How to Open IQcent Account - TU Expert review

When choosing a broker to trade financial markets, it is important to consider how difficult it is to open an account. IQcent is quite popular and many novice traders consider this brokerage company. Therefore, it is important to find out how difficult it is to open an account with this broker and know in advance what kind of information you will need to provide. Traders Union experts prepared a guide on How to Open IQcent Account. The article explains what a trader needs to open an account and what information the broker requests traders to provide.

Short introduction of IQcent

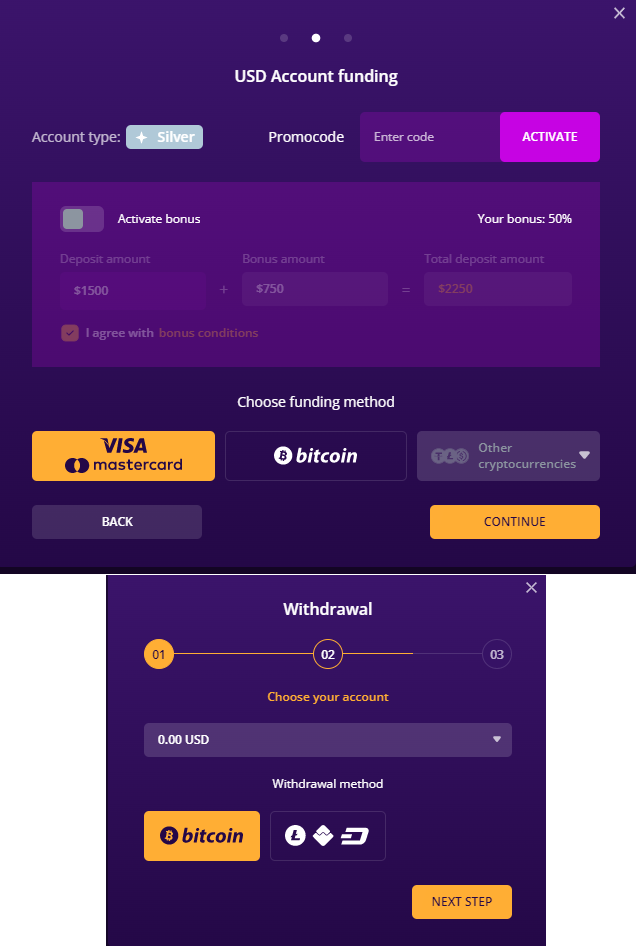

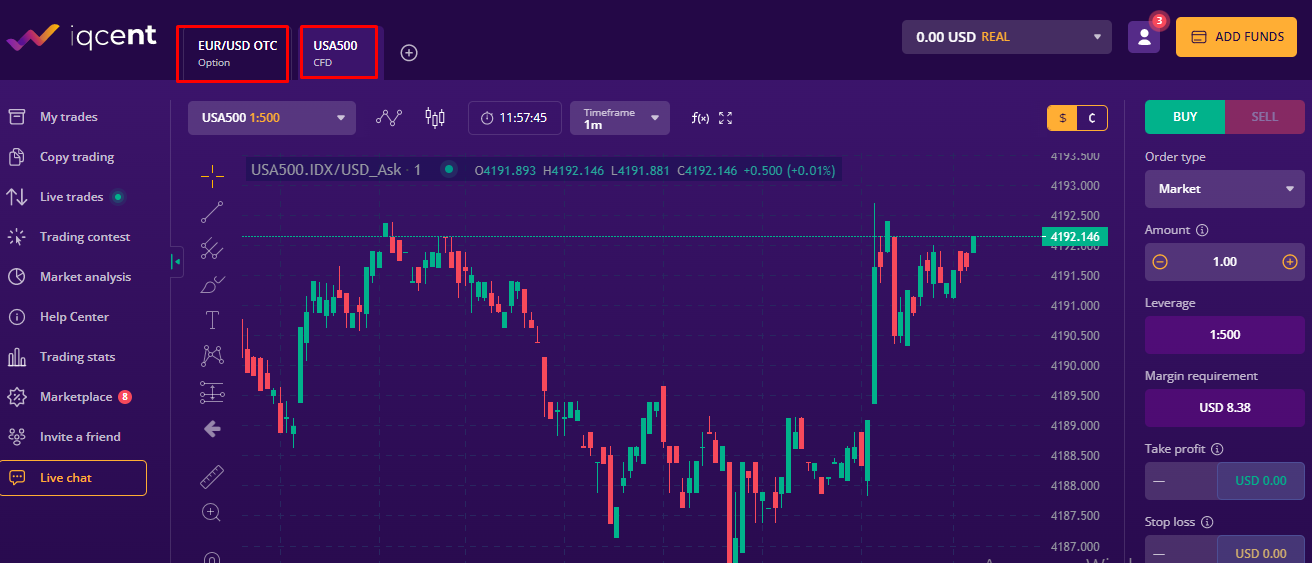

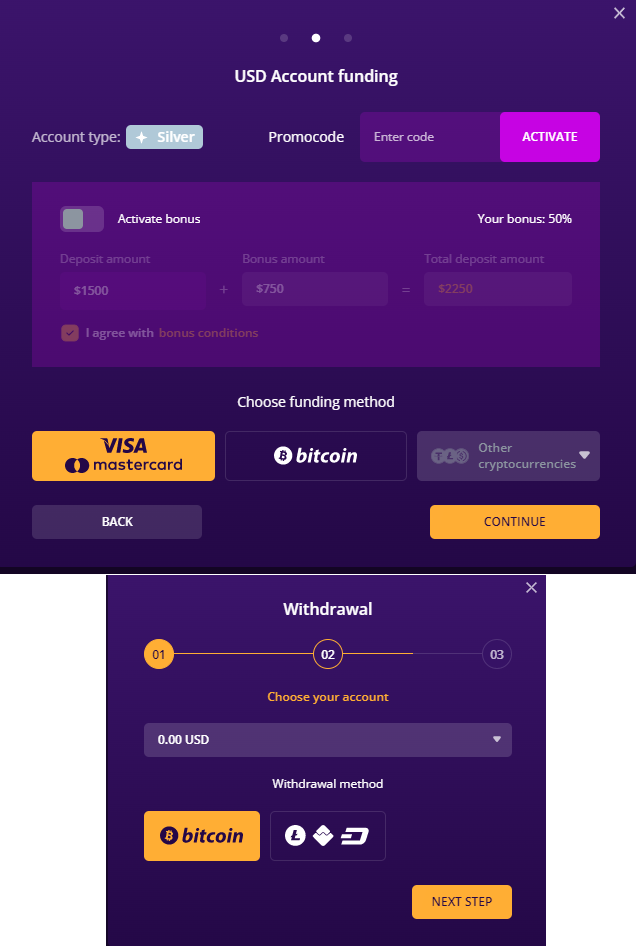

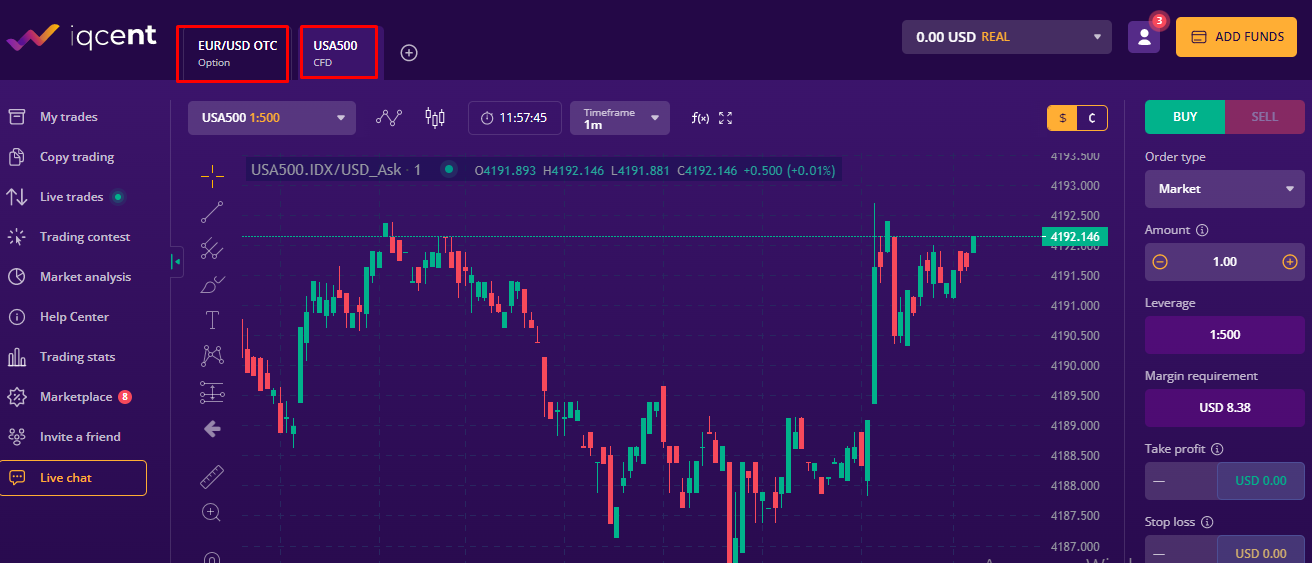

IQcent is a Marshall Islands-registered broker that offers access to online CFD and binary options trading. The company accrues many bonuses to customers and allows you to use electronic payment systems for depositing and withdrawing funds. IQcent offers a proprietary terminal with built-in technical analysis tools that support standalone and copy trading. The company also has a trading platform for mobile devices (mobile app). IQcent clients get trading access to the following instruments: binary options, CFDs on stock indices, gold, silver, currencies, and cryptocurrencies. In total, more than 100 trading instruments are