Fake Forex Brokers List In The UK

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Fake Forex brokers in the UK for 2025 are:

Lucror Capital Markets. Frequent complaints about unfulfilled payment obligations and poor service.

Zenfinex. Clone of the FCA-regulated entity.

Europa Trade Capital. Offshore broker with a history of unregulated activity and frequent issues with withdrawal refusals.

Brown Finance. Clone of the FCA-regulated entity.

Saxofx-24. L isted in FCA’s warning list as an unauthorized broker.

The Forex market presents exciting opportunities, but it also attracts scammers who seek to exploit unsuspecting traders. In the UK, regulatory oversight aims to protect investors, yet fraudulent brokers and platforms persist. Here’s a comprehensive guide on spotting Forex scams, the importance of regulatory authorities, and a list of suspicious brokers to avoid.

Fake Forex brokers in the UK

The following brokers have been flagged by regulatory bodies or user complaints for suspicious or unethical practices:

Lucror Capital Markets

Lucror Capital Markets LP, based in New Zealand, markets itself as a reputable broker for institutional and retail clients. Despite these claims, user reviews frequently report significant issues with compliance, trading integrity, and payment practices. Many have found the company prioritizes its own interests over client protection and trading security.

Scam indicators:

Poor client service and support.

Ignoring trading discipline and payment obligations.

Account blocks without reason.

Frequent technical issues and misleading trade recommendations.

