Blueberry Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT4

- MT5

- WebTrader

- ASIC

- VFSC

- 2018

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT4

- MT5

- WebTrader

- ASIC

- VFSC

- 2018

Our Evaluation of Blueberry Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Blueberry Markets is a moderate-risk broker with the TU Overall Score of 5.72 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Blueberry Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Blueberry Markets is a regulated Forex and CFD broker that provides services worldwide. It is suitable for active traders and passive investors, as it allows the usage of a variety of trading strategies.

Brief Look at Blueberry Markets

The international Forex broker Blueberry Markets has been offering access to the financial and currency markets since 2016. It has representative offices in Australia and Vanuatu that operate under the control of ASIC (Australian Securities and Investments Commission, ABN: 49 167 260 504) and VFSC (Vanuatu Financial Services Commission, 012868). With this brokerage company, you can trade more than 300 assets including currency pairs and CFDs, join copy trading platforms, and invest in MAM accounts. Blueberry Markets offers advanced analytics, three levels of training, and a free VPS server. In 2020 and 2021, the company has been a finalist for the Best Online Client Service Award, established by the Finder website with over 1 million users.

- Regulation in two jurisdictions and availability of ASIC and VFSC licenses;

- A wide range of financial instruments to which you can attach short and long positions;

- Availability of MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, as well as access to DupliTrade;

- Possibility to trade with minimal spreads on accounts with a fee per lot;

- Free forecasts for Forex and the most popular types of CFDs;

- Leverage is up to 1:500;

- No ban on the use of different trading techniques, copying transactions, or involvement of counselors.

- The minimum deposit is $100;

- The broker does not have standard bonus offers;

- Cent accounts are not available to its clients.

TU Expert Advice

Financial expert and analyst at Traders Union

The broker Blueberry Markets offers market execution. At the same time, all orders are executed in the GTC (Good Till Canceled) mode, that is, they remain open until they are canceled by the trader. Thus, the result of the transaction always depends on a decision by the client, not the company. The exception is the positions closed by Blueberry Markets due to insufficient capital.

Non-Australian clients are allowed to hedge and scalp. Moreover, the broker does not hold margins for hedged positions. ASIC bans hedging and the involvement of counselors that work on this strategy, so they cannot be used by traders in Australia. There are exceptions to this rule: Australian wholesale investors with the Blueberry Pro qualification can engage in hedge trading.

Many payment services are available for depositing and withdrawing funds, including cryptocurrencies. However, the company withdraws profits using the same method that the client used to fund the trading account. If the money was credited in several ways, then the trader will receive his profit on a Visa or MasterCard. Blueberry Markets employs the legal requirements imposed by KYC (Know Your Client/Customer) rules on fintech (financial technology) firms and brokers, so identity verification is mandatory. Also, the transfer of funds to and from third parties is strictly prohibited.

Blueberry Markets Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4, МТ5, WebTrader |

|---|---|

| 📊 Accounts: | Demo, Blueberry Standard account, Blueberry Direct account |

| 💰 Account currency: | USD, EUR, GBP, AUD, NZD, SGD, CAD |

| 💵 Replenishment / Withdrawal: | Bank Wire, credit cards Visa and MasterCard, Neteller, Perfect Money, Skrill, China UnionPay, Dragonpay, FASA, PayTrust, STICPAY, THB QR Payment, Cryptocurrency, Poli (deposits only) |

| 🚀 Minimum deposit: | 100 USD |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 0.0 pips (direct account), from 1 pips (standard account) |

| 🔧 Instruments: | Forex, CFDs (commodities, cryptocurrencies, stock, indices) |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | 5-7 different liquidity providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Dynamic leverage; Trading limitations for Australian users; Advisers on all trading platforms. |

| 🎁 Contests and bonuses: | 20% deposit bonus (occasionally) |

To start trading with Blueberry Markets, you need to fund your live account balance with at least $100. However, if a trader uses the China UnionPay payment system, he is not allowed to fund less than $300. Blueberry Markets provides access to trading by means of over 300 financial instruments in MetaTrader terminals. Transactions with cryptocurrencies can only be made on weekdays. The broker can block an account with a balance of less than $50 if there is no trading activity within a month.

