CWG Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT5

- FCA

- 2020

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT5

- FCA

- 2020

Our Evaluation of CWG Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

CWG Markets is a broker with higher-than-average risk and the TU Overall Score of 3.44 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by CWG Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

CWG Markets is a CFD broker, that positions itself as an optimal platform for novice traders, but in reality, professionals also benefit significantly from working with this broker. The ease of work is defined by the wide variety of assets, moderate leverage, and additional earning options. This broker operates transparently and CWG Markets is a regulated organization. However, it lacks copy trading and a standard referral program. Traders have access to only one platform, albeit a top-notch one. Regional restrictions are not a unique feature as all brokerage companies have them. Considering all these factors, the platform can be recommended for exploration.

Brief Look at CWG Markets

CWG Markets offers over 500 CFDs on currency pairs, stocks, indices, metals, commodities, and commodity futures. Traders can open a demo account for free to explore the platform's features before transitioning to a live account. There are three live account types, each with different spreads and trading commissions. The minimum deposit starts at $50, and the maximum leverage is 1:100. Spreads start from 0 pips. The Classic account has no commissions, while the Advanced and Institutional accounts have commissions of $3 and $1.5 per lot, respectively. Deposits and withdrawals can be made via bank transfers, as well as through Skrill and Neteller systems, with no fees. There is no negative balance protection. Traders have access to only one trading platform — MT5. Alternative earning options include accounts and IB partnerships. The education provided is basic, with a lot of current analytics available. The technical support operates 24/5.

- The Classic account includes a low entry threshold of $50 with a free demo account.

- Flexible conditions with three real accounts offering different spread/commission parameters for specific needs.

- A wide range of assets from six different groups and flexible leverage from 1:1 to 1:100, offering high-profit potential.

- Objective low costs, thanks to spreads starting from 0 pips and trading commissions of up to $3 per lot.

- This broker provides popular deposit and withdrawal options without imposing fees, except for bank fees. MAM and PAMM accounts are among the most sought-after passive income options on modern brokerage platforms.

- The MetaTrader 5 trading platform is user-friendly, packed with useful features, and customizable to the user's preferences.

- This broker does not offer other passive income options apart from joint accounts.

- The platform has some regional restrictions.

- Technical support operates 24-hour but only on weekdays, so it is unavailable on weekends.

TU Expert Advice

Financial expert and analyst at Traders Union

CWG Markets is the trading brand of CWG Markets Ltd. The company is registered in England and Wales. Like all British brokers, CWG Markets is regulated by the Financial Conduct Authority (FCA), one of the leading regulators in both the local and international markets.

This broker offers fairly standard conditions for top positions in its segment, but they have several constructive advantages. A minimum trade size of 0.01 lots, a stop-out level at 100%, and a free demo account are features that CWG Markets is unlikely to surprise anyone with. More interesting are the raw spreads starting from 0 pips and regular spreads starting from 1 pips. Moreover, the commission on an account with raw spreads is $3 per full lot, which provides exceptional financial benefits when compared to offers from its leading competitors.

This broker does not charge fees for deposits or withdrawals. They offer only three channels: Neteller and Skrill, plus bank transfers. However, in certain regions, other deposit and withdrawal methods are also available, such as Union Pay. This detail should be clarified with client support. Fortunately, client services are available 24/5, i.e., not on weekends, which can be considered a drawback.

CWG Markets offers modern-level MAM and PAMM accounts, meaning they come with a lot of customization options. For example, there's the ability to automatically distribute profits in proportions or percentages, or the manager can do it manually. Furthermore, a trading advisor can become a manager. Undoubtedly, some of these options may seem risky, but this broker, by minimizing its limitations, allows clients to earn most conveniently using them. According to user reviews, it works very well.

Regional restrictions are minimal. The absence of copy trading and a typical referral program is, of course, a drawback, but not a critical one. However, this broker offers an IB partnership, provides basic education, and offers a substantial amount of current analytics. The only tool is an economic calendar. Considering all these factors, the experts at Traders Union see no reason why a beginner or experienced trader wouldn't consider working with this broker.

