Trading platform:

- Web platform

- Mobile Apps

USAA Bank Review 2024

- USA

Currencies:

- USD

- 0.01%/-2.27%

- $250,000

Summary of USAA Bank

The USAA (United Services Automobile Association) is a digital bank headquartered in Texas. It has operated since 1922, is a member of the Federal Deposit Insurance Corporation (FDIC), and is regulated by the Texas Department of Insurance and the SEC. USAA provides banking, brokerage, and investment services to U.S. military personnel, their spouses, and children. Products available include loans, insurance, retirement savings, and current and savings accounts for minors. The bank also offers debit and credit cards with cashback. USAA accounts can only be opened by U.S. citizens.

| 💼 Main types of accounts: | Checking Account, Savings Accounts (USAA Savings, USAA Youth Savings, USAA Performance First); Uniform Transfer to Minor Act (UTMA) Account, Certificate of Deposit (CD) Account (Standard, Jumbo, Super Jumbo) |

|---|---|

| 💱 Multi-currency account: | No (only U.S. dollars, conversion at the rate of Visa/MasterCard/American Express) |

| ☂ Deposit insurance: | Yes ($250,000 for individuals) |

| 👛️ Savings options: | Refinancing of previous loans, plans for retirement, and student savings |

| ➕ Additional features: | Connection of autopayments, Direct Deposit, cashback on credit cards from 1% to 5% |

👍 Advantages of trading with USAA Bank:

- Licenses from reputable U.S. regulators and participation in state compensation funds.

- Services adapted to a specific social group — U.S. military personnel and their families.

- The minimum amount to open a deposit account is $250.

- The ability to take out a loan for specific needs, not just to buy a vehicle or real estate.

- Support for American Express, Visa, and Mastercard payment systems.

- Access to contactless payments such as Apple Pay, Google Pay, and Samsung Pay.

- Free withdrawals from over 60,000 ATMs of partner networks.

👎 Disadvantages of USAA Bank:

- USAA provides services only to U.S. military personnel (former and current) and their first-line family members such as wives, husbands, and children.

- Rates on consumer loans are higher than the market average.

- The annual interest rate on deposits is lower than that of its competitors.

Evaluation of the most influential parameters of USAA Bank

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest USAA Bank News

- Analysis of USAA Bank

- Dynamics of the Popularity

- Investment Programs

- Terms for Cooperation

- Detailed Review

- Banking features

- Technical Support

- Social programs

- How to open an account?

- User Reviews of USAA Bank

- FAQs

- TU Recommends

Geographic Distribution of USAA Bank Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of USAA Bank

USAA customers can sign up for Visa, Mastercard, or American Express debit and credit cards. They can be added to Google Pay, Apple Pay, or Samsung Pay mobile payment services. Credit cards are issued by the USAA Savings Bank. Debit cards and banking services are handled by USAA Federal Savings Bank. Both banks are registered with FDIC, so their customers' deposits are insured for up to $250,000 per account.

Mobile banking can be used to make bank transfers, but only within the United States. Two transfers of up to $10,000 each are available within 30 days. Sending larger amounts and international transfers can only be requested by phone. Processing times for payment orders vary depending on when it receives them. Transfers within the U.S. are processed the same business day if the client submitted the request before 4:00 p.m. (Central Time). For international transfers, you must do it by 3:30 pm.

USAA customers can set up direct deposits. This service is free but saves you money on your loan rate. When you connect Direct Deposit, the annual interest rate is reduced by 0.25% on average. Moreover, automatic online payments can be set up to pay utility bills, internet bills, etc.

USAA has a few peculiarities. For example, a savings plan is available for minors, but the bank doesn’t offer loans to cover higher education expenses. It's advantageous to transfer funds within the U.S. through USAA, but the bank charges a high fee for international payments. The maximum cashback on USAA Credit Cards is 5%, but it is only available for the first $3,000. Generally, the customer gets back 1-2% of the purchase amount, which is less than at other U.S. banks.

