According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €1

- BlackTrader

- CNMV

- FINRA

- SIPC

- 2012

Our Evaluation of Blackbird

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Blackbird is a moderate-risk broker with the TU Overall Score of 5.9 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Blackbird clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Blackbird offers a functional electronic platform, margin financing, investment solutions, and 24/7 support available in Spanish.

Brief Look at Blackbird

Blackbird is a Spanish stock broker that is regulated by CNMV (Comisión Nacional del Mercado de Valores) and is a member of the FOGAIN (Fondo General de Garantía de Inversiones) public investment guarantee fund. The BlackTrader platform provides for trading both underlying assets (stocks, ETFs, and bonds) and derivatives (options, futures, and CFDs on currency pairs, stocks, and indices). The company was incorporated in 2012 and it received numerous awards, including awards for the Best Platform and the Best Training for Novice Traders. Blackbird offers access to 15 global markets and focuses on providing services to investors from Spain and Latin America. Its clients can use several investment solutions, including those with personal support and portfolio building.

- Versatility. The broker provides access to a wide range of financial instruments, both underlying assets and derivatives, and investment products;

- Global coverage. On the Blackbird platform, traders can work on global financial markets, and not only on Spanish stock exchanges;

- Advanced analytical tools. These are newsfeeds, YouTube videos, research, and market forecasts;

- High degree of reliability and security. The broker is regulated in two jurisdictions and participates in compensation funds of Spain and the U.S.;

- Leverage. The broker's clients can use margin financing to increase their trading volumes;

- Focus on traders from Spain. Education and support are available in Spanish;

- Average trading fees as compared to other global brokers that provide access to the stock market.

- Individual portfolios are available only upon depositing €25,000 or more;

- Minimum fees for stocks and ETFs are higher than those of the broker’s competitors;

- Deposits and withdrawals are made only by bank transfers, which may cause additional expenses.

TU Expert Advice

Financial expert and analyst at Traders Union

Blackbird is a broker focused on Spanish-speaking traders and investors. It provides for trading with a small initial deposit, which makes its services available to a wide range of traders. The company holds webinars and offers courses for novice traders, including face-to-face lessons and group online sessions.

To enter the market through Blackbird, its clients can use its in-house platforms. The desktop platform is compatible with Windows, macOS, and Linux. Also, it is possible to trade from smartphones, tablets, or in a web version of the platform. Regardless of the software, Blackbird’s clients get access to real-time market data, research, and advanced analysis tools.

The broker provides access to markets in the U.S., Europe, and Asia and yet customizes its services for Spanish traders. They can get assistance in their native language, place or correct their orders by free phone numbers, and request personalized portfolio monitoring. Blackbird has offices in Madrid and Barcelona, where traders can receive answers to questions on trading conditions or accounts.

Blackbird Trading Conditions

| 💻 Trading platform: | BlackTrader |

|---|---|

| 📊 Accounts: | Paper (demo) and Real |

| 💰 Account currency: | EUR |

| 💵 Deposit / Withdrawal: | Bank transfers |

| 🚀 Minimum deposit: | €1 |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | Stocks, ETFs, and futures; options on indices, stocks, and futures; and CFDs on stocks, indices, Forex, and bonds |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Minimum fixed fee for all instruments |

| 🎁 Contests and bonuses: | No |

Blackbird’s clients get access to trading stocks and ETFs of Spain and 14 more markets. Futures are traded as micro, mini, and standard contracts. Investment in option contracts on stocks, indices, and futures is available. Also, Blackbird provides access to trading Forex and CFDs. All instruments are available on one platform — the proprietary BlackTrader. To protect the portfolio from strong stock market volatility, traders can use fixed-income bonds of Spain. They can work on live and demo accounts, trade with leverage, and place basic and advanced order types.

