deposit:

- $50

Trading platform:

- cTrader

- MetaTrader4

- MetaTrader5

- 0%

Errante Review 2024

deposit:

- $50

Trading platform:

- cTrader

- MetaTrader4

- MetaTrader5

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Errante Trading Company

Errante is a high-risk broker with the TU Overall Score of 2.74 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Errante clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. Errante ranks 341 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Trading, deposit, and withdrawal conditions for Errante clients vary depending on their country of residence.

Errante is an international broker that was registered in 2019. Since March 2020 it has been regulated by the Cyprus Securities and Exchange Commission (CySEC). The company also has a subsidiary in Seychelles, which operates under a license from the Seychelles Financial Services Authority (FSA). Errante is a partner of leading banks and a member of reliable compensation and insurance funds. In 2021, Errante received an award at the Ultimate Fintech Awards, and in 2022, it was recognized as the Best ECN/STP Broker.

| 💰 Account currency: | EUR, USD |

|---|---|

| 🚀 Minimum deposit: | €50/$50 |

| ⚖️ Leverage: | For traders from the EU — up to 1:500 |

| 💱 Spread: | From 1.8 pips (Standard), from 1 pips (Premium), from 0.8 pips (VIP), from 0.0 pips (Tailor Made) |

| 🔧 Instruments: | Forex, shares, metals, energy, commodities, indices, cryptos (available through FSA regulated division) |

| 💹 Margin Call / Stop Out: |

CySEC — 100%/50% FSA — 100%/20% |

👍 Advantages of trading with Errante:

- Regulation by the Cyprus Securities and Exchange Commission (CySEC).

- Protection of client deposits through the Investors Compensation Fund's insurance program and compensation fund.

- Minimum deposit of $50/€50.

- A good choice of currency pairs.

- Dynamic leverage.

- Wide range of trading accounts.

- Adaption of trading conditions to meet local financial regulatory requirements.

👎 Disadvantages of Errante:

- Errante CopyTrade service is available only for non-EU nationals.

- The broker does not offer cent accounts.

- Traders from the EU cannot deposit or trade cryptocurrencies.

Evaluation of the most influential parameters of Errante

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Errante

Errante has been providing access to Forex and CFDs since 2019, and during this time, it has not manifested any frauds, scams, or dishonest activity. On the contrary, its activity is recognized with awards for high-quality services, fast development, and best execution of orders. Errante’s website and user accounts are available in 13 languages.

According to CySEC's policy, Errante divides clients into two groups — retail and professional. Trading conditions change depending on the qualifications, additional services, and other particulars. When opening a trade account with Errante, the trader must confirm that they are familiar with the basics of Forex and risk management. The registration form includes 12 questions that must be answered.

For retail trading, the broker offers 4 account types. The swap-free feature is available on each of them, but it can only be activated by Muslim traders. Errante also provides demo accounts that can be used without a time limit. However, if there is no activity on the demo account for 90 days, the company will block it. In the case of real accounts, inactivity without penalty sanctions is possible for up to 12 months, so they can be used for long-term strategies.

Dynamics of Errante’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Errante’s clients can earn passive income, but the methods available differ depending on the country of residence. EU citizens are limited in their choice of investment solutions. They are allowed to use expert advisors for automated trading, but CopyTrade and its affiliate programs are not available.

Errante’s copy trading service provides passive income:

For clients who are non-EU residents, Errante provides access to its CopyTrade platform. With it, investors can duplicate trades made by traders who trade on MT4 and MT5 platforms. If the copied trade generates profit for the investor, they pay a commission to the provider based on his performance. Errante’s CopyTrade features include:

Investors can set stops and limits to manage risk.

There are over 700 trading signal providers available for copying. The ranking of the best traders is presented in the user account on the company’s website.

For successful trading, the trader receives 5%-40% of the investor’s profit.

The minimum investment amount to start copy trading is $100. However, the ranking also includes traders who require investors to deposit $25,000-50,000.

