Varo Bank Review 2024

- The entire world, except blacklist countries (see the website)

Currencies:

- USD

- 2-5% APY

- USD 250,000

Summary of Varo

The Varo digital bank provides the full range of online banking services, with all of the bank’s features available 24/7. Account opening is free, there is no monthly fee, and no minimum deposit requirement. Varo Bank issues a plastic payment card for its clients. The card can be used to shop offline and withdraw cash fee free from 55,000 Allpoint ATMs. The overdraft amount is up to $100, and there is no fee for a cash advance under $20. The bank offers 6% cash back in cash, not points. Deposits of Varo clients are FDIC-insured to up to $250,000. All account data is aggregated in the mobile app. Varo Money also offers a savings program with up to 5% APY, as well as many tools to build your savings, including pots and automatic rounding up.

| 💼 Main types of accounts: | Standard account (debit and credit card) |

|---|---|

| 💱 Multi-currency account: | No |

| ☂ Deposit insurance: | Yes, up to USD 250,000 |

| 👛️ Savings options: | Account statistics, limits and notifications, savings pots, rounding up |

| ➕ Additional features: | 6% cash back in cash, free withdrawal at Allpoint ATMs, automatic conversion, free overdraft up to $20 |

👍 Advantages of trading with Varo:

- quick and free registration, only one plan with no monthly fee and all online banking features;

- fee-free overdraft up to USD 20 and cash back, credited to a client’s account once the amount reaches $5;

- free transfers between Varo accounts, instant transfers to account at other banks, online payment;

- the Varo Money digital bank issues debit and credit cards you can use to pay offline;

- clients can open savings accounts at 5 APY; the deposits are insured;

- credit score does not matter; the neobank has special instruments for improving clients’ credit score;

- clients can restructure loans taken out at another bank under better conditions.

👎 Disadvantages of Varo:

- a fee is charged on transfers from card and accounts at banks;

- depositing funds through a third-party organization that charges a fee (except for Reload@theRegister);

- simplified verification causes the bank to be often used by fraudsters and light-fingered clients.

Evaluation of the most influential parameters of Varo

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Varo

The Varo Money neobank was established in 2015. As of now, the bank hasn’t had any open conflicts, user data leakages or hacks. The company operates under U.S. law, and is a member of the FDIC (registration data confirmed). The bank hasn’t experienced issues with tax reporting, and its operation is 100% transparent. Deposits of the bank’s clients are insured up to USD 250,000, as prescribed by the FDIC regulation.

In terms of online banking services, Varo provides standard opportunities, although in this case it is the highest standard. The Varo app supports all mobile operating systems and is perfectly optimized (no bugs, lagging or vulnerabilities). The interface is very simple and intuitive. Even if you’ve never used the services of online banks before, you will understand how the Varo Money works in a matter of minutes. The bank provides a full-fledged account with a virtual card, and also issues a physical debit and credit card (credit score is not taken into account).

The registration is free; there is no monthly fee or minimum account balance. The bank does not offer solutions for businesses and corporate clients. Varo Bank focuses on working with private individuals.

The loan conditions depend on many factors, including purpose and amount. The best rate is 10% APR and the highest is 33% APR. That’s a rather competitive range, although many neobanks in the U.S. offer better conditions. On the other hand, a savings account at 5% APY is an excellent option for passive investing. To sum up, the Varo neobank offers truly beneficial conditions for managing personal finances and growing capital.

Dynamics of Varo’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of Varo Bank

The Varo digital bank does not offer investment programs as such. This means that you cannot buy stocks, securities, or invest in third-party projects. The app does not have this kind of functionality. However, Varo Money offers a savings account, which is a more stable passive income option. Any verified client can open a savings account.

Varo offers a savings account at 2-5% annual percentage yield. It is also very easy to get the 5% APY. This APY is 38 times higher than the average percentage yield on savings in the U.S. The accounts are flexible, which means they can be replenished at any time, or clients can withdraw money from them without submitting a request in advance.

