BlackBull Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- MT4

- MT5

- WebTrader

- TradingView

- BlackBull Trade

- BlackBull Shares

- FSA

- FMA

- 2014

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- MT4

- MT5

- WebTrader

- TradingView

- BlackBull Trade

- BlackBull Shares

- FSA

- FMA

- 2014

Our Evaluation of BlackBull Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

BlackBull Markets is a moderate-risk broker with the TU Overall Score of 5.36 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by BlackBull Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

BlackBull Markets objectively provides favorable trading conditions, including thousands of assets, tight spreads, low trading commissions, moderate leverage, and multiple account options. Key advantages include a low entry threshold (no minimum deposit requirement for the Standard account) and comprehensive education for beginners. Traders can choose from five trading platforms, including Black Bull’s proprietary solution. The broker imposes no restrictions on trading, which allows scalping, hedging, and the use of expert advisors. Passive earning options are also available. Unfortunately, the company has regional limitations, does not offer joint accounts, and the majority of instruments are CFDs (which should be taken into account as a feature, rather than a disadvantage).

Brief Look at BlackBull Markets

BlackBull Markets provides access to the markets of currency pairs and CFDs (contracts for difference). The CFDs are grouped into the following categories: stocks, indices, commodities, agricultural commodities, metals, energies, cryptocurrencies, and futures. In total, there are over 26,000 assets. Apart from the demo account, there are three real accounts: Standard, Prime, and Institutional. They differ in terms of the minimum deposit, spreads, and commissions. The Standard account has no minimum deposit requirements, while the others require $2,000 and $20,000, respectively. Spreads start from 0.8, 0.1, or 0 pips depending on the account. The commissions range from $0, $4, or $6 per lot, depending on the account selected by the trader. The maximum leverage is 1:500. Clients of the company can trade through platforms like MT4, MT5, WebTrader, and TradingView, as well as this broker's solutions such as BlackBull Trade for currency and CFD trading, and BlackBull Shares for copy trading. The company offers partnership opportunities through “Refer a Friend” and its IB (Introducing Broker) programs. The website provides educational materials for traders of different levels and offers analytical tools.

- It offers a free demo account and a substantial volume of educational materials.

- Three real account types allow traders to customize their offerings, providing immediate access to the entire pool of currency pairs and CFDs.

- Spreads are below market average, and trading commissions are favorable.

- The broker offers leverage to enhance profitability and provides news and analytics to facilitate traders' forecasting.

- A wide selection of trading platforms allows users to find optimal trading conditions and work comfortably on any device.

- The broker provides three options for its partnership program, along with the “Refer a Friend” promotion and copy trading service for additional earnings.

- Various deposit and withdrawal methods are available, including bank cards, transfers, and international systems like Skrill and Neteller.

- While this broker offers a considerable number of assets, it has only 70 currency pairs, while other trading instruments are represented as CFDs.

- BlackBull Markets does not serve traders from certain regions worldwide.

- The platform does not offer MAM or PAMM joint accounts, and the “Refer a Friend” program may not be the most advantageous, while the IB partnership is primarily aimed at legal entities.

TU Expert Advice

Financial expert and analyst at Traders Union

BlackBull Markets is the trading name of BBG Ltd, founded in Auckland, New Zealand, in 2014. The company is registered in Seychelles and operates under local regulations with a confirmed license. There have been no confirmed instances of non-performance of obligations towards clients, and the platform has never been hacked. It operates transparently within the framework of the applicable legislation.

The broker offers three real accounts, with spreads starting from 0 pips, and there is no trading commission on the Standard account. On accounts where a commission is present, it does not exceed the average market rate. Thus, the trader's costs are average or below average. As for withdrawal fees, BlackBull Markets has fixed fees of 5 units of the base currency, regardless of the withdrawal method. For large transactions, this is an advantage, but it is not advantageous for withdrawing small amounts.

The minimum lot size is 0.01, and the maximum leverage is 1:500. In terms of these indicators, BlackBull Markets is on par with top competitors. Copy trading and partnership programs are available. However, there are no joint accounts, which some traders perceive as a disadvantage. On the other hand, a definite advantage is an opportunity for BlackBull Markets clients to trade through the most popular platforms, including MT4/5, WebTrader, and TradingView. Additionally, this broker offers its proprietary trading platform.

Testing did not reveal any bugs or weaknesses. It appears that the company uses advanced technological solutions, ensuring high speed and reliability by modern standards. This also applies to technical support, which operates without interruptions, even during nights and weekends. Therefore, there are no complaints regarding the client service provided by this broker.

The educational resources are good, the analytics are standard, and there are no unique tools. An important feature of BlackBull Markets is the vast number of assets available for trading. However, almost all of them are contracts for difference (CFDs) based on stocks, indices, cryptocurrencies, metals, commodities, agricultural commodities, energies, and futures. In addition to CFDs, there are 70 currency pairs available.

- You value a wide range of tradable assets. BlackBull Markets offers access to over 17,000 assets, including forex, CFDs on shares, metals, energies, indices, and cryptocurrencies, providing a diverse selection for trading.

- You prefer ECN (Electronic Communication Network) execution. BlackBull Markets primarily operates as an ECN broker, offering direct access to market liquidity and potentially tighter spreads, which can be advantageous for certain trading strategies.

- You require extensive educational materials and hand-holding. BlackBull Markets' educational resources are moderate, and personalized support might be limited. If in-depth educational materials and extensive support are crucial for your trading journey, you might need to explore brokers with more comprehensive educational offerings.

