Best P2P Crypto Exchanges In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, the best P2P crypto exchange is OKX. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- A high level of liquidity allows you to quickly complete transactions.

- The ability to trade cryptocurrencies around the clock from any device.

Best P2P crypto exchanges:

- OKX - Best automated trading solutions (copy trading, easy bot integration)

- Kraken - Best for trading crypto-fiat pairs (supports 7 fiat currencies, simple trading platform)

- Crypto.com - Best mobile app for crypto activities (Visa card support, trading and passive earning)

- CoinMetro - Suited for conservative trading (simple UI and low leverage of up to 1:5)

- Ledger Wallet - Best for managing assets in a hardware wallet (15 apps to buy, swap, earn crypto and NFTs)

Peer-to-peer (P2P) exchanges are becoming increasingly popular for cryptocurrency trading. These platforms allow users to trade directly with each other, offering more privacy and often lower fees compared to traditional exchanges. In this article, we'll review the best P2P exchanges, focusing on several key aspects. We will compare the transaction fees, the range of supported fiat currencies and cryptocurrencies, and the available payment methods. This detailed comparison will help you choose the best platform for your trading needs.

Best P2P cryptocurrency exchanges

A peer-to-peer (P2P) crypto exchange allows traders to exchange cryptocurrencies directly with each other, bypassing intermediaries like banks. This direct interaction simplifies transactions and offers more privacy, as there's no need for an order book to match buy and sell orders.

On P2P exchanges, verified users can trade cryptocurrencies hassle-free. These platforms don't control the cryptocurrencies but facilitate direct transactions between users, ensuring they retain custody of their funds and choose from various payment methods with different fees.

| P2P | Min. Deposit, $ | P2P Maker Fee, % | P2P Taker Fee, % | Withdrawal fee | Open an account | |

|---|---|---|---|---|---|---|

| Yes | 10 | 0 | 0 | 0,0004 BTC 2,6 USDT | Open an account Your capital is at risk. |

|

| Yes | 1 | 0,10 - 0,16 | 0,16 - 0,20 | 0,0005 BTC | Open an account Your capital is at risk. |

|

| Yes | 1 | 0,1 | 0,2 | 0-0,1% | Open an account Your capital is at risk. |

|

| Yes | 10 | 0 - 0.40 | 0.05 - 0.60 | Fixed fee - 25 USD PayPal - 1,5% USDC - 10 USD | Open an account Your capital is at risk. |

|

| Yes | 10 | 0 | 0 | Network fees | Open an account Your capital is at risk.

|

What coins and fiat currencies can I exchange P2P?

We compared the total number of coins as well as fiat currencies available for exchange on these platforms, which are typically traded by users on P2P exchanges. This analysis helps in identifying which P2P exchanges offer the most diverse options for trading.

| Coins Supported | USD | EUR | GBP | Open an account | |

|---|---|---|---|---|---|

| 329 | Yes | Yes | No | Open an account Your capital is at risk. |

|

| 250 | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| 72 | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| 249 | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| 474 | No | No | No | Open an account Your capital is at risk.

|

What payment options do P2P exchanges support?

P2P exchanges support a variety of payment options to facilitate transactions between users. Common payment methods include:

Bank transfers. Most P2P platforms support direct bank transfers, allowing users to transfer funds from their bank accounts to complete transactions.

Credit and debit cards. Some P2P exchanges allow users to use credit and debit cards for buying and selling cryptocurrencies.

E-wallets. Popular e-wallet services like PayPal, Skrill, and Neteller are often supported, providing a quick and convenient payment option.

Cryptocurrency wallets. Users can also pay directly from their cryptocurrency wallets, making the process seamless for crypto-to-crypto transactions.

Mobile payment systems. Services like Apple Pay, Google Pay, and other mobile payment systems are sometimes supported for ease of use.

| Crypto | PayPal | Bank Card | Bank Wire | Advcash | Google Pay | Apple Pay | |

|---|---|---|---|---|---|---|---|

| Yes | No | Yes | No | No | Yes | Yes | |

| Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Yes | No | Yes | Yes | No | No | No | |

