Trading Made Simple | Trading Basics and Key Terms to Learn

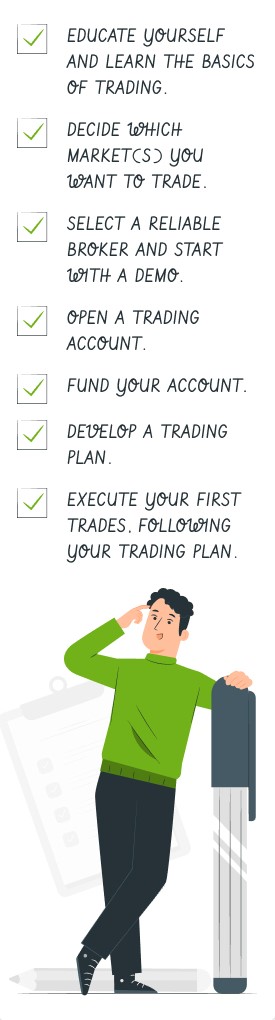

To make your first steps in trading you can follow a plan:

- 1

Educate yourself and learn the basics of trading

- 2

Decide which market(s) you want to trade

- 3

Select a reliable broker and start with a demo

- 4

Open a trading account

- 5

Fund your account

- 6

Develop a trading plan

- 7

Execute your first trades, following your trading plan

Trading can be challenging for beginners due to its inherent complexity and volatility. This beginner’s guide is designed to help novice traders take their first steps into the exciting world of trading. Whether you're interested in stocks, Forex, cryptocurrencies, or other markets, this article will provide you with the basic knowledge and essential terms you need to understand. Discover why trading can be an interesting endeavor for beginners and how to trade stocks, Forex and other markets.

What is trading?

Trading refers to the activity of buying and selling financial assets, such as stocks, currencies, commodities, or derivatives, with the aim of making a profit. It is a dynamic and ever-evolving process that takes place in various markets worldwide.

In simple terms, trading involves speculating on the price movements of assets. Traders analyze market trends, news, economic factors, and other relevant information to make informed decisions about when to enter and exit trades. The ultimate goal is to buy an asset at a lower price and sell it at a higher price, thereby generating a profit.

Trading can be conducted by individuals, institutional investors, or even automated systems known as algorithms. It can take place on various platforms, including online trading platforms provided by brokerage firms. While some traders prefer short-term trading to capture quick price movements, others take a long-term investment approach.

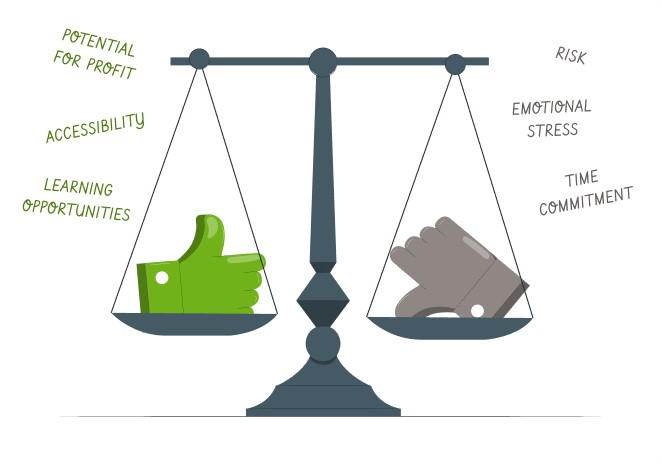

Trading Pros and Cons for Beginners

👍 Pros

• Potential for Profit:

Trading offers the opportunity to earn substantial profits, often surpassing returns from traditional investments

• Flexibility:

Traders can choose their preferred markets, trading styles, and timeframes

• Accessibility:

Many online platforms and brokerage firms make trading accessible to beginners with low initial investment requirements

• Learning Opportunities:

Engaging in trading provides valuable insights into global markets, economics, and financial instruments

👎 Cons

• Risk:

Trading involves the risk of losing money, especially for inexperienced traders who may make incorrect predictions

• Emotional Stress:

The pressure and fluctuations in the market can cause emotional stress and impulsive decision-making, leading to poor results

• Time Commitment:

Successful trading requires time for research, analysis, and monitoring market movements

How does trading work?

Let's consider the example of a trader named Max to understand how trading works.

To calculate the profit or loss, we need to consider the difference between the entry price and the exit price, multiplied by the position size.

In the first scenario:

Max receives a trading signal to buy Bitcoin (BTC) at a price of $25,200, with a target price of $31,000

Entry Price: $25,200

Exit Price: $31,000

Difference: $31,000 - $25,200 = $5,800

Profit/Loss: $5,800 * $10,000 / $25,200 ≈ $2,301.59

Max would have made a profit of approximately $2,301.59 if the trade went as anticipated

In the second scenario:

Max decided to short sell 75 Amazon (AMZN) stocks at $133, with a target price of $122. The position size is near $9.975

Calculate the difference in stock price: Difference = Initial selling price - Target price = $133 - $122 = $11

Calculate the profit: Profit = Difference in stock price × Number of shares = $11 × 75 = $825

Max would have made a profit of approximately $825 if the trade went as anticipated.