- You prioritize traditional account types. BlackBull Markets primarily offers Standard and ECN accounts, which might not cater to specific needs like IRAs or managed accounts

BlackBull Markets Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4, MT5, WebTrader, TradingView, BlackBull Trade, and BlackBull Shares |

|---|---|

| 📊 Accounts: | Standard, Prime, and Institutional |

| 💰 Account currency: | USD, EUR, GBP, AUD, NZD, SGD, CAD, and JPY |

| 💵 Replenishment / Withdrawal: | Bank transfer, Visa, MasterCard, Union Pay, Neteller, Skrill, and FasaPay |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating, from 0 pips |

| 🔧 Instruments: | The available instruments are currency pairs, CFDs on stocks, indices, commodities and agricultural commodities, metals, energies, cryptocurrencies, and futures. |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Low entry threshold, several accounts to choose from, all popular platforms plus this broker's trading platform with integrated transaction copying service, and low trading costs |

| 🎁 Contests and bonuses: | Yes, including rebates from TU |

Usually, if a broker offers multiple account types, the minimum deposit depends on the selected account. In this case, the pattern holds: there are no minimum deposit requirements for the Standard account; it is $2,000 for the Prime account; and it is $20,000 for the Institutional account. Leverage is not dependent on the chosen account; it is determined by the asset type. The highest trading leverage is provided for currency pairs, at 1:500. You can trade with lower leverage or without it altogether. Also, this broker does not impose any restrictions. As for client support, it is available through a call center, email, and LiveChat. All communication channels operate 24/7.

