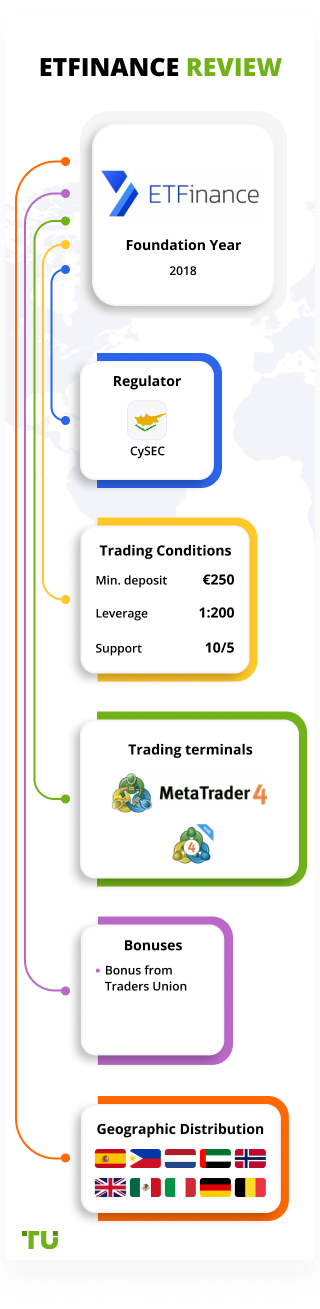

deposit:

- €250

Trading platform:

- MetaTrader4

- Web Trader MT4

- CySEC

ETFinance Review 2024

Attention!

This brokerage company is on the Blacklist. Working with companies on the Blacklist carries high risks of losing your money. We continuously monitor the Internet in order to identify new scams aimed at defrauding traders, and categorically do not recommend working with companies on the Blacklist.

We advise traders to choose reliable and trustworthy licensed companies from among top brokers of our rating:

Summary of ETFinance Trading Company

ETFinance is a Cypriot STP broker licensed by CySEC that has been providing online CFD — contracts for (price) differences — trading services since 2018. The company offers clients a wide range of CFDs that support leveraged trading and provides the most popular contracts among Forex traders operating a MetaTrader 4 platform. The CFDs offer traders and investors an opportunity to profit from price movement without owning the underlying asset. ETFinance was awarded over 10 awards from European financial publications. In 2020, the company was recognized as the Best Forex CFD Provider and Best CFD Broker Europe by World Finance and Global Banking & Finance resources

👍 Advantages of trading with ETFinance:

- Over 750 trading instruments.

- A license from the CySEC regulator.

- Deposit insurance for up to €20,000 per client.

- Providing various types of accounts such as standard STP, Islamic, educational and professional.

- Only the spread is withheld, no extra commissions.

- Ability to quickly deposit and withdraw funds using cards, Skrill, and bank transfers.

- Ability to trade through a desktop, mobile, or web version of MetaTrader 4.

👎 Disadvantages of ETFinance:

- Non-optimal terms for novice traders such as deposit from €215, spreads from 2.2 pips.

- There are no cent accounts.

- There are no trust accounts (PAMM/MAM) for passive investment.

- Trading commissions are high compared to its competitors and leverage is limited to 1:30 for retail traders.

Geographic Distribution of ETFinance Traders

Popularity in

Video Review of ETFinance i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Investment Programs, Available Markets and Products of the Broker

ETFinance is focused on providing services to active traders but doesn’t prohibit the use of passive strategies. The company also offers clients an affiliate program that allows them to get extra income for the activity of other traders.

Methods for generating passive income at ETFinance

Investors have access to the following solutions for making money without self-trading:

-

Standard MT4 functions. You can connect to expert advisors for automated trading and subscribe to trading signals from the MT4 website to copy trades of other members of the MQL4.community.

-

Investing in exchange-traded funds (ETFs). The broker offers ETFs that are registered in the United States and Canada. With their help, an investor can get income from investments in companies in the financial, industrial, energy, and medical sectors.

Every trader registered with a broker can become an investor. Know that ETFinance specialists don’t give investment advice, so you must choose an acceptable way to get passive income.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

ETFinance’s affiliate program:

-

Affiliate program. ETFinance invites both retail traders and companies to cooperate with this passive income program. Partners have access to a CPA plan, which provides for the accrual of monetary rewards for the targeted action of a potential client that comprises registration, making a deposit, trading activities.

ETFinance's special marketing department develops and creates materials for effective partner network expansion. To become a partner of the company, just register on its website, and then fill out the form in the Affiliate Program section. After that, the manager contacts you and selects an individual plan during a telephone conversation.

