Saxo Bank Bonuses Explained

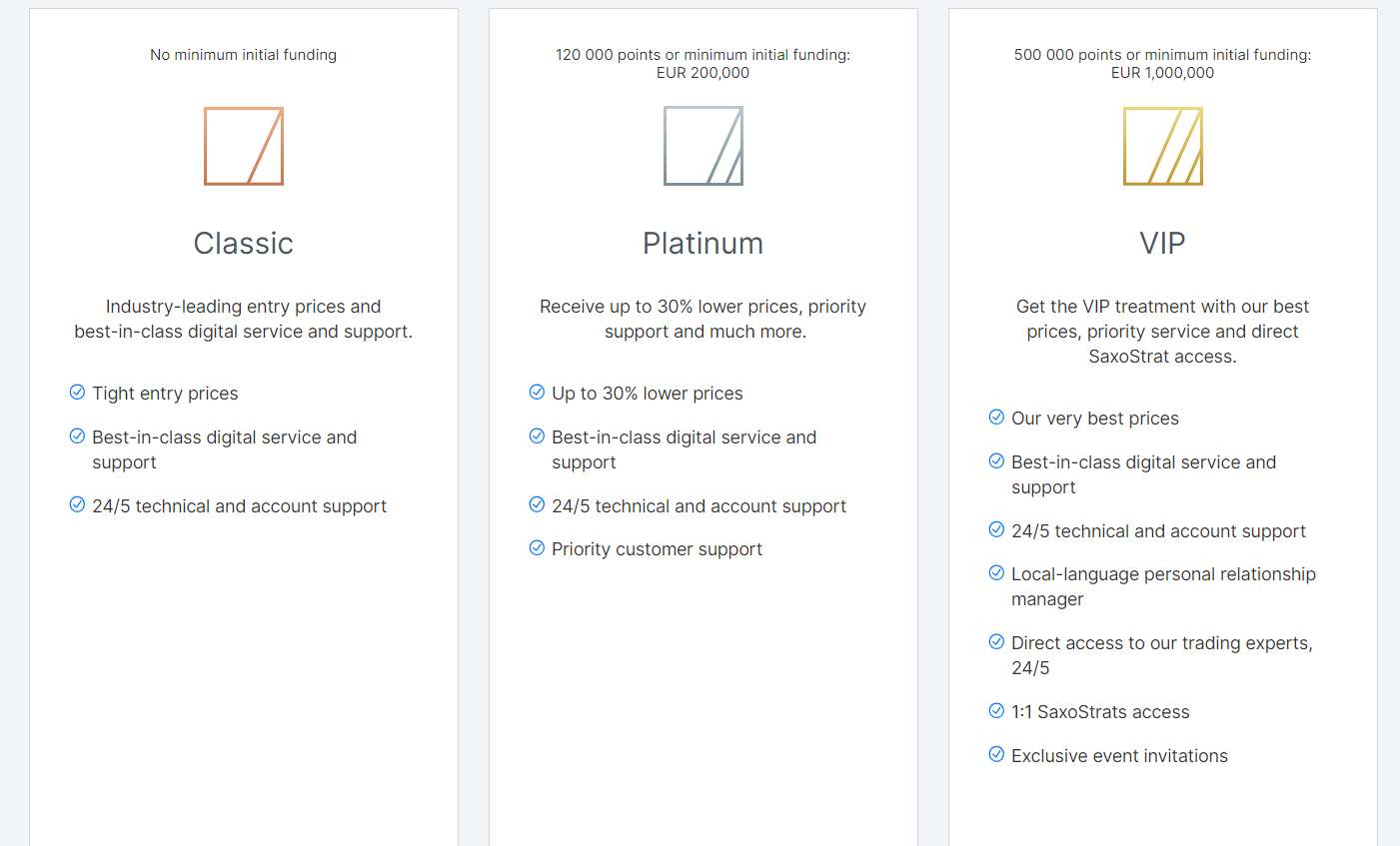

Saxo Bank has no traditional bonuses. Instead the company has developed a loyalty program, thanks to which users receive points for trading activity, which are needed to move to an improved level of service. There are three levels available - “Classic”, “Platinum” and “VIP”. The “Classic” level is assigned to users after registration, to move to “Platinum” you need to accumulate 120,000 points, the opportunities of the “VIP” level are opened to traders after 500,000 points.

