Best Trading Apps In The USA For 2024

The best trading app in the USA - eToro

Top trading apps in the USA are:

-

eToro - Tailored for beginners with its copy trading and simplified functionality.

-

IG Markets - Provides access to over 100 technical indicators and flexible charting variations.

-

Oanda - No minimum deposit requirement, competitive spreads.

-

Interactive Brokers - Offers the best range of markets and over 30.000 trading instruments.

-

Thinkorswim - Best analytical tools for experienced traders

In this article, TU experts analyze and compare the top US Forex brokers for 2023, focusing on their features, pros, and cons. The article delves into specific platforms such as eToro, IG Markets, Oanda, Interactive Brokers, and Thinkorswim, offering valuable insights for both beginner and experienced traders. Additionally, it provides essential tips on choosing a Forex broker in the USA, addresses the legality and safety of Forex trading, and recommends noteworthy choices of apps for stock trading.

-

Which app to use for trading in the USA?

For trading in the USA, eToro and Interactive Brokers are popular choices. eToro offers commission-free trading, a social investing community, and a user-friendly mobile app, while Interactive Brokers provides a multi-asset platform with low commissions, advanced tools, and global regulation.

Best Forex trading apps in the USA comparison 2024

| Forex Trading Platform | Regulatory Authority | Copy– trading | Max Leverage | Dollar (USD) Accounts |

|---|---|---|---|---|

FCA, ASIC, CySEC |

Yes |

1:30 |

Yes |

|

|

FCA, ASIC, MAS |

No |

1:50 |

Yes |

|

|

FCA, ASIC, IIROC, CFTC |

No |

1:50 |

Yes |

|

| Interactive Brokers |

FCA, SEC, IIROC, ASIC |

No |

1:50 |

Yes |

| Thinkorswim |

NFA, CFTC |

No |

1:50 |

Yes |

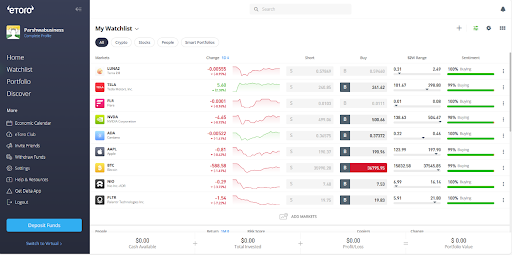

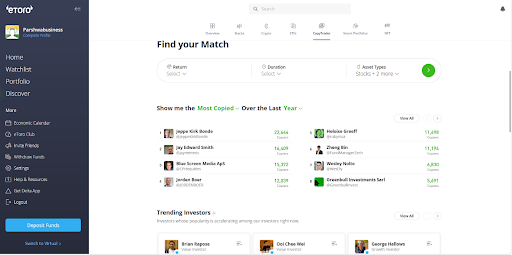

eToro

eToro website

eToro is a good option for local residents with its innovative features, cost–effective trading model, and a diverse array of investment opportunities. Available in numerous countries, eToro's mobile app is downloadable from the Google Play Store and offers seamless trading transitions between laptops, tablets, and mobile devices. The platform's standout feature is its social community, enabling users to observe peers' trading activities, post inquiries, and receive insights from a global network of investors. The minimum deposit is $200 initially, and subsequently, it is as low as $50 ensuring flexibility for investment preferences.

eToro adheres to regulatory standards, having approvals from prominent authorities such as the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities & Investments Commission (ASIC). Experts have discussed below pros and cons related to this trading platform.

Copy Trading feature

👍 Pros

• Zero–commission stock trading. eToro eliminates commission fees, particularly advantageous for investing in popular US stocks and ETFs.

• Social investing. The social community fosters a collaborative environment, enhancing the overall trading experience. The platform also allows a copy trading feature which serves as an asset for investors.

• Crypto offering. eToro accommodates the growing interest in cryptocurrencies, providing a diverse range of digital assets.

• Multi–asset platform. With over 3,000 stocks and 300 ETFs, eToro caters to a broad range of investment preferences.

