Should I Use TradingView or MT4?

-

TradingView boasts advanced charting, a social community, and multi-device access

-

MT4 excels in automated trading, strategy backtesting, and security features

-

TradingView requires a subscription for full features. MT4 is cost-effective

-

TradingView offers diverse trading instruments. MT4 focuses on forex and CFDs

-

Choosing between 2 may not be necessary. It’s very possible to combine using both

The quest for the most effective trading platform is perpetual in Forex trading. Traders, novices and seasoned professionals alike, face a common dilemma-selecting a platform that not only meets their trading needs but also enhances their market analysis and decision-making process.

Among the plethora of options, two names frequently emerge at the forefront: TradingView and MetaTrader 4 (MT4). This article aims to dissect these platforms, comparing their features, strengths, and weaknesses, to guide traders in making an informed choice.

-

Why are trading platforms important?

Trading platforms are essential as they offer a suite of tools for market analysis, trade execution, and portfolio management, which are vital for successful trading.

-

Is MT4 and TradingView the same?

No, MT4 and TradingView are distinct platforms; MT4 is known for automated trading, while TradingView is celebrated for its advanced charting and social networking features.

-

Can you use MetaTrader 4 with TradingView?

Yes, MetaTrader 4 can be used with TradingView by linking the two through third-party bridging software.

-

Are MetaTrader 4 and TradingView free to use?

MetaTrader 4 is free to use, although some brokers may charge fees. TradingView offers a basic free version, but advanced features require a paid subscription.

Best Forex brokers

What is TradingView used for?

TradingView stands out as a modern, web-based charting and analysis tool favored by many traders worldwide. At its core, it provides a comprehensive suite of features designed for market analysis, trading, and social networking among traders.

