Major Risks Associated With Cryptocurrency Trading

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Cryptocurrency trading can be exciting but also comes with risks: the potential for sudden changes in prices (volatility), the danger of hacking or other security issues, and the possibility of changes in laws and regulations.

Cryptocurrency trading has gained immense popularity, offering exciting opportunities for significant financial gains in the digital age. However, we recommend being aware of the potential risks involved.

In this article, we will explore the key challenges and risks hindering the cryptocurrency market, such as price volatility, security breaches, and regulatory uncertainty. Having an understanding of these risks can help you preserve your capital better.

Price Volatility

Cryptocurrencies can have extreme price swings because of things like market sentiment, low liquidity, speculative trading, and the fact that the market is still new. This makes them much more volatile than traditional assets like stocks and bonds. For example, Bitcoin's price shot up to nearly $20,000 in December 2017 but dropped to around $3,200 by December 2018. In contrast, Apple's stock (AAPL) doesn't show such extreme changes.

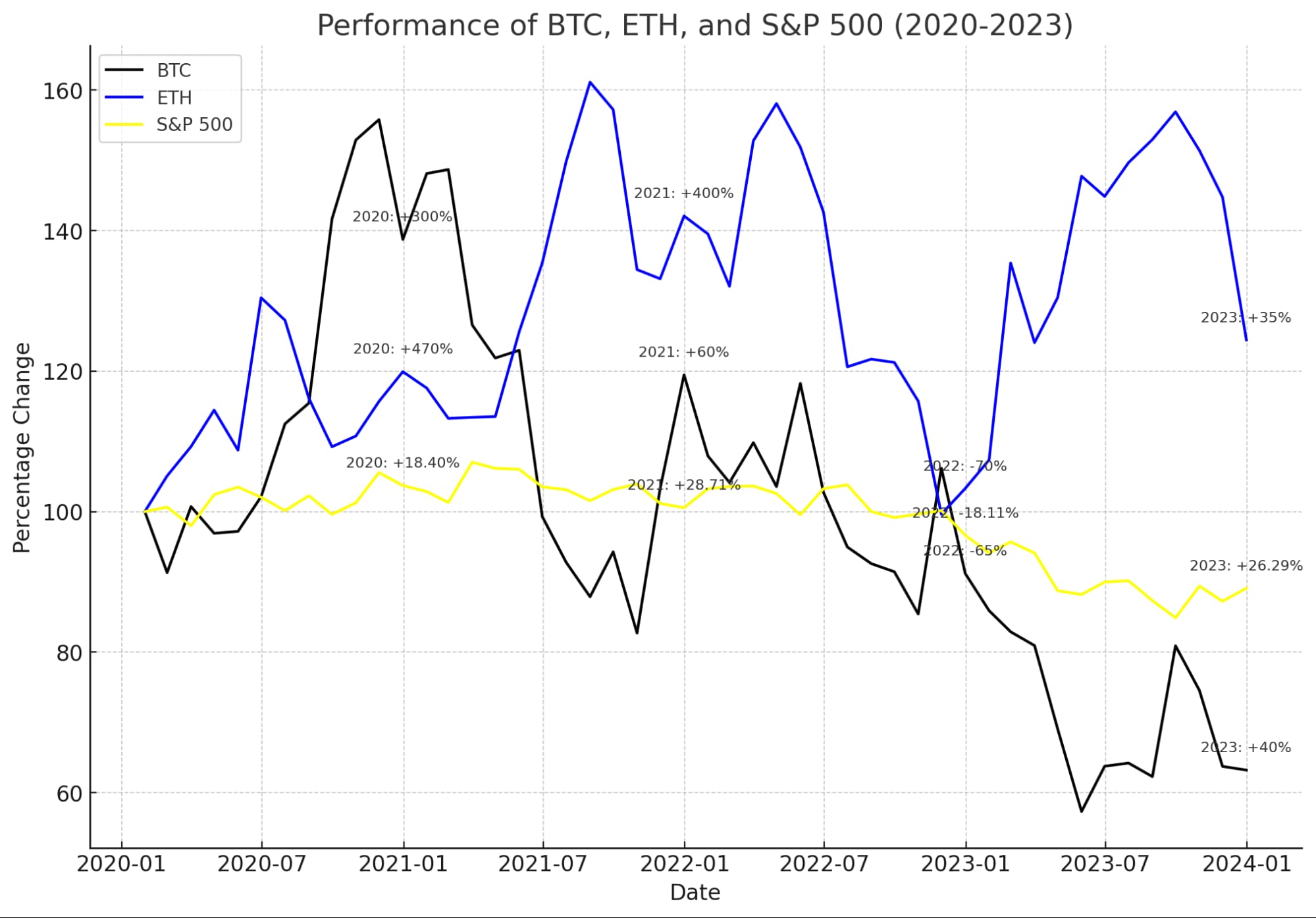

Price volatility over time for major cryptocurrencies

Price volatility over time for major cryptocurrenciesTo handle this volatility, beginners should try diversification. This means spreading your investments across different assets to reduce risk. Another helpful strategy is setting stop-loss orders, which automatically sell your assets if prices drop to a certain level, limiting your losses. Using stablecoins, which are linked to stable assets like the US dollar, can also help protect your investment during market ups and downs. These strategies can help make cryptocurrency trading less risky.

