Trading platform:

- Mobile Apps

- Web-Plattform

- Bill Pay

- PayPal

- Zelle platforms

CIT Bank Review 2024

- USA

Currencies:

- USD

- 0.1% -1.4%

- $250 000

Summary of CIT Bank

The digital bank CIT belongs to the large American holding company CIT Group Inc and was founded in 1908. Since 2022, CIT Bank has been part of First Citizens Bank and is regulated by the Federal Reserve Board (FRB), the Federal Reserve Bank of New York (FRBNY), the United States Office of the Comptroller of the Currency (OCC), and the Utah Department of the Treasury (UDFI). CIT Bank provides services to individuals and legal entities and offers home loans, financing, and leasing solutions for small and large businesses. The range of available accounts includes current (settlement) accounts, savings, deposits, and custodial accounts for children. Only US citizens and residents can open an account with CIT Bank.

| 💼 Main types of accounts: | eChecking, Money Market, Savings Accounts (Savings Builder, Savings Connect, Spring Savings, High Yield Savings, Premier High Yield Savings), Certificates of Deposit/CD (Term, No-Penalty, Ramp Up, Jumbo), personal, custodial, business, commercial |

|---|---|

| 💱 Multi-currency account: | Unavailable (only US dollars, conversion at the rate of MasterCard) |

| ☂ Deposit insurance: | Available (up to $250,000 per client) |

| 👛️ Savings options: | Savings accounts, discounts on the mortgage rate when making a down payment of 10% of the total amount |

| ➕ Additional features: | Financing plans for small and large businesses |

👍 Advantages of trading with CIT Bank:

- State regulation and participation in the FDIC federal compensation scheme.

- A wide range of savings accounts with different terms and annual rates of return.

- Accrual of interest income on the balance of free funds on current accounts.

- Opportunity to get a mortgage for up to $3 million, including with partners.

- No fees for opening and maintaining accounts, processing, and standard delivery of debit cards by mail.

- Free withdrawal of funds from ATMs of the CIT Group network.

- A functional mobile application with which you can conveniently manage funds, active accounts, and cards.

👎 Disadvantages of CIT Bank:

- Limited choice of services, for example, you can not get insurance, and loans are represented only by mortgages.

- The bank does not offer credit cards and does not accrue cashback on debit cards.

- CIT Bank customers can only transfer funds to accounts in the US. International bank transfers are not currently available.

Evaluation of the most influential parameters of CIT Bank

Table of Contents

- Geographic Distribution

- Video Review

- Latest Comments

- Expert Review

- Latest CIT Bank News

- Analysis of CIT Bank

- Dynamics of the Popularity

- Investment Programs

- Terms for Cooperation

- Detailed Review

- Banking features

- Technical Support

- Social programs

- How to open an account?

- User Reviews of CIT Bank

- FAQs

- TU Recommends

Geographic Distribution of CIT Bank Traders

Popularity in

Video Review of CIT Bank i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of CIT Bank

CIT Bank is a trusted digital bank licensed by US regulators that also has physical branches. Its services are available exclusively to US citizens, including those living abroad. You need a Social Security Number (SSN) to open an account. In CIT Bank, you can open both a personal account (for yourself) and a custodial account (for a child under 18). Accounts for small and large businesses are also available.

CIT Bank is oriented toward residents of North America who are interested in accounts with interest income. For these purposes, the bank offers a wide range of savings accounts, however, an annual rate is also charged on current accounts. The choice of loan products is limited, so CIT Bank customers only have access to housing loans.

CIT Bank’s eChecking offers Mastercard debit cards to current account holders. Customers are only allowed to have one debit card, regardless of the number of active accounts. The cards support Apple Pay and Samsung Pay. The bank does not credit them with cashback for purchasing goods or paying for services. The cardholder can choose a dollar transaction limit, enable push notifications for certain transactions, and select external regions where payments will be blocked by the bank.

CIT Bank does not currently offer outgoing international transfers. Wire transfers can only be sent within the United States, with a minimum transaction amount of $1,000. Bank customers can transfer funds from their accounts free of charge through the ACH clearing house. Such payment is initiated through online banking or at an external financial institution using CIT Bank routing and account numbers (recipient and sender). Payments are also available through the Bill Pay, PayPal, and Zelle platforms.