CWG Markets Summary

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. CWG Markets Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | МТ5 |

|---|---|

| 📊 Accounts: | Demo, Classic, Advanced, Institutional |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Skrill, Neteller, bank accounts, regional systems |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to1:100 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | CFDs on currency pairs, stocks, indices, metals, commodities, and commodity futures |

| 💹 Margin Call / Stop Out: | Yes |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

Demo account can be opened for free, There are three live, low entry threshold, Low trading costs and no withdrawal fees, MAM and PAMM accounts, Trading is conducted through MT5, Basic training and lots of analytics, Economic calendar is available. |

| 🎁 Contests and bonuses: | Yes, including rebates from TU |

Typically, when a broker offers multiple live accounts, the minimum deposit differs for each of them. CWG Markets clients can open one of three account types: Classic, Advanced, and Institutional. The minimum deposit for these accounts is $50, $200, and $50,000, respectively. The leverage does not vary depending on the chosen account type as it is determined solely by the traded asset. The maximum trading leverage is 1:100. Traders are not obligated to use leverage. Client support is available 24/5, which means that on weekends, traders are left to handle their issues on their own. The available communication channels include two call centers, email, support tickets on the website, and live chat.

CWG Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

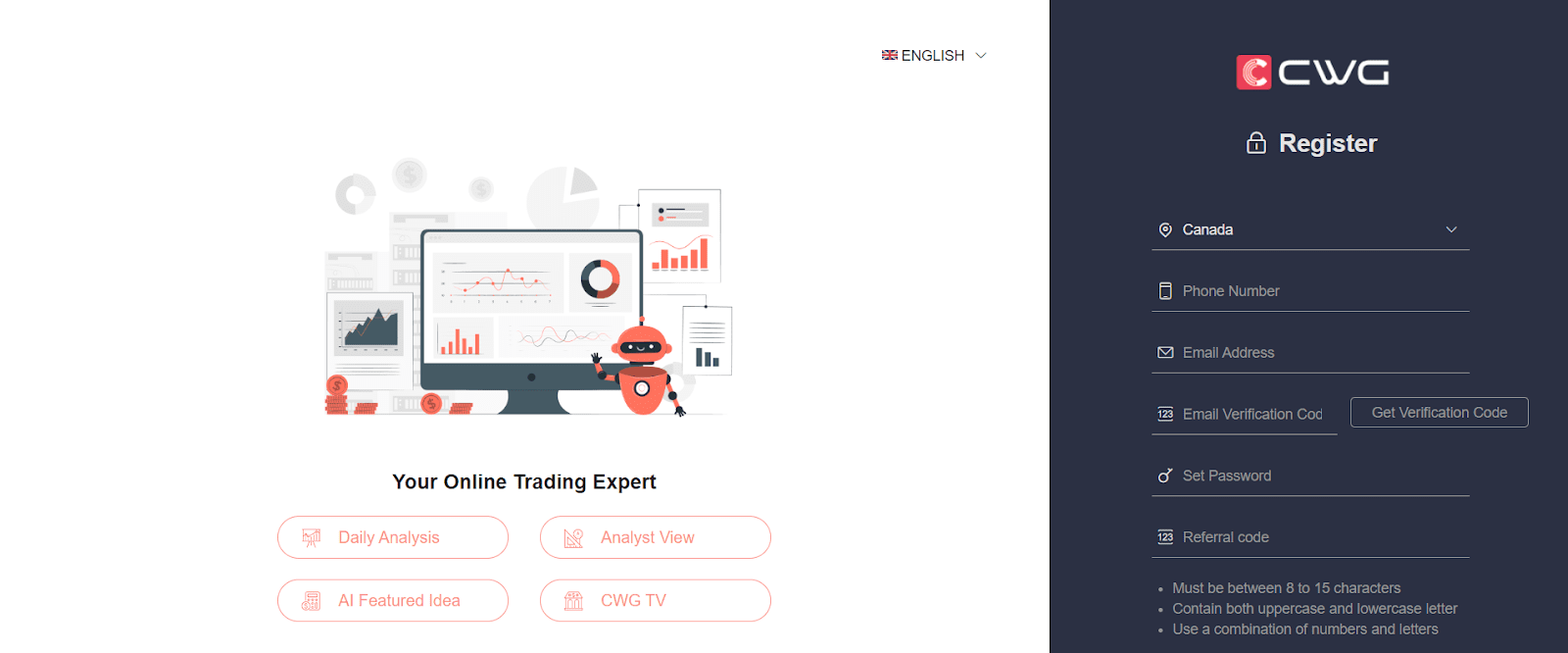

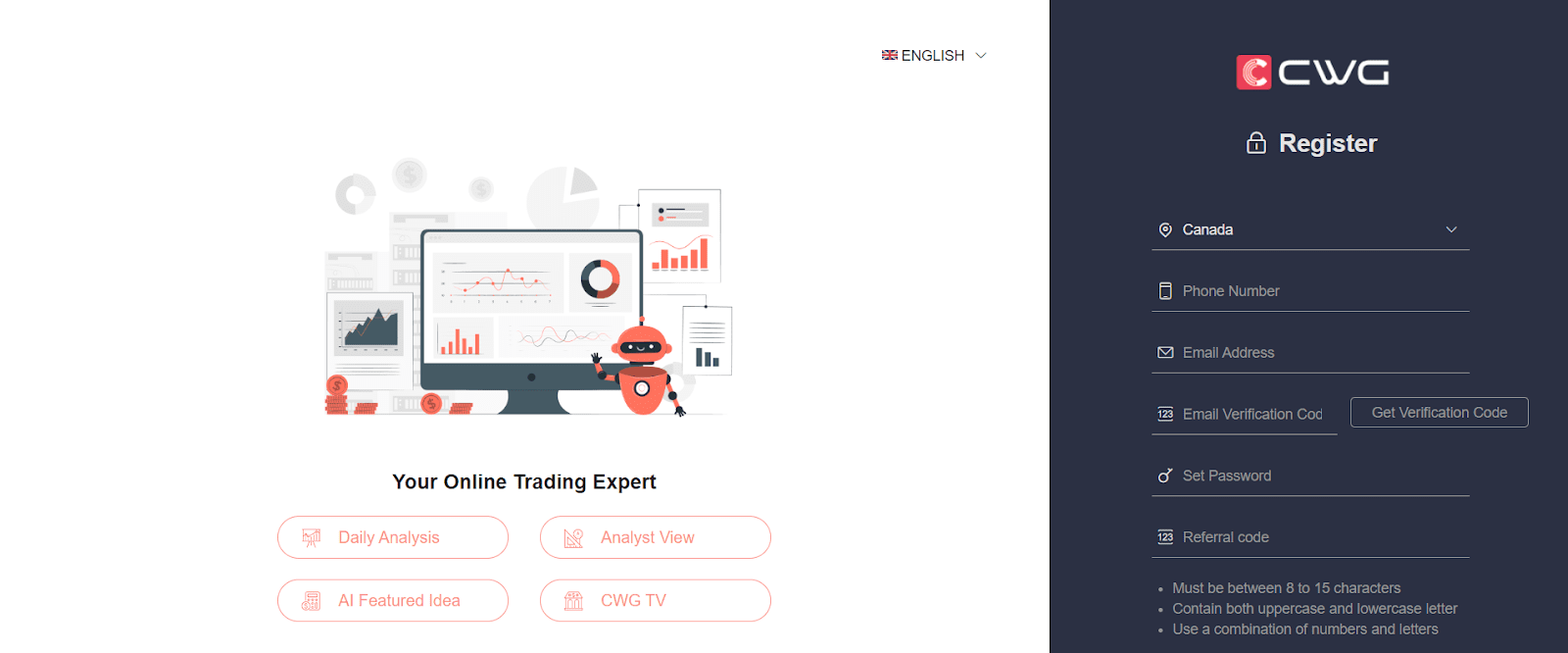

To begin trading with this broker, register on its official website. During registration, you'll need to undergo verification to confirm your personal information. Afterward, the trader selects account parameters, makes a deposit, and downloads and installs the trading platform. TU experts have outlined the entire process step by step to address any questions. They have also presented the capabilities of this broker's user account.

Go to this broker's official website. In the top right corner, click on the "Create Account" button.

Choose your preferred language and account type. Provide your first and last name and select your country of residence from the list. Enter your email address and phone number. Click "Continue."

Select the MT5 trading platform, account type, and account currency. Create a password and confirm it. Enter additional information about yourself: date of birth, gender, nationality, and type and number of identity document. Specify your occupation and optionally provide additional personal information. At the bottom of the registration form, enter your tax information.

Enter your complete registered address with your postal code. Indicate how long you have lived at this address. Check other details and enter any missing ones, e.g., a second email. Note that if your registered and residential addresses are different, you need to provide both addresses, and there are separate sections for this on the page.