BlackBull Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

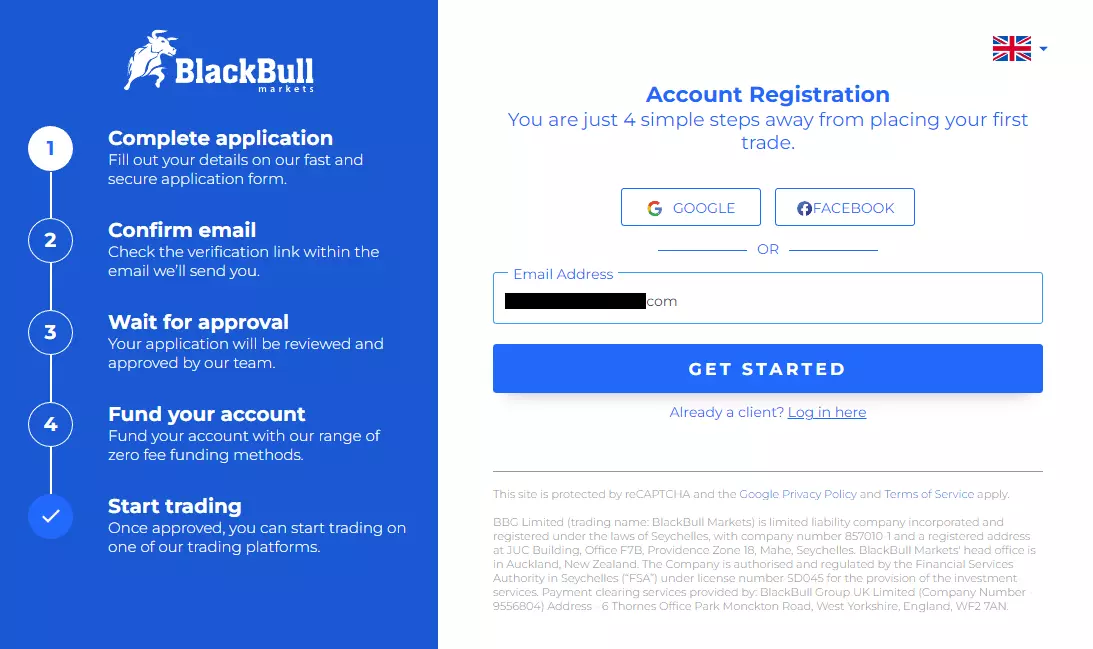

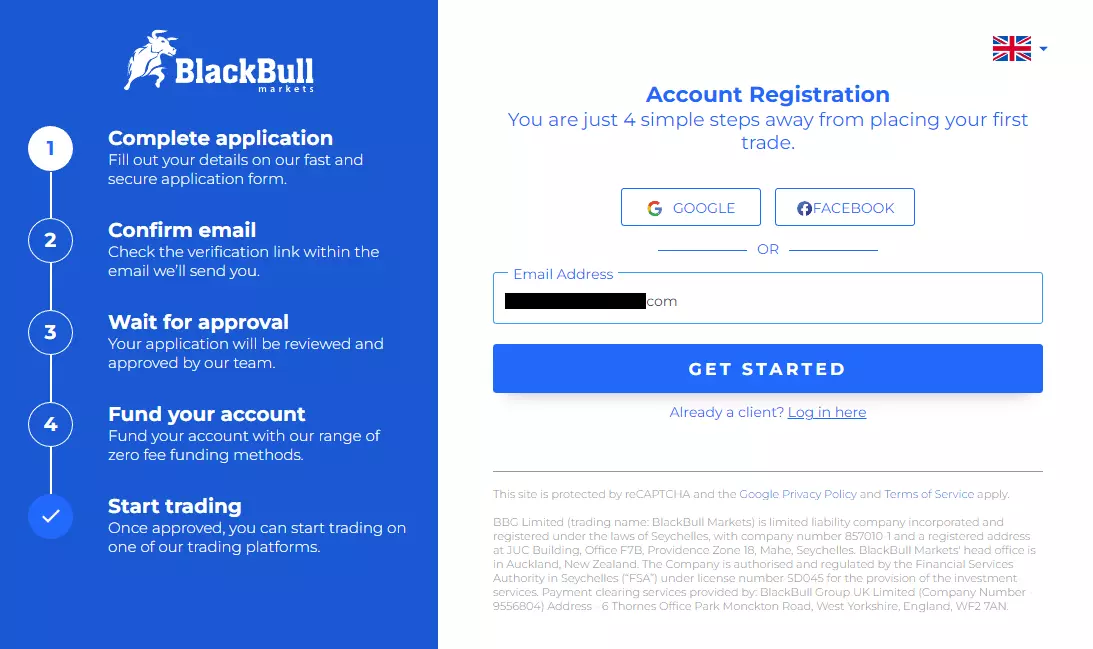

To start collaborating with this broker, register on its official website, complete the verification process, and open a real account. After that, download the appropriate trading platform. Experts at TU have prepared a guide that will help you to complete the registration and inform you of the features of the BlackBull Markets user account.

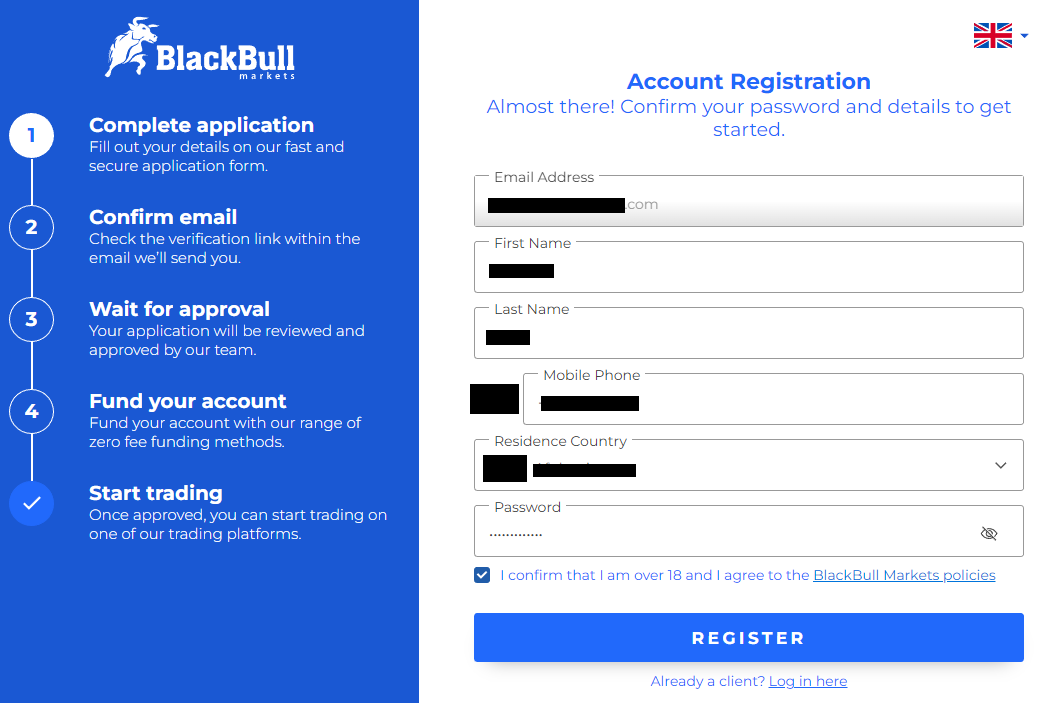

Go to this broker's website. In the upper right corner, select your preferred language. Click on the “Join Now” button.

You can log in through your Google or Facebook account. Otherwise, enter your email address.

Enter your first name, last name, and your country of residence. Provide your phone number and create a password. Check the box confirming that you are at least 18 years old. Click on “Register”.

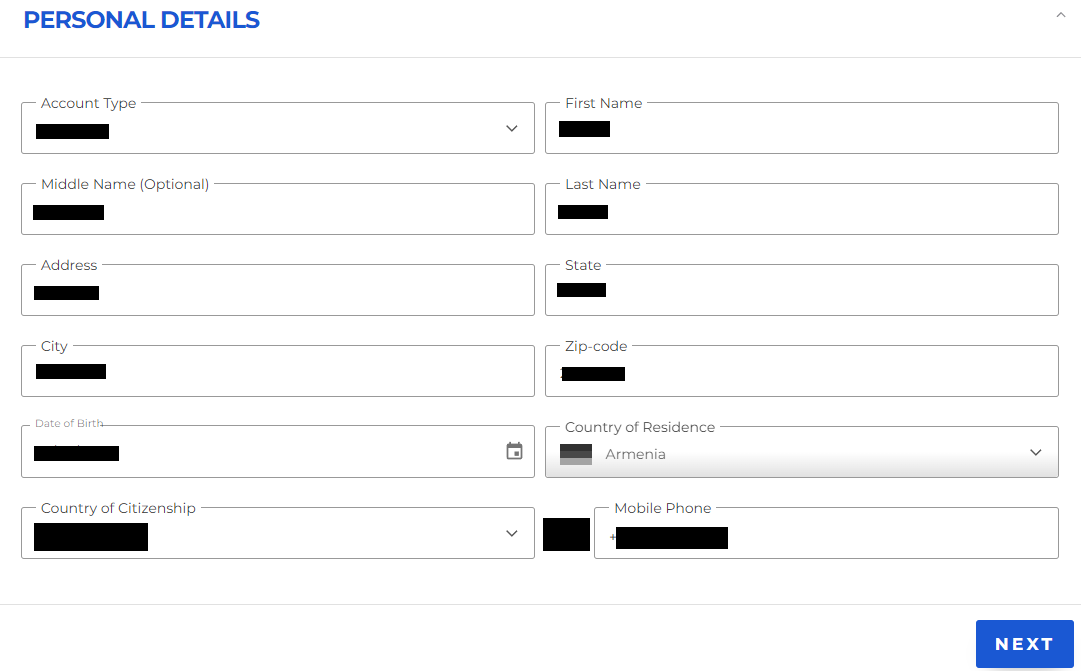

Enter your date of birth and complete address. Click on ‘Next”.

