deposit:

- $80

Trading platform:

- NinjaTrader

- Rithmic

- TradingView

- Tradovate

deposit:

- $80

Trading platform:

- NinjaTrader

- Rithmic

- TradingView

- Tradovate

- A free 14-day trial period

- No initial fee

- Monthly fee later

- Challenge reduces the monthly fee

- Profitable partnership program

- Individually

Summary of Elite Trader Funding Trading Company

Elite Trader Funding is a moderate-risk prop trading firm with the TU Overall Score of 6.43 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Elite Trader Funding clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. Elite Trader Funding ranks 7 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Elite Trader Funding is a rather young prop firm, but it is already quite popular. It has thousands of partners worldwide. The main advantages are a large selection of accounts and tariffs, minimum restrictions, and flexible adjustment of trading tools. Traders keep 80-100% of the profit, which is significantly higher than many of its competitors. Also, there is a profitable partnership program that can bring regular profits to socially active partners. According to the above, the platform is recommended for review, especially because of its free 14-day trial period.

The Elite Trader Funding prop (proprietary) firm works with several liquidity providers such as SWOT, CME, COMEX, NYMEX, and SMFE. The platform offers trading futures contracts on currencies, cryptocurrencies, stocks, agricultural commodities, metals, and energies. There are three types of accounts. Each provides several tariffs, which differ in balance and trading conditions. The minimum balance is $10,000 and the maximum is $300,000. There is a free 14-day trial period, after which a subscription fee is charged. This fee decreases if a trader completes a challenge. When partners of the prop firm reach the drawdown limit, they can pay for the account reset and return to the original account parameters. The account reset costs $75. At the start, a trader keeps 100% of the profit (it is relevant for the first $12,500 of income), then traders receive 80% of their profits. Elite Trader Funding has a profitable partnership program.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $80 |

| ⚖️ Leverage: | Individually |

| 💱 Spread: | No |

| 🔧 Instruments: | Futures on currencies, cryptocurrencies, stocks, commodities, energy, and metals |

| 💹 Margin Call / Stop Out: | Not available |

👍 Advantages of trading with Elite Trader Funding:

- Offers several types of accounts and tariffs with the opportunity to receive funds for trading in the amount from $10,000 to $300,000;

- The platform charges a monthly fee, but a new partner can use all the services for free within 14 days;

- A trader receives 100% of the profit with income up to $12,500, when the amount of income increases, the ratio is 80/20;

- The platform provides access to the 76 most popular futures contracts;

- Traders can use leverage, and there are no restrictions on strategies;

- If traders reach the maximum drawdown, they can simply reset the account parameters;

- The partnership program pays traders 15% of the monthly fee of each referral.

👎 Disadvantages of Elite Trader Funding:

- Elite Trader Funding requires its clients to pay a monthly subscription fee unlike most of its competitors, who charge an initial fee only;

