Binance Launchpad: How It Works & How To Join

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

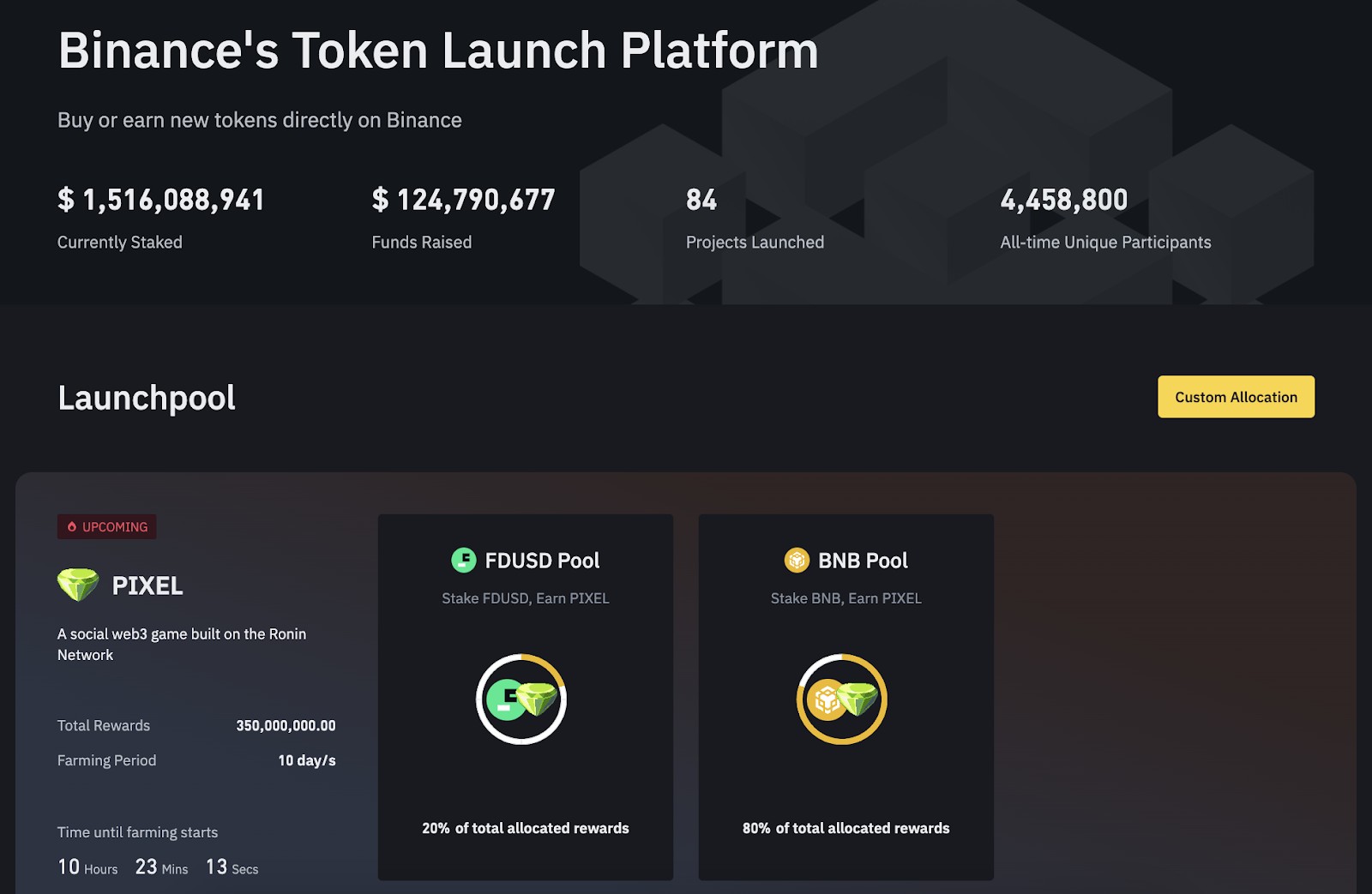

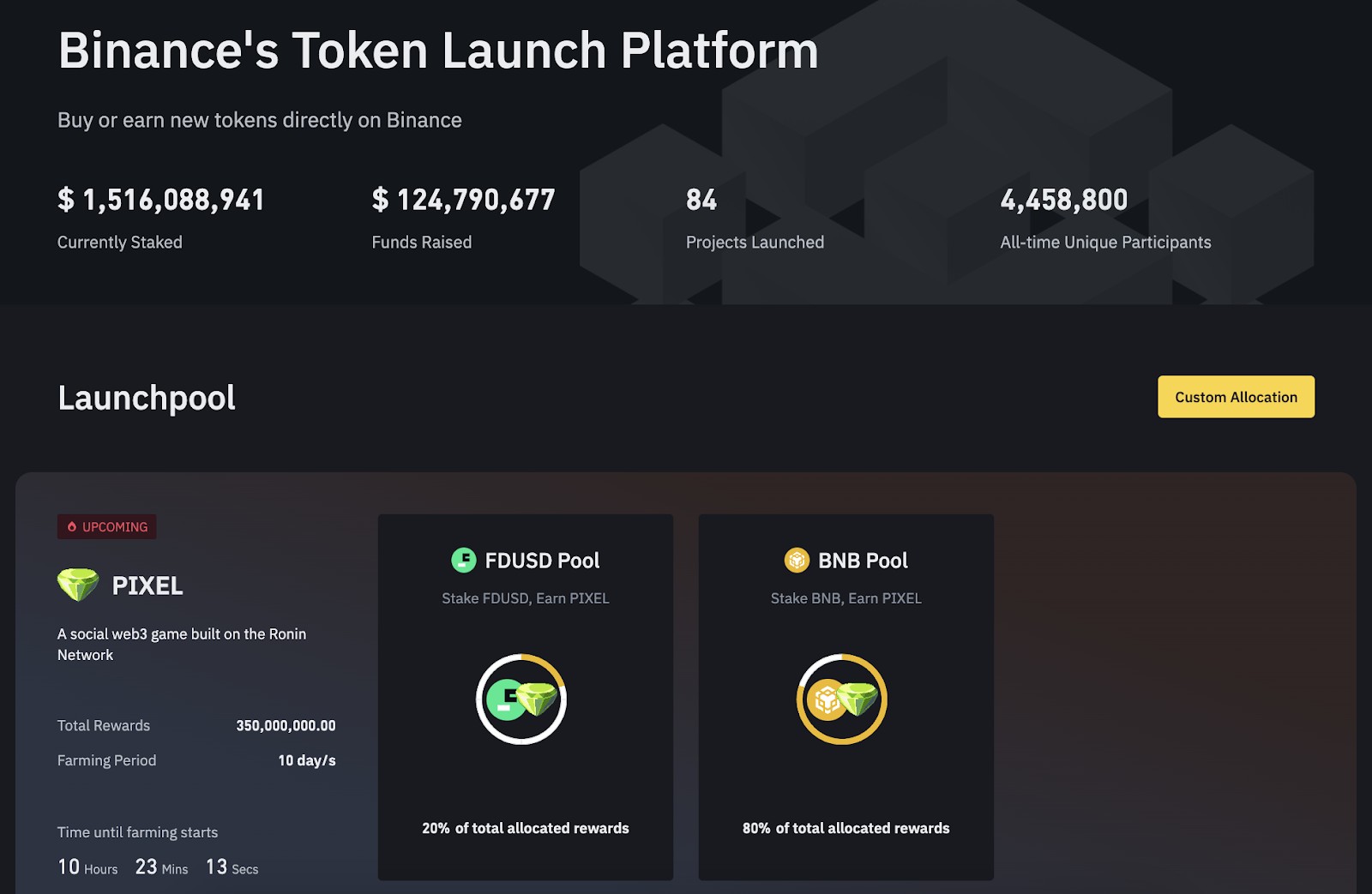

Binance Launchpad is a platform that facilitates Initial Exchange Offerings (IEOs), allowing users to invest in new cryptocurrency projects at early stages. To participate, users must complete identity verification (KYC) and hold Binance Coin (BNB) in their accounts. Notable projects launched through Binance Launchpad include Polygon (POL, ex-MATIC), Axie Infinity (AXS), and The Sandbox (SAND).

