deposit:

- $2

Trading platform:

- Spreadex

- FCA

- 0%

Spreadex Review 2024

deposit:

- $2

Trading platform:

- Spreadex

- FCA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Spreadex Trading Company

Spreadex is a broker with higher-than-average risk and the TU Overall Score of 4.45 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Spreadex clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Spreadex ranks 171 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Spreadex is a CFD and Forex broker that specializes in mobile trading. The broker targets Asia and the British Isles.

Spreadex is a CFD and Forex broker that has been operating since 1999. The platform offers clients access to six classes of trading instruments. Here you can trade currency pairs (Forex) and contracts for difference (CFDs) on stocks, bonds, indices, commodities, and ETFs. Spreadex is headquartered in the UK and is regulated by the UK Financial Conduct Authority (FCA, 190941). Betting on sports is a secondary activity of the company.

| 💰 Account currency: | USD, EUR, GBP |

|---|---|

| 🚀 Minimum deposit: | From USD 2 |

| ⚖️ Leverage: | up to1:30 (Forex) |

| 💱 Spread: | From 0.6 pips |

| 🔧 Instruments: | Currency pairs (60), CFDs on stocks (3000), indices (30), commodities (27), bonds (6), ETFs (200) |

| 💹 Margin Call / Stop Out: | 100%/50% |

👍 Advantages of trading with Spreadex:

- Tight spreads (from 0.6 pips for EUR/USD).

- Withdrawal fee - 0%.

- 3,500+ trading instruments.

- Free broker analytics.

- Minimum deposit from USD 2.

👎 Disadvantages of Spreadex:

- There are no investment instruments.

- Support is not 24/7.

Evaluation of the most influential parameters of Spreadex

Geographic Distribution of Spreadex Traders

Popularity in

Video Review of Spreadex i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Spreadex

The Spreadex Broker has been operating since 1999. The company was established as a sports spread-betting broker. Predicting the price of an asset and trading on the prediction that does not involve the actual ownership of assets. Besides Forex and CFD trading, the company is heavily involved in sports betting.

The broker offers clients one type of trading account, so the trading conditions are the same for everyone. The minimum spread on the platform is only 0.6 pips for EUR/USD, which can be considered an attractive commission. Fixed commissions per lot or per trade are not provided here. It is also worth noting the low level of the minimum deposit, which is from USD 2. Also, a USD 1 commission is paid by traders for replenishing an account with less than USD 50.

Spreadex is not suitable for clients who want to invest and receive passive income, since there are no investment tools on the platform. However, traders will feel comfortable working with this broker. The platform offers 3,500+ trading instruments, of which 3,000+ are CFDs on stocks. In addition, there are useful chart and candlestick analysis services, which make technical analysis much faster.

Latest Spreadex News

Dynamics of Spreadex’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The Spreadex broker specializes exclusively in trading services. The platform does not provide any investment programs or ways to generate passive income. The only way to generate additional income is through an affiliate program from Spreadex, but only webmasters can use it.

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Spreadex’s affiliate program:

-

Standard affiliate program. Available only to webmasters who promote services through websites, blogs, social networks, instant messengers, etc.

An affiliate is a client who has followed the affiliate link, registered, and made a deposit on the platform. The company charges up to 20% of the deposit amount as affiliate payments. To become a member of the affiliate program, you must submit an appropriate application. The platform provides banner ads, videos, and other necessary tools for webmasters.

Trading Conditions for Spreadex Users

Spreadex offers clients six classes of trading instruments. Leverage depends on the chosen trading instruments. The maximum size is applied up to 1:30. There is no demo account, and there is no swap-free account either.

