deposit:

- 250 EUR

Trading platform:

- MetaTrader4

- MetaTrader5

- CySEC

- FSA

- 0%

deposit:

- 250 EUR

Trading platform:

- MetaTrader4

- MetaTrader5

- CySEC

- FSA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Squared Financial Trading Company

Squared Financial is a broker with higher-than-average risk and the TU Overall Score of 4.51 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Squared Financial clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Squared Financial ranks 165 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Squared Financial is a broker that offers favorable trading conditions for both active traders and passive investors. At the same time, market participants with any level of training can successfully implement their strategies with this broker.

Squared Financial is a Fintech investment and wealth management company that has been providing brokerage services since 2005. It has offices in Cyprus and the Republic of Seychelles. The broker is owned and operated by Squared Financial (CY) Limited, a group licensed by reputable regulatory bodies such as the Cyprus Securities and Exchange Commission (CySEC, 329/17) and the Seychelles Financial Services Authority (FSA SC, SD024). In 2020, Squared Financial was recognized as the most transparent broker by the Global Awards.

| 💰 Account currency: | EUR, USD, GBP, CHF |

|---|---|

| 🚀 Minimum deposit: | 250 EUR |

| ⚖️ Leverage: | 1:30 |

| 💱 Spread: | From 0.0 pips |

| 🔧 Instruments: | Crypto CFDs, Futures, Forex, Energies, Metals, Indices, Stock CFDs |

| 💹 Margin Call / Stop Out: | 100%/50% |

👍 Advantages of trading with Squared Financial:

- Licenses of international regulators such as CySEC and FSA SC.

- Wide range of trading tools — 7 asset classes with different levels of volatility.

- Tight floating spreads starting from 0.0 pips on Elite type of accounts.

- Provides the most popular trading platforms like MetaTrader 4 and MetaTrader 5.

- Huge selection of payment systems for deposits and withdrawals. Many electronic payment systems allow you to make payments instantly.

👎 Disadvantages of Squared Financial:

- There are no Micro accounts.

- To access an account with tight spreads from 0.0 pips, you need to deposit $5,000.

- There is no round-the-clock online chat on the website or in the personal account.

Evaluation of the most influential parameters of Squared Financial

Trade with this broker, if:

- You prefer direct market access without intermediary intervention, ensuring fairer pricing and faster execution of trades. This also helps if you want benefit from institutional-level liquidity, tight spreads, and swift order execution, enhancing your trading experience.

- You require regulated broker as Squared Financial is licensed and regulated by reputable authorities such as the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA SC, SD024), providing you with a level of trust and security.

Do not trade with this broker, if:

- You seek direct ownership of US stocks, Squared Financial primarily offers Contracts for Difference (CFDs) on US shares rather than actual ownership of the underlying assets.

- You prioritize advanced features such as sophisticated indicators or data feeds. Squared Financial's platforms may not cater sufficiently to your needs, as they primarily offer basic charting and analysis tools.

Table of Contents

- Geographic Distribution

- Video Review

- Latest Comments

- Expert Review

- Latest Squared Financial News

- Analysis of Squared Financial

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Squared Financial

- User Reviews of Squared Financial

- FAQs

- TU Recommends

Geographic Distribution of Squared Financial Traders

Popularity in

Video Review of Squared Financial i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Squared Financial

Squared Financial is a regulated Forex and CFD broker that acts as a financial intermediary for individual and institutional clients. The company offers 7 classes of trading assets, tight market spreads, and passive income solutions. Thus, the Multi-Account Managers (MAM) service is available to investors and experienced managers. You can also make money on affiliate programs.

Squared Financial provides an optimal trading environment for professional market participants. Traders who have deposited over $5,000 can trade with spreads starting from 0.0 pips. The broker also offers favorable trading conditions for beginners like no minimum deposit, the possibility to train on demo accounts, and high-quality training.