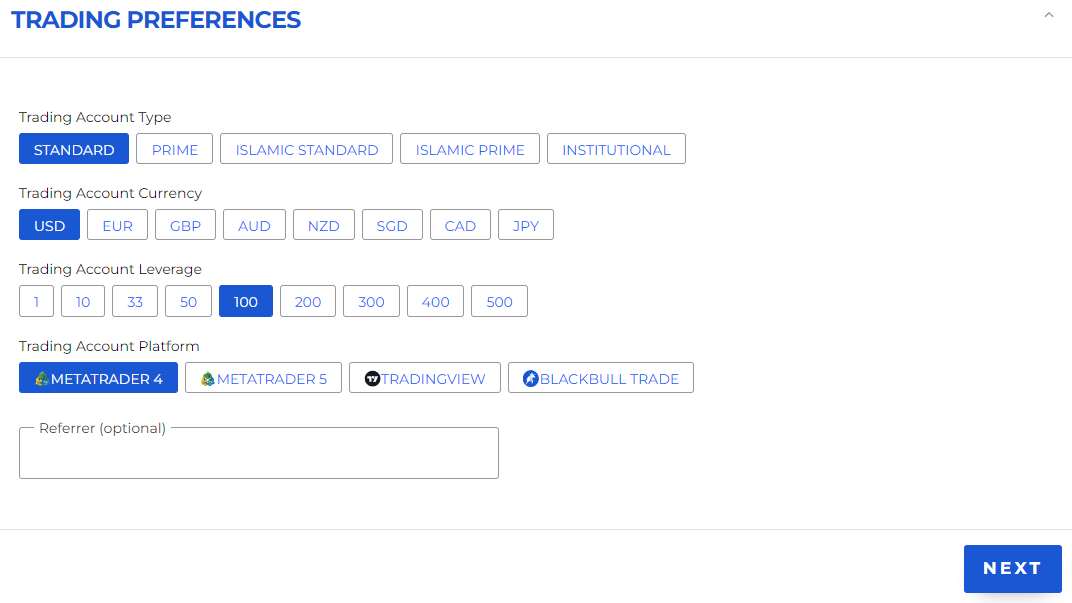

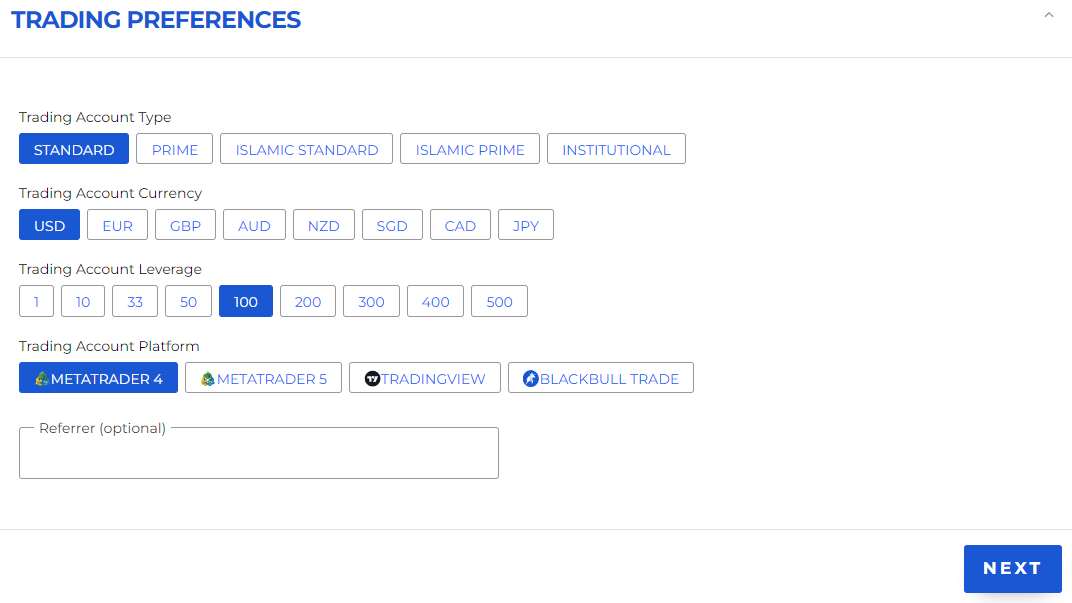

Choose the account type, base currency, leverage, and trading platform. Enter a referral code if you have one. Click on “Next”.

