deposit:

- $119

Trading platform:

- MetaTrader4

- MetaTrader5

- CySEC

deposit:

- $119

Trading platform:

- MetaTrader4

- MetaTrader5

- 18 programs to choose from

- Challenges without strict deadlines

- 1 trade a month minimum

- Profit split is 80%/20%-100%/0% subject to trader’s success

- Scaling up to $2,500,000.

- Up to 1:30

Summary of Funded Trading Plus Trading Company

Funded Trading Plus is one of the best proprietary trading firms in the financial market with the TU Overall Score of 8.39 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Funded Trading Plus clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the firm’s clients are fully satisfied with the company. Funded Trading Plus ranks 3 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Funded Trading Plus is registered in the UK and provides quite loyal working conditions for traders with diverse experiences. It offers complete freedom of action, and there are no restrictions on methods, strategies, and challenge deadlines. Scalping, hedging, and use of advisors are allowed. The profit split for real trading is fair and brokerage fees of its partners are below market average. Also, the prop firm offers a partnership program with substantial payouts and occasional promotions.

Funded Trading Plus clients trade CFDs on currency pairs, indices, precious metals, energies, and cryptocurrencies. There are 18 programs with one- and two-phase challenges, or without evaluation. These programs also differ in initial fees, profit targets, maximum total drawdown, and other criteria. Traders can receive from $5,000 to $200,000 under management upon successfully passing the challenge or immediately if they choose the program without evaluation. Scaling up to $2,500,000 is available. The profit split is 80%/20% at the start and 90%/10% or even 100%/0% later. Traders work on MetaTrader 4 and MetaTrader 5. Leverage is up to 1:30.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $119 |

| ⚖️ Leverage: | Up to 1:30 |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | CFDs on currency pairs, indices, precious metals, energies, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | Set by a broker |

👍 Advantages of trading with Funded Trading Plus:

- Wide choice of programs with universal parameters and acceptable requirements;

- One-time initial fee, refundable for programs with one- and two-phase challenges. No monthly subscription;

- Simple and understandable conditions, no hidden obligations, and profitable trading split;

- The prop firm partners with Eightcap and ThinkMarkets. It offers spreads from 0 pips and low trading fees;

- A demo account with $100,000 in virtual funds is available for exploring the trading process and instruments;

- 24/7 technical support is provided via four communication channels;

- Deposits and withdrawals are made with Visa, Mastercard, bank transfers, and crypto wallets without fees.

👎 Disadvantages of Funded Trading Plus:

- The Master program without evaluation is very expensive — a non-refundable initial fee of $4,500 is required for the balance of $100,000;

- Funded Trading Plus offers only CFDs without real assets or futures;

- The firm’s website contains much information, but some important nuances, like the reset fee, are not provided.

Evaluation of the most influential parameters of Funded Trading Plus

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest Funded Trading Plus News

- Analysis of Funded Trading Plus

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Funded Trading Plus

- User Reviews of Funded Trading Plus

- FAQs

- TU Recommends

Geographic Distribution of Funded Trading Plus Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Funded Trading Plus

Funded Trading Plus is registered in the UK as a brand of FTP London Ltd and has been on the market since 2021. Today its client base is significant and over 90% of trader’s reviews on the net are positive.