More than one million clients around the world who make up to 300,000 transactions every day - these are the figures published on the website of Saxo Bank, which positions itself as one of the most reliable brokers in the world. The company has 30+ years of experience in the industry, over 200 partner banks, several dozen awards and endorsements from a number of reputable regulators, including the UK's FCA and the Danish Financial Supervisory Authority.

It promises its clients a variety of assets (fiat and digital currencies, commodities, precious metals, etc.), transparent commissions, leverage, high quality service, training materials, video guides, etc. But today we would like to pay attention to one more aspect of Saxo Bank's activity - bonuses. This article will explain whether they are available in principle, and what you need to do to get them.

Does Saxo Bank have bonuses?

Saxo Bank does not offer its clients any bonuses. As an alternative, the company has developed a loyalty program that rewards traders with points for trading activity. When making trades on the Saxo Bank platform, you receive points for each qualified order, which you can then exchange for a higher level of service, including reduced trading costs, access to webinars and educational resources, expert support, etc.

Also, the company's website provides an affiliate program that works on the principle of “Bring a Friend”. A trader receives guaranteed payments for each user who registers on the platform and deposits a balance by clicking on his referral link. The size of the reward depends on the size of the deposit the referral makes. For example, if he deposits 10,000 dollars, the user will receive 500 euros. Read a detailed comparison of IC Markets and Saxo Bank.

What is a Saxo Bank loyalty programme?

Saxo Bank's loyalty program is called Saxo Rewards and all clients of the company join it automatically without any additional fees. The program has three levels - “Classic”, “Platinum”, and “VIP”.

-

Classic: no points are required. Traders receive standard service including 24/7 technical support and account maintenance.

-

Platinum: 120,000 points or a minimum deposit of 200,000 euros is required. The company offers discounts of up to 30% and priority support.

-

VIP: 500,000 points or a minimum initial funding of one million euros. This level includes specialized 24/7 support, personal meetings with experts, the tightest spreads and lowest commissions, and exclusive invitations to events.

Saxo Bank loyalty program levels

To qualify for a level of service upgrade, you must earn a certain number of award points. Qualification for a tier is determined by the number of points you earned this month and the three previous months.

The number of points will depend on the products you trade and the size of the trade. For example, trading $10,000 worth of currency options will earn you 40 points, while investing in bonds of the same amount will earn you 256 points.

How can I get Saxo Bank bonus points?

