForex

- FORTEX 6

- MFSA

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1000

- MT4

- JForex

- FORTEX 6

- MFSA

Our Evaluation of Tier1FX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Tier1FX is a broker with higher-than-average risk and the TU Overall Score of 3.31 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Tier1FX clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Tier1FX provides generally comfortable working conditions. The platform offers a variety of assets, and significant leverage, and operates transparently. Additional advantages include multiple trading platforms, passive income options, and quality technical support. However, drawbacks include a 60-day limit on the demo account, a high entry threshold, and a withdrawal fee despite average market trading costs. Only bank transfers are accepted for deposit and withdrawal, and there is no educational support, only basic FAQs about the platform.

Brief Look at Tier1FX

Tier1FX offers access to the markets of currency pairs, metals, and commodities. The broker's pool also includes CFDs on indices and cryptocurrencies. The minimum deposit is $1,000, with a maximum leverage of 1:200. The account's base currency can be EUR, USD, or GBP. The minimum spread is 0.2 pips, and the trading commission depends on the traded asset, for example, $2.75 per lot for currency pairs. Only bank transfers are accepted for deposit and withdrawal, with a fixed withdrawal fee of $20. Available platforms include MT4, JForex, and Fortex 6. Traders can use any trading strategy with no restrictions, and there are joint accounts (e.g., MAM), segregated funds, and a referral program. However, there are no educational programs available.

- A single live account with universal conditions is suitable for both beginners and experienced traders.

- Spreads are lower than the market average, with trading commissions competitive with leading competitors.

- Transparent cooperation with all commissions known in advance, and no additional hidden charges.

- There are no restrictions on traders, allowing scalping, algorithmic trading, and the use of advisors.

- The broker offers moderate leverage, enabling increased profit potential without excessive risk.

- Broker provides the choice of three trading platforms, each with desktop and mobile versions.

- Multiple options for passive income for investment-focused clients.

- The minimum deposit requirement is $1,000.

- Complete absence of any educational programs.

- Not available for residents of Iran, North Korea, Japan, and some other countries.

TU Expert Advice

Financial expert and analyst at Traders Union

Tier1FX is a trading brand of Hogg Capital Investments Ltd, a brokerage company registered in Malta. The company is regulated, and its license is confirmed. The platform has been operating for over 10 years, with no confirmed cases of failure to meet obligations to its clients. Community ratings are predominantly high.

In terms of trading conditions, Tier1FX has both strengths and weaknesses. The broker offers a demo account and a single live account with universal parameters. However, it's important to note the relatively high entry threshold, determined by a minimum deposit of $1,000. Despite this, the spreads are low (starting from 0.2 pips for currency pairs), and the trading commissions are acceptable ($2.75). Still, the withdrawal fee of $20 is higher than that of most brokers. Thus, the overall costs for traders are moderate.

The asset pool is extensive, including over a hundred instruments, such as currency pairs, metals, commodities, CFDs on indices, and cryptocurrencies. The leverage is flexible, ranging from 1:1 to 1:200. Traders can choose from three trading platforms (MT4, JFOREX, FORTEX 6), which is a definite advantage compared to its competitors, as many of them only offer MT solutions. An important aspect is that Tier1FX does not impose restrictions on trading, so its clients may use any lawful style or method.

Regarding alternative earning options, there are three available: MAM-type joint accounts, segregated investment funds, and a referral program (available for both individuals and legal entities, with terms negotiable). This is a platform advantage, as many top brokers do not offer passive income opportunities or only have partnerships with questionable potential.

Considering the high minimum deposit and the absence of educational materials, it's evident that Tier1FX is geared towards professionals. This is neither a positive nor a negative but rather a characteristic of the broker that should be considered. However, if a novice trader has sufficient capital and ambition, nothing is preventing him from registering a live account here and successfully earning. Therefore, the platform can be recommended to all traders, at least for exploration through a free demo account.

