FXChoice (FX Choice) Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- MT4

- MT5

- FSC

- 2010

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- MT4

- MT5

- FSC

- 2010

Our Evaluation of FXChoice

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FXChoice is a moderate-risk broker with the TU Overall Score of 5.52 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FXChoice clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

FXChoice is a broker for active and passive trading that is more suitable for professional traders that have a certain amount of free funds.

Brief Look at FXChoice

FXChoice was established in 2010. The broker is licensed by the International Financial Services Commission of Belize (FSC, 000067/501) and provides quality brokerage services for active and passive trading on the Forex market. FXChoice enjoys popularity among Western traders thanks to the broker’s commitment to business integrity, focus on customers, and to high requirements for its global employees. In particular, in 2019 the broker received the LiveHelpNow’s Exceptional Customer Service award every month of the year!

- Tight market spreads (from 0.0 pips) on popular currency pairs;

- The license by FSC, an international regulator;

- Several passive income options: partnership program, copy trading services, and MAM accounts.

- No cent accounts;

- Withdrawals via Visa and Mastercard debit/credit cards are not available;

- Low leverage;

- Customer support responds in English only.

TU Expert Advice

Financial expert and analyst at Traders Union

FXChoice is committed to providing quality services for active and passive trading. For this reason, the company continuously expands its arsenal of trading instruments and services for automated trading. The customers are offered classic accounts, and professional ECN accounts with tight market spreads. The broker is licensed by FSC, a regulator with strict rules.

The trading conditions of FXChoice are primarily suitable for experienced traders. The broker does not offer cent accounts, zero spreads, or optimal leverage for beginners. The broker provides a demo account option, but the account validity is limited to 90 days. The loyalty program with rebate and reduction of commission per lot is also designed for professional customers with high trading volumes, from $10 million.

The company’s website is localized in 8 languages. Customer support operators answer in English. For this reason, mainly Western investors use the broker’s services.

- You prefer using advanced trading platforms such as MetaTrader 4, MetaTrader 5, and Myfxbook AutoTrade for a comprehensive trading experience.

- If you are an experienced trader seeking tight spreads and competitive fees. FXChoice offers spreads as low as 0.6 pips on certain pairs and charges fixed commissions on their ECN accounts, providing an attractive option for high-volume traders focused on cost efficiency.

- If you are looking for withdrawal options via Visa and Mastercard debit/credit cards.

FXChoice Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МТ4, MT5 |

|---|---|

| 📊 Accounts: | Classic Account, Optimum Account, Pro Account |

| 💰 Account currency: | USD, EUR, GBP, AUD, CAD, Gold |

| 💵 Replenishment / Withdrawal: | Wire transfer, Visa/Mastercard debit/credit cards (only deposits), Skrill, Neteller, Paysafe, SafetyPay, Perfect Money, FasaPay, Perfect Money, AstroPay, Poli, Airtm, VLOAD, STICPAY, AdvCash, and EPAY |

| 🚀 Minimum deposit: | USD 10 |

| ⚖️ Leverage: | up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 lots |

| 💱 Spread: | from 0.0 pips (Pro), from 0.5 pips (Classic), from 1.5 pips (Optimum) |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, commodities, metals, and energies |

| 💹 Margin Call / Stop Out: | 25/15% |

| 🏛 Liquidity provider: | Mostly European banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution, NDD |

| ⭐ Trading features: | MAM accounts; Licensed by FSC; Algorithmic trading. |

| 🎁 Contests and bonuses: | 15% deposit bonus on deposits, rebate, commission reduction per lot |

FXChoice trading conditions are quite attractive for professional traders. The spreads are floating, starting from 0.0 pips on the Pro Account and 0.5 pips on the Classic account. The maximum leverage is 1:1000. The stop-out level is 15-80% depending on the account type, either individual or corporate.

FXChoice Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To open a live trading account and start earning on Forex, you need to take the following steps:

Go to the broker’s official website and press Register on the Home Page.