Latest CIT Bank News

Dynamics of CIT Bank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of CIT Bank

As an investment solution, CIT Bank offers accounts with an annual percentage yield (APY). The amount depends on the selected account, balance, and the selected period during which the funds will be held. So, after depositing $100, the client can receive different incomes: when choosing an eChecking account it is 0.1% -0.25% per annum, and in the case of savings accounts, it is 0.25% -1.35%. On CD accounts, you can get 0.25% -1.4% per annum, but they require a deposit of $1,000, and for some types of accounts (Ramp Up and Jumbo), the required deposit is $25,000-$100,000. For CD deposit accounts, there are certain periods during which money cannot be withdrawn or transferred. The minimum blocking period is 6 months, and the maximum is 5 years. The No-Penalty CD account with the highest APY rate must be funded with a minimum of $1000, deposit terms are 11 months.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Terms for Cooperation with CIT Bank

CIT Bank does not offer multi-currency accounts, so all transactions are carried out in USD. Deposits can be made using ACH, an incoming bank transfer, or by mailing a check to the bank. CIT Bank has a large selection of current and savings accounts, which accrue an income rate which is either fixed or calculated using a compound interest formula. All accounts are FDIC-insured. Credit cards are not available.

| 💼 Main types of accounts: | eChecking, Money Market, Savings Accounts (Savings Builder, Savings Connect, Spring Savings, High Yield Savings, Premier High Yield Savings), Certificates of Deposit/CD (Term, No-Penalty, Ramp Up, Jumbo), personal, custodial, business, commercial |

|---|---|

| 💱 Multi-currency account: | Unavailable (only US dollars, conversion at the rate of MasterCard) |

| 💵 Deposit terms and conditions: | From $100, from 6 months to 5 years, the rates are from 0.1% to 1.4% per annum |

| 💳 Loan terms and conditions: | Overdraft fee $0-25, mortgage up to 3 million dollars with a rate of 0.1% |

| ☂ Deposit insurance: | Available (up to $250,000 per client) |

| 👛️ Savings options: | Savings accounts, discounts on the mortgage rate when making a down payment of 10% of the total amount |

| 📋 Types of payment: | Plastic debit cards, ACH, Zelle, Bill Pay, PayPal, bank transfer, Apple Pay, Samsung Pay |

| ➕ Additional features: | Financing plans for small and large businesses |

Comparison of CIT Bank with other Brokers

| CIT Bank | Wise | Bunq | Curve Bank | Quontic Bank | Suits Me Bank | |

| Supported Countries | USA | Globally | Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Slovenia, Republic of Cyprus, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Norway, Poland, | UK and EEA | USA | UK and worldwide |

| Supported Currencies | USD | 54 currencies | Euro (16 European currencies in the Easy Money plan) | 26 currencies | US dollar | GBP, EUR, RON, SEK (for transactions with other currencies, automated conversion is made) |

| Deposit insurance | $250 000 | No | EUR 100,000 | No | $500,000 | No |

| Minimum deposit | $100 | No | No | No | €100 | No |

| Deposit rate | 0.1% -1.4% | No | 0.09% APY | No | 3%-4,45% | No |

| Loan Rate | От 0.1% | No | The bank does not issue loans | No | Individually | No |

Detailed review of CIT Bank

Credit and investment company CIT Bank was founded in 1908 in St. Louis (Missouri), but later its headquarters moved to New York. In the 1980s, the company experienced a rebranding and significantly expanded the range of services, turning into a commercial bank, which after 2008 re-qualified as a digital bank. In January 2022, CIT Bank and its OneWest Bank division became part of the Nasdaq-listed First Citizens Bank holding company with a combined capital of over $3.5 billion. All current and deposit accounts of CIT Bank are insured by the FDIC, the state-owned Federal Deposit Insurance Corporation of the United States.