Tier1FX Summary

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Tier1FX and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT4, JFOREX, FORTEX 6 |

|---|---|

| 📊 Accounts: | Demo, Main |

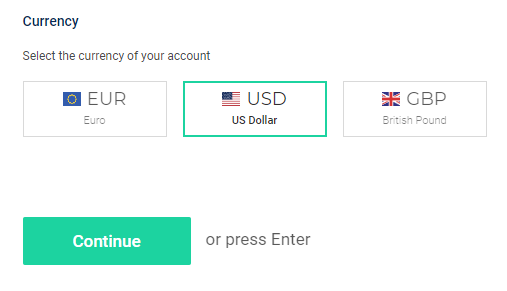

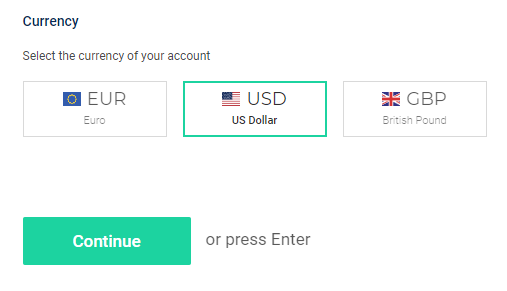

| 💰 Account currency: | EUR, USD, GBP |

| 💵 Replenishment / Withdrawal: | Bank transfer |

| 🚀 Minimum deposit: | $1000 |

| ⚖️ Leverage: | Up to 1:200 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating from 0.2 pips |

| 🔧 Instruments: | Currency pairs, metals, commodities, CFDs on indices, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Free demo account, one live account with versatile trading conditions, high initial deposit, many asset types, moderate leverage, several basic account currencies, several trading platforms, no education programs, and analytics. Technical support is available 24/5. |

| 🎁 Contests and bonuses: | Yes (rebates from TU) |

If a broker offers multiple live accounts, the minimum deposit for them often differs because trading conditions vary. However, Tier1FX has only one live account, so the deposit is consistently set at $1,000 in any case. As for leverage, it is determined not only by the traded asset but also by the trader's rank. Under general conditions, the highest leverage for currency pairs is 1:30. Professional rank allows increasing leverage to 1:100, and under certain circumstances, it can be as high as 1:200. The broker's technical support operates 24/5 and is available through a multi-channel call center, email, site tickets, and live chat.

Tier1FX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To initiate work with Tier1FX broker, register on its website, undergo verification, and open an account. This is a relatively simple process that doesn't take much time. However, experts at Traders Union have prepared a step-by-step guide to eliminate any questions. They have also explored the features of the user account.