All clients, regardless of the amount deposited, have access to free analytics, dynamic leverage up to 1:500, and access to trading via MT4 and MT5. At the same time, Squared Financial support staff promptly answers customer questions via online chat, Facebook messenger, and email.

Latest Squared Financial News

Dynamics of Squared Financial’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Squared Financial enables clients to generate both active and passive income. For experienced managers and investors, the broker offers the Multi-Account Managers (MAM) service. Squared Financial does not have a proprietary social trading platform, but investors can use MT4 and MT5 trading terminals to connect to the built-in services for copying transactions of other MQL5.community members. In turn, successful traders can make their own trading strategy available and receive passive income.

Multi-Account Managers — high-security trust accounts with investment protection

The unique MAM technology allows an experienced trader (account manager) to simultaneously manage the accounts of an unlimited number of passive investors. At the same time, the investor gets increased protection of funds due to contracting with the manager after full disclosure of information about him. The manager does not have access to all the investor’s funds: he opens transactions using only the volume of investments that the passive investor has entrusted to him. Features of the Multi-Account Managers service:

-

Only an institutional partner who has provided Squared Financial and potential investors with full information about themselves can become a manager.

-

Management of accounts can be opened on the MT4 and MT5 platforms.

-

The investor has the right to close the account manager’s transactions; that is, correct his strategy if it does not correspond to the acceptable level of risk.

-

An investor can arrange for individual settings. The investor has access to setting the limit for the maximum lot for transactions and the maximum amount of loss as a percentage of the account balance.

Before transferring funds under management, the account manager enters into a separate agreement with each passive investor. It contains all the conditions of cooperation, the rights and obligations of the parties, and the amount of remuneration for the manager. The Master assumes legal responsibility for the money entrusted to him, which guarantees full transparency of the process.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Squared Financial’s affiliate program

-

Introducing Broker (IB). The amount of remuneration for the single and multi-level IB program is up to 65% of the trading commission of the attracted referral.

Both financial corporations and private traders can become partners. The more open transactions users make, the more income the IB gets. Institutional clients also have access to White Label, MAM, institutional partnership as well as improved liquidity solutions.

Trading Conditions for Squared Financial Users

Squared Financial offers favorable trading conditions for both professionals and novice traders. Clients can choose an account based on the available capital. For trading with small amounts, you can use its Pro account. Spread amounts depend on the selected account type. They are floating and start from 1.2 pips on Pro accounts (no commission per lot) or from 0.0 pips on Elite (with $5 commission per lot). Leverage at Squared Financial is dynamic.

250 EUR

Minimum

deposit

1:30

Leverage

24/7

Support

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5 |

|---|---|

| 📊 Accounts: | SquaredPro, SquaredElite |

| 💰 Account currency: | EUR, USD, GBP, CHF |

| 💵 Replenishment / Withdrawal: | Bank transfer, credit/debit cards, Skrill, Neteller, Perfect Money, FasaPay, PayTrust, RPNPay, Finrax, MPSA (China Union Pay), PayRetailers, Help2Pay (FXPay88), AwePay (WalaoPay), EasyEFT (SLDPayments), PagSmile |

| 🚀 Minimum deposit: | 250 EUR |

| ⚖️ Leverage: | 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.0 pips |

| 🔧 Instruments: | Crypto CFDs, Futures, Forex, Energies, Metals, Indices, Stock CFDs |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | MarketPlace (proprietary aggregator) |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Invest funds in МАМ accounts; Islamic accounts; Affiliate program with high commissions. |

| 🎁 Contests and bonuses: | Welcome deposit bonus, Cashback |

Comparison of Squared Financial with other Brokers

| Squared Financial | RoboForex | Pocket Option | Exness | Forex4you | AMarkets | |

| Trading platform |

MetaTrader4, MetaTrader5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5 | MT4, MT5, AMarkets App |

| Min deposit | $250 | $10 | $5 | $10 | No | $100 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:10 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.1 points | From 0 points |

| Level of margin call / stop out |

50% / 30% | 60% / 40% | 30% / 50% | No / 60% | 100% / 20% | 50% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | Yes | No |