Blueberry Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

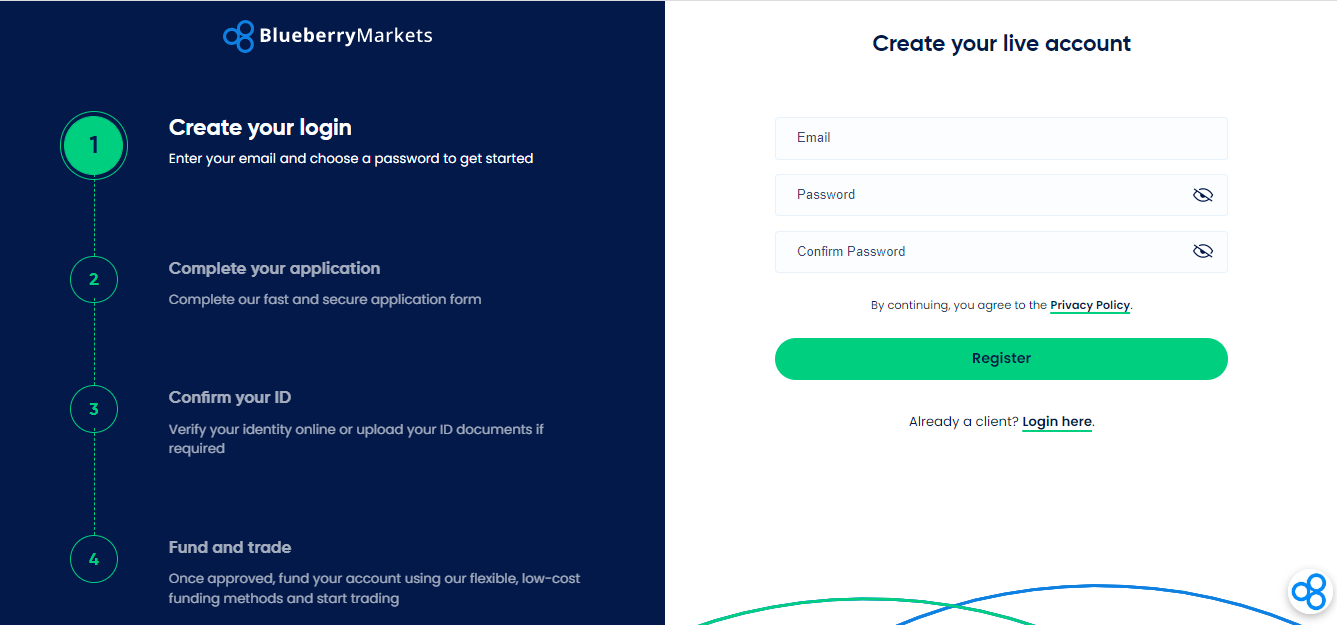

Later, the Traders Union will discuss how to create an account on the Blueberry Markets website and how to receive TU rebates on spreads. Below is the brief instruction:

First, register on the Traders Union website, then go to the Blueberry Markets profile and click the “Open an Account” button at the top of the page. In the next open box enter your email address and a secure password to protect your account.

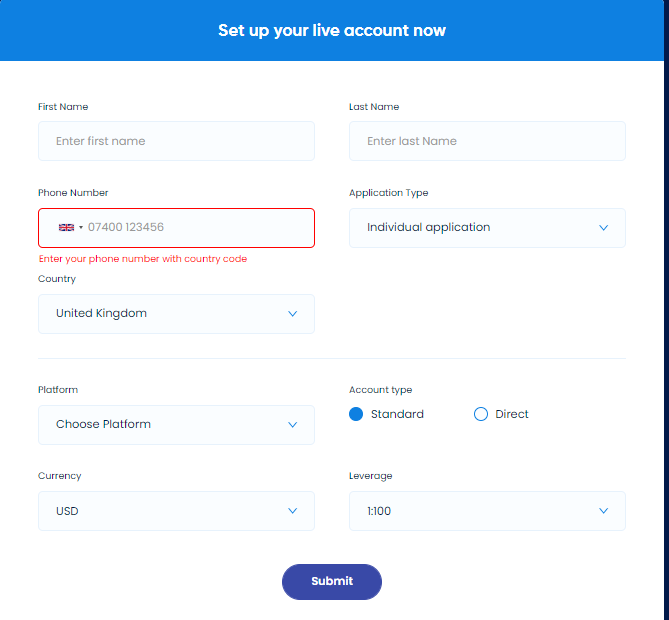

Then you can open a trading account. To do this, enter your first name, last name, phone number, and indicate an individual type of account. You also need to select a trading platform, leverage, account type, and currency.

