deposit:

- $1

Trading platform:

- Paper Trading Account

- Individual

- Joint

- Corporate

- Money Manager Account

- 0%

MEXEM Review 2024

deposit:

- $1

Trading platform:

- Paper Trading Account

- Individual

- Joint

- Corporate

- Money Manager Account

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of MEXEM Trading Company

MEXEM is a high-risk broker with the TU Overall Score of 2.24 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by MEXEM clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. MEXEM ranks 391 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

MEXEM brokerage company opens up broad trading and investment opportunities, but its new clients will have to learn trading on their own and explore the features of the trading platform. To do this, they can use the Interactive Brokers partner website and a free demo account.

MEXEM is an investment company and an Interactive Broker and introducing broker (IB) that is licensed by CySEC. The company started its activity in 2018 and has a Cyprus registration. For trading, it offers a desktop platform from Interactive Brokers, as well as a web portal and proprietary mobile apps. The available assets include stocks (whole and fractional), funds, futures, options, and bonds. This broker also allows you to trade FX currency pairs and contracts for differences (CFDs) in prices, i.e., derivatives. MEXEM ensures the highest level of security for client funds and takes a responsible approach to fulfilling all contractual obligations for brokerage services.

| 💰 Account currency: | 23 fiat currencies |

|---|---|

| 🚀 Minimum deposit: | 1 unit of the base currency of the account |

| ⚖️ Leverage: | No |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, mutual funds, bonds, options, futures, warrants, metals, Forex, CFDs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with MEXEM:

- The company is monitored by several regulators and holds a license from the Cyprus Securities and Exchange Commission (CySEC).

- A wide range of markets and financial instruments, including stocks and derivatives.

- Low fees for trades with American stocks and ETF funds.

- Support for fractional stock trading.

- Ability to use margin to increase the return on investment.

- No fees for deposits, account maintenance, or the first withdrawal in each month.

- Free advanced analytics from Trading Central, fundamental data, news, forecasts, and trading ideas on various markets.

👎 Disadvantages of MEXEM:

- The only way to deposit and withdraw funds is through a bank transfer, which is the slowest and most expensive method of sending and receiving payments.

- Because the broker doesn’t provide educational materials, a potential client with no trading experience should consult third-party websites.

Evaluation of the most influential parameters of MEXEM

Trade with this broker, if:

- You are looking for regulated broker as this company is monitored by several regulators and holds a license from the Cyprus Securities and Exchange Commission (CySEC).

- You require a broker having access to a wide range of markets and financial instruments, including stocks and derivatives.

Do not trade with this broker, if:

- You are looking for multiple transaction methods as the only way to deposit and withdraw funds with this broker is through a bank transfer, which is the slowest and most expensive method of sending and receiving payments.

- You require in-depth research and analysis tools. This broker offers some research tools, but they might not be as extensive as those of some competitors.

- You are based in the US or certain restricted countries as MEXEM currently does not accept clients from the US and a few other countries. If you reside in one of these restricted jurisdictions, you will not be able to open an account with this broker.

Geographic Distribution of MEXEM Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of MEXEM

MEXEM is a regulated broker that operates under the supervision of several European regulators and participates in their compensation funds. The range of assets and analytical capabilities of the offered trading platforms will satisfy the needs of traders with any level of trading skills, including experienced market participants and institutional clients. MEXEM invites professional managers to cooperate to broaden the range of passive investment strategies.

The range of MEXEM’s trading assets includes stocks, ETFs, bonds, metals, currencies, futures, and options contracts. The broker allows margin trading at a rate of up to 9.9% per annum. Negative balance protection is applied to spot trades involving currency pairs and derivatives in the CFD format.

A trader can start trading with a comfortable amount, but it should be enough to purchase a financial instrument and pay fees to a broker, exchanges, and regulators. MEXEM’s fees are based on order volume; however, for some assets (such as US and Canadian stocks), the broker charges a flat fee for each security sold or purchased.

