Sword Capital Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- MT4

- MT5

- CMA

- 2010

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- MT4

- MT5

- CMA

- 2010

Our Evaluation of Sword Capital

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Sword Capital is a broker with higher-than-average risk and the TU Overall Score of 4.55 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Sword Capital clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Sword Capital opens doors to major financial markets, allowing traders to work comfortably. Trading costs are average, the asset pool is quite extensive, and leverage is high. There are various account types, including those focused on passive income. The broker offers numerous analytical tools and proprietary analytics. Unfortunately, some popular alternative earning options are missing, and there are regional restrictions.

Brief Look at Sword Capital

Sword Capital's pool includes hundreds of diverse assets, such as currency pairs and CFDs on stocks, indices, metals, energies, and commodities. The minimum deposit is $500, and trading with flexible leverage up to 1:200 is available. Spreads are variable, starting from 1 pips for currency pairs, with no trading commission. For contracts for difference (CFDs), there is a market spread, with fees starting at $5 per full lot. In addition to a Personal account, clients can open Corporate, IB, and Hedge Fund accounts. A free demo account is also available. Traders can trade using MT4 and MT5 trading platforms, and the broker offers a multifunctional application with integrated analytical tools, although trading is not possible through it. The company's website publishes daily signals, detailed reports, newsfeeds, and more. Client support is active 24/7.

- Transparent cooperation with all terms and trading costs are known in advance.

- Average market spreads and commissions, allowing traders to trade comfortably without overpaying.

- Moderate entry threshold, and flexible leverage to enhance profit potential.

- Diverse assets, giving traders flexibility in trading strategies.

- Choice of two trading platforms, plus a mobile app for account management.

- Platform users can earn additional income through hedge funds and the IB program.

- Client support is available through multiple communication channels, and it operates 24/7.

- Information on the broker's website is not sufficiently comprehensive, and there is also a lack of details on options for fund deposits or withdrawals.

- Clients cannot earn through copy trading or joint accounts.

- Residents of Iran, Cuba, Sudan, Syria, and other countries listed by FATF (Financial Action Task Force) cannot trade with the broker.

TU Expert Advice

Financial expert and analyst at Traders Union

Sword Capital operates under the supervision of the U.K. Competition and Markets Authority (CMA) and has a presence in Asia, Africa, Europe, Australia, and South America. A retrospective analysis has not revealed any instances of failure to fulfill its obligations to clients.

The platform allows for the registration of both Personal and Corporate accounts, along with separate accounts for hedge fund owners and participants in the IB program. The entry threshold is relatively low with a minimum deposit of $500. Traders are not restricted in strategies and trading methods, whether they choose to scalp, trade on news events, carry trades overnight, or use advisors.

Trading costs are average. Spreads for currency pairs start from 1 pips, slightly higher for other assets, plus a commission starting from $5 per full lot. Withdrawal fees exist and vary for each available channel such as bank transfer, bank card, and Skrill. Users note that the broker's commission policy is acceptable, providing full transparency with no undisclosed fees.

Leverage ranges from 1:1 to 1:200, allowing traders to choose based on their preferences. The classic trading platforms are MT4 and MT5. However, the broker has a proprietary mobile application, which is highly recommended. While partly duplicating the website and user account features, the app also offers additional options. It facilitates account management, newsfeeds, and market analysis. The only thing is that trading is not possible within the app, so traders have to switch to MetaTrader.

Analytical tools are a strong point for Sword Capital. The broker provides an economic calendar, current quotes, and spreads directly on the website, allowing users to build charts and apply basic indicators. The user account and the application offer even more capabilities, including newsfeeds and video reviews regularly published by broker experts. All of these significantly aid traders in forecasting and investing.

Relative drawbacks include a complete absence of educational materials and multiple regional restrictions. There are no copy trading or MAM or PAMM accounts, but hedge funds are available, allowing earnings beyond active trading. Overall, despite some drawbacks, the broker can be characterized as a comfortable, reliable partner.

