Trading platform:

- Plastic card

- Apple Pay

- Google Pay

- Samsung Pay

- Bank account

- Android Pay

Chime Bank Review 2024

- US

Currencies:

- USD

- 5%-30%

- Yes

Summary of Chime Bank

Chime Bank is an American digital bank where you can open a dollar account and manage it through a mobile application. The bank issues a Visa card, which can be used to pay online and offline stores worldwide. The bank has no tariff plans. Registration, use of the application, and the card are free. There are no commissions for transfers, and Chime customers receive transfers instantly. There is a savings account with an annual rate of 0.50%. The bank offers overdraft protection of up to $200 without interest. In the Chime Bank app, you can apply for and receive a loan within two minutes without bureaucracy and lengthy checks. The bank supports only US dollars, so storage and use of other currencies are not possible.

| 💼 Main types of accounts: | Only standard |

|---|---|

| 💱 Multi-currency account: | No |

| ☂ Deposit insurance: | Yes (FDIC) |

| 👛️ Savings options: | Round-ups: transfer of percentage of purchases to a savings account; no commissions for transfers (including international ones) |

| ➕ Additional features: | You can get paid before the due date |

👍 Advantages of trading with Chime Bank:

- Free registration and no tariff plans or subscription fees for using bank services.

- In case of overspending, an overdraft with a limit of $200 is automatically triggered, for which you do not need to overpay.

- Loans without collateral, no annual fee or interest.

- After registration, the bank sends the client a Visa card, which can be used globally without restrictions.

- There are no limits on withdrawals and transfers, and the client can dispose of his funds without commissions.

- The client’s savings account provides 0.50% per annum and is replenished at any time (including via automatic functions)

- The bank offers tools for savings and accrual, for example, Round-ups with cents rounded when paying.

👎 Disadvantages of Chime Bank:

- The client’s account is not a multi-currency one; using this account you can store and use only US dollars.

- The bank does not offer children’s accounts, business accounts, and other types of accounts, only the standard ones.

- There are no additional tools for investment, referral, or bonus programs.

Evaluation of the most influential parameters of Chime Bank

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest Chime Bank News

- Analysis of Chime Bank

- Dynamics of the Popularity

- Investment Programs

- Terms for Cooperation

- Detailed Review

- Banking features

- Technical Support

- Social programs

- How to open an account?

- User Reviews of Chime Bank

- FAQs

- TU Recommends

Geographic Distribution of Chime Bank Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Chime Bank

Chime Bank has been operating since 2013. The company is registered under this name, the banking services are provided by The Bancorp Bank and Stride Bank NA. Both companies have banking licenses and are regulated by the FDIC. Therefore, Chime can be trusted. A review of the 9-year history revealed no fraud or unresolved conflicts with clients.

Chime is a typical new generation digital bank. Account management is carried out through a mobile application with an intuitive and functional interface. You can also manage accounts through the site, but the smartphone is always with you, so it is more convenient to do so with your phone. Accounts are only for individuals and only in US dollars. There are no subscription fees or tariffs. Transfers are free, including transfers to accounts in other banks.

Opportunities for accrual are standard. An example - rounding the amount when making a payment and setting aside the rounded cents in a savings account. All neobanks have similar options. At Chime, they are implemented at the highest level, everything is transparent, and no training is required to navigate the application. There is a record of income and expenses with the ability to set goals and limits. Notifications with reports are sent to the user upon reaching the set goals.

Chime clients cannot increase their capital with the help of other means, except for savings deposits at 0.5%. The percentage is average for the market. What is really worth noting is the interest-free loan, which is issued even if you don’t have a pristine credit history. Issuance with a very bad history is not guaranteed, but Chime automatically gives its customers 30 points and conducts a loyal check. This is a significant plus.