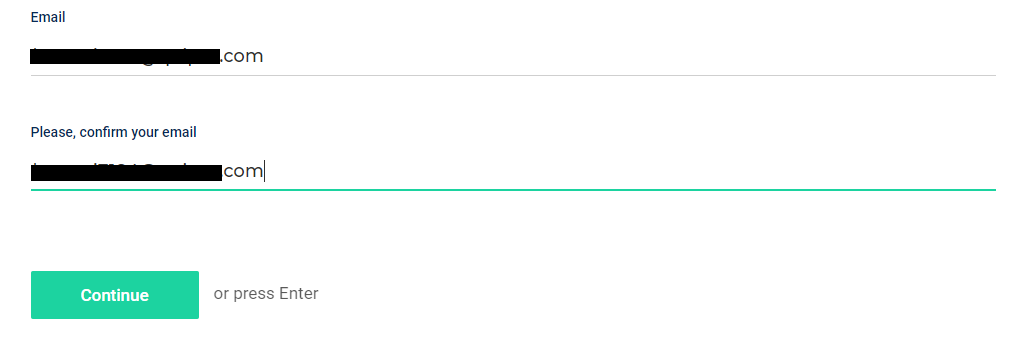

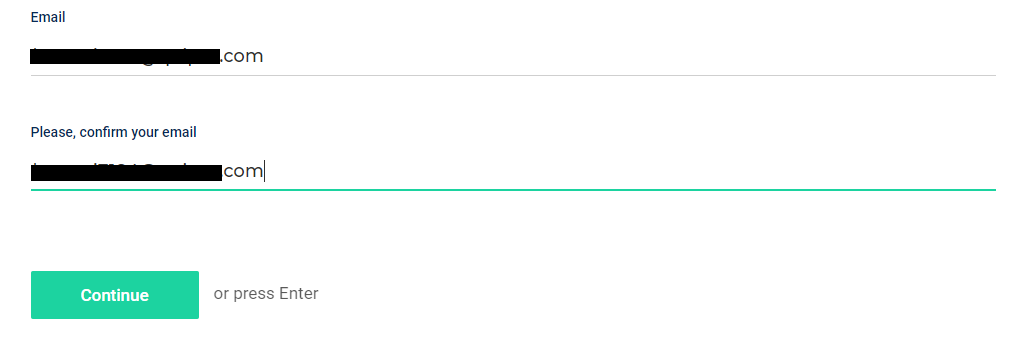

Go to the official broker's website. In the upper right corner, select the interface language. Click on "Open Live", then "Get Started".

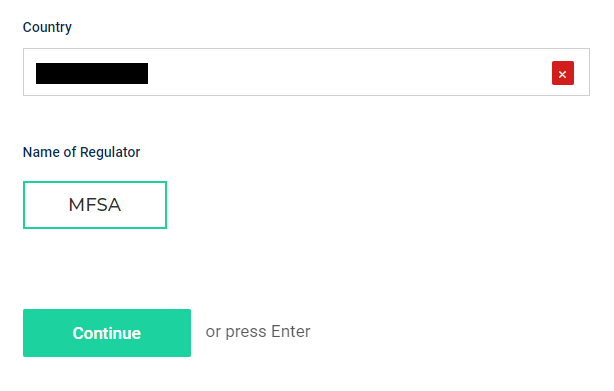

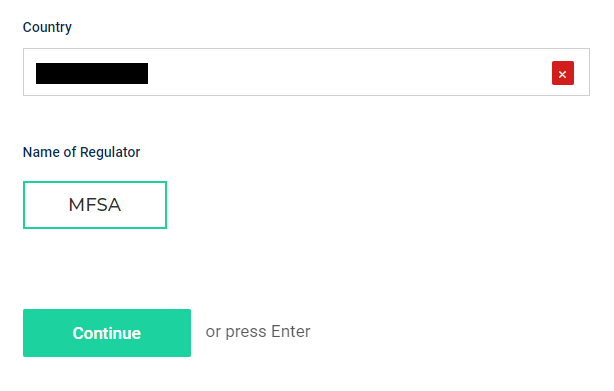

Select your country and regulator, then click “Continue.”

Specify the account type, and enter your full name, phone number, and email. Repeat the email. Generate a password and agree to the terms of collaboration by checking the corresponding box. After filling in each data block, click "Continue".

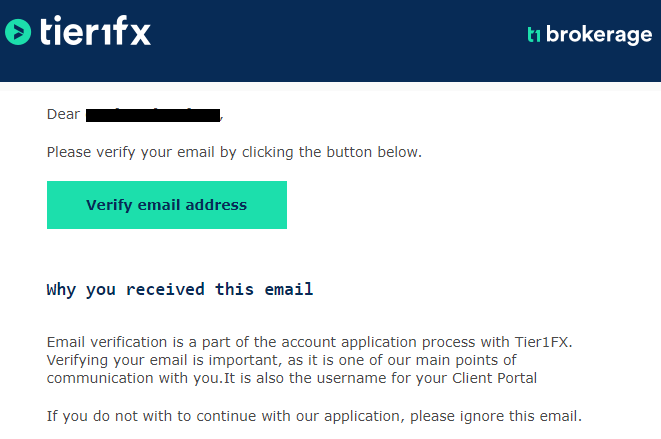

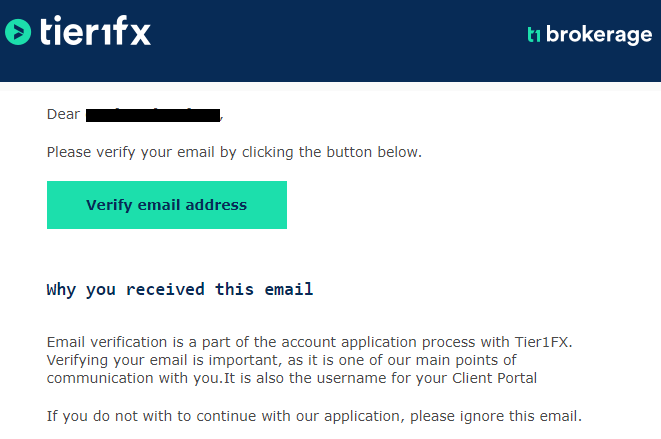

An email will be sent with a confirmation link. Follow the link to continue the registration.

