deposit:

- 20 rand

Trading platform:

- MT4

- FICA

- 0%

FBK Markets Review 2024

deposit:

- 20 rand

Trading platform:

- MT4

- FICA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of FBK Markets Trading Company

FBK Markets is a high-risk broker with the TU Overall Score of 2.91 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FBK Markets clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. FBK Markets ranks 324 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

FBK Markets has several advantages, such as asset diversity, flexible leverage, tight spreads, and reasonable commissions. The availability of multiple account types, particularly the Micro and ECN accounts, is also a positive aspect. However, it offers only basic options for deposit and withdrawal, and some traders note that additional resources are necessary. While MetaTrader 4 is a popular trading platform, there are other popular solutions not offered by FBK Markets. The referral program can be a good source of income for socially active traders. Clients may need to use external resources for analysis and specialized tools as this broker does not provide them.

FBK Markets broker’s clients get access to Forex and CFD markets. This broker offers five real accounts, including the Micro account, which allows users to explore the platform and practice without risking financial losses. Spreads are variable, starting from 0 pips. The trading commission depends on the account type, ranging from $0, $4, to $9 per 1 standard lot. The minimum deposit required is just 20 rand (~1.05 USD) for the Micro account and 100 rand for other account types. The leverage is flexible and determined by the client's account balance, with a maximum ratio of 1:1000. Trades can start from 0.01 lots, and the only restriction is on scalping, which is not allowed. FBK Markets clients trade through the MetaTrader 4 trading platform. Account currencies accepted are USD, GBP, and ZAR. The company is registered in South Africa. It offers various options for deposit and withdrawal methods. The only passive income option available is its referral program, and its educational resources are basic. This broker regularly conducts contests for its clients.

| 💰 Account currency: | ZAR, USD, GBP |

|---|---|

| 🚀 Minimum deposit: | 20 rand |

| ⚖️ Leverage: | Up to 1:1000 |

| 💱 Spread: | Floating, from 0 pips |

| 🔧 Instruments: | Currency pairs, metals, indices, bonds, energies and commodities |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with FBK Markets:

- The platform has a low entry barrier with a minimum deposit requirement of only 20 rand, and it offers both demo and Micro accounts.

- Traders can choose from five real accounts, providing an individualized approach to trading.

- Trading is conducted through the user-friendly and customizable MetaTrader 4 trading platform, which also supports various plugins.

- Clients can deposit and withdraw funds using Visa/MC bank cards, Skrill, Virtual Pay, and Ozow payment systems.

- The spreads are average or lower than the market average, and the trading commissions are also favorable, resulting in reasonable costs.

- Traders have access to a wide range of assets, including currency pairs, metals, indices, bonds, energies, and commodities.

- This broker offers technical support through all major communication channels, available 24/7 (except on holidays).

👎 Disadvantages of FBK Markets:

- This broker lacks full transparency, as there is no information on withdrawal fees provided on their website.

- It does not offer typical passive income options like joint accounts or copy trading services.

- Its range of tools is limited, as it lacks technical and fundamental analysis resources; but it does have a margin calculator.

Evaluation of the most influential parameters of FBK Markets

Trade with this broker, if:

- You prefer trading through the MetaTrader 4 (MT4) platform. FBK Markets uses MT4, known for its speed, security, and reliability in forex trading.

- You want adjustable leverage options. FBK Markets offers leverage options up to 1:1000, providing flexibility in managing risk.

- Transparency and registration are important to you. FBK Markets is registered in South Africa and operates transparently.

Do not trade with this broker, if:

- You are looking for various passive income options. FBK Markets offers only a referral program as a passive income option, which might be limiting if you seek more diverse opportunities for passive income.

- You require extensive educational resources. The educational resources provided by FBK Markets are basic, which may not be sufficient for traders who value comprehensive learning materials and tools,

Geographic Distribution of FBK Markets Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of FBK Markets

FBK Markets SA (Pty) Ltd, a company registered in South Africa, started operating in 2020. It conducts its activities under the supervision of the Financial Intelligence Centre Act (FICA). Until now, there have been no recorded conflicts with clients or confirmed cases of this broker failing to fulfill its obligations. The platform operates with overall transparency, although some aspects (such as withdrawal fees) are initially hidden from unregistered clients.

The trading conditions are on par with industry leaders. There are five real accounts, one of which is the Micro account, which allows trading in cents instead of dollars and is designed for platform exploration and strategy testing. The other four accounts are full-fledged, differing only in spreads and commissions. The spreads are variable, starting from 0 pips, and the commissions range from $0 to $9 per lot. These are advantageous indicators as many brokers have significantly higher costs.