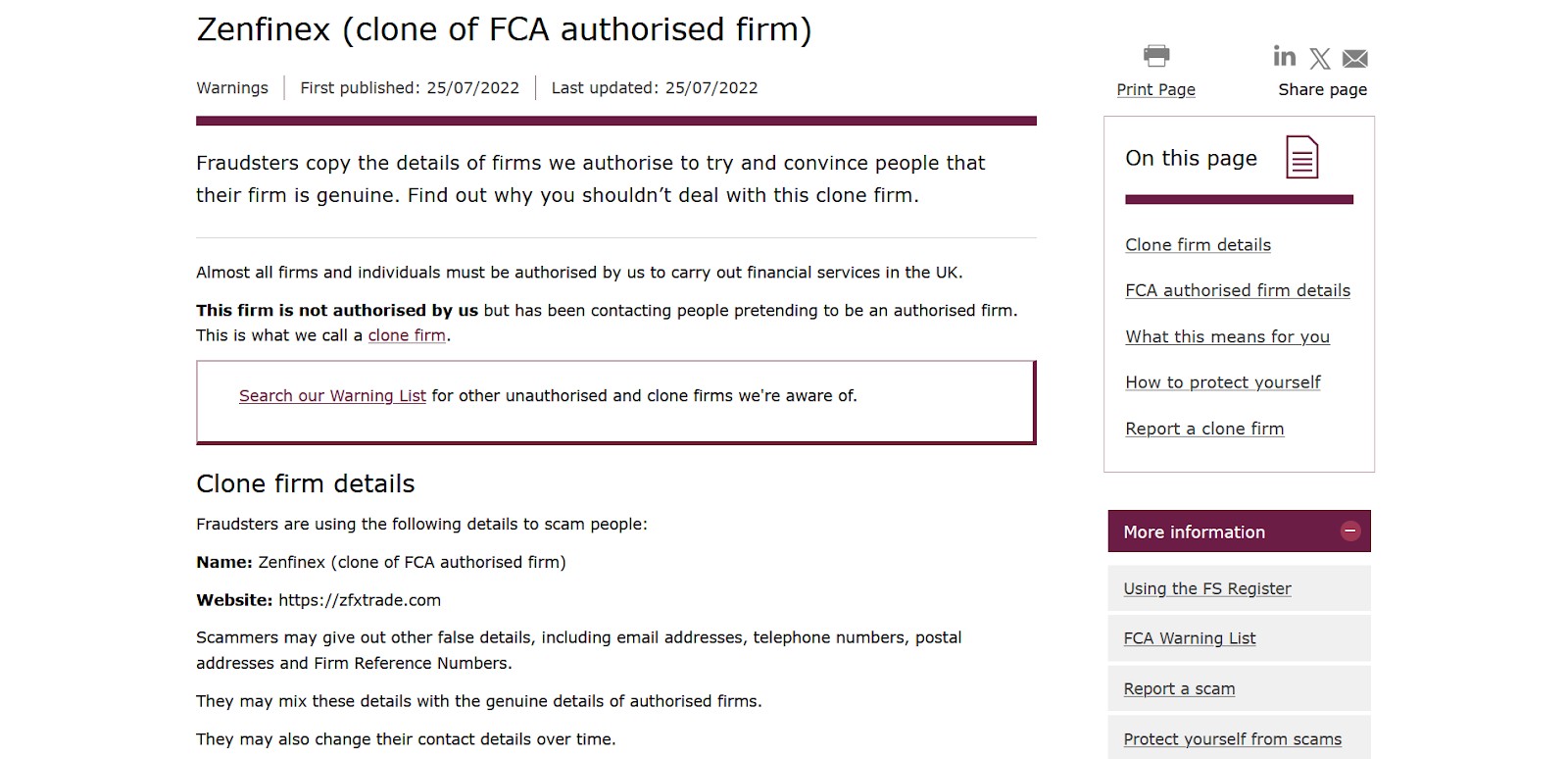

Zenfinex (clone)

Zenfinex has been identified by the Financial Conduct Authority (FCA) as a clone firm misrepresenting itself as an FCA-authorized entity. Clone firms use the details of genuine, regulated companies to appear legitimate. The FCA's warning specifies that this unauthorized entity falsely claims association with the FCA-authorized firm Zenfinex Limited.

Scam indicators:

Misrepresentation as an FCA-authorized firm.

Use of false information to mimic a legitimate company.

Potential risk of financial loss to clients dealing with an unlicensed entity.

Lack of legal recourse or client protection.