• Mobile accessibility. The user–friendly mobile app ensures convenient and flexible trading for residents.

👎 Cons

• Limited service in certain areas. eToro's crypto services may not be accessible in all American states, limiting availability for residents in specific regions.

• No crypto–to–crypto trading pairs. The absence of this feature restricts options for users interested in direct cryptocurrency exchanges.

• Withdrawal fees. A $5 withdrawal fee and a somewhat complex crypto withdrawal process may be considered drawbacks.

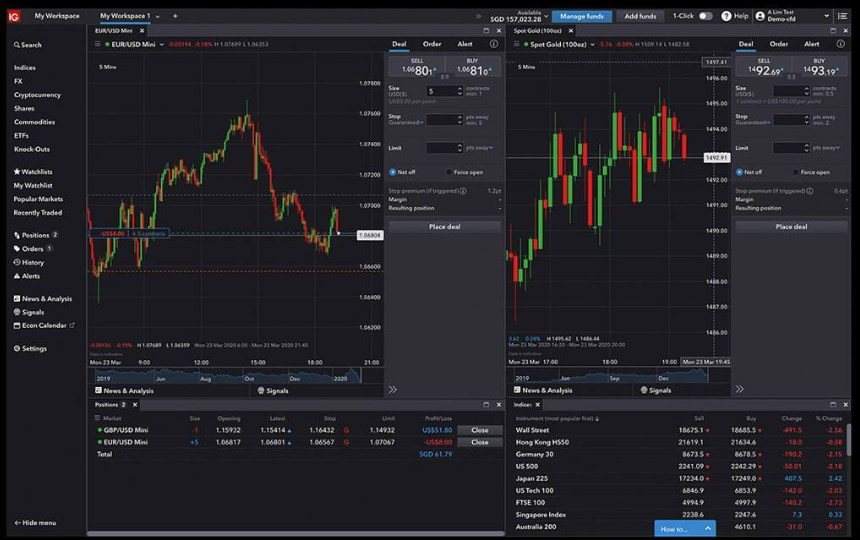

IG Market

IG Market trading platforms

IG Markets stands out as one of the leading online brokers with over 45 years of industry presence, specializing in Forex trading, Spread Betting, CFDs trading, and Share dealing. The platform has six tier–1 regulation, including oversight from the UK Financial Conduct Authority (FCA), the US Securities and Exchange Commission (SEC), the Investment Industry Regulatory Organization of Canada (IIROC), and the Australian Securities and Investments Commission (ASIC), contributing to its reputation as one of the most trusted CFD brokers globally.

With an extensive offering of over 17,000 instruments, IG Markets provides a classic MT4 platform with modified functionality, coupled with their proprietary platform. Traders benefit from access to over 100 technical indicators and flexible charting variations for each market. The minimum deposit for this broker varies by country, ranging from £250 in the UK to no minimum deposit in Australia, ensuring accessibility.

👍 Pros

• Regulatory Compliance. Founded in 1974, IG demonstrates a commitment to regulatory excellence by being publicly traded (LON– IGG) and regulated in eight Tier–1 jurisdiction, two Tier–2 jurisdiction, and one Tier–4 jurisdiction. This extensive regulatory oversight enhances trust and transparency, positioning IG as a reliable and secure online trading platform.

• Comprehensive educational resources. IG provides extensive materials for traders to enhance their skills.

• Guaranteed best market prices. Order execution is made with least slippage.

• Award–winning trust. IG's recognition as the most trusted broker for Forex and CFDs in the 2023 Annual Awards solidifies its standing as a top–tier platform.

• 24/7 Customer support. The platform is accessible by traders via phone, email, and live chat.

👎 Cons

• Web platform configuration. While IG's industry-leading web platform is excellent, the absence of predefined layouts may require some manual configuration, potentially requiring users to invest additional time in setting up their preferred interface.

• Limited product portfolio in some countries. Availability of products may vary by region.

• Limited tradable instruments. Despite premium MT4 add–ons and Autochartist integration, IG's MetaTrader offering falls short with only around 80 tradable instruments, potentially limiting diversification options for users.

