Can You Day Trade Crypto On Robinhood Without $25K?

Yes, you can day trade cryptocurrencies on Robinhood without a minimum balance of $25,000, as the Pattern Day Trader (PDT) rule does not apply to cryptocurrencies. This allows traders to make unlimited day trades in cryptocurrencies, regardless of their account size. However, it is important to remember that day trading is high-risk, and it is recommended to carefully analyze the market and develop sound trading strategies.

Cryptocurrency day trading is a popular choice for traders due to its high volatility, which allows for quick profits. However, many new investors are wondering: does the Pattern Day Trader (PDT) rule, which requires a minimum balance of $25,000, apply to crypto trading on the Robinhood platform? This rule often causes confusion among users, especially those who want to start trading with a small capital. In this article, we will look at how cryptocurrency day trading on Robinhood works, whether there are any restrictions associated with it, and what this means for traders. The answers will help you understand how to make the most of the platform.

Can I trade cryptocurrency on Robinhood without $25K?

Yes, the Pattern Day Trader (PDT) rule, which requires a minimum balance of $25,000 to frequently trade stocks, does not apply to cryptocurrencies. This is because cryptocurrencies are not classified as securities.

However, day trading is high-risk, so it is recommended to have a strategy and clear goals.

Robinhood Crypto is a commission-free cryptocurrency trading platform developed by Robinhood Financial LLC, an SEC-registered broker-dealer. Users can buy, sell, and hold assets such as Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Dogecoin, and more.

There are no fees on trades, but the platform makes money on order flows and interest on cash balances. When trading cryptocurrency, you need to consider high volatility, possible security risks, and the possibility of losing funds.

Robinhood allows you to buy and sell cryptocurrencies including Bitcoin, Ethereum, and Dogecoin, and also offers access to stocks, options, and ETFs. Users can place market and limit orders, using real-time data and charts for analysis. The platform does not charge commissions on trades, making it attractive to active traders.

How to trade cryptocurrency on Robinhood?

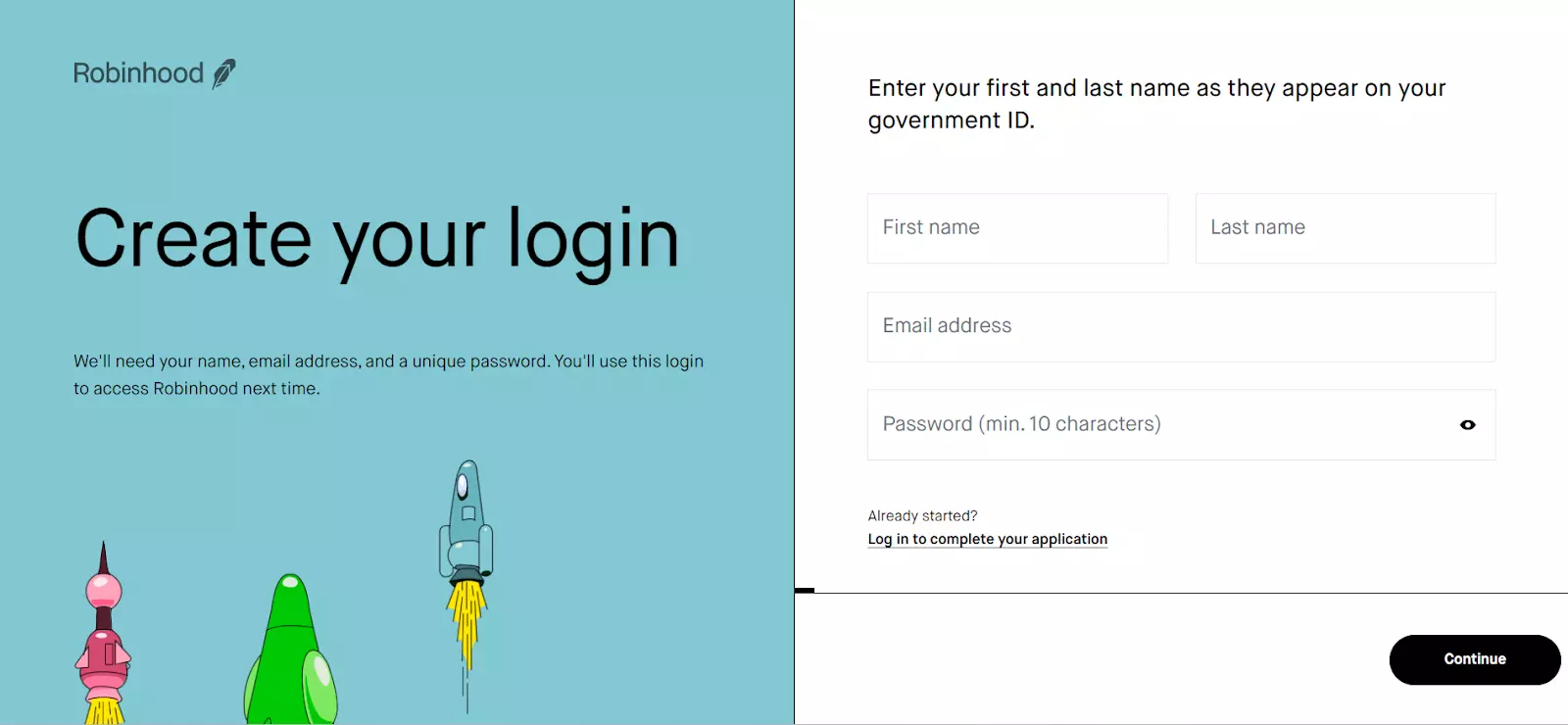

Step 1. Sign up for a Robinhood account through their website or mobile app. You will need to provide some personal information and verify your identity.