Only one trading platform is available MetaTrader 4, which is highly customizable. Traders are virtually unrestricted in trading styles and methods; they can hedge, trade the news, and use advisors, with only scalping being prohibited. One of the key drawbacks of this broker is the almost complete absence of typical analysis and forecasting tools. However, the platform offers decent basic education, mainly aimed at beginners and to some extent intermediate-level traders.

There is a wide range of assets as it is a Forex and CFD broker. Interestingly, leverage is determined by the account balance. The higher the trader's balance, the lower the leverage. For example, if you have up to $1,000, you can apply leverage of up to 1:1,000. If your capital ranges from $2,000 to $5,000, the maximum leverage available is 1:300. The execution speed is within a few dozen milliseconds, and there is negative balance protection.

The platform has regional restrictions, like most brokers, which should be considered. The partial transparency raises questions, but these can be addressed during the trading process. Unfortunately, the only option for passive income is the referral program. A significant advantage is the 24/7 technical support, available even on weekends. Overall, this broker is recommended for consideration.

Dynamics of FBK Markets’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The absence of investment options is not something TU calls a critical drawback. After all, most traders come to this broker to trade independently. For them, comfortable working conditions are more important than alternative earning methods. However, cryptocurrency staking or dividend stocks may interest many. Currently, the most sought-after ways to earn additional profits are joint accounts, copy trading, and referral programs. FBK Markets offers only the latter.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

FBK Markets’ referral program and conditions

Traders need to fill out a form in the "Partners" section. To participate, they must have a verified account and either a Standard or Zero Spread account. The platform may decline the partnership if it believes the trader won't actively promote the program. If the partnership is approved, the user receives a referral link, which will be displayed in the corresponding section of the user account. This broker's clients can place this link on the internet and on various platforms. Anyone who clicks on the link becomes the partner’s referee. After registering and depositing funds, the referred trader will start bringing bonuses to the partner who invited them.

Trading Conditions for FBK Markets Users

Usually, if a broker has multiple trading accounts, each has its entry threshold. At FBK Markets, to open a Micro account, a minimum balance of 20 rand is required, while for all other accounts, the minimum deposit is 100 rand. This is a very low requirement because many brokers demand a much higher initial deposit. As for leverage, it is not account- or asset-dependent but determined by the trader's account balance. Initially, they have access to maximum trading leverage of 1:1000, but as the balance increases, it reduces to 1:100. This broker's client support operates 24/7, meaning it is available even at night and on weekends. The only exception is national and cultural holidays when support is available from 9:00 to 14:00.

20 rand

Minimum

deposit

1:1000

Leverage

24/7

Support

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Standard, Zero Spread, Bonus 100, ECN, Micro |

| 💰 Account currency: | ZAR, USD, GBP |

| 💵 Replenishment / Withdrawal: | Bank transfer, Visa, Mastercard, Skrill, Virtual Pay, Ozow |

| 🚀 Minimum deposit: | 20 rand |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating, from 0 pips |

| 🔧 Instruments: | Currency pairs, metals, indices, bonds, energies and commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Free demo, five real accounts (including Micro), tight spreads, average market commissions, fast order execution, no PAMM accounts or copy trading, trading only through MT4 trading platform, basic education tools, 24/7 technical support, no analytics or forecasting tools. |

| 🎁 Contests and bonuses: | Yes |

Comparison of FBK Markets with other Brokers

| FBK Markets | RoboForex | Pocket Option | Exness | Forex4you | Deriv | |

| Trading platform |

MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5 | Deriv bot, Deriv MT5, Derivix, Deriv Trader, SmartTrader |

| Min deposit | $20 | $10 | $5 | $10 | No | $1 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:10 to 1:1000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 1.00% |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.1 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 100% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | Yes | No |

Broker comparison table of trading instruments

| FBK Markets | RoboForex | Pocket Option | Exness | Forex4you | Deriv | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | No | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | Yes |

FBK Markets Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | Spreads from $5, and no commission | Yes |

| Zero Spread | Spreads from 0 pips, commission is $9 per lot | Yes |

| Bonus 100 | Spreads from $5, and no commission | Yes |

| ECN | ECN Spreads from 0 pips, commission is $4 per lot | Yes |

| Micro | Spreads from $5, and no commission | Yes |

Withdrawal fees are the third item on the list of the trader's main expenses on any platform. Sometimes brokers do not charge this fee, but it is not as common as one would like. Usually, there is a fee, and it can vary depending on many factors, such as the withdrawal method and the amount. In the case of FBK Markets, a new or non-client would not be aware of the withdrawal fees. The exact amount of the fee becomes known to the client at the withdrawal request stage. This means the client will still be informed in advance, and there will be no situation of an unexpected undisclosed fee. To understand how advantageous FBK Markets' offer is, it needs to be compared with the conditions of other brokers. The table below provides information on the average trading fees of FBK Markets and two leading competitors in the field.