Dynamics of MEXEM’s popularity among

Traders Union’s traders, according to 2023 data

MEXEM’s investment programs, available markets, and products

MEXEM clients can trade independently or become investors and earn passive income without trading. The broker allows you to use algorithmic trading, transfer the portfolio to management, or copy the strategies of experienced traders. Another opportunity for additional earnings without actively trading is participation in a referral program involving new clients.

MEXEM’s passive income options

The broker supports algorithmic trading. Private traders can develop their apps in Java, .NET (C#), C++, Python, or DDE. Institutional clients are allowed to create their own automated trading systems using API and FIX CTCI solutions, high-speed order routing, and wide market depth. MEXEM prioritizes the result of the trade over the speed with which it is executed, so the broker doesn’t support high-frequency trading (HFT).

The company also offers a personal money management service. Professional consultants or managers through a Money Managers Account can involve investors and rebalance their portfolios. The investor pays the account manager a percentage of the actual profit. The rate is set by the manager and prescribed in the contract. There is no input or output fee.

Also, MEXEM clients can track and copy the trades of other traders through the Collective2 social trading platform. It allows using automated strategies for trading stocks, options, futures, and currencies after paying a monthly subscription fee.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

MEXEM referral program:

The referral program for MEXEM is provided through the Adtraction platform, which also provides marketing tools for other investment groups such as DEGIRO, eToro, and FXFlat Bank.

MEXEM partners are paid for trading activity by involved traders, but the amount of remuneration is not specified on the company’s website. The rate is negotiated on an individual basis and depends on the partner’s country of residence, the number of followers on social networks, and the type of partnership chosen.

Trading Conditions for MEXEM Users

MEXEM offers a wide range of assets for trading and investing. There are also margin trades available. The broker doesn’t support high-frequency trading but is more focused on medium- and long-term strategies. Intraday trading is allowed but requires an initial margin of $25,000 or more. If a trader doesn’t engage in intraday trading and only transfers positions, they can make any deposit, starting with one unit of the base currency. MEXEM doesn’t accept or withdraw cryptocurrencies, nor does it allow depositing and withdrawing funds through electronic payment systems or bank cards.

$1

Minimum

deposit

1:1

Leverage

13/5

Support

| 💻 Trading platform: | Paper Trading Account (demo), Individual, Joint, Corporate, Money Manager Account |

|---|---|

| 📊 Accounts: | Paper Trading Account (demo), Individual, Joint, Corporate, Money Manager Account |

| 💰 Account currency: | 23 fiat currencies |

| 💵 Replenishment / Withdrawal: | Bank transfer, SEPA |

| 🚀 Minimum deposit: | 1 unit of the base currency of the account |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | N/a |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, mutual funds, bonds, options, futures, warrants, metals, Forex, CFDs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Interactive Brokers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market, market-on-close, limit, stop limit, limit-on-close, mid-price, stop, trailing stop, trailing stop limit |

| ⭐ Trading features: | Broker is not suitable for high-frequency trading |

| 🎁 Contests and bonuses: | No |

Comparison of MEXEM with other Brokers

| MEXEM | RoboForex | Pocket Option | Exness | AMarkets | Deriv | |

| Trading platform |

Paper Trading Account, Individual, Joint, Corporate, Money Manager Account | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, AMarkets App | Deriv bot, Deriv MT5, Derivix, Deriv Trader, SmartTrader |

| Min deposit | $1 | $10 | $5 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:1 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:3000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 1.00% |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

10% / 10% | 60% / 40% | 30% / 50% | No / 60% | 50% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| MEXEM | RoboForex | Pocket Option | Exness | AMarkets | Deriv | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No | No | No |

| Options | Yes | No | No | No | No | Yes |

MEXEM Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual | $2.5 | Yes, starting with the second withdrawal per month |

Stamp duty for UK securities is 0.5%; for Ireland securities, it is 1%.