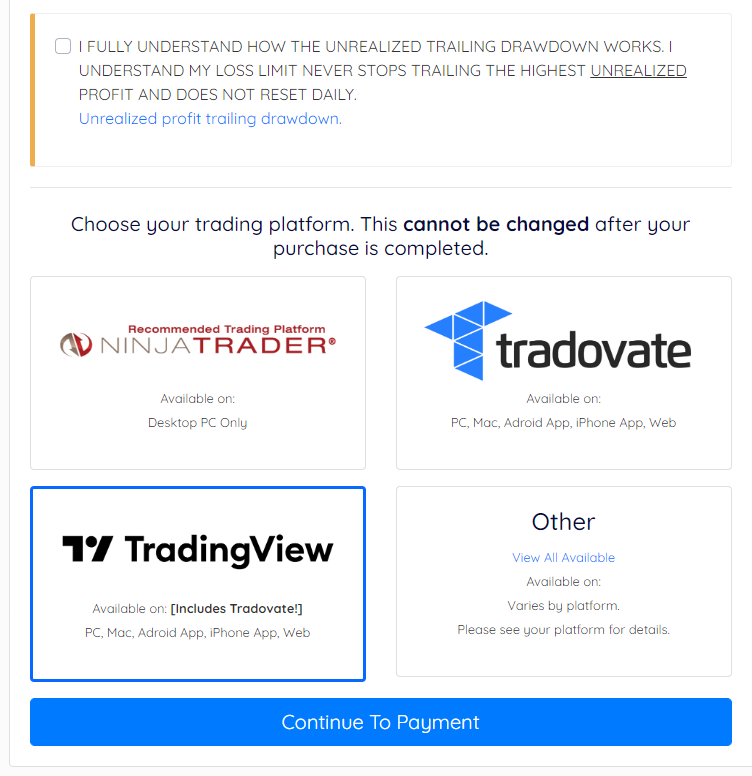

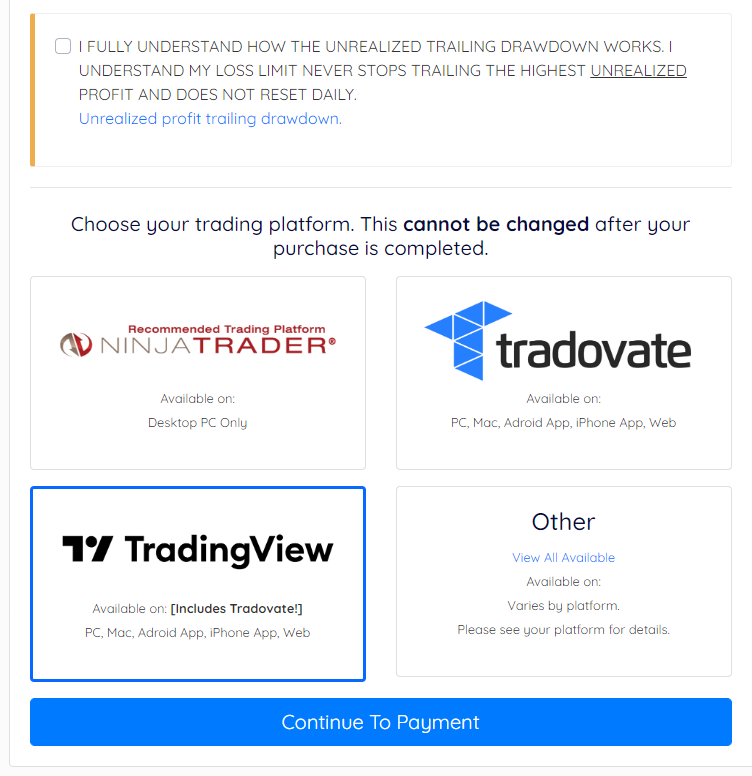

- The prop firm does not allow trading via MetaTrader 4 and MetaTrader 5 (MT5). Instead, the firm uses NinjaTrader, Tradovate, TradingView, and Rithmic platforms;

- There are no requirements for the general maximum drawdown, but there is a limit for the trailing and intraday drawdowns.

Evaluation of the most influential parameters of Elite Trader Funding

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest Elite Trader Funding News

- Analysis of Elite Trader Funding

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Elite Trader Funding

- User Reviews of Elite Trader Funding

- FAQs

- TU Recommends

Geographic Distribution of Elite Trader Funding Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Elite Trader Funding

Elite Trader Funding is a well-known prop firm, though it is young. Its advantage is that several platforms at once act as its partners, including SWOT, CME, COMEX, NYMEX, and SMFE. This allows Elite Trader Funding to enter several markets at the same time and provide its traders with dozens of the most sought-after assets with tight spreads and the lowest possible trading fees. In addition, the company has no limits on the general allowable drawdown, as well as limits on time and trading strategies.

