Trading platform:

- Plastic card

- Apple Pay

- Google Pay

- Wire transfer

N26 Bank Review 2024

- Globally

Currencies:

- 38 currencies

- No

- Yes

Summary of N26 Bank

The N26 mobile bank offers private and business accounts with a full range of internet banking features. A multi-currency account allows accumulating all funds in one place with convenient management via a mobile application. The client automatically gets a virtual card, the ability to pay through Apple Pay and Google Pay, and optionally can order a plastic or metal MasterCard. The account and the card are valid worldwide. The bank client can create subaccounts; there is a function that creates smart statistics, reports with income and expenses are formed according to the set parameters, and it is possible to specify limits and goals. The N26 bank account provides a wide range of life and property insurance solutions, including travel insurance.

| 💼 Main types of accounts: | Standard, Smart, Metal, Business Standard, Business Smart, and Business You |

|---|---|

| 💱 Multi-currency account: | Yes (all currencies) |

| ☂ Deposit insurance: | Yes (€100,000 per client) |

| 👛️ Savings options: | Rounding of purchases, budgeting, linked accounts |

| ➕ Additional features: | Perks |

👍 Advantages of trading with N26 Bank:

- All banking services for individuals and legal entities are controlled via a mobile phone.

- Clients can customize any aspect of their financial policy down to spending limits.

- There is a free account type, it offers all the typical features of a neobank and will suit many customers.

- The account is multi-currency, and you can keep funds in any world currency up to €50,000 or the equivalent.

- Insurance for €100,000 for each client, plus 3D-Secure and 2FA-authentication.

- For international payments, the bank itself doesn’t charge a commission, only the standard fee of the payment system.

- Extended statistics are available on the business account, and there is a 0.1% cashback on all expenses.

👎 Disadvantages of N26 Bank:

- On the free Standard plan, there is no insurance and limited additional features (e.g., no subaccounts).

- Technical support by phone is only available to customers with paid tariffs such as Smart, Metal, and similar plans for businesses.

- All tariffs have a limit of a free number of cash withdrawals per month (not more than 8 for Metal tariffs).

Evaluation of the most influential parameters of N26 Bank

Table of Contents

Geographic Distribution of N26 Bank Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of N26 Bank

This digital bank has been operating since 2013. It has no headquarters, and 1,500 employees are distributed in 80 cities worldwide. The bank has a valid license, cooperates with insurance funds and international regulators, and its activities are 100% transparent.

This neobank offers a full range of banking services by modern standards. There is a function of instant transfers between clients' accounts. International transfers are also available, and they are free of charge even on the Standard starting tariff. The bank's clients can make 3, 5, or 8 free withdrawals per month from ATMs in the eurozone. Free withdrawals in any currency without restrictions are available only within the Metal tariff.

In general, N26 bank's tariff schedule is quite transparent and subject to the customer-oriented paradigm. The free rate is suitable for people who are not too active in using their money offline. The first paid tariff, Smart, provides expanded banking options and increased limits. Metal is optimal for those who globetrot frequently and have to work with a large number of currencies and counterparties.

Business accounts also offer three rates. They are not conceptually different from accounts for individuals. The difference is simplified reporting for corporate business processes. Plus, there is cashback for business accounts.

Comprehensive function testing revealed no glitches or errors. The application is intuitive and works stably. There are no problems with transfers either because they perform within the declared terms. Also, no hidden fees, charges, or withdrawals were noted. In this respect, user reactions coincide with the expert evaluation, indicating the high usability and quality optimization of the technical parts of the platform. Finally, the honesty and decency of N26 bank in its interaction with customer funds must be praised.

Latest N26 Bank News

Dynamics of N26 Bank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of N26 Bank

There are no investment solutions at N26 bank. Neobank customers cannot open a savings account or otherwise increase their savings. However, the digital bank offers a wide range of savings solutions, including end-to-end statistics, setting limits, and cashback on business accounts. There is also a standard feature for modern mobile banks to round up the amount when paying to a whole number, with rounding off to a separate savings account.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Terms for Cooperation with N26 Bank

The N26 bank offers equally favorable terms to individuals and legal entities. The same features are available for all types of accounts, with minor differences due to business needs. However, it is important to choose the right plan. For example, the personal Metal plan provides free cash withdrawals from ATMs globally. In the eurozone, for all plans, once the withdrawal limit is exceeded, each such transaction will cost an additional €2 (or the equivalent in another currency). For withdrawals made outside the eurozone, there is a flat fee of 1.7% for most fares, but none for business if you have a Metal tariff.