Dynamics of Chime Bank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of Chime Bank

Unfortunately, Chime does not offer specialized investment programs. However, bank customers have the opportunity to open a savings account on standard terms. The savings account can be funded at any time, and no minimum amount is set. The annual rate is 0.50%. This is the market average, with very few digital banks offering higher interest rates on their savings accounts. The advantage of Chime is that the client does not pay for account maintenance and can automate its funding during transactions (for example, when receiving a transfer, a percentage of the amount can be redirected to a savings account).

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Terms for Cooperation with Chime Bank

The Chime Bank app allows you to comprehensively manage your finances. Operations are formed into reports according to specified criteria, which makes it possible to take into account income and expenses of various types. Plus, there is an overdraft and an auto-loan on favorable terms within minutes (even with a bad credit history). Chime has maintained a competitive position among the leading neobanks in the US and the world for many years. You do not need to be a resident of a particular country to cooperate with this bank. The cards of this bank work all over the planet.

-

• No monthly fees and no minimum balance fees.

An online checking account with no monthly fees is available to everyone. -

• No overdraft fees.

Instead of charging you an overdraft fee, Chime allows you to overdraft on debit card purchases with no fees. -

• 60,000+ fee-free ATMs.

You can also use the map in your Chime app to find the closest fee-free ATM near you.

| 💼 Main types of accounts: | Only standard |

|---|---|

| 💱 Multi-currency account: | No |

| 💵 Deposit terms and conditions: | 0.50% on savings account |

| 💳 Loan terms and conditions: | No bank commission, loyal credit history check |

| ☂ Deposit insurance: | Yes (FDIC) |

| 👛️ Savings options: | Round-ups: transfer of percentage of purchases to a savings account; no commissions for transfers (including international ones) |

| 📋 Types of payment: | Bank account, Visa plastic card, Apple Pay, Google Pay, Samsung Pay, Android Pay |

| ➕ Additional features: | You can get paid before the due date |

Comparison of Chime Bank with other Brokers

| Chime Bank | Wise | Bunq | Curve Bank | BOQ Bank | Starling Bank | |

| Supported Countries | US | Globally | Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Slovenia, Republic of Cyprus, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Norway, Poland, | UK and EEA | US dollar (11 currencies) | UK |

| Supported Currencies | USD | 54 currencies | Euro (16 European currencies in the Easy Money plan) | 26 currencies | Australia | GBP, EUR, USD |

| Deposit insurance | Yes | No | EUR 100,000 | No | $250,000 | Yes |

| Minimum deposit | No | No | No | No | $1,000 | No |

| Deposit rate | 5%-30% | No | 0.09% APY | No | 7.39% | 15%-35% |

| Loan Rate | 0.50% | No | The bank does not issue loans | No | 10.99% | 0.05% |

Chime Bank Commissions & Fees

The Chime neobank does not charge a subscription fee to its customers. Registration and use of services are completely free. Order, delivery, and replacement of a plastic card are free as well. There is no commission for overdraft and use of credit services (except for some situations described below). All payments are free, including international ones. The only type of commission that the bank charges to customers is a commission when withdrawing funds from a non-partner ATM. View the list of approved ATMs on the company’s website.

We also compared Chime fees with similar types of fees on other Digital banks.

| Broker | Overdraft fee | ATM Withdrawal Fee | International transfer fee | International exchange fee |

| Monzo Bank | 19-39% | Free in the UK In other countries: - up to £200 - free - beyond £200 - 3% | €0.5 | 0.35%-2% |

| Revolut | No | Up to $350 - free - beyond $350 - 2% | 0.3% (min. $0.30, max. $6) | From 0% to 1% |

| Chime Bank | No | No | No | 3% (max.$5) |

The Chime Bank app in terms of functionality and ease of use competes confidently with applications from the world’s leading neobanks. The organization operates under a license, there is an international regulator, and its activities are transparent. There are no services for legal entities, and there is only one type of account: personal, for an individual. The main advantage of Chime Bank is the absence of commissions for using bank services and transfers. This also applies to international transfers and transfers to accounts of people who are not Chime customers. Users also receive loyal loan conditions and interest-free overdraft protection.