available to IQcent clients. The company does not charge commissions for making a deposit, withdrawing funds in cryptocurrency, and maintaining a trading account. IQcent provides clients with access to primary training articles and guides and uses modern technologies to ensure the safety of client funds and users' personal data. 256-bit SSL encryption, 3D Secure, and Visa MasterCard Secure Code are used to achieve these goals.

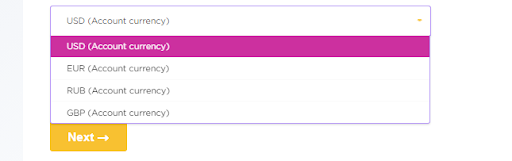

| 💰 Account currency: | USD, EUR, GBP, BTC, ETH |

| 🚀 Minimum deposit: | 20 to 50 USD depending on region |

| ⚖️ Leverage: | Up to 1:500 |

| 💱 Spread: | From 0.7 pips |

| 🔧 Instruments: | CFDs on currency pairs, indices, commodities (gold, silver), cryptocurrencies, binary options |

| 💹 Margin Call / Stop Out: | Margin calls are triggered by a margin level of 5% (5% of free funds + margin on open positions) |

IQcent Pros and Cons

👍 IQcent Pros:

•The available minimum deposit is $20 on a Bronze account.

•A simple but functional web trading terminal that does not require installation and is compatible with most devices.

•Regular update of bonus programs.

•The ability to receive additional income for attracting new customers.

•Access to trade in more than 100 financial instruments, including currency pairs, cryptocurrencies, stock indices, gold, and silver.

•Availability of useful tools such as technical and fundamental analysis tools, a section with current news, and an economic calendar.

•The support team, including online chat operators, is available 24/7.

•Regulation IFMRRC.

👎 IQcent Cons:

•IQcent does not provide MetaTrader terminals.

Things to know about registering an account with a broker?

Only users who registered with a broker can trade financial markets. A trading account determines conditions (brokers may offer several account types), serves as a wallet and stores trader’s settings. It is impossible to work in financial markets without a personal account.

Brokers have different registration procedures. Some companies ask only for general information, while others request more detailed personal information that involves filling out several forms.

Basic information requested by all brokers includes the following:

-

First name and last name;

-

Date of birth;

-

Email;

-

Password (can be sent to your email);

-

Place of residence (country, city, address).

Brokers also may request additional information, such as marital status, sources of income, etc.

Is verification mandatory?

It is important that you carefully fill out all the forms and provide truthful information, because you will need to pass verification next. ID verification is an important requirement of brokers registered in reliable jurisdictions. The companies that are licensed in the U.S., the EU, Australia, etc., operate in compliance with AML/KYC.