| Yes | Yes | Yes | Yes | No | Yes | Yes | |

| Yes | No | Yes | Yes | No | Yes | Yes |

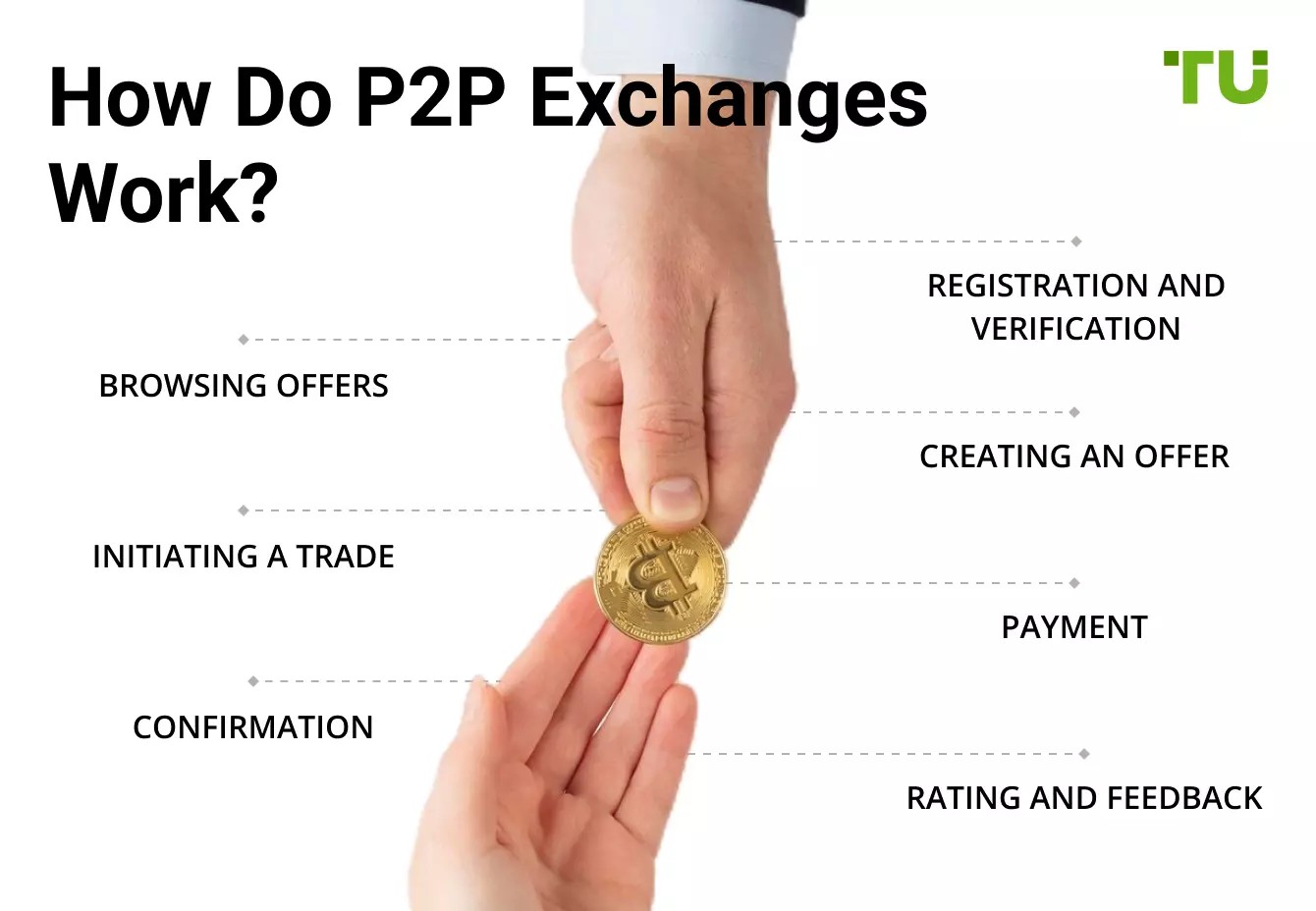

Registration and verification. Users sign up on a P2P exchange platform and complete any required identity verification processes.

Browsing offers. Users browse through offers posted by other users, which include details about the exchange rate, payment methods, and limits.

Creating an offer. Alternatively, users can create their own offers, specifying the amount of cryptocurrency they want to buy or sell, preferred payment method, and exchange rate.

Initiating a trade. Once a suitable offer is found, the user initiates a trade. The P2P platform typically holds the cryptocurrency in escrow to ensure the transaction proceeds smoothly.

Payment. The buyer transfers the agreed-upon amount of fiat currency to the seller using the specified payment method.

Confirmation. After receiving the payment, the seller confirms the transaction on the platform, which then releases the cryptocurrency from escrow to the buyer.

Rating and feedback. Users can rate and leave feedback about their trading experience, helping to build trust within the community.