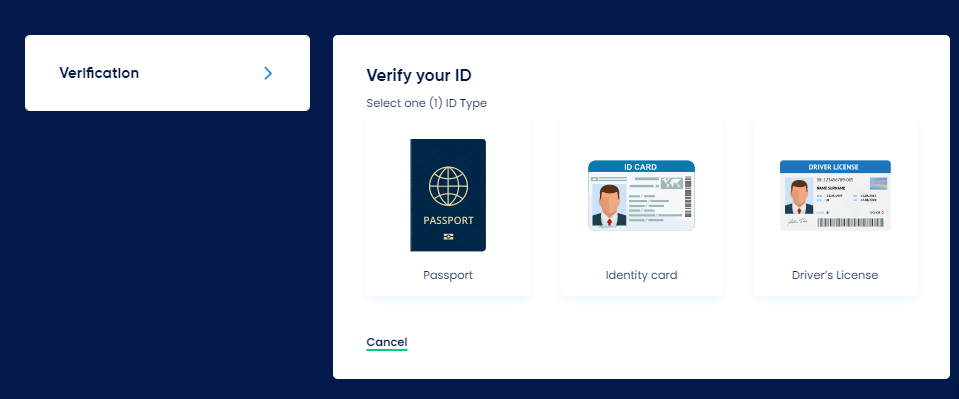

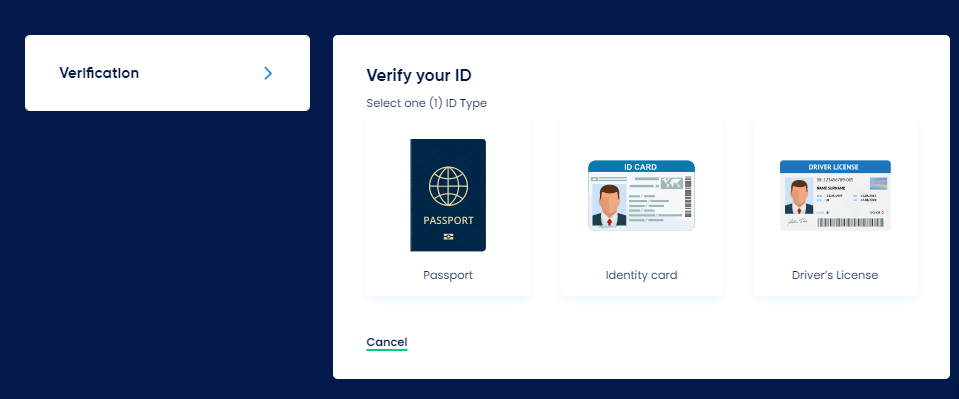

Then get verified.