| Broker | Average commission | Level |

| FBK Markets | $5.6 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of FBK Markets

FBK Markets has been operating for 3 years. The company's technological stack adheres to advanced standards, providing fast order execution. It is worth noting that this broker is strictly focused on active trading. Regarding passive income opportunities, it only offers a typical referral program, which is nothing out of the ordinary. Additionally, this broker does not provide any tools on its website, except for a basic margin calculator. This is a common practice since most traders use third-party software and online resources for market analysis. In this case, the primary importance lies in the impressive pool of assets and comfortable trading conditions, facilitated in part by the constructive advantages of the MT4 trading platform.

FBK Markets by the numbers:

The minimum deposit is 20 rand.

There are 5 real account types available.

Spreads start from 0 pips.

Commissions start from $4 per lot.

The maximum leverage is 1:1000.

FBK Markets is a Forex and CFD broker for traders of any level

For a broker primarily focused on active trading, the composition of its asset pool plays a crucial role. It is essential to offer a wide range of trading instruments to enable clients to build diversified investment portfolios and implement various strategies. As a Forex and CFD broker, FBK Markets allows trading with currency pairs, metals, indices, bonds, energies, and commodities, ensuring a broad assortment of assets. Traders can customize their trading conditions extensively due to the integration of hundreds of free plugins with the MT4 trading platform. Lastly, the leverage, determined by the account balance, allows traders to earn more with limited capital.

FBK Markets’ analytical services:

Margin calculator. A standard service that helps calculate the required margin for specific trade conditions.

Margin calculator for Micro accounts. It is identical to the standard version but allows users to calculate the margin for trades with micro-lots.

Education Centre. Includes e-books and video guides that cover the basics of trading on Forex and CFD markets in a simple and accessible manner.

Advantages:

Novice traders who are starting with FBK Markets receive favorable conditions. The minimum deposit is only 20 rand, and they get access to a top-notch trading platform.

Traders benefit from comfortable conditions, including a wide range of assets from six groups, narrow spreads, average or below-average commissions, and high leverage.

Platform clients can become partners by undergoing additional registration. Partners can earn commissions from referrals.

The Micro account type allows any trader to explore the platform or experiment with trading strategies without risking significant financial losses.

This broker's technical support adheres to advanced quality and responsiveness standards, assisting 24/7, or every day.

Guide on how traders can start earning profits

First, it is necessary to choose the best account type for you. The Micro account is not considered here as it is not suitable for full-scale trading aimed at significant earnings. The Standard account is universal, with narrow spreads and no commissions. The Bonus 100 account is similar to the standard one but offers a 100% bonus on the first deposit. The Zero Spread account has floating spreads starting from 0 pips, but it comes with a relatively high commission of $9 per lot. The ECN account utilizes ECN technology, providing the fastest order execution. Here, spreads also start from 0 pips, and the commission is $4 per lot. The minimum deposit for all these accounts is the same, 100 rand (except for Micro, which allows a deposit of 20 rand).

Account types:

If the trader is new to this broker, they usually start with a demo account to explore the platform and test their strategies. In this case, the Micro account can also serve the same purposes. Later, they can open a full account of any available type based on their trading preferences.

Investment Education Online

Experienced traders know that practical experience alone is not enough. High-quality theoretical preparation is also required. Typically, traders acquire knowledge from e-books, webinars, and online lectures. Many brokers try to contribute to this by organizing various levels of educational resources. However, most often, it offers basic materials that can be studied remotely. For example, on the FBK Markets website, there is a series of video tutorials covering the basics of trading, as well as relevant literature available in digital format.

There are no articles or in-depth analyses available, and the materials are aimed at beginners. This is a common situation as most brokers provide basic information and only a few additional resources for traders with intermediate experience. Professional traders are unlikely to find FBK Markets' educational resources beneficial. However, this is not a broker’s drawback, as it is not obligated to educate its clients. FBK Markets logically assumes that once a user has registered, he already has some knowledge. For those without any experience, the platform does provide basic educational materials to help them get started.