• Absence of MT5. Notably, IG lacks MetaTrader 5 (MT5) support, a drawback for users seeking the advanced features and capabilities offered by the latest MetaTrader version.

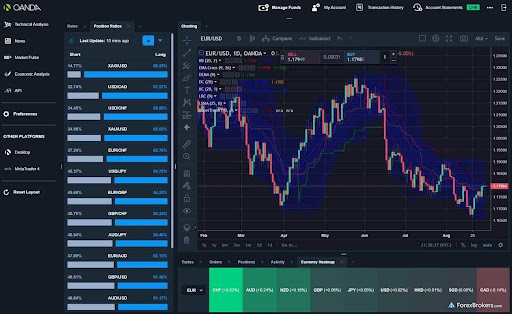

OANDA

OANDA trading platforms

OANDA, established in 1996, stands as a reputable online broker renowned for its longevity and regulatory adherence. Regulated by prominent authorities including the FCA, ASIC, IIROC, and CFTC, OANDA caters to a diverse range of traders with its user–friendly platforms and various account options. OANDA's browser-based platform offers a stellar desktop trading experience. With no minimum deposit requirement, the platform provides cost-effective trading with spreads starting at just 0.8 pips on major currency pairs.

The platform supports over 1700 instruments, spanning FX, indices, metals, commodities, bonds, and cryptocurrencies. OANDA's technical analysis tools, including indicators and AutoChartist, empower traders to make informed decisions. Further, access to real–time market news from providers like Dow Jones FX Select and 4CAST enhances the trading experience.

👍 Pros

• Low minimum deposit. OANDA welcomes traders with a remarkably low minimum deposit of $1, fostering accessibility for a wide range of users.

• Extensive instrument selection. Traders benefit from a vast selection of over 1700 instruments, spanning FX, indices, metals, commodities, bonds, and cryptocurrencies, providing diverse trading opportunities.

• Reputable regulatory oversight. OANDA's commitment to regulatory compliance through multiple authorities ensures a secure and trustworthy trading environment.

👎 Cons

• Cost–effective trading. OANDA boasts low trading fees, with spreads starting at just 0.8 pips on major currency pairs, appealing to traders seeking to maximize profits while minimizing costs.

• Inactivity fee. Traders need to be aware of the $10 monthly inactivity fee for dormant accounts exceeding 12 months, potentially affecting infrequent traders.

• Competitive pricing discrepancy. While OANDA generally maintains low fees, a drawback arises in the form of a comparatively higher cost for the EUR/USD pair when compared to some competitors.

• Account variety. The absence of cent accounts and bonus programs may be a drawback for traders seeking more diverse options.

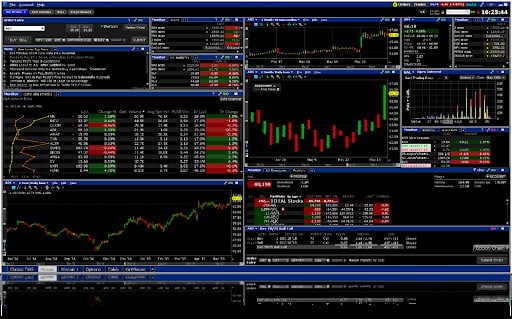

Interactive Brokers

Interactive Brokers trading platforms

Interactive Brokers caters to a diverse audience with varying account types having minimum deposit requirements where Cash accounts have no minimum, T Reg margin accounts require $2,000, and portfolio margin accounts mandate $110,000. Regulatory oversight is robust, with authorities such as the SEC, FINRA, FCA, and ASIC ensuring compliance. The broker operates in over 200 countries, providing global access to its extensive features.

👍 Pros

• Low Commission. IBKR Lite offers zero–commission stock and ETF trades. IBKR Pro provides a competitive commission rate of $0.005 per share ($1.00 minimum per trade) for higher-volume traders.

• Low margin rates. Margin rates at Interactive Brokers are substantially lower than competitors, up to 49% lower than the industry average. It is particularly beneficial for investors carrying large margin balances over extended periods.