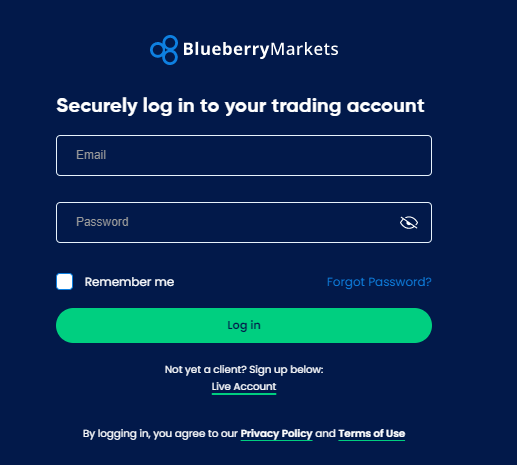

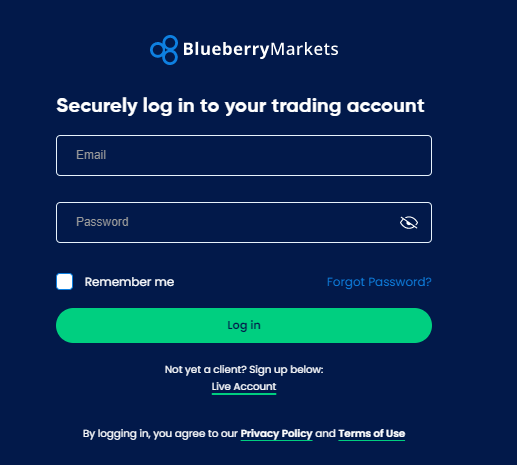

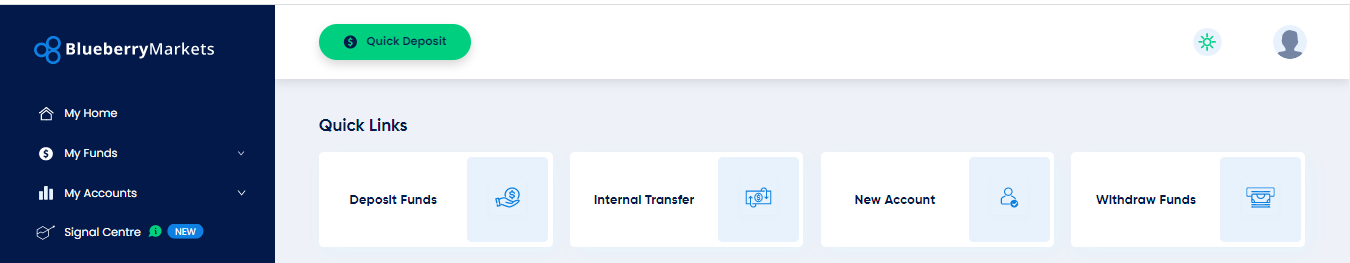

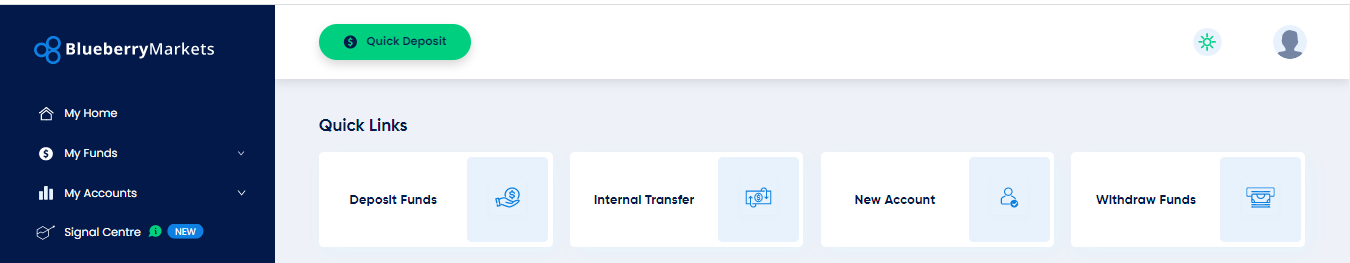

Authorization to log in to the user account (called the Client Portal on the Blueberry Markets website) is carried out using an email address and your previously created password.

Blueberry Markets’ user account menu:

Also, in the user account, the broker's client can:

-

Open a trading or demo account;

-

View his payment history;

-

Download the trading platform;

-

Get acquainted with the statistics of the partnership program;

-

Request technical support assistance.

Regulation and safety

Blueberry Markets is a private limited liability company with an Australian Business Number (ABN) 40 606 959 335. It has two divisions. ACY Securities Pty Ltd is regulated by ASIC, and its AFSL (Australian Financial Services License) number is 403863. ACY Capital Australia Limited is registered in Vanuatu and operates under VFSC license number 012868.

Advantages

- Blueberry Markets is a member of the Compensation Fund

- The company offers negative balance protection for all retail clients

- Clients’ funds are held separately from the broker’s capital on segregated trust accounts with an AA-rated Australian bank

Disadvantages

- Trading restrictions apply for Australian traders

- Clients outside Australia trade with Blueberry Markets offshore office

- To enter the real market, you need to go through the KYC (Know Your Client) procedure

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard account | From $10 | Depends on the amount and the payment provider |

| Direct account | From $10 | Depends on the amount and the payment provider |

Swaps for cryptocurrencies are calculated as a percentage; for other instruments, pips is used and afterward converted into the basic currency of an account. Swaps are tripled on Wednesdays.