Another important point is payment. The firm does not have an initial fee, like most of its competitors. Instead, partners are charged a subscription fee. It may vary depending on a number of factors. There is a free 14-day trial period with trading on a demo account. On some tariffs an increased fee is charged within the first 2-8 weeks of live trading, on others, it is determined only by traders’ expertise. For example, an EOD account with a balance of $150,000 charges a subscription fee of $340 without taking the challenge, and after its successful completion the fee is $80.

That is, it is beneficial for traders to complete the challenge as quickly as possible. Moreover, it is objectively simple. Let's say a Standard account with a balance of $100,000 has a target profit of $6,000. You can open up to 14 positions with a trailing drawdown of $3,000. Clients trade at their own pace, although it must be said that those traders who support aggressive strategies receive the greatest profit. This is confirmed by the firm’s statistics.

To conclude, it should be noted that Elite Trader Funding allows trading via NinjaTrader and TradingView among the most popular trading platforms. Tradovate and Rithmic are also available. Among the instruments, only futures are offered. The basic assets are represented by currencies, cryptocurrencies, stocks, metals, agricultural commodities, and energies.

Dynamics of Elite Trader Funding’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

This prop trading firm does not provide investment solutions in their traditional sense. For example, partners of the platform cannot invest in dividend stocks or staking. However, they still have the opportunity to receive passive income when using the referral program.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program of Elite Trader Funding:

Each partner of the platform receives a referral code, which can be distributed on the internet without restrictions. A trader who registers with a prop firm using this code becomes a referral of the code owner. A referral brings the owner 15% of the subscription fee within 180 days of the date of registration (relevant for Standard and EOD accounts). For an Accelerated evaluation account, the bonus payout is 7%. All payments are credited within 14-20 days and can be withdrawn to an e-wallet when at least $100 is accumulated.

Traders with exceptional success can receive unique codes that give advantages to referrals and bring increased profits to their owners. Thus, the platform motivates its partners to trade more successfully, including via passive methods, in order to earn more.

Trading Conditions for Elite Trader Funding Users

One of the main features of the Elite Trader Funding prop firm is that it does not charge an initial fee, but there is a subscription fee. Partners trade for free within the first 14 days. Then they pay a standard fee or a reduced fee, if they were able to complete the challenge. Leverage helps them to get higher profits. It differs depending on the asset and liquidity provider conditions. Technical support is available from 8:00 to 16:00 Central Time Zone (CST). It is represented by only two communication channels, which are a ticket system on the website (the response comes to the email specified by a trader) and live chat. Unfortunately, the analysis of reviews shows that support responses are not always prompt.

$80

Minimum

deposit

individual

Leverage

8/5

Support

| 💻 Trading platform: | NinjaTrader, Tradovate, TradingView, and Rithmic |

|---|---|

| 📊 Accounts: | Standard, EOD, Accelerated |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfers, bank cards, and e-wallet |

| 🚀 Minimum deposit: | $80 |

| ⚖️ Leverage: | Individually |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | No |

| 🔧 Instruments: | Futures on currencies, cryptocurrencies, stocks, commodities, energy, and metals |

| 💹 Margin Call / Stop Out: | Not available |

| 🏛 Liquidity provider: | СВОТ, СМЕ, COMEX, NYMEX, SMFE |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

A free 14-day trial period; No initial fee;Monthly fee later; Challenge reduces the monthly fee; Profitable partnership program |

| 🎁 Contests and bonuses: | Yes |

Comparison of Elite Trader Funding to other prop firms

| Elite Trader Funding | Topstep | FTMO | Funded Trading Plus | Funded Next | The Concept Trading | |

| Trading platform |

NinjaTrader, Rithmic, TradingView, Tradovate | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | MetaTrader4 | MetaTrader4, MetaTrader5 |

| Min deposit | $80 | $1 | $155 | $119 | $99 | $77 |

| Leverage | No |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:200 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0.9 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | No | 75% / 50% |

| Execution of orders | No | ECN | Instant Execution | Market Execution | N/a | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| Elite Trader Funding | Topstep | FTMO | Funded Trading Plus | Funded Next | The Concept Trading | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | No | Yes |

| Crypto | Yes | No | Yes | Yes | No | Yes |

| CFD | No | No | Yes | Yes | No | Yes |

| Indexes | No | No | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | No | No | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | Yes |