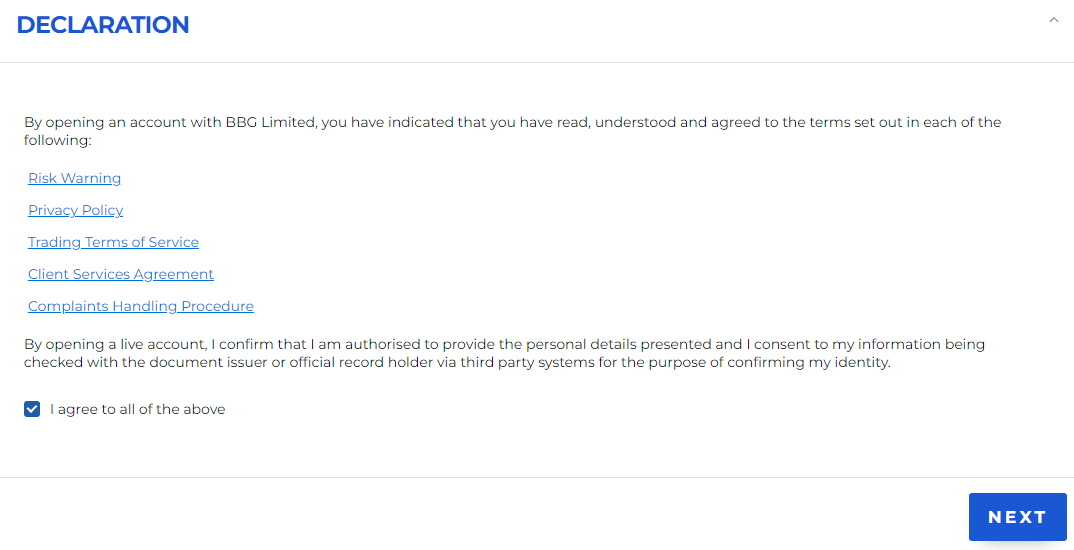

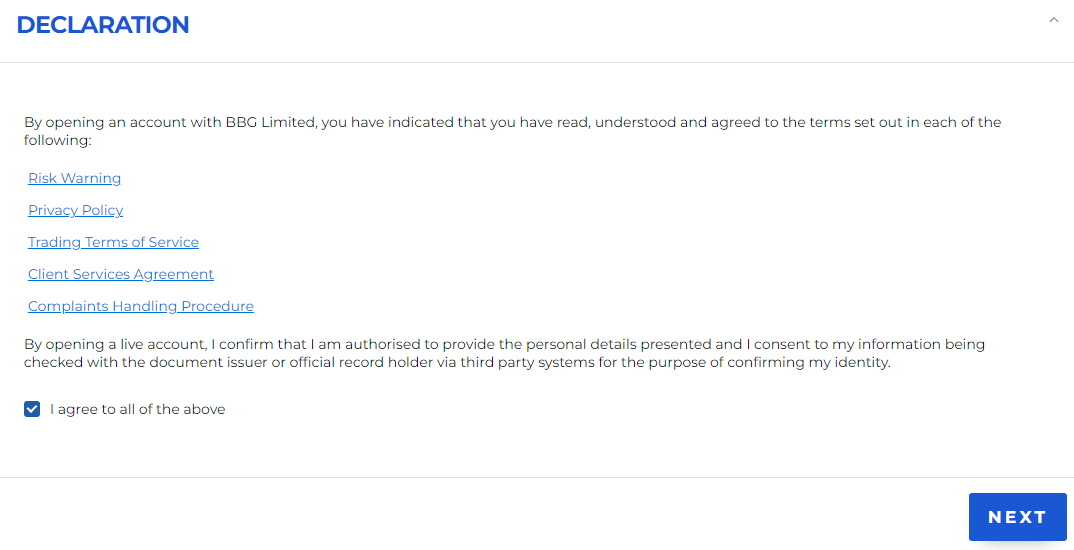

Answer a few questions. Read and agree to the terms and conditions by checking the box. Click on “Next”.