Security Breaches

Cryptocurrency exchanges and wallets are targets for hackers and fraudsters. There have been several notable security breaches, such as the Bitfinex hack in 2016, where nearly 120,000 Bitcoins were stolen, and the Mt. Gox collapse in 2014, which lost over 850,000 Bitcoins. These incidents highlight the risks of keeping your funds on exchanges and the importance of securing your investments.

Two-factor authentication on popular exchanges

Two-factor authentication on popular exchangesConsider using cold storage, such as hardware wallets, to keep your funds offline and safe from hackers. Regularly update your security practices to stay ahead of potential threats.

Here's a comparison table of some of the cryptocurrency exchanges based on various factors such as fees, supported currencies, security and user experience:

| Exchange | Trading fees | Supported currencies | Security features | User experience | Open an Account |

|---|---|---|---|---|---|

0.10% per trade | 500+ | Two-factor authentication, cold storage | Advanced, feature-rich | Open an account Your capital is at risk. | |

0.50% per trade | 100+ | Two-factor authentication, insurance | User-friendly, intuitive | Open an account Your capital is at risk. | |

0.16% maker, 0.26% taker | 50+ | Two-factor authentication, cold storage | Reliable, advanced tools | Open an account Your capital is at risk. | |

0.10% maker, 0.20% taker | 100+ | Two-factor authentication, cold storage | Advanced features | Open an account Your capital is at risk. |