Blackbird Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

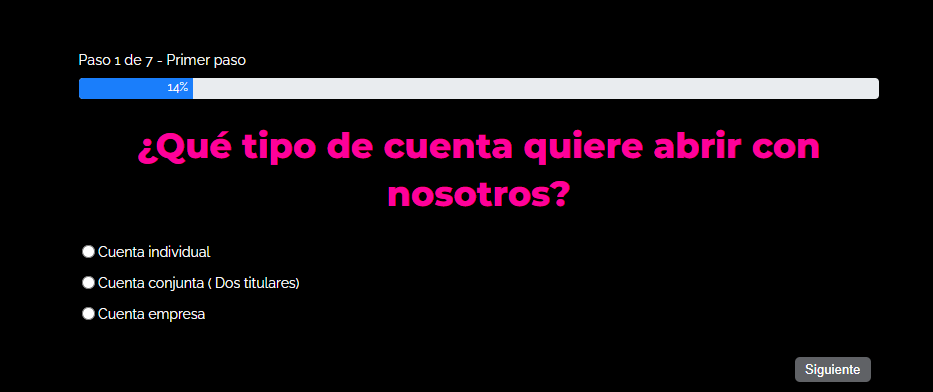

Trading Account Opening

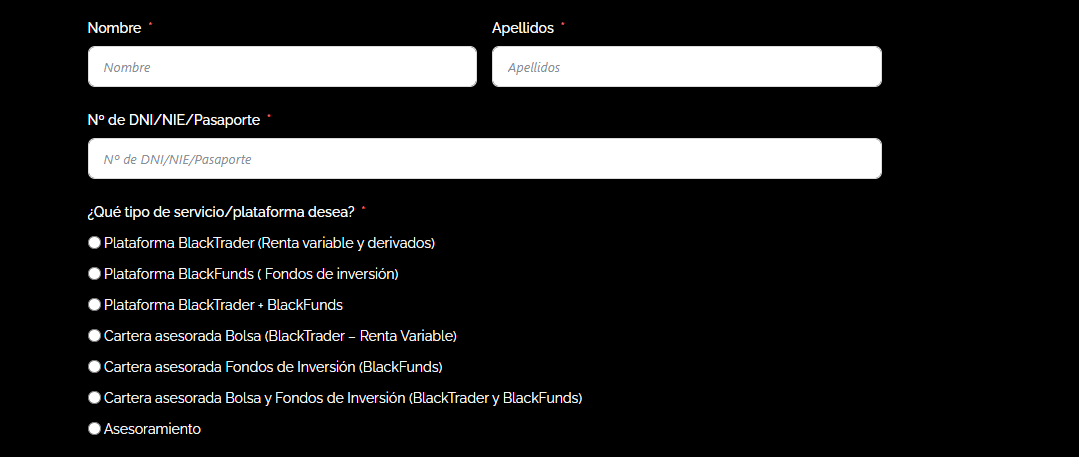

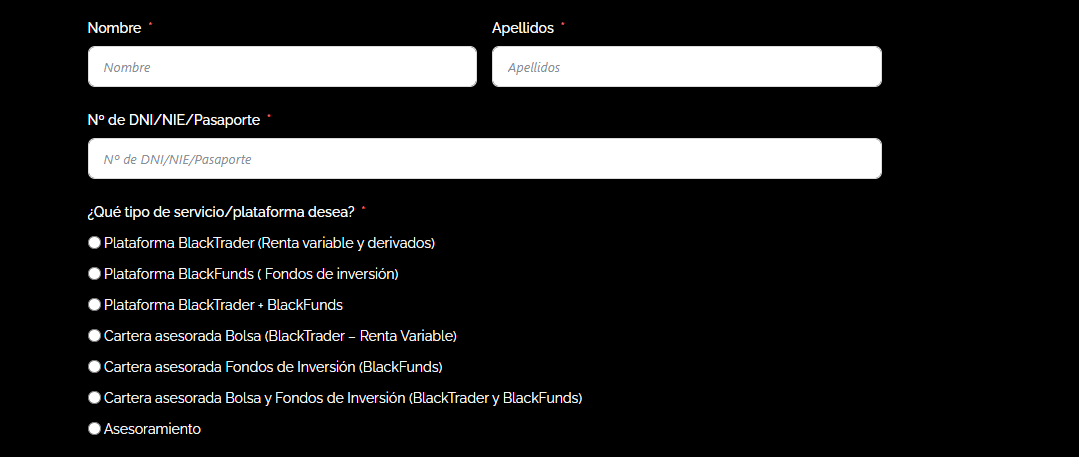

The user account on the Blackbird website is created in several stages.

To launch the registration process, click the “Abrir una cuenta” button.

Next, choose your preferred account type. If you are a retail investor, tick the Cuenta individual box.

In the form that opens, enter your first and last names, and your passport number. Also, choose the service that is your priority.