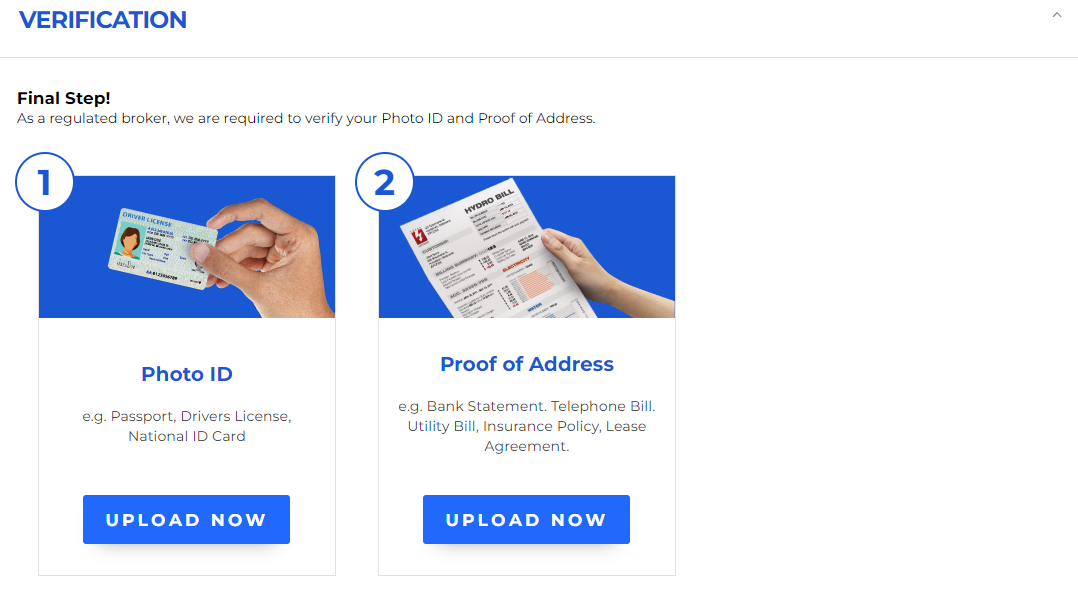

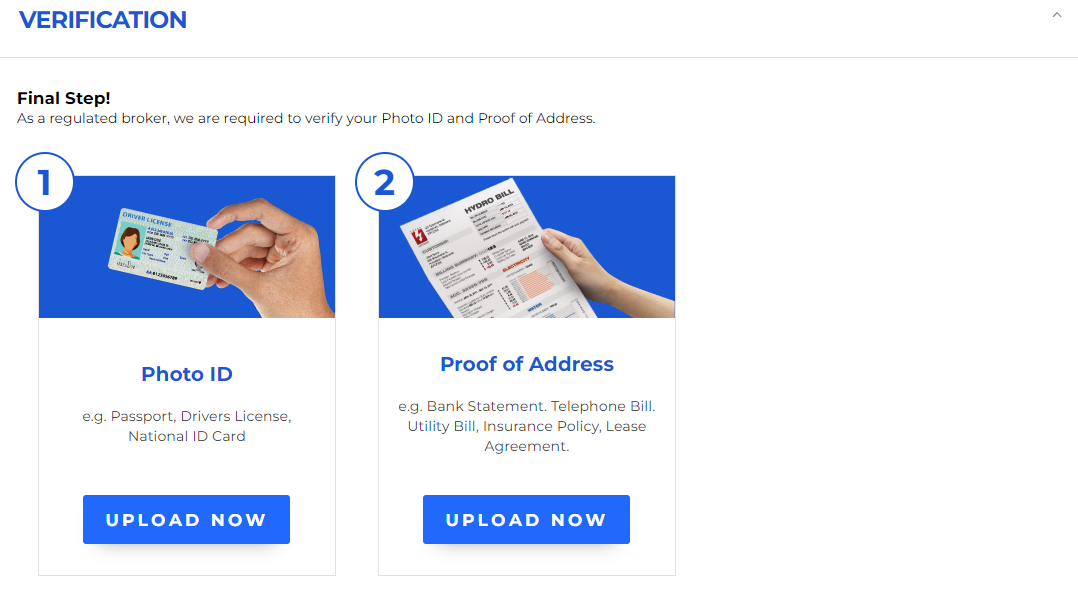

Select the document type you want to use for verification. Upload a scan/photo following the on-screen instructions. Click on “Next”. Data verification may take several days.