Regulatory uncertainty

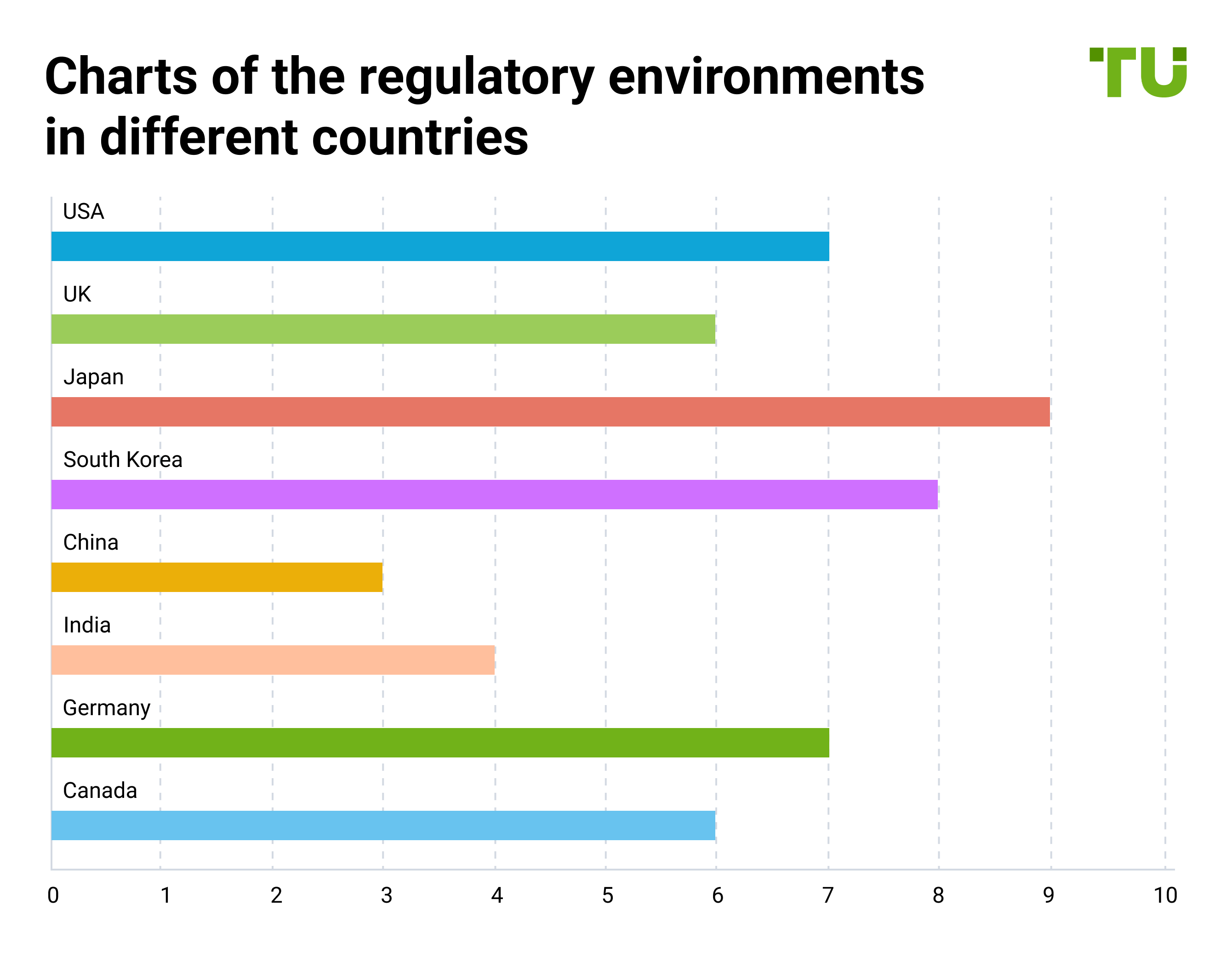

The lack of clear regulations in cryptocurrency markets can create uncertainty and instability. Different countries have different approaches to regulating cryptocurrencies. For example, Japan has strict regulations to protect investors, while China has banned many crypto activities. These varying regulations can affect how easily you can trade and what risks you might face.

Charts of the regulatory environments in different countries

Charts of the regulatory environments in different countriesTo trade cryptocurrencies safely, it's important to stay updated on regulatory changes. Understand the legal rules in your region so you know what is allowed and what isn't. Consider how new regulations might affect your trading and be prepared to adjust your strategies. Keeping informed will help you navigate the market more confidently and avoid potential legal issues.