CIT Bank by the numbers:

-

the bank was founded over 114 years ago;

-

during the past 5 years it received more than 40 awards for banking products and corporate social responsibility;

-

the retail chain, known as OneWest Bank, has 70 branches throughout Southern California;

-

the bank offers 8 types of personal accounts;

-

the maximum annual rate of return is 1.4%.

You can manage your CIT Bank account directly on the bank’s website, but it’s more convenient to do it in a mobile application. Its interface allows you to transfer funds via Zelle and Bill Pay, as well as pay for purchases using Samsung Pay and Apple Pay. In the mobile application, you can generate a statement of all open accounts and contact a technical support representative 24/7. It is also available to set up notifications about actions with a debit card and set restrictions and limits on it.

Userful functions of CIT Bank:

-

Help Center. It contains all useful information for the user about accounts, services, and savings options. Also, there are educational articles, news, legal documentation, and contacts for communication.

-

Savings account calculator. It can be used to calculate interest income after a selected period of time. The calculation is made by taking into account the initial deposit amount, additional investments, and APY rates.

-

Deposit account calculator. It allows you to calculate compound interest for keeping funds on the CD account.

-

Recommendations on financial planning. These regard buying a house and emergency savings.

-

Twitter@CITgroup. The company’s tweets focus on smart savings strategies, financial news, investment tips, and more.

-

Video section. It has instructions for working with savings accounts and recommendations for getting the best interest rate.

-

Card blocking from unauthorized access. The cardholder can set supported limits, regions, transaction types, and merchants. The card is blocked if a third party uses it for their own purposes.

Advantages:

Fully digital account opening without the need to visit a physical branch of the bank.

The minimum deposit for opening current, savings, and Money Market accounts is $100.

The deposit rate reaches 1.4%, which is higher than the average for US banks.

The mobile application has all the necessary functionality for the convenient management of funds and accounts.

The bank offers loan programs and financial planning solutions for businesses, including small ones.

Clients have access to various types of mortgages with variable rates and repayment periods.

In CIT Bank, you can open personal and custodial accounts, as well as business accounts.

Issuance and standard delivery (by mail) of debit cards are free of charge.

Popular fast payment services such as PayPal, Zelle, and Bill Pay are available in mobile banking.

Types of accounts for individuals and businesses

Banking features

CIT Bank focuses on accounts for making payment transactions within the United States and accounts for earning interest. For individuals, it offers current (settlement) accounts and a wide range of savings and deposit accounts with various APY rates. Debit cards are linked to the current account, and the option “Overdraft protection” is available.

Various types of loans up to $500,000 are available to small businesses for the purchase of equipment, payment of salaries to employees, purchase of a franchise, etc. For legal entities (companies and organizations), CIT Bank offers commercial financing services, access to capital markets, and debt and equity investment solutions.

Lending programs are represented by mortgages. CIT Bank does not provide consumer loans, car loans, or university education loans. There is also no opportunity to refinance previously taken loans and get insurance. The bank does not offer a credit card, but it can be ordered from the management company First Citizens Bank after linking an account with CIT Bank.

Technical Support

The FAQs section of the official website is intended for obtaining detailed information on banking services and products from CIT Bank. Mobile app support is available 24/7. The fax number for communication is 866-914-1578. The contact section also lists support numbers for commercial, corporate, and business accounts.

For questions about a new or existing account, call 855-462-2652 (for US Residents). If a person is abroad, then he should dial 626-535-8964. International calls are not free.

Phone support hours are Monday through Friday 9:00 am to 9:00 pm, and Saturday 10:00 am to 6:00 pm ET. Sunday is an off day. Loan advisers are available from Monday to Friday from 9:00 to 20:00. The contact phone number issue 800-217-6629.

Social programs of CIT Bank

CIT Bank cares about the planet, therefore, it encourages customers to abandon paper documents and use eStatements, a tool for generating electronic statements. The Bank strives to adapt the site for people with disabilities. The content complies with the requirements set out in the World Wide Web Consortium (W3C) Web Content Accessibility Guidelines.

CIT Bank is focused on the development of Southern California. Since 2016, the company has invested about $5 billion in affordable housing lending, economics, and educational projects. CIT Bank is also partnering with Operation HOPE, a non-profit organization, to organize business promotion workshops for women who own small businesses in New York and Los Angeles.