Provide your bank account details. Answer a few questions about your financial circumstances and priorities.

Answer a few questions about your trading experience. Fill in the last section of the registration form by simply selecting the appropriate answer. Click “Next.”

Read the document that contains the terms and conditions of collaboration. Agree to them by checking the box. Click “Next.”

Check the data entered in the previous steps. If necessary, go back and correct them. After verification, click "Confirm."

You will receive a confirmation email at the provided email address. Return to the website and enter your login (email address) and password (previously specified) to access the user account.

Go to the "Documents" section, then to “My Documents”. Upload scans/photos of documents confirming the following information: address, secondary address, and identity. You will also need to provide two additional documents.

Go to the "My Accounts" section. Click "Create New." You will need to create a digital signature. Follow the on-screen instructions and wait for confirmation. Afterward, choose the parameters for the real account and create it.

Go to the "Transfers" section. Select the funding channel (bank account, Skrill, Neteller), enter the amount, and follow the on-screen instructions. Wait for the balance to be replenished.

Finally, download the trading platform. You can do this on this broker's website or on the MetaTrader portal. Choose the appropriate version, get the distribution, and install it on your device. Use your registration details to log in and start trading.

Your CWG Markets user account also provides access to:

-

Dashboard. Here, you can view the status of active accounts, and current and completed trades. The block also includes trading hours, news, and other useful information. Generating various reports is available here.

-

My Accounts. In this section, the trader can open new accounts and close existing ones. Note that this only applies to real accounts; demo account registration is done through the website.

-

Transfers. This option is for depositing and withdrawing funds. Current methods include Skrill, Neteller, and bank accounts. Additional channels may be available for some regions. Check with client support.

-

Documents. Here, the trader uploads scans for verification and, if necessary, replaces already uploaded files, which requires new verification. This section also contains this broker's official documents.

-

Profile. Modifying personal data after registration is not possible, but you can change your password, add a channel for deposit/withdrawal, and configure promotional newsletters.

Regulation and safety

A broker must be registered as a financial organization, otherwise, it is a fraudster. Official registration confirms the legality of the company's activities. Whereas regulation indicates its financial transparency and client orientation. The regulator on its part undertakes to protect the interests of traders in disputable situations. CWG Markets Ltd, which owns the CWG Markets trademark, is registered in the UK, under license number 08888720. This broker's activity is monitored by the Financial Conduct Authority (FCA), and it can be found in the management register under the number FRN 785129. Thus, clients of this broker can be assured that they are working with a reliable proven platform, which upholds its obligations.

Pros

- The company is officially registered in the U.K.

- This broker is regulated by the FCA

- Contact Traders Union’s legal department for a consultation and representation. It protects its members’ rights without charge.

Cons

- Regulators other than the FCA will not be able to help a broker’s client

- Clients will get nothing from contacting local financial authorities if he lives outside the UK

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Classic | From $10 | No |

| Advanced | From $0 | No |

| Institutional | From $0 | No |

As for the question about withdrawal fees, CWG Markets has something with which to pleasantly surprise its clients. They don't charge anything for withdrawals. The trading channel selected, the amount, and the frequency of transactions are irrelevant. This is noteworthy because many platforms charge 1-2% of the withdrawal amount. Users should keep in mind that fees may be levied by a third party involved in the withdrawal, such as a bank. This broker has no connection to such fees, and traders need to clarify all such details in advance. The table below provides data on the average trading fees for CWG Markets and two other brokers. This allows for an assessment of the platform's competitiveness.

| Broker | Average commission | Level |

|---|---|---|

|

$3.3 | |

|

$1 | |

|

$8.5 |

Account types

Start by choosing an account type. CWG Markets offers three, each with different spreads and trading commissions. The Classic account is positioned as an account for beginners, the Advanced account suits most traders, and the Institutional account, as the name suggests, is for large corporations. You should also consider the minimum deposit, as it varies for each account. All other parameters are the same. Leverage depends on the user's status and the traded asset. The range of trading instruments is the same for all accounts. Choosing a trading platform is straightforward since CWG Markets only works with one solution – MetaTrader 5. There are versions available for all devices and operating systems. Traders who want to trade from anywhere can use the mobile MT app, allowing them to monitor their accounts and execute trades with a smartphone in hand.