Therefore, they require traders to provide the following:

-

Proof of Identity. It could be a national ID or a foreign passport. Some brokers also accept a driver’s ID;

-

Proof of Address. It could be utility bills, bank statements, etc.

If a trader plans to work with a reliable and trustworthy broker, he will need to pass verification. As a rule, it takes 24-48 hours.

How to Open IQcent Account and Review of the User Account

To create a personal account at IQcent, you need to register on the company's website by using a PC, laptop, tablet, or smartphone. Follow these steps:

Go to the official website of the IQcent broker. Click Sign Up or Start Trading Now.

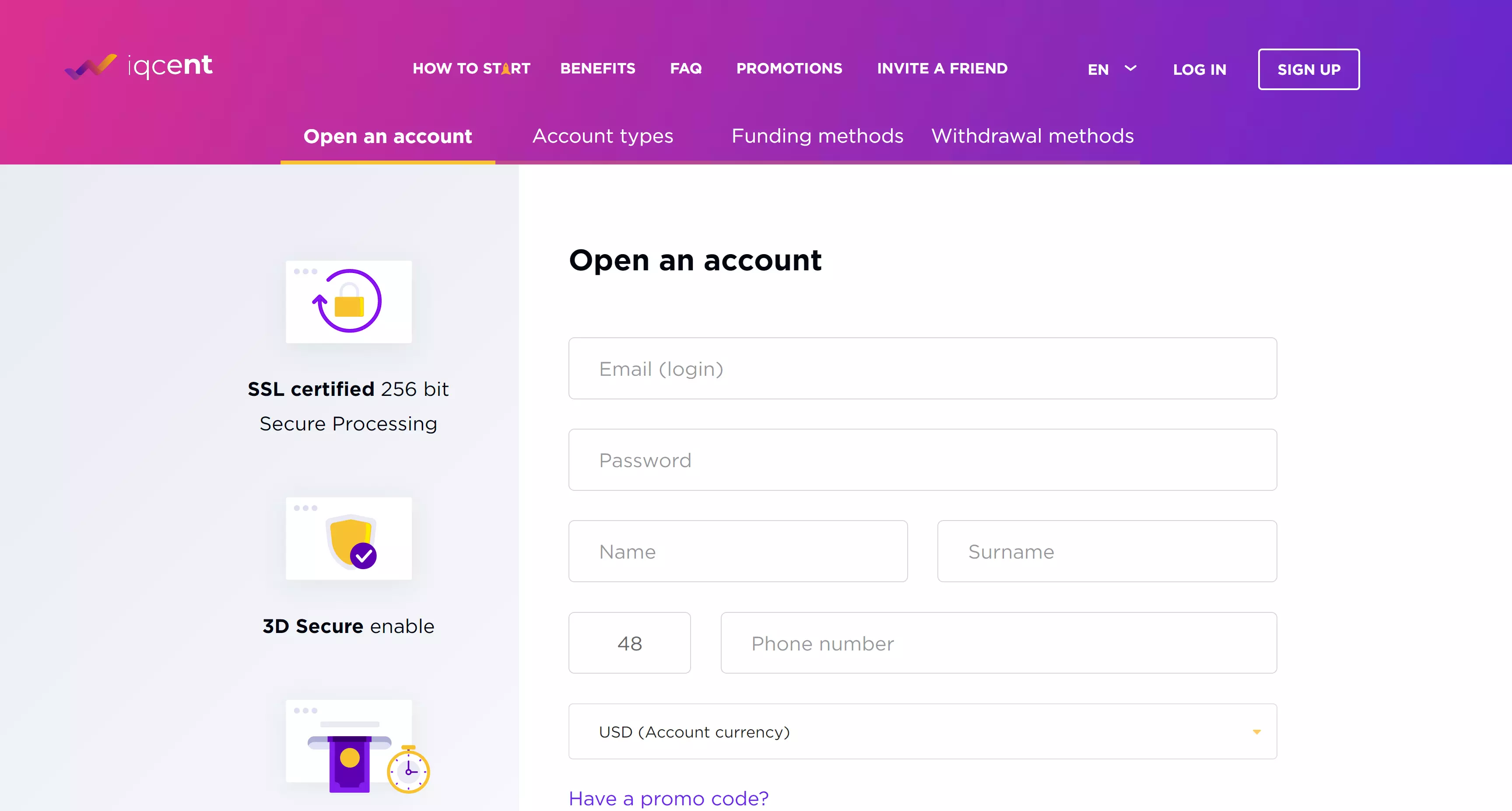

In the opened registration form, indicate your first name, last name, phone number, and email address. Also, generate a strong password.