There are two built-in options. The first option is that if you use direct deposit, the set percentage will be automatically transferred to your savings account (on all transactions or specified ones). The second option is rounding up purchases, with the “change” transferred to the savings account. Combined with the highest APY of 5%, the additional options help speed up reaching a desired amount by 2.6 times on average compared to traditional savings methods. Of course, it is not mandatory to use these options. Unlike many other digital banks, Varo does not impose any services on its clients.

All tabs in the menu of a user account and on the app do not require additional explanation. If some third-party conditions do exist, the neobank is not trying to conceal them.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Overdrafts, loans, and flexes

Varo Bank provides up to USD 100 in overdraft. No fee is charged if your overdraft is below $20. If the overdraft amount is $20-50, the fee is $3. If you ‘overpaid’ $75, your fee will be $4. For the maximum overdraft of $100, the fee is $5, which is much lower than average for the U.S. digital banks.

The overdraft and the fee must be paid within 15-30 days. Note that the overdraft is provided only if a user’s account has been active for at least 30 days, and the total deposit to the account in the last 30 days amounted to $1,000 or more (the total amount deposited, not the maximum balance at a point in time). It is also necessary to have a Varo debit card linked to the client’s account.

The neobank provides only one type of loan, when you apply for a Varo Believe credit card. The card works everywhere, where Visa is accepted. No minimum deposit is required, and no monthly fee is charged. Clients can use their security deposit to repay the loan; credit score is not taken into account. The peculiarity of the Varo loan is that clients independently choose their conditions based on the purpose and loan period. The loan rate ranges from 10% to 33%.

Terms for Cooperation with Varo

The U.S. dollar is the account currency at the Varo digital bank. For any transaction involving conversion, the conversion is performed by the bank automatically at the market exchange rate. For example, this applies to a restaurant bill, if it is not in the U.S. dollars. A bank’s client does not need to notify the vendor (service provider) of payment conversion. The neobank will do it under better conditions. You do have to keep in mind, however, that the conversion fee is 3% on average. Similarly, you can use your Varo card to replenish electronic wallets, including cryptocurrency wallets, i.e. the U.S. dollars will be automatically converted into any other asset.

| 💼 Main types of accounts: | Standard account (debit and credit card) |

|---|---|

| 💱 Multi-currency account: | No |

| 💵 Deposit terms and conditions: | Up to 5% APY |

| 💳 Loan terms and conditions: | Individually, at 10-33% APR |

| ☂ Deposit insurance: | Yes, up to USD 250,000 |

| 👛️ Savings options: | Account statistics, limits and notifications, savings pots, rounding up |

| 📋 Types of payment: | All types of online and offline payments |

| ➕ Additional features: | 6% cash back in cash, free withdrawal at Allpoint ATMs, automatic conversion, free overdraft up to $20 |

Comparison of Varo with other Brokers

| Varo | Wise | Bunq | Curve Bank | CIT Bank | SoFi Bank | |

| Supported Countries | The entire world, except blacklist countries (see the website) | Globally | Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Slovenia, Republic of Cyprus, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Norway, Poland, | UK and EEA | USA | USA |

| Supported Currencies | USD | 54 currencies | Euro (16 European currencies in the Easy Money plan) | 26 currencies | USD | USD |

| Deposit insurance | USD 250,000 | No | EUR 100,000 | No | $250 000 | $250,000-$500,000 |

| Minimum deposit | No | No | No | No | $100 | $1 |

| Deposit rate | 2-5% APY | No | 0.09% APY | No | 0.1% -1.4% | 0.90%-1.50% |

| Loan Rate | 10-33% APR | No | The bank does not issue loans | No | От 0.1% | 1.89%-22.23% |

Varo Commissions & Fees

It is a truly important advantage of Varo that the digital bank practically does not charge commissions and fees that are considered standard for neobanks. Transactions between clients are not charged with commissions or fees. Activation of all available options is free. The fees for transfers to accounts of other banks are minimal (calculated individually and displayed before the transfer is made).

Deposits are free only via Reload@theRegister, all other deposits are charged with a fee. In this case, the fee depends on the operator and can amount up to $5.95. Cash withdrawals from Allpoint ATMs are free and without limits. Target, CVS and Safeway ATMs are part of this system. The fee for cash withdrawals at other ATMs is fixed at $2.5. Since the account supports only the U.S. dollars, there is automatic conversion for other currencies at 3% fees. Nonetheless, comparison shows that Varo indeed charges fewer fees than competitors, and these fees are often lower.