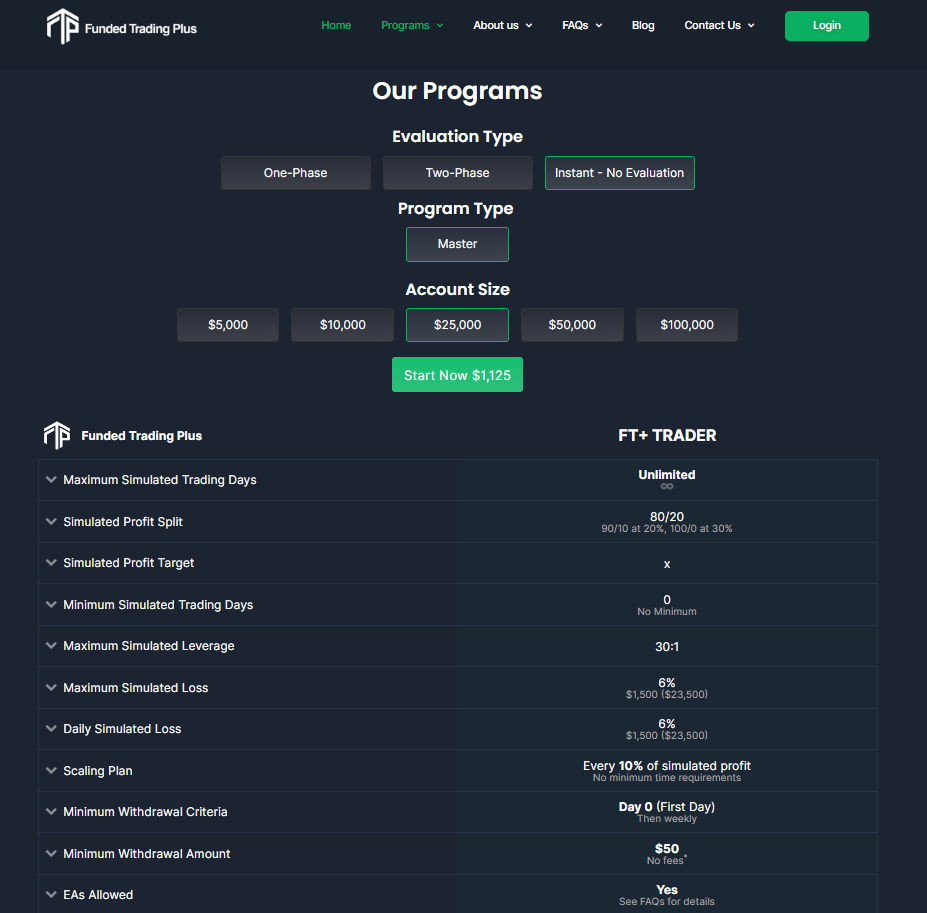

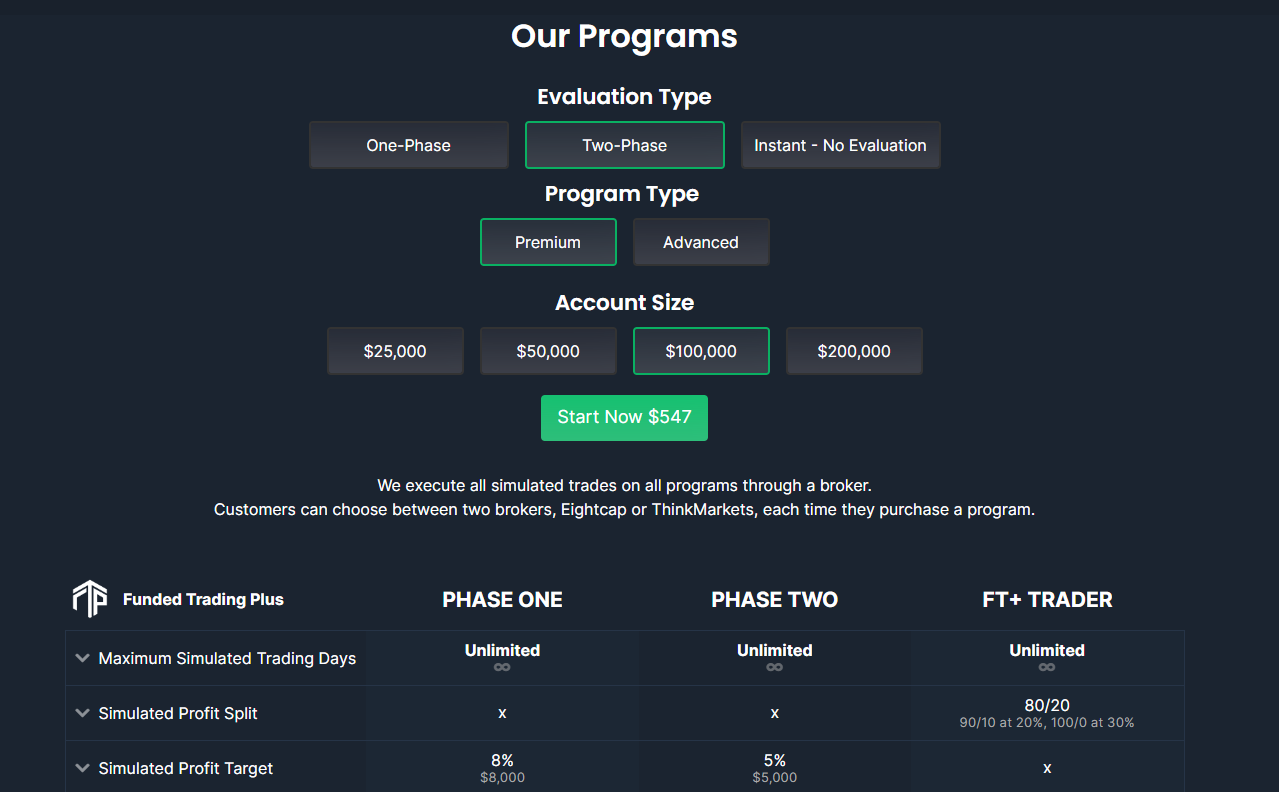

Traders can choose among four program types — Experienced, Premium, Advanced, and Master. The Experienced program implies a one-phase challenge, an initial fee of $119-$949, and the account size of $12,500-$200,000. Premium and Advanced programs imply two-phase challenges, initial fees of $199-$1097, and an account size of $25,000, $50,000, $100,000, or $200,000. Those who pay for the Master program, don’t have to complete a challenge and can immediately start real trading. To receive $5,000-$100,000, the required initial fee is $225-$4,500. Also, programs differ in daily and maximum loss limits. Those that imply challenges differ in profit targets. All programs are described in detail on the prop firm’s website.

Programs have much in common as well, such as leverage is up to 1:30 and MetaTrader platforms are available. The scaling plan is the same, as every 10% of the profit increases the balance by an additional 10%. The profit split is always 80%/20% at the start. If you regularly trade in Plus, it can be 90%/10% or even 100%/0%, which is a very surprising and profitable offer. To prevent account blocking, at least one trade a month is required. Note that the initial fee is refundable only in programs with a challenge.

Trading with the prop firm is quite comfortable. It partners with Eightcap and ThinkMarkets. Among the trading instruments are CFDs on currency pairs, indices, precious metals, energies, and cryptocurrencies. There are about 200 assets in total. For the EUR/USD pair, spreads are from 0 pips and the fee is $7 per lot. Some asset types don’t imply fees, traders pay only spreads that are overall competitive. The allowed methods and strategies range from scalping and advisors to hedging and trading on news events.

The firm’s partnership program is quite profitable as traders receive 20% of their referrals’ first deposit. The blog is regularly updated, and deposit and withdrawal methods include bank transfers, Visa, Mastercard, and crypto wallets. Technical support is multilingual and is available 24/7 via email, phone, and live chat. Also, traders can use the ticket system.

Among the disadvantages, high and non-refundable initial fees for the Master account are the most significant. This account type isn’t suitable for novice traders, moreover, experienced traders have to think twice before choosing it. The prop firm offers only CFDs, which is true for most firms. Another disadvantage, though not crucial, is the lack of NinjaTrader, Traderstation, or other alternatives to MT solutions. Regional restrictions are minimal and the firm doesn’t provide its services to traders from Cuba, North Korea, Syria, Iran, or Myanmar.