$2

Minimum

deposit

1:30

Leverage

8/7

Support

| 💻 Trading platform: | Spreadex (desktop, Android, iOS, Webtrader) |

|---|---|

| 📊 Accounts: | Standard |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Credit cards, bank transfers |

| 🚀 Minimum deposit: | From USD 2 |

| ⚖️ Leverage: | up to1:30 (Forex) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.6 pips |

| 🔧 Instruments: | Currency pairs (60), CFDs on stocks (3000), indices (30), commodities (27), bonds (6), ETFs (200) |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | More than 20 large banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant execution, Market execution |

| ⭐ Trading features: | No inactivity fee on the account |

| 🎁 Contests and bonuses: | No |

Comparison of Spreadex with other Brokers

| Spreadex | RoboForex | Pocket Option | Exness | FxGlory | InstaForex | |

| Trading platform |

Spreadex | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5 | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $2 | $10 | $5 | $10 | $1 | $1 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:3000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | 8.00% | No |

| Spread | From 0.6 points | From 0 points | From 1.2 point | From 1 point | From 2 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 20% / 10% | 30% / 10% |

| Execution of orders | Instant Execution, Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Instant Execution, Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Broker comparison table of trading instruments

| Spreadex | RoboForex | Pocket Option | Exness | FxGlory | InstaForex | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | No | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | No | Yes |

| Stock | Yes | Yes | Yes | Yes | No | Yes |

| ETF | Yes | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Spreadex Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | From $6 | No |

There are swaps (commission for transferring a position to the next day). The analysts at the Union also compared the size of the average trading commission of Spreadex, Admiral Markets and FXPro. The comparative results are presented in the form of the below table:

| Broker | Average commission | Level |

| Spreadex | $6 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of Spreadex

The Spreadex broker specializes in spread betting. Spread betting is a wager or trade on the up or down movement of prices. However, the trader does not actually own the asset with which he works. The platform allows the client to choose the type of order execution such as instant execution or market execution. Traders can use the analytics of the company, which is provided for free. A single type of trading account is available for all clients.

Spreadex by the numbers:

-

22 years of experience in the market.

-

3,500+ trading instruments.

-

0.6 is the minimum spread for EUR/USD.

Spreadex is a broker for active trading

The Spreadex broker trades independently. Thus, the company has two types of order execution, such as instant execution and market execution. Liquidity is ensured by cooperation with more than 20 major banks. The platform provides traders with access to six types of trading instruments, including the Forex market and Contracts for Difference (CFDs) on stocks, ETFs, bonds, indices, and commodities.

Spreadex offers its clients a proprietary trading terminal. Also, desktop, mobile, and Webtrader versions of the platform are available. Clients have the opportunity to connect to trading with one click. Any trading strategy can be used.

Useful services of Spreadex:

-

Economic calendar. On the Spreadex website, traders can follow upcoming economic events. In the economic calendar, you can sort events by dates, assets, expected volatility, etc.

-

Chart analysis service. Thanks to this application, clients can find patterns on charts, identify support and resistance lines, etc.

-

Candlestick analysis service. An extension for candlestick analysis is available on the platform, which will help confirm a trend or find an approximate reversal point, find an entry point, and a take-profit point.

-

Economic data. Spreadex regularly publishes key economic indicators of the world's leading economies, such as inflation, employment, information on the real estate sector, key interest rates, industrial production, etc.

Advantages:

There are six asset classes available for trading.

To ensure the safety of client funds, the company stores them in segregated accounts.

Tight spreads (from 0.6 pips).

A proprietary trading terminal with adaptability for browsers, desktop, and mobile devices.

The broker provides analytics and online tools to improve the quality of trading.

All analytical services of Spreadex are available to traders free of charge and without additional conditions.

How to Start Making Profits — Guide for Traders

The Spreadex broker offers traders one type of trading account, so all clients of the company work under the same conditions. The minimum deposit to open an account on the platform is USD 2 or the equivalent in another currency. Spreadex offers clients margin trading. The leverage varies depending on the trading instruments you choose:

There is no demo account on the platform.

Spreadex is a broker that offers clients favorable trading conditions, a minimum entry threshold, and a large number of instruments to trade.

Bonuses Paid by the Broker

Currently, the Spreadex broker does not provide bonuses to its clients. Traders who have opened an account here have to use 100% of their personal funds during trading.