Signals providers can be sorted by 8 criteria, including maximum yield per day, the total amount of managed investments, and the size of the trades for successful trades. Errante regularly evaluates the performance of registered signals providers and offers investors detailed information about their trading, including charts.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Errante’s affiliate programs

Traders from non-EU countries can earn a referral fee by registering as an IB (Introducing Broker). Errante gives the IBs a part of its commission from trades made by their referred clients.

Affiliate programs are not available to clients from the European Union.

Trading Conditions for Errante Users

Trading conditions for traders from different regions differ. Errante has representative offices in Cyprus and Seychelles. Traders from EU countries trade under the regulation of CySEC, so they are limited in terms of leverage, choice of platforms, payment systems, services, and assets. For example, they cannot trade cryptocurrencies or copy trade. The commission rates for all Errante clients are the same, and the available account types do not differ.

$50

Minimum

deposit

1:500

Leverage

24/5

Support

| 💻 Trading platform: | MetaTrader 5 (for all regions), MetaTrader 4 and cTrader (for outside the EU) |

|---|---|

| 📊 Accounts: | Demo, Standard, Premium, VIP, Tailor Made |

| 💰 Account currency: | EUR, USD |

| 💵 Replenishment / Withdrawal: | Bank wire transfer (Swift, Sepa), debit/credit cards, e-wallets (Skrill, Neteller, SticPay, Perfect Money, Advcash, and others) |

| 🚀 Minimum deposit: | €50/$50 |

| ⚖️ Leverage: | For traders from the EU — up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1.8 pips (Standard), from 1 pips (Premium), from 0.8 pips (VIP), from 0.0 pips (Tailor Made) |

| 🔧 Instruments: | Forex, shares, metals, energy, commodities, indices, cryptos (available through FSA regulated division) |

| 💹 Margin Call / Stop Out: |

CySEC — 100%/50% FSA — 100%/20% |

| 🏛 Liquidity provider: | Major quote providers (not disclosed) |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | The trading terms vary depending on the client’s jurisdiction |

| 🎁 Contests and bonuses: | No |

Comparison of Errante with other Brokers

| Errante | RoboForex | Pocket Option | Exness | Octa | InstaForex | |

| Trading platform |

cTrader, MetaTrader5, MetaTrader4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $50 | $10 | $5 | $10 | $25 | $1 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.8 point | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 30% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Broker comparison table of trading instruments

| Errante | RoboForex | Pocket Option | Exness | Octa | InstaForex | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Errante Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | $18 | Yes |

| Premium | $10 | Yes |

| VIP | $8 | Yes |

| Tailor Made | $0 | Yes |

For positions held overnight, a swap commission is applied except on swap-free (Islamic) accounts, which are opened at the request of the trader.

To determine how beneficial Errante’s commissions are for traders, Traders Union analysts compared them with fees from other Forex brokers. The table below shows the results of the research.

| Broker | Average commission | Level |

| Errante | $9 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed review of Errante

The Errante broker offers individual and corporate accounts for secure trading on the interbank market. Errante applies the most advanced encryption technologies to protect its client’s personal data and funds, to collaborate with Lloyd’s of London Insurance Corporation. Errante keeps traders’ deposits in segregated accounts in major banks. It also provides services worldwide, while adapting trading conditions to the requirements of local financial market regulations.

Errante by the numbers:

-

Over 4 years of providing brokerage services.

-

2 regulated branches.

-

Over 100 trading instruments.

-

Client insurance up to €1,000,000.

Errante is a broker that takes into account the different needs and requirements of traders

Errante allows its clients to trade currency pairs, metals, energy and commodities, shares, and stock indices with leverage. The broker does not provide access to stock exchanges, so trading with assets is conducted in the form of CFDs. This means that traders earn not by buying or selling real financial instruments, but by trading contracts for differences in their prices. Trading conditions for each trader vary depending on the country of their residence and the amount of capital they have. There is no limit on the maximum number of orders. The total volume of open positions on accounts with deposits up to €5000 cannot exceed 50 lots and 80 lots for deposits of €5.000 and higher.

European traders can trade on the MetaTrader 5 platform. It needs to be installed on a device with a Mac, Windows, Android, or iOS operating system. Clients from other countries can choose from MT4, MT5, and cTrader, including the web versions of these platforms.