TU considers Funded Trading Plus as a worthy representative of the industry that offers qualitatively balanced conditions.

Dynamics of Funded Trading Plus’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The prop firm itself invests in its clients and in their ability to profitably trade CFDs. Traders, in their turn, can additionally earn from its partnership program.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from Funded Trading Plus

To participate in the program, apply by email or in the live chat on the firm’s website. Upon confirmation and acceptance of the application, traders receive a unique text link and graphic promotional materials that may be placed on all available resources — from their own websites to newsletters. Each referral attracted by these materials, who registers with the firm and pays the initial fee, brings the partner 20% of the deposited amount. All subsequent referral payments don’t bring partners anything. Rewards are withdrawn once a month.

Trading Conditions for Funded Trading Plus Users

Traders select what initial fee to pay according to the trading capital necessary for them and whether they are ready or not to pass the challenge. The cheapest option is $119 for a one-phase challenge with $12,500 on the account. The most expensive program costs $4,500 for real trading without a challenge and with $100,000 on the balance. The fee is one-time and is refunded in programs with a challenge. Leverage is up to 1:30 and it can be used within the available range for a certain asset. Technical support is available 24/7 via phone, email, live chat, and the ticket system on the website.

$119

Minimum

deposit

1:30

Leverage

24/7

Support

| 💻 Trading platform: | MetaTrader 4 and MetaTrader 5 |

|---|---|

| 📊 Accounts: | Experienced, Premium, Advanced, and Master |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfers, Visa, Mastercard, and crypto wallets |

| 🚀 Minimum deposit: | $119 |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | CFDs on currency pairs, indices, precious metals, energies, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | Set by a broker |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

18 programs to choose from; Challenges without strict deadlines; 1 trade a month minimum; Profit split is 80%/20%-100%/0% subject to trader’s success; Scaling up to $2,500,000. |

| 🎁 Contests and bonuses: | Yes |

Comparison of Funded Trading Plus to other prop firms

| Funded Trading Plus | Topstep | FTMO | The5ers | Fidelcrest | The Funded Trader | |

| Trading platform |

MetaTrader4, MetaTrader5 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader5 | MetaTrader4 | MetaTrader5, MetaTrader4, TradingView |

| Min deposit | $119 | $1 | $155 | $85 | $99 | $189 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:200 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | 10% / 10% | No |

| Execution of orders | Market Execution | ECN | Instant Execution | N/a | Market Execution | N/a |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| Funded Trading Plus | Topstep | FTMO | The5ers | Fidelcrest | The Funded Trader | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No | Yes | Yes |

| CFD | Yes | No | Yes | No | Yes | No |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | Yes | No | No |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

Funded Trading Plus Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Experienced | $2 | No |

| Premium | $2 | No |

| Advanced | $2 | No |

| Master | $2 | No |

The prop firm doesn’t charge withdrawal fees regardless of the method. However, there are some expenses such as those charged by banks or third parties to the withdrawal process, that almost always charge fees for international transfers and cryptocurrency transactions.

Comparison to its major competitors allows traders to evaluate how profitable Funded Trading Plus’ offer is. The table below provides the average trader costs.

Detailed review of Funded Trading Plus

Funded Trading Plus was incorporated 2.5 years ago. It is managed by professional experts on financial markets, who have ensured a comprehensive and extensive service of providing trading capital to its clients. Working conditions are fair and mutually beneficial. Traders have the opportunity to study the conditions on a demo account and then, if everything suits them, pay the initial deposit and start completing the challenge, or trade on a live account. MT4 and MT5 are the best and most proven platforms. Flexible leverage is up to 1:30, which is enough for even risky strategies. Traders work at their own pace. It’s enough to execute one trade a month to exclude blocking of an inactive account.