Dynamics of USAA Bank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of USAA Bank

USAA offers various types of deposits for passive income. Clients can choose from fixed, adjustable, and variable rate programs. The least amount of money is required for a variable-rate deposit, starting at $250. To get an adjustable or variable rate, you must deposit $1,000 or more. The annual percentage ranges from 0.01% to 2.27%, with terms ranging from 30 days to 7 years. You can also invest in various types of financial instruments through USAA — ETFs, mutual funds, options, and stocks and bonds. Through a Charles Schwab partner, automated investing is available with a robotic advisor that builds and manages a portfolio. It is also possible to open a funded retirement account with the option of investing in stock assets. Individual Retirement Accounts (IRAs) are offered by Charles Schwab and Victory Capital.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Terms for Cooperation with USAA Bank

USAA doesn’t offer multi-currency accounts; all transactions are in U.S. dollars. In addition to debit cards, you can get USAA Credit Cards with cashback or reward points on purchases. Deposits have annual interest rates ranging from 0.01% to 2.27%. The interest rate on loans depends on the amount, term, loan type, and direct monthly debit settings.

| 💼 Main types of accounts: | Checking Account, Savings Accounts (USAA Savings, USAA Youth Savings, USAA Performance First); Uniform Transfer to Minor Act (UTMA) Account, Certificate of Deposit (CD) Account (Standard, Jumbo, Super Jumbo) |

|---|---|

| 💱 Multi-currency account: | No (only U.S. dollars, conversion at the rate of Visa/MasterCard/American Express) |

| 💵 Deposit terms and conditions: |

Fixed-rate: from $1.000, from 30 days to 7 years, 0.01%-2.27% per annum Variable rate: from $250, from 182 days to 1 year, 0.01% per annum Adjustable rate: from $1,000, from 3 to 7 years at 0.01% per annum |

| 💳 Loan terms and conditions: | Free overdraft, personal loans from $2,500 to $100,000 with rates from 7.39% to 10.64%, credit cards with a rate of 7.65%-26.65% |

| ☂ Deposit insurance: | Yes ($250,000 for individuals) |

| 👛️ Savings options: | Refinancing of previous loans, plans for retirement, and student savings |

| 📋 Types of payment: | Plastic debit and credit cards, bank transfers, Google Pay, Apple Pay, Samsung Pay, and Zelle |

| ➕ Additional features: | Connection of autopayments, Direct Deposit, cashback on credit cards from 1% to 5% |

Comparison of USAA Bank with other Brokers

| USAA Bank | Wise | Bunq | Curve Bank | SoLo Funds | Ally Bank | |

| Supported Countries | USA | Globally | Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Slovenia, Republic of Cyprus, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Norway, Poland, | UK and EEA | US dollar | US |

| Supported Currencies | USD | 54 currencies | Euro (16 European currencies in the Easy Money plan) | 26 currencies | USA | US dollar |

| Deposit insurance | $250,000 | No | EUR 100,000 | No | According to FDIC | 500,000 dollars |

| Minimum deposit | $250 | No | No | No | $10,000 | No |

| Deposit rate | 0.01%/-2.27% | No | 0.09% APY | No | $0-$5 | 4% |

| Loan Rate | 3.19%/-10.64% | No | The bank does not issue loans | No | 2 × (0.9% of the principal loan amount + $0.7) | Individually |

Detailed review of USAA Bank

USAA combines two banks: USAA Savings Bank offers credit cards and USAA Federal Savings Bank performs other banking functions. Both banks are members of the FDIC, the Federal Deposit Insurance Corporation, which is controlled by the U.S. government. Initially, USAA was only engaged in insurance. It was among the first in the world to use the concept of "direct marketing" — bank employees communicate with clients rather than insurance agents. In the 1970s, USAA began offering brokerage and investment management services, and in the 1980s it added banking products. Activities were conducted remotely, first by mail and telephone, and, since 1999, also via the internet.

USAA by the numbers:

-

The bank has been operating for over 100 years.