The table below shows a comparison of basic fees of Varo with fees of other digital banks.

| Broker | Overdraft fee | ATM Withdrawal Fee | International transfer fee | International exchange fee |

| Revolut | No | Up to $350 - free - beyond $350 - 2% | 0.3% (min. $0.30, max. $6) | From 0% to 1% |

| Chime Bank | No | No | No | 3% (max.$5) |

| Varo | Zero fee up to $20, for higher amounts, the fee is up to $5 depending on the amount | Free-free at Allpoint ATMs, $2.5 fee per withdrawal from other ATMs | Calculated individually | 3% |

The Varo digital bank charges rather low fees. The bank does not charge most fees charged by other neobanks. Registration is fee, there is no monthly fee or fees for all transactions between the accounts of the bank’s clients. Conversion fee is standard at 3%. The bank’s clients can withdraw cash at Allpoint ATMs for free, which is rather an exclusive benefit (the fee for withdrawals from other ATMs is $2.5). The only disadvantage is the deposit fee for all methods, except for Reload@theRegister, which is not always convenient to use.

Detailed review of Varo Bank

The Varo digital bank offers online banking services in their standard form. All transactions are performed in the user account on the website or mobile app for iOS and Android. The absolute majority of transactions are not charged with a fee, including cash withdrawals at Allpoint ATMs. Varo offers a number of unique solutions for the clients with middle-class income. For example, the highest APY on deposits is available for clients with account balance up to $5,000. Also, there are the following limits on debit cards: up to $2,500 per day spending limit, up to $750 per day ATM withdrawal limit, and up to $1,000 limit per day over-the-counter withdrawals.

Varo by the numbers:

-

0 – account opening fee and monthly fee;

-

1 – number of plans; everything is simple, all features are available right away;

-

10% – minimum APR on a loan;

-

5% – maximum APY on deposits;

-

250,000 – maximum deposit insurance coverage in U.S. dollars.

Account opening takes a couple of minutes. The majority of transactions (including international transfers) are instant or nearly instant. The Varo neobank offers a multi-channel phone number for customer support, which is available 24/7. The operators’ response is super-fast. Even by email, the operators respond within 8 hours. Therefore, we can confidently state that Varo Money is one of the most efficient banks in the U.S. In fact, its efficiency can be witnessed everywhere: from operation of the app to customer support.

Useful features of Varo

-

Debit card. It is a standard MasterCard card that can be used to shop online and offline.

-

Credit card. It is a standard credit card with an average interest rate for the U.S. neobanks.

-

Overdraft. You can safely overpay $20 fee free; the maximum overdraft is $100.

-

Consumer loan. Credit score does not matter; at 10-33% APR.

-

Savings account. Maximum APY is 5%, flexible conditions (replenishment and withdrawal allowed).

-

Rounding up payments. The option allows clients to transfer the “change” from the rounding up to a separate pot or savings account.

-

Early direct deposit. The bank posts deposits on the same day they are received.

-

Early paycheck. The neobank’s clients can receive their paycheck 2 days early.

-

Automatic insurance. Each deposit is insured for up to $250,000.

-

International transfers. Clients can transfer funds from their account at Varo to an account of any other bank anywhere in the world.

-

Free transfers. All transactions on a client account and between client accounts of Varo are fee-free.

-

Free withdrawal. Cash withdrawal up to $750 per day is fee-free at Allpoint ATMs.

-

Conversion. Varo accounts only support the U.S. dollar. Transactions in a different currency are automatically converted at the current market rate.

Advantages of Varo

-

The bank offers free registration that literally takes a couple of minutes (on the website or on the app).

-

No monthly fee. The neobank offers only one plan with all online banking features available.

-

The mobile app is available on all devices; it has a simple and intuitive interface.

-

The bank does not charge fees on most transactions; the fees the bank does charge are at the level of competitors.

-

The bank issues a debit and credit card of MasterCard standard, which can be used for online and offline payments.