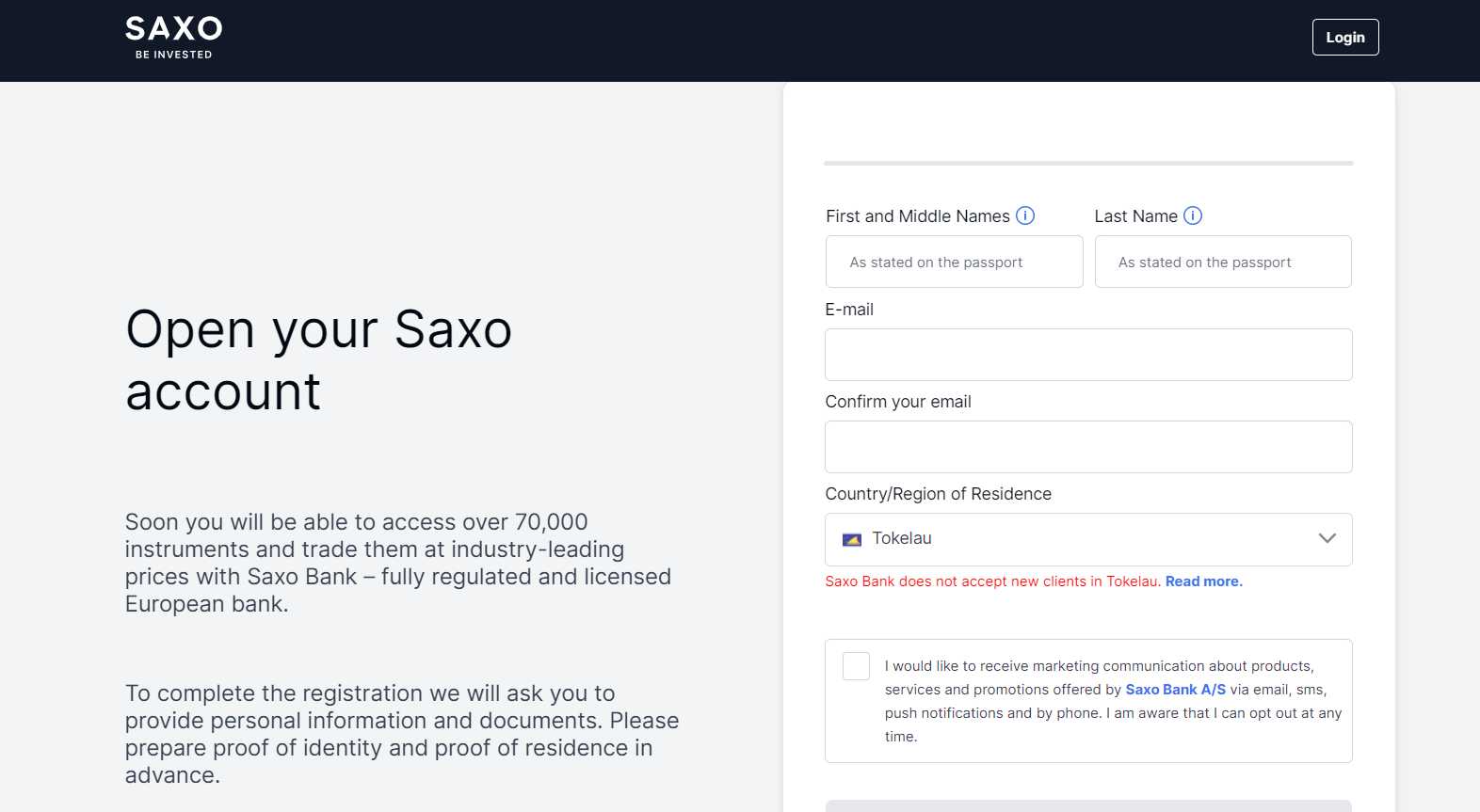

When users open an account on the Saxo Bank website, they automatically join the loyalty program. To create an account you need to take the following steps:

-

Click on the “Open account” button, which is located in the upper right corner of the page.

-

Fill in the registration form by entering first and last name, e-mail, country/region of residence.