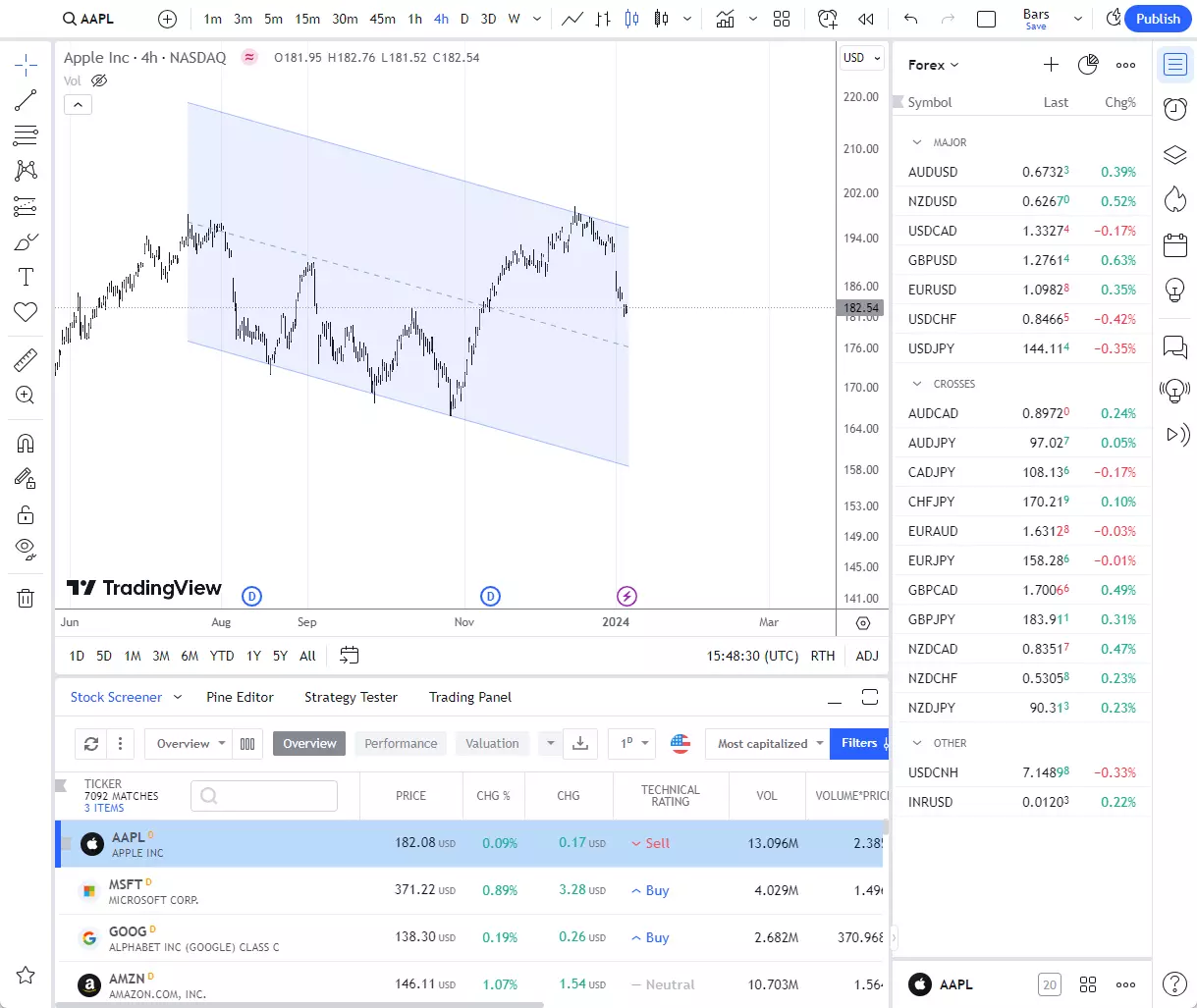

This is how the TradingView platform looks like

The image above reveals the sophisticated yet user-friendly interface of TradingView. The platform's layout displays an intricate balance of functionality and aesthetics. It features various analytical tools and indicators around a detailed chart in the center. These tools are intuitively placed for easy access, reflecting the platform's commitment to both functionality and user experience.

Strengths:

-

Advanced Charting: TradingView is renowned for its advanced charting capabilities. It comes packed with a multitude of technical indicators, drawing tools, and customization options. These features empower traders to visualize data comprehensively and identify trading opportunities with greater precision

-

Community and Social Features: A unique aspect of TradingView is its robust community and social networking features. Traders can share ideas, collaborate, and learn from each other through public charts, watchlists, and forums. This collaborative environment fosters a sense of community, allowing users to gain insights from fellow traders

-

Web-based Platform: The platform's web-based nature ensures accessibility from any device with an internet connection. This flexibility is crucial for traders who need to monitor markets and make decisions on the go

-

Variety of Instruments: TradingView supports a wide range of trading instruments. Users can trade stocks, Forex, cryptocurrencies, and other assets from various exchanges, making it a versatile platform for diverse trading strategies

-

Cool Features: TradingView is not just about charts and data. It offers unique features like fundamental analysis, a powerful scanner for identifying trading opportunities, and a replay mode for backtesting strategies

Weaknesses:

-

Paid Functions: While TradingView offers a free version, many of its advanced features are locked behind a paywall. Traders seeking the full suite of tools will need to opt for a paid subscription

-

Occasional Overload of Information: For beginners, the sheer amount of data and tools available can be overwhelming. Navigating through the platform's extensive features might require a steep learning curve

-

Limited Automated Trading Capabilities: Unlike some other platforms, TradingView has limitations in automated trading features, which might be a drawback for traders who rely heavily on algorithmic strategies

For a comprehensive review and detailed insights, it's recommended to read Is Tradingview Worth it? An Honest Tradingview Review, which dives deeper into the platform's capabilities and user experience.

How do I link my Forex account to TradingView?

Linking your Forex account to TradingView enhances your trading experience by allowing you to execute trades directly from the platform. The process is straightforward, yet it requires careful attention to ensure a seamless integration.