-

The USAA Group holding company includes 19 companies with U.S. regulatory licenses;

-

The bank's equity capital exceeds 40 billion dollars;

-

It has over 12 million customers;

-

There are more than 60,000 ATMs across the U.S. that are available to withdraw money without a fee.

Logging into your USAA account is available through the web platform — from both personal computers and smartphones. On your phone, you can manage your accounts through a browser, but the bank also offers handy mobile apps for Android and iOS. The apps have all the functionality you need to have full control over your funds and interest payments on your loans. In 2022, however, USAA plans to refine the interface, simplify navigation, add smart search, and improve performance.

Useful features of USAA:

-

A tool for assessing the state of your finances. You take a special test, after which the bank gives you an individual action plan to improve your financial situation with specific advice and recommendations.

-

Military salary calculator. It allows you to calculate an approximate salary depending on the rank, unit, duty station, and the number of dependents.

-

A library of resources with tips. It has advice on financial planning, insurance, buying real estate and a car, retirement, etc.

-

Calculators and comparison tools. A bank customer can calculate the rate for a car loan, compare offers from different car rental firms, and assess property risks. Calculators of a deferred annuity, immediate annuity, mortgage payment, IRA distribution, etc. are also available.

-

USAA perks. A catalog for shopping for discounted goods and services. It has great deals on autos, homes, health, and recreation products. You can also buy discounted hotel reservations, airline tickets, and memberships to amusement parks and fitness clubs.

-

Training materials on investing and planning. The USAA website has a section with the basics of investing in mutual funds, stock indices, and fractional stocks. Also, there are articles on automated trading, and financial and retirement planning.

-

Community. It is designed to communicate with other USAA customers or technical support. Each user can join an existing discussion or start his own.

Advantages:

Customer deposits are nationally insured because USAA Bank is a member of the FDIC.

The company's website has a wide range of loan calculators and other tools for calculating and assessing your level of finances.

The bank doesn’t charge a fee for opening and maintaining current accounts, execution, and delivery of debit and credit cards.

USAA's services are tailored to the needs of U.S. service members and their families, so its customers have access to specific products that other digital banks don't offer.

Parent-managed current and savings accounts for children are available.

You log in to your account by entering a unique numeric identifier.

Accounts can be monitored and managed through a variety of devices — personal computers, laptops, tablets, or smartphones.

It is possible to obtain a loan for various needs from $2,500, including consumer loans, mortgages, and loans for the purchase of vehicles.

The bank doesn’t charge a fee for overdrafts.

Types of accounts for individuals and businesses

Banking features

USAA is a digital bank that provides all basic banking services online. Its clients can choose from various types of insurance — life, business, vehicle, property, and valuables. Medical, dental, and vision insurance are available. Rare types include pet, phone, and cybersecurity insurance.

For passive income, USAA has deposit accounts and funded retirement accounts. It is also possible to open a current or savings account for a minor child. The bank offers mortgage refinancing, through which the customer can reduce the interest rate, get cash or repay the loan faster.

USAA also offers loans for vehicles (cars, motorcycles, boats, campervans, motor homes) with rates of 3.19%-6.69% for up to 180 months. You can take out a consumer loan of up to $100,000 at 7.39%-10.64% APR. Six types of mortgages are also available, including loans over $647,000 (Jumbo).

Technical Support

The USAA website has an option to call the automated agent. It allows the user to retrieve the password and network indicator number to log in to the account, as well as to register and check if their account request has been approved.

You can contact technical support representatives by phone. The two main numbers for U.S. residents are 210-531-8722 and 800-531-8722. The contact section lists foreign phone numbers for 19 countries, as well as numbers for various departments such as mortgage lending, insurance, investing, etc.

The bank is open 6 days a week: Monday through Friday from 7 a.m. to 6 p.m., and Saturday from 8:30 a.m. to 1 p.m., Pacific time. Customers who use the mobile app to manage funds can ask for help around the clock and any day of the week through online chat.