Binance Launchpad is a platform for launching new cryptocurrency projects through the Initial Exchange Offering (IEO) mechanism. It provides users with the opportunity to invest in promising tokens before they are listed on the Binance exchange. Participation in Binance Launchpad requires compliance with certain rules, including having a verified account and the required amount of BNB on the balance.

In this article, we will analyze how Binance Launchpad works, what conditions must be met to participate, and what projects have already passed through the platform. We will also consider how to access Launchpad and what to pay attention to when investing.

What is Binance Launchpad and how it works

Binance Launchpad is a platform by Binance that helps blockchain startups raise funds through Initial Exchange Offerings (IEOs). It allows investors to access new cryptocurrency projects early while ensuring a secure and structured investment process.

Key features

Early access to tokens – investors can buy project tokens before public listing.

Secure platform – Binance conducts thorough vetting to protect investors.

Comprehensive support – projects receive guidance for market success.

How does Binance launchpad work?

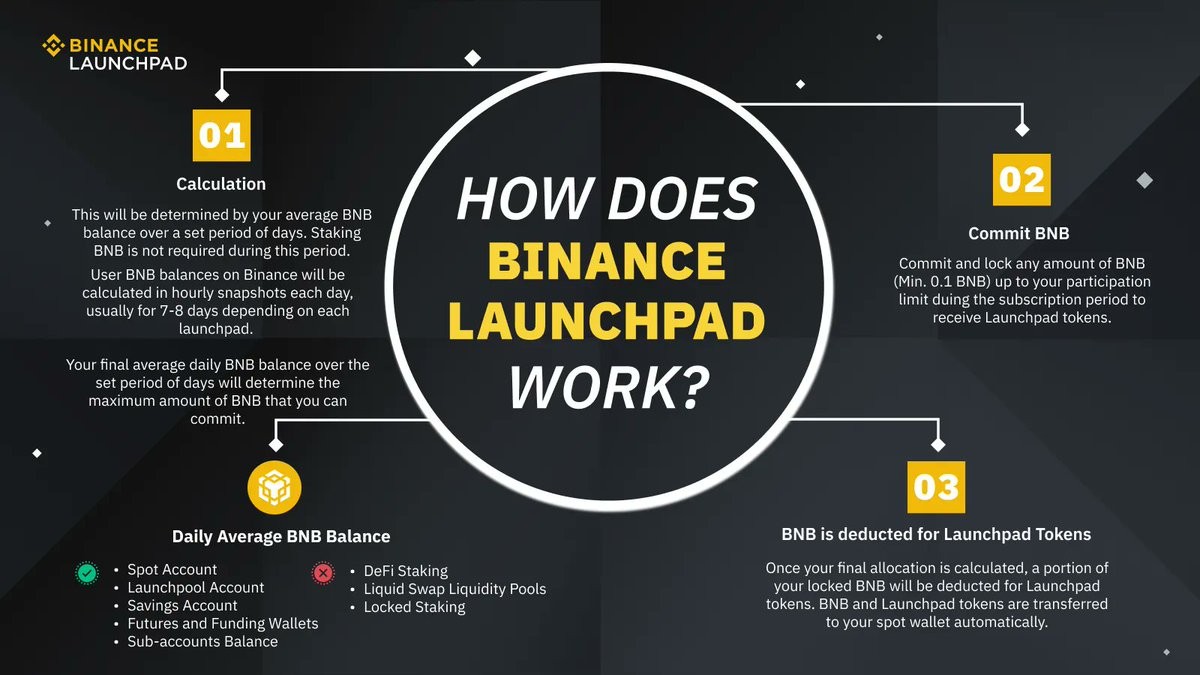

Step 1: Calculation

Binance calculates your average daily BNB balance over a set period (usually 7–8 days).

Hourly snapshots are taken each day.

Staking is not required during this period.

Your average balance determines how much BNB you’ll be allowed to commit.

Step 2: Commit BNB

During the subscription period, you can commit any amount of BNB (minimum 0.1 BNB), up to your calculated limit.

Committed BNB is locked temporarily.

Step 3: Token Allocation

After the subscription period ends, Binance calculates final allocations.

A portion of your committed BNB is deducted in exchange for Launchpad tokens.

The tokens and any unspent BNB are automatically transferred to your spot wallet.