Sword Capital Summary

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Sword Capital and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT4, MT5 |

|---|---|

| 📊 Accounts: | Demo, Personal, Corporate, IB, Hedge Fund |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfer, bank card, and Skrill |

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: | Up to 1:200 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating from 1 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, metals, energies, and commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Free demo account, one account each for individuals and companies, has hedge funds, a moderate number of assets, rather large leverage, average market costs, several deposit/withdrawal options, and prompt 24/7 client support. |

| 🎁 Contests and bonuses: | Yes (rebates from TU) |

It's not unusual for brokers with multiple real accounts to have varying minimum deposits because the conditions differ. In essence, Sword Capital also offers several account types such as Personal, Corporate, IB (Introducing Broker), and Hedge Funds, along with a demo account. However, no deposit is required for the IB account, while the Hedge Fund account is opened under individual conditions, and the demo account is provided for free. For Personal and Corporate accounts, the minimum deposit is $500. The maximum leverage depends not on the account but on the asset selected by the trader. The highest leverage for currency pairs is 1:200. Traders have the flexibility to decrease the leverage or not use it at all. Client support is a strong point for the broker, as it is available through multiple communication channels and operates 24/7.

Sword Capital Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

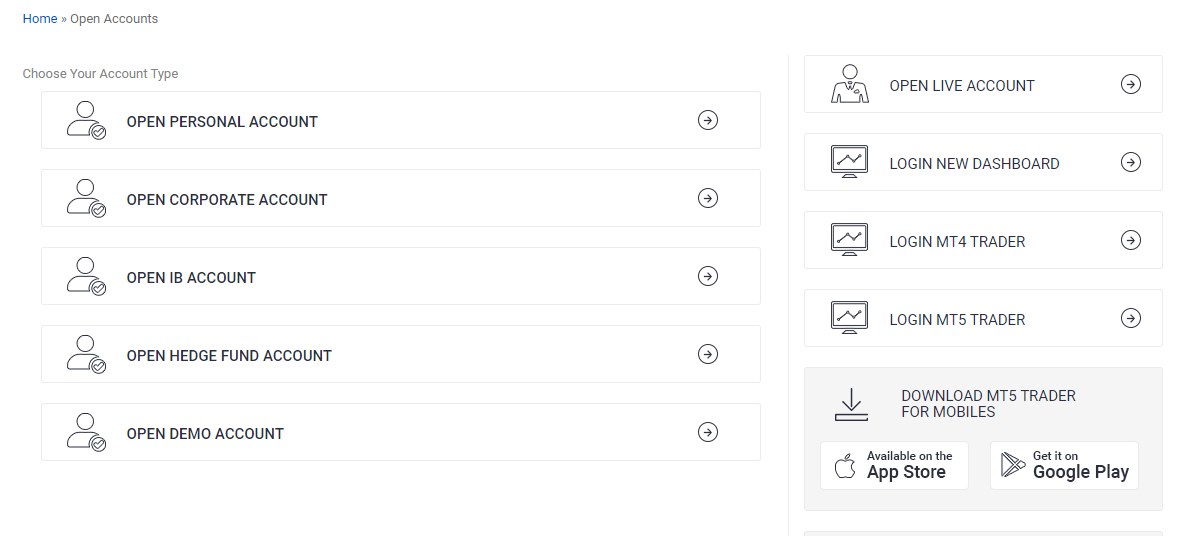

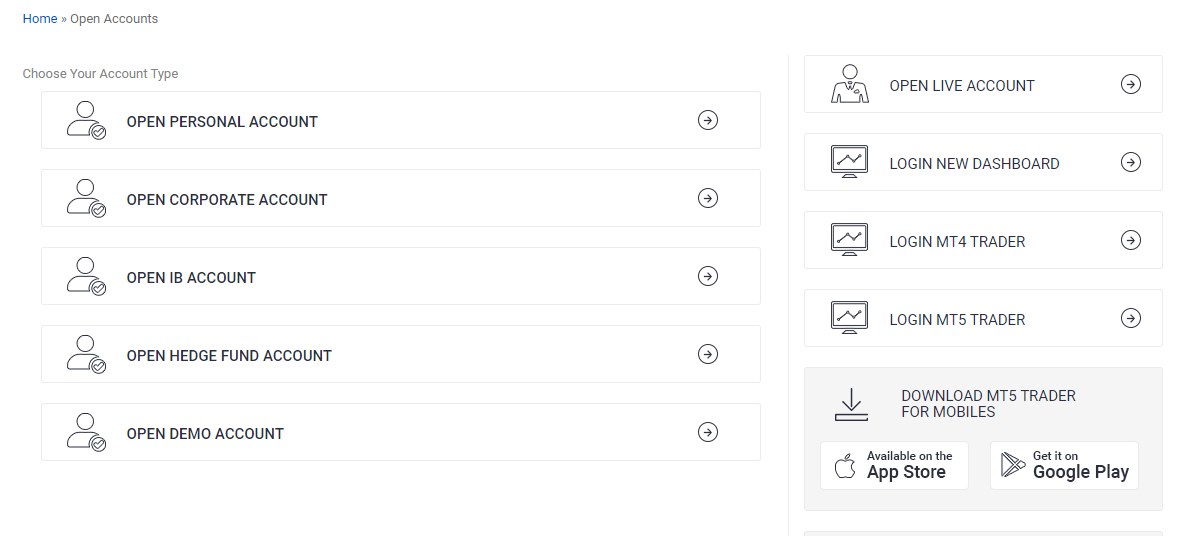

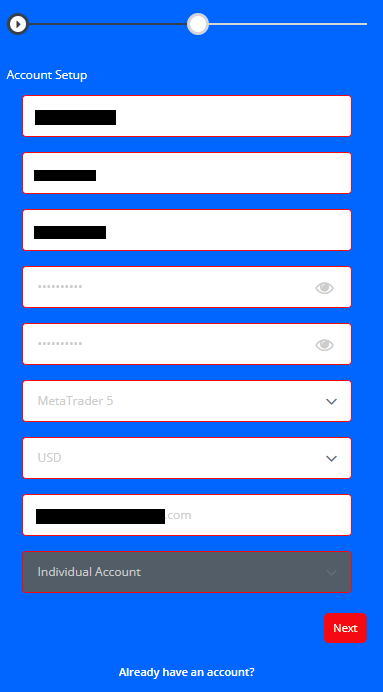

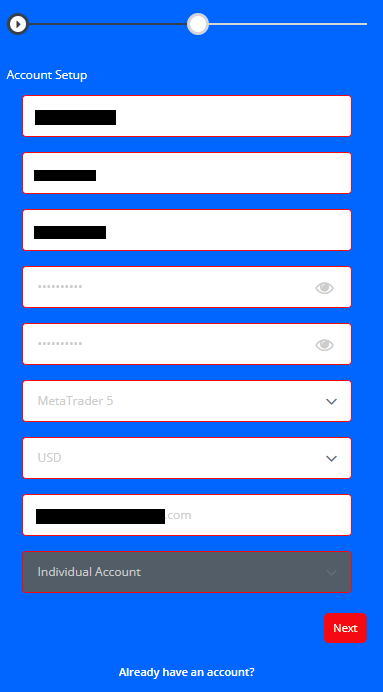

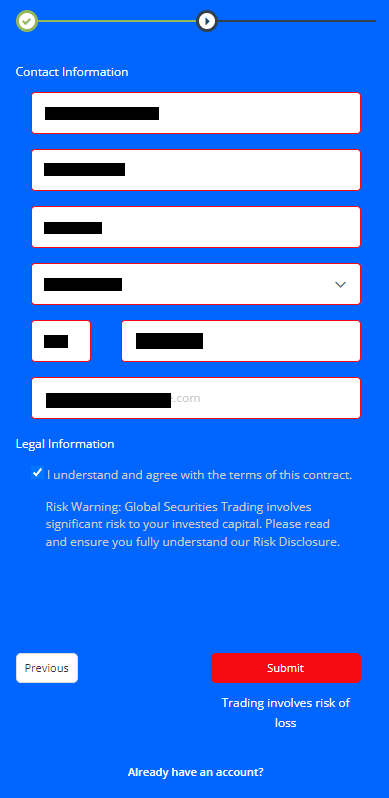

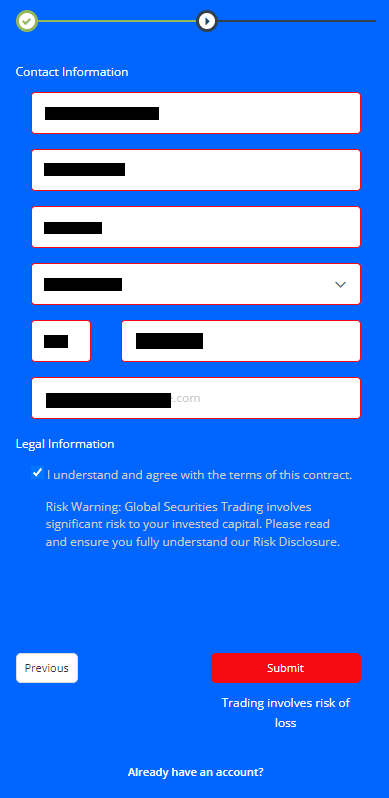

Trading Account Opening

To start working with the broker, register on its official website, undergo verification, and open a real account. Afterward, make a deposit, download the trading platform, and preferably the broker's mobile application. TU experts provide a step-by-step guide to help you pass each of these stages smoothly. The guide below also offers a description of the features of the user account.

Go to the broker's website. In the top right corner, choose your preferred interface language. Click on Open Real Account.

Choose the account type from the list. In this case, it's a Personal account for individuals.

Enter your first and last name. Create a password and enter it twice. Choose a trading platform and the account currency (only USD). Enter your email. At the end, specify the account type again. Click on Next.

Provide your complete address. Enter your phone number and duplicate your email. Agree to the cooperation terms by ticking the box. Click on Submit.