Specialists of the analytical department of the Traders Union not only calculated the average fee of MEXEM but also compared it to the fees of its competitors. The results of the research are summarized in the table below.

| Broker | Average commission | Level |

| MEXEM | $2.5 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed analysis of MEXEM

MEXEM is the representative broker of Interactive Brokers; therefore, it offers the same products and services. Its clients can trade in over 100 global markets. MEXEM is suitable for algorithmic and independent trading as well as passive investment through a money management service. Acting as a representative of Interactive Brokers, MEXEM ensures high security of client funds and assets: the company stores them in segregated accounts with major European banks and fulfills all obligations stipulated by CySEC regulations.

MEXEM by the numbers:

-

Provides access to more than 150 exchanges in 33 countries worldwide.

-

"Client Portal" trading web platform supports an interface in 12 languages.

-

Offers over 44,000 mutual funds for trading.

MEXEM is a broker with a wide range of assets and trading platforms for professional investment

A wide range of assets is one of the advantages of MEXEM. So, traders can invest in the securities of companies in the USA, Great Britain, China, Japan, the EU, and other Asian countries. There are also trades with currency pairs (Forex) and CFDs on various asset classes. A trading account can be opened in 23 currencies, which is an advantage for traders who make trades with instruments from various international markets. Opening an account in the currency of the quoted asset allows you to save on currency exchange fees.

MEXEM trading platforms have not only an interface for making trades but also analytics, research materials, and advanced technical analysis tools. The TWS desktop platform from Interactive Brokers is intended for skilled traders. It supports 127 indicators, more than 100 types of orders, and order routing. Mobile apps and web platforms are more suitable for beginners. On the other hand, their analytical capabilities are limited. A convenient function of mobile trading platforms is a chatbot. You can use it to place orders and track the value of selected assets.

MEXEM’s useful services:

-

Market news. A section of the website provides an overview of events that may influence the value of financial instruments.

-

MEXEM TV. Broadcasts economic news and market analytics. The videos are available on the broker’s website and its YouTube channel.

-

Trading ideas. A section of a user’s account with analytics, recommendations, and forecasts from Trading Central. Traders also have access to a news feed, financial indicators for companies, and information on dividends.

-

Research. This block provides fundamental analytical materials. It contains an economic calendar, as well as analytics and macroeconomic indicators from Refinitiv, a global provider of data on global financial markets.

Advantages:

Unlike many other stock brokers, MEXEM has no minimum deposit requirements.

The fee for trading stocks of American companies is only $0.005.

The broker allows for passive income and offers a portfolio management service, algorithmic trading, and social trading options.

Traders can use a training account to test the trading conditions and execution speed of MEXEM without depositing real money.

The company provides a trading platform with advanced capabilities for technical analysis and various types of orders for professional trading.

The mobile app implements the IB Key technology from Interactive Brokers for two-factor authentication. To log in to the account, you will need to use a fingerprint or enter a unique PIN. While the IB Key is not configured, the user can log in with the code from the SMS message.

Guide on how traders can start earning profits

MEXEM offers a wide range of accounts for individuals and legal entities. In this review, TU focuses on the accounts for retail traders. Conventionally, they are called “Individual Accounts”. MEXEM allows trade using two types of user accounts: cash and margin accounts.

Account types:

Also, MEXEM offers a demo account (Paper Trading account), but it is only available in the Trader Workstation desktop trading platform. To use the training account, the trader must install the trading platform on a PC or laptop.

In addition to user accounts, MEXEM offers corporate, joint, and Money Manager accounts for the management of funds.

Investment Education Online

There are no videos or articles on the MEXEM website that can help beginners master the essentials of trading financial instruments. There is some educational information in the Support section of the website, but it will not be enough to fully immerse in the field of investing in the stock market.

Traders registered with the broker have access to an education tool from Interactive Brokers called “Student Trading Lab”, which is a trading simulator. Using this tool, a beginner can connect their training demo account to the account of a trading teacher and thus gain real-life trading experience without investing funds.

Security (Protection for Investors)

MEXEM (legal name: MEXEM, Ltd.) is regulated by the CySEC commission, license no. 325/17. The broker is a member of the Investor Compensation Fund (ICF) and the Irish Investor Compensation Scheme (ICS). According to their conditions, all clients are provided with coverage in the amount of up to €20,000 in case of MEXEM’s bankruptcy.