Detailed review of Chime Bank

This neobank offers exceptionally favorable conditions for using mobile banking services. An account is registered and a plastic card is issued for free. Transfers and withdrawals at approved ATMs are interest-free. However, there are several nuances. First, it is possible to withdraw cash for free only at the ATMs of Chime and its partners, a commission is charged at other ATMs. Second, an interest-free overdraft is available to clients who meet the requirements of the SpotMe program (more about it below). Third, when paying via Apple Pay, Google Pay, Samsung Pay, or Android Pay, an operator’s commission may be charged.

Chime mobile bank by the numbers:

-

It takes only 2 minutes to open an account with Chime Bank;

-

$0 is the subscription fee for using the bank;

-

$0 is the commission for transfers, including international ones;

-

$200 is for overdraft protection without commission for most clients;

-

60,000 approved ATMs around the world offer free cash withdrawals.

Among digital banks (not only American ones), Chime Bank also stands out because it has no data plans. Usually, banks provide extended opportunities or loyal conditions for typical functions for customers who pay VIP rates. At the same time, most banks have a free account with limited functionality and hard limits.

When a user opens a Chime Bank account, no limits apply to him, except for those that he set himself. That is, in the settings you can set a spending limit for a certain period or for a selected category. If the limit is exceeded, the user is notified. Chime offers a range of options for self-regulating a client’s financial policy.

Chime’s useful features:

-

Free overdraft. One of the main features that made Chime popular. Bank customers can freely overpay in stores up to 200 US dollars, without charging commissions. It will only be necessary to return the overdraft amount to the bank.

-

Free transfers. If a Chime Bank user transfers funds to another Chime Bank user, no commission is charged, and the transfer comes instantly. If the transfer is made to an account in another bank, it is also free, but it takes up to 14 days.

-

Free international transfers. This is another unique feature available in the Chime Bank app. A transfer to anywhere in the world does not require payment of commission to the bank (only a commission that a third-party payment system may charge).

-

Early pay. If you make your account in Chime a current account for receiving wages, the funds will arrive 2 days ahead of schedule. This is due to the specifics of the work of Chime partner banks.

-

Free cash withdrawal. Neobank customers have access to 60,000 ATMs worldwide, where they can withdraw funds from a card without limits and commissions. Most digital banks set hard withdrawal limits without paying fees.

-

Savings account. A bank client can open a savings account with flexible replenishment conditions. The annual percentage rate is 0.50%. Funds on the account are not frozen, it is possible to replenish them at any time.

-

Payment rounding. If the feature is enabled, the amount will be rounded up to a whole number in dollars on each transaction. The cents rounded in this way are sent to a savings account or a separate pot, which will allow you to successfully save money.

-

Interest from payment. The client can activate a feature that will allow for each transaction to write off some interest on top of it, and it will be sent to a savings account or a separate pot. The interest from payment helps to form targeted savings.

Pay attention to the SpotMe program. It allows you to get an interest-free overdraft. The SpotMe program is activated automatically as soon as the client meets the following condition: he received a direct transfer in the amount of at least 200 US dollars 31 days before the activation of the overdraft. If the client does not meet this condition, an overdraft fee will be charged (calculated individually).

In this case, the received payment must go through the Automated Clearing House (ACH) or through the original credit transaction (OCT) service. The payment must come from an official, such as an employer, wage provider, or payer for some service (say, a tenant). The minimum overdraft amount is $20. An overdraft of up to $200 is received by a client of a neobank over time, subject to active use of the services.

Advantages:

The Chime Bank app allows you to control the income and expenditure of funds using convenient tables, graphs, and other analytics.

The users can set limits and goals for themselves which are accompanied by notifications from the system to the user when the limits are reached.

The bank does not charge commissions for transfers and acceptance of payments, including international transactions with accounts of other banks.