-

Cash from the debit card can be withdrawn at any ATM; withdrawal at Allpoint ATMs is fee-free.

-

Cash back is 6% (only for certain brands); it is accrued directly in cash, not points.

-

Technical support is available by phone and email; the responses are prompt.

-

The operation of the Varo digital bank is 100% transparent, with no pitfalls or hidden fees.

-

The neobank is a member of the FDIC, which guarantees fulfillment of obligations to the clients.

-

The clients of the bank can draw the conditions of a loan independently based on the required amount, purpose and period.

-

All online banking features are available 24/7, including customer support.

Account types for individuals and businesses

Many people are surprised that Varo Money offers only one account type. However, all features are available on the standard account for individuals. Clients are not required to meet additional requirements to access a certain option. Users get a full-fledged bank account, and can order a physical debit and/or credit card (the virtual card is provided automatically). Savings pots, loans, instruments for saving and growing capital are available.

Banking features

Overall, the Varo digital bank is identical to most neobanks in terms of features. The advantage of this kind of bank is that you don’t need to visit a branch to perform any action. Account opening, transfers, ordering a card, all types of payments, statistics, statements, references for tax authorities can all be performed remotely. All you need to do is simply choose the option you need on the mobile app of the bank or on its official website. You can apply for a loan within a matter of minutes, determining its conditions independently. The bank will have to approve or deny the loan, but it won’t be using your credit score to do that, and if you are denied a loan, it won’t affect your credit score.

Technical Support

Varo offers three methods of contacting customer support: a multi-channel call center, email and tickets in the Support section. The response on tickets is sent to a user’s email and usually takes no more than 8 hours. The website also features the Help Center section with answers to frequently asked questions. In most cases, using the Help Center is usually enough (it has the search by keywords feature). Support by phone is available 24/7. The Varo neobank is known for the quick and effective work of its managers and technical specialists.

Social programs of Varo Bank

The global social mission of the Varo digital bank is implementation of advanced financial technologies in the simplest and most understandable way. The bank aspires to make good conditions on debit cards, loans at low interest rate and deposits with high yield rate available to as many U.S. residents as possible. This is the only priority of the company. The bank is not involved in charity, is not a member of any foundations, including green movements. However, many Varo clients participate in such events, which is partially due to the beneficial conditions the bank offers.