It's important to note that if the forecasts did not work out and the trades moved against Max's expectations, he would have incurred losses. This emphasizes the importance of trading risk management through techniques like implementing stop-loss orders. Controlling risk is crucial in trading to protect capital and ensure long-term success.

Is trading hard?

Trading can be challenging. It requires knowledge, skills, experience, and the ability to make informed decisions in a dynamic and often unpredictable market environment. Here are some reasons why trading can be considered hard:

Market Complexity:

The financial markets are complex, with various factors influencing price movements, such as economic indicators, geopolitical events, and investor sentiment. Understanding these dynamics and their impact on trading requires continuous learning and staying updated with market trends

Risk and Uncertainty:

Trading involves inherent risks, including the potential for financial losses. The market can be unpredictable, and even the most thorough analysis and research cannot guarantee accurate predictions. Traders must learn to manage risk effectively through techniques like risk management, diversification, and setting appropriate stop-loss orders

Emotional Control:

Successful trading requires emotional discipline and the ability to control impulses. Traders need to remain calm and objective, avoiding emotional decision-making driven by fear, greed, or excitement. Emotional control is essential to stick to a trading plan and avoid impulsive actions that can lead to losses

Continuous Learning:

Markets evolve, and new trading strategies, techniques, and instruments emerge over time. Traders need to dedicate themselves to continuous learning, staying updated with market developments, and honing their skills to adapt to changing market conditions

While trading can be challenging, it's important to note that with dedication, education, practice, and a disciplined approach, individuals can learn and improve their trading skills over time. It's recommended for beginners to start with a solid foundation of knowledge, seek guidance from experienced traders or mentors, and gradually gain experience through simulated or small-scale trading before risking significant capital. You may also be interested in the article: How Long Does It Take To Learn To Be A Trader?

Top Trading Terms to Know

- a

Bid/Ask Price:

The bid price is the highest price buyers are willing to pay, while the ask price is the lowest price sellers are willing to accept - b

Long/Short:

Long refers to buying an asset with the expectation that its value will rise, while short refers to selling an asset with the anticipation of its value decreasing - c

Stop-Loss Order:

A stop-loss order is a predetermined price level at which a trader will exit a trade to limit potential losses - d

Take-Profit Order:

A take-profit order is a predefined price level at which a trader will close a trade to secure profits - e

Volatility:

Volatility refers to the degree of price fluctuations in a market. High volatility presents both opportunities and risks - f

Margin:

Margin is the amount of money required to open and maintain a leveraged position in the market - g

Volume:

The number of shares or contracts traded in a security or market during a specific period - h

Bull Market:

A bull market refers to a market trend characterized by rising prices and optimism among traders - i

Bear Market:

A bear market refers to a market trend characterized by falling prices and pessimism among traders - j

Liquidity:

Liquidity refers to the ease of buying or selling an asset without causing significant price fluctuations - k

Technical Analysis:

A method of evaluating securities by analyzing statistical trends and patterns in historical price and volume data - l

Fundamental Analysis:

Fundamental analysis involves evaluating the financial health, performance, and potential of a company or asset based on economic factors

Top 10 Tips for Beginner Traders

Traders Union has prepared top tips for beginner traders to enhance their productivity:

Educate Yourself:

Invest time in learning about financial markets, trading strategies, and risk management. Acquire knowledge through books, courses, and reputable online resources to develop a solid foundation

Start with a Demo Account:

Practice trading in a simulated environment using a demo account. This allows you to familiarize yourself with the trading platform, test strategies, and gain confidence without risking real money

Define a Trading Plan: Create a well-defined trading plan that outlines your objectives, risk tolerance, entry/exit criteria, and position sizing. Stick to your plan and avoid impulsive decisions driven by emotions

Use Proper Risk Management:

Implement risk management techniques such as setting stop-loss orders to limit potential losses. Never risk more than a predefined percentage of your trading capital on a single trade

Monitor Market News: Stay updated with financial news and economic events that can impact the markets. This helps you make informed decisions and adjust your trading strategy accordingly

Start with Small Positions:

Begin trading with smaller position sizes to manage risk effectively. As you gain experience and confidence, gradually increase your position sizes

Keep Emotions in Check: Emotions can cloud judgment and lead to poor decision-making. Maintain discipline, control greed and fear, and avoid making impulsive trades based on emotional reactions

Maintain Trading Records:

Keep a record of your trades, including entry/exit points, rationale, and outcomes. Regularly review your trading journal to identify patterns, strengths, and weaknesses, and learn from your past trades

Utilize Stop-Loss Orders:

Always use stop-loss orders to protect your capital. These orders automatically close a trade if the price reaches a predetermined level, limiting potential losses

Seek Guidance and Support:

Join trading communities, forums, or mentorship programs to connect with experienced traders and gain insights. Networking and learning from others can greatly enhance your trading journey

Remember, becoming a successful trader takes time and dedication. By following these tips and continuously honing your skills, you can increase your productivity and improve your trading results over time.

