Trading platform:

- Plastic card

- Apple Pay

- Google Pay

- Samsung Pay

Starling Bank Review 2024

- UK

Currencies:

- GBP, EUR, USD

- 15%-35%

- Yes

Summary of Starling Bank

Starling Bank is a British digital bank that has been operating since 2014. It is regulated by the FSCS deposit insurance system. Starling offers individual and business accounts, with only one tariff (with zero monthly fees). The only monthly fee is £2 when you open an additional account. A bank customer's plastic card is issued free of charge. There is an overdraft charge for personal and business accounts, but no additional payments, except for a standard assessment of 15% per annum. You can open a multi-currency account for GBP, USD, and EUR. The mobile bank has the most simple and functional application that allows you to perform relevant actions within a few seconds.

| 💼 Main types of accounts: | Standard, business, child |

|---|---|

| 💱 Multi-currency account: | Yes (pounds, euros, dollars) |

| ☂ Deposit insurance: | Yes |

| 👛️ Savings options: | Reports & Categories, Smart Statistics, Round-ups |

| ➕ Additional features: | Pots within an account, joint accounts, free transfers between bank users |

👍 Advantages of trading with Starling Bank:

- clients receive a current account and a bank card with access to all tools without a subscription fee;

- 100% digital registration, only submit scans and digital signatures (no need to submit paper documents);

- four-level system for protecting user funds and data;

- the bank operates under the license of the FSCS regulator;

- money can be withdrawn at any ATM in the world, there are no additional fees outside the UK;

- the standard account simultaneously acts as an account for deposits with a rate of 0.05% per annum (with a balance of up to £85,000);

- mobile banking functions include electronic checks, expenses by categories, tools for reporting, and savings;

- you can open an additional account for a child, fully controlled by the main account of the parent.

👎 Disadvantages of Starling Bank:

- international transfers require a fixed commission fee of 0.4% + £5.5 when converted;

- there is a daily withdrawal limit of £300, after that, an additional commission may be charged;

- if the amount of a mobile bank account is more than £85,000, the 0.05% per annum fee is waived.

Evaluation of the most influential parameters of Starling Bank

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest Starling Bank News

- Analysis of Starling Bank

- Dynamics of the Popularity

- Investment Programs

- Terms for Cooperation

- Detailed Review

- Banking features

- Technical Support

- Social programs

- How to open an account?

- User Reviews of Starling Bank

- FAQs

- TU Recommends

Geographic Distribution of Starling Bank Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Starling Bank

In the UK, mobile banking has been around for a long time, with Starling being one of the path-breakers. It has operated for 8 years and has hundreds of thousands of customers globally. This is a conceptual feature of the organization because it is not singularly focused on UK residents, and anyone can open an account with this bank.

Of the key advantages, there’s the nonexistence of a monthly fee. At the same time, the bank does not have premium and professional accounts. There are only personal ones and ones for business; both are free and immediately offer all the tools. Opening an additional account of any type costs £2 per month. Usually, customers open a savings account, a child account, or a business account. All accounts are managed from one account in the application.

As a default, the overdraft function is active, which allows you to spend up to £1,200 over the account amount. Interest is debited monthly at 15-35%, it depends on the amount. An important point is that if an overdraft is agreed in advance in the application, no interest is charged for it, but some functions, such as international transfers, will not be available. The bank does not have loans for individuals, only the overdraft facility.

For business, Starling is convenient with a simplified account management system, transparent controls, and reporting tools. There is also full-scale business lending of up to £250,000, and for UK residents there is state support.