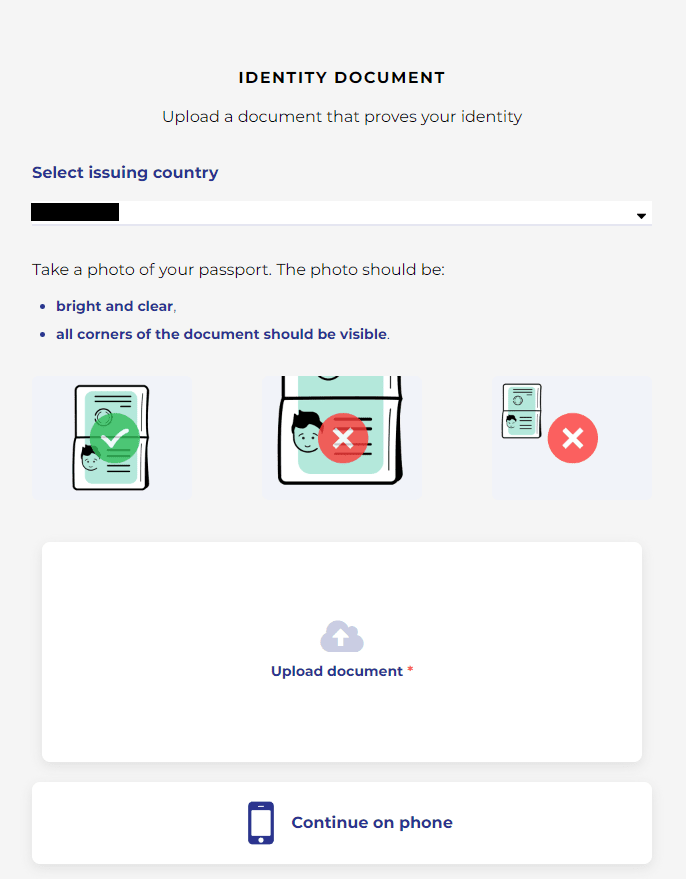

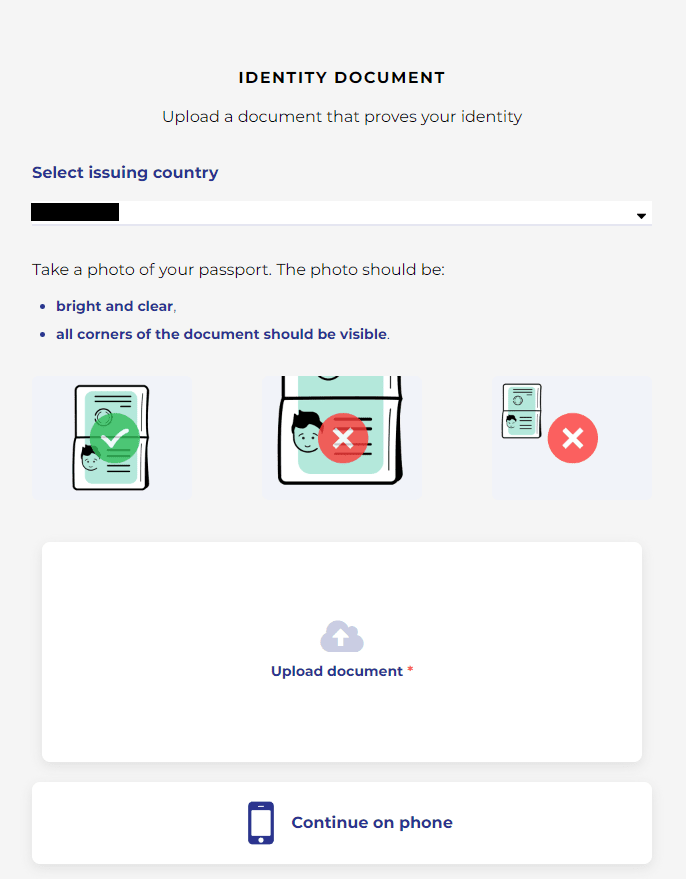

Initiate the verification process in the corresponding section of the user account. Specify the country and the document type that can confirm your identity. Follow the on-screen instructions. Upload a scan or photo of the document. Verification can be done via smartphone. Wait for the verification process to complete.