Security (Protection for Investors)

If a trader wants to assess the safety of working with a particular broker, the first thing to look at is its registration. If the company is officially registered as a financial organization and has a headquarters, it indicates the legality of its operations. The second point to consider is regulation, which refers to oversight by a competent authority like FSA or ASIC. In the case of FBK Markets, TU is focusing on a trading brand owned by FBK Markets SA (Pty) Ltd. The company is registered in the Republic of South Africa, with its office located in Sandton. The regulator overseeing FBK Markets is the FICA (Financial Intelligence Centre Act), the regulatory body of South Africa. The oversight provided by FICA theoretically ensures protection for traders against unauthorized or fraudulent actions by this broker.

👍 Where can you go for help

- To the FBK Markets’ client support

- To the FICA regulator

👎 There is no point in contacting

- State financial control authorities outside of South Africa

- International regulators not monitoring the activities of FBK Markets

Withdrawal Options and Fees

This broker's clients can initiate a withdrawal request for all or part of their profits at any time. This is done through the user account.

The following withdrawal methods are available: bank transfer, Visa/MC cards, Skrill, Virtual Pay, and Ozow.

The processing time for withdrawals is up to 48 hours (excluding special circumstances).

This broker processes only one withdrawal request at a time. All transactions for additional withdrawals may be canceled.

The exact time of funds reaching the specified channel depends, in part, on the processing speed of the third-party transfer service (e.g., the bank).

This broker charges a withdrawal fee, and the trader will be informed of all associated costs in advance, before submitting the withdrawal request.

Customer Support

Technical support is essential for any broker, as traders regularly encounter situations that they cannot resolve on their own. They seek quick and competent assistance for their inquiries. If technical support is not responsive, takes too long to resolve issues, or fails to address problems competently, clients may become disappointed and will often switch to a competitor. That's why brokers nowadays pay great attention to the quality of their support services.

The client service at FBK Markets operates 24/7, meaning traders can get in touch with specialists at any time. The only exception is during holidays when the managers are available from 9:00 to 14:00. Requests can be submitted via phone, email, WhatsApp, or through the ticket system on the website.

👍 Pros

- You can contact client support even if you are not a broker's client yet

- Specialists respond at any time

- Various communication options with managers are available.

👎 Cons

- Operating hours may be limited during holidays

If you are already working with FBK Markets or are planning to become their client, feel free to reach out to client support with trade-related inquiries. It is there to help you quickly resolve many obstacles you may encounter. Here are the current contact options:

Phone;

WhatsApp;

Email;

Ticket on the website.

FBK Markets also has profiles on Twitter, Instagram, and Facebook. Traders can use these social media platforms to contact the support team as well. It is recommended to follow this broker on its social media platforms to stay updated on their important news and promotions.

Contacts

| Foundation date | 2020 |

| Registration address | 1 Chadwick Ave, Wynberg, Sandton, 2090 |

| Regulation |

FICA |

| Official site | https://fbkmarkets.com/ |

| Contacts |

Email:

support@fbkmarkets.com,

Phone: +27(0)87 702 9234 |

Review of the Personal Cabinet of FBK Markets

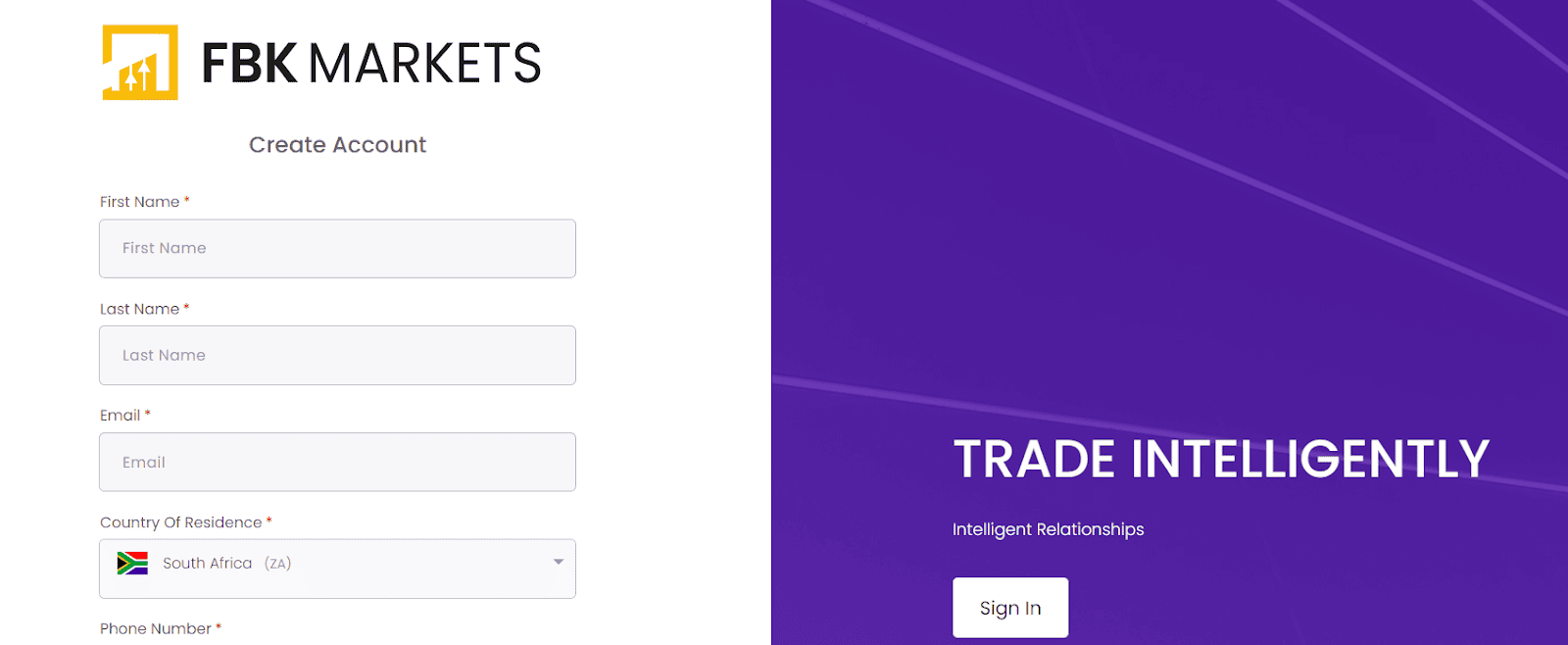

To begin collaborating with FBK Markets, you need to register on its official website. Then, open an account, undergo verification, make a deposit, and download and install the trading platform. TU experts have prepared the below step-by-step guide for registration and an overview of the features available in the FBK Markets user account.

Go to this broker's website and click on the "Start Trading" button in the top right corner.

Enter your name, surname, email, and phone number. Choose your country from the list. Create a password and enter it twice. Agree to the terms and conditions and data processing by checking the box. Click "Sign Up".

You will receive an email to the provided address. Click on the link in the email to confirm your email address.