Funded Trading Plus by the numbers:

-

4 program packages are offered, each including several balance options;

-

Minimum initial fee is $119;

-

Up to $200,000 is available upon completion of the challenge;

-

Maximum scaling plan is up to $2,500,000;

-

Profit split is 80%/20%, 90%/10%, or 100%/0%.

Funded Trading Plus is a prop firm with a wide choice of financial instruments and no trading restrictions

Funded Trading Plus offers about 200 assets, that comprise CFDs on currency pairs, indices, precious metals, energies, and cryptocurrencies. Such a wide and diverse pool provides for building a well-diversified trading portfolio. Here, the negative trend of one position is compensated by the stability and progress of others. Traders can use any strategies and methods, such as scalping, hedging, trading on news events, and algorithmic trading, to achieve their investment goals.

Useful services offered by Funded Trading Plus:

-

Working with Eightcap and ThinkMarkets. Traders can choose through which broker to execute trades. Brokers significantly differ in conditions and asset types, but they are definitely among the top representatives of the industry.

-

Blog with articles. This is an extensive collection of materials useful for novice traders and those who are not very experienced at trading.

-

Partnership program. To participate in this program, traders are not required to be clients of the prop firm. If they have their websites, blogs, or popular social media accounts, they can receive good additional income.

Advantages:

Numerous programs for traders with any experience;

One-time fee refundable for all programs, except for Master which carries no monthly fees;

Many assets from 5 groups, tight spreads, and acceptable trading fees (for example, $7 per lot for EUR/USD);

Profit split is one of the most profitable and scaling up to $2,500,000 is available;

Technical support is available 24/7 via main communication channels.

Guide on how traders can start earning profits

The most important thing is to choose the right program out of the 18 available by carefully studying their conditions. Those programs that imply a one-phase challenge, are usually completed faster than those with a two-phase challenge. However, the daily and maximum loss level is much lower for them, which increases the risk of failure and results in paying the reset fee. The ratio of the initial fee to available capital is more or less similar. Programs without evaluation are much more expensive. For example, to receive the balance of $100,000, traders must deposit $4,500. What is more important, the fee is non-refundable for this program. In addition to the program, traders choose the broker they are going to work with. For this, visit the Eightcap and ThinkMarkets websites. Also, they choose a trading platform. Their previous experience helps to decide on the version of MetaTrader platforms. If traders have no experience, they can try both versions on a demo account and then choose the one best for them.

Program types:

Bonuses from Funded Trading Plus

Occasionally, the prop firm holds special promotions that allow traders to receive certain economic benefits, like an initial fee discount, increased profit share of 90%, etc. There is another advantage applicable to trading itself.

Investment Education Online

Funded Trading Plus is among the prop firms that don't offer much education. The introduction of this section has been announced, but as of the beginning of 2024, there has been only one blog updated once a week.

The firm’s management believes that if traders pay initial fees, they have certain trading experience and are sure of positive results. After all, they can always request assistance from experts.

Security (Protection for Investors)

It is highly recommended not to contact a prop firm that doesn’t provide information on its registration, because it can be a scammer that takes your initial fee and hunts other careless traders. Also, make sure to study reviews of a firm on the internet. Funded Trading Plus is registered in the UK. It partners with Eightcap and ThinkMarkets which are reliable regulated brokers. There are many reviews and most of them are positive.

👍 Advantages

- Reputation

- Official registration

👎 Disadvantages

- Some information important for traders isn’t provided on the firm’s website

Withdrawal Options and Fees

-

Successful trading brings profit to traders. They keep 80%, 90%, or even 100% of the profits.

-

Withdrawals can be requested once a week by clicking the “Withdrawal request” button. The minimum amount is $50.

-

Available methods are bank transfers, Visa, Mastercard, and crypto wallets.

-

In most cases, transactions take 2 hours. The maximum time is 48 hours.