Dynamics of Starling Bank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of Starling Bank

The mobile bank does not offer separate investment tools. Each client, as a default, increases his savings thanks to payments of 0.05% per annum of the standard account amount. However, if the amount on all accounts of the client exceeds £85,000 (or the equivalent in dollars or euros), interest ceases to be paid. The bank itself does not provide other options for passive income; such options are possible only through partner projects.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Terms for Cooperation with Starling Bank

You do not need to be a UK resident to open an account with Starling neobank bank. You can have citizenship from almost any country (the official list is presented in the Terms of Cooperation that are published on the website). A bank client gets the opportunity to use a plastic card, Apple Pay, Google Pay, and Samsung Pay globally and deposit and withdraw funds at any ATM. The table below shows the main parameters of Sterling banking.

| 💼 Main types of accounts: | Standard, business, child |

|---|---|

| 💱 Multi-currency account: | Yes (pounds, euros, dollars) |

| 💵 Deposit terms and conditions: | Accrual of 0.05% per annum on a standard account |

| 💳 Loan terms and conditions: | Up to £1,200 overdraft at 15-35%, business loan up to £250,000 |

| ☂ Deposit insurance: | Yes |

| 👛️ Savings options: | Reports & Categories, Smart Statistics, Round-ups |

| 📋 Types of payment: | Plastic card, Apple Pay, Google Pay, Samsung Pay |

| ➕ Additional features: | Pots within an account, joint accounts, free transfers between bank users |

Comparison of Starling Bank with other Brokers

| Starling Bank | Wise | Bunq | Curve Bank | Axos Bank | Suits Me Bank | |

| Supported Countries | UK | Globally | Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Slovenia, Republic of Cyprus, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Norway, Poland, | UK and EEA | USA | UK and worldwide |

| Supported Currencies | GBP, EUR, USD | 54 currencies | Euro (16 European currencies in the Easy Money plan) | 26 currencies | USD | GBP, EUR, RON, SEK (for transactions with other currencies, automated conversion is made) |

| Deposit insurance | Yes | No | EUR 100,000 | No | $500,000 | No |

| Minimum deposit | No | No | No | No | $50 | No |

| Deposit rate | 15%-35% | No | 0.09% APY | No | Up to 1.25% | No |

| Loan Rate | 0.05% | No | The bank does not issue loans | No | Individual | No |

Starling Bank Commissions & Fees

A resident of any country can open an individual or business account with Starling mobile bank free of charge. He gets access to all the features and tools without having to pay extra for anything. There is no subscription fee for having one account under any circumstances.

Each additional account, regardless of its type, is subject to a fixed subscription fee of £2 per month. For example, if an additional child account is opened, you need to pay £2 for it. But if the account holder has a teenage child, and he opened the account himself, you do not need to pay for the account.

There is no commission for transfers within the country. There are also no fees for depositing funds, the source does not matter. There is a limit on cash withdrawals from ATMs for up to £300 and up to 6 withdrawals per day, thereafter, an individual commission is charged for each withdrawal (its amount is specified on the website). The commission for international transfers is 0.4% + £5.5. Overdraft fees for individuals are 15%, 25%, or 35% depending on the amount (can be calculated on the website). Business lending is considered individually.

We also compared Starling fees with similar types of fees on other Digital banks.

| Broker | Overdraft fee | ATM Withdrawal Fee | International transfer fee | International exchange fee |

| Monzo Bank | 19-39% | Free in the UK In other countries: - up to £200 - free - beyond £200 - 3% | €0.5 | 0.35%-2% |

| Starling Bank | 15-35% | No | 0.4% transfer fee + local fees | 0.4% |

| Chime Bank | No | No | No | 3% (max.$5) |

Starling digital bank is a modern mobile bank that meets the highest standards. It has been operating for many years, it has a valid license, and is insured which requires it to report to the international regulator. Various types of accounts are offered, including for business and children. The first account opened has no subscription fee, for each subsequent account, there is a £2 charge per month. You can open accounts in euros and dollars. The bank is reliable and is recommended for cooperation.

Detailed review of Starling Bank

Starling Bank offers mainly typical functionality as a modern digital bank. It is built according to process management standards, is cross-functional, and is suitable for all users without restrictions. It has no representative offices and branches and is a completely online organization. Unlike most British neobanks, Starling allows you to open accounts in other currencies and is focused not only on residents of your country. Plastic cards and contactless smartphone payments are valid worldwide with the standard MasterCard fee.