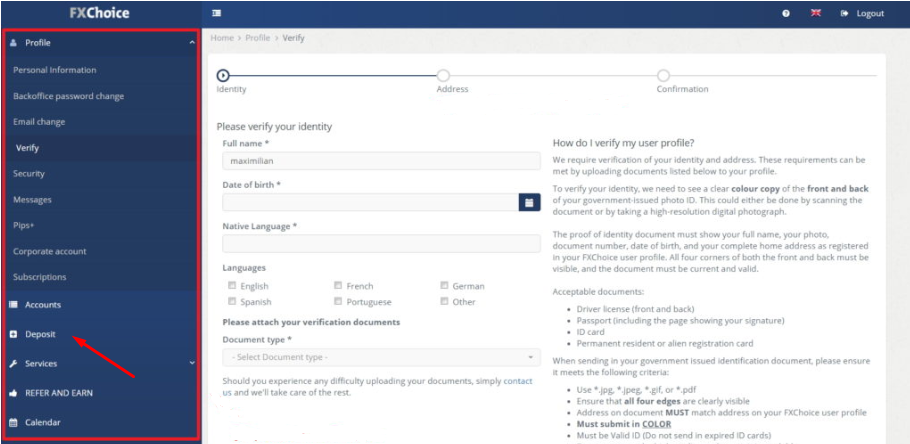

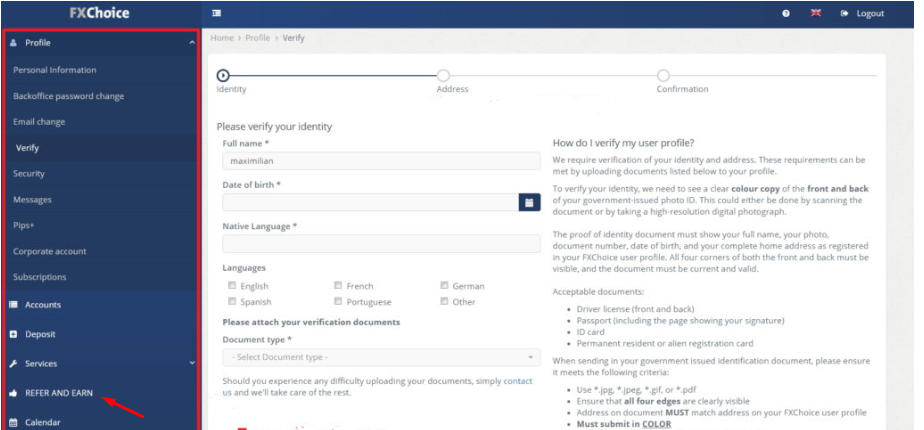

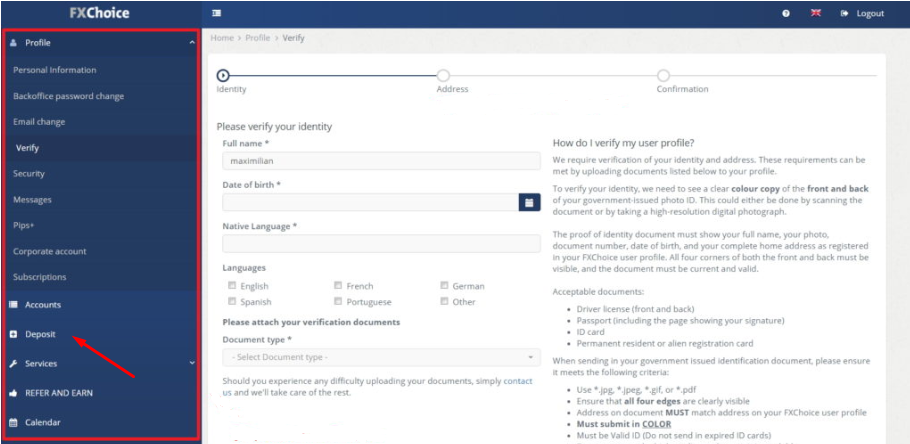

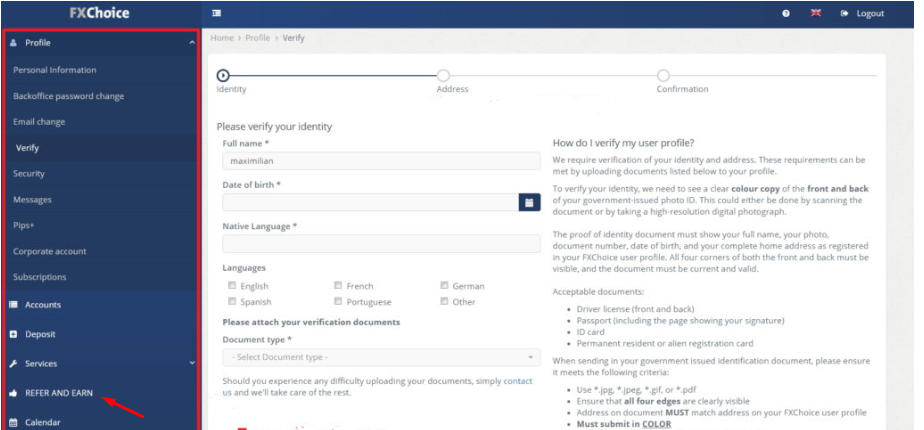

Enter your name and email address and come up with a secure password. After authorization in the system, you need to select the account type and currency. Access Backoffice and select Verify Your Profile on the orange banner or select Verify Your Profile in the menu on the left side of the screen. To complete the process, you need to upload scanned copies of your documents.