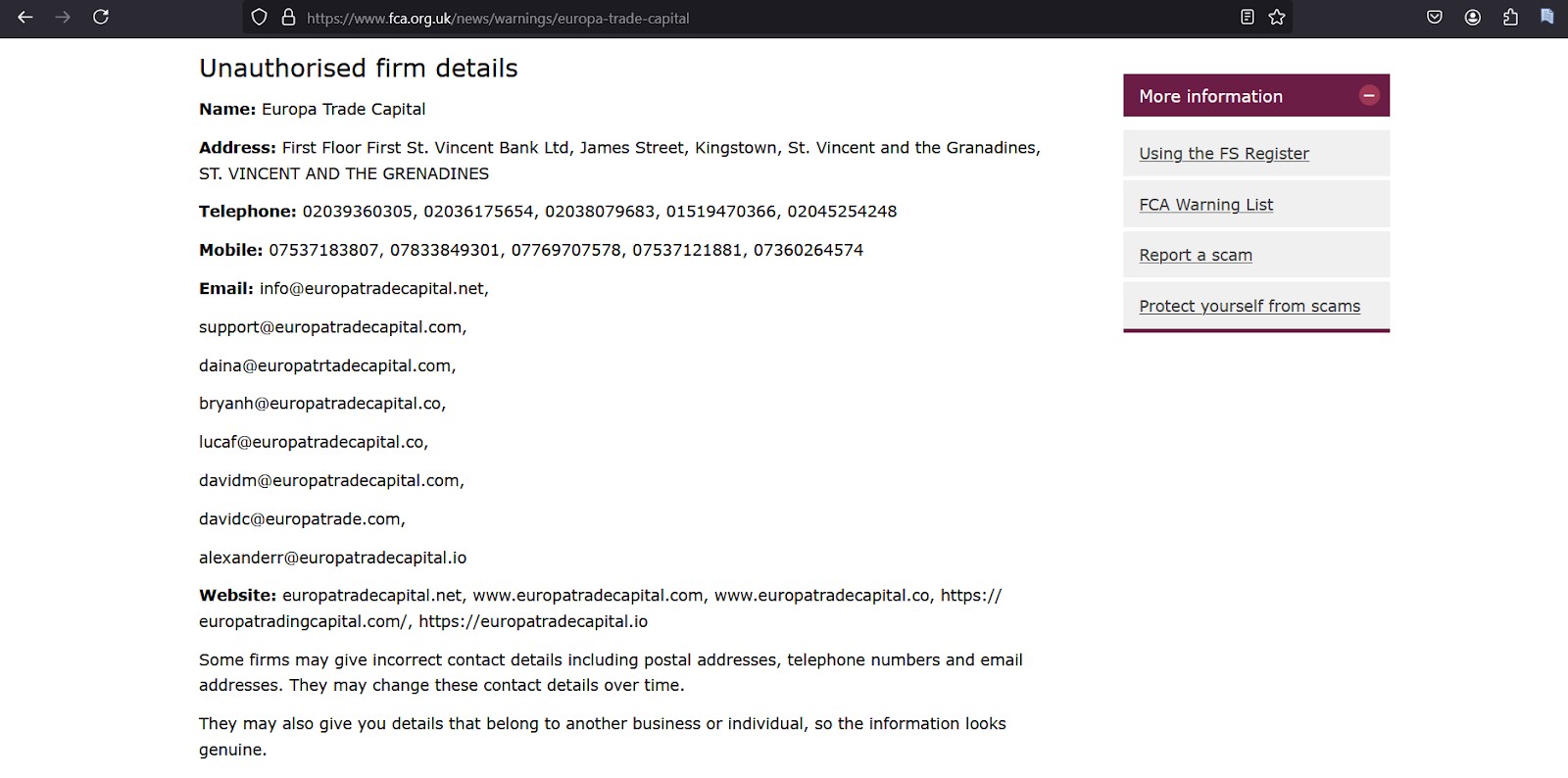

Europa Trade Capital

Registered offshore in Saint Vincent and the Grenadines, Europa Trade Capital claims a 20-year history, though it remains unregulated. Despite a wide selection of account plans and leverage up to 1:500, multiple complaints and FCA blacklisting reveal a concerning disregard for client welfare.

Scam indicators:

Negative online reputation.

Presence on the FCA blacklist.

Trade manipulation and forced account losses.

Fictitious reasons to deny withdrawals.

Unauthorized commission changes and hidden fees.