-

The prop firm doesn’t charge withdrawal fees, but banks can withhold those. Fees are always charged for verifying cryptocurrency transactions.

Customer Support Service

Funded Trading Plus has a lot of information on its website. Conditions of programs, deposits, withdrawals, and trading nuances are described in detail there. Nevertheless, traders may have some questions. If they don’t get prompt and competent answers, they can choose another firm. Funded Trading Plus’ support is available 24/7 via email, phone, ticket system, and live chat on the website.

👍 Advantages

- Technical support is available 24/7

- The four most popular communication channels

- Managers provide comprehensive advice

👎 Disadvantages

- Sometimes responses via email and live chat are not prompt

To contact technical support, use the following communication channels:

-

Phone;

-

Email;

-

Tickets on the website;

-

Live chat in the user account.

Also, there is an active Discord community. The firm has its profiles on Facebook, X (formerly Twitter), LinkedIn, and TikTok, where traders can contact support as well.

Contacts

| Registration address | 7 Bell Yard, London, WC2A 2JR |

| Regulation |

CySEC |

| Official site | https://www.fundedtradingplus.com/ |

| Contacts |

Email:

info@fundedtradingplus.com,

Phone: +44 333 090 9800 |

Review of the Personal Cabinet of Funded Trading Plus

The registration process is standard. Go to the firm’s website, choose the program, pay the initial fee, and start trading. Below is a step-by-step guide prepared by TU experts.

Go to the prop firm’s website, choose the appropriate program, and click the “Start Now” button.