• Extensive tradable securities. A wide range of tradable securities, including options, futures, mutual funds, crypto, fixed income, and more. It also has access to foreign stocks in 150 global markets, offering diversified investment opportunities.

• Variety of trading platforms. Multiple trading platforms cater to different experience levels. IBKR Lite for casual investors and IBKR Pro for advanced traders, each with no account minimums.

• Overnight trading. The platform allows overnight trading, providing flexibility for traders.

👎 Cons

• Website ease–of–use. The platform's website, while information–rich, may pose challenges in terms of user–friendliness. Different commission and fee structures for IBKR Pro can be confusing for users.

• Lack of IPO and OTC access. Interactive Brokers does not offer access to initial public offerings (IPOs). Also IBKR Lite accounts do not have access to over–the–counter (OTC) stocks.

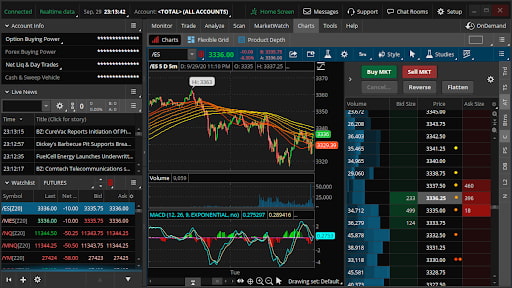

Thinkorswim

Thinkorswim trading platforms

Thinkorswim, initially offered by Charles Schwab and in 2009 acquired by TD Ameritrade (one of the biggest brokers in the US), is a robust electronic trading platform designed for trading various financial assets. It offers live or simulated trading, extensive research tools, advanced charting capabilities, and synchronization across platforms. Regulated by FINRA and SIPC, it ensures fund protection up to $500,000 in case of insolvency or fraud. The platform also offers a rich array of research tools, including screeners, scanners, and a news feed, enabling in–depth analysis of stocks, funds, options, and derivatives. Traders can seamlessly access their accounts from any device using the web platform or mobile app, with synchronization of positions, orders, watchlists, and alerts.

👍 Pros

• Advanced charting capabilities. Thinkorswim stands out with its advanced charting tools, providing traders with a comprehensive analysis of market trends. The platform offers a diverse range of technical indicators, drawing tools, and chart patterns, empowering traders to make well–informed decisions.

• Customizable interface. Traders benefit from a highly customizable interface on Thinkorswim, allowing them to tailor the platform to their preferences. The flexibility to rearrange windows, add or remove tools, and create multiple layouts provides a personalized trading environment.

• Access to a wide range of financial instruments. Thinkorswim offers access to an extensive array of financial instruments, enabling traders to diversify their portfolios. Real–time data and news updates for each instrument contribute to staying informed about market developments.

• Paper trading feature. The inclusion of a paper trading feature is advantageous for both novice and experienced traders. This feature allows traders to practice their strategies without risking real money, aiding in skill development and strategy testing.

👎 Cons

• Steep learning curve. The feature–rich environment of Thinkorswim may pose a challenge for novice traders, requiring a substantial investment of time and effort. While educational resources are available, overcoming the learning curve can be a significant hurdle.

• Limited mobile app functionality. The mobile app version of Thinkorswim has limitations compared to the desktop version. Some advanced features may be inaccessible or not fully functional on the mobile app, potentially impacting traders who heavily rely on mobile platforms.

• High minimum deposit. Thinkorswim imposes a high minimum deposit requirement, which may deter traders with budget constraints. The minimum deposit, although varying, tends to be higher compared to requirements from other Forex brokers.

How to choose a Forex broker’s app in the USA?

Experts have discussed below some necessary tips to consider before choosing a Forex broker in the US.

Regulation and Legal Compliance

-

Ensure the broker is regulated by a top–tier financial authority, such as FCA (UK), ASIC (Australia), or CySEC (Cyprus).

-

Regulatory bodies like FCA and NFA provide investor protection and require brokers to segregate client funds.

Trading Platforms and Tools

-

Select a broker with a reliable and user–friendly trading platform.