Chime issues a Visa card to customers that can be used for online, offline payments, and cash withdrawals.

You can withdraw cash from Chime-approved ATMs and partner banks for free (for other ATMs, a commission depends on the owner bank).

A savings account with an interest rate of 0.50% per annum can be opened free of charge, and there is no minimum deposit or other conditions.

Overdraft protection is applied automatically, and no commissions are charged (subject to the SpotMe program).

You can pay directly from your account, as well as use Apple Pay, Google Pay, Samsung Pay, and Android Pay.

There are several features for comfortable savings, such as rounding up and deducting additional interest when paying on the created pot.

Chime technical support is available 24/7.

Types of accounts for individuals and businesses

Chime Bank does not offer business accounts (corporate accounts, accounts for legal entities, etc.). Only an individual can open an account with this neobank. Only one type of account is provided — personal; and there are no tariff plans. Chime does not offer accounts for children or teens.

Banking features

Chime Bank fully meets the requirements which the global financial system sets for online banking services. The company's customers can aggregate all their financial flows, make purchases, make transfers around the world, keeping detailed statistics of all their actions in an application on a smartphone.

The philosophy of banking also allows multiplying the client's savings. To do this, Chime offers a savings account, a rounding-off function, and a special account to collect interest from each payment. The mobile bank user can set goals with alerts to systematize savings.

Chime Bank Account provides other banking features as well. The app has simple and user-friendly functionality while being perfectly optimized and running at peak speeds.

Technical Support

The “Help Center” section contains comprehensive answers to most questions that a bank client may have, from technical issues to the conditions for the provision of certain services. Also on the site and in the application, there is a FAQs section, where the same information is presented, but in a compressed form. The “Blog” section publishes news related to the activities of the neobank, including changes in the policy of working with clients and the introduction of new functions.

The easiest and fastest way to contact Chime Bank’s technical support is to call 844-244-6363. The number is multi-channel. The call center works 24/7 without breaks and on weekends. An alternative option is to write to the online chat in the application, where managers are also present around the clock. Another contact option is email support@chime.com.

Chime Bank is represented on Twitter, Facebook, and Instagram. It is possible to contact the company through its official accounts if for some reason other methods of communication are not available. Please note that the bank’s technical support works only in English. Your operator may charge calls to an international number.

Social programs of Chime Bank

Chime Mobile Bank's social program includes helping the poor and families who are in financial difficulty for various reasons, from bankruptcy to natural disaster. Neobank annually allocates up to USD 600,000 to help those who cannot currently take care of themselves. Chime cooperates with several affiliate organizations in America, participates in social initiatives, provides donations and grants through ERG.

The mobile bank also implements its own projects, mainly aimed at ensuring racial equality around the world. Chime is part of the Pledge 1% international group, the essence of which is that the organization itself and each of its employees gives 1% of their income to charity, and spends 1% of their working time on volunteering. The mobile bank application has a VolunteerMatch function, thanks to which each customer of the company can organize their own volunteer event.