When analyzing a broker, the Traders Union analysts always compare its fees to those of other companies. Blueberry Markets is no exception. The comparative table below is a matchup among Blueberry Markets, RoboForex, and PocketOption.

| Broker | Average commission | Level |

|---|---|---|

|

$5 | |

|

$1 | |

|

$8.5 |

Account types

o earn profit from trading with Blueberry Markets, open a live account. The broker offers two types of accounts, which differ in fees. The minimum deposit amount, range of assets, and leverage are the same for both accounts. Each client can have up to 10 live accounts, five in each of the terminals.

Account types:

-

The brokerage fee is included in the spread in all Blueberry Markets standard accounts. There is no fee charged for each transaction. Spreads start from 1 pips;

-

The Blueberry Markets direct account has raw spreads starting from 0.0 pips and a fixed fee of $7 per lot.

The demo account is intended for trading using a virtual deposit. You cannot earn or lose real money on it.

Blueberry Markets is a broker for beginners and experienced traders who deal with currencies and various types of CFDs in MetaTrader terminals.

Deposit and Withdrawal

-

Available withdrawal methods depend on the client's country of residence. Thus, Bank Wire, Visa, MasterCard, Perfect Money, STICPAY are available globally. Residents of all countries except Australia can withdraw profits in cryptocurrencies; Neteller and Skrill are not available to EU citizens. Only traders from Asia can withdraw funds with China UnionPay, Dragonpay, FASA, PayTrust and THB QR Payment;

-

Blueberry Markets processes all withdrawal requests within 24 hours;

-

The minimum withdrawal amount is $50;

-

The terms for crediting funds depend on the payment system and range from 1 to 7 business days;

-

Skrill and STICPAY may charge fees ranging from 1% to 3%. The bank transfer fee is $25. Withdrawals to cards and through FASA are free of charge. For other methods, the amount of fees depends on the commission policy of the receiving bank.

Investment Options

To receive passive income, Blueberry Markets offers copy trading platforms, trade by signals, and the use of robots and counselors to automate the process. Experienced traders can earn their fees by managing MAM accounts. Also, additional passive profits are available to clients who become partners of Blueberry Markets.

DupliTrade is an advanced copy-trading service

Blueberry Markets’ clients can copy trades from the MQL4 website and also use the DupliTrade platform. The broker does not withhold fees for accessing them but does not guarantee profit as well. The signal providers on DupliTrade are successful traders with years of proven experience who trade on live accounts.

Features of DupliTrade copy trading service:

To start copy trading, you need to make a deposit in the amount of $2,000 or more;

An investor determines the proportions of the ratio of copied transactions himself and can change them when needed, but only within the predetermined risk limits of the platform;

DupliTrade offers a free demo account for 30 days;

An investor can at any time opt out of the active trading system, and resort to manual trading, or combine copy trading with manual trading.

Blueberry Markets offers MAM accounts. Traders who manage capital of at least $50,000 can become their managers. The company also broadcasts trading signals, which can be used to trade in a semi-automatic mode.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Blueberry Markets’ partnership program:

Refer a Friend program. Here, a partner receives $100 per each referral who makes a deposit of at least $1000 and makes a loss of 1 lot of any instrument. The limit is 5 referrals. The accrued reward can be withdrawn or used in trading;

Introducing Brokers (IBs). IBs receive up to 60% of the spread deducted from the referred client's trading. Profit is paid throughout the trading activity of traders;

Affiliates. It's a program for owners of websites, blogs, and resources dedicated to finance and trading assets of different classes. CPA (cost per action) fee for affiliates can go up to $1000;

Fund Managers. Blueberry Markets invites experienced MAM account managers to cooperate. They receive individual execution and trade with lower commission fees.

Clients from Australia cannot become partners of Blueberry Markets. Traders from other countries must register on the company's website and contact the partnership department through the feedback form to participate in the programs. The specialist of the company describes all the available offers and selects the option of cooperation via telephone.

Customer support

Traders can contact Blueberry Markets technical support at any time as the service is available 24/7.

Advantages

- 24/7 support

- Prompt and detailed answers in the chat

Disadvantages

- Call back is not available

The support service provides assistance to traders through the following channels:

-

online chat;

-

phone;

-

email.