Trading Conditions for ETFinance Users

The ETFinance broker offers trading accounts for retail and professional Forex and CFD trading. Account currency is the euro, but deposits and withdrawals can also be made in USD and GBP. To start trading with the company, deposit at least €215 into your deposit account. The leverage varies depending on the asset and the status of the client. ETFinance only holds the spread as a trading commission. There is no commission for a lot.

€250

Minimum

deposit

1:200

Leverage

10/5

Support

| 💻 Trading platform: | MetaTrader 4 (desktop, mobile, WebTrader) |

|---|---|

| 📊 Accounts: | Demo, Silver, Gold, Platinum, Islamic, Pro |

| 💰 Account currency: | EUR |

| 💵 Replenishment / Withdrawal: | Bank Transfer, credit and debit cards Mastercard, Visa, Maestro, V Pay, Skrill |

| 🚀 Minimum deposit: | From €250 |

| ⚖️ Leverage: | Up to 1:30 (retail clients), up to 1:200 (professional clients) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.7 pips for the EUR/USD pair |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, commodities, indices, gold, silver, cryptocurrencies, CFDs on ETFs |

| 💹 Margin Call / Stop Out: | Retail clients: 100%/50%Professional clients: 100%/15% |

| 🏛 Liquidity provider: | OBR investments Ltd |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution, Instant execution |

| ⭐ Trading features: | Lot commission is not applied, the number of available assets depends on the platform chosen |

| 🎁 Contests and bonuses: | No, except for Traders Union bonuses |

ETFinance Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Silver | from $22 | Available for a withdrawal of less than €50 by bank transfer |

| Gold | from $13 | Available for a withdrawal of less than €50 by bank transfer |

| Platinum | from $7 | Available for a withdrawal of less than €50 by bank transfer |

There is a swap (commission for shifting transactions to the next day).

Also, The Traders Union analysts compared the ETFinance spread with the competitors' spreads. The basic asset for comparison was the main currency pair EUR/USD. The comparison table below shows the spread in USD for a full standard lot.

| Broker | Average commission | Level |

| ETFinance | $14 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of ETFinance

The ETFinance broker provides services to traders from countries of the European Economic Area (EEA) following the rules of MiFID II and adhering to the Know Your Customer (KYC) verification system and Anti Money Laundering (AML) policies. The company strives to meet the trading needs of both retail clients (novice and experienced traders) and professionals who own a portfolio exceeding €500,000. ETFinance supports leveraged trading and allows you to open Islamic accounts.

ETFinance by the numbers:

-

Received over 13 awards in the field of online trading.

-

Supports trading twenty-four/seven

-

Has provided brokerage services for over 3 years.

-

Offers clients over 750 trading assets.

-

The website is translated into 8 languages.

ETFinance is a broker that offers a wide range of assets and provides a secure trading environment

ETFinance is an STP broker. It offers clients to trade 62 currency pairs, 15 stock indices, 17 commodities, and over 150 stocks. Gold, silver, and copper are available from metals, as well as Bitcoin (₿), Litecoin (Ł), Ethereum (Ξ), Tether (₮), and Dash (Ð) from cryptocurrencies. It also supports CFDs trading on ETFs registered in Canada and the United States. ETFinance uses advanced technologies to ensure security for every customers’ transaction such as robust firewalls and the Secure Sockets Layer (SSL) application. The company's trade server is located in a certified data center according to the SAS 70 standard, and only services that comply with the PCI-DSS Level 1 security standard are available for payments.

ETFinance uses the MetaTrader 4 terminal. There are 3 versions of the terminal available: desktop, mobile, and WebTrader. The MT4 interface is provided in 11 languages. The mobile terminal functionality is slightly inferior to the desktop version since it offers only 350 trading instruments.

Useful ETFinance services:

-

Quarterly profit and loss statements. These contain fundamental data on the largest world companies, including the amount of net profit, the movement in the shares value, information on dividends accrued to shareholders, etc.

-

Economic calendar. It reflects the dates of the important events that may affect the financial markets and price changes of key assets.

-

The educational center. It provides training materials for novice traders who want to master CFD trading.

Advantages:

The broker allows you to test trading terms using a demo (training) account.

Opening an account takes no more than 5 minutes, verification of documents provided by a trader takes from 1 to 2 working days.

All retail accounts have negative balance protection.

The broker offers several types of affiliate programs to generate passive income in the Forex market.

Hedging, trading using algorithmic advisors (EAs), and connecting custom indicators in the MQL language are allowed.