Choose the base currency of the account, trading platform, and other parameters. Click "Continue" each time.

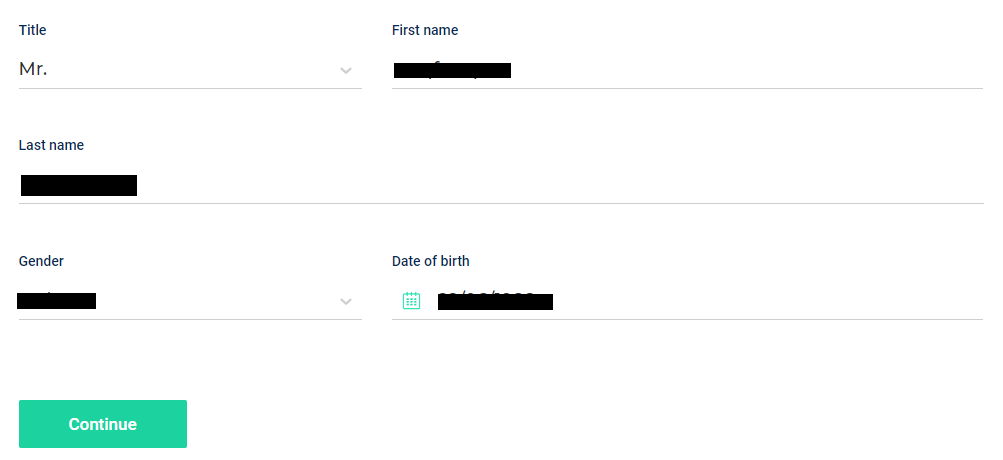

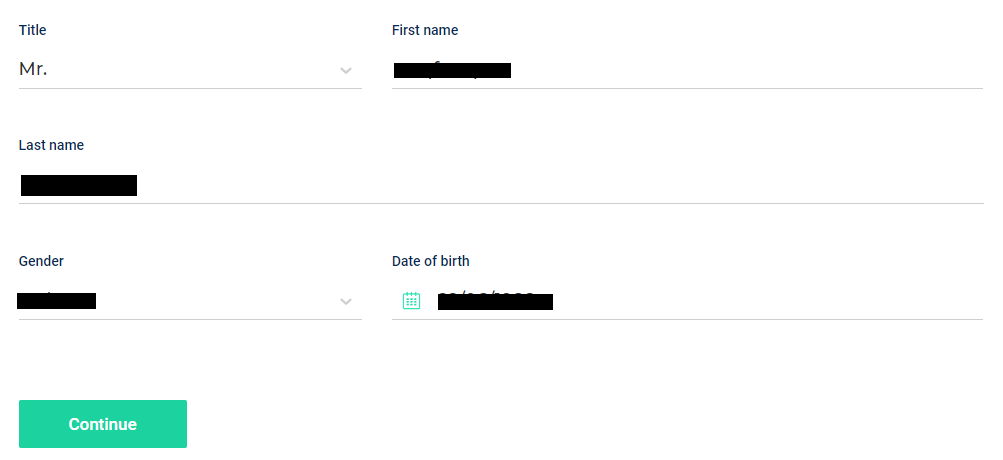

Provide detailed information about yourself such as gender, date of birth, registration address, residency, as well as tax and finance details.

Enter details about your bank and the account (this can be done later).

Share information about your trading experience by answering a few questions. Click "Continue".

Familiarize yourself with the broker's warnings and recommendations. Check the boxes in each field and click "Continue".

In the final registration stage, a verification code will be sent to your phone. Enter it in the corresponding field. You will then gain access to the user account, where you can fund your account.

You can download any of the supported trading platforms, e.g., MetaTrader 4, from the respective feature's website. Install it on your device, enter the registration details, and start trading.