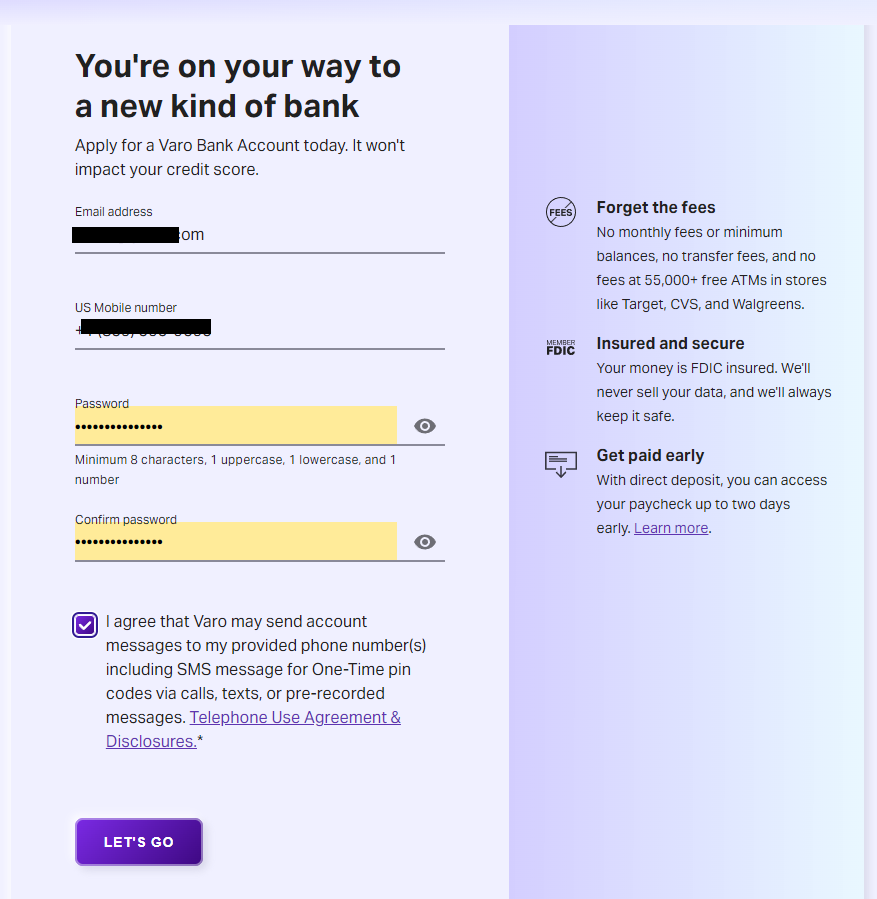

How to open an account at Varo Bank

Go to the official website of the Varo Money neobank. In the top right corner click on the Open Account button. Wait for the application form to load, as it may take some time, depending on your region and internet connection quality.

Once the registration form opens, enter your email and mobile number, come up with a password and confirm it. Tick the box agreeing to the use agreements and click Let’s Go.

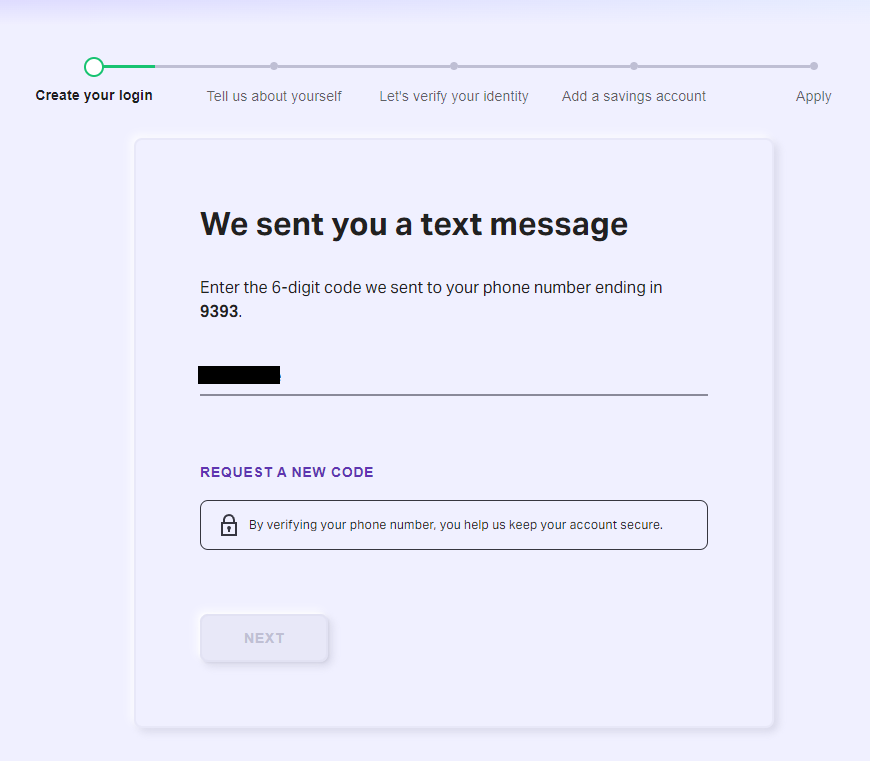

Next, confirm your email by entering the confirmation code. Confirm your mobile number, where the text with the code will be sent. Provide your personal and financial information by following instructions on the screen. You will need to provide a scanned copy of your identity document (passport or a driver’s license). It is a standard verification procedure, which is much quicker at Varo than at most other banks.

Once you are verified, you will be granted full access to your account. In the footer of the website, find the Download the App section featuring two links to the App Store and Play Market. You can use the one you need to install the app for your gadget. Registration on the app does not differ from the registration on the website.

Articles that may help you

FAQs

How does Varo earn money?

The main income of Varo is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does Varo protect its customers?

Varo uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

Varo provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through Varo?

Yes. Varo allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Bunq's secure website.

Via Curve's secure website.