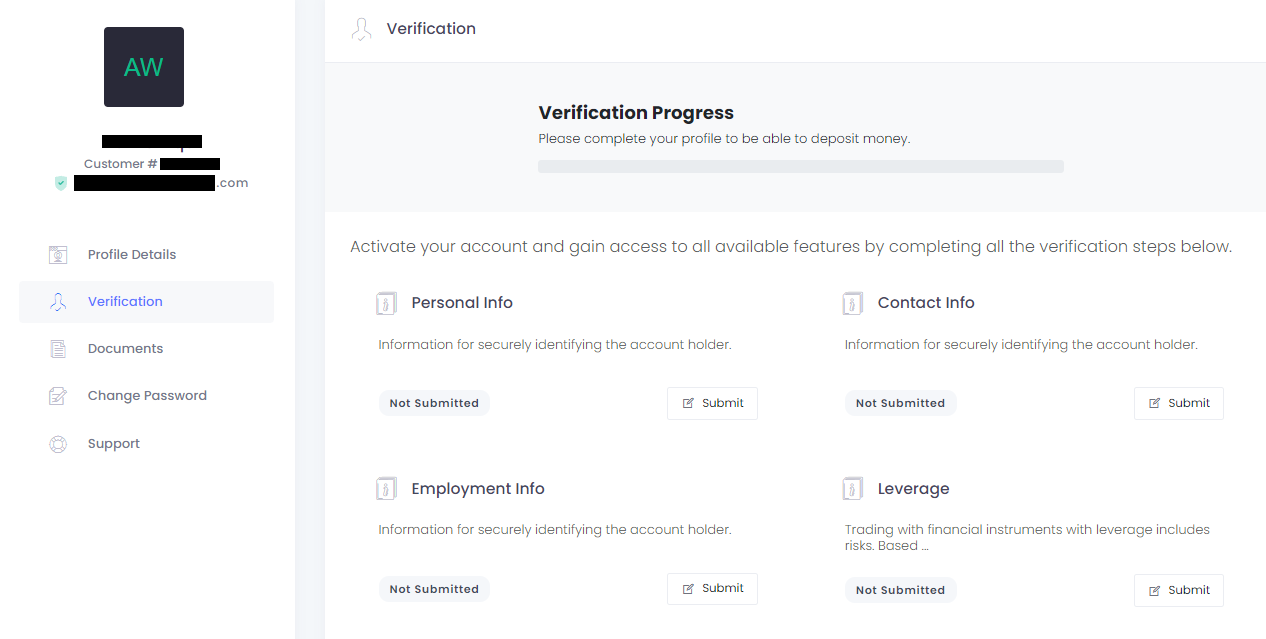

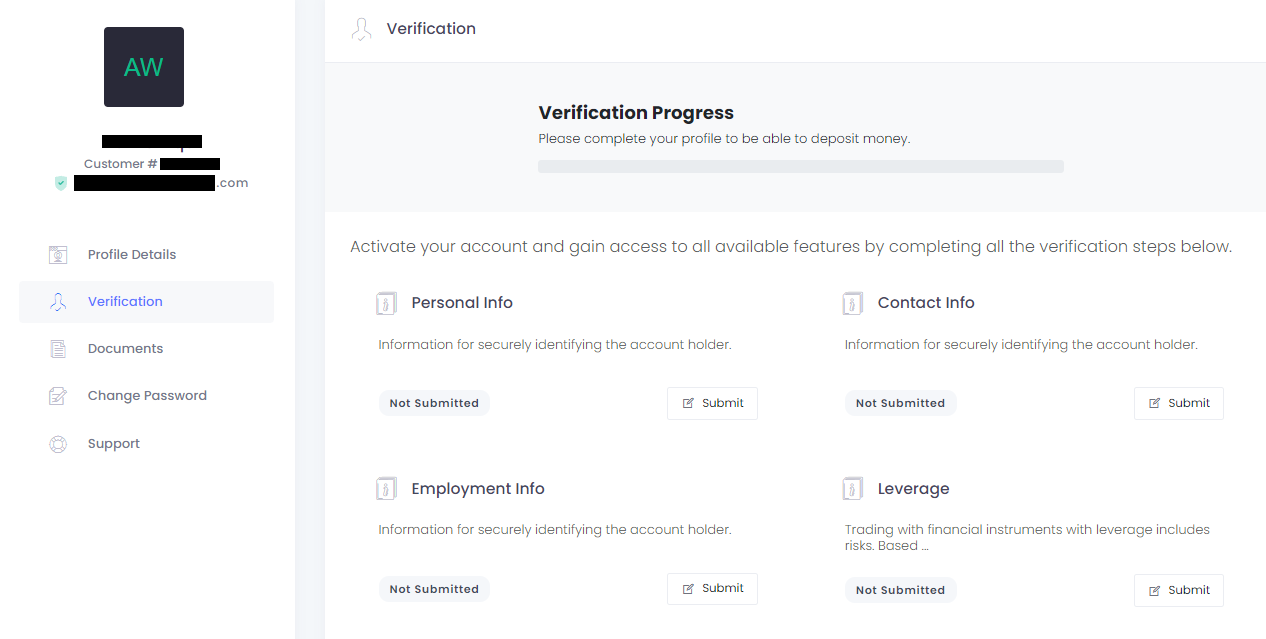

Go to the "Profile" section and navigate to "Verification." There, you will see four blocks: "Personal Info," "Contact Info," "Employment Info," and "Leverage." Go into each section and fill in your details. Note that you will need to provide photos/scans of documents confirming your identity. Read the comments carefully and follow the on-screen instructions.