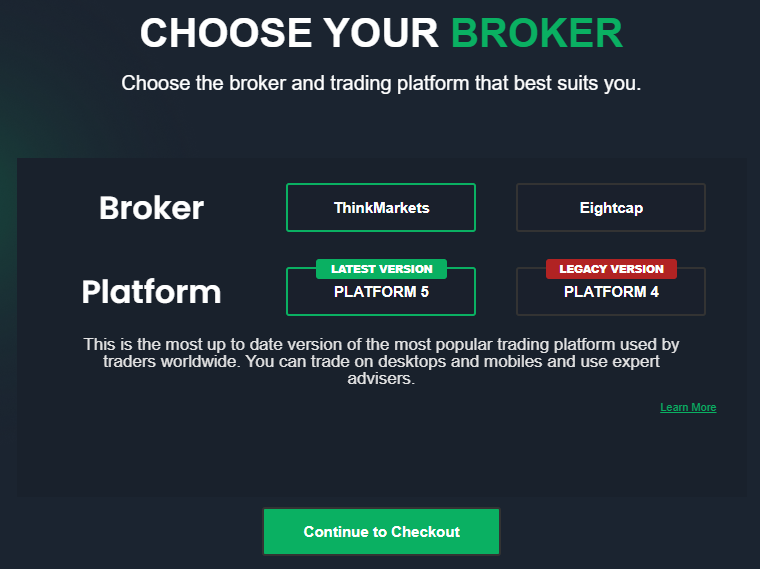

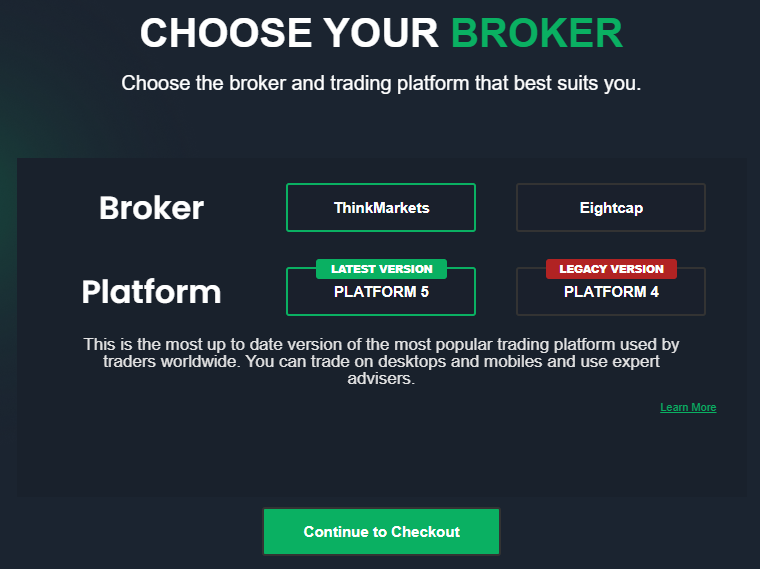

Indicate the broker you prefer to trade with and choose the trading platform, MT4 or MT5. Click the “Continue to Checkout” button.

