10 Best Digital Banks in the USA for 2024

Best digital bank in the US - Wise

TOP digital banks in the US:

The way we bank has come a long way from the days of lining up at teller windows between 9 and 5. In the digital age, money management is literally at our fingertips.

Enter the new kids on the block: digital-only banks that let you handle your finances from anywhere via app or online portal. No clunky paperwork or imposed branch hours. Simply deposit checks from your couch or pay bills on the go.

These fintech upstarts have shaken up the scene in recent years by delivering modern conveniences without the old baggage of physical overhead. Understandably, their customer-first methods are winning fans - especially among millennials who expect banking to be as intuitive as online shopping.

In this article, we evaluate 10 top-rated digital banks currently operating in the United States. Each allows customers to open checking and savings accounts and carry out all management entirely online or through a mobile app. Some also provide perks like investment features, budgeting tools, higher interest than legacy banks, and other bonuses.

By analyzing factors such as fees, account options, investment availability, customer service reputation, and more, we highlight the digital banks that rise to the top in terms of value and customer-first experience.

-

How do you sign up for a digital bank?

Signup processes vary but typically involve providing basic information online or within a mobile app and verifying your identity. Funds can then be transferred from an existing account.

-

Can you deposit and withdraw cash from a digital bank?

While some partner with physical banks for over-the-counter services, most digital banks do not handle cash directly. Deposits are made electronically from other bank accounts.

-

Are digital banks just as safe as traditional banks?

Yes. Digital banks are FDIC insured just like standard banks, so your money is equally protected. They use advanced security measures as well.

-

Can I still speak to someone if I have issues?

Of course. All digital banks have customer service representatives available by phone, chat, or email during regular banking hours or 24/7 in some cases.

What is a Digital Bank?

A digital bank has no branches. Its work is carried out virtually and online. Each person who wants to become a digital bank’s client must download the mobile application and register. Like a physical bank, digital platforms require customer identification but do not require copies of documents. You just need to scan them with your smartphone and send them for approval. Once accepted, your account will be verified and you will be able to enjoy all the features.

Digital banks do not require branches because all the main functions of such banks can be performed online. For example:

-

Storage of personal information and financial documents.

-

Custody of customer funds.

-

Conducting transactions, and processing payments.

-

Formation of reports, etc.

A digital bank has all the same functions as a regular one, but it is much more convenient for the client. This is due to the huge popularity of such services and the constant growth in demand for their services.

List of the Best US Digital Banks

The first digital bank was launched in the United States in 1995. Over the years, lots of banks have popped up, including traditional banks with digital "branches.”

Below is a summary of the best digital banks in the US. This follows diligent research into the available digital banks in the US and an in-depth look into their reliability, valuation, security, fees, benefits, and a plethora of other factors.

| Bank | Loan rate | Credit rate | Account fee | Investment options | |

|---|---|---|---|---|---|

|

Not Applicable |

Not Applicable |

None |

Stocks Cash |

|

|

|

Revolut |

0.65% to 0.70% |

6.45% |

None |

Crypto Stocks |

|

|

Curve |

Not Applicable |

Not Applicable |

None |

None |

|

|

Axos |

7.89% |

7.15% to 17.99% |

$50 deposit |

Stocks ETFs Margin trading |

|

|

SoFi |

1.89% to 33.83% |

0.90% to 1.50% |

None |

Stocks ETFs Shares |

|

|

Ally |

0% to 26.99% |

1.4% |

None |

Bonds ETFs Stocks Mutual funds Margin trading |

|

|

Chime |

0.50% |

5% to 30% |

None |

None |

|

|

Varo |

3.3% |

0.45% |

None |

None |

|

|

Aspiration |

3% to 5% |

Not Applicable |

$10 minimum deposit |

Shares |

|

|

N26 |

Not Applicable |

Not Applicable |

None |

Stocks Bonds |

1. Wise

Taavet and Kristo started Wise back in 2011, with the aim of providing affordable and seamless international money transfers for customers worldwide. Wise accepts over 50 currencies and multi-currency exchanges at no extra cost and is available for both individuals and businesses.