Elite Trader Funding Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | Set by a liquidity provider | No |

| EOD | Set by a liquidity provider | No |

| Accelerated | Set by a liquidity provider | No |

This prop firm operates transparently. This means that the firm does not charge fees that a partner has not been notified about. Traders know everything about the conditions, including additional fees, before each money transaction.

Detailed review of Elite Trader Funding

Few prop firms use multiple liquidity providers simultaneously. Elite Trader Funding uses five. Due to this, flexible trading conditions and a wide variety of instruments are the key advantages of the platform. However, traders do not have the opportunity to trade basic assets, only futures are available. Clients can trade on a choice of platforms, including TradingView and NinjaTrader.

Another unique feature of the firm is the opportunity to trade without completing the challenge. However, it is important to estimate the risks correctly, because without completing the test, the subscription fee is quite high. The $80 fee (after completing the challenge) is more attractive, especially since a trader keeps 100% of the net profit initially, and 80% of the profit later on.

Elite Trader Funding by the numbers:

-

A partner’s initial fee is $0;

-

The minimum subscription fee is $80;

-

The maximum trading balance is $300,000;

-

An account reset costs $75.

Elite Trader Funding is a prop firm for trading a wide range of financial instruments

Platform partners trade futures. There are 76 instruments, including futures on currency, cryptocurrency, agricultural commodities, energies, and metals. The list of instruments is regularly updated in accordance with the global market’s current situation and the needs of the community. Leverage is available for all instruments, its size is determined individually at the moment of trading.

A trader can become the prop firm’s partner without completing the test. But in this case, the higher subscription fee applies. After the completion of the challenge, the fee is reduced. For example, the subscription fee of $590 is charged for an EOD account with a balance of $250,000 without completing the challenge, whereas, it is $80 after the test is successfully completed. The monthly fee for Accelerated accounts is reduced automatically after a certain period, but it is also recommended to complete the challenge.

Useful services of Elite Trader Funding:

-

There are three types of accounts. Each type of account has its own rates, which differ in balance and trading conditions. This allows traders to choose the account that is best for them;

-

A partner of the prop firm may not complete the test and trade with a standard subscription fee. But if the challenge is successfully completed, the fee is significantly reduced;

-

A trader does not need to carefully monitor the drawdown. Restrictions on daily and trailing drawdowns apply only to some types of accounts; and there are no restrictions on the general drawdown. You can always reset your account and start again.

Advantages:

When traders earn up to $12,500, they keep 100% of the profit. Thereafter, they get 80% of the profit, and the firm takes 20%;

The prop firm allows to trade on news, and use any trading styles and strategies. Restrictions are minimal compared to its competitors;

There are no additional fees or extra charges. A trader uses the website within the first 14 days for free, then only the subscription fee is charged;

Traders can pay $75 to reset their accounts any time. This is usually done if the trailing drawdown is exceeded;

A trader has 76 assets available for trading, including all the most popular ones.

Depending on the trading balance, a trader can open from 3 to 30 positions on Standard accounts. The balance can be scaled if a trader has been successfully trading for a long time.

Guide on how traders can start earning profits

Many accounts to choose from is an advantage, but it is important that traders understand what type of account is optimal for them. Standard, Accelerated, and EOD accounts differ in terms and conditions and are suitable for different trading styles. There are several tariffs inside the accounts, they differ in specific values such as balance, target profit, available trailing drawdown, etc. Carefully study the possibilities of each account in order to make the right choice. You will be able to reduce the monthly fee and increase the balance, but it will not be possible to influence the basic parameters determined by the initial account settings.