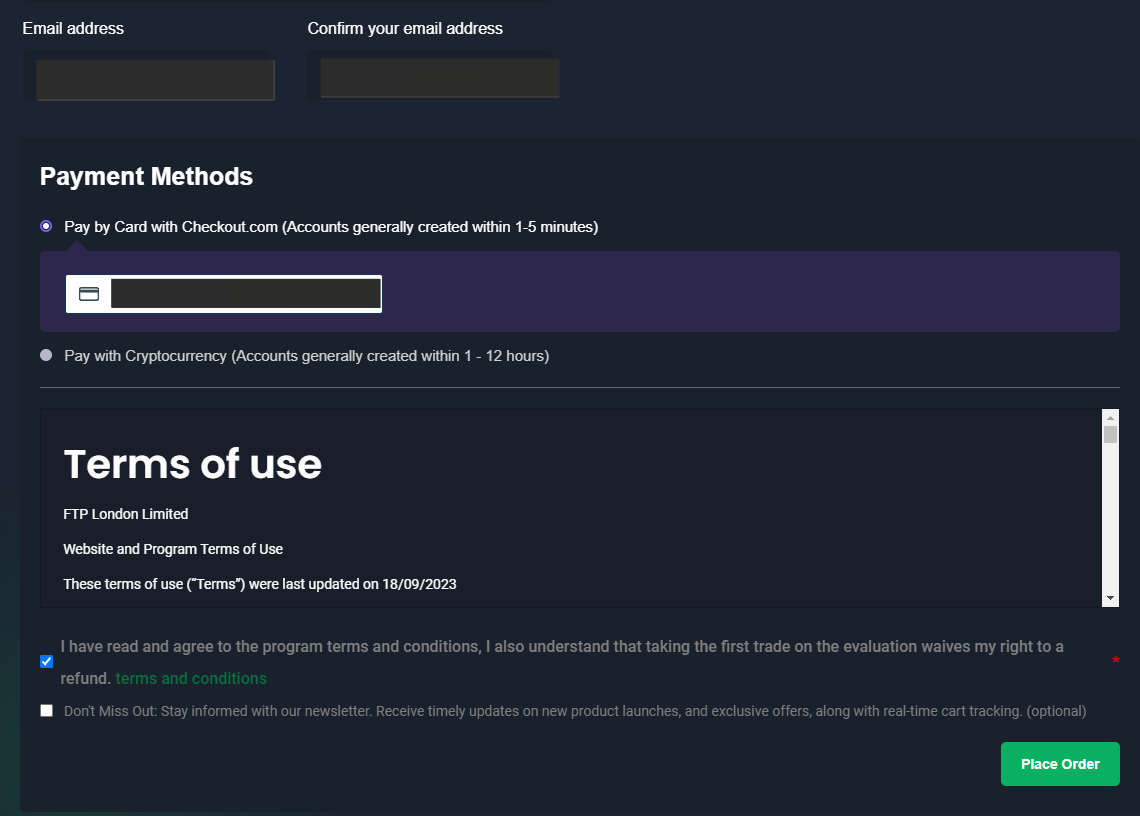

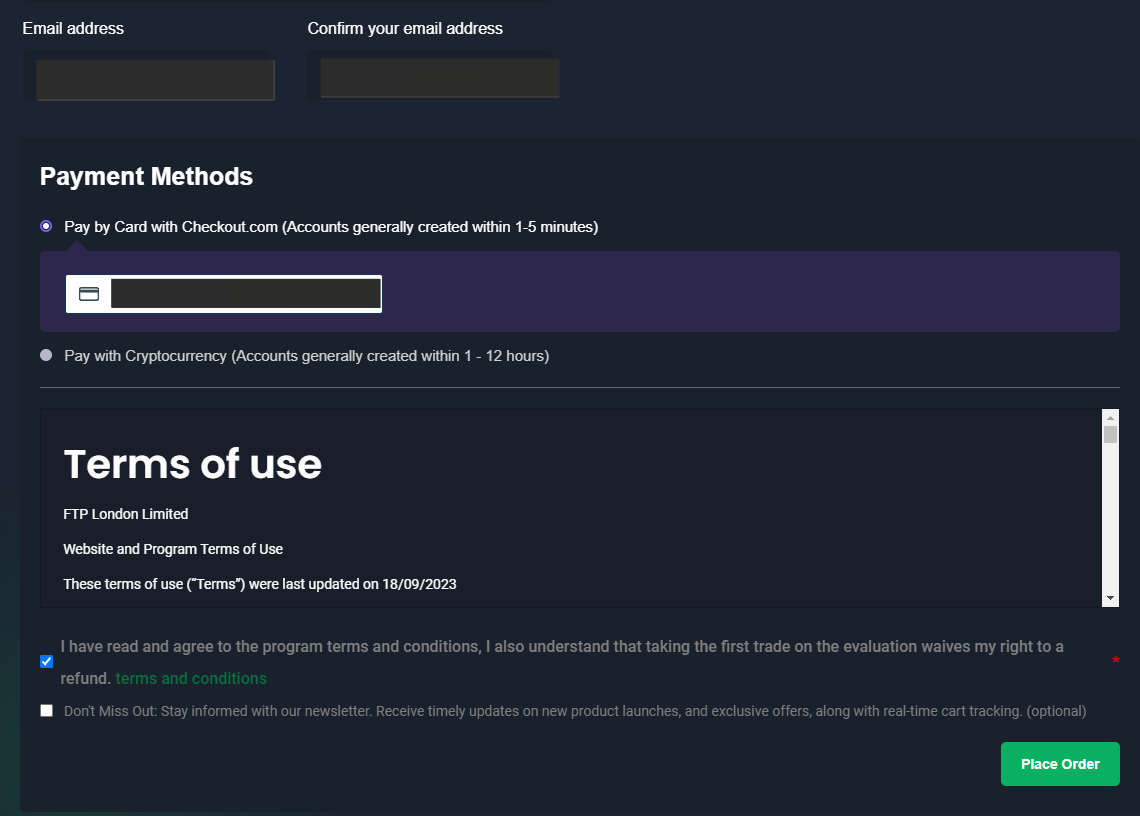

Provide your first and last names, country of residence, and other personal information. Indicate your phone number and email. Choose a payment method, a card, or a crypto wallet, and enter your payment details. Agree to the terms of use and click the “Place Order” button.

Upon paying the initial fee and downloading the platform, start taking a challenge or trading on a live account, if you choose the program without evaluation.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact Funded Trading Plus rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about Funded Trading Plus you need to go to the company's profile.

How can I leave a review about Funded Trading Plus on the Traders Union website?

To leave a review about Funded Trading Plus , you need to register on the Traders Union website.

Can I leave a comment about Funded Trading Plus if I am not a Traders Union client?

Anyone can post a comment about Funded Trading Plus in any review about the company.

Traders Union Recommends: Choose the Best!

Фируза Гулямова

Фируза Гулямова  UZ Tashkent

UZ Tashkent