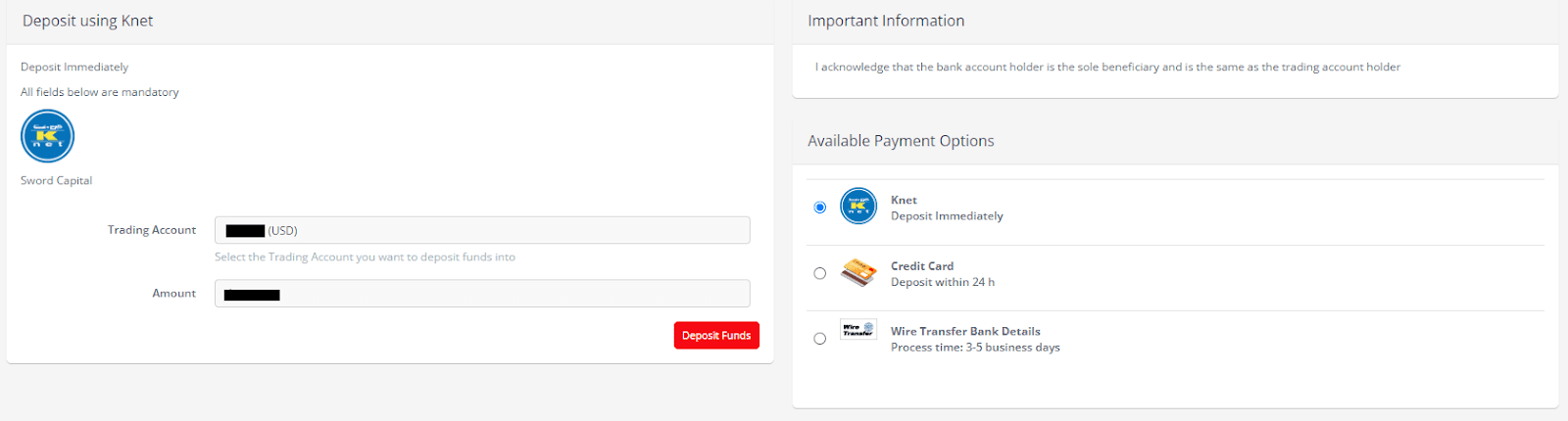

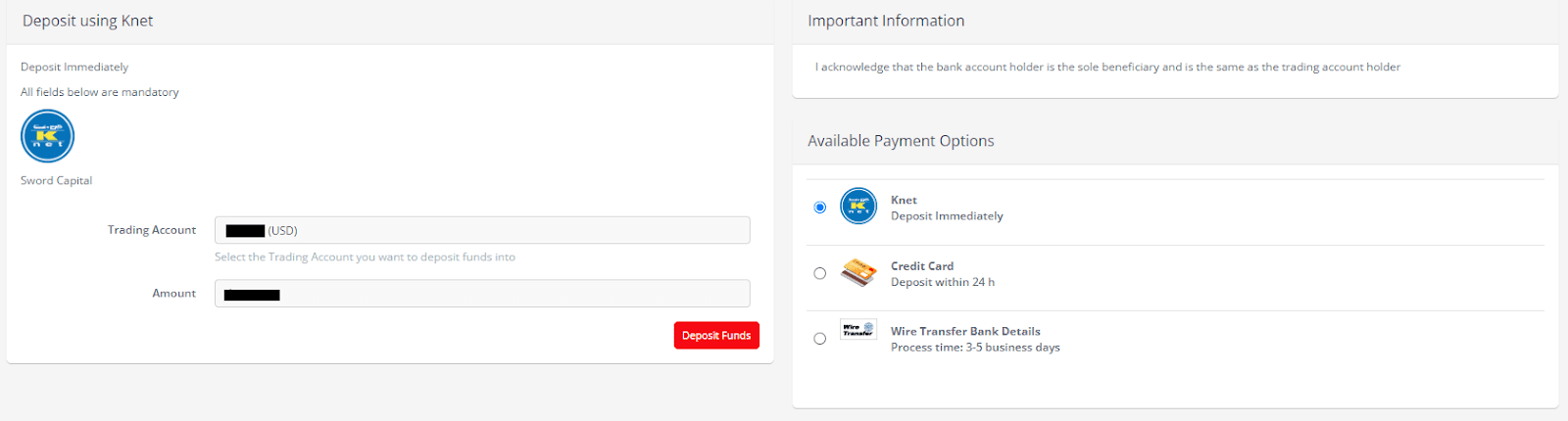

Go to the Deposit section. Choose the account from the list (you can open multiple accounts). Available deposit channels will appear on the right. Choose the appropriate option and click on Deposit Funds. Follow the on-screen instructions. Wait for the balance to be replenished.

Go to the Trading Platforms section. Choose a suitable platform, download the platform, and install it on your device. Note that it's not mandatory to download the platform from the broker's website as you can also do it on the MT portal. After installing the platform, launch it, enter your registration details, and start trading.

Your Sword Capital user account also provides access to:

-

My Account. This section is a dashboard that displays the status of open accounts. You can detail the data, get a summary, or generate a report.

-

Fund Account. In this section, the trader selects the account and makes a deposit. Note that available deposit channels differ by region.

-

Trades. A table displaying trades across all accounts. The list can be filtered, including viewing archived trades.

-

Account Settings. Here, the trader adjusts personal information, uploads documents for verification, and sets security parameters.

-

Trading Requests. Another table displaying all initiated transactions for deposit, and withdrawal, indicating their status.

-

Platforms. Here, the broker's client can download the MetaTrader trading platform (fourth and fifth versions are available).

Regulation and safety

When a trader discovers a potentially interesting brokerage platform, it's essential to ensure it's not a scam. To do this, two aspects must be checked — registration and regulation. Sword Capital is officially registered in Kuwait, the U.A.E., Qatar, and Egypt. In other words, the broker operates legitimately. As for regulation, the platform is overseen by the Competition and Markets Authority (CMA), a regulator well-recognized in the international market and highly regarded. Thus, Sword Capital guarantees transparency of conditions and fulfillment of commitments to its traders.