Investment Education Online

There is a separate tutorial section on the Spreadex website, but the information there is not comprehensive and is mainly presented in the form of articles only.

The broker does not have cent accounts or a demo account, so you will have to solidify any newly acquired knowledge by practicing on a real account.

Security (Protection for Investors)

The broker has a representative office located in the UK. The official name of the management company is Spreadex Limited.

The broker carries out its activities transparently. Spreadex is licensed by the UK's Financial Conduct Authority (FCA). The Financial Activity Authorization Number is FCA No. 190941. The company has negative balance protection. Funds are held in segregated accounts.

👍 Advantages

- Client funds are segregated from Spreadex capital and held in segregated bank accounts

- Negative balance protection always active

- In case of violation by the broker of the obligations prescribed in the offer, the client can file a complaint with the regulator

👎 Disadvantages

- Financial transactions are possible only after verification

Withdrawal Options and Fees

-

Spreadex processes a withdrawal request within 2-5 business days.

-

Money can be withdrawn to Visa and Mastercard (debit and credit) and by bank transfer.

-

It takes up to 2 additional business days to process a withdrawal request by bank transfer.

-

Spreadex does not charge withdrawal fees.

-

A USD 1 commission is charged for replenishment of the account with less than USD 50.

-

Deposits and withdrawals of funds are available only after passing the verification.

Customer Support Service

Support operators are available 7 days a week. Business hours are from 8:00 am to 5:30 pm London time.

👍 Advantages

- In the online chat, you can ask a question without being a client of the company

- Works 7 days a week

👎 Disadvantages

- No 24/7 support

- Support is provided in English only

This broker provides the following communication channels:

-

by phone; the number is listed in the Contact section;

-

by email;

-

by online chat - on the website and in the personal account;

-

by feedback form.

Not only a registered client but also a trader without an active account may ask the broker's representative a question.

Contacts

| Foundation date | 1999 |

| Registration address | Churchill House, Upper, Marlborough Road, St Albans, Hertfordshire, AL1 3UU |

| Regulation |

FCA |

| Official site | https://www.spreadex.com/ |

| Contacts |

Phone:

08000 526 570

|

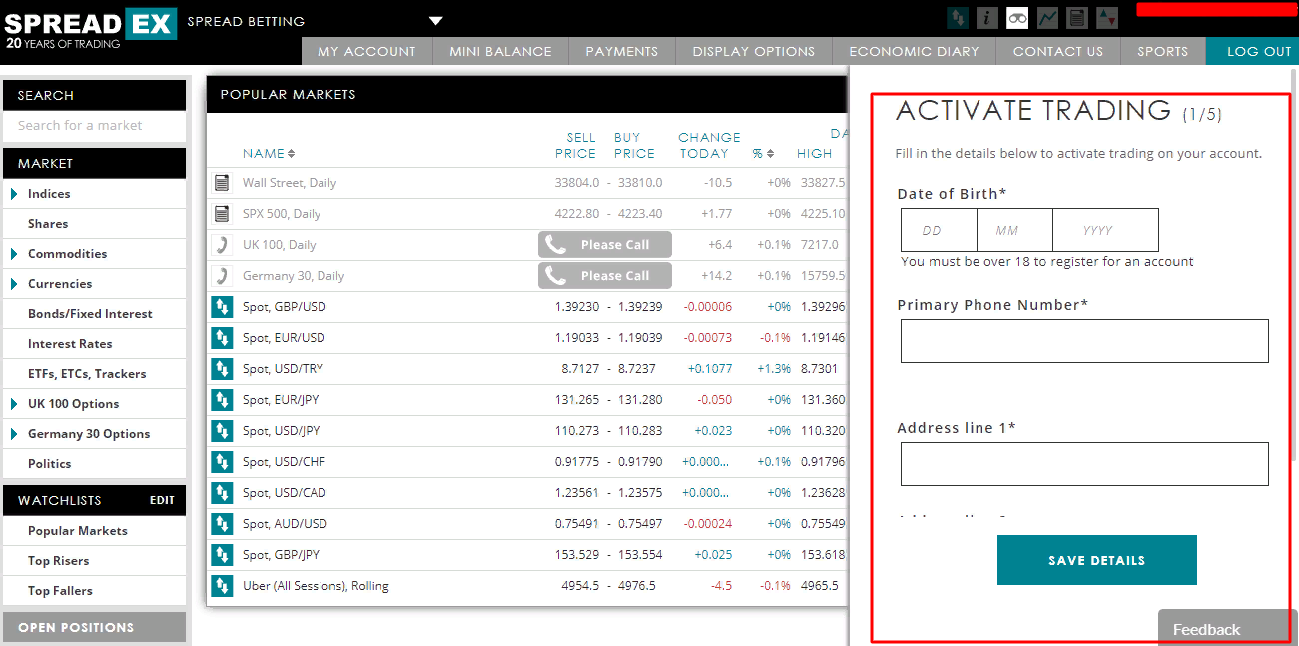

Review of the Personal Cabinet of Spreadex

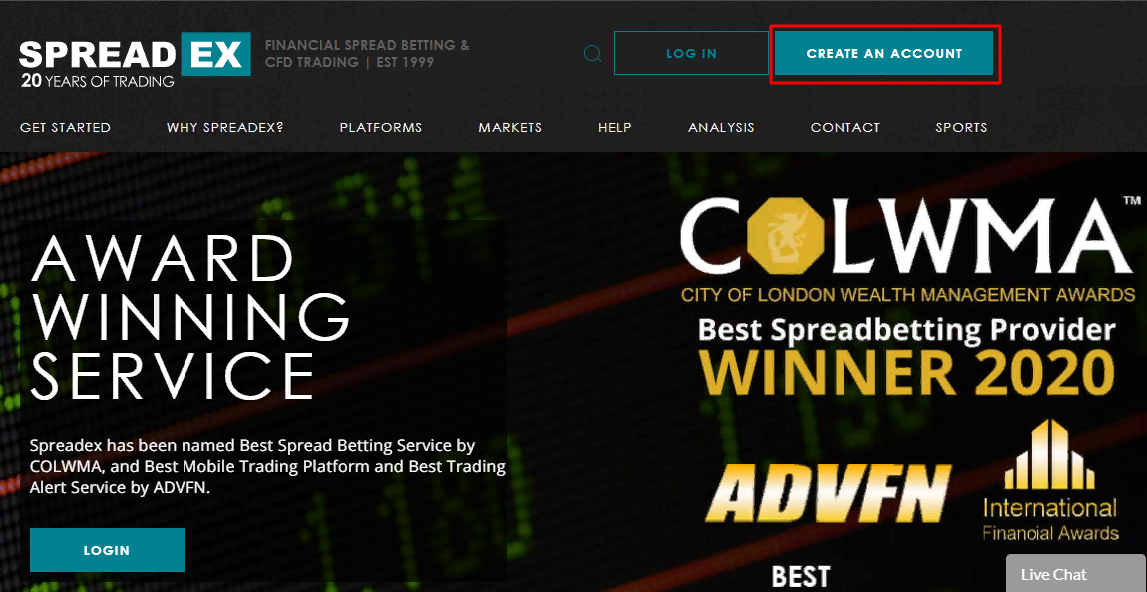

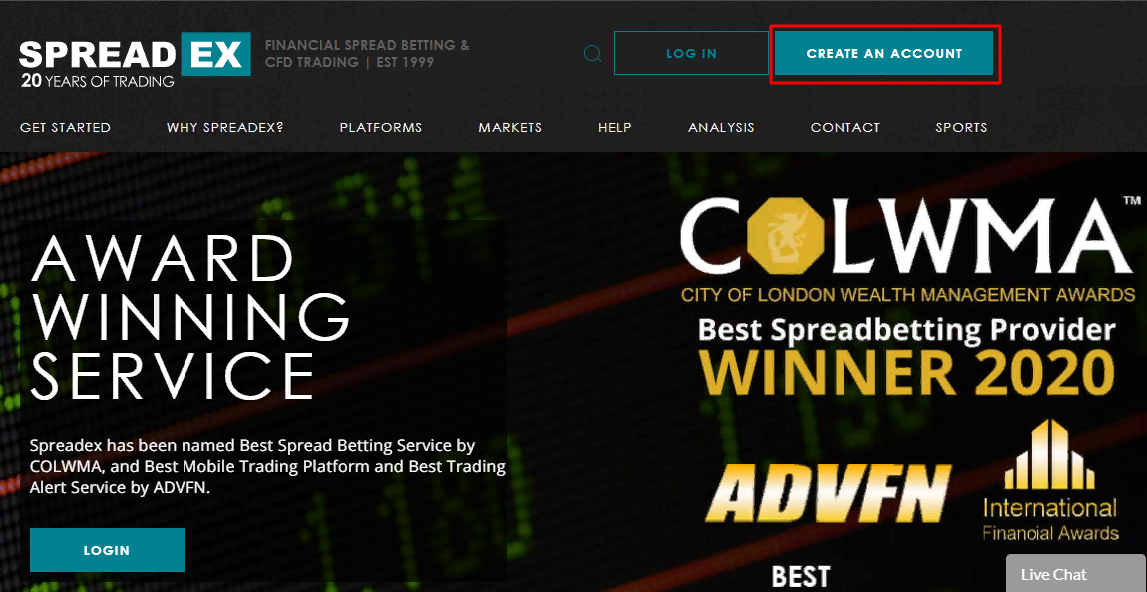

To start trading on Spreadex, you need to become a client of the broker by opening a trading account. A quick guide looks like this:

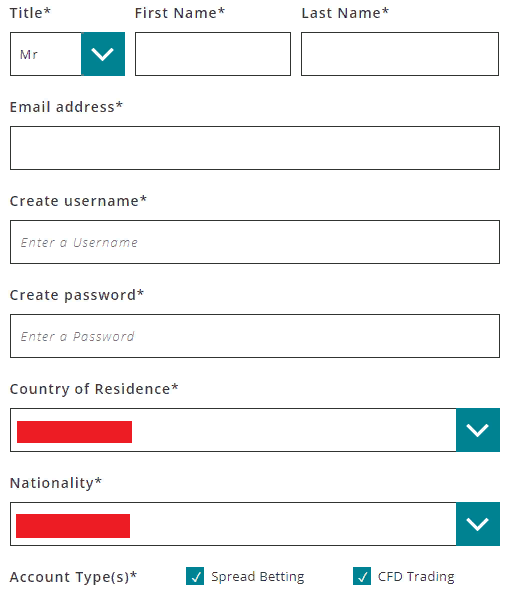

On the main page of the Spreadex broker, click on the “Create an Account” button. After that, a basic registration form will open.

Fill out the basic registration form with your name, nationality, country of residence, email address, username, and password, and choose the type of trading, such as spread betting, CFD trading, or both.

Next, you will get access to your account, but in order to trade, you need to fill out a detailed form and go through verification. In the detailed form, you need to indicate your address, financial situation, trading experience, and answer questions related to trading. If you answer three or more questions incorrectly, you can only re-take the survey after 24 hours. After that, you need to go through verification, for this, you need to upload a scanned copy of your identity card to the platform.

In the personal account, the trader also has access to:

-

Economic calendar with information about upcoming economic events in the world.

-

Broker analytics - economic reports for the past day and the week.

-

Financial Blog – Here, the Spreadex experts conduct market analysis and provide trading insights.

Find out how Spreadex stacks up against other brokers.

Articles that may help you

FAQs

Do reviews by traders influence the Spreadex rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Spreadex you need to go to the broker's profile.

How to leave a review about Spreadex on the Traders Union website?

To leave a review about Spreadex, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Spreadex on a non-Traders Union client?

Anyone can leave feedback about Spreadex on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.