Errante’s analytical services:

-

Market analysis. At the beginning of every week, the company's website features a new review. The latest news that can affect the value of different assets is also regularly published.

-

Webinars. These are conducted by Errante experts in English and Italian. Any broker's client can apply to participate in the webinar. The past online sessions are available in recordings.

-

Errante calculators. With their help, a trader can compute the size of swaps for short and long positions, as well as the margin size and the cost per point for a specific asset.

Advantages:

The broker provides access to trading with more than 50 currency pairs 5 days a week.

For accounts with a deposit of €5,000 or more, a VPS server is provided free of charge.

Every Errante client can participate in educational and analytical webinars.

Accounts with individual trading conditions, a personal manager, and an extended range of educational materials are available.

Different styles and strategies are allowed, including algorithmic trading using advisors, scalping, and hedging.

Errante provides free market analysis, and trading calculators for Forex traders, and conducts online seminars to improve the professionalism of its clients.

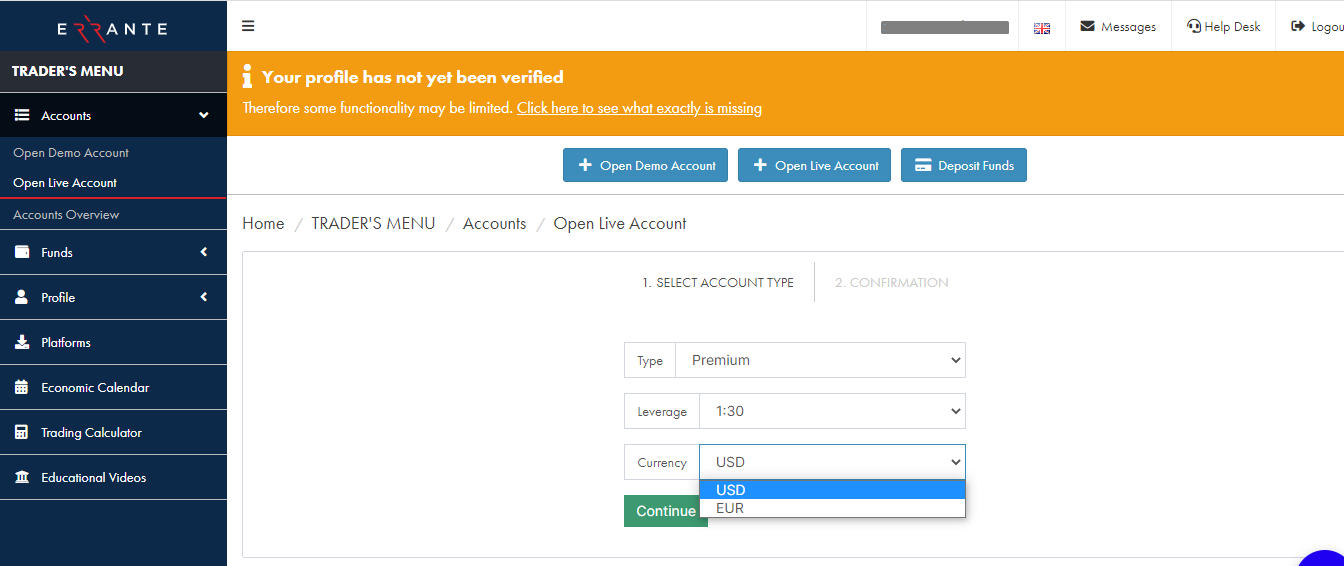

Guide on how traders can start earning profits

Errante offers various types of accounts for real trading. Each client can open 2 trading accounts: one in USD, and the other in EUR. Muslim traders can request an Islamic account (swap free), on which no commission will be charged for carrying an open position overnight. Errante’s accounts differ in minimum deposit amounts and trading commissions.

Account types:

In addition to real accounts, the broker also offers demo accounts with an unlimited time period.

Errante allows each trader to choose an account with acceptable commissions and minimum deposit size. You can also test the broker’s trading conditions on demo accounts.