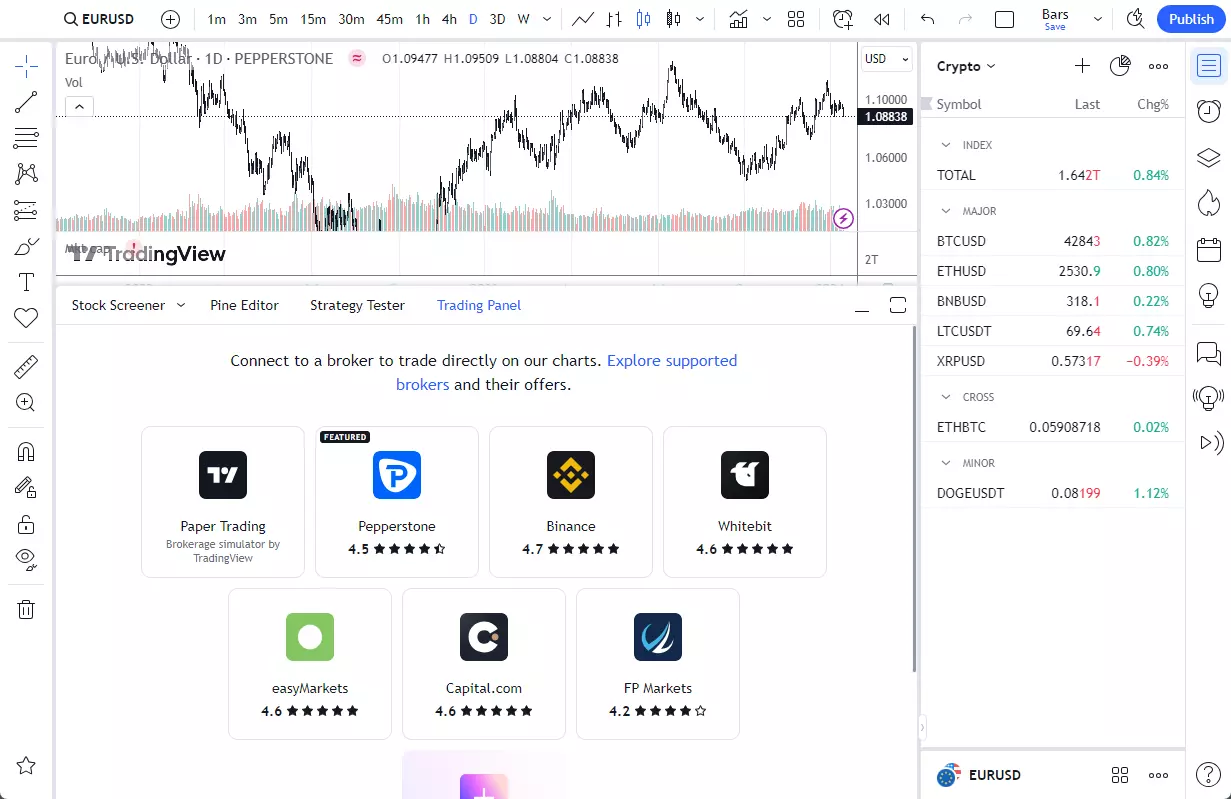

The trading panel lists the available Forex brokers

Here’s a step-by-step guide:

-

Choose a Compatible Broker: First, ensure that your Forex broker is compatible with TradingView. The platform supports a range of brokers, but it’s crucial to verify this compatibility. You can find a list of supported brokers directly on the TradingView website or in your account settings

-

Log in to TradingView: Access your TradingView account. If you don’t have one, you'll need to create it. Opt for the version that best suits your needs-the free version may be sufficient for starters, but the paid subscriptions offer more features

-

Navigate to the Trading Panel: Once logged in, locate the “Trading Panel”. This panel is your gateway to linking your brokerage account

-

Connect Your Broker Account: In the Trading Panel, you'll find options to connect to various brokers. Select your broker from the list and enter your brokerage account details. This step typically requires your login credentials for the broker’s platform

-

Authorize and Verify the Connection: Follow the prompts to authorize TradingView’s access to your brokerage account. This step might involve security verifications like two-factor authentication, depending on your broker's requirements

-

Test the Integration: After linking, though not absolutely necessary, it’s advisable to test the integration. Try placing a test trade or accessing broker-specific features through TradingView to ensure that the connection is functioning correctly

-

Start Trading: Once everything is set up and tested, you’re ready to start trading directly from TradingView. Enjoy the convenience of analyzing and executing trades all in one place

Remember, while TradingView facilitates a unified trading experience, it’s crucial to maintain awareness of the risks involved in trading and ensure that your strategies align with your risk tolerance and trading goals.

What is MetaTrader 4 used for?

MetaTrader 4 (MT4) is a trading platform widely recognized for its robust functionality and reliability in the Forex trading community. Developed by MetaQuotes Software, MT4 is predominantly used for trading Forex, although it also supports CFDs and futures trading.

Its strength lies in its advanced trading and analytical technologies, which cater to experienced traders as well as beginners due to its user-friendly interface.