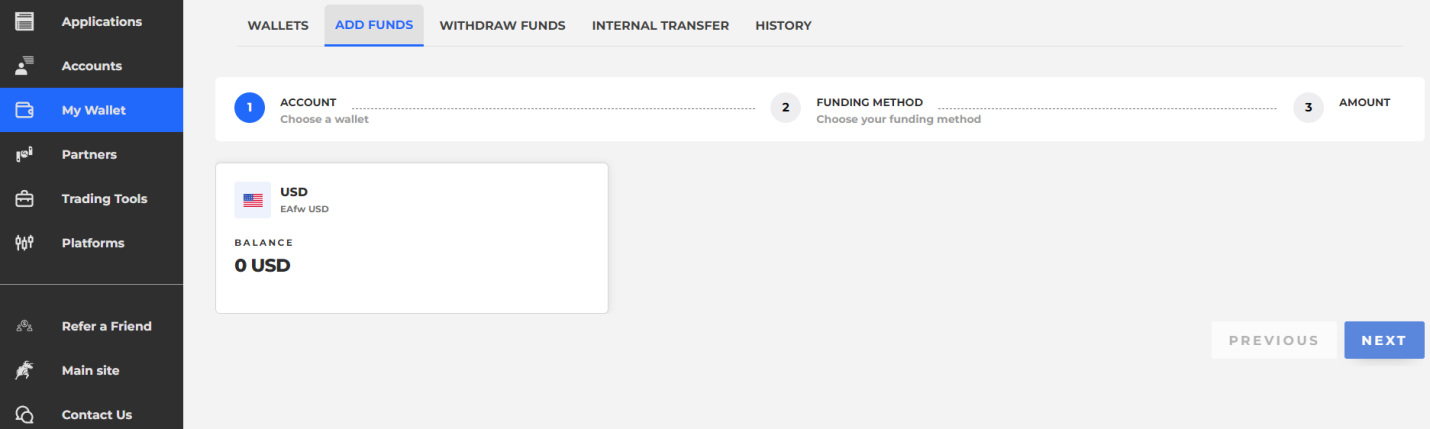

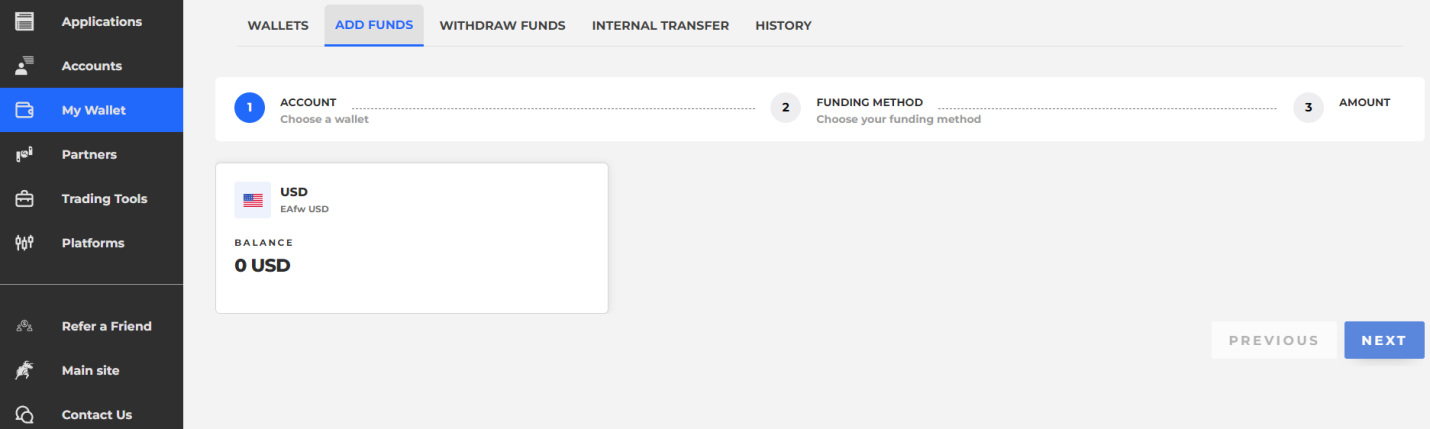

Go to the “My Wallet” menu. Choose the preferred deposit method and complete the transfer following the on-screen instructions. In the "Platforms" section, download the distribution of the suitable trading platform. Start trading.

Your BlackBull Markets user account also provides access to:

A place where traders can open/close real accounts, as well as open a demo account.

Deposits, withdrawals, and internal transfers are carried out through the respective options.

A place where traders can view detailed information about their accounts and transaction reports.

A separate section dedicated to the partner program (additional registration is required).

The "Refer a Friend" menu that pertains to the corresponding promotion, where traders can see their referrals.

Analytical tools, including Autochartist.

The copy trading service that is integrated into the user account, with no additional login required.

Traders can download distributions of supported trading platforms.

The “Contact Us” menu which provides all the communication channels to client support.

Regulation and safety

If a brokerage company is not officially registered, its activities are illegal, and it can be considered to be fraudulent. However, registration alone is not enough; regulation is also necessary, which involves oversight by a competent international agency. The BlackBull Markets broker is registered in Seychelles, and its activities are monitored by the FSA (Financial Services Authority, SD045 ). In the event of a conflict, FSA experts will seek to ensure that this broker fulfills its obligations to traders.

Where can you go for help?

- You may contact BlackBull Markets’ client support

- You may contact the FSA regulator

- Contact Traders Union’s legal department for free consultation and representation. It protects its members’ rights without charge.

There is no point in contacting

- Financial regulatory bodies outside Seychelles

- Regulators that do not oversee this broker's operations

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| ECN Standard | From $8 pips, floating, and without commission | 5 units of the account's base currency |

| ECN Prime | From $1 pips, floating, and commission is $6 per lot | 5 units of the account's base currency |

| ECN Institutional | From 0 pips, floating, and commission is $4 per lot | 5 units of the account's base currency |

As you can see, the Institutional account has the lowest costs, but it has a higher entry requirement. It is easier to start with the Standard account, where the spreads are below the market average, and there is no commission. As for the withdrawal fee, it always amounts to 5 units of the account's base currency, regardless of the withdrawal channel. This is a moderate fee, but some brokers do not charge any withdrawal fees. The table below shows the average trading fee data for BlackBull Markets and two of its leading competitors.

| Broker | Average commission | Level |

|---|---|---|

|

$6.33 | |

|

$1 | |

|

$8.5 |

Account types

A trader needs to choose an account that meets his needs. The Standard account, according to this broker's statement, is designed for beginners. Therefore, there is no minimum deposit or trading commission (but the spreads are the highest). The Prime account is optimal for players with average experience. It requires a significant minimum deposit but offers lower spreads, and there is also a trading commission at the average market level. On the Institutional account, the spread is the lowest, and the commission is lower than that of most of its competitors. However, the minimum deposit is extremely high. The minimum lot size and leverage are the same for all account types. The broker does not impose any trading restrictions, so scalping, hedging, and the use of advisors are allowed. Therefore, when choosing, the new client should rely solely on his experience and available budget.

Account types:

It is advisable to start by opening a demo account to familiarize yourself with the platform's conditions and then transition to a real ECN account. Among other things, a demo account is used to practice trading strategies without the risk of financial losses because trading on it is conducted using virtual currency.

Deposit and Withdrawal

-

At any time, traders can submit a withdrawal request through their user account on the website.

-

The following methods can be used for withdrawals: bank transfer, Visa, and MasterCard cards, Union Pay, Neteller, Skrill, and FasaPay.

-

Regardless of the chosen method, a commission of 5 units of the account's base currency applies.

-

The commission amount is not affected by the volume of funds being withdrawn or other factors.

-

Please note that third parties involved in the withdrawal process may charge their fees.

-

The broker processes withdrawal requests within 24 hours, and funds typically arrive within 3-5 days.

Investment Options

Investment solutions are rarely an end goal for traders because most come to brokerage platforms to trade independently. However, joint accounts and copy trading services have gained significant popularity in recent years. Their advantage is that if the signals provider is a verified and experienced player, investors can earn a stable passive income, which can be quite substantial. Additionally, copy trading provides a unique experience that is invaluable for novice traders. As for partnership programs, they target socially active market participants because to invite many users to the platform and receive bonuses for it, one needs to engage proactively and constantly on the internet. BlackBull Markets offers three sources of additional passive income.

BlackBull CopyTrader.

The proprietary Lead and Follow service is integrated with this broker's application and the MT4 trading platform. A trader can register as a signals provider or an investor. As a signals provider, the trader trades as usual and broadcasts his trades to interested users. Investors connect to the signals providers and replicate their trading decisions. The copying process can be customized, for example, by reducing the position size. In the case of a successful trade, everyone earns a profit proportional to their positions, and the provider charges a small commission for his services from the investors. If the trade is unsuccessful, everyone loses their trade.