Starling mobile bank by the numbers:

-

providing services for more than 8 years;

-

Gains a new client every 39 seconds;

-

430,000 corporate clients;

-

£0 fee for a standard account;

-

0.05% per annum on a standard account.

A client can enter his user account through a browser on a personal computer or tablet. However, it is easier and more convenient to manage your account(s) through the bank's mobile application, which can be downloaded from the App Store or Google Play. The application is free and provides a complete list of functions and tools according to the standards of modern mobile banks.

Starling’s useful features:

-

Standard and Multi-currency accounts. By default, all Standard accounts hold funds in GBP only (automatically converted at the current MC rate). But any account can be made multi-currency by adding euros and US dollars.

-

Starling Marketplace. Out-of-the-box integration with a wide range of socially important products, from private pension funds to investment solutions, plus accounting software and other free extensions.

-

Mobile check deposits. Deposit checks up to £500 through the mobile app. Only a clear photograph of the receipt is required. Checks are instantly processed.

-

Connected card. The account holder can legally provide his plastic card to another person for use for his personal purposes. Full reporting will be available for the period while the card was used by another person.

-

Bills Manager. Aggregator of accounts and pots, which allows you to combine statistics on all client resources in one group of windows in the application. Clients have full control of the intuitive operation with no limits.

-

Round-ups. If the feature is activated, each purchase is rounded to the nearest pound on the reports, and the difference is allocated to a separate pot. Round-ups allow you to permanently form savings.

Advantages:

The bank has several levels of protection. It has never been hacked, and no breach of user funds or personal data has been recorded.

Like any digital bank, Starling provides technical support 24/7, and communication by phone, chat, and email are available.

The bank does not have premium accounts. This means that each client gets full and equal access to the list of financial instruments and services.

Payment of £2 per month for an additional account - one of the lowest monthly fees in this segment.

Built-in marketplace allows you to manage your life through your mobile phone, as almost all goods and services are available.

Intelligent and transparent statistics display a breakdown of replenishment and expenses by category, imposition of individual limits, and the Round-up function. These result in a perfect systematization of finances.

The Settle-up function will adjust and make all financial interactions between relatives and friends as transparent as possible.

To open an account, you do not need anything other than a scan of an identity document. The plastic card is sent free of charge within the UK.

Types of accounts for individuals and businesse

At the moment, the mobile bank offers several types of accounts. Personal, business, and individual entrepreneur accounts are opened free of charge, a child account cannot be opened free of charge because it must be linked to the parent's account and registered on it. Accordingly, this is an additional account, and the bank charges a monthly subscription fee of £2 for each additional account.

Another type of account available with Starling is the joint account. A bank client can link his account with any other account, and that one can be opened through a third-party bank. Linked accounts get shared reporting, a single credit history, and overlapping features. For example, you can pay for online purchases with funds from another account.

Banking features

Modern neobanks operate on the principle of giving the client total control over financial decisions. The bank client receives detailed reports in the form of tables and diagrams on income and expenses. You can set individual goals, track them by milestones, and set limits and alerts. All this is done in just a couple of touches of the mobile phone screen.

Another benefit of Starling is that the bank is open to residents of all countries and is quite loyal in terms of the policy of commissions and fees. If a client pays for purchases online and hardly withdraws money from ATMs, then the service for him is free for the first account and £2 per month for each subsequent one. If the client is actively spending money, you need to take into account the limits and use the smart savings features to optimize spending.

Accounts for sole traders, the self-employed, and organizations offer many business functions, including automated tax reporting and simplified accounting due to the multifunctionality of end-to-end processes.

Technical Support

The site and the application have a "Help" item with basic FAQs on the neobank's functions. The Help Center section provides detailed explanations on various items, including legal issues. To clarify operational situations, you can use the chat in the application, send an email to help@starlingbank.com, or to the ticket system on the website.

Communication with specialists by phone is available through the corresponding function in the mobile application's support center. The legal address of the company where paper letters can be sent is PO Box 74352 LONDON EC2P 2QU.