-

Popular choices include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Trading Costs and Spreads

-

Compare spreads and commission structures among brokers.

-

Tighter spreads and lower commissions are favourable for reducing overall trading costs.

Leverage and Margin Requirements

-

Choose a broker offering leverage suitable for your trading strategy and risk tolerance.

-

Evaluate margin requirements, as they determine the capital needed for positions.

Customer Support and Service

-

Prioritize brokers with responsive 24/5 customer support through multiple channels.

-

Check for multilingual support and read client reviews to assess the broker's reputation.

Educational Resources and Research

-

Select brokers offering comprehensive educational resources, including webinars, tutorials, and articles.

-

Access to market analysis, research reports, and economic calendars enhances informed decision–making.

Deposit and Withdrawal Options

-

Ensure the broker provides secure and convenient payment methods, such as bank transfers, credit cards, and e–wallets.

-

Check withdrawal processes for hassle–free transactions without excessive fees.

Currency Pairs and Markets Offered

-

Ensure the broker provides a diverse range of currency pairs, including minors and exotics.

-

Consider additional markets like commodities and indices if you plan to diversify.

Account Features

-

Look for risk management tools such as stop–loss and take–profit orders.

-

Demo accounts are essential for practicing strategies without financial risk – check for limitations.

Trading Hours

-

Confirm the broker's trading hours and whether it aligns with your preferred trading times.

-

Some brokers offer extended hours, providing flexibility.

Reputation and Reviews

-

Research the broker's reputation through comparisons, reviews, and industry awards.

-

Real trader experiences and forums can provide insights into the broker's reliability.

Best Forex trading app for beginners in the USA

For beginner Forex traders looking to explore currency exchange in the USA, eToro emerges as an optimal choice. The user–friendly interface sets it apart, ensuring a seamless experience. Also noteworthy is the innovative CopyTrader™ feature, allowing beginners to replicate strategies of seasoned traders for valuable insights. Committed to education, eToro provides tutorials, webinars, and a risk–free demo account for hands–on learning. With regulatory compliance, traders can trust the platform's integrity. In moments of inquiry, a responsive customer support team is readily available. In summary, eToro combines accessibility, educational resources, and regulatory assurance, making it a professional and prudent selection for those taking their initial steps in Forex trading.

Is Forex legal in the USA? Is it safe?

For traders wondering is Forex trading is legal in the US – yes, Forex trading is legal and well–regulated in the United States. Oversight is provided by two key bodies– the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).

The CFTC, an independent agency, is responsible for regulating various markets, including Forex. On the other hand, the NFA, designated by the CFTC, acts as a self–regulatory organization for futures and derivatives markets in the U.S.

These regulations are designed to protect individual investors and ensure fair practices in the market. Forex brokers operating in the U.S. undergo strict scrutiny from the CFTC and NFA, adhering to rules that include limitations on leverage, with major currencies capped at 50:1 and minor currencies at 20:1. Brokers must register as Futures Commission Merchants (FCMs) and Forex Dealer Members (FDMs) to comply with regulatory standards.

To safeguard your funds, it's crucial to choose a Forex broker that is duly regulated. Some of the top–regulated Forex brokers in the U.S. prioritize the security and interests of their clients.

Which app is the best for stock trading in the USA?

When it comes to choosing the best app for stock trading in the USA, Interactive Brokers stands out as the optimal choice for users. Offering a user–friendly interface, it caters to both beginners and experienced traders, ensuring a seamless trading experience. What distinguishes Interactive Brokers is its cost–effective approach, featuring low commissions and fees, allowing users to manage their trading expenses efficiently.

Beyond stocks, Interactive Brokers provides a diverse range of investment opportunities, including options and futures, making it a comprehensive platform for portfolio diversification. The app's analytical tools and research resources deliver real–time data and market insights, empowering users to make well–informed decisions.

Emphasizing security, Interactive Brokers adheres to stringent regulatory standards, establishing a secure trading environment. Its reliability and prompt trade execution reinforce its position as the premier stock trading app, offering users a trustworthy platform to navigate the intricacies of the stock market.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).