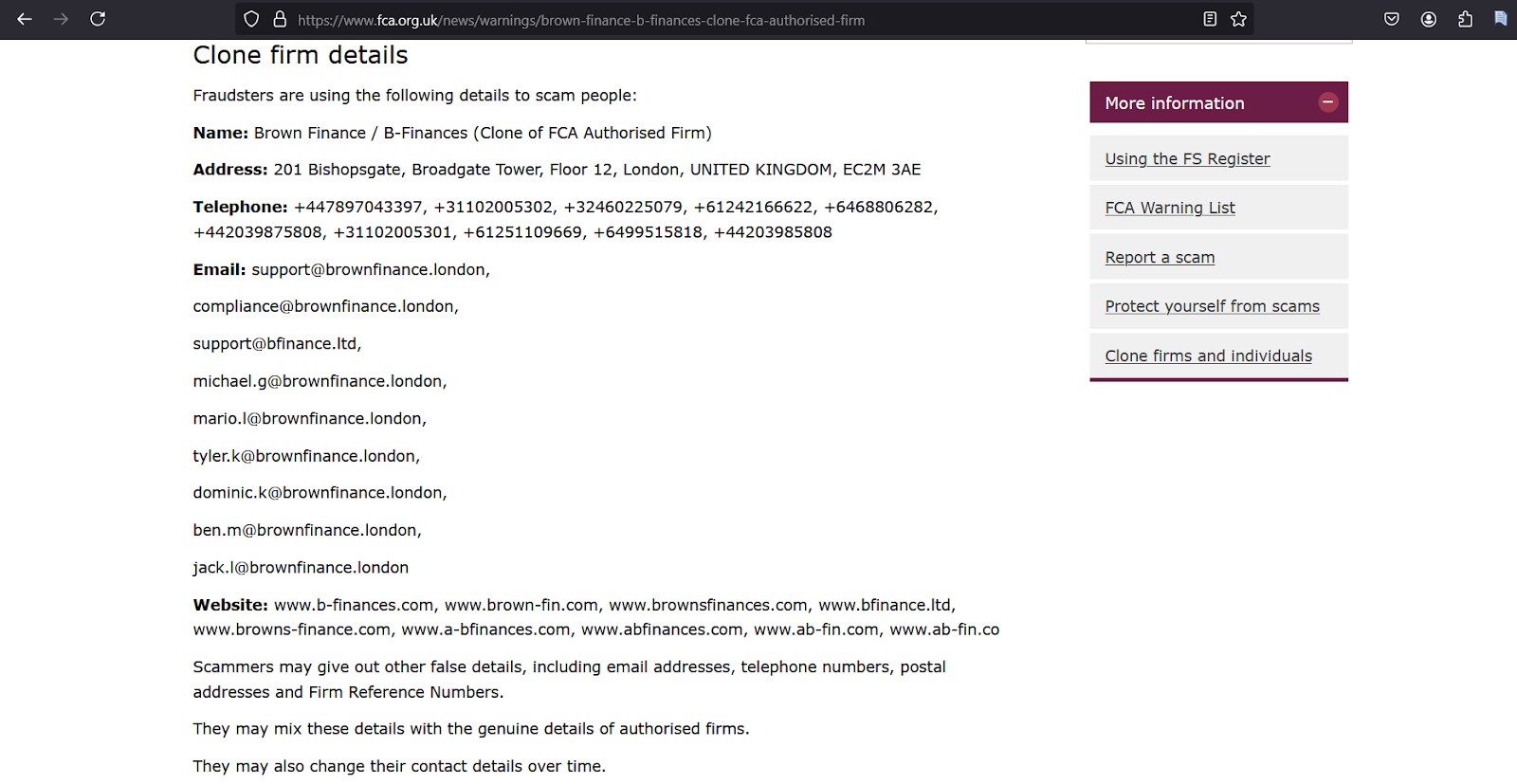

Brown Finance

The Financial Conduct Authority (FCA) has issued a warning against Brown Finance (also known as B-Finances), identifying it as an unregulated entity that falsely claims to be associated with an FCA-authorized firm. This company targets investors by offering what seems like a broad investment portfolio but operates without legitimate oversight or protection.

Scam indicators:

Fraudulently posing as an FCA-regulated firm (clone firm).

Lack of genuine legal authorization.

High-pressure tactics involving trading advice and personal account managers.

Exorbitant minimum investment demands (e.g., €10,000).

Issues with trade execution, including technical malfunctions and requotes.

Non-compliance with standard payment protocols.