Broker comparison table of trading instruments

| Squared Financial | RoboForex | Pocket Option | Exness | Forex4you | AMarkets | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | No | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Squared Financial Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Pro | from $12 | No |

| Elite | from $0.1 | No |

There is a commission for transferring a position to the next day (swap). Also, experts of the analytical department of Traders Union calculated the average commissions of Squared Financial, Admiral Markets and FXPro, and then compared the results in the table below.

| Broker | Average commission | Level |

| Squared Financial | $6 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of Squared Financial

Squared Financial is a Forex and CFD broker that offers online and mobile trading services to individual and institutional clients. The company provides flexible technological solutions adapted not only to professional traders but also to novice market participants. Squared Financial offers a wide range of trading instruments and tools, including cryptocurrencies and Multi-Account Managers (MAM). It also has social trading platforms that allow investors to generate passive income without trading independently.

Squared Financial in numbers:

-

7 asset classes available for trading.

-

More than 15 payment systems are available for depositing and withdrawing funds.

-

The company’s experience in the international Forex market exceeds 16 years.

Squared Financial is a broker for novice traders and professionals

Squared Financial is a regulated Forex broker that provides the possibility to trade Forex, energy, CFDs, stocks, precious metals, and indices. The company uses NDD technology, which provides institutional level liquidity with tight spreads and fast execution of transactions according to the market execution model. Squared Financial offers its clients two types of accounts with different commission levels and minimum deposits. It allows automated trading and the use of advisors.

Squared Financial provides registered users with the two most popular trading platforms, which are MetaTrader 4 and MetaTrader 5. Mobile applications are available for Android and iOS devices. Desktop versions of MT4 and MT5 work on PCs and laptops with Windows, macOS, and Linux operating systems.

Squared Financial’s useful services:

-

Daily market analytics. Traders have access to an exclusive market overview of eight financial tools, comments from financial experts, forecasts of future price movements, and major trends.

-

Education section for traders. A section with information on current market trends, the latest news, trading analysis, training guides, and reviews of important events that may affect the movement of financial markets.

-

Trading tools. The broker provides free trading calculators to accurately assess opportunities, indicators for technical analysis, and a real-time economic calendar to track market events.

Advantages:

A wide selection of trading tools — 50 currency and 5 cryptocurrency pairs, gold, silver, oil, natural gas, over 1,000 stocks, 13 major indices, plus futures.

The broker does not charge a commission for depositing or withdrawing funds.

There is an affiliate program with high commissions.

There is quality education materials and free analytics.

There are several types of bonus programs available such as cashback for trading and a welcome bonus.

Muslim traders can open Islamic accounts.

The broker does not restrict clients’ trading strategies. Hedging, scalping, automated trading, and advisors are all allowed here.

How to Start Making Profits — Guide for Traders

Squared Financial’s clients can trade from two types of accounts that are available on the MT4 and MT5 platforms. The broker offers different conditions for each such as the amount of the deposit and the trading commission. This is so that both a professional and a novice trader can choose a suitable option.

Types of accounts:

You can test the speed of order execution and get acquainted with the full set of available assets on a demo account.

Squared Financial has tailored the terms of the accounts to suit the needs of traders with varying experience levels and available capital. A high degree of customer focus makes it a versatile broker for both beginners and experienced Forex traders.

Investment Education Online

The Education section of the company’s website contains training materials from its Squared Academy which is managed by its team of experts and analysts. The information published here will be useful not only for novice traders but also for experienced professionals who strive to stay abreast of current market trends.

Security (Protection for Investors)

Financial holding Squared Financial (CY) Limited is registered in Cyprus. It consists of two companies: Squared Financial (Cyprus) Limited (CySEC License No.329/17) and Squared Financial (Seychelles) Ltd (FSA SC License No.SD024).