-

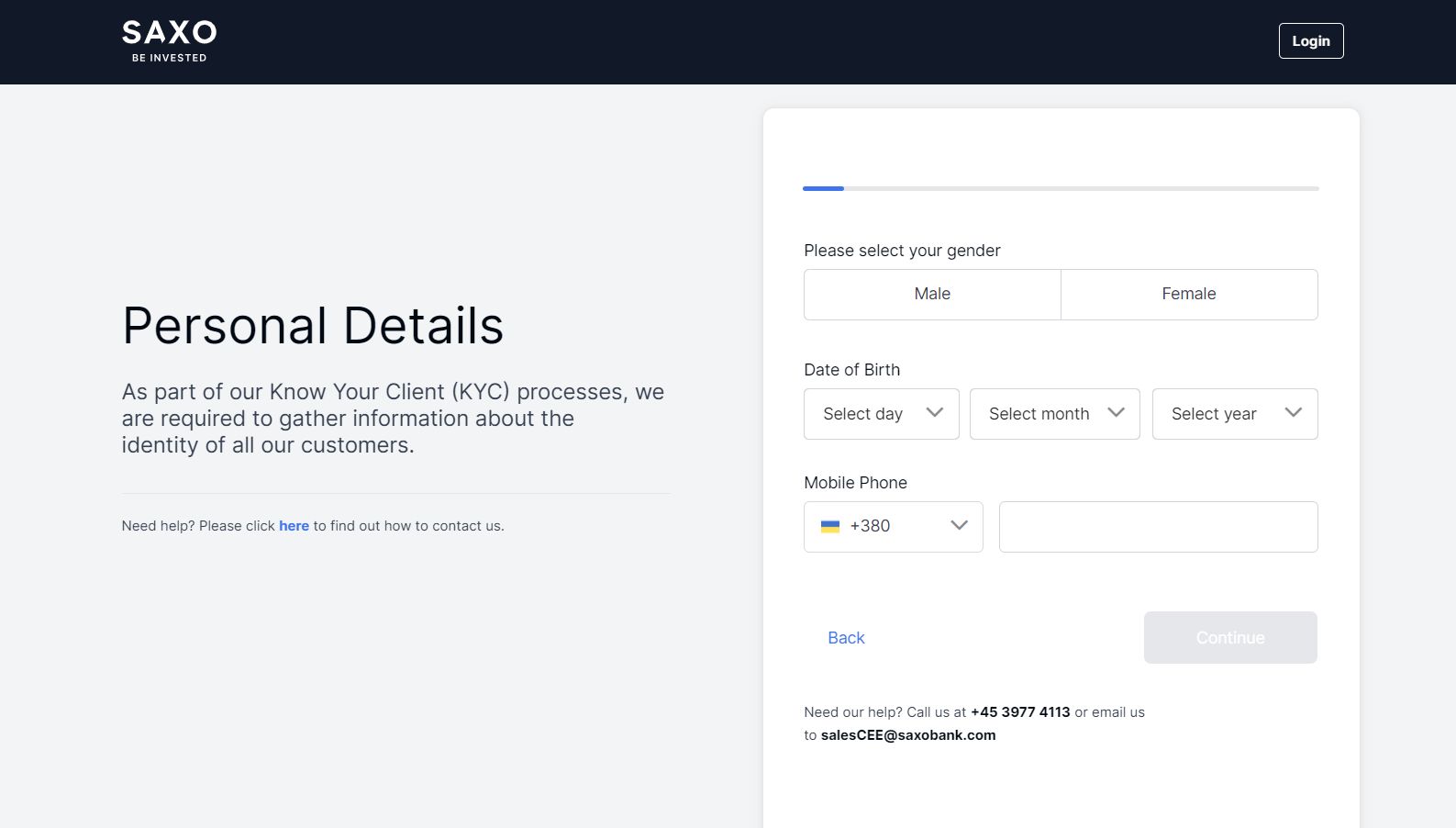

Next, you need to enter personal information about yourself: gender, date of birth, phone number. You will also need to provide details of your employment, including your occupation and connections with politically exposed persons.

-

The company also asks users to share their financial information (annual salary after taxes, main source of income, amount you plan to invest in Saxo Bank, etc.) and describe your trading experience (what instruments you have traded before and how well you understand the basics of trading).

-

Next, you will be asked to provide your citizenship data, tax information, residential address, etc.

-

Account verification is a mandatory condition. To pass it, you must upload several documents, namely: an ID card (passport or ID-card) and a document confirming your place of residence (it can be a bank statement or a utility bill issued in your name - no more than 6 months should have passed since the receipt was issued).