| 💼 Main types of accounts: | Standard, Smart, Metal, Business Standard, Business Smart, and Business You |

|---|---|

| 💱 Multi-currency account: | Yes (all currencies) |

| 💵 Deposit terms and conditions: | No |

| 💳 Loan terms and conditions: | No |

| ☂ Deposit insurance: | Yes (€100,000 per client) |

| 👛️ Savings options: | Rounding of purchases, budgeting, linked accounts |

| 📋 Types of payment: | Plastic card, Apple Pay, Google Pay, electronic transfers |

| ➕ Additional features: | Perks |

Comparison of N26 Bank with other Brokers

| N26 Bank | Wise | Bunq | Curve Bank | Chime Bank | Monzo Bank | |

| Supported Countries | Globally | Globally | Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Slovenia, Republic of Cyprus, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Norway, Poland, | UK and EEA | US | UK |

| Supported Currencies | 38 currencies | 54 currencies | Euro (16 European currencies in the Easy Money plan) | 26 currencies | USD | GBP |

| Deposit insurance | Yes | No | EUR 100,000 | No | Yes | £85,000 |

| Minimum deposit | No | No | No | No | No | £500 |

| Deposit rate | No | No | 0.09% APY | No | 5%-30% | 1.16%-1.50% |

| Loan Rate | No | No | The bank does not issue loans | No | 0.50% | 0-19% |

N26 Bank Commissions & Fees

The N26 neobank offers moderate subscription fees and is competitive among leading mobile banks in Europe and the US. Its fees are below average. Almost no neobank charges 1.7% (or less) when withdrawing cash from ATMs, given that we are talking about any ATM in the world. And within the tariffs with the highest monthly fees, there are no withdrawal fees at all (in the eurozone, there are still restrictions on the number of withdrawals without fees).

According to all factors, N26 provides objectively favorable terms for individuals and legal entities, you just need to choose the right rate. For example, if a client rarely withdraws cash and doesn't need insurance, there is no point in having paid rates. On the other hand, high account activity requires more loyal terms and priority technical support, which free rates don't provide.

We also compared N26 fees with similar types of fees on other Digital banks.

| Broker | Overdraft fee | ATM Withdrawal Fee | International transfer fee | International exchange fee |

| Monzo Bank | 19-39% | Free in the UK In other countries: - up to £200 - free - beyond £200 - 3% | €0.5 | 0.35%-2% |

| Revolut | No | Up to $350 - free - beyond $350 - 2% | 0.3% (min. $0.30, max. $6) | From 0% to 1% |

| N26 Bank | 8.9% | 3 to 5* free ATM withdrawals per month, beyond this - €2 | From €0 to €0.49 | No |

The N26 bank offers optimal cooperation terms for residents of all countries. It is a classic mobile bank, where you can open several accounts (depending on the tariff), keep any currencies, and transfer them around the world for free. The bank has implemented the following functions, which include insurance, tools for budgeting, and the ability to link several accounts for end-to-end control. Other unique features are relevant for tariffs with the highest subscription fees. Even though investment and savings functions are not available in N26, it can be recommended for cooperation.

Detailed review of N26 Bank

With an N26 bank account, you have access to all banking services, even with a free plan. This includes instant transfers within the bank, international transfers, and the functions of an ordinary debit card. A virtual card is issued free of charge, a plastic card can be ordered at any time (plus one extra at paid rates). Basic functions for budget tracking are also available on the Standard tariff, but for full-fledged budgeting, it is recommended to use at least the Smart banking plan. A plastic N26 card can be used to make payments online and offline in stores around the world, and cash can be withdrawn at any ATM. Although there are no fees for withdrawals outside the eurozone at paid rates, you should keep in mind that local ATMs and payment systems often have their own fees.

N26’s mobile bank by the numbers:

-

over 7 million clients worldwide;

-

300,000 downloads of the app for iOS and Android;

-

a full banking license since 2016.

-

€100,000 – insurance for each client.

-

£0 - subscription fee for the Standard tariff.

-

4 levels of user facilities and data protection.

In terms of security, it is worth noting that all N26 bank accounts are linked to a single device, and additional gadgets cannot be connected. Biometric identification by fingerprint or facial recognition is available. Modified 3D Secure (3DS) technology eliminates the possibility of hacking during transactions. The application's discrete mode of operation prevents data leakage through nonvalid channels.