Create login

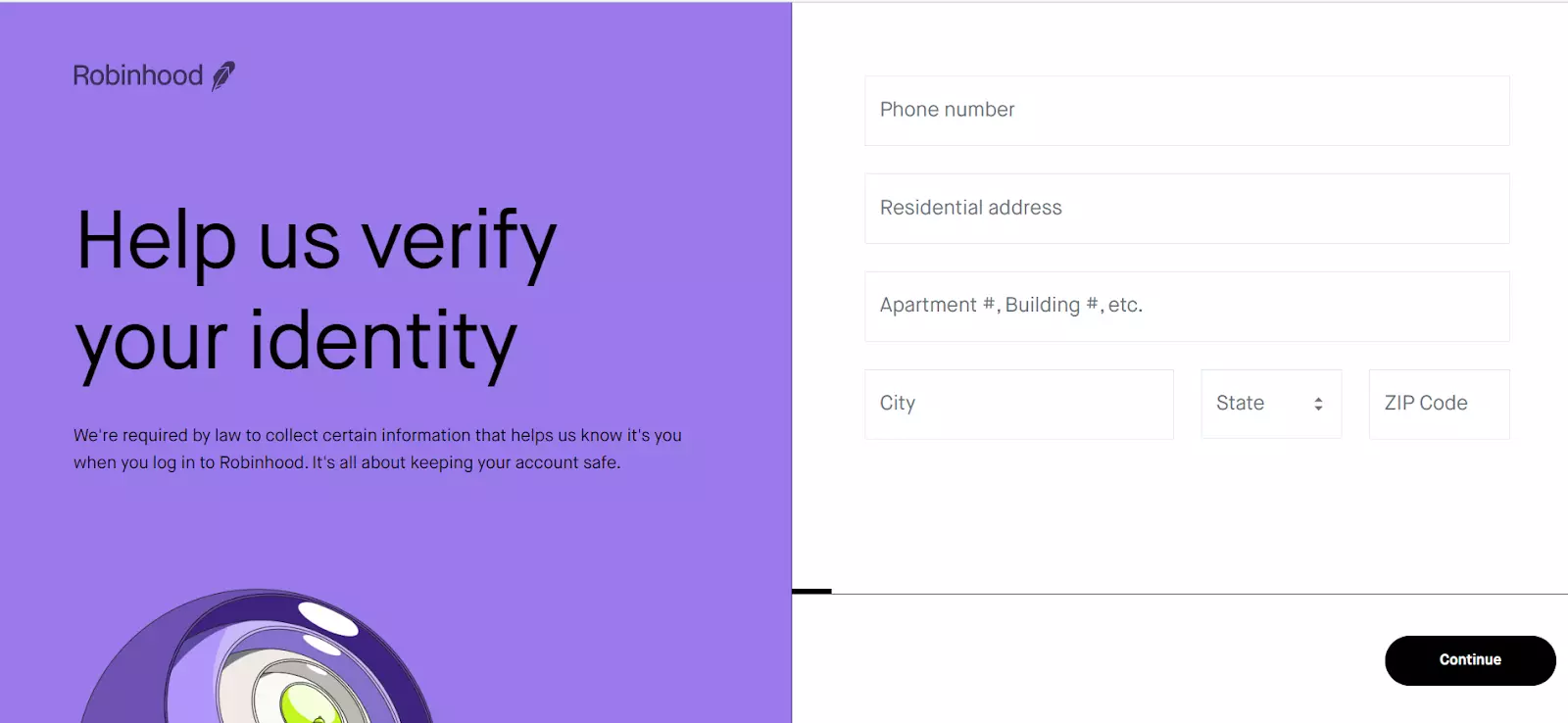

Step 2. Please enter your address details to verify your identity.

Verification

Step 3. Once you have opened an account, link your bank account and transfer funds to your Robinhood account.

Step 4. Go to the Account tab in the app and select “Add a Product” to enable cryptocurrency trading.

Step 5. Choose one of the cryptocurrencies supported by the platform, including Bitcoin, Ethereum, Dogecoin, and more.

Step 6. Go to the page for your chosen cryptocurrency, click “Buy” or “Sell,” enter the amount, and select the order type (market or limit).

Step 7. Find your placed trades in the order history section. You can also set up price alerts to receive notifications when certain levels are reached.