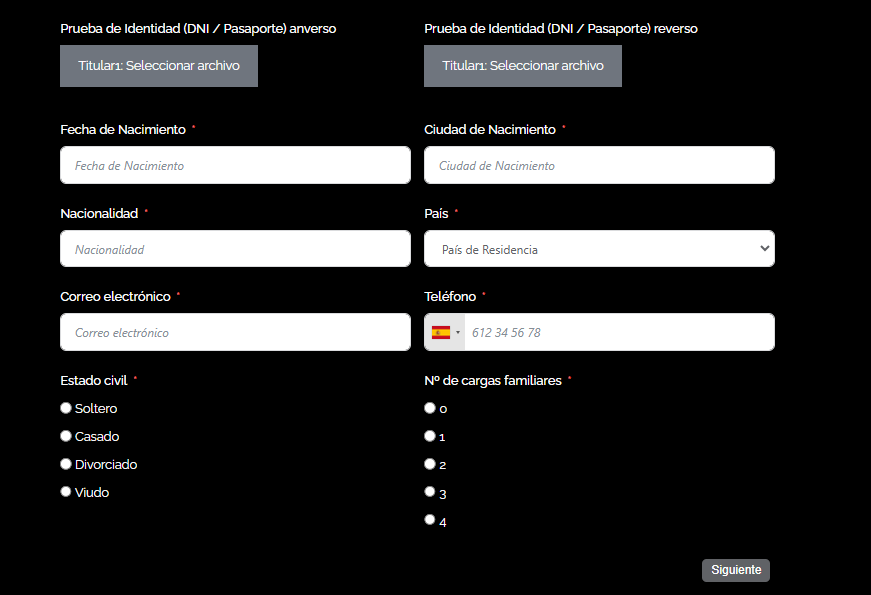

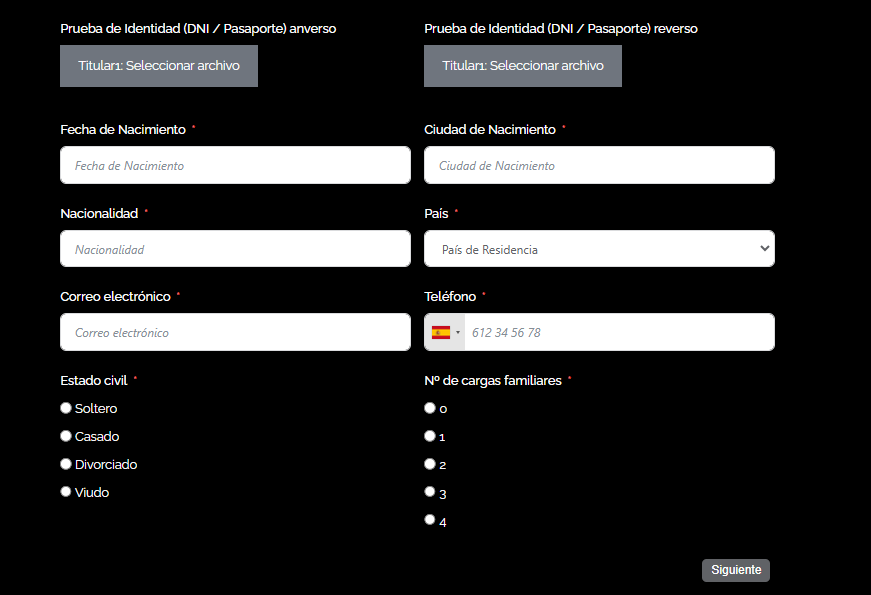

Further, upload your documents and provide additional personal data.

Regulation and safety

Blackbird has a safety score of 9/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 13 years

- Strict requirements and extensive documentation to open an account

Blackbird Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CNMV CNMV |

Comisión Nacional del Mercado de Valores | Spain | Up to €100,000 | Tier-1 |

Blackbird Security Factors

| Foundation date | 2012 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Blackbird have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Blackbird with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Blackbird’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Blackbird Standard spreads

| Blackbird | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,1 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,3 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,7 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Blackbird RAW/ECN spreads

| Blackbird | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,50 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,12 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Blackbird. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Blackbird Non-Trading Fees

| Blackbird | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

To get access to BlackTrader, become the broker’s client. To register, it is required to fill in a special form and provide the necessary documents. To activate the account, fund it with any amount.

Account type:

Before opening a trading account, you can train in a demo mode of the platform. This service is free and allows traders to work on the real market with virtual funds.

Blackbird provides access to numerous financial markets in different countries. Among available financial instruments are stocks, investment funds, futures, options, and CFDs.

Deposit and withdrawal

Blackbird received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

Blackbird offers limited payment options and accessibility, which may impact its competitiveness.

- Minimum deposit below industry average

- No deposit fee

- Bank wire transfers available

- Low minimum withdrawal requirement

- Only major base currencies available

- USDT payments not accepted

- BTC not available as a base account currency

What are Blackbird deposit and withdrawal options?

Blackbird offers a limited selection of deposit and withdrawal methods, including Bank Wire. This limitation may restrict flexibility for users, making Blackbird less competitive for those seeking diverse payment options.