MEXEM is a representative broker for Interactive Brokers in the EU territory. Deposits and assets of its clients are stored in the Irish division of Interactive Brokers, which is regulated by the Central Bank of Ireland. MEXEM is registered with the Netherlands Financial Markets Authority (AFM) as well as the Belgian Financial Services and Markets Authority (FSMA).

👍 Advantages

- Regulation is performed by reputable EU financial commissions

- The Central Bank of Ireland acts as a guarantor of the safety of client funds and assets

- Two-factor authorization via SMS, PIN code, or fingerprint

👎 Disadvantages

- To open an account, you need to provide full personal details and information on your sources of income

- Account approval takes up to 3 business days

- The broker only accepts payments and allows the withdrawal of funds only via bank transfer

Withdrawal of funds from MEXEM

-

Bank transfer is the only withdrawal method available in MEXEM. The broker doesn’t accept credit or debit cards, or electronic wallets. Payments in cryptocurrency are also not supported.

-

The timing of crediting money to the account depends on the bank processing the transaction.

-

The first withdrawal per month is made for free. For all the subsequent transfers, the trader pays a fee depending on the withdrawal currency and the type of bank transfer.

-

The withdrawal is made in the currency of the account. If a different currency is selected, a conversion fee is applied.

Customer Support Service

You can reach the technical support service with your questions on weekdays. From Monday to Thursday, operators are available from 8:30 to 22:00, and on Friday — from 8:30 to 17:30.

👍 Advantages

- Connection to the chat operator is fast

- Relevant answers

👎 Disadvantages

- Technical support service is not available on weekends

- You can only use WhatsApp for online messaging

Communication with the company’s representatives is through the following channels:

-

WhatsApp;

-

phone;

-

email.

To send a message or call MEXEM, you do not need to sign up with this broker. All of the above communication channels are available to potential clients.

Contacts

| Foundation date | 2018 |

| Registration address | Archiepiskopou Kyprianou, 1, Loucaides Building, 3036, Limassol, Cyprus |

| Official site | https://www.mexem.com/ |

| Contacts |

Email:

info@mexem.com,

Phone: +31-202622685 +32-35470144 |

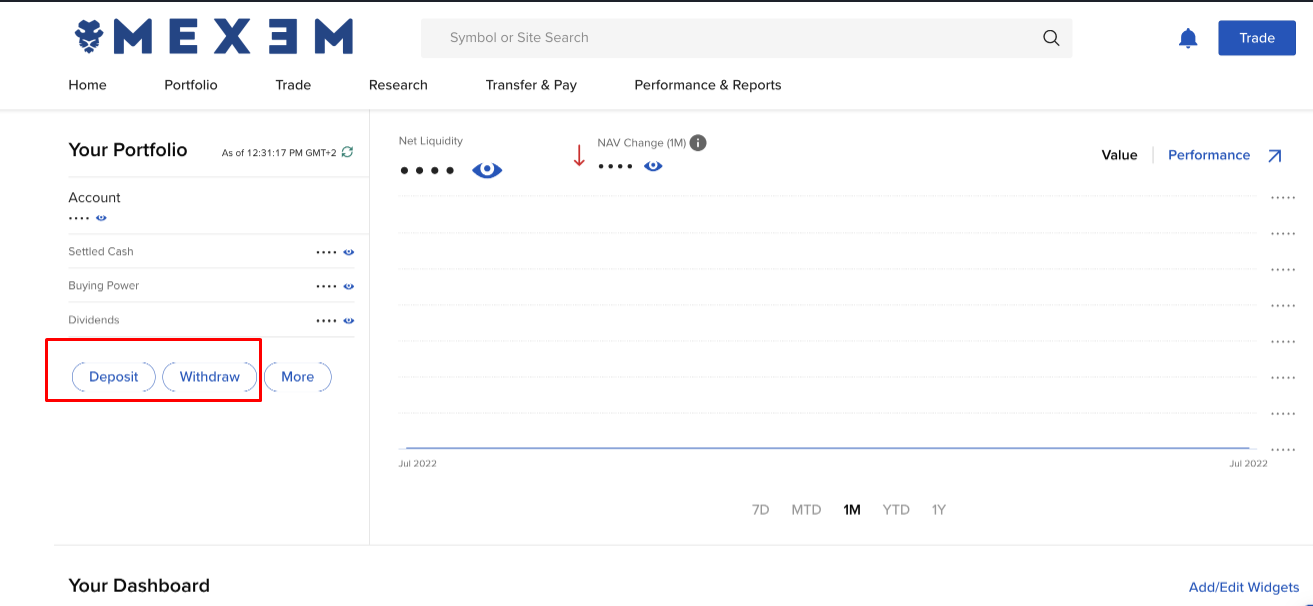

Review of MEXEM user account

To get access to your user account, you need to sign up with a broker. The procedure is as follows:

Visit the official website of MEXEM, go to the main page, and click the “Open Account” button.

The next step will be to enter and confirm the phone number. You will also need to enter your first name, last name, date of birth, address, taxpayer number, and ID details in the registration form. The next step is to specify your trading experience and information about your capital. To get a login and password for your user account, you need to provide a photo of the front and back of an ID card (passport or driver’s license) and a utility bill payment receipt to confirm the specified residential address.

The main functions available from the MEXEM user account are:

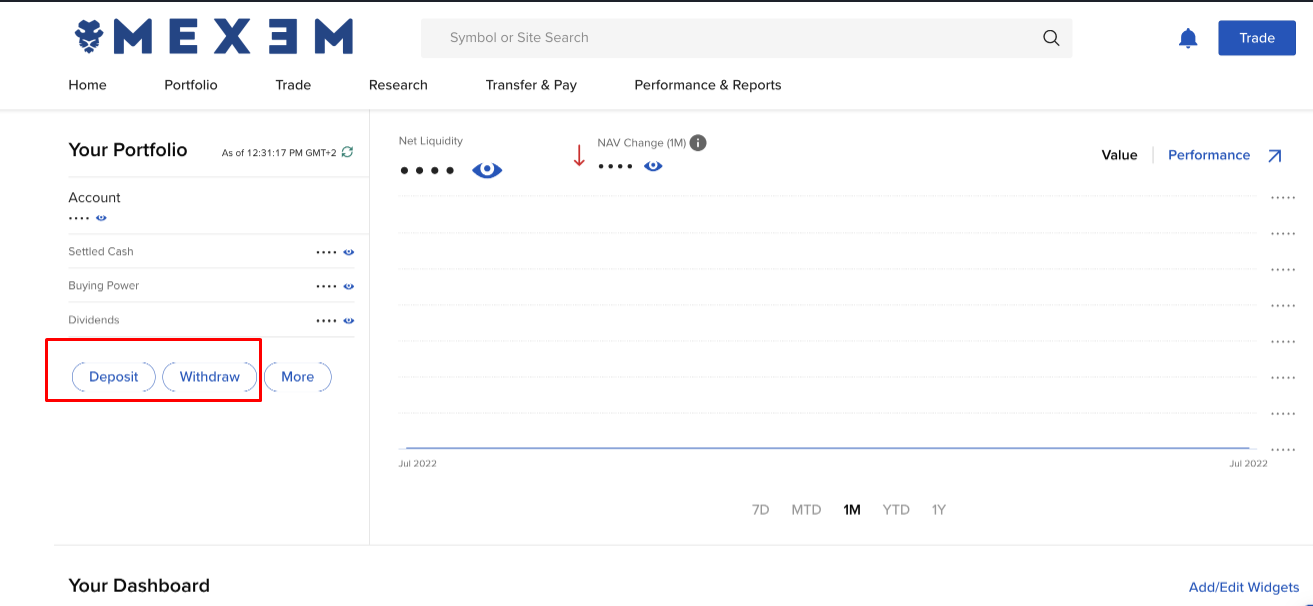

1. Making a deposit and submitting a withdrawal request:

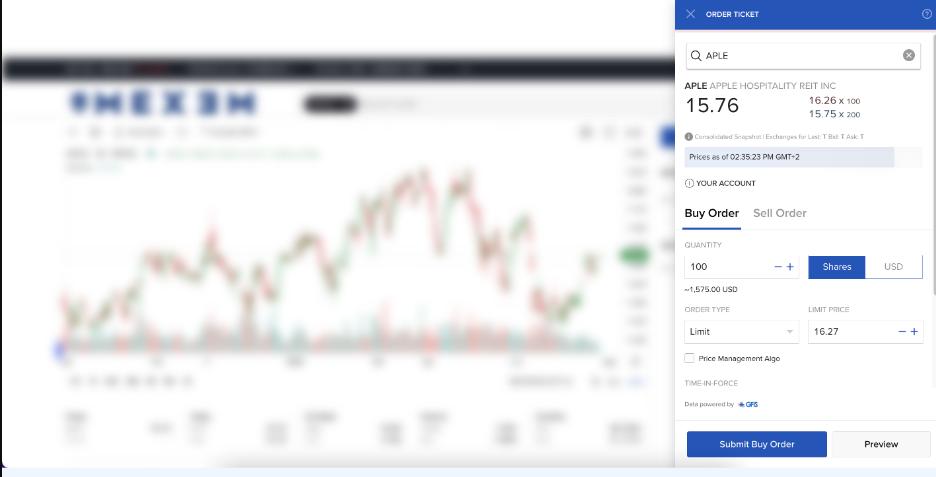

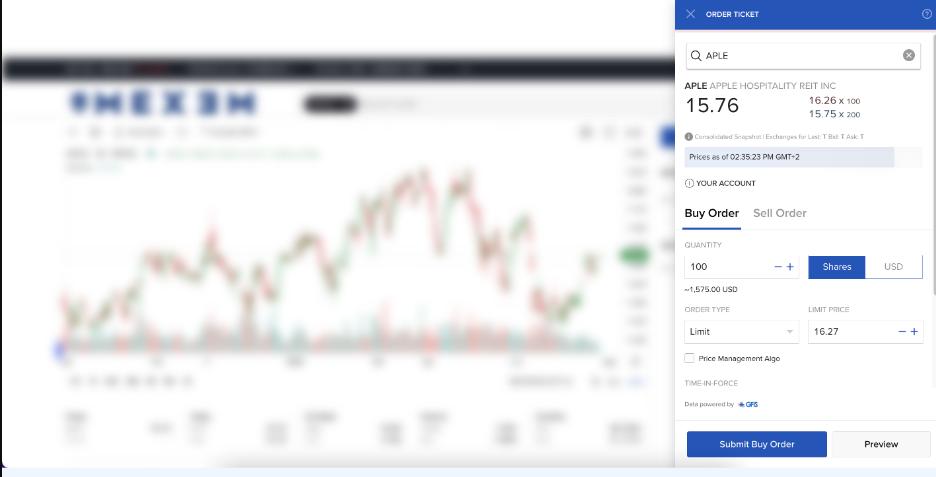

2. Placing trading orders for selected assets:

1. Making a deposit and submitting a withdrawal request:

2. Placing trading orders for selected assets:

Other features accessible through the user account:

-

Statistics about the investment portfolio such as the profit/loss balance and fees paid.

-

Two-factor authentication.

-

Configuring price alerts.

-

Trading ideas and analytics from Trading Central.

-

Daily market summaries, a news feed, calendars of income, and economic events.

Articles that may help you

FAQs

Do reviews by traders influence the MEXEM rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about MEXEM you need to go to the broker's profile.

How to leave a review about MEXEM on the Traders Union website?

To leave a review about MEXEM, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about MEXEM on a non-Traders Union client?

Anyone can leave feedback about MEXEM on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.