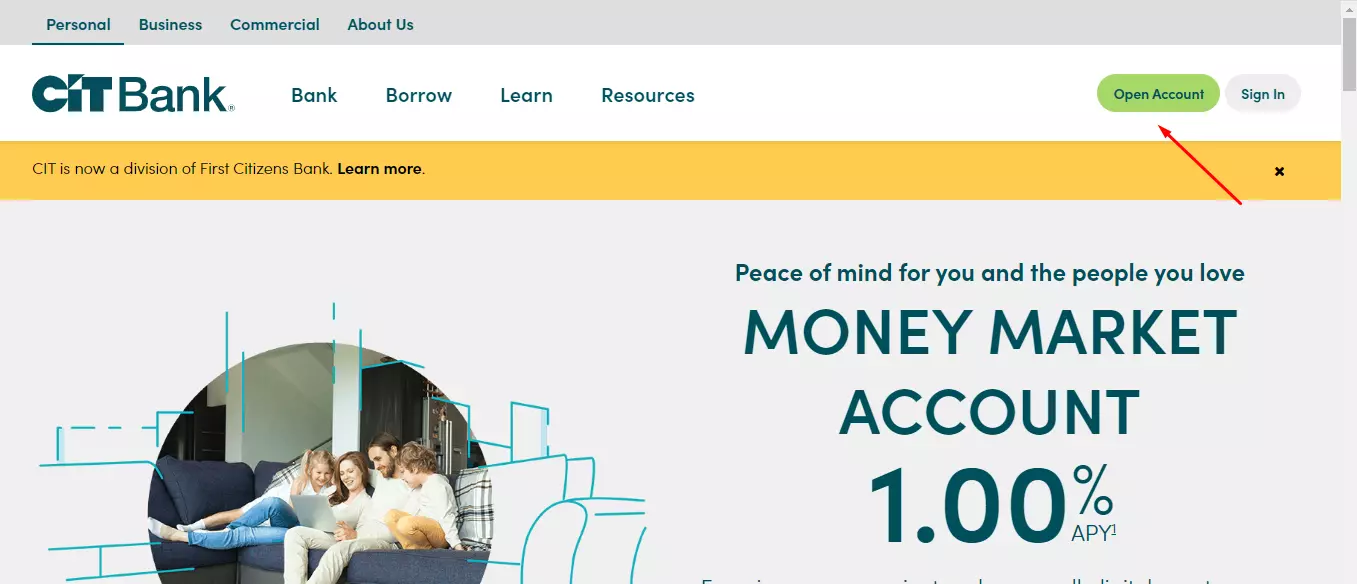

How to open an account at CIT Bank

CIT Bank is a digital bank, so the account opening takes place online on its official website. To create an account, click the Open Account button. It is on any page of the site in the upper right corner. After that, a registration form will open, in which you need to select the type of account by the method of management (Personal/Custodial) and by purpose (current, eChecking, savings, Money Market, deposit, or CD).

After choosing an account, enter your first name, last name, residential address, phone number, and email. Also, include your Social Security number. All the information provided must be confirmed with screenshots of documents such as a US citizen’s passport or a driver’s license. When CIT Bank employees check the data, a confirmation letter will be sent to the email address specified during registration.

Now you can log in to your account on the site or download the mobile application and use it for authorization. The first action after opening an account is to replenish its balance. You need to deposit a minimum of $100. Funds can be transferred by wire transfer, check, or transfer from another bank account.

To get a debit card, you need to open an eChecking current account. When creating it, you must specify the address of the exact location, a map is sent to it. The debit card is mailed free of charge, but the customer can also order express delivery for $45. There is no commission for opening an account.

Disclaimer:

Your capital is at risk. Via CIT Bank's secure website. Your capital is at risk.

Articles that may help you

FAQs

How does CIT Bank earn money?

The main income of CIT Bank is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does CIT Bank protect its customers?

CIT Bank uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

CIT Bank provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through CIT Bank?

Yes. CIT Bank allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Bunq's secure website.

Via Curve's secure website.