Pros of Using Wise

Wise is a super convenient digital bank, with millions of users from across the divide. Some pros of Wise include

Easy registration and an intuitive user interface

Allows borderless cash transfer

Allows batch-processing for up to 1,000 payments

Reasonable rates and affordable fees

Cons of Using Wise

Despite providing seamless cross-border cash transfers, Wise isn’t without its drawbacks. Some cons of using Wise include:

There’s a cap on how much money you can transfer

Wise easily deactivates accounts

Cash transfer speeds are sometimes slow

2. Revolut

Revolut was launched in Britain back in 2015 as a travel card with reasonable banks. Over the years, it has evolved to be a giant in the digital banking industry.

Pros of Using Revolut

Some advantages of using Revolut include

Seamless application process

Lenient exchange rates

Solid security

Allows freezing of accounts in case of hacking

Availablity of Revolut business loan

Multiple accounts options

Cons of Using Revolut

Revolut is a good digital bank, but may not be the best, given the following cons.

Doesn’t accept checks or cash deposits

Customers don’t earn interest on the money they save

Only EUR account holders can debit directly

2% withdrawal fees

3. Curve

Curve started as a fintech company back in 2015 with an app and a smart card. Curve lets you aggregate all your bank cards onto a single platform. That way, you can manage your finances better.

Pros of Using Curve

Premium subscription options

Combines all your cards on a single platform

Easy-to-use app interface

Cons of Using Curve

Limits on how customer spending and withdrawals

Relatively unresponsive customer support

No budgeting and saving features

4. Axos Bank

Axos was originally established in 2000 and is among the pioneer digital banks in the country. Not only does it allow you to access your money anywhere conveniently, but it also lets you invest in a myriad of financial products.

Pros of Using Axos

Wide array of checking accounts to choose from

Most accounts allow ATM reimbursements

Robo-advisor service for investors

Cons of USing Axos

Relatively high investing fees

Zero physical locations

Comparatively low CD rates

5. So-Fi

So-Fi is hands down one of the best investment banks for investors across the globe. Some benefits of using SoFi include:

Pros of Using So-Fi

Wide array of diverse investment options

Excellent customer support

Connects customers to certified financial planners

Management is completely free

Availability of low-cost investment options

Cons of Using So-Fi

Doesn’t permit tax-loss harvesting

Only boasts a handful of account types

6. Ally

Ally is a US online bank that has gained a lot of traction over the past few years. Apart from stellar banking services, Ally also offers top-of-the-line financial products for its customers, making it a great choice for anyone looking to save and invest.

Pros of Using Ally Bank

Wide array of financial products for customers to invest in

Checking accounts can earn interest

A lot of educational resources for investors

Cons of Using Ally Bank

Relatively expensive overdraft fees

No direct cash deposit for checking and saving accounts

Currency conversion fees for international money transfers

7. Chime

Chime is a pioneer in the digital banking industry, having started way back in 2012. The platform allows free transfer of money by partnering with other third-party financial firms.

Pros of Using Chime

Zero monthly and overdraft fees

Relatively high interest rate for savings

Availability of direct deposits for faster transactions

Cons of Using Chime

Limited top only US citizens

Lackluster customer service

No topping up with debit cards

8. Varo

Varo holds the title of being America’s first digital bank, and is also the first one to receive a national banking charter. Free checking accounts and secured savings accounts are among the many reasons Varo enjoys widespread popularity.

Pros of Using Varo

Access to over 55,000 Allpoint ATMs

No monthly charges on checking and savings account

Relatively high savings rate

Cons of Using Varo

No paper checks available

Only has two deposit accounts

Cash deposits are made through a third party that charges a fee

9. Aspiration

Aspiration is a digital financial firm that allows for saving and financial transactions for account holders. It offers special offers for customers that purchase from ethical companies.

Pros of Using Aspiration

Completely free with no minimum requirements

Easy-to-use user interface

Relatively high interest rate

incentives for green-conscious customers

Cons of Using Aspiration

No direct deposit into bank accounts

Limits debit card transactions in some countries

Unresponsive customer support

10. N26

N26 received the award for best digital bank in 2021 from Forbes. It’s also probably the most complete digital bank, and an excellent choice for most people.