All Muslim clients have access to Islamic accounts regardless of the size of the deposit.

Traders who have opened Gold and Platinum accounts get free access to webinars and video tutorials on trading.

ETFinance provides services not only to active traders but also to those who want to get passive income.

How to Start Making Profits — Guide for Traders

The broker offers its clients 3 types of accounts and their Islamic counterparts. Higher leverage is available on all types of assets for traders who have Pro status. They can also trade cryptocurrencies with a 1:2 leverage, while retailers can only trade these instruments using their own funds.

Types of accounts:

The broker provides a demo account, but access to it opens only after the trader opens a real account. A demo account with a virtual balance of $10,000 is valid for 7 days, but its terms can be extended at the request of the client.

ETFinance is an STP broker that offers accounts for professionals and novice traders focused on CFD trading.

Bonuses Paid by the Broker

Bonuses are not available to ETFinance clients at the moment. For this reason, if you are planning to cooperate with this company, please take into account that you can open trades only with your own funds.

Investment Education Online

ETFinance's official website has a dedicated training section called Education Center. The articles there are divided into several blocks to make it easier to find the information you need. Register on the broker's website to get access to all materials and webinars.

Novice traders can practice trading, while more experienced traders can improve their skills and test new strategies on demo accounts.

Security (Protection for Investors)

ETFinance is the trading name of Magnum FX (Cyprus) Ltd. Its activities are regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 359/18.

ETFinance is a member of the Investor Compensation Fund (ICF), which covers retail clients of Cypriot investment firms. Every registered trader is entitled to compensation for up to €20,000 regardless of the number of open accounts and country of residence.

👍 Advantages

- The company uses segregated accounts to store customer funds

- Protection from negative balance is provided for different clients

- Payment transactions can be made not only by bank transfer and cards but also through the Skrill system

👎 Disadvantages

- ICF compensation doesn’t apply to professional clients

- Must provide detailed financial information to open an account

- Financial audit results are not publicly available

Withdrawal Options and Fees

-

You can withdraw money using Visa, Mastercard, Maestro, V Pay, bank transfer, and Skrill.

-

All withdrawal requests submitted before 09:00 AM Cyprus time are processed on the same business day and after 09:00 AM during the next business day. Applications made on weekends and holidays are considered by the specialists of the financial department on the next working day.

-

The minimum withdrawal amount by bank transfer without commission is €50 (or the equivalent in USD, GBP). If the client requests a withdrawal of less than €50, the broker will withhold €15.

-

Money can be withdrawn in euros, US dollars, and pounds sterling.

Customer Support Service

The broker's customer service works Monday through Friday from 8:00 AM to 5:00 PM (EEST). Chat operators answer on weekdays from 10:00 AM to 8:00 PM (EEST).

👍 Advantages

- No registration is required to communicate with the chat operator

- Support is provided in English and Spanish

👎 Disadvantages

- Support cannot be contacted on Saturday, Sunday, and public holidays

- Chat operators answer general non-trading questions

- No call back option

The following methods are available to contact the broker's support service:

-

Live chat;

-

phone;

-

email;

-

contact form;

ETFinance can also be contacted through the following social networks: Facebook, Instagram, Twitter, and LinkedIn.

Contacts

| Foundation date | 2018 |

| Registration address | Magnum FX (Cyprus) Ltd, KPMG Center, 1 Agias Fylaxeos Street, 2nd Floor - Office 1, 3025 Limassol, Cyprus |

| Regulation |

CySEC |

| Official site | https://www.etfinance.eu/en/ |

| Contacts |

Email:

support@etfinance.eu,

Phone: +441133284213 |

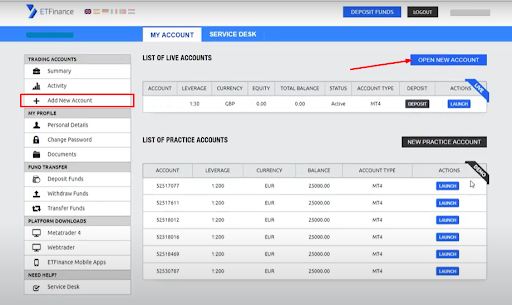

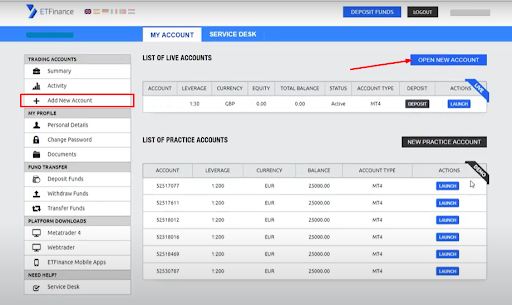

Review of the Personal Cabinet of ETFinance

To cooperate with ETFinance follow these instructions:

A personal account is created on the official website of the company. Click the Open an Account button on the main page of the site to start the registration process.