Investment Education Online

On the Errante website, there is an Education Centre section that features educational videos, market analysis, and webinars. Video lessons are divided into two groups: Beginner and Advanced. Videos for beginners are available to any website visitor, while advanced videos are only available to Errante clients who have deposited at least 30 USD or EUR.

To practice trading on the Forex market, Errante recommends opening a demo account. It has no expiration date, so it can be used as long as necessary to develop trading skills.

Security (Protection for Investors)

Errante is a trademark owned by the Errante Group. It includes two companies. Notely Trading Ltd provides services to traders from Europe and is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 383/20. All client investments from the EU are protected up to a sum of €20,000 by the Investors Compensation Fund.

Errante Securities (Seychelles) Ltd serves residents of other countries and is supervised by the Financial Services Authority (FSA) under license number SD038. They have access to insurance from Lloyd’s of London up to a sum of €1,000,000. Funds are paid in the case of the broker’s actions that have caused financial losses to clients, such as errors, negligence, or fraud.

👍 Advantages

- Investments of clients from all jurisdictions are insured

- Errante’s financial performance is publicly available

- Regulators do not prohibit depositing and withdrawing funds using electronic payment systems

👎 Disadvantages

- The leverage for traders from the EU is limited to 1:30

- It is not possible to start trading without identity confirmation

Withdrawal Options and Fees

-

Errante clients can withdraw funds to a bank account, credit or debit card, Skrill, or Neteller. Traders residing outside of the EU can also withdraw in cryptocurrencies using SticPay, Perfect Money, Advcas, and local e-wallets.

-

The minimum withdrawal amount for bank transfers is €100 or $100; for cards and e-wallets, it is €20 or $20; and for cryptocurrencies, it is $50 (XRP, USDT-TRC20) or $100 (USDT-ERC20, BTC, ETH).

-

Requests for fund withdrawals are processed by the company from Monday to Friday, from 9:00 to 18:00 (GMT+2). Funds are credited to cards, e-wallets, and crypto wallets within 1 business day, and to bank accounts within 2-4 days.

-

If a client requests a withdrawal of more than 80% of the deposit made within 48 hours, but has traded less than two lots, the company withholds 5% of the requested amount. If more than 48 hours have passed, the commission is reduced to 3%.

Customer Support Service

Client support is available 24/5.

👍 Advantages

- You can quickly contact a representative of the company in chat and by phone

- Both broker's clients and guests can request support

👎 Disadvantages

- On Saturdays and Sundays, support is not available.

- You can't order a callback.

Support can be contacted in several ways:

-

Call the numbers listed in the contact section;

-

Send an email to the company;

-

Write to the LiveChat;

-

Fill out a contact form via email.

Clients can create a ticket with a description of the problem in their user accounts.

Contacts

| Foundation date | 2019 |

| Registration address | 7 Spyrou Kyprianou, 4042 Limassol, Cyprus |

| Official site | https://errante.eu/ |

| Contacts |

Email:

nfo@errante.eu,

Phone: +357 25 253300 |

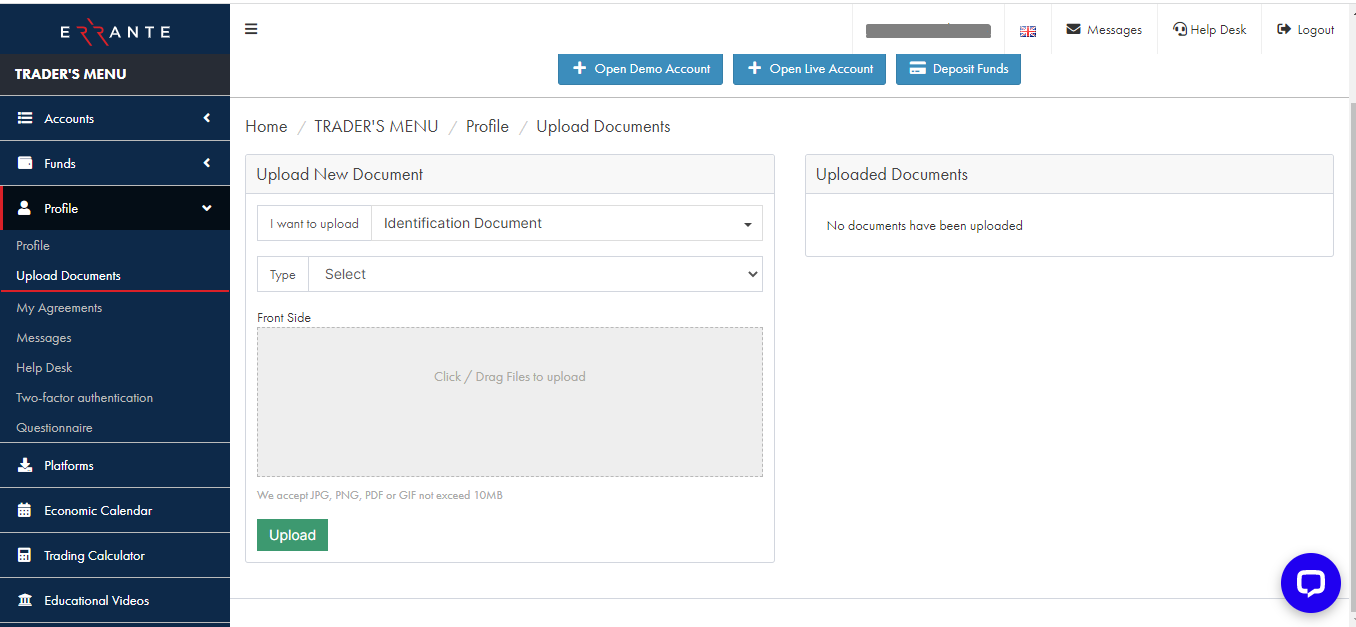

Review of the Personal Cabinet of Errante

To create a user account on the Errante website, you need an account:

To open the registration form, click on Register or Join Now.

Fill in the information requested by the broker in the form, including your last name, first name, phone number, and email. Indicate your country of residence and create a password to access your user account. After that, check your email: Errante will send you a PIN code for the first authorization of your account. Enter it in the registration form and then log in to your user account using your email address and password.

The first steps after registering with Errante’s user account include:

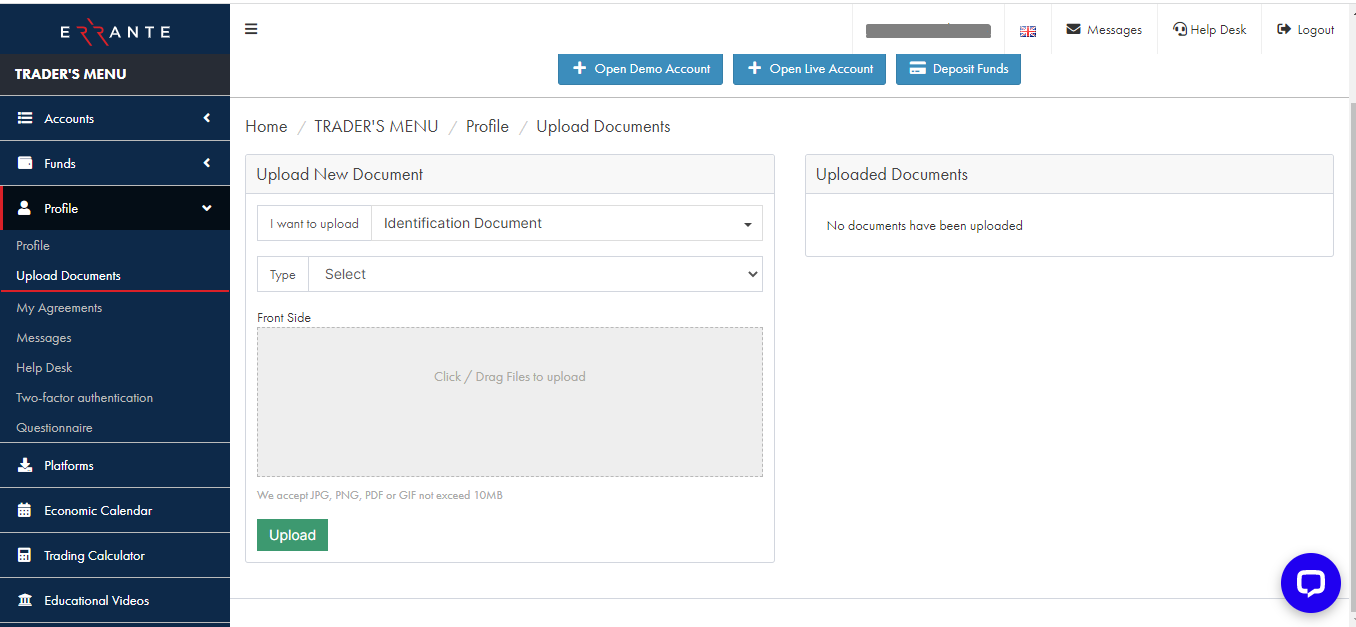

1. Providing screenshots of documents to confirm identity and place of residence:

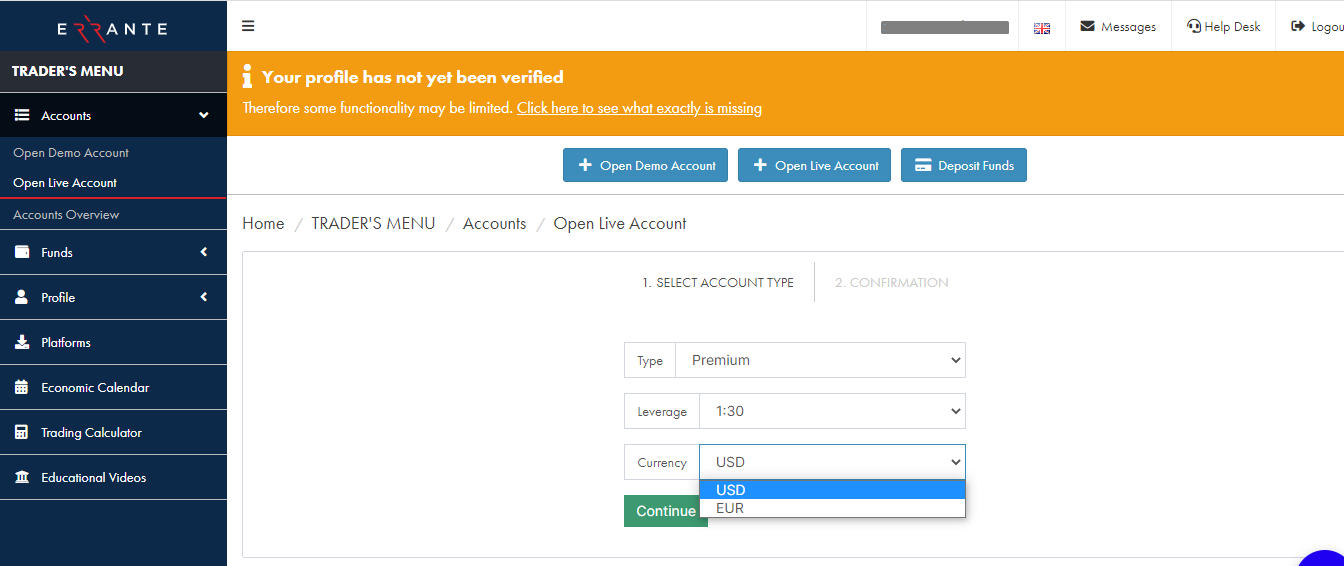

2. Opening a trading account:

1. Providing screenshots of documents to confirm identity and place of residence:

2. Opening a trading account:

Your Errante user account also provides access to:

-

Downloading the trading platform.

-

Opening demo accounts.

-

Making a deposit and transferring funds between accounts.

-

Submitting a request to withdraw profits.

-

Enabling two-factor authentication.

-

Creating a support ticket.

-

Viewing the Economic calendar and educational videos, using Errante calculators.

Articles that may help you

FAQs

Do reviews by traders influence the Errante rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Errante you need to go to the broker's profile.

How to leave a review about Errante on the Traders Union website?

To leave a review about Errante, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Errante on a non-Traders Union client?

Anyone can leave feedback about Errante on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.