Pros of Using N26

Unlimited withdrawals on the Allpoint network

No monthly fees and accounts are free to open

Cons of Using N26

The platform charges for withdrawals outside of Allpoint’s network

No credit cards are available

How to Choose a Digital Bank in the US

There’s no shortage of digital banks in the US, which is certainly good news for consumers. However, with so many digital banks to choose from, it can be hard to pick the right one for your needs. Here are a couple of tips for choosing the best digital bank.

Check Their Service Charge

Different digital banks charge differently for their services. While some banks allow free transactions, others charge a fee for opening and transacting.

Try to find a bank that charges a reasonable fee for account opening and transactions. You could always go with banks that are completely free, but consider all the other factors before making a final decision.

Check the Bank’s Versatility

Only settle for a bank that accepts payments on multiple digital platforms. There’s no point having cash in a digital bank when you can’t use it. Check what platforms are compatible with your digital bank, and pick the one that’s compatible with most of them.

Alternatively, you can pick a bank that accepts the payment platforms you use most often. That way, you can always have “cash” on hand regardless of where you are and what you’re paying for.

Consider the Bank’s User-Friendliness

Most digital banks have smartphone apps and websites that customers can use to transact with them. Be sure to learn about the bank's user interface to find out whether you’ll have an easy time with all your banking activities. Check other customer reviews and see what they have to say about the smoothness of the bank’s user interface.

24/7 Availability

Make sure you find a digital bank that’s always available throughout. There are some digital banks that only operate during certain hours. This can be a huge problem given that different regions have different time zones. Only settle on a digital bank with 24/7 availability, including customer service.

Best US Digital Bank Fees

The fee structure of digital banks is different from that of traditional banks. So, what fees should you expect to pay with a digital bank? Here’s a breakdown of digital banking fees in the US.

-

Registration fee: Some digital banks charge customers to register with them. However, most of them offer free registration. Others have different accounts where entry-level accounts are free, while customers pay for high-level accounts.

-

Monthly fee: Some banks charge a monthly fee for using their banking services. Banks like Tend charge a monthly fee of $10 for their baseline accounts. However, other banks don’t charge a dime for registering with them.

-

Transaction fee: These are fees customers pay for transacting through the banking platforms. This includes withdrawal; deposit, cash transfer, and balance inquiry fees. Most digital banks are pretty lenient with their transaction fees. However, this may not be the case for international transactions.

-

Overdraft Fee: Your digital bank will charge you a fee if you withdraw more money than what you have in your bank account.

| Digital Bank | Overdraft Fees | ATM Withdrawal Fees | International Transfer Fee | International Exchange Fee |

|---|---|---|---|---|

|

Wise |

None |

$1.5 per transaction below $100 2% for transaction above $100 |

From 0.41% |

From 0.41% |

|

Revolut |

None |

2% above $1,200 per month |

From 0.3% |

0% to 1% |

|

SoFi |

None |

None |

$15 to $45 |

0.2% to 0.9% |

|

Ally |

None |

None |

Up to 1% |

Up to 1% |

|

Curve |

None |

2% |

None |

0% to 2% |

|

Axos |

None |

None |

1% |

1% |

|

Chime |

None |

None $2.50(other ATMs) |

None |

3%(capped at $5) |

|

Varo |

None |

None $2.5(Other ATMs) |

None |

None |

|

Aspiration |

None |

None |

1%(Mastercard fee) |

2% |

|

N26 |

8.9% |

0% to 1.7% |

None |

1.7% |

Fee breakdown for Chime

Best Digital Bank Saving Accounts in the US

Digital banks have made saving a lot easier since you can access all the information about your savings from your smartphone. If you’re looking for a digital bank to save your hard-earned cash, here are some excellent options to consider.

Varo

Varo was the first digital bank in the US to receive a national charter. What makes Varo such a great bank for saving is its array of features for managing your finances. Some of these features include a spending tracker, Save Your Pay, and Save Your Change. It also allows you to instantly lock your debit card in case you lose it.