Binance Launchpad provides blockchain startups with fundraising opportunities while giving investors a secure way to access high-potential projects early.

Binance Launchpad rules you need to know

Participation requirements

To take part in token sales on Binance Launchpad, users must meet certain criteria.

Verified Binance account. Users must complete the Know Your Customer (KYC) process, which involves providing personal details and submitting a government-issued identification document. This ensures compliance with regulatory requirements.

BNB holding requirement. Participants must hold a specific amount of Binance Coin (BNB) for a designated period before the token sale. The holding period usually ranges from 7 to 30 days, depending on the project. Binance calculates the user's average daily BNB balance over this period to determine eligibility.

Country restrictions. Due to legal regulations, some countries are restricted from participating in Binance Launchpad token sales. Users should check Binance's latest guidelines to confirm if their region is eligible.

BNB balance calculation and allocation process

Binance Launchpad follows a structured system for allocating tokens based on a user’s BNB holdings.

Average BNB balance calculation. Binance calculates the average daily BNB balance using hourly snapshots taken across users’ accounts, including spot, margin, and Binance Earn holdings. This balance determines the maximum amount of new tokens a user can subscribe to.

Subscription period. After the holding period, eligible users commit their BNB during the subscription window. The amount of BNB they commit affects the final allocation of tokens.

Token distribution. At the end of the subscription phase, Binance distributes tokens proportionally based on the amount of BNB each participant committed relative to the total BNB committed by all participants.

KYC procedures and security measures

Binance requires all users participating in token sales to complete KYC verification. This includes providing personal details such as full name, date of birth, residential address, and submitting a valid identification document.

KYC verification enhances security by preventing fraudulent activities and ensuring compliance with anti-money laundering regulations. It also grants users full access to Binance's services, including trading, deposits, and withdrawals.

Following these requirements ensures a fair and secure process for participating in Binance Launchpad token sales.

Which projects have launched on Binance Launchpad

Binance Launchpad has established itself as an effective platform for launching innovative blockchain projects. Some of the most successful examples include:

Axie Infinity (AXS). Launched in 2020, this project achieved significant growth. The initial token price was $0.10, and by November 2021, AXS reached an all-time high of $164.90, delivering a 1,649x return on investment.

Polygon (POL, ex-MATIC). Listed on Binance Launchpad in 2019 at $0.00263 per token, MATIC peaked at $2.92 in December 2021, marking a 1,110x increase.