Your Tier1FX user account also provides access to:

-

The dashboard that allows the trader to monitor the status of active accounts, and receive details and reports.

-

The ability for traders to open and close live accounts (only one demo account is available).

-

Options for depositing funds into the account balance, and conducting internal transactions are available.

-

The ability for traders to submit a request to withdraw profits at any time.

-

A section where personal data can be adjusted, and security settings can be configured.

-

The technical support for a trader via all channels, including live chat (only on weekdays).

Regulation and Safety

Unfortunately, there are quite a few scammers in the market, and to avoid falling victim to one of the infamous Forex bucket shops, it's essential to verify the broker. First, it should be registered, indicating its official status. Second, the broker needs regulation, which signifies its transparency and provides clients with legal protection. Tier1FX is registered in Malta and regulated at the local level, with the Maltese MFSA (Malta Financial Services Authority) being recognized as one of the primary regulators in the European Union. Therefore, traders can have confidence in this company.

Advantages

- Broker has been operating for more than 10 years

- Registered in Malta

- Regulated by MFSA

Disadvantages

- Outside the E.U., traders do not receive regional-level protection.

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Main | From $2, and commission is $2.75 per lot | $20 |

Withdrawals and deposits are only possible through bank transfers. The withdrawal fee is fixed at $20. While this is a relatively high figure, there are many reputable brokers with a similar withdrawal fee. In this case, what matters more is that the platform operates 100% transparently. This means the trader always knows exactly how much commission they need to pay for each transaction.

As for the average trading costs, the table below provides data for Tier1FX and two leading competitors. This allows for the evaluation of how favorable the broker's offer is.

| Broker | Average commission | Level |

|---|---|---|

|

$2 | |

|

$1 | |

|

$8.5 |

Account Types

Choosing from several trading account types can be a challenging task. Therefore, many platforms simplify the process by offering clients one account type with universal trading conditions. Tier1FX adheres to this approach. However, the choice of the trading platform is a separate matter. Traders can work with MT4, JFOREX, or FORTEX 6, each with its characteristics. Experts recommend trying all three options before deciding, as they are all free. As for alternative methods of earning, there are plenty of them, allowing everyone to find a suitable option. For instance, a trader can become a manager of a joint account (MAM).

Account types:

If a trader has never worked with the broker before, it makes sense to start with a demo account. This allows for exploring the platform and experimenting with trading strategies without financial risks. If everything suits the user, they can then transition to a live account and engage in full-fledged trading.

Deposit and Withdrawal

-

If a trader is using a demo account, they are using virtual money and do not earn real profits.

-

When transitioning to a live account, the broker's client starts making full-fledged trades and earns profits in case of success.

-

Profits from the account balance can be withdrawn at any time, either in full or partially.

-

Currently, there is only one withdrawal method available – bank transfers.

-

The broker charges a withdrawal fee from the trader, which amounts to $20 (or its equivalent in another currency).

-

Additionally, the trader's bank, the third participant in the transaction, often imposes its fee.

-

Withdrawal of funds usually takes up to 1 business day, but in some cases, the timeframe may be extended.

Investment Options

Despite traders primarily joining brokerage platforms for active trading, alternative earning options can be of interest to many users. Tier1FX does not offer a copy trading service, although this investment solution is currently quite popular. Instead, the platform provides joint accounts, segregated funds, and a referral program.

Joint MAM accounts

Traders can open such an account and become a manager or join an already opened account as an investor. The manager executes trades using both his capital and investors’ funds. Investors can set limits, for example, when the manager invests $500, only $200 is deducted from the investor's account. In the case of a successful trade, everyone profits based on their contribution, and the manager charges a small commission from each investor. If the trade is unsuccessful, everyone loses their funds.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Referral program

The broker offers several collaboration models for individuals and legal entities. Regular traders can earn by inviting new clients. For each client who registers a live account and starts trading, the broker's partner receives a monetary bonus.