N26’s useful features:

-

Multi-currency account. Regardless of the tariff, a client of N26 can keep any currency on his account, use it for payment and withdraw it in cash from ATMs.

-

Instant transfers and transfers worldwide. Transfers to other N26 customers are made instantly with a touch of the screen. Transfers around the world take some time, and the bank doesn't charge for them on the Metal tariff.

-

Subaccounts. Customers on paid plans can have up to 10 additional accounts. These are full-fledged international standard accounts, not just pots on one account.

-

Budgeting. The full feature is only available on paid plans. It allows you to get detailed statistics on incomes/expenses, and set limits and goals with push notifications.

-

Rounding when paying. If you pay in euros, you can make it so that the amount is always rounded to a whole number, and the remaining cents are transferred to a separate account. Rounding is also available for any other currency.

-

Insurance. Different types of insurance are available to customers with paid rates, for example, against accidents during travel. There is health and property insurance.

-

Deposit protection. This neobank insures its customers' funds up to €100,000. This is an innovative German deposit protection system, which is valid even for free rates.

-

Discounts at partners. This digital bank officially cooperates with a wide list of European brands. The bank's clients can order products and services from these brands on favorable terms.

-

Perks. This is a separate option for customers with a Metal tariff. It allows you to order food, buy a gym membership, pay utility bills, and perform hundreds of other actions directly from the app.

Advantages:

Variety of tariffs to choose from with different limits and features, there are advantageous free tariffs.

Regardless of the tariff, the client gets full access to all banking functions at a modern standard.

On the N26 account you can store any currency, and on the paid Metal tariff, withdrawal from ATMs outside the eurozone is free.

Transfers between N26 customers' accounts are instant and free.

If you exceed the withdrawal limit, the fees are lower than average (1.7% outside the eurozone).

You can open up to 10 sub-accounts, these are full-fledged international standard accounts for independent purposes.

Neobank N26 offers accounts for individuals and legal entities, and accounts for businesses allow you to automate accounting.

Paid plans provide various types of insurance, including travel insurance.

Types of accounts for individuals and businesses

Banking features

Modern banking is an opportunity to perform almost all operations with your account remotely through a mobile application without visiting a bank office and avoiding the paperwork. From this point of view, The N26 bank provides a full range of services that may be required by a metropolitan resident and owner of a business.

The bank offers a convenient division by tariffs. The client does not need to overpay for features he doesn't need. There are 6 tariffs in total, 2 of them are completely free and they are quite sufficient for many N26 bank account users. The company doesn’t impose additional services on clients.

Another peculiarity of N26 banking is a high level of optimization of the application, which is reflected in impeccable usability, good adaptability, and scalability. The client can customize the application to his own vision of a conventional financial system. Dozens of settings and hundreds of combinations for each account are available.

Technical Support

The main ways to communicate with N26 technical support are chat-bot and live chat. They are available on the website (you need to log in to your account) and in the application. Chats work 24/7 without breaks and on weekends. The call center is available only to customers with paid tariffs, with a dedicated line with priority service open for the Metal tariff.

There is a "Support Center" in the footer of the site, which explains the main points of how to work with the mobile banking application. The option is available in English, German, French, and Spanish. Clients are also advised to regularly check the blog newsfeed, which publishes all innovations and important news from the world of finance.

Social programs of N26 Bank

N26 Mobile Bank implements several social programs based on the organization's own independent research. The first program of its kind is called The Female Opportunity Index. It is aimed at eliminating gender inequality in those regions of the planet where the problem still exists.

Any woman can contact the N26 support center and receive comprehensive consultations, advice and recommendations with links to regional precedents and regulations. In this way, N26 has already helped thousands of women find decent jobs that match their qualifications.

The neobank also supports female investors by providing them with all kinds of manuals with free training on profitable investments. The N26 scientific research in the field of financial markets is invaluable and its results are provided free of charge.