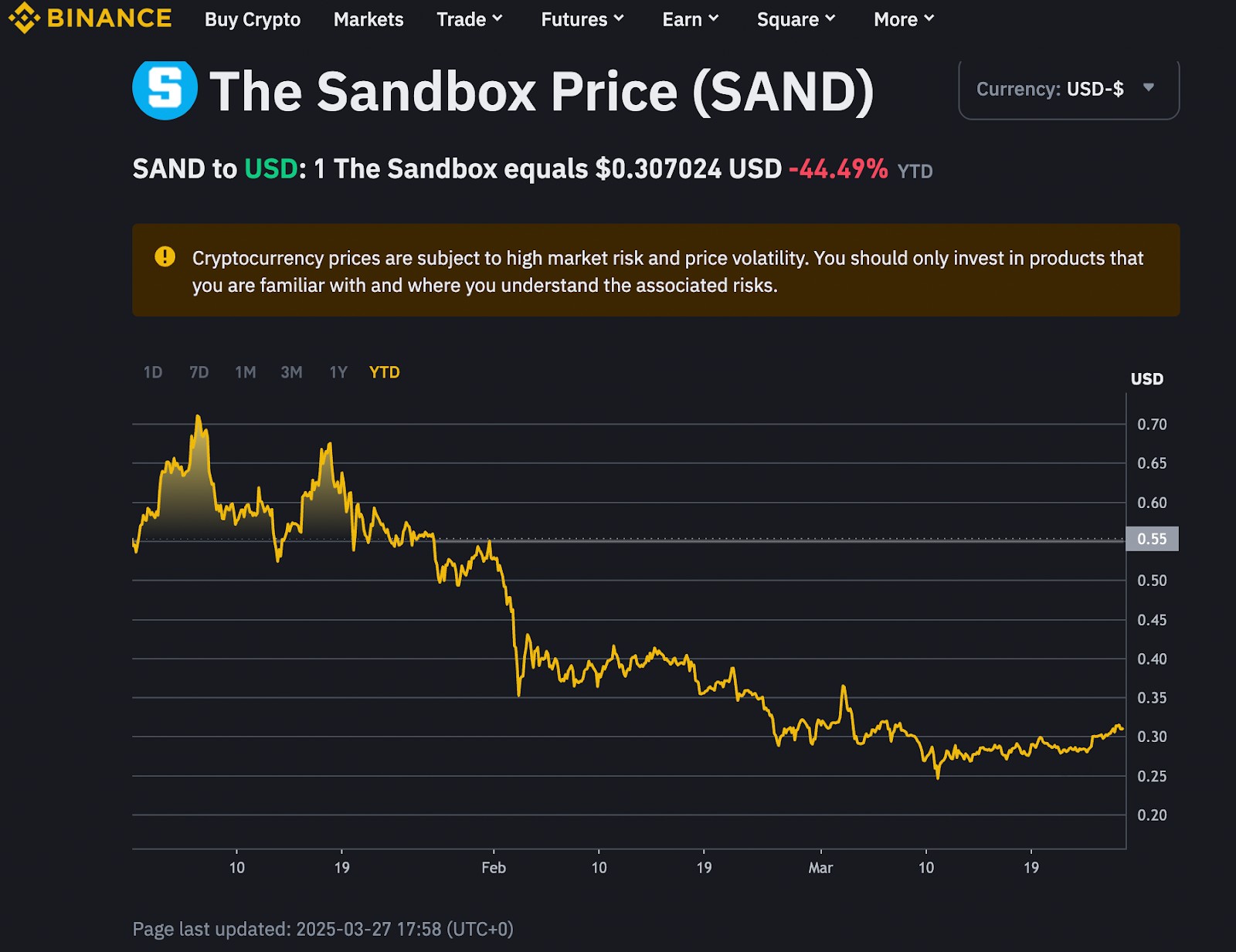

The Sandbox (SAND). Launched in 2020 at an initial price of $0.008333, SAND reached its highest value of $8.40 in November 2021, providing investors with a 1,008x return.

According to sources, the average return on investment (ROI) for projects launched on Binance Launchpad stands at 18,481.4% at their all-time high (ATH). This highlights the high-profit potential for participants in IEOs on this platform.

How to participate in Binance Launchpad

Step 1: Register on Binance and complete KYC

To join a token sale on Binance Launchpad, you must have a verified Binance account. After registration, you need to complete the Know Your Customer (KYC) process, which requires submitting identification documents to verify your identity. This step is mandatory to comply with security and regulatory requirements.

Step 2: Fund your account with BNB and prepare for participation

Once KYC verification is complete, you need to hold a certain amount of Binance Coin (BNB) in your Binance account. The required BNB balance varies depending on the token sale conditions. The system calculates your average BNB balance over a set period, and maintaining the required balance ensures eligibility for participation.

Step 3: Confirm participation and token distribution

During the subscription period, you must confirm your participation by committing a specific amount of BNB for the token purchase. Once the subscription period ends, Binance calculates the final token allocation based on the total committed BNB and the overall demand. The required BNB amount will then be deducted, and the purchased tokens will be credited to your spot wallet.

Potential risks and tips for successful IEO participation

Country restrictions. Some jurisdictions prohibit participation in token sales. Ensure that your country is not on the restricted list before proceeding.

Investment risks. Investing in new projects carries high volatility and risk. Conduct thorough research on the project before committing funds.

Technical issues. During high-demand token sales, network congestion or platform delays may occur. Prepare in advance and act promptly during the subscription window.