Step 8. Develop a strategy and set realistic targets before trading to minimize potential losses.

| Cryptocurrency | Trading Pair | Mode |

|---|---|---|

|

Bitcoin |

BTC/USD |

Payments |

|

Ethereum |

ETH/USD |

Blockchain platform |

|

Dogecoin |

DOGE/USD |

Payments, Meme coin |

|

Bitcoin Cash |

BCH/USD |

Payments |

|

Bitcoin SV |

BSV/USD |

Payments |

|

Litecoin |

LTC/USD |

Payments |

|

Ethereum Classic |

ETC/USD |

Ethereum Classic |

Robinhood vs competitors

| Robinhood | eToroX | Binance US | |

|---|---|---|---|

|

Supported Coins |

Bitcoin, Ethereum, Dogecoin, Bitcoin Cash, Bitcoin SV, Litecoin, and Ethereum Classic |

Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Stellar, Tron, Dash, Cronos, Ethereum Classic, API3, Skale Network, Immutable X, IOTA, Tezos, Polkadot, Maker, Filecoin, Uniswap, Cardano, XRP, etc. |

BNB, Bitcoin, Green Metaverse Coin, Gaxle, Ethereum, Ripple, Cardano, Solana, Polygon, Dogecoin, Shiba Inu, Polkadot, Litecoin, Tron, Uniswap, Avalanche, Bitcoin Cash, Monero, Filecoin, etc. |

Robinhood crypto fees

Robinhood offers free cryptocurrency trading, with no additional fees for trades. The platform allows trading around the clock, 24/7, giving users the flexibility to analyze the market and make decisions. In the next section, we will compare Robinhood fees with competitors.

| Robinhood | eToroX | Binance US | |

|---|---|---|---|

|

Crypto spot fees |

Free |

1% |

Free |

|

Withdrawal fee |

Free |

$5 |

Flat fee on the conversion amount during the transaction process |

How to withdraw crypto from Robinhood?

On a daily basis, you can send/withdraw crypto worth up to $5,000 or 10 transfers. To do this, follow this sequence:

-

Login to your profile.

-

Visit the detail page that contains all information about your cryptos.

-

Select the asset/crypto you wish to transfer.

-

Select send, and enter the amount you wish to withdraw in the box.

-

Enter the wallet address from which you want to withdraw.

-

Verify the information on the Preview Page.

-

Click on “Confirm”.

Robinhood Website

Pros and cons of cryptocurrency trading on Robinhood

👍 Pros:

• Commission-free trading, allowing you to reduce costs.

•Simple, beginner-friendly app.

•Support for popular cryptocurrencies such as Bitcoin and Ethereum.

•Trading via mobile app anywhere.

•Real-time market data and news for decision making.

👎 Cons:

• No function to transfer cryptocurrencies to external wallets.

•Limited list of available cryptocurrencies and functionality such as stop loss and margin trading.

•The platform is not available in all US states and is subject to security risks.

Learn the ropes and make use of Robinhood’s unique offerings

You can day trade crypto on Robinhood without worrying about the $25K rule, but the trick is knowing how to work within its limits. Instead of chasing high-volatility coins, try trading stable ones when the market opens — it’s less risky and gives you room to learn the ropes. Robinhood doesn’t have fancy features like trailing stops, so stick to simpler trades that won’t catch you off guard.

Also, don’t be afraid to make small trades in bits and pieces. It’s like dipping your toes in the water to understand the current without jumping in headfirst.

Here’s something most people miss: Robinhood doesn’t charge fees, so take advantage of that by testing out tiny trades during slow trading hours. Fewer people trading means prices don’t bounce around as much, giving you a better shot at predicting where things are headed.

To level up, keep an eye on market trends using free tools like CoinMarketCap and match that with how Robinhood users are acting. Sometimes, the buzz within the app can hint at what’s about to take off. It’s all about thinking creatively and staying one step ahead.

Conclusion

The ability to trade cryptocurrencies on Robinhood without commissions and restrictions, such as the $25K rule, makes the platform attractive to traders of all levels. Ease of use and access to popular assets make it possible for even beginners to start trading effectively. However, the lack of advanced tools, such as transferring cryptocurrencies to external wallets, limits functionality. Before trading, study the associated risks, such as high volatility . To achieve stable results, we recommend developing a well-thought-out strategy and using available analytical tools. This approach will help minimize losses and increase the chances of success.

FAQs

Do I need to maintain a minimum balance to day trade cryptocurrency on Robinhood?

No, there is no minimum balance requirement to day trade cryptocurrency on Robinhood.

What order types does Robinhood support for cryptocurrency trading?

Robinhood supports market orders and limit orders for cryptocurrency trading.

Is there a limit on the number of cryptocurrency trades per day?

There is generally no limit on the number of cryptocurrency trades per day. However, frequent trading may result in higher spreads or order execution delays, especially during periods of high volatility.

How to choose the right cryptocurrency to trade?

Consider the asset’s liquidity, trading volume, and historical stability. Cryptocurrencies with high trading volume provide fast order execution and less risk of price spikes.

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).