Advantages

- Broker has been present for a long time in the market |

- Registered in the U.A.E, Kuwait, Egypt, and Qatar

- Regulated by CMA

Disadvantages

- No other major regulators like FSA (The Financial Services Authority)

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Personal | $10 | Yes |

| Corporate | $10 | Yes |

| Hedge Found | $10 | Yes |

The withdrawal fee depends on the withdrawal channel used. Information about it is not publicly available. However, traders can expect full transparency, as they will know the commission amount in advance before making a withdrawal.

To understand how advantageous it is to work with the platform, one can only do so by comparing it with competitors. This is why TU experts propose the below table that includes average values of trading fees for Sword Capital clients and two other brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$10 | |

|

$1 | |

|

$8.5 |

Account types

Typically, the trader's initial task is to choose an account that suits them best. However, at Sword Capital, Personal and Corporate accounts share common conditions, making them versatile. IB and Hedge Fund accounts, on the other hand, serve specific purposes. Thus, if a trader is an individual, they register on a Personal account; if a legal entity, a Corporate account. An IB account is justified for socially active users, as earning from the partner program is anything but passive. Correspondingly, a Hedge Fund account is needed if the broker's client wants to create a fund. Regarding trading platforms, it makes sense to try both, as MT4 and MT5, while sharing some common features, differ significantly in their functional capabilities.

Account types:

If a trader has never worked with this broker before, it makes sense to start by registering on a demo account. This allows exploration of the platform and fine-tuning of strategies without the risk of financial losses. Afterward, the user can transition to an appropriate real account and open additional ones as needed.

Deposit and Withdrawal

-

If a trader is trading on a demo account, the trader does not receive real profits and cannot withdraw funds from the platform.

-

Upon switching to a real account, the broker's client begins executing full-fledged trades and achieving earnings.

-

To withdraw funds, one needs to submit a request in the user account or mobile application.

-

Currently available withdrawal channels include a bank account, a bank card, and Skrill.

-

The broker charges withdrawal fees, dependent on the withdrawal channel.

Investment Options

Brokers often enhance their range of services with additional features like copy trading or joint accounts such as MAM or PAMM. However, if these earning options are not available, for most traders, it won't be a conceptual drawback. After all, they join brokerage platforms primarily to earn through manual trading. Clients of Sword Capital enjoy comfortable conditions for working with financial markets, but they also have the potential for additional earnings through the IB program and hedge funds.

Introducing Broker (IB)

The company’s clients can open an IB account in addition to their main account. The broker provides them with marketing solutions and ready-made mechanisms to attract new users to the platform. If a user registers, funds their account, and starts trading, the inviting trader receives a monetary bonus. These funds accumulate in the IB account, which has features that monitor referrals and track profits. Later, the money can be transferred to the main account or withdrawn.

Hedge funds

A separate account is provided for this option. If a trader has sufficient qualifications, the platform allows them to organize their investment fund. Consequently, the company’s clients also can join such accounts. Investors do not participate in the management of the overall investment portfolio. The hedge fund manager charges a commission from each investor for their trading services. Several commission options are available, with flexible and convenient conditions for all fund participants. Unlike the IB, for the investor, this is a 100% passive income.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Customer support

Questions like, "Can I deposit funds with a Visa card issued in the United States?" or "What are the spreads for the USD/EUR pair and CFDs on the S&P 500 index?" often arise from traders' inattentiveness or insufficient preparation. However, sometimes these questions result from the absence of crucial information on the platform or real issues with depositing or withdrawing funds. Sword Capital clients always have the option to contact client support. There are two call centers, email, tickets on the website, and live chat. The support service operates 24/7 (only via chat; for other channels, see the table).

Advantages

- Four communication channels are available

- Client support operates day and night

- Support managers are available on weekends

Disadvantages

- The call center and email respond from 9:00 to 19:00 GMT every day, except Sunday, at other times, only live chat is available. You can also submit a ticket, but the response will be sent to your email during the working hours of client support.