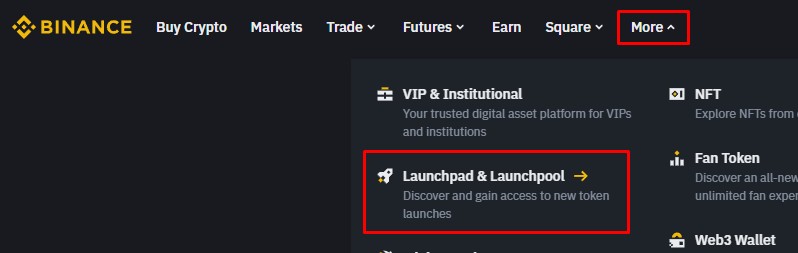

How to access Binance Launchpad

Binance Launchpad allows users to participate in token sales for new blockchain projects. It is available through both the Binance website and mobile app. Below is a step-by-step guide to accessing it on different platforms.

Accessing Binance Launchpad on the web

Log in. Visit the Binance website and enter your credentials to access your account.

Navigate to Launchpad. Hover over the "Earn" section in the top menu. Click on "Launchpad" from the dropdown. This will take you to the page where you can view active and upcoming token sales.

Accessing Binance Launchpad on the mobile app

Open the app. Launch the Binance mobile application.

Find Launchpad. Tap the "More" icon on the home screen. Under the "Earn" section, select "Launchpad." This will take you to the list of available token sales.

Features of Binance Launchpad

Project listings. Users can view detailed information about ongoing and upcoming token sales, including project descriptions, fundraising goals, token supply, and allocation mechanics.

Participation requirements. The platform provides details about minimum and maximum investment limits, required BNB balance, and subscription periods.

Historical data. Users can review past project performance to make informed investment decisions.

Common access issues and solutions

Regional restrictions. Binance services are restricted in some countries due to regulations. If you cannot access Launchpad, check if your region allows Binance services.

App issues. If the Binance app crashes or does not work correctly, update it to the latest version or reinstall it. Clearing the app cache in your device settings may also help.

Browser compatibility. For web users facing issues, ensure that the browser is up to date and supports JavaScript and cookies. Using incognito mode can help troubleshoot login problems.

Login problems. If you cannot log in, check that you are using the correct credentials. If issues continue, reset your password using the recovery options available.

For further assistance, Binance customer support can help resolve access issues.

Token unlock risks and BNB timing tricks investors should know

Be wary of token unlock timelines and market sell-offs. A lot of investors focus too much on the launch price but ignore what happens when more tokens start unlocking. Some projects release only a small amount of tokens at first, while the rest become available over time. If too many tokens unlock too fast, early investors might rush to sell, pushing prices down.

Before committing, check how long tokens remain locked and how similar projects performed in the past. If insiders or early investors can sell long before most users, it’s a bad sign. The best projects create demand before unlocking a big chunk of tokens, helping the price hold steady.

Time your BNB holdings smartly. Binance takes daily snapshots of your BNB balance before token sales, but you don’t need to hold the same amount all the time. Some investors increase their BNB balance right before snapshots begin, then move funds back once the calculation is done. This lets you qualify for a higher allocation without holding BNB for longer than needed. Keeping track of when Binance does these checks can help you get a bigger stake in new projects without taking on unnecessary price risk.

Conclusion

Evaluating a project's team, technical implementation, market potential, and community interest is essential when investing through Binance Launchpad. Analyzing tokenomics, roadmap, and partnerships helps assess the project's long-term sustainability. Beyond participating in IEOs, investors can explore buying tokens after listing, using Launchpool to farm new assets, or investing in DeFi projects. Some startups also offer private funding rounds or sell tokens through IDO (Initial DEX Offering) platforms. Regardless of the approach, diversification and risk management remain fundamental principles for successful investing.

FAQs

How can you tell if a token is overvalued after listing?

Analyze market capitalization and the price-to-initial offering ratio. If the market cap is unexpectedly high and trading volume declines, the token might be overpriced. Monitor large holders' activity — if they start selling aggressively, it could indicate an overheated market.

What are alternative ways to get tokens before listing?

Besides traditional platforms, early access can be gained through private rounds or testing reward programs. Some projects distribute tokens to active users as incentives for ecosystem participation.

How can you reduce losses when investing in new projects?

Check token liquidity after listing, review vesting conditions for early investors, and analyze anti-manipulation mechanisms. Diversifying investments across multiple projects can mitigate losses if one underperforms.

Can you participate in token sales without buying digital assets?

Some platforms offer staking-based access, allowing users to earn token allocations without direct purchases. Profitability depends on lock-up duration and overall demand on the platform.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).