Official website of Saxo Bank

Official website of Saxo Bank

Official website of Saxo Bank

Next, choose the type of account to join the loyalty program. Saxo Rewards points can be earned in the following ways:

-

Make trades. You'll earn points based on asset class and trade size. Stocks, ETFs and ETNs earn 200 points per $10,000 of trading value, and bond investments earn 256 points per $10,000 of trading value.

-

Deposits are made within the first 30 days of account opening. Users are awarded 0.6 points for each euro deposited (or its equivalent in the currency of your account). Therefore, if you deposit €200,000, you will earn more than 120,000 points and qualify for the Platinum account level.

-

Securities transfer within 30 days. Points are awarded based on the value of the transferred position, just as with cash funding. That is, if you transfer 1,000,000 euros to your account, you will be credited with 600,000 prize points and will be assigned the “VIP” level.

Are Saxo Bank bonuses available in my country?

Saxo Bank serves clients from more than 170 countries, including Denmark, France, the UK, Singapore, Switzerland, etc. The broker's offers, including the loyalty program, are not available to residents of the Russian Federation and the Republic of Belarus starting in 2022. Also, Saxo Bank does not serve users from Libya, Myanmar, Somalia, Iraq, Iran, DPRK, etc.

To find out whether the broker's services are available in your country, contact Saxo Bank's support team.

Expert Opinion

Despite the fact that Saxo Bank decided not to provide any bonuses, it still took care of its clients by offering them a convenient loyalty program consisting of three levels. Each new level opens up more and more new opportunities for traders. While on the “Classic” level you can count on a limited set of privileges, including strict entry prices and 24/7 technical support, the “VIP” level gives you priority access to the latest price and market news, events and statistics from Saxo Strats experts and analysts, exclusive invitations to events, the tightest spreads and lowest costs.

All a user needs to do to get to the next level is trade actively or deposit a certain amount within the first 30 days of account creation. But if you choose the second option, be prepared to invest a large amount of money, as Saxo Bank requires a deposit of 200,000 euros to obtain “Platinum” status, while the “VIP” level will cost you a million euros.

Final thoughts

Saxo Bank is a broker whose reliability has been proven by years of work and millions of satisfied clients. It is primarily focused on professional traders and investors with large deposits, believing that this audience does not need bonuses. Nevertheless, to make the trading process even more profitable for all categories of clients, the company has developed a loyalty program that opens up a lot of additional advantages for traders - from low commissions to professional expert support.

FAQs

How do you get reward points at Saxo Bank?

Saxo Bank awards points for making trades in different asset classes. For example, trading €10,000 worth of stocks/ETF/ETN will earn you 250 points, while investing in bonds will earn you 320 points. Points can be earned through deposit transactions as well. When a client accumulates enough points, he/she is automatically promoted to the next level of service.

What bonus alternatives does Saxo Bank offer?

Currently, Saxo Bank does not offer any bonuses, as it positions itself as a company focused on professional traders and investors with a large initial deposit. Nevertheless, the affiliate program allows to make trading more profitable, participating in which users receive payments for each invited client. There is also a loyalty program: traders are awarded points for each transaction, allowing them to move to a new level of service.

How does the Saxo Bank loyalty program work?

The loyalty program has three levels - “Classic”, “Platinum”, and “VIP”. You get points for each completed transaction, thanks to which you discover new opportunities, such as: 24/7 technical support, direct access to trading experts, exclusive events, etc. The more points, the higher the level of service. For example, clients who accumulate 500,000 points receive VIP level, which includes: the tightest spreads, personalized meetings with experts and other options.

Is Saxo Bank good or bad?

Saxo Bank has a number of advantages: a wide range of products including stocks, bonds, futures, etc., 24/7 support, competitive commissions, several platform options, different order types, algorithmic trading and more. In addition, Saxo Bank can be safely called a reliable company, as it is supervised by the FCA, ASIC, FINMA and SFC.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).