The addresses of Blueberry Markets offices in Sydney (Australia) and Port Vila (Vanuatu) are available on the broker's website in the Contact Us section.

Contacts

| Foundation date | 2018 |

|---|---|

| Registration address | 1/397 Pacific Highway, Crows Nest, NSW, Australia, 2065 |

| Regulation |

ASIC, VFSC

Licence number: 391441 |

| Official site | blueberrymarkets.com |

| Contacts |

+61280397480

|

Education

Educational materials on the Blueberry Markets website are located in the Learn section. They are divided into 3 levels — beginner, intermediate, and advanced. The website also contains video tutorials for traders with different trading experiences and detailed guides for working with MetaTrader terminals.

Practical application of trading theory can be achieved using a demo account. Blueberry Markets allows you to open a demo account in both MT4 and MT5.

Comparison of Blueberry Markets with other Brokers

| Blueberry Markets | RoboForex | Pocket Option | Exness | TeleTrade | Deriv | |

| Trading platform |

MT4, MT5, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | Deriv bot, Deriv MT5, Derivix, Deriv Trader, SmartTrader |

| Min deposit | $100 | $10 | $5 | $10 | $1 | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 1.00% |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0.8 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 70% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of Blueberry Markets

The founder and managing director of Blueberry Markets is a trader with over 10 years of trading experience, so he knows the priorities of people investing in financial markets. His brokerage company strives to offer the best conditions for its clients: low fees, a wide range of assets, and high-speed order execution. Blueberry Markets is active on social media having broker profiles on Facebook, Twitter, LinkedIn, Instagram, Telegram, and YouTube.

Blueberry Markets by the numbers:

-

More than 7 years of experience in financial markets;

-

The activity is regulated by 2 international commissions;

-

Over 300 instruments are available for trading;

-

Over 50,000 active clients.

Blueberry Markets offers dynamic leverage

Traders from Australia deal with a local representative of Blueberry Markets, which operates under the supervision of ASIC. This financial commission sets leverage limits for retail clients of up to 1:30; and for professionals, it’s up to 1:200. Traders outside Australia are served by a VFSC-licensed broker. This regulator allows trading with leverage of up to 1:500. The amount of available leverage depends on the account balance: the more funds a trader deposits, the less leverage he gets. For example, with a deposit of up to $5,000, a leverage of 1:500 is provided, but if a deposited amount starts from $100,000, then the value drops to 1:1 up to 1:100.

The broker offers the MT4 and MT5 platforms. However, some instruments can only be traded in the MT5 terminal. These include all CFDs on the U.S. and Australian stocks, USD/HKD and XPT/USD pairs, and VIXIndex. Moreover, clients from Australia cannot make transactions with cryptocurrencies in MT4.