The following features are available in your personal account:

Other features of the personal account include:

-

Services. Includes access to trading platforms, including Myfxbook Autotrade, an automated trading service, and browser version of Metatrader 4 and Metatrader 5 platforms;

-

Pips+. Includes loyalty program statistics;

-

Economic calendar;

-

Messages. Used for quick communication with customer support and other traders who are currently trading online.

Regulation and safety

The operation of FXChoice is regulated by the International Financial Services Commission of Belize (license number 000067/96).

The FSC is a government agency of Belize that is guided by the laws that control the financial transactions of its licensees. After issuing the license, FSC strictly controls whether all the requirements are observed. Also, FXChoice operates in compliance with the Anti-Money Laundering and Countering Financing of Terrorism Act.

Advantages

- Customer funds are kept in segregated accounts away from the broker’s equity

- Negative balance protection

- Full control over the broker’s activity by the state

Disadvantages

- The regulator does not consider claims of private traders with small amounts

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Classic | from $5 | No |

| Pro | from $5 | Charged in certain situations |

| Optimum | from 15$ | No |

Swaps are charged (a commission for rollover of the position to the following day). For your convenience, we also compared trading commissions of FXChoice with similar indicators of its competitors, with each broker assigned a corresponding level. The results of the comparison are provided in the table below.

| Broker | Average commission | Level |

|---|---|---|

|

$8.3 | |

|

$1 | |

|

$8.5 |

Account types

FXChoice offers three types of live accounts – Classic, Pro and Optimum. They differ by the spread, Margin call/Stop out value, and whether the commission per lot is charged or not.

Account types:

Before opening a live account, you can test the broker's conditions and functions on its trading platforms by using a demo account.

FXChoice offers conditions that are more suitable for professional traders. The broker has a rather high minimum deposit and does not offer cent accounts.

Deposit and Withdrawal

-

Withdrawal requests received during operating hours are processed on the same day. In case the request is received during non-operating hours, it is processed on the following working day.

-

Requests for withdrawal submitted during the operating hours are processed within 1-3 days.

-

The following are available for withdrawals: wire transfer, Skrill, Neteller, Perfect Money, BitcoinCash, Litecoin, Ripple, Tether, FasaPay, Airtm, VLOAD, STICPAY, AdvCash, EPAY. Withdrawals to Visa/Mastercard cards are not available.

-

The minimum amount to make a wire transfer is EUR 1,000 (or an equivalent). There is no limit on withdrawals via electronic payment systems.

-

Withdrawals to electronic systems take from 1 minute to 24 hours. The transfer of funds to a bank account takes up to 5 business days.

Investment Options

FXChoice has developed conditions for active trading and passive investment. The company offers several copy trading services and also allows the use of automatic trading advisors. The broker provides an opportunity to open a MAM account, which is similar to a PAMM account, where each investor can transfer their deposit to a professional trader to manage. The profit is accrued to the investor’s account minus the manager’s fee.

The MQL5 trading signals and Myfxbook AutoTrade are services for automated trading

FXChoice aims to become a leader in online trading by providing several instruments for automatic trading. They allow investors to connect to the accounts of more experienced traders and copy their trades without personal involvement. If a trader is successful, the investor pays the trader a predetermined fee out of his profit. The company’s VPS server is compatible with most copy-trading services. The broker offers the following:

-

MQL5 Signals — a service for instant copying of signals via the MT4 platform. The subscription for the chosen supplier is set for the duration of one month. The subscribers pay a fixed fee once a month or once a week;

-

Myfxbook AutoTrade — a service that allows you to copy trades of the most successful traders, with their rating published on the Myfxbook website. The service is available on MT4 and MT5 for trading accounts with a minimum balance of USD 1,000;

-

Expert Advisors (EAs) — a robotized trading program for automatic trading on MT4. There are versions of the program designed for scalping and also for short and medium-term strategies.