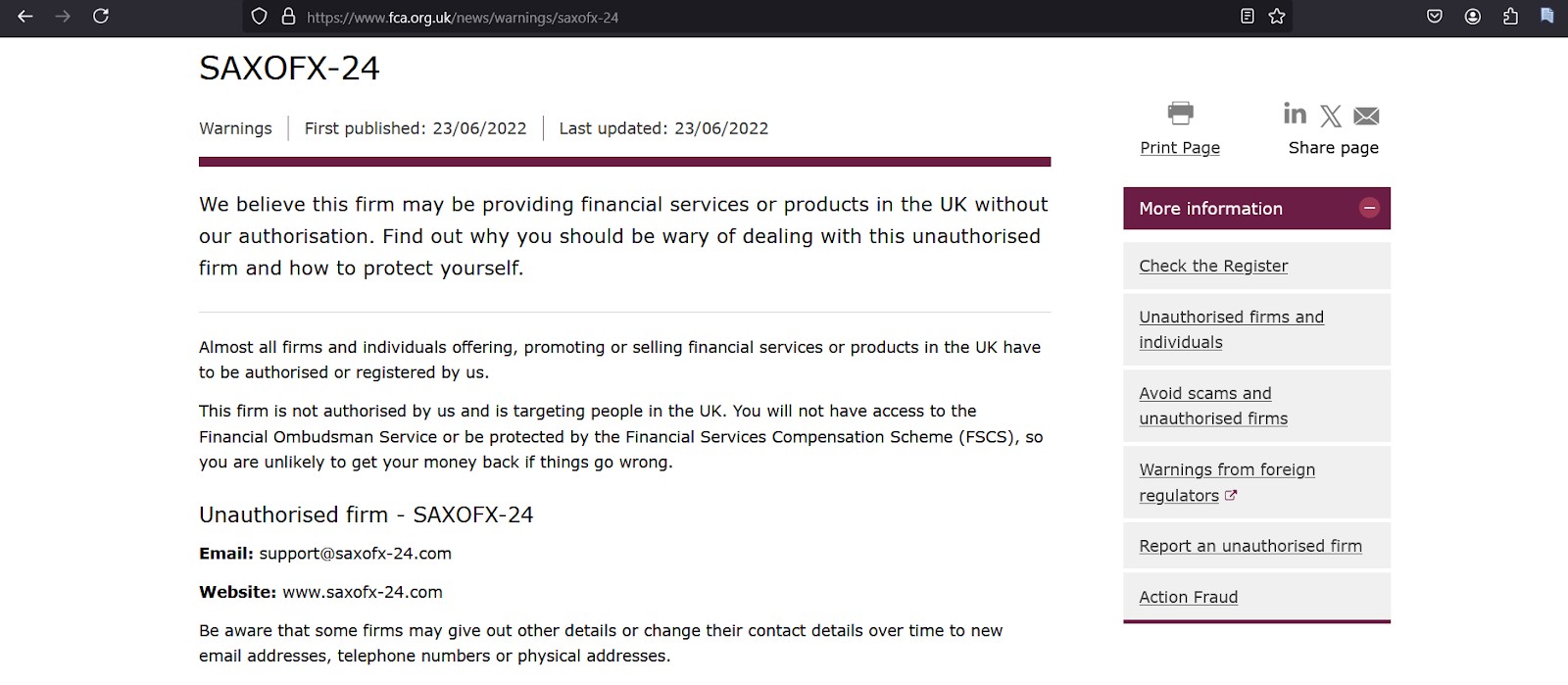

Saxofx-24

Originally an educational center, Saxofx-24 became a Forex broker in 2018, promising excellent support and transparent conditions. However, users report blocked accounts, poor service quality, and unachievable bonus conditions, all of which have led to its blacklisting. It is listed in FCA’s warning list as an unauthorized broker.

Scam indicators:

Listed in FCA warning list as an unauthorized broker.

Unrealistic bonus conditions.

Issues with withdrawals and account blocks.

Dubious service quality.

Financial extortion and manipulated trading quotes.

No legal framework for protection.