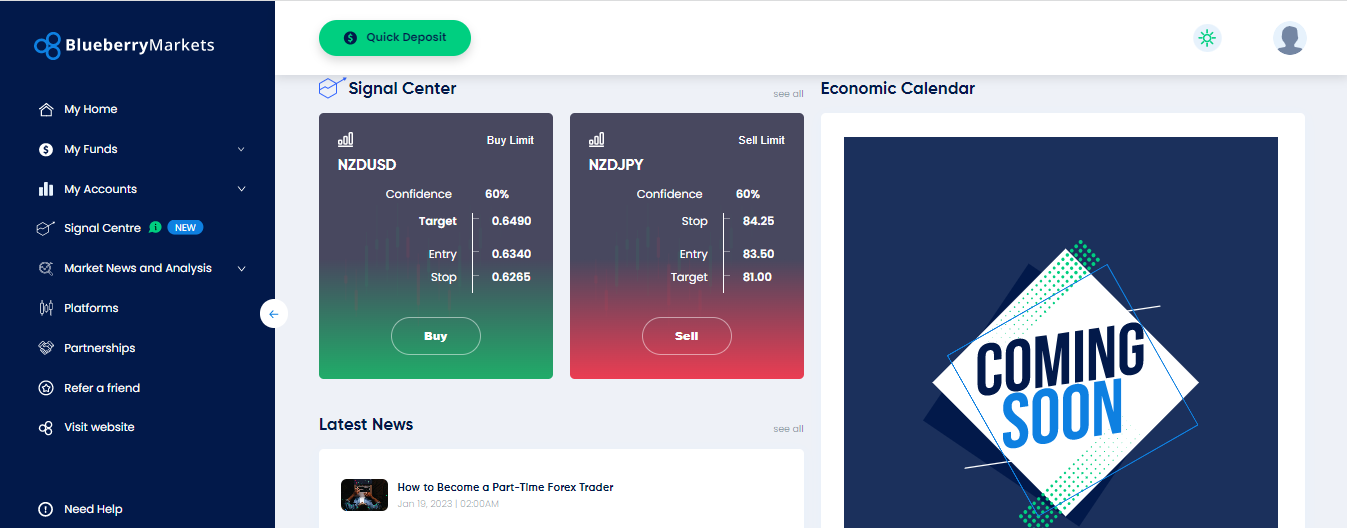

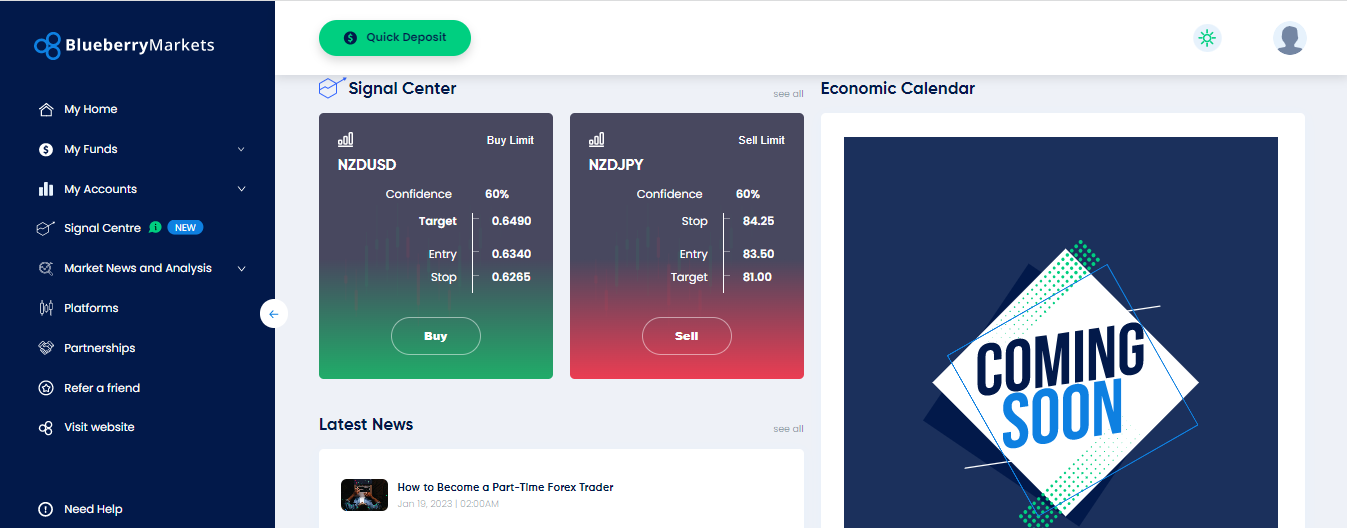

Useful services of Blueberry Markets:

-

Forex calculators. The company's website provides calculators for determining position size, the value of pips, profit, and margin. These tools are located in the Help Center section;

-

Economic calendar. It broadcasts important news and events that may affect the value of financial instruments. The calendar supports the option of sorting events by three levels of influence on the markets — low, medium, and high;

-

Analytics. The company's experts regularly make price forecasts for Forex, cryptocurrencies, stocks, and commodities. The website also provides a daily analysis of currency pairs;

-

Blueberry Jam. This is a bulletin with useful information for traders, which is sent by email weekly.

Advantages:

Deals with CFDs on currency pairs, indices, stocks, cryptocurrencies, metals and commodities are available;

The broker allows the involvement of advisers on all trading platforms;

The company's website contains high-quality training for traders;

Professional traders make deals on individual terms (upon request);

High referral remuneration is accrued for attracting new clients.

All clients are provided a free VPS server which achieves execution speeds of 1-3 ms.

User Satisfaction