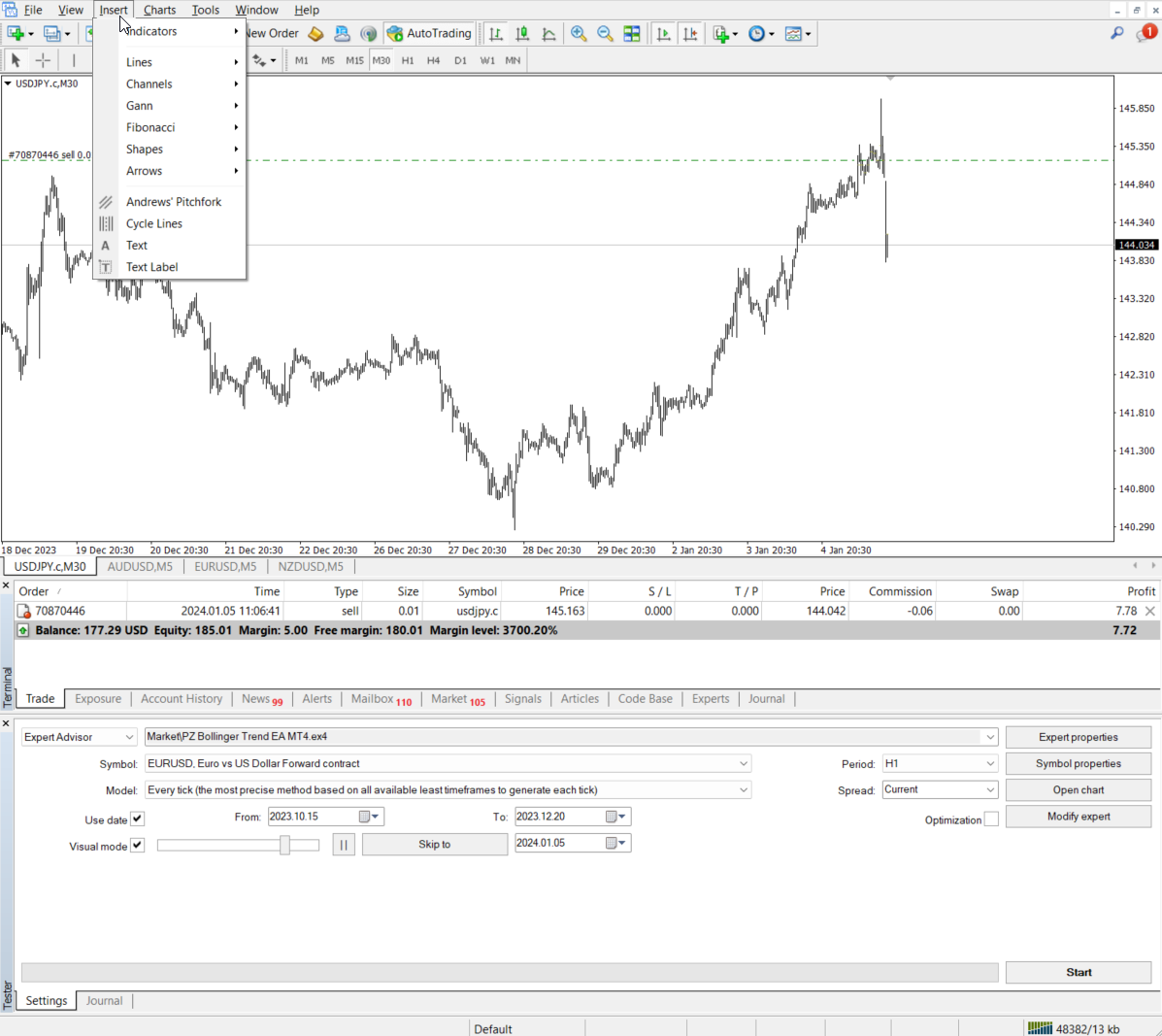

This is how Metatrader4 looks like

The image gives us a glimpse into the MT4's interface, illustrating its practical design focused on efficiency. The main window presents real-time price movements in a classic chart view, demonstrating MT4’s straightforward approach to market tracking.

Below the chart, the terminal section reveals open trades, complete with details such as order numbers, trade sizes, and running profits, painting a picture of the platform's order management capabilities.

Strengths:

-

Order Execution: MT4 is celebrated for its reliable and swift order execution, allowing traders to enter and exit the market with precision

-

Algorithmic Trading: The platform's native MQL scripting language is a powerful tool for developing automated trading strategies, known as Expert Advisors (EAs), which can trade autonomously based on predefined criteria

-

Backtesting: MT4's comprehensive backtesting tools allow traders to evaluate and fine-tune their strategies using historical data for better performance

-

Large User Base and Community: The platform benefits from a widespread user base, providing an abundance of resources and support from other users and a community of developers

-

Customizability: Users can personalize the platform with custom indicators and tools, enhancing the trading experience to suit individual preferences

-

Security: MT4 offers a high level of security, encrypting data between the server and the client with a 129-bit key

Weaknesses:

-

Basic Charting: Although MT4 provides essential charting capabilities, it lacks the advanced visualization tools found in platforms like TradingView

-

Limited Social Features: The platform puts less emphasis on community interaction, missing out on the benefits of social trading functionalities

-

Desktop-Based Platform: MT4 requires downloading and installation, which limits accessibility compared to web-based platforms

-

Limited Instrument Variety: While MT4 supports a wide range of Forex pairs and CFDs, it has less support for other asset classes like stocks and cryptocurrencies

-

User Interface: The interface, while functional, has not seen significant updates over the years and may appear outdated compared to newer platforms

-

Mobile App Limitations: While MT4 does offer a mobile application, it’s not quite as comprehensive when compared to the desktop version

MT4’s emphasis on powerful trading tools and automated trading options makes it a firm favorite among traders who value technical capabilities over graphical sophistication and social trading features. Its time-tested platform provides a secure and comprehensive environment for dedicated Forex trading.

Can you connect TradingView with MT4?

Yes, it is indeed possible to bridge TradingView with MetaTrader 4 to leverage the strengths of both platforms. Traders often want to utilize the advanced charting tools and social features of TradingView alongside the robust trading and analytical capabilities of MT4. To achieve this synergy, follow these steps:

-

Third-Party Service: Utilize a third-party bridging service (such as PineConnector), which acts as a conduit for transferring TradingView signals to MT4 for trade execution

-

Install a Script on MT4: You'll need to install a script or an Expert Advisor (EA) on MT4 that can interpret signals from TradingView. These scripts are usually accessible through trading forums or the service provider

-

Set Up Alerts on TradingView: On TradingView, configure your charts and set up trade signal alerts. These alerts should be capable of sending notifications via email or SMS, which the bridging service will use

-

Configure MT4 for Alerts: The third-party service will need these alert details to place trades on MT4. You'll have to input your trade parameters, such as entry points, stop losses, and take-profit levels into the service

-

Demo Testing: It’s good practice to test the configuration in a demo trading environment to ensure that the alerts are accurately executed on MT4

-

Live Trading: After a successful demo, you can switch to live trading, executing TradingView signals on the MT4 platform

TradingView vs MT4: Which platform is right for you?

Choosing between TradingView and MT4 ultimately hinges on your trading style, preferred instruments, and the importance of certain features to your trading strategy. Below is a comparative table with use cases to help determine which platform aligns with your needs:

| Use Case | Best For | TradingView | MT4 |

|---|---|---|---|

Advanced charting and analysis |

Technical traders |

✅ |

❌ |

Social trading and community |

Socially-driven traders |

✅ |

❌ |

Automated trading strategies |

Algorithmic traders |

❌ |

✅ |

Multi-device accessibility |

On-the-go traders |

✅ |

✅ |

Comprehensive backtesting |

Strategy testers |

❌ |

✅ |

Trading diverse instruments |

Multi-asset traders |

✅ |

❌ |

Ease of use and learning |

Beginners |

✅ |

❌ |

High-security transactions |

Security-conscious traders |

❌ |

✅ |

Cost-effective trading |

Budget-conscious traders |

❌ |

✅ |

For the technically inclined trader who relies on advanced charting tools and values a tight-knit community for sharing insights, TradingView is a match. Its web-based platform allows for trading flexibility across devices and offers an array of instruments.

Conversely, if you're an algorithmic trader who utilizes custom scripts and values the robustness of a platform that has stood the test of time, MT4's powerful automated trading capabilities and comprehensive backtesting tools may serve you best.

Additionally, for traders who emphasize security and prefer a cost-effective solution without the need for extensive charting or social features, MT4's straightforward approach is advantageous.

When choosing, consider not just the features but also how the platform fits into your daily trading routine. Each platform serves different trading philosophies and workflows, and the best choice may even be a combination of both to maximize their unique strengths.

Conclusion

The choice between TradingView and MT4 isn’t strictly binary. Both platforms offer distinct advantages that cater to different aspects of trading.

TradingView excels in charting and community engagement, making it ideal for traders who prioritize technical analysis and peer interaction. MT4, on the other hand, stands out for its automated trading features and backtesting capabilities, which are favored by those who employ intricate trading algorithms.

Ultimately, the decision may not be about choosing one over the other but rather understanding how each can complement your trading strategy. Some traders may find a hybrid approach most effective, using TradingView’s analytical strengths to inform decisions while executing trades through MT4’s robust system. Assess your trading needs, experience level, and priorities to make the right choice or combination for your trading journey.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Backtesting

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.

-

4

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

-

5

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.