Automatic trading systems provide an opportunity for traders with all levels of experience to trade automatically. Automated trading is suitable not only for novice traders on Forex but also for busy customers who do not have the time or desire to trade independently. A broker’s customer can connect the services either in the trader’s personal account or directly on the trading platform.

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

FXChoice affiliate programs:

-

Refer-and-Earn Plan – you can earn a USD 25 bonus for each $100 deposited by the referred customers once they reach the required volume of USD 200,000 turnover. The maximum bonus is USD 250 once the customer reaches $2,000,000. Additionally, each referral will receive a one-time 15% deposit bonus.

-

Affiliate — up to 50% of spread amount on all currency pairs per each referred trader;

-

Multi-Account Management (MAM) — allows competent traders to manage funds of less experienced traders for a specific fee. The fee amount depends on the account effectiveness and the country of the partner’s account registration.

These programs allow partners to build their own referral network by introducing new active traders and to receive a reward from the broker for that. The amount of the reward is discussed with each partner individually.

Customer support

The broker’s customer support responds to customer inquiries 24 hours a day, 5 days a week.

Advantages

- Online chat and support by phone

- Multi-language support

Disadvantages

- Does not operate on the weekends

Methods of contacting customer support:

-

By phone numbers, as specified on the website;

-

By email;

-

Online chat on the broker’s website;

-

Feedback form.

Customer support is available on the broker’s website and in the personal account.

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address | Corner Hutson & Eyre Street, Blake Building, Suite 302, Belize City |

| Regulation |

FSC

Licence number: 000067/96 |

| Official site | en.myfxchoice.com |

| Contacts |

+52 558 526 80 32, + 501 227 27 32

|

Education

There is an extensive FAQs section on the broker’s website to help the trader become more knowledgeable. It contains all information a trader may require to start working with a broker. In the Knowledge Base, a novice trader on the Forex market can find a theory course with basic notions on the Forex and CFD.

A free demo account allows traders to test each of the listed instruments.

Comparison of FXChoice with other Brokers

| FXChoice | RoboForex | Pocket Option | Exness | FreshForex | Tickmill | |

| Trading platform |

MT4, MT5, Webterminal | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT4, MT5, Tickmill Mobile App |

| Min deposit | $10 | $10 | $5 | $10 | No | $100 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

25% / 15% | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | 100% / 30% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | $30 | $30 |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed Review of FXChoice

FXChoice is a regulated broker, which employs SSL (Secure Socket Layer) technology to guarantee transparency and security of all transactions for its customers. The company offers NDD order execution technology, highly professional customer support, and ensures the security of customer funds. Upon the customer’s request, the broker provides its own virtual VPS server to ensure continuous online trading. The funds of registered traders are kept in segregated accounts.

These are several key figures about FXChoice that are published on the broker’s official website:

-

2010 is the year the broker began its operation;

-

150,000 digital transactions per day;

-

202 educational articles contained in the Knowledge Base.

FXChoice is a well-suited broker for active and passive investment.

FXChoice is an international broker offering access to 39 trading currencies, precious metals, and CFDs. The company’s customers can open Classic and Pro accounts with a floating spread that averages 0.5 pips. There is an opportunity to work directly with the liquidity providers from private or corporate accounts. Regarding passive income, the broker offers copy trading services and several options of the partnership program. Different strategies are allowed, including hedging and scalping, as well as trading advisors and automatic signals.

Traders who opened a Classic account with FXChoice can only use the MetaTrader 4 platform. Traders with a Pro account can choose between MT4 and MT5. Both platforms are available in desktop, mobile, and web versions which are compatible with most popular browsers, including Internet Explorer, Microsoft Edge, Mozilla Firefox, Google Chrome, Safari, and Opera.

Useful services offered by FXChoice:

-

Web terminal. The browser versions MT4 and MT5 are available. It is not necessary to download and install either on your PC or mobile device;

-

Market Watch. Shows latest currency quotes;

-

Contract specification. Shows the spread and commission per lot (for Pro account) in real-time mode.

Advantages:

Licensed by FSC, the International Financial Services Commission of Belize;

Typical tight spread on popular currency pairs;

Possibility to trade via popular MetaTrader 4 and MetaTrader 5 platforms. Availability of mobile and web versions of the platforms;

Algorithmic trading is allowed: use of advisors, MQL5 signals, and copy trading services;

Options for passive income without independent trading;

Several types of partnership programs and rebates.

There are no restrictions on the use of trading strategies. The broker does not have any requirements for the minimum period of holding trades open in the market.

User Satisfaction