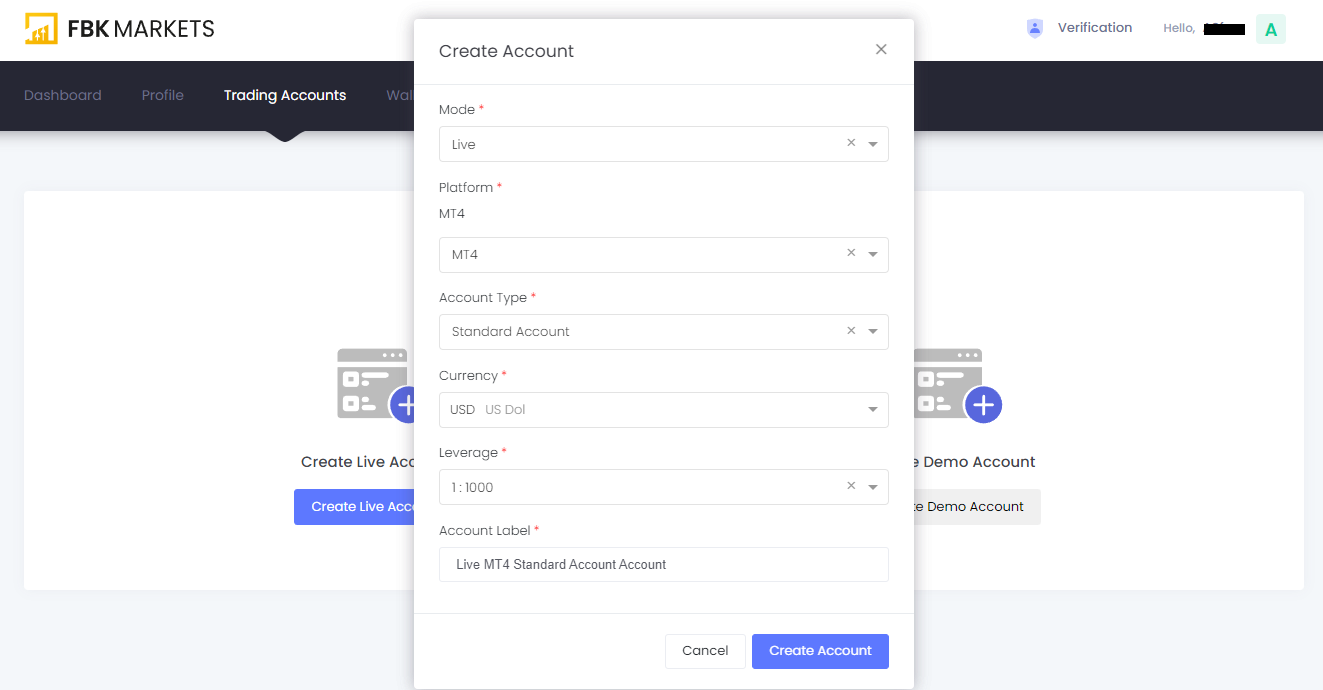

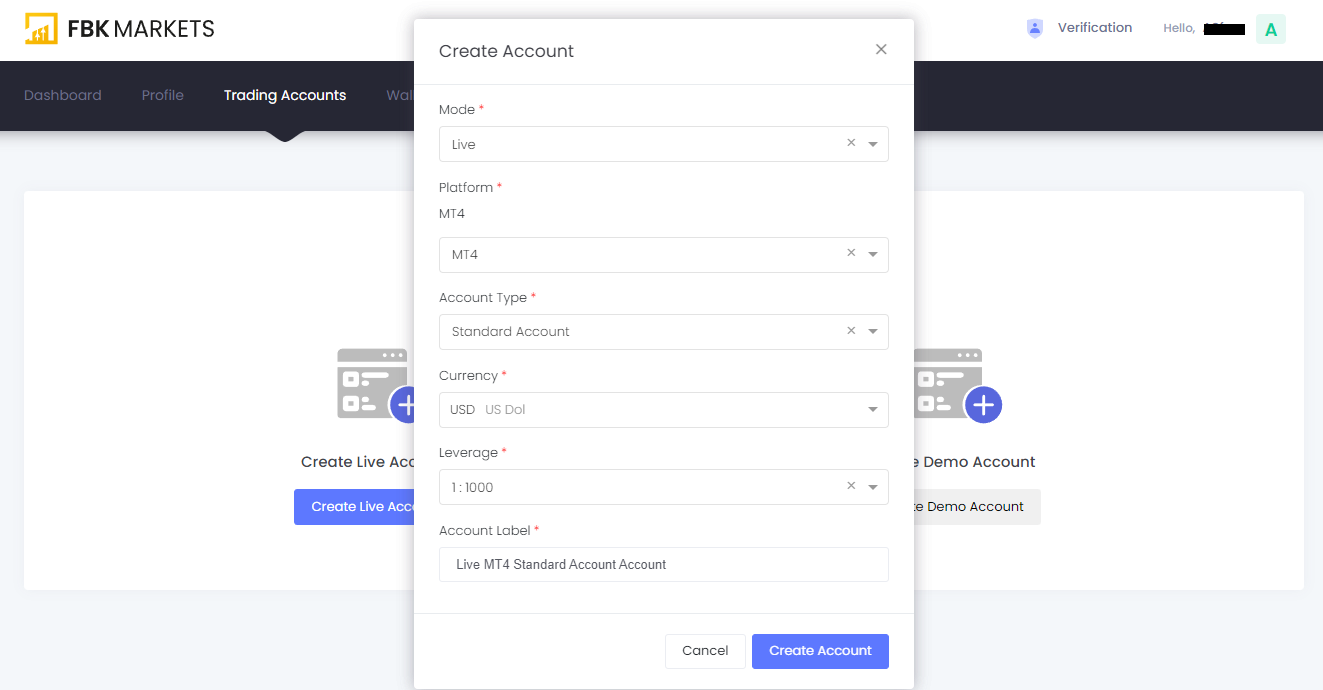

Go to the "Trading Accounts" section by clicking the link in the top menu. Click the "Open Live Account" button. Choose the account type, base currency, and leverage. Click "Create Account."