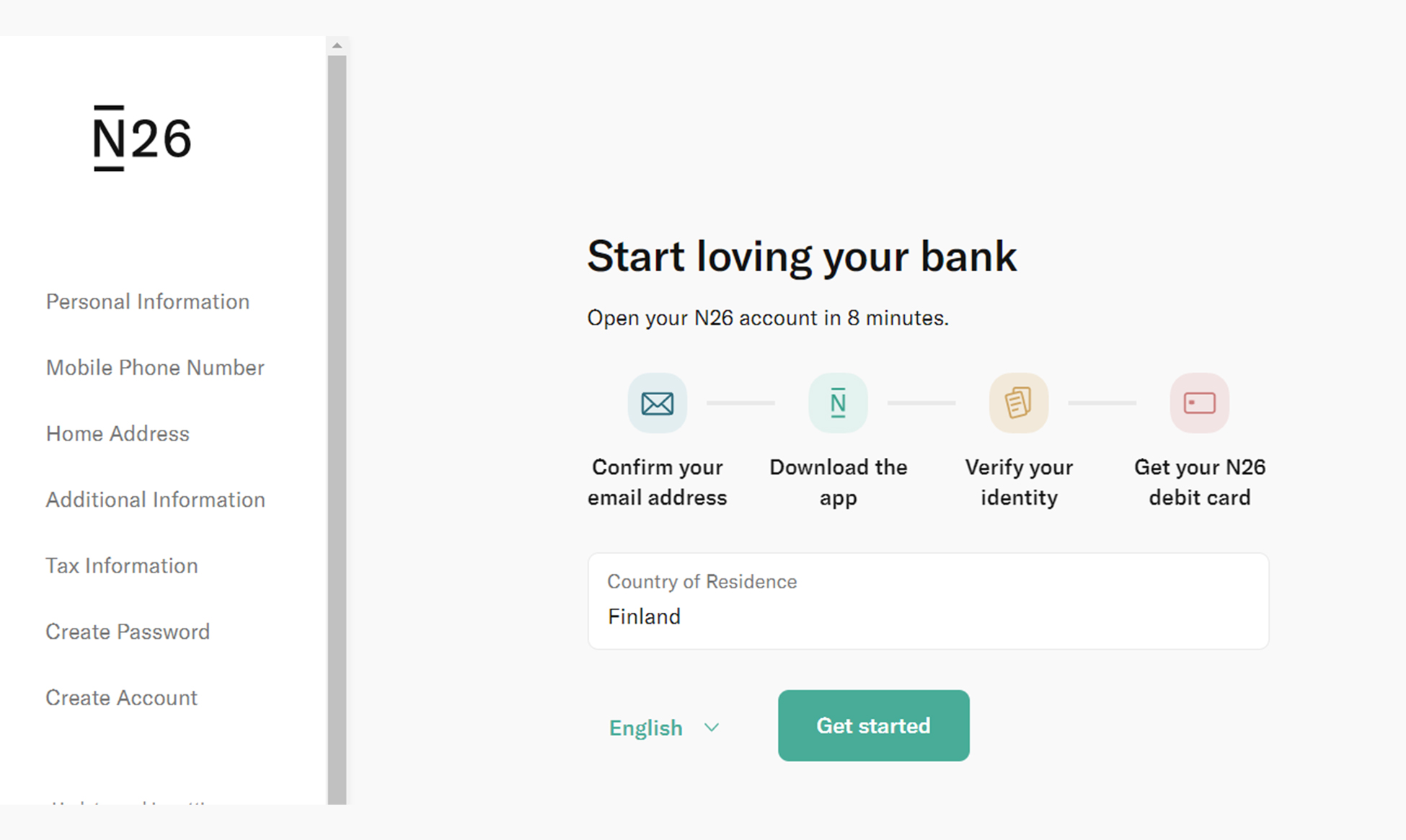

How to open an account at N26 Bank

Follow the main neobank website. Find the "Join Waiting List" button in the upper right corner. Click on it and you will be redirected to the registration menu. You can also click the "Online Banking" button, then select "Create Account" and you will get to the same menu.

Note that at the moment it is not possible to instantly create an N26 bank account. This is due to the large flow of new customers, who are attracted by favorable terms of cooperation. In the registration menu select your region, interface language, and press "Start". Indicate your country of residence, and enter your name, surname, email address, date of birth, phone number, and additional information.

Create a password, agree to the terms of cooperation (check the boxes), and click "Create an account”. Follow the instructions on the screen. The system will offer you to download the bank's application to your mobile device. You can immediately download the application from the App Store or Play Market and register there.

At the final stage of registration, you need to submit a photo or scan of your ID card. This can be a passport or a driver's license. Wait for verification and start banking.

Articles that may help you

FAQs

How does N26 Bank earn money?

The main income of N26 Bank is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does N26 Bank protect its customers?

N26 Bank uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

N26 Bank provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through N26 Bank?

Yes. N26 Bank allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Bunq's secure website.

Via Curve's secure website.