Social programs of USAA Bank

USAA's business strategy is based on three principles: inclusion, diversity, and equity. The staff is made up of people of different social, gender, and racial backgrounds. Every USAA team member has a right to vote and the opportunity to share ideas about the bank's development and expansion of its services.

USAA was created by the military for the military, so all of its services are adapted not for civilians, but for those who serve in the U.S. military. For this reason, there are quite specific programs available. For example, the husband or wife of a deceased spouse can access his or her account management. The USAA website has many useful resources for service members such as tips on planning for life after the military, a community of spouses, a military pay calculator, and more.

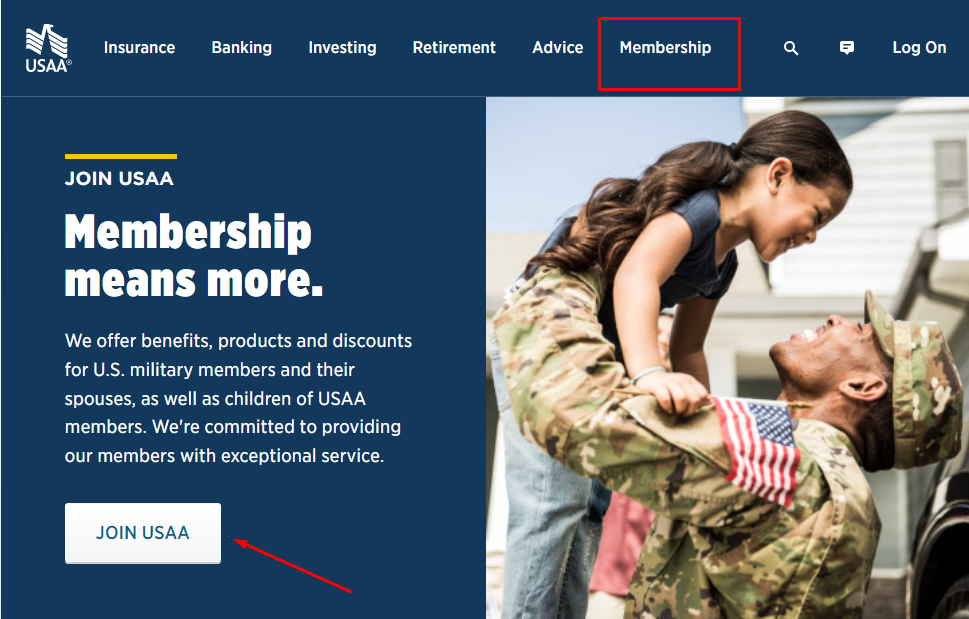

How to open an account at USAA Bank

U.S. military personnel (active, retired, veterans), as well as their wives and husbands, can open a USAA bank account. An account is available for a minor child. To open a USAA digital bank account, go to its official website, click Membership on the home page, and then join USAA. A registration form will open, in which you need to give true information about yourself.

The bank will ask you to enter data that will identify you. You must write your first and last name (as in your documents), address, date of birth, tax identification number, or Social Security number. USAA will ask for a copy of your identification documents to verify this information. You can provide screenshots of your U.S. passport or driver's license.

Once you pass the check, you can access your account. You can log in through the website or a mobile app, which you can download from Google Play or the App Store. An Online ID, a digital identifier tied to a registered email address is used for authorization. To increase the security of the application, in addition to a password, the client can connect fingerprint, face, or voice recognition.

A USAA member account creation is free. You can sign up for a debit or credit card in your user account or on a smartphone app. A USAA courier will deliver the card free of charge to the address provided at registration. If you have a question about services or cards, you can ask it in the online chat in the mobile app.

Articles that may help you

FAQs

How does USAA Bank earn money?

The main income of USAA Bank is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does USAA Bank protect its customers?

USAA Bank uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

USAA Bank provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through USAA Bank?

Yes. USAA Bank allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Bunq's secure website.

Via Curve's secure website.