Main Types of Trading

Day Trading

Day traders open and close positions within the same trading day, aiming to profit from short-term price fluctuations. They typically don't hold positions overnight and take advantage of intraday price movements.

Swing Trading

Swing traders hold positions for a few days to several weeks, aiming to capture larger price moves. They analyze charts and technical indicators to identify trends and potential reversals, seeking to enter trades at optimal points.

Position Trading

Position traders hold positions for an extended period, ranging from weeks to months or even years. They focus on long-term market trends and fundamental analysis to make trading decisions. Position trading is less concerned with short-term price fluctuations and more focused on capturing larger market movements.

Scalping

Scalpers aim to make small profits from frequent, quick trades. They capitalize on small price differentials and liquidity imbalances, often entering and exiting trades within seconds or minutes. Scalping requires fast execution and tight spreads.

Comparison Table of Trading Styles:

| Trading Style | Risk for Beginners | Time Commitment |

|---|---|---|

Day Trading | High | Assets for copy trading High |

Swing Trading | Moderate | Assets for copy trading Moderate |

Position Trading | Low | Assets for copy trading Low |

Scalping | High | Assets for copy trading High |

It's important to note that trading strategies can vary greatly depending on individual preferences, risk tolerance, and market conditions. Traders often combine elements from different types of trading to create their unique approach or adapt their strategies as market conditions change.

Key Markets to Consider for Beginners

Choosing the right market for beginners is crucial for several reasons. Different markets have varying levels of complexity and learning curves. For beginners, it's important to select a market that offers relatively easier entry and understanding. Some markets, such as stocks, may have more accessible resources, educational materials, and established frameworks for analysis, making it easier for beginners to grasp the fundamentals. Let’s consider the top markets to choose.

Stocks

The stock market involves buying and selling shares of publicly traded companies. Pros include potential long-term growth and dividends, while cons include market volatility and the need for in-depth research. Stocks are a good option for beginners due to their relative accessibility, abundant educational resources, established frameworks for analysis, and the potential for long-term investment growth.

Forex

Forex trading involves buying and selling currency pairs. Pros include high liquidity and 24/5 market availability, while cons include high leverage and currency volatility. Forex markets can be suitable for beginners who are interested in currency trading, as they offer high liquidity, the ability to start with smaller investment amounts (from $10--$100), and the availability of demo accounts for practice.

Cryptocurrencies

Cryptocurrency trading involves buying and selling digital assets like Bitcoin and Ethereum. Pros include high volatility and potential for significant profits, while cons include market unpredictability and regulatory risks.

Cryptocurrency markets can be appealing to beginners seeking high potential returns and a decentralized digital asset class, but they require thorough research, risk management, and understanding of crypto-specific factors such as market volatility and security measures.

Derivatives (futures, options etc)

With futures and options people can trade a wide range of financial instruments, including stocks, commodities (oil, wheat, gold etc). Derivatives markets, such as options or futures, can offer opportunities for beginners to hedge or speculate on price movements, but they often involve complex concepts and strategies that require a solid understanding before diving in.

Comparison Table of Key Markets:

| Market | Typical Leverage | Passive Income Opportunity | Minimum investment |

|---|---|---|---|

Stocks | up to 1:3 | Assets for copy trading Dividends | Regulator $100-$500 for most investors $25.000 - for day traders in the US |

Forex | Up to 1:50 | Assets for copy trading Copy Trading, PAMM, Forex Signals | Regulator $100-$500 |

Cryptocurrencies | Up to 1:10 | Assets for copy trading Staking, Yield Farming | Regulator $100 or even less |

Derivatives | Up to 1:20 | Assets for copy trading Dividends | Regulator near $500 |

How much money do I need to start trading?

The amount of money needed to start trading varies depending on the market and broker. Typically, Forex and cryptocurrency trading can be started with a small amount, such as $100 or even less.

Stock trading may require a larger investment, depending on the price of the shares you wish to buy. Some stock brokers have no minimum deposit requirements, while others may require a minimum investment of a few hundred dollars or more.

Derivatives trading often requires a higher minimum investment due to the complexity and risks involved. Minimum investment requirements can vary significantly depending on the specific derivative and the broker or platform you use.