Account types of Elite Trader Funding:

Only some features of the accounts have been discussed. All of them differ in balance, target profit, types of drawdown, and other limits. Almost all accounts and rates require at least 5 trading days per cycle. Note that a reset costs $75, however, this feature is not available on Accelerated accounts.

Investment Education Online

The prop trading firm is interested in its partners improving their skills. After all, the better clients trade, the higher their profits, part of which goes to the firm. However, Elite Trader Funding almost never publishes educational materials on its website.

The prop firm has communities on different social media. Traders can communicate with their colleagues and learn from their success and experience. Also, technical support is ready to provide some explanatory materials.

Security (Protection for Investors)

Prop firms do not provide trading services; they act as intermediaries between traders and liquidity providers or brokers. Additionally, they provide finance for trading. All Elite Trader Funding partners are registered and licensed, and they operate under local and international laws.

👍 Advantages

- Traders can file a complaint to the technical support of the prop firm

- Traders can contact liquidity providers

👎 Disadvantages

- No centralized mechanism to protect traders

Withdrawal Options and Fees

-

Traders receive 100% of the profit until they earn a total of $12,500 (regardless of the account type);

-

After targeting the specified limit, a trader keeps 80% of the net profit, the remaining 20% goes to the prop firm;

-

Bonuses from the referral program arrive to a trader's user account regularly, but they are stored and withdrawn separately;

-

Traders submit an application for withdrawal of profits through the user account. The application is processed within a few days.

-

A trader can withdraw money to a bank account, bank card, e-wallet, or in other ways.

Customer Support Service

The Elite Trader Funding technical support is available 5 days a week. Saturdays and Sundays are off days. Business hours are from 8:00 to 16:00 Central Time Zone (CST).

👍 Advantages

- Clients and non-clients of the prop firm can contact technical support

- Traders can contact client support via the website’s feedback system or live chat

👎 Disadvantages

- No call center

- Long wait for a response

Partners of the Elite Trader Funding prop firm can contact the website specialists in the following ways:

-

ticket system in the "Contact Us" section;

-

live chat (available on any page of the website).

The best communication option is live chat because it is faster. If you use the ticket system, the response will come to the email you specified.

Contacts

| Foundation date | 2010 |

| Registration address | Elite Trader Funding LLC, Attn: Data Protection Officer, 2810 N Church St, PMB 53832, Wilmington, DE 19802 |

| Official site | https://elitetraderfunding.com/ |

| Contacts |

Email:

support@elitetraderfunding.com,

|

Review of the Personal Cabinet of Elite Trader Funding

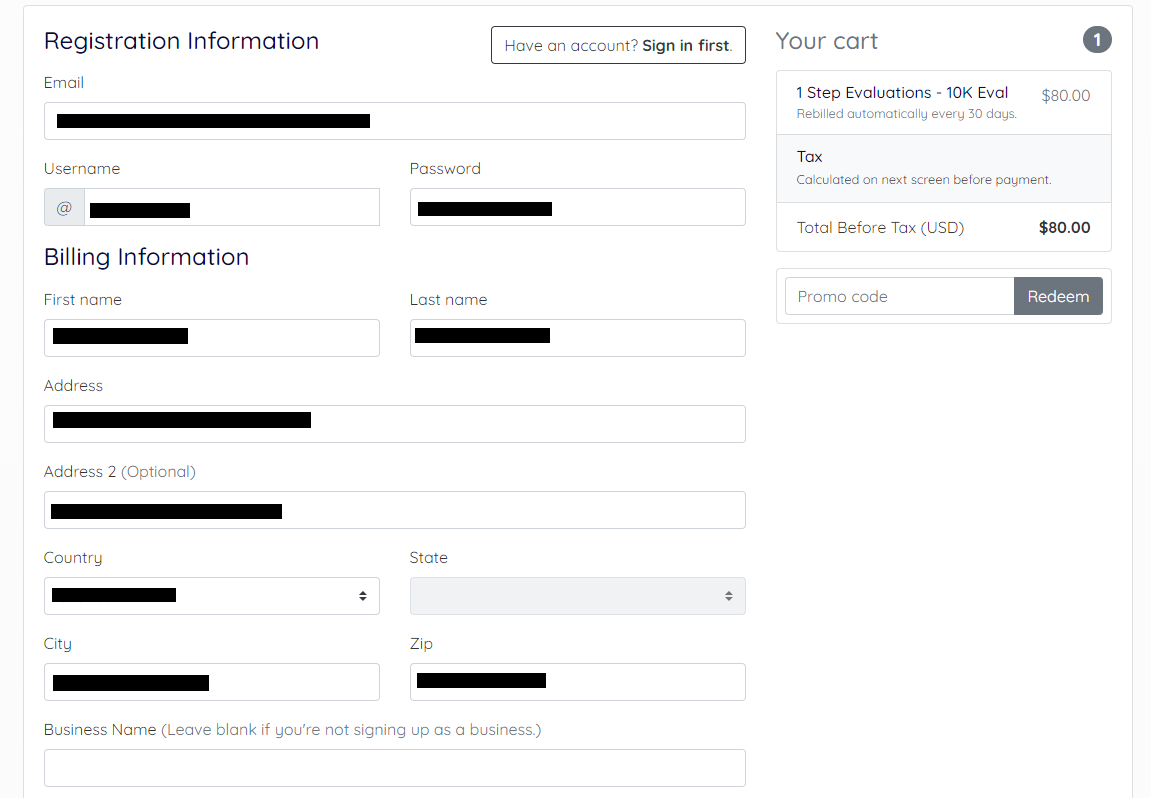

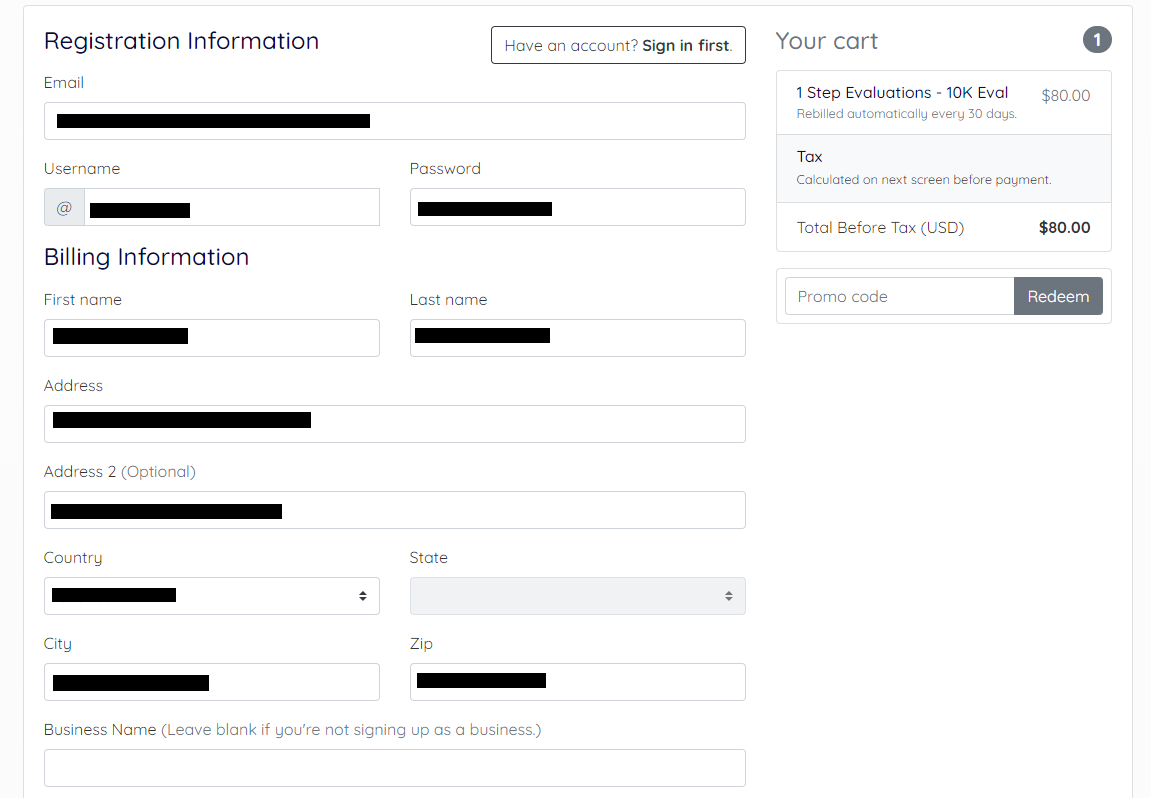

To become a partner of the prop trading firm, register on its official website and get verified. There is no initial fee, the platform is completely free within the first 14 days, then a monthly subscription fee is charged in accordance with the selected account type. The step-by-step registration process and brief description of the possibilities of the user account follow:

Go to the prop firm’s website. Click on the button "Start Trading” in the upper right corner.