Select the currency of your trading account and click Next. The system will automatically redirect you to your personal account.

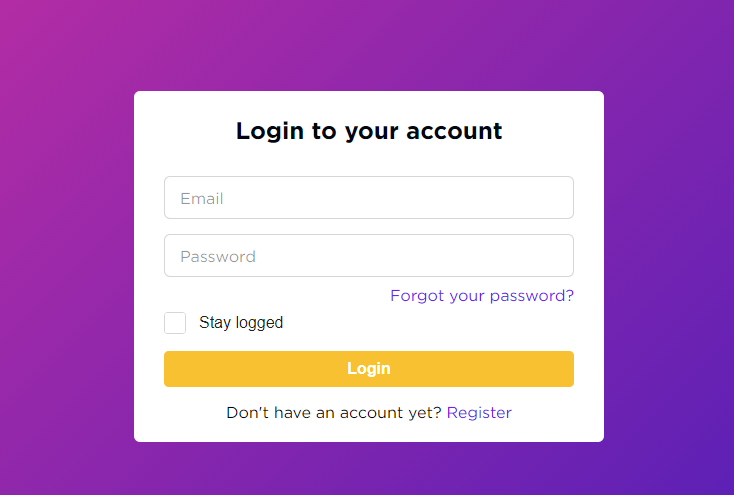

To re-enter your personal account, on the main page of the site, click Log In, and then enter the email (login) and password previously specified during registration.

The main functions of the IQcent personal account:

Also, the personal account displays:

-

Transaction history for the period selected by the user.

-

Available bonuses, active contests, and promotions.

-

Referral program statistics.

-

Menu for passing verification, establishing two-factor authentication, changing personal and payment information.

-

Button for changing the interface language of the personal account and the trading terminal.

-

Support section for quick communication with the online chat operator.

Brokers similar to IQcent

In order to choose the right broker, it is necessary to compare its conditions with those offered by other brokers and review the rules of different companies for opening an account. Traders Union experts prepared a comparison of trading conditions of companies and features of their trading accounts.

Comparison of IQcent with other Brokers

IQcent is suitable for traders who are ready to trade CFDs and binary options through the broker’s proprietary terminal. IQcent's trading conditions are suitable for both beginners and experienced traders, who can access more than 100 trading instruments through the broker's terminal.

Pocket Option is an unregulated broker focused on cooperating with professional traders who do not need training or additional bonuses.

Binarium is a binary options broker for novice traders with a simplest and intuitive platform and attractive rewards.

Binary is the right broker for those who appreciate a variety of financial instruments. Due to the low minimum deposit, the company is suitable for novice traders who do not want to risk large amounts of money.

Nadex is a highly regulated transparent binary options broker, but so far almost inaccessible to CIS traders.

Centobot is a solution for traders who prefer trading with bots. Centobots are designed to generate passive income from fiat and cryptocurrency trades. They apply technical indicators to analyze the market and make trades.

Conclusion

Opening a trading account is something every trader goes through. This is why it is important to know how it works and what kind of information needs to be provided. In this article, traders were given an opportunity to learn about conditions and rules for opening a trading account with IQcent, and also compare broker’s conditions with competitors. This information is important to have when you are choosing a company to trade financial markets with.

FAQs

Can I trade with a broker or on an exchange without an account?

No. You need to have a trading account to trade, make deposits, withdraw funds, etc.

Can I learn how the broker protects data?

Yes. Every broker must have a document titled Privacy Policy. Make sure you read it before you start registering an account.

Do you choose a trading account when you register?

Choosing the type of a trading account and trading account settings usually happen during registration, although not always.

Can you trade in the financial markets without verification?

Brokers registered in reliable jurisdictions do not allow trading without verification. Offshore brokers may offer this option, but not all of them.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.