CySEC (Cyprus Securities and Exchange Commission) and FSA SC (Seychelles Financial Conduct Authority) are international bodies that oversee the activities and financial position of brokerage companies reporting to them. All Squared Financial’s clients are insured by Lloyd’s of London, which guarantees $1,000,000 net loss return per client in the event of the company’s closure or bankruptcy.

👍 Advantages

- Customer accounts are separated from the broker’s corporate accounts

- All trading operations are carried out following the Client Agreement

- An insurance policy is available to cover damages related to the broker’s financial insolvency

👎 Disadvantages

- Regulators impose a fine on the broker only in case of registering systematic violations of obligations

- It is impossible to open and top up an account without passing the verification

Withdrawal Options and Fees

-

Squared Financial does not charge deposit or withdrawal fees. Payment systems charge a fee for transactions under an internal customer service offer.

-

Money can be withdrawn to a bank account and to cards (debit and credit), via EPS protocols. There are 13 electronic payment systems available, including the Finrax provider, which allows you to make payments in cryptocurrency.

-

Money is credited to e-wallets instantly. Withdrawal to a bank account takes 2-3 business days.

-

There are limits for bank transfers: the minimum amount is USD/EUR 150. Withdrawal by bank details in other currencies is not carried out.

-

A complete list of currencies available for withdrawal: USD, EUR, GBP, CHF, IDR, MYR, THB, VND, CNY, BRL, COP, MXN, KRW, ZAR, BTC, BCH, ETH, LTC, XRP, USDT.

-

Withdrawals are made the same way that is used to make a deposit.

Customer Support Service

The support service works 24 hours a day, 5 days a week.

👍 Advantages

- Can be quickly contacted on Facebook Messenger

- Support available in 7 languages

👎 Disadvantages

- Doesn’t work on the weekend

Communication channels with company representatives:

-

online chat;

-

phone number that can be found in the Contact Us section;

-

email to support@squaredfinancial.sc;

-

Facebook Messenger;

-

feedback form.

You can contact the technical support operator through the website or your personal account.

Contacts

| Foundation date | 2005 |

| Registration address | 205, Arch. Makarios Avenue, Victory House, 5th Floor, 3030, Limassol, Cyprus |

| Regulation |

CySEC, FSA Licence number: 329/17, SD024 |

| Official site | squaredfinancial.com |

| Contacts |

Email:

support@squaredfinancial.com,

Phone: +357 22090227 |

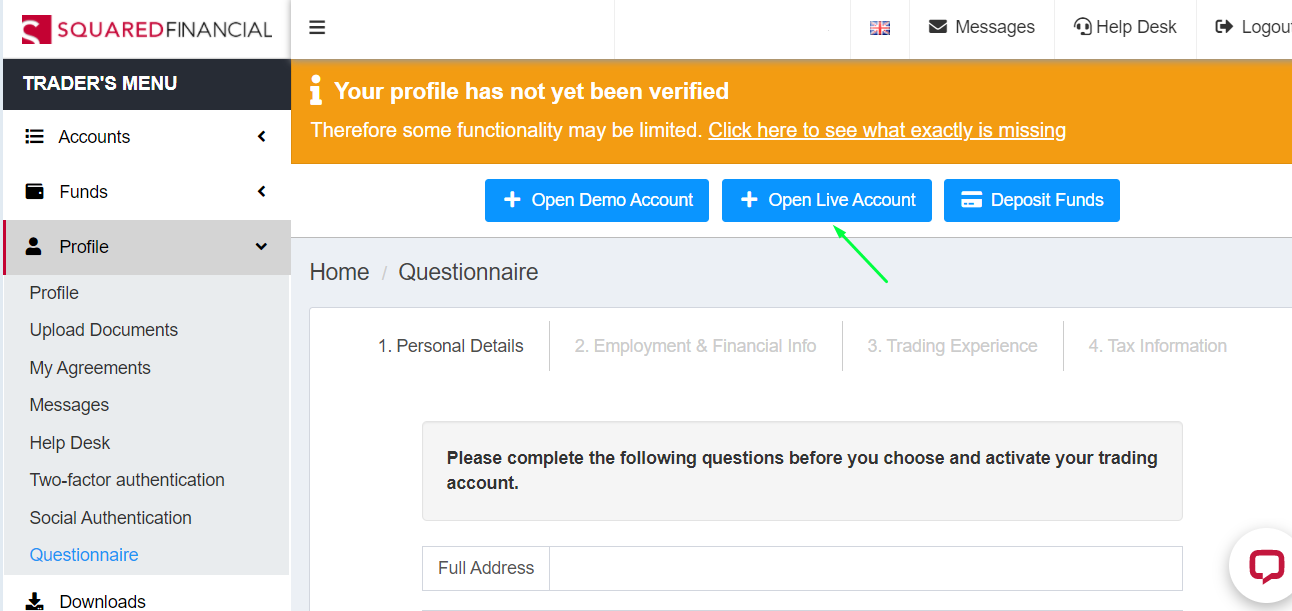

Review of the Personal Cabinet of Squared Financial

You can start trading with Squared Financial only after creating a personal account on the company’s website. A quick guide to starting trading looks like this:

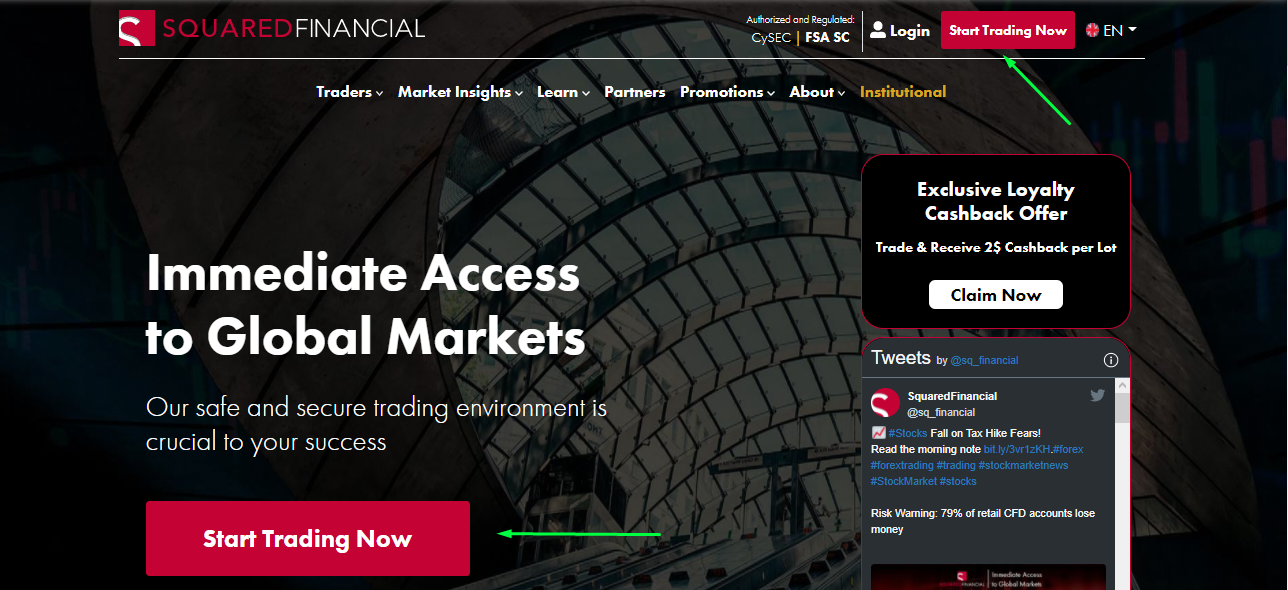

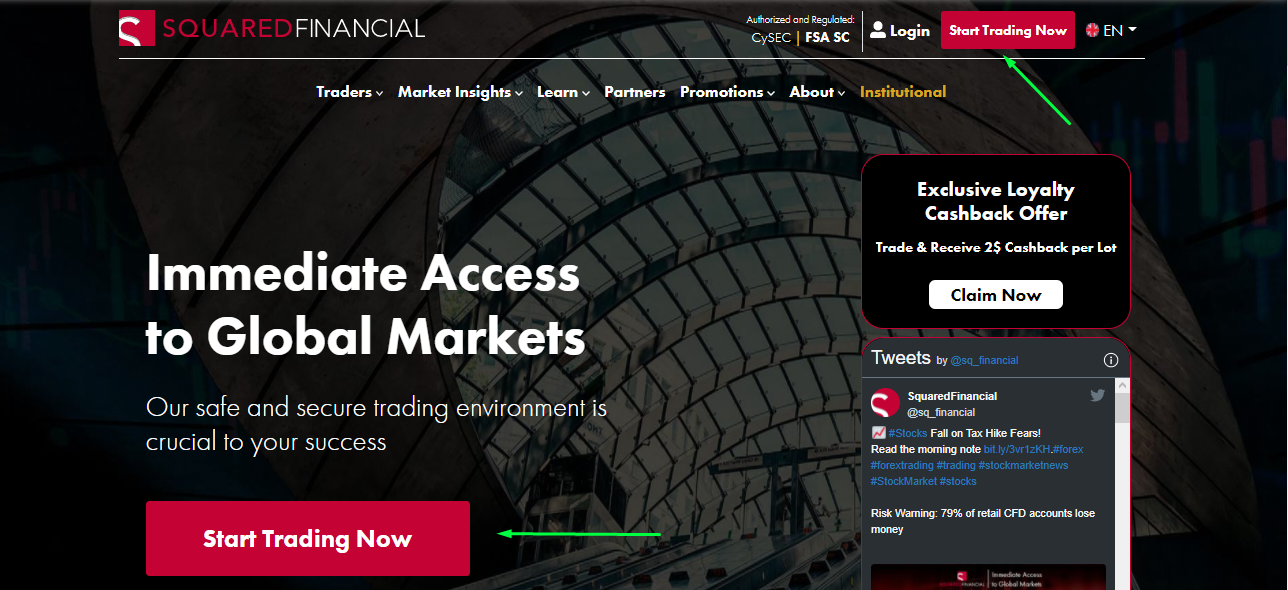

Register on the Squared Financial website. To do this, click the Start Trading Now button and fill out a standard form, choose Individual for the client status. Indicate your last and first name, country of residence, phone number, email, preferred language of communication. Create and repeat a password, and then click Continue. You can also register through your Facebook profile. Next, you need to enter the 4-digit PIN that is sent to the email address you specified.