What’s more, Varo boasts one of the highest APYs among digital banks. There’s a chance you can earn some cash by keeping your cash with Varo. With a high APY and saving-oriented features, Varo is definitely a top-contender for the best digital bank for saving.

Axos

Like Varo, Axos boasts more than a couple of features for its customers. These features include bank transfers, mobile check deposits, and a financial tracker. All that, plus a seamless user interface, is what makes Axos worth considering for a savings digital bank.

Axos also boasts a high APY on all accounts with less than $25,000. However, you need a minimum balance of $250 to open an account with Ax0s. For a savings account, this shouldn’t be a problem for most people.

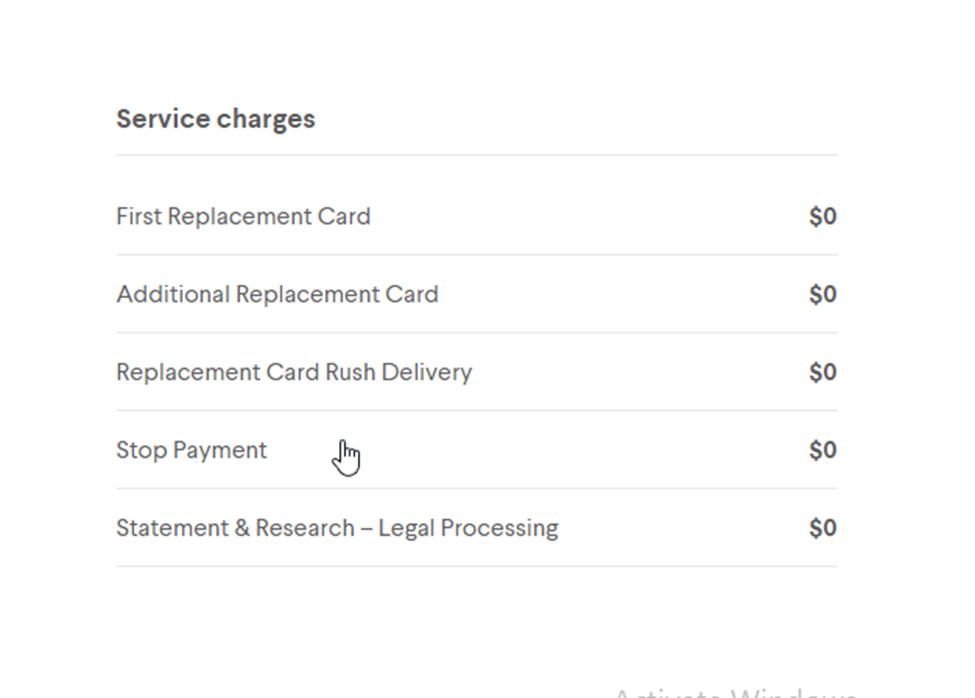

Axos Invest managed portfolio allocation

Best US Online Bank for Investments

Digital banks are a safe haven for some of your most-prized investments. With digital banks, you can transfer assets and also check the state of your investments at your convenience. If you’re looking for a well-established online bank for your investments, consider the below options.