“Refer a Friend”.

Traders can invite any number of users to the platform. When a user meets the deposit and trading volume requirements, both the user and the inviting trader receive a bonus payout. There are two payout options. If the new client deposits at least $1,000 and trades a minimum of 5 lots within 90 days, both parties receive $100. If the initial deposit is at least $10,000, and the invited trader trades more than 20 lots within 3 months, the bonus amount is $250. Each broker's client can receive only one bonus per referred user, but there is no limit on the number of referrals. The program seems lucrative but requires significant time and effort to earn substantial rewards.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

IB affiliate program.

Individuals or legal entities can register on the platform as Introducing Brokers (IBs). In essence, the task here is the same as in the “Refer a Friend” program, which is to bring new users to the platform. The broker provides promotional materials and special mechanisms that can be integrated into other online platforms for this purpose. There are three partnership options: registration-based reward, conversion-based reward, and promotion-based reward. The first option is suitable for content creators, the second is for socially active professionals, and the third targets those who want to have (or already have) a full-fledged trading business.

Customer support

Regardless of their experience, every trader occasionally encounters complex situations during trading or related processes. The broker’s clients need to receive prompt and competent assistance. If the support team takes a long time to respond or lacks sufficient competence, traders may become disappointed and switch to a competitor. In the case of BlackBull Markets, such an outcome is practically impossible. The platform's support is highly valued by clients and experts. It operates 24/7, including on Saturdays and Sundays. Specialists can be contacted by phone, email, or LiveChat.

Advantages

- You can call or write to client support

- The time of day does not matter

- Managers respond in multiple languages

Disadvantages

- During peak hours, the response may not be as prompt

If you are already trading with this broker or considering starting a collaboration and have a question, you may contact client support using the following channels:

-

Call center;

-

Email;

-

LiveChat on the website and in the user account.

You can also visit the office in Seychelles. Please note that it operates on weekdays only, from 10:00 to 23:00 local time. The company has its profiles on the following social platforms: LinkedIn, Twitter, Facebook, Instagram, and YouTube. You can also contact support there.

Contacts

Education

For a trader to achieve consistent success in trading, it is necessary to read specialized literature, communicate with colleagues and experts, and attend relevant webinars. Many brokers strive to assist their clients by offering their educational systems. On some platforms, these systems may be limited to trader glossaries and basic FAQs, while others provide comprehensive educational courses. On the BlackBull Markets website, there is no structured education system, but there are articles on various topics, market reviews, platform overviews, and current analytics.

Novice traders will find a lot of useful information in the “Education” section. However, there are fewer useful materials available for experienced players. Also, regular webinars are recommended for everyone, as they provide valuable and up-to-date information.

Comparison of BlackBull Markets with other Brokers

| BlackBull Markets | RoboForex | Pocket Option | Exness | FxPro | InstaForex | |

| Trading platform |

BlackBull Shares, BlackBull Trade, MT4, MT5, TradingView, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $200 | $10 | $5 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

70% / 50% | 60% / 40% | 30% / 50% | No / 60% | 25% / 20% | 30% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of BlackBull Markets

The broker provides free virtual dedicated servers to clients who meet certain criteria. Under standard conditions, NYC and BeeksFX servers are used, while individual parameters are available for Institutional accounts. Special attention is given to stocks, and for trading CFDs on stocks, this broker offers its solution called BlackBull Shares, as well as the BlackBull Research service with professional analytics. Clients can use this service for free for three months. The platform even offers ready-made portfolio templates that experts have been tracking since 2015.

BlackBull Markets by the numbers:

-

The minimum deposit is $0.

-

There are over 26,000 financial instruments.

-

The minimum spread is 0 pips.

-

The maximum leverage is 1:500.

-

Technical support is available 24/7.

BlackBull Markets is a Forex and CFD broker for traders of all levels

Most traders primarily consider this broker's asset pool. This is indeed important because the more trading instruments available and the more diverse they are, the wider the client's possibilities are to diversify his portfolio. Clients can use any strategy, including experimental ones. Moreover, if assets are represented in different groups, it allows for successful risk diversification. However, there is one nuisance: this broker should not impose trading restrictions. For BlackBull Markets clients, there are no limitations, and the number of available assets is sufficient to trade in comfortable conditions, successfully minimizing the probability of financial losses. Traders can work with currency pairs and CFDs on 8 groups of assets.

BlackBull Markets’ analytical services:

-

Lead and Follow. This trade copying system allows signals providers to earn commissions, while investors receive passive income and unique experience.

-

BlackBull Research. The platform's experts analyze the stock market daily. The result of a comprehensive analytical approach is well-developed forecasts for quotations.

-

Economic calendar. This is a basic analytical tool that no trader can do without. The calendar displays all the most important economic and political events capable of influencing the value of various assets.

Advantages:

The broker offers comfortable conditions for beginners such as no minimum deposit requirements on the Standard account, tight spreads, a wide range of assets, and additional earning options, including passive income.

Experienced market participants receive high leverage, and low trading costs, and can choose from five trading platforms, including this broker's own platform.

BlackBull Markets provides access to over 26,000 trading instruments, including the most popular currency pairs and CFDs on stocks, cryptocurrencies, and other asset types.

The educational system of the platform includes several levels, and even professionals can find something useful here, especially in regular webinars.

Technical support is available through all major communication channels like a call center, email, and LiveChat. Plus, specialists work 24/7.

User Satisfaction