P2P vs centralized exchanges — how do they compare?

| Feature | P2P exchanges | Centralized exchanges |

|---|---|---|

| Privacy | Higher, no intermediaries | Lower, requires verification and KYC |

| Fees | Generally lower, sometimes zero | Often higher to cover operational costs |

| Transaction Speed | Slower, dependent on user actions | Faster, automated matching and execution |

| Liquidity | Lower, depends on user availability | Higher, managed by the exchange |

| Payment Methods | Various, flexible | Limited, typically bank transfers and cards |

| Security | Depends on user caution, potential for scams | Higher, robust security measures in place |

| Customer Support | Limited, community-based support | Extensive, dedicated support teams |

| Control over Funds | Full control, no third-party intervention | Less control, funds held by the exchange |

| Global Access | Wide access, fewer restrictions | Often restricted by regional regulations |

How to choose the best P2P crypto exchange?

Choosing the right peer-to-peer (P2P) cryptocurrency exchange is essential for a safe and smooth trading experience. Here are the key points to consider:

Security. Prioritize platforms with strong security measures like two-factor authentication (2FA), encryption, and escrow services. These features help protect your transactions and funds from potential threats.

Supported currencies. Ensure the exchange supports the cryptocurrencies and fiat currencies you want to trade. A broader range of options makes it easier to meet your trading requirements.

Payment options. Look for exchanges that offer multiple payment methods, such as bank transfers, debit or credit cards, and digital payment systems. Having flexibility in payment options can simplify your transactions.

Fees. Check the exchange's fee structure, including trading fees, withdrawal fees, and any hidden charges. Low or zero fees can make a significant difference for frequent trades.

User experience. A clear and easy-to-navigate interface helps avoid confusion and errors during transactions. This is especially important for those new to trading.

Reputation. Research the exchange's history and user reviews to gauge its reliability. Positive feedback and a strong track record indicate trustworthiness.

Customer support. Accessible and responsive customer service is important, especially when dealing with transaction issues. Check if the platform provides live chat, email, or phone support.

Regulatory compliance. Ensure the exchange complies with local regulations and has proper licensing. Regulatory compliance adds credibility and helps protect your interests.

Methodology for compiling our ratings of crypto exchanges

Traders Union applies a rigorous methodology to evaluate crypto exchanges using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

-

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

-

Trading instruments. Exchanges are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

-

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

-

Trading platforms. Exchanges are assessed based on the variety, quality, and features of platforms offered to clients.

-

Extra services. Unique value propositions and useful features that provide traders with more options for yield generation.

-

Other factors like brand popularity, client support, and educational resources are also evaluated.

How to choose a P2P platform for P2P transactions

When diving into peer-to-peer (P2P) crypto trading, it's crucial to recognize that while these platforms facilitate direct transactions between users, they also come with unique challenges. One often overlooked aspect is the importance of understanding the platform's dispute resolution mechanisms. In the event of a transaction disagreement, knowing how the platform mediates disputes can be the difference between a quick resolution and prolonged frustration. Before engaging in trades, familiarize yourself with the platform's policies on conflicts and ensure they have a robust system in place to protect your interests.

Another specialized consideration is the platform's liquidity for your specific trading pairs. Even if a P2P exchange supports a wide array of cryptocurrencies, the actual availability of buyers and sellers for your desired pair can vary significantly. Low liquidity can lead to unfavorable pricing and longer transaction times. Regularly monitor the platform's market activity for your chosen assets to ensure you can execute trades efficiently and at competitive rates.

Conclusion

P2P cryptocurrency platforms allow you to exchange digital assets safely and directly, eliminating intermediaries. When choosing a platform, it is important to consider the level of security, fees, and reputation among users. Careful study of the terms of work and the use of security tools will help minimize risks and increase the convenience of trading. Transparent conditions, a reliable escrow service, and access to a variety of currencies make P2P exchange an attractive choice for many traders. Following practical recommendations, you can choose the best platform and effectively manage your assets. In the modern world, P2P trading is becoming an integral part of the cryptocurrency market, providing convenient and flexible solutions for users.

FAQs

Is P2P the best way to buy crypto?

P2P is considered one of the best ways to buy crypto because it offers more privacy, lower fees, and greater accessibility. With P2P, users can buy and sell cryptocurrencies directly with other individuals without the need for a centralized exchange or intermediary.

Can I use P2P without verification?

Most P2P platforms don't require ID verification as any banks or other authorities do not mediate them. So you may only need to provide an email address and password.

How long does it take to receive payment on P2P?

Depending on the P2P platform and seller you choose, the transaction can take a few seconds to a few business days. Binance P2P makes sure to expedite the transaction as much as possible.

Are P2P payments safe?

P2P payments are safer than OTC payments since the assets aren't stored on the exchange. As the traders never lose custody of their coins, they don't have to worry about data breaches and theft.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

A wire transfer is a method of electronic funds transfer in which money is sent from one bank or financial institution to another, typically across international or domestic boundaries. It involves the sender providing their bank with specific instructions, including the recipient's bank details and the amount to be transferred, and the funds are then electronically moved from the sender's account to the recipient's account.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.