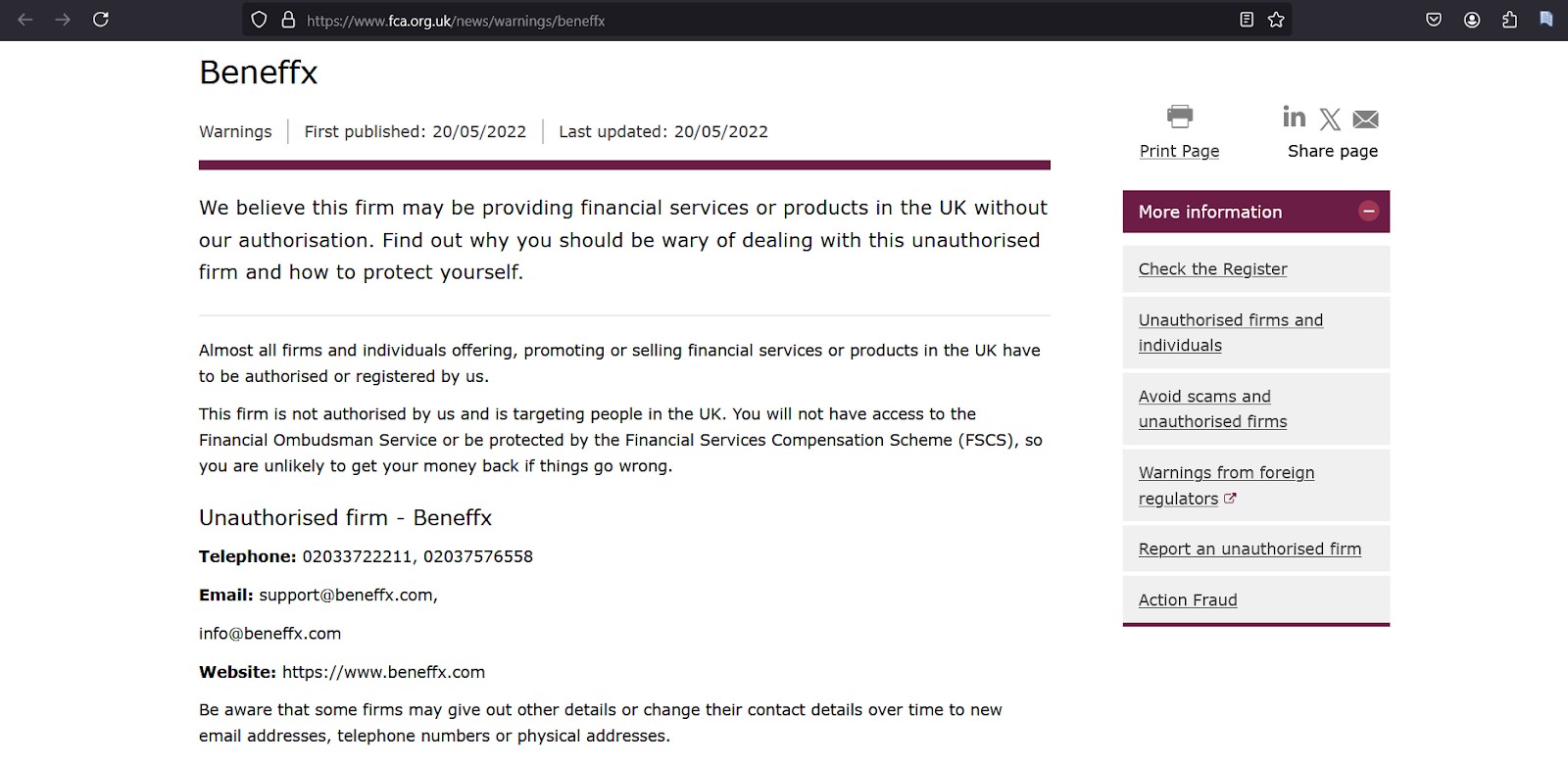

BenefFX

Based in the Marshall Islands and operated by Optium Ltd., BenefFX is an unlicensed broker that offers 1,000+ trading assets. With a minimum deposit of $250, clients quickly face issues such as hidden fees and account blocking, which have led to numerous negative reviews. It is listed in FCA’s warning list as an unauthorized broker.

Scam indicators:

Listed in FCA warning list as an unauthorized broker.

Fake trade recommendations and pressured investments.

Hidden commissions and blocked accounts.

Poor quality educational materials.

Platform controls manipulated by scammers.