Customer Support

Why can't I fund my account with an electronic transfer? What types of orders can I open when using the MT4 platform? Why was my trade forcefully closed? Some questions from traders arise from their lack of competence or inattention. However, users often encounter atypical situations and issues with trading, deposits, or withdrawals. In any case, when a Tier1FX client has a question, they can reach out to client support. The client support operates 24 hours, but it is unavailable on Saturdays and Sundays. Managers can be contacted by phone, email, submitting a ticket on the website, or live chat.

Advantages

- Eight communication channels are available

- Managers are available day and night on weekdays

- User reviews of client support are mostly positive

Disadvantages

- On weekends, the broker's clients cannot receive qualified assistance

It doesn't matter whether you are a company client or not because even unregistered users can contact client support.

Here are the current contact methods:

-

Phone;

-

Email;

-

Ticket on the page;

-

Live chat on the website.

It is recommended to subscribe to the broker's newsletter or periodically check the "News" section on the website. This is necessary to stay informed about the latest platform changes.

Contacts

| Registration address | Nu Bis Centre Mosta Road, Lija LJA9012 Malta |

|---|---|

| Regulation | MFSA |

| Official site | https://www.tier1fx.com/ |

| Contacts |

+356 23 27 3000, +356 23 27 3999

|

Education

Often traders who have no experience in trading come to brokers. That is why some platforms offer training materials such as e-books, video lectures, podcasts, and full-fledged courses. But Tier1FX has none of these. The broker assumes that if a user opens an account here, he knows what to do next. The company's website has only basic FAQs and comments on the peculiarities of working with the platform, no educational materials are presented.

The absence of training cannot be considered a drawback of Tier1FX that makes it inferior to competitors. After all, most brokers either lack educational resources altogether or have very limited offerings. Traders should understand that if they want to work with the platform, they need to acquire at least basic theoretical preparation elsewhere.

Comparison of Tier1FX with other Brokers

| Tier1FX | RoboForex | Pocket Option | Exness | IC Markets | FxGlory | |

| Trading platform |

FORTEX 6, MT4, JForex | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, cTrader, MT5, TradingView | MT4, MobileTrading, MT5 |

| Min deposit | $1000 | $10 | $5 | $10 | $200 | $1 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 8.00% |

| Spread | From 0.2 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 2 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 20% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of Tier1FX

Tier1FX has been in the market for over 10 years, establishing itself as a well-known brokerage firm that implements best practices and uses advanced technological infrastructure. Its microservices architecture eliminates the possibility of a global system failure, while virtual servers and top-tier liquidity providers ensure high-speed order execution. Token authentication and SSL protocols guarantee security, safeguarding user funds and data from fraudulent activities. The broker's favorable trading conditions attract a stable influx of new clients, eliminating the need for special promotions. It's worth noting the relatively high entry barrier, which filters out those who are not confident in their abilities. Thus, Tier1FX creates a community of professional traders focused on results.

Tier1FX by the numbers:

-

The minimum deposit is $1000.

-

There are 100+ instruments from 5 different groups available.

-

The maximum leverage is 1:200.

-

The minimum spread is 0.2 pips.

-

The withdrawal fee is $20.

Tier1FX is a broker for active trading and investing

The platform offers an extensive pool of diverse assets, from currencies to CFDs on indices. This allows traders to implement various trading strategies, and the broker imposes no restrictions. Simultaneously, many financial instruments provide the opportunity to create a diversified investment portfolio, allowing traders to remain profitable even when one asset declines due to unforeseen trend changes. In addition to active trading on financial markets, Tier1FX offers joint accounts and segregated funds that can provide clients with stable passive income. The partner program can also be lucrative for both individuals and legal entities. An additional advantage is that partnership conditions are individually negotiated.

Tier1FX’s analytical services:

-

MAM accounts. Joint accounts of the MAM type allow for passive income on investor positions (with managers earning additional commissions).

-

Partnership options. The broker offers several collaboration models for both individuals and legal entities, including unique comprehensive automatic mechanisms for asset management and trade tracking.

Advantages:

The broker provides transparent collaboration with all fees known in advance.

One live account with optimal trading conditions (low fees, moderate leverage).

Extensive pool of diverse assets with no restrictions on trading strategies.

Several options for passive income and individual partnership conditions.

24/5 technical support providing competent consultations.

User Satisfaction