Liquidity risks

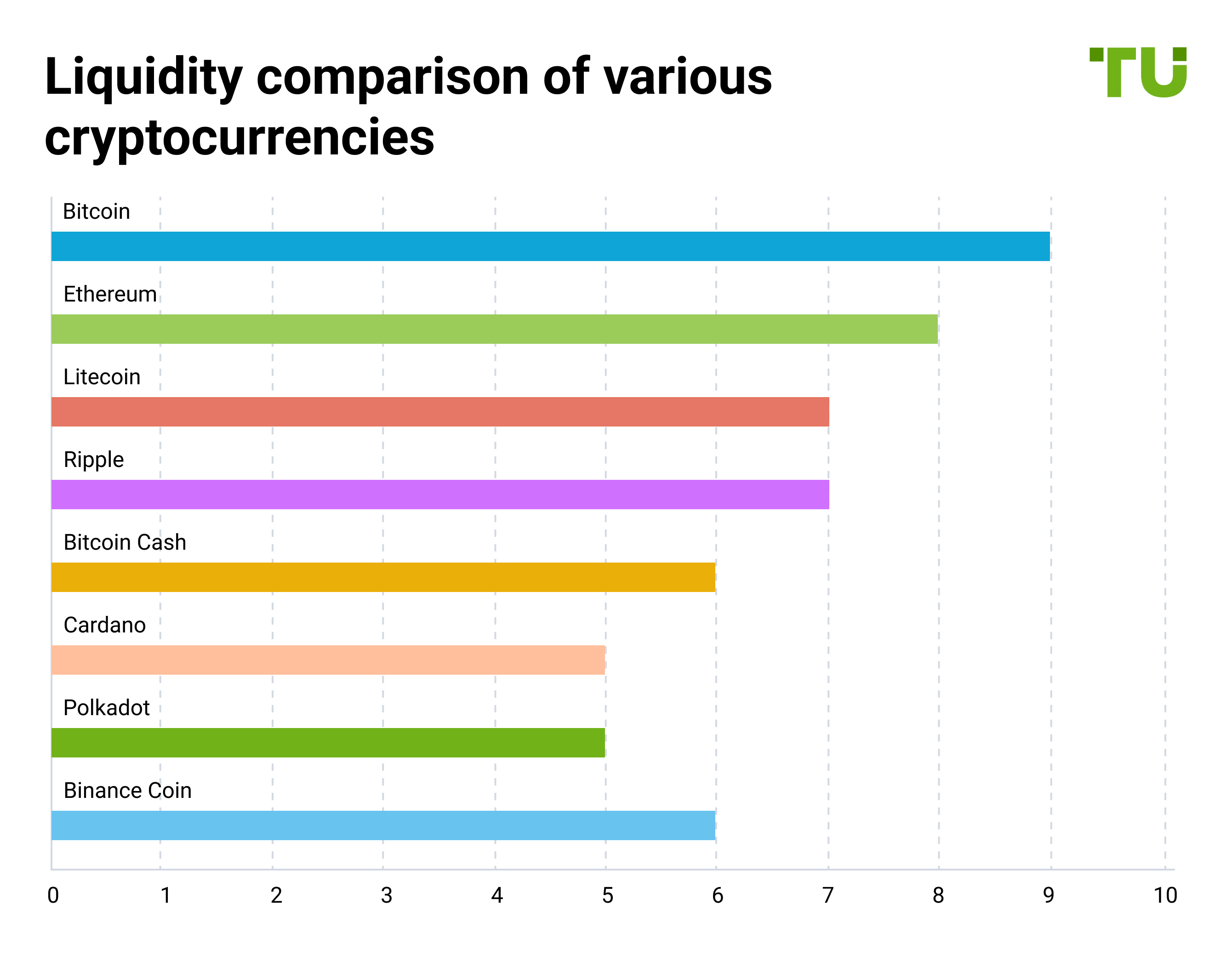

Liquidity risk means you might not be able to buy or sell cryptocurrencies quickly at a fair price. When a cryptocurrency has low liquidity, there aren't many buyers or sellers, making it harder to trade without affecting the price. This problem is common with smaller cryptocurrencies, which can have large price swings and make it tough to get the price you want.