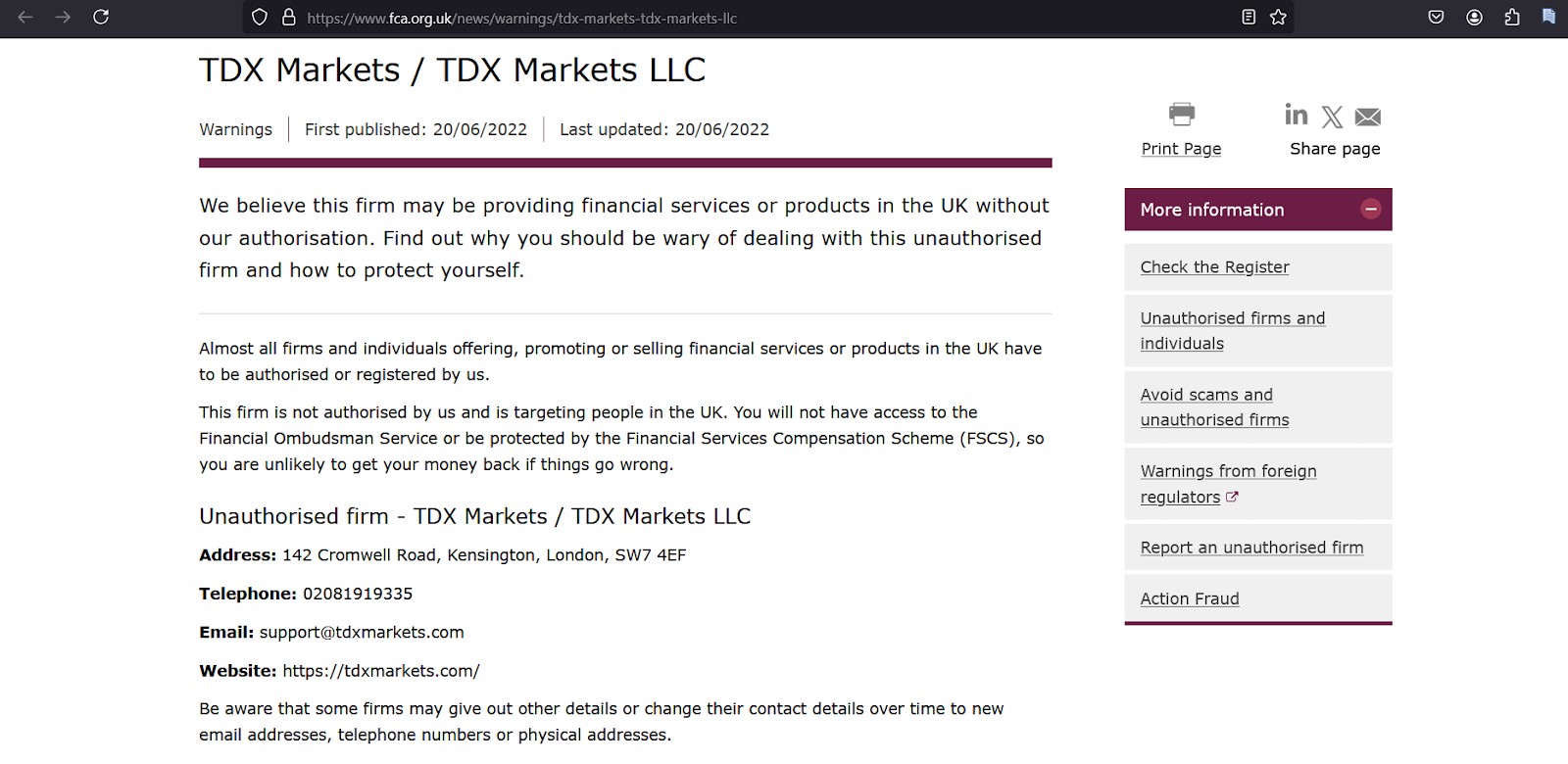

TDX Markets

Operating out of Saint Vincent and the Grenadines, TDX Markets claims to be a fast-growing platform for professionals and novices alike. However, a lack of regulation and numerous user complaints suggest otherwise.

Scam indicators:

Offshore registration.

Embezzlement and blocked accounts.

Non-responsive support and refusal to pay out profits.

Manipulated charts and controlled quotes.

| Name | Established | Minimal Losses |

|---|---|---|

| Lucror Capital Markets | 2017 | $10 |

| Zenfinex | 2017 | $50 |

| Europa Trade Capital | 2002 | $10.000 |

| Brown Finance | 2021 | €10.000 |

| Saxofx-24 | 2018 | $250 |

| BenefFX | 2017 | $250 |

| TDX Markets | 2019 | $500 |

The Traders Union advises caution with these brokers due to the main signs of scams detected by its experts. Avoid falling for the empty promises of financial scammers. Further, please note that these were just some of the blacklisted brokers by the FCA.

How to recognize Forex scams in the UK

Scam brokers employ a variety of tactics to lure in traders, such as promising unrealistic returns, pressuring clients to deposit more money, or making it difficult to withdraw funds. Here are some red flags to watch for:

Unrealistic promises. Brokers promising high returns with low risk are often not genuine.

Unregulated platforms. Ensure the broker is authorized by the Financial Conduct Authority (FCA) or another recognized body.

Lack of transparency. A legitimate broker provides clear information about fees, trading conditions, and company details.

Difficulty withdrawing funds. Scam brokers often prevent clients from withdrawing their money.

How to report Forex scams in the UK

If you believe you’ve encountered a Forex scam, you can report it to the FCA. Reporting helps prevent further fraudulent activity and may assist you in recovering funds.

Gather evidence. Compile emails, transaction records, and other communications with the broker.

File a complaint. Submit your complaint to the FCA and explain your experience.