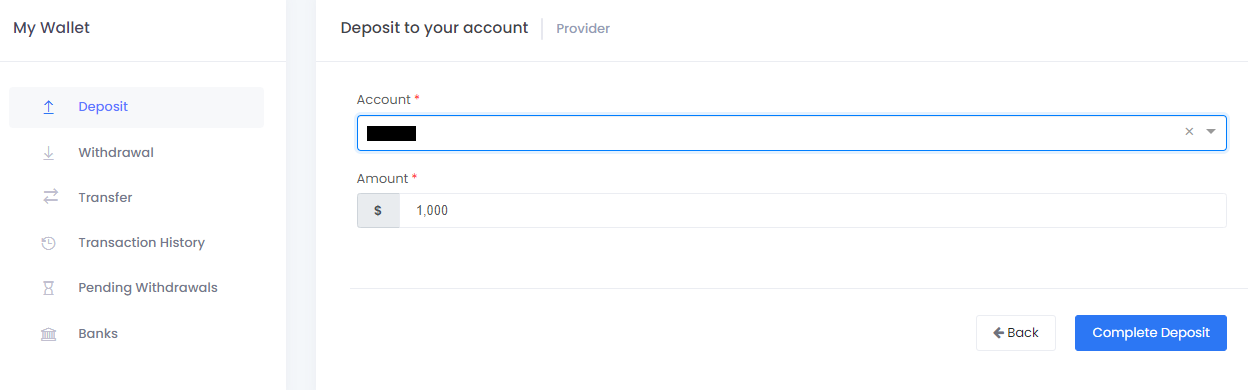

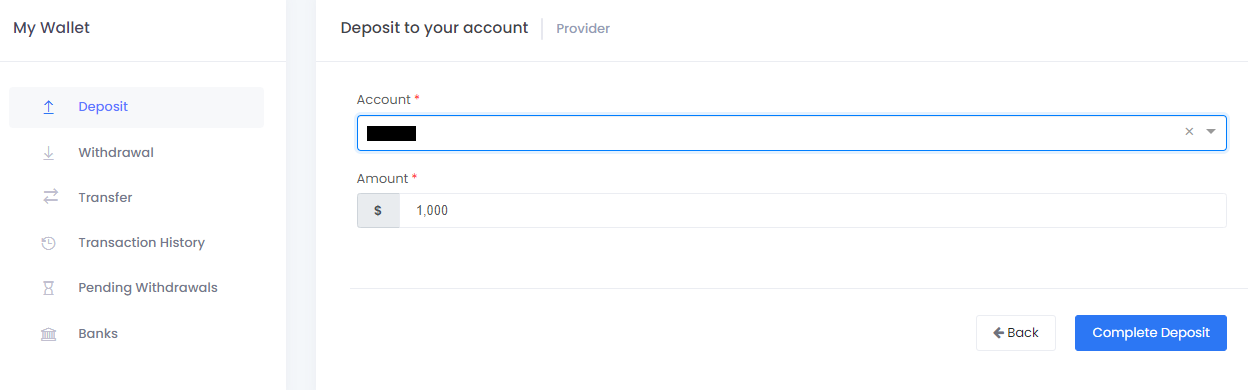

Visit the "My Wallet" section. Select the account and deposit method. Follow the on-screen instructions.

Next, go to the "Available Platforms" section. Download the suitable MetaTrader 4 trading platform version and install it on your device. Now, you can start trading.

Your FBK Markets user account also provides access to:

-

Dashboard. Here, traders can view summarized data for their active accounts, and certain conditions can be tweaked.

-

Profile. In this section, users can update their personal information, undergo verification, and modify security settings.

-

Trading accounts. Here, clients can open demo and real accounts, and they also have the option to close accounts.

-

Wallets. This block is used for depositing, withdrawing, and conducting other transactions.

-

Platforms. In this section, traders can always download different versions of the MetaTrader 4 trading platform.

Articles that may help you

FAQs

Do reviews by traders influence the FBK Markets rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about FBK Markets you need to go to the broker's profile.

How to leave a review about FBK Markets on the Traders Union website?

To leave a review about FBK Markets, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about FBK Markets on a non-Traders Union client?

Anyone can leave feedback about FBK Markets on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.