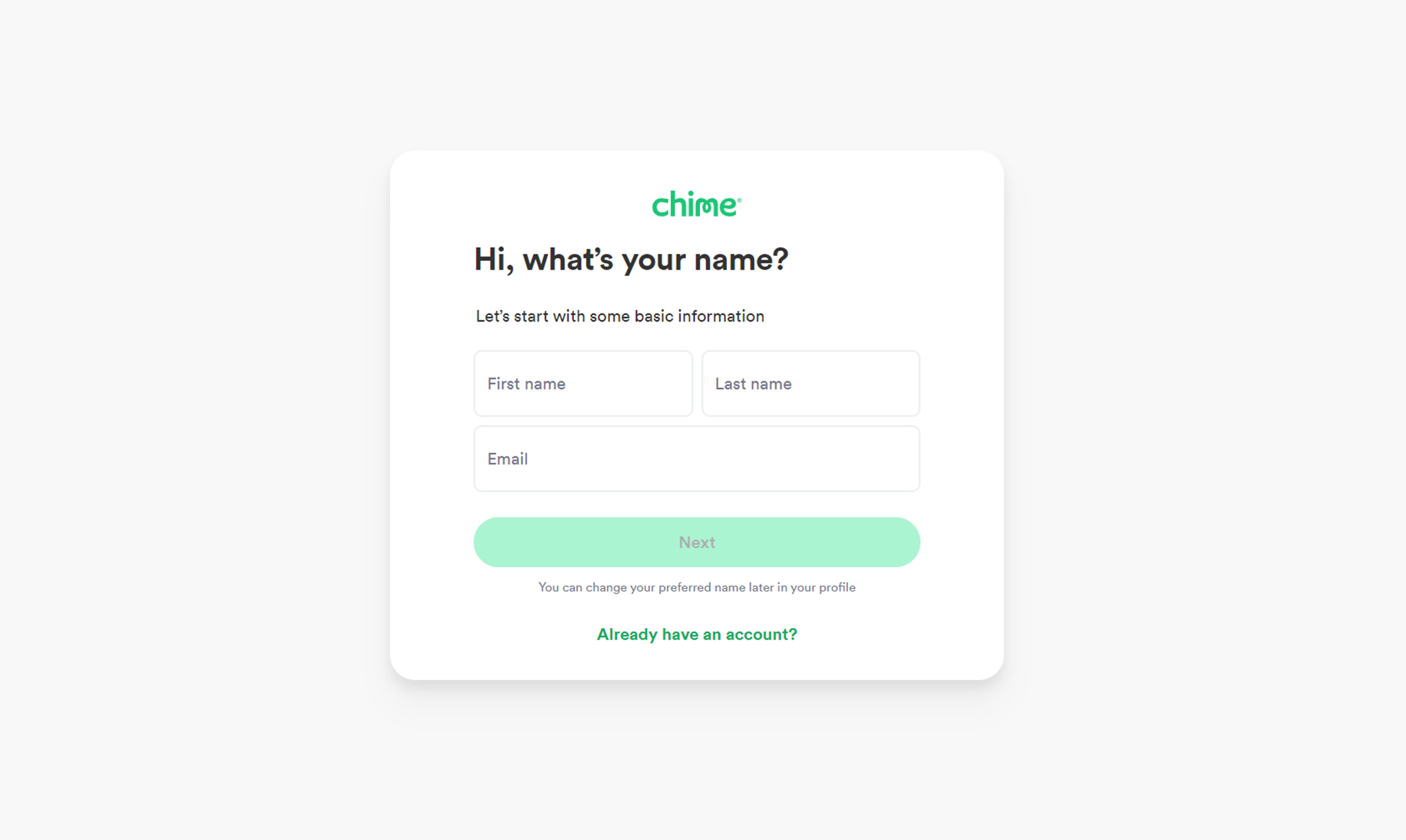

How to open an account at Chime Bank

Go to the official website of Chime neobank, and click the “Start” button in the upper right corner. Please note that registration is not available for some regions at the moment. If your region is not on the blocked list, you will be taken to a page where you need to enter your email and generate a password.

To protect against scammers and fakes, the system will require you to pass a simple check. Then you need to enter personal data, including the address to which the plastic card will be sent. Then just follow the instructions on the screen. At the end of registration, the system will ask you to provide a photo or scans of identification documents (for example, a driver's license).

Verification of documents may take several days. Once the verification is complete, you will receive a notification. Go to the Play Market or App Store and download the Chime Bank app. Use your login details (email and password) to log in. You can do this before checking the documents, but access to the application’s functions will be activated only after the process has been successfully completed.

Articles that may help you

FAQs

How does Chime Bank earn money?

The main income of Chime Bank is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does Chime Bank protect its customers?

Chime Bank uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

Chime Bank provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through Chime Bank?

Yes. Chime Bank allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Bunq's secure website.

Via Curve's secure website.