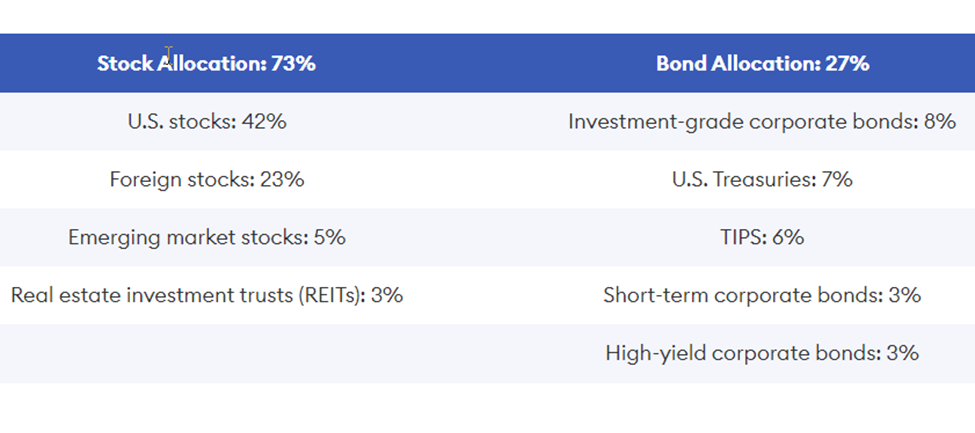

Vivid

Vivid allows for multiple investments, including stocks, crypto, and ETFs. The app offers a feature called Pocket, which is essentially a repository for your investments. You can have a pocket for your ETFs, another for your crypto, and the last for your stocks.

Vivid also offers stock rewards, which lets customers get cash back on card payments. However, you don’t get actual cash back, but instead a fractional stock of your choice. What’s more, you also get a 0.5% mark-up on currency exchanges.

Best performing stocks and EFTs on Vivid

Openbank

Openbank is a subsidiary of Santander, a giant in the banking industry. Openbank’s investment feature, called Openbank Wealth, allows customers to invest in different assets from their phones.

The platform’s standard feature, however, is its Robo-Advisor. An automated feature that puts customers’ investments in the hands of financial experts. All customers have to do is to fill in their financial information and watch their investments grow.

However, it’s worth noting that there’s still some degree of risk with robo-advisors. The only difference is that you don’t have to control every single aspect of your investment. Instead, you can leave it to the pros. However, you need to put in at least 500 euros' worth of investment to qualify for a robo-advisor.

Pros and Cons of Digital Banks

Digital-only banks with no teller windows or locations are attracting new users with their convenience. However, going branchless does have some drawbacks too.

👍 Pros:

• Save on fees: Many digital banks offer fee-free banking with no monthly account fees or surcharges. You'll keep more of your money

• Paperless convenience: Manage your finances anytime, anywhere via mobile apps. Pay bills, deposit checks, and transfer funds without relying on paper statements or branches

• Higher interest: Digital banks offer competitive interest rates on savings accounts and CDs, letting your money grow more over time

• Safety and security: Digital banking leverages robust encryption to keep your information and money protected. Multiple security layers like passwords and pins safeguard your accounts

• Flexibility to bank on your terms: Access your accounts day or night from any device. No need to wait in lines or adhere to bank hours—bank seamlessly around your schedule

👎 Cons:

• Lack of in-person support: While mobile and online banking handle most tasks, some miss being able to get face-to-face assistance from a teller when needed

• Limited ATM access: You may pay fees when withdrawing cash from other banks' ATMs since digital banks have fewer branch locations

• Cash deposit challenges: A few digital banks don't accept cash deposits, requiring workarounds like depositing funds at partner ATM locations instead of a teller window

Are Digital Banks Safe?

Most digital banks can be considered safe, as they employ advanced encryption protocols, two-factor authentication and other transaction security measures. Clients can also stop suspicious transactions by adding advanced security settings and blocking unwanted activity.

In terms of financial security, a license issued by a U.S. regulatory authority for all types of services a bank provides serves as main guarantee. It is also important to be aware that the requirements for financial organizations differ depending on the type of services they provide: investment services, banking services, or simple money transfer.

Summary

Digital banks are the future, and now that you know the best digital banks in the US, it’s time for you to open your account with one of them. Wise takes the cake when it comes to the best digital bank in the country, but it’s getting stiff competition from the likes of Axos and Vivid. Anytime you have qualms about settling for a digital bank, check our online bank US list and make your choice.

When picking a digital bank in US for your needs, remember to do tons of research on the currencies supported, investment options, and other crucial factors. This will help you make a more informed decision when picking a digital bank for your needs. Open a digital banking account today.

Team that worked on the article

Johnathan M. is a U.S.-based writer and investor, a contributor to the Traders Union website. His two primary areas of expertise include finance and investing (specifically, forex and commodity trading) and religion/spirituality/meditation.

His experience includes writing articles for Investopedia.com, being the head writer for the Steve Pomeranz Show, a personal finance radio program on NPR. Johnathan is also an active currency (forex) trader, with over 20 years of investing experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.