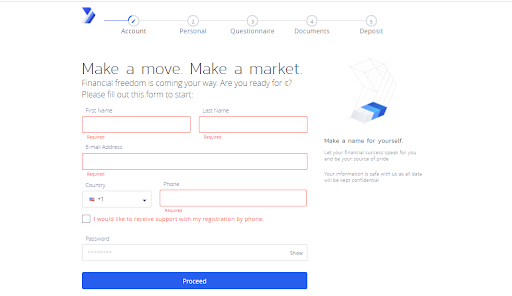

In the form that opens, enter your name, surname, email, phone number, address, and date of birth. Also, come up with a strong password.

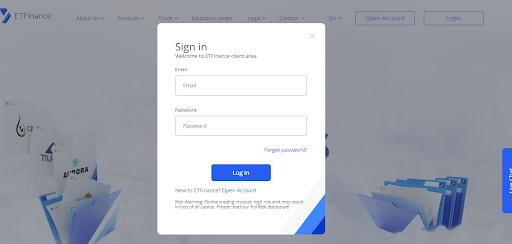

Log in to the company's website after confirming the email address. To do this, click the Login button on its main page, and in the window that opens, specify your email and the password.

The functionality of the ETFinance personal account allows a trader to:

1. Open the trading account:

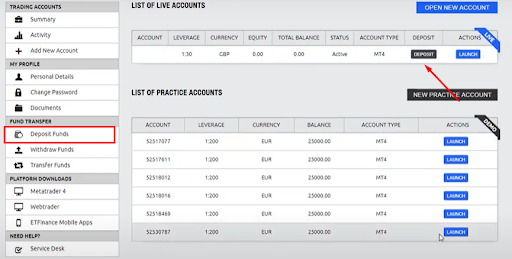

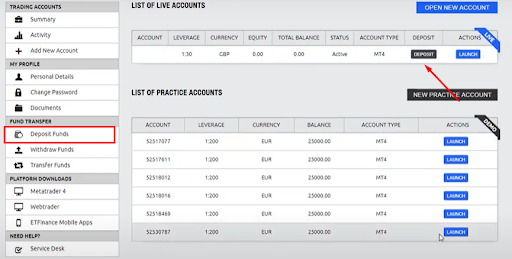

2. Make a deposit:

1. Open the trading account:

2. Make a deposit:

Also, in the user's personal account you can:

-

Go through verification.

-

Change personal data and password for entering your personal account.

-

Download desktop or mobile terminal.

-

Go to WebTrader.

-

View your trading history.

-

Complete a withdrawal application.

-

Open a demo account.

We constantly monitor the Internet for the emergence of new fraudulent schemes to deceive traders. We have been collecting data about scam brokers for more than 10 years and we think we know every dishonest company in the market. Below we have collected for you the information about the scammers from the List of SCAM Brokers.

Articles that may help you

FAQs

Why has ETFinance been placed on the Forex Broker Blacklist?

Possible reasons:

• multiple complaints have been filed against ETFinance by traders claiming the broker failed to fulfil its obligations, including process withdrawals;

• the website of ETFinance is down, not updated or operates with clear errors and some features are not available;

• ETFinance has been blacklisted by the regulatory authority, and a warning has been published on the regulator’s website.

What should I do if ETFinance got blacklisted and I still have money in my account?

Don’t panic right away. First, try to find out the reason why ETFinance got blacklisted. The situation may be temporary. Contact Traders Union client service for details. If the situation is critical, try to withdraw money. The best way to do it in parts, so that the broker does not suspect that you want to withdraw your entire balance and close the account.

What should I do if I cannot withdraw my money from ETFinance?

If your broker refuses to process withdrawals under various pretexts, your algorithm of actions is as follows:

• Get a clear response from the broker’s Support Service with reference to the clauses of the Terms of Use (User Agreement). Save your correspondence and download the transaction history from your account.

• With a full package of documents, appeal to the following organizations: the broker’s regulator or corresponding law enforcement agencies. If you make your deposit with a bank transfer, try to initiate a chargeback request.

• Share your situation on traders’ forums, add the broker to blacklists of various websites, as it will help others avoid the mistake.

Is there any chance to recover my money if ETFinance is a scam?

On rare occasions, yes, for example, if the broker was a member of a compensation fund, or upon a court’s ruling.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.