Client support can assist you even if you are not yet a client of the broker. The service has predominantly positive reviews due to its promptness and competence.

Here are the current contact methods:

-

Phone;

-

Email;

-

Tickets on the page;

-

Live chat on the website.

Additionally, you can contact the broker via WhatsApp by clicking the corresponding button at the bottom left of the website or choosing the same option in the application.

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address |

Kuwait Sharq Blk7 Tower44 Floor 19-18 Gate Village, Building 04, Level 03, Business Center, Office 02 Dubai International Financial Center, Dubai, United Arab Emirates Qatar – Doha, Al Fardan Tower, Floor 9, Office 946-01 Office No 6 1st Floor, Dekk House, Zippora Street, Providence Industrial Estate, Mahé, Seychelles Egypt – Cairo, Nile City Towers, North Tower, 22nd Floor |

| Regulation | CMA |

| Official site | https://www.sword-capital.com/ |

| Contacts |

+965-2246-8817, +965-2246-8813

|

Education

Sometimes brokers offer educational materials to their clients. This can include a trader's glossary, detailed FAQs, or a library of articles. Less frequently, there are video guides, podcasts, and webinars. In this way, platforms aim to provide newcomers with essential knowledge. However, Sword Capital, like many other companies, believes that if a trader has registered, it means they already understand how to operate in financial markets. The broker's website provides numerous analytical tools, but formal education is not presented.

Therefore, if a user knows nothing about trading, they need to find external sources of information for theoretical preparation. Later on, they can open a demo account here to test and refine their skills.

Comparison of Sword Capital with other Brokers

| Sword Capital | RoboForex | Pocket Option | Exness | Octa | InstaForex | |

| Trading platform |

MT4, MT5, TWS Trader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $500 | $10 | $5 | $10 | $25 | $1 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1 point | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 30% / 10% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of Sword Capital

The Sword Capital brokerage company is well-established in Europe, Asia, and other regions. It boasts dedicated servers located in various countries, providing traders with 24/7 market access and order execution speeds as fast as 1 second. Moreover, Sword Capital features a well-planned and optimized infrastructure that caters to both individual and corporate clients, an IB program, and hedge funds. In terms of safeguarding user funds and data, the company adheres to modern standards, offering various solutions, including SSL protocols for internet connections.

Sword Capital by the numbers:

-

The minimum deposit is $500.

-

Broker offers 4 account types and a demo account.

-

Broker offers 6 groups of financial instruments.

-

The maximum leverage is 1:200.

-

Spreads for currency pairs start from 1 pips.

Sword Capital is a versatile CFD and Forex broker

Traders have access to currency pairs and CFDs covering stocks, indices, commodities, energies, and metals, amounting to several hundred assets. This diverse pool of financial instruments allows for a wide range of strategic decisions, and the formation of diversified investment portfolios. Many users find the 1:200 leverage optimal, as it significantly increases profit potential without a critical rise in trading risks. Another advantage affirming the platform's universality is that traders use both MT4 and MT5 trading platforms. Both solutions are known for their user-friendly interfaces and high functionality. Additionally, the broker provides a free mobile application, featuring extensive analytics and special tools for forecasting and account management.

Sword Capital’s analytical services:

-

Trading signals. The broker publishes daily trading signals, and optimal entry points determined by experts based on market analysis.

-

Charts with indicators. The website offers interactive charts for all tradable assets, allowing the overlay of various indicators and tools.

-

Mobile apps. Specialized software enabling not only the monitoring of trader accounts but also comprehensive market tracking and analysis.

Advantages:

Traders have access to a wide variety of assets, with no restrictions on trading styles or methods imposed by the broker.

Optimal leverage allows for increased profits with a manageable level of risk.

The platform operates transparently, with all fees and commissions known to the trader before executing a trade or transaction.

Sword Capital offers a convenient user account and a functional mobile app for account control.

The broker provides a wide range of diverse analytics and trading tools.

User Satisfaction