Social programs of Starling Bank

The general trend for British neobanks is the desire to preserve nature. Starling is phasing out fossil fuel counterparts and is not investing in such projects. By 2050, the bank intends to achieve the complete absence of its negative impact on the environment, even indirectly.

Each client of the bank can take part in a unique promotion. A referral link is available to him in his user account. This link can be sent to a friend, acquaintance, or other people. If another person registers with Starling Bank using this referral link and passes the identity verification, the bank will plant a tree. The owner of the referral link will receive a full report.

The program is implemented jointly with Trillion Trees, BirdLife International, and the WWF. To date, Starling has planted about 50,000 trees.

How to open an account at Starling Bank

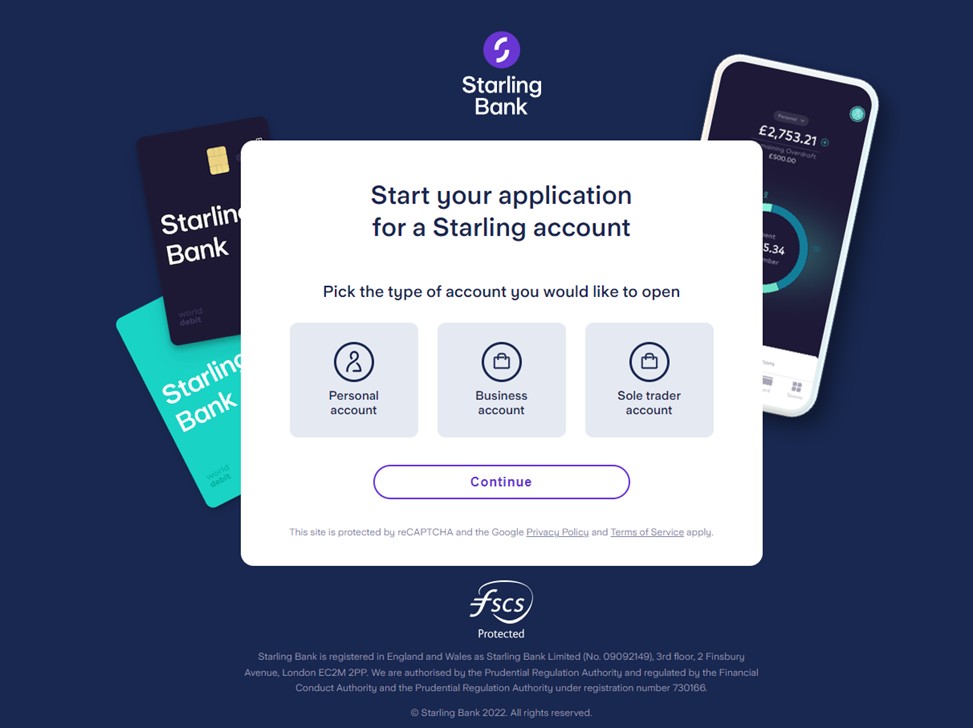

Go to the official Starling Bank website, click on the "Start" button in the upper right corner of the screen. Select the type of account: private, business,or individual entrepreneur. Click "Continue" and indicate if you have used Starling services before and click "Continue" again. Enter your name, then enter your mobile phone number and get a link to download the mobile application in the App Store or Google Play.

You can also go directly to the digital store, search for Starling, and download and install the app directly. After installation, the application will ask you to provide personal data and to send a scan or photo of a document proving your identity (a driver's license will do). Verification takes one to three days. As soon as it is completed, you will receive a notification and will be able to enter your user account.

Then, follow the instructions on the screen. We recommend that you immediately go to the "Security" section in the settings and enable all options for protecting your account. You can use the banking functions from your mobile phone or through a personal computer browser.

Articles that may help you

FAQs

How does Starling Bank earn money?

The main income of Starling Bank is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does Starling Bank protect its customers?

Starling Bank uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

Starling Bank provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through Starling Bank?

Yes. Starling Bank allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Bunq's secure website.

Via Curve's secure website.