Account types:

Typically, if a trader has not previously traded with a chosen broker, they first open a demo account. But why bother if you can't earn anything on a demo account? The point is that such an account provides access to the real market, but trading is done with virtual currency. This allows traders to explore this broker's capabilities in real conditions and refine their strategies. Later, if everything suits them, they can open a real account based on their trading preferences and start making full-fledged trades.

Deposit and Withdrawal

If a trader is using a demo account, they cannot make a profit since all trades are conducted with virtual currency.

On a real account, the trader makes full-fledged trades, and if they are successful, they earn income, which replenishes their balance.

This broker's client can withdraw profits in full or in part at any time through the corresponding option in the user account.

Currently, the main withdrawal options are Skrill and Neteller, as well as wire transfers.

In the withdrawal section of the user account, the trader can choose an alternative channel, for example, Union Pay.

Withdrawal requests are processed on the day of submission, excluding weekends, and the funds take up to 3 days to arrive.

This broker does not charge withdrawal fees, but sometimes they are imposed by a third party, such as a bank.

Investment Options

Traders come to brokerage platforms primarily to trade independently and earn profits. However, if a user sees a good opportunity for passive income, they will certainly take advantage of it. For this reason, some brokers offer investment programs. These can be cryptocurrency staking or dividend stocks, but more often, they involve three of the most in-demand options: copy trading, joint accounts, and an affiliate program. CWG Markets clients can use joint accounts. Additionally, IB partnership (plus White Label for corporate clients) is also available.

Joint accounts

CWG Markets offers MAM and PAMM accounts, which are the most popular, and there is no fundamental difference between them in terms of profit mechanisms. A trader can register as a manager of a joint account or as an investor. The manager controls their account, which is the main account, as well as the investors' accounts (sub-accounts). They make trades with the joint capital, and all trading decisions lie solely with them. On the investor's side, there are certain limitations they can impose to protect themselves. For example, if the manager places a $1,000 trade, the investor can ensure that no more than $200 is deducted from their account. There's also an automatic risk-tracking system that prevents the sub-account from participating in certain trades. There are many settings on both sides, they are intuitive and highly useful. If the manager's trade is successful, everyone profits based on their investments (or the manager distributes the profit manually). In case of an unsuccessful trade, everyone, including the manager, loses their trades. The manager additionally earns commissions from the investors, while investors trade 100% passively with reduced risk.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

IB (Introducing Broker) Partnership

Any trader can apply for an IB partnership, but it's essential to understand that it involves actively promoting this broker's services. This means that a potential partner must have the capability to make marketing offers to a broad audience. If a trader lacks such a capacity, this broker will reject their partnership request. CWG Markets, on its part, provides ready-made promotional materials and client acquisition mechanisms. The partner's task is to invite as many traders as possible to the platform. The advantage for the referred traders is gaining access to unique bonuses from this broker, which are unavailable to regular users. The partner earns a commission for each trade made by the referred trader. Moreover, there is no limit to the number of referrals. Potentially, IB partnership can even become the primary source of income, but it requires significant online activity and a wide reach.

Customer support

Can bank transfers be used to fund the account? Can funds be withdrawn through WebMoney in Europe? What will be the commission for trading American company stocks? In reality, there are hundreds or even thousands of questions that traders may have, regardless of their experience. And even an extensive FAQs section may not help in some cases. Moreover, unforeseen situations and real problems arising during trading or deposit/withdrawal may occur. In any case, the trader contacts client support, receives a prompt and competent response, or an operational solution, and then continues trading. This is ideal! However, if the support responds slowly or cannot resolve the issue, the user may become disappointed and switch to a competitor. Such a scenario, even without this broker's significant fault, is almost inevitable in case of financial loss. CWG Markets seeks to prevent complaints against itself by offering competent client service. Specialists are available by phone, email, live chat, and through tickets. Client support operates 24/5.

Pros

- You do not need to be a registered broker’s client to contact support

- The most popular communication channels are available.

- You can ask questions platform's specialists even at night

Cons

- Tech support specialists are not available on weekends and some holidays

Are you already a CWG Markets client? Or are you planning to become one? In either case, if you have a question, do not hesitate to call or write to the support managers. Here are the current methods:

Phone.

Email.

Live chat on the website and in the user account.

Tickets.