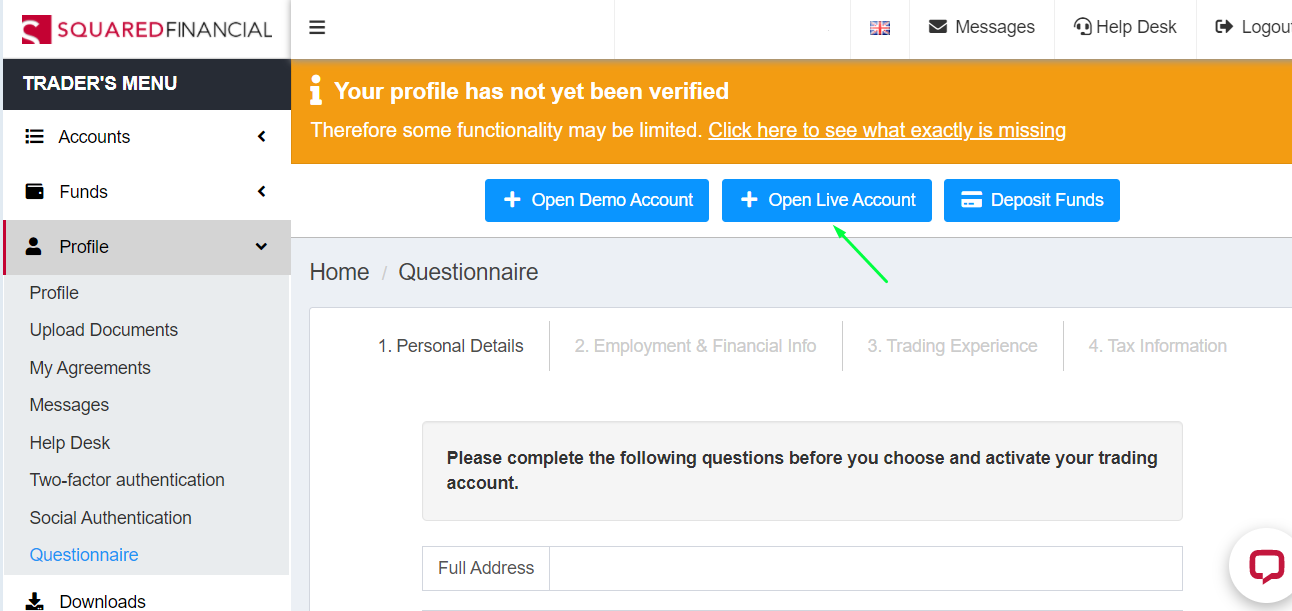

Authorization in the personal account. Enter the email and password specified during registration. Further, to activate all functions of the account, you must fill in the blocks with personal data, financial and tax information, and trading experience. After completing the questionnaire, you must provide scanned copies of documents for verification.

In the personal account, a Squared Financial client can do the following:

1. Open trading accounts:

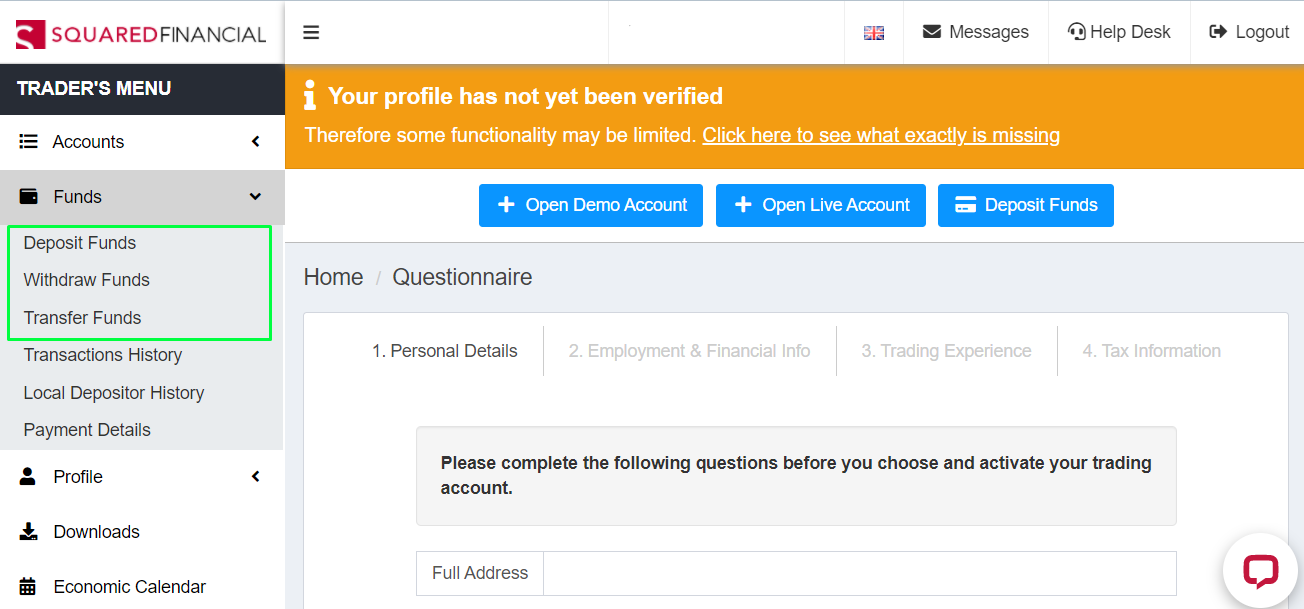

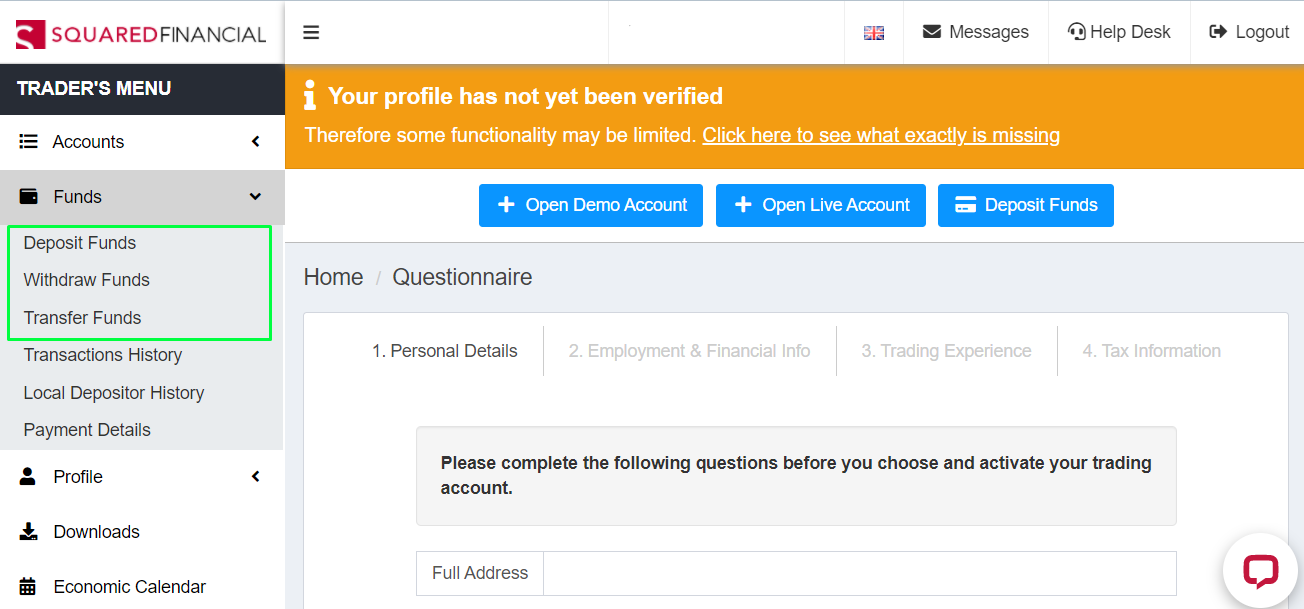

2. Make a deposit, transfer funds between accounts opened with Squared Financial, and withdraw money:

1. Open trading accounts:

2. Make a deposit, transfer funds between accounts opened with Squared Financial, and withdraw money:

The main sections of the personal account:

-

Partners’ menu. Using the menu, you can apply for participation in the affiliate program and see statistics on the accrued remuneration.

-

Downloads. Here you can download trading terminals for installation on mobile devices and PCs.

-

Educational and analytical tools. They are displayed in the sections labeled FAQs, Economic Calendar, and Academy.

Disclaimer:

Your capital is at risk. 