Blackbird Deposit and Withdrawal Methods vs Competitors

| Blackbird | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Blackbird base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Blackbird supports the following base account currencies:

What are Blackbird's minimum deposit and withdrawal amounts?

The minimum deposit on Blackbird is $1, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Blackbird’s support team.

Markets and tradable assets

Blackbird offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 50 Forex pairs.

- 50 supported currency pairs

- Commodity futures are available

- Indices trading

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by Blackbird with its competitors, making it easier for you to find the perfect fit.

| Blackbird | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 2800 | 1200 | |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | Yes | Yes | No |

Investment options

We also explored the trading assets and products Blackbird offers for beginner traders and investors who prefer not to engage in active trading.

| Blackbird | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Technical support is available 365/24/7. Physical offices in Barcelona and Madrid accept clients from 9:00 to 18:00 (GMT+1) Monday through Friday.

Advantages

- Communication with support is available in a live chat on the website and instant messengers

- 24/7 support in Spanish

Disadvantages

- Responses in a live chat are sometimes delayed

- No call-back option

Traders can contact the company using the following communication channels:

Live chat;

Telephone numbers, provided on the broker’s website;

Email;

WhatsApp;

Telegram.

The Contact section has a ready-made form to ask for assistance by email.

Contacts

| Foundation date | 2012 |

|---|---|

| Registration address | Av. Diagonal, 413, L'Eixample, 08008 Barcelona, Spain |

| Regulation | CNMV, FINRA, SIPC |

| Official site | https://blackbird.es/ |

| Contacts |

932713315

|

Education

The Blackbird website doesn’t contain education for novice traders, but it offers training for professionals in different formats. Its clients get access to a 90-hour video course, webinars, interactive practical seminars, trading sessions with experienced traders, and personalized education. The demo mode of the trading platform is used to study its interface and to learn how to invest.

Blackbird offers paid courses on stock markets worth €350 and €2,240. They combine theory with practice and provide real advice from experts who trade on stock exchanges professionally.

Comparison of Blackbird with other Brokers

| Blackbird | Eightcap | XM Group | RoboForex | Markets4you | Kama Capital | |

| Trading platform |

BlackTrader | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MobileTrading, MT5 | MetaTrader5 |

| Min deposit | $1 | $100 | $5 | $10 | No | No |

| Leverage |

From 1:1 to 1:30 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:10 to 1:4000 |

From 1:1 to 1:400 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 7 points | From 0 points | From 0.8 points | From 0 points | From 0.1 points | From 0 points |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 20% | 20% / No |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | Yes |

Detailed review of Blackbird

Blackbird is regulated in Spain at the state level and participates in FOGAIN. The company strictly adheres to the investment services standards. It partners with Interactive Brokers and Banco Inversis which provide the broker’s clients with services of execution and custody of funds and assets. Investment products are available to every broker’s client. However, traders with capital from €25,000 have more options and opportunities.

Blackbird by the numbers:

12+ years of working on global stock exchanges;

Access to securities markets of 15 countries;

30+ selected investment funds with forecast profitability;

Trading platform is compatible with 3 operation systems;

Investment into 9 asset classes.

Blackbird is a broker that offers platforms with clever routing and access to advanced order types

The BlackTrader platform is suitable for both experienced and novice traders. It helps to conduct deep market analysis, manage funds, and trade stocks, options, futures, CFDs, currencies, and ETFs. The convenience and versatility of BlackTrader made it the best platform at Barron’s Awards.

In addition to the functional trading platform, Blackbird has high-quality order execution, for which it received awards over 11 years. The platform has a clever routing system that provides the best execution. It supports over 60 order types, which allows traders to use most of their strategies and capital. Also, the Chart Trader market evaluation program developed by Blackbird is available to its clients.

Useful services offered by Blackbird:

Reuters and Bloomberg TV newsfeeds are integrated into BlackTrader;

Free webinars and group seminars held by professional speakers;

Real-time trading alerts, risk tools, and main market data by Thomson Reuters;

Demo mode of the trading platform;

Free basic analytics and more advanced research with a monthly subscription of €35-€75.

Advantages:

The broker has been on the market since 2012 and regulated by CNMV since 2017;

Trading on all available markets from one account;

Wide range of trading instruments;

Proprietary trading platform suitable for traders with varied experience;

Efficient technical support that helps to solve relevant issues and problems; it is also available in popular messengers.

Blackbird strives to regularly introduce new technologies and provide innovative solutions for online trading and financial services. One of the latest offers was Private Banking and building investment portfolios.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i