If you have limited starting capital, one option is to consider joining a reputable proprietary trading firm (prop firm). Prop firms provide traders with access to their capital and trading infrastructure in exchange for a share of the profits. These firms often have lower minimum capital requirements compared to trading with your own funds, allowing individuals to start trading with less initial investment. However, it's important to thoroughly research and choose a reputable prop firm that offers fair terms, adequate support, and a transparent profit-sharing structure.

Is trading risky?

Yes, trading carries inherent risks. It is important to recognize that trading involves the potential for financial losses. Market volatility, unpredictable price movements, and other factors can lead to substantial losses, especially if proper risk management techniques are not employed. It is crucial for traders to understand and accept these risks and to develop appropriate strategies to manage and mitigate them. Successful trading often requires a combination of knowledge, experience, discipline, and risk management practices.

How to Start Trading | Step-by-step guide

- 1

Educate Yourself. Learn the basics of trading, including market analysis, risk management, and trading strategies

- 2

Choose a Market. Decide which market(s) you want to trade, considering your interests, knowledge, and risk tolerance

- 3

Select a Reliable Broker. Research and choose a reputable broker that provides access to your chosen market(s) and offers user-friendly trading platforms. It’s a good idea to start with demo account to try your hand

- 4

Open a Trading Account. Follow the broker's account opening process, providing the necessary identification and financial information

- 5

Fund Your Account. Deposit funds into your trading account using a suitable payment method

- 6

Develop a Trading Plan. Create a well-defined trading plan that outlines your goals, strategies, risk tolerance, and money management rules

- 7

Execute your first trades, following your trading plan and continuously evaluating and improving your performance. If you want to find out whether trading is possible under the age of 18, read the article Traders Union.

Individual Trading Alternatives

Value investing involves identifying undervalued stocks and holding them for the long term, based on fundamental analysis. Pros include potential long-term growth and lower trading activity, while cons include slower returns and the need for extensive research

Copy trading allows beginners to replicate the trades of successful traders. Pros include the ability to learn from experienced traders and potentially earn profits, while cons include the reliance on others' decisions and potential losses if the copied trader performs poorly

PAMM (Percentage Allocation Management Module): PAMM investing involves allocating funds to a professional trader who manages the investments on behalf of the participants. Pros include professional management and potential passive income, while cons include the risk of choosing an underperforming manager and potential fees

How much can I earn as a beginner?

As a beginner trader, it's important to approach your earning potential with a realistic mindset. While trading can be lucrative, it also involves risk, and success is not guaranteed. After many years of practice, some traders become millionaires, and even billionaires, but the majority achieve more modest results.

The path to becoming a successful trader often involves a significant learning curve and overcoming various challenges. Many beginners experience losses or struggle to consistently generate profits in the initial stages. It takes time to develop a trading strategy that works well and suits one's individual style and risk tolerance.

Trading outcomes depend on numerous factors, including economic conditions, political events, and accurately predicting these factors with high precision is practically impossible. Even experienced traders can face losses and unsuccessful trades. Therefore, despite the potential for earning, traders should be aware that there are no guarantees of income in trading.

Where to learn more?

The most important sources of trading knowledge include reputable financial websites, books written by experienced traders, and educational courses provided by established institutions. Additionally, engaging with trading communities, attending webinars, and following market analysis from trusted experts can provide valuable insights and perspectives.

To learn trading better:

Access comprehensive online trading courses covering various trading topics, strategies, and market analysis techniques

Look for experienced trading mentors who can provide guidance, support, and personalized advice to help you improve your trading skills

Consider trading signals to learn how experienced traders analyze markets

FAQs

Can I day trade with $100?

Technically it’s possible on Forex and cryptocurrency markets. However, day trading with a small account size like $100 is challenging due to the potential for high transaction costs and limited margin options. It's advisable to have a larger trading capital for day trading.

What is the number 1 rule in trading?

The number one rule in trading is to manage your risk. Implement proper risk management techniques, such as setting stop-loss orders and diversifying your portfolio, to protect your capital.

Is trading hard to learn?

While trading requires knowledge, practice, and discipline, it is possible to learn and become a successful trader with dedication and continuous learning.

How to start trading with $500?

Starting with $500 allows for more flexibility in trading. Follow the step-by-step guide mentioned earlier, focusing on risk management and position sizing to make the most of your capital.

Can I trade for a living?

Yes, it is possible to trade for a living, but it requires a combination of skill, knowledge, discipline, risk management, and the ability to adapt to changing market conditions. Success as a full-time trader often takes time, practice, and a consistent track record of profitability.

Glossary for novice traders

-

1

Take-Profit

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.

-

2

Crypto trading

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

Short selling

Short selling in trading involves selling an asset the trader doesn't own, anticipating its price will decrease, allowing them to repurchase it at a lower price to profit from the difference.

-

5

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).