Consider legal options. In some cases, legal action or third-party mediation services can help recover lost funds.

Considerations for traders

Regulation. Choose brokers regulated by top authorities (e.g., FCA, SEC ). We have provided a list of top options in the table below.

| Accessible in the UK | Max. Regulation Level | Demo | Min. deposit, $ | Max. leverage | Investor protection | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | Tier-1 | Yes | 100 | 1:500 | £85,000 €20,000 | Open an account Your capital is at risk. |

|

| Yes | Tier-1 | Yes | 5 | 1:1000 | £85,000 €20,000 | Open an account Your capital is at risk. |

|

| Yes | Tier-1 | Yes | 10 | 1:500 | No | Open an account Your capital is at risk. |

|

| Yes | Tier-1 | Yes | 50 | 1:2000 | €20,000 £85,000 | Open an account Your capital is at risk. |

|

| Yes | Tier-1 | Yes | 100 | 1:500 | No | Open an account Your capital is at risk. |

Security. Look for strong security features like 2FA and encryption.

Fees. Opt for competitive fees and spreads to maximize profits.

Account types. Ensure they offer accounts and demo options suited to your level.

Customer support. Reliable, 24/7 support is ideal for quick help.

Platform quality. User-friendly platforms with essential tools are key.

User reviews. Check for consistent complaints on withdrawals or service.

Payment options. Convenient deposit/withdrawal methods and prompt payouts.

Educational tools. Helpful if you’re new; look for tutorials and analysis.

Avoid unrealistic promises. Be wary of “guaranteed returns” or huge bonuses.

Firstly, verify the broker's registration

In online trading, fake Forex brokers have become a widespread issue, even in heavily regulated markets like the UK. Protecting your assets requires a thorough understanding of how to avoid falling victim to fraudulent brokers. Here are a few essential expert tips to help you steer clear of these traps.

Firstly,verify the broker's registration with a trusted regulatory authority. In the UK, the Financial Conduct Authority (FCA) strictly regulates Forex brokers to ensure they meet industry standards. Genuine brokers are registered with the FCA and have a valid license. Always check the license number on the official FCA website, and confirm that it matches the details provided by the broker.

Another critical step is researching the broker’s reputation. Look up trader reviews on independent review sites and forums. Pay close attention to patterns in complaints about withdrawal delays, hidden fees, or questionable practices. While no broker is without negative reviews, repeated complaints about serious issues are red flags.

Additionally, be cautious of brokers who offer unrealistic bonuses or promise guaranteed returns, as this is often a bait used by fraudulent platforms. Trusted brokers are transparent about the risks of Forex trading and avoid marketing gimmicks that promise easy profits.

It’s also a good idea to test the broker’s customer service. Reach out with questions about their platform, fees, or licensing. Legitimate brokers typically have responsive and knowledgeable support teams that are willing to assist and clarify any concerns.

Finally, consider using demo accounts, which allow you to experience the broker’s platform without committing real money. This can reveal issues like lag in execution or unstable trading conditions, which may indicate unreliable or unsafe practices.

Conclusion

Before you choose to open an account with any broker, make sure to check their status on the official FCA website. Prioritize brokers with strong regulatory oversight, robust security, and transparent fees to protect your investments. Look for user-friendly platforms with essential tools and reliable, responsive customer support. Check user reviews to avoid issues with withdrawals or poor service. Beware of brokers offering “guaranteed returns” or big bonuses, as these can be red flags. Taking the time to find a trustworthy broker ensures a safer, more successful trading experience.

FAQs

Can I get my money back if a broker blocks my account?

It can be challenging, but try contacting support and documenting all interactions. If unsuccessful, report the issue to relevant authorities or seek legal help.

I’m having trouble withdrawing funds; what should I do?

First, ensure you’ve met all withdrawal requirements. If problems persist, contact support and escalate to a regulator if needed.

Is it normal for brokers to delay withdrawals?

While occasional delays happen, consistent or unexplained delays are a red flag. Check for reviews on similar issues with the broker.

Why does my broker’s platform show different prices from others?

Some brokers use their own pricing feed, which may differ slightly, but large discrepancies could indicate manipulation.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).