This broker has official pages on the following social media platforms: Facebook, X (formerly Twitter), LinkedIn, Instagram, and YouTube. You can also contact support managers there. This broker also recommended subscribing to stay informed about its events.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address | 76 Cannon Street, 3rd Floor, London, EC4N 6AE, United Kingdom |

| Regulation | FCA |

| Official site | https://www.cwgmarkets.co.uk/ |

| Contacts |

+44(0)2039471777

|

Education

Some platforms offer their clients educational materials. These may include articles, thematic blogs, collections of e-books, or online webinars. Their goal is to provide traders with basic and sometimes advanced knowledge in the field of financial markets. CWG Markets provides its users with several sources of useful and practically applicable information. For example, there is a detailed glossary that covers key terms, trading strategies, and methods. The website also has an FAQs section where not only the specifics of working with the platform, and MT5 trading platform are explained, but also the basics of trading. This broker regularly releases short videos with the latest news and current analytics that help traders of all levels. However, to access the full range of materials, registration is required.

The website does not have sections that provide in-depth explanations of specific trading methods. However, if a user has never encountered financial markets or has minimal experience working with them, they will undoubtedly find a lot of useful information here. Experienced market participants should pay attention to "CWG TV," where expert analysis is provided.

Comparison of CWG Markets with other Brokers

| CWG Markets | RoboForex | Exness | TeleTrade | FxPro | InstaForex | |

| Trading platform |

MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $50 | $10 | $10 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1 point | From 0.8 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 60% / No | 70% / 20% | 25% / 20% | 30% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of CWG Markets

CWG Markets Ltd is a major British fintech company that has been offering brokerage services for several years. To gain a clear understanding of the platform's technological capabilities, only one key aspect should be considered, and it is order execution in as little as 11.06 milliseconds. This is one of the lowest execution times in the market. The platform continually expands its asset pool and enhances its microservices infrastructure. Special attention is given to technical support, which receives predominantly positive reviews. And lastly, there is official regulation in place. FCA (Financial Conduct Authority), is the largest regulator in Europe and one of the most reputable globally. This is critically important because no broker's advantages matter if they cannot be trusted. CWG Markets Ltd is a trustworthy choice. This trust extends not only to global aspects of collaboration but also to local levels, as CWG Markets Ltd takes various measures to protect its clients, such as offering negative balance protection.

CWG Markets by the numbers:

The minimum spread is 0 pips.

The maximum commission is $3 per lot.

The minimum deposit is $50.

There are 500+ instruments from 6 groups available.

Client support operates 24/5.

CWG Markets is a reliable broker with convenient conditions

In addition to the commission policy, the platform's asset pool policy plays a critical role. When there are many assets available, traders have more earning opportunities, especially if this broker doesn't restrict their strategies and methods. Many traders appreciate CWG Markets for this reason. The platform provides access to hundreds of trading instruments of various types and imposes almost no limits. A large asset pool is beneficial because it allows the creation of a diversified investment portfolio, reducing potential losses when forecasts change abruptly. Another aspect is leverage. A leverage of 1:100 is considered optimal by many experts. The final factor contributing to the convenience of CWG Markets' trading conditions is the trading platform. MetaTrader 5 is an advanced solution with an intuitive interface and high adaptability. It's an excellent platform for users of all levels.

CWG Markets’ analytical services:

Joint accounts. MAM and PAMM accounts allow traders to trade as managers or investors. Managers earn additional profits from the commissions they charge, while investors trade passively with reduced risks.

Economic calendar. This basic tool for fundamental analysis provides a table with the most significant events in politics and the economy. Each event includes the asset affected and a forecast of how it will impact its quotes.

Analyst view. This constantly updated feed displays the latest news that has led to changes in the quotes of various trading instruments. CWG Markets also has a proprietary television channel featuring news analysis.

Advantages:

This broker operates transparently, immediately informing traders of all fees and charges so they are aware of every expense.

You can start with a free demo account, and the minimum deposit for a real account is only $50.

This broker's website includes FAQs on trading and a glossary, plus it regularly publishes news with current analytics.

Traders can work at their own pace with no restrictions, including the use of bots and advisors.

Traders who are tired of active trading have the option to invest in MAM and PAMM accounts and earn passive income.

The platform features a simple and user-friendly interface, quick registration, and responsive client support.

User Satisfaction i