Liquidity comparison of various cryptocurrencies

Liquidity comparison of various cryptocurrenciesPsychological factors

Emotions like fear and greed can heavily impact your trading decisions. Fear can make you sell too soon, while greed might push you to hold onto a trade for too long, hoping for more profit. These impulsive actions can lead to significant losses.

AI Depiction Of Weak Trading Psychology

AI Depiction Of Weak Trading PsychologyFOMO (Fear of Missing Out): This happens when you jump into a trade because you see others making money and don't want to miss out. It often leads to buying high and selling low;

FUD (Fear, Uncertainty, Doubt): Negative news or rumors can cause panic, making you sell your assets at a loss, even if the fundamentals haven't changed.

Understanding these traps can help you stay calm and make more rational trading decisions.

Find a key to successful trading

From my experience, crypto traders remain vulnerable to a set of risks. Tackling them can be tough, but here’s how I handle them personally.

First, there's price volatility. Cryptocurrency prices can change dramatically in a short time, leading to big gains or losses. This can be mitigated by the use of risk management tools, such as stop-loss orders.

Second, security breaches. Even with advanced blockchain technology, exchanges and wallets can still be hacked. However, working with reputed exchanges that offer additional security features can help.

Third, regulatory challenges, which are important to consider. Laws and rules about cryptocurrencies are constantly changing, which can affect the market. It is always advisable to trade using regulated exchanges.

Fourth, liquidity risks exist, especially with lesser-known cryptocurrencies. It can be hard to buy or sell these without moving the market price. But a simple work around for this is to focus on the top cryptocurrencies that are more frequently traded and have high volume.

Lastly, psychological factors, the intangible sword. The high-risk nature of crypto trading can lead to emotional decisions, often resulting in poor outcomes. Only practice, discipline, and a strong will can help you tackle this challenge.

Summary

In conclusion, investing in cryptocurrencies is not for the weak of the heart. It is a difficult endeavor involving a lot of risks and challenges, which include volatility, a lack of regulation, vulnerability to errors and hackers, illiquid markets, and the evergreen dance of greed and fear. To successfully survive in the cryptocurrency market, traders should start small, create a thoughtful trading plan, and have an objective viewpoint to avoid giving in to the feelings of FOMO and FUD.

Also understand and deal with the risks. Especially with cryptocurrencies becoming all the rage.Trading professionals may better protect their cash and exploit chances in this exciting but risky market by arming themselves with knowledge and using caution.

FAQs

What is FOMO and FUD?

"Fear of Missing Out", or FOMO, is a psychological phenomenon when consumers make rash purchases of assets out of a concern about losing out on prospective gains. FUD, or "Fear, Uncertainty, Doubt," is a marketing strategy that involves disseminating unfavorable information to engender uncertainty and anxiety.

Is trading crypto high-risk?

Yes, trading cryptocurrencies have a significant risk level because of the severe price swings, ambiguous regulations, hackability, and lack of investor protection. It's critical to be knowledgeable about these risks.

Why is crypto too risky?

Cryptocurrencies carry a significant level of risk because of their unstable prices, lack of regulation, potential for technical failures, and potential for money loss due to hacking. These elements make it a difficult asset class.

Is crypto riskier than stocks?

In general, yes, cryptocurrencies are riskier than stocks. Cryptocurrencies lack the investor protections and regulations that regular stock markets' stocks normally have, and their price volatility is higher.

Related Articles

Team that worked on the article

Igor is an experienced finance professional with expertise across various domains, including banking, financial analysis, trading, marketing, and business development. Over the course of his career spanning more than 18 years, he has acquired a diverse skill set that encompasses a wide range of responsibilities. As an author at Traders Union, he leverages his extensive knowledge and experience to create valuable content for the trading community.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

FOMO in trading refers to the fear that traders or investors experience when they worry about missing out on a potentially profitable trading opportunity in the financial markets.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.