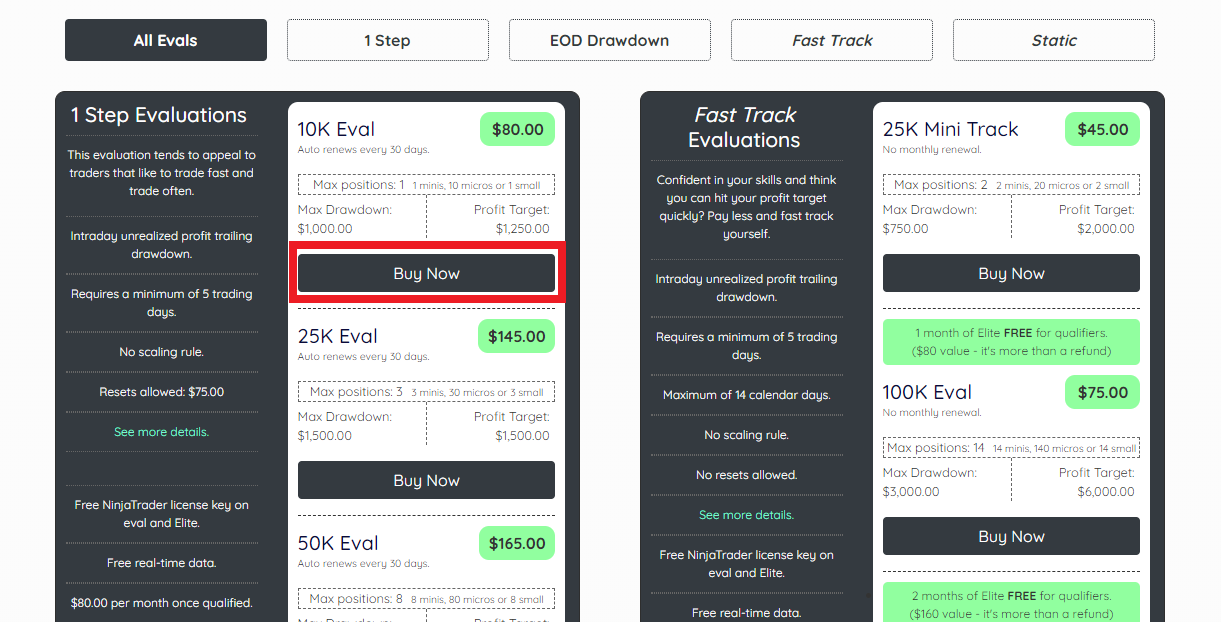

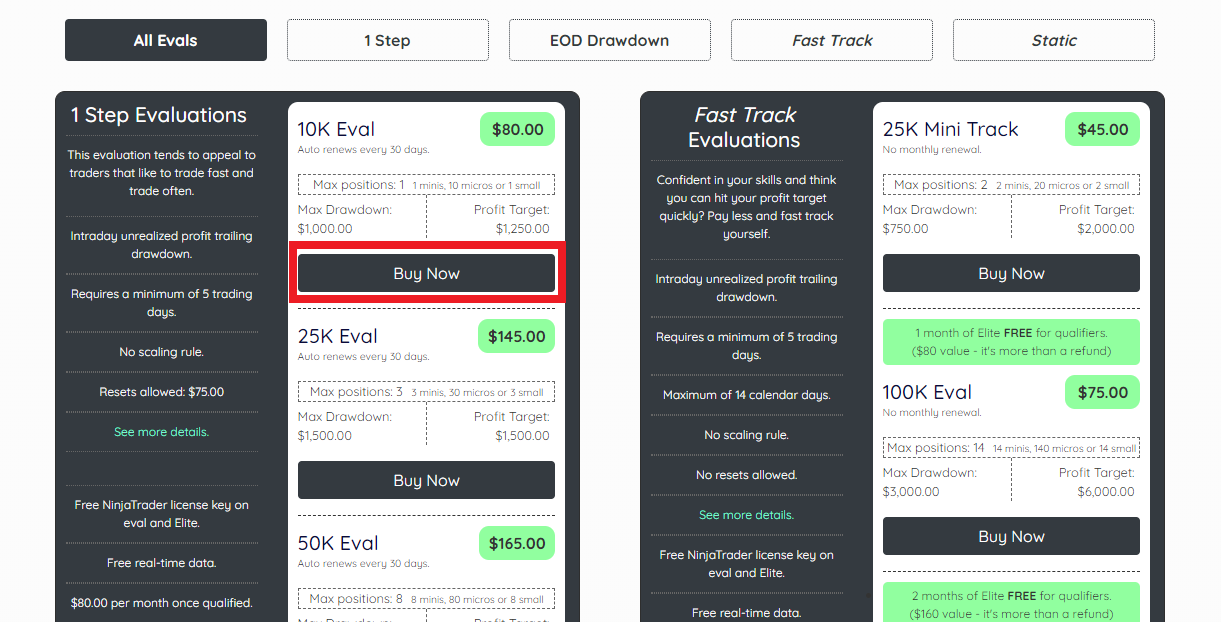

Explore the features of different types of accounts. Once you have chosen the best option for you, click the "Buy Now" button.

Enter your email, create a username and password for your user account. Enter your first and last names, also add your registration address.

Agree to the terms of the website by ticking the appropriate boxes. Choose your preferred trading platform and click the "Continue to Payment" button.

Enter your payment information and follow the instructions on the screen. If you want to try it for free within 14 days, click the "Free Trial" button on the main page of the website.

Regardless of which version you have chosen (paid or free), you will be given access to your user account after registration is completed. Verification (data confirmation) and payment may take some time.

Services of Elite Trader Funding’s user account for traders:

-

Review of user account information;

-

Control of the progress in the challenge;

-

Information on trades;

-

Tracking of referral bonuses;

-

Submitting requests for withdrawal of profits;

-

Change security settings.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact Elite Trader Funding rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about Elite Trader Funding you need to go to the company's profile.

How can I leave a review about Elite Trader Funding on the Traders Union website?

To leave a review about Elite Trader Funding , you need to register on the Traders Union website.

Can I leave a comment about Elite Trader Funding if I am not a Traders Union client?

Anyone can post a comment about Elite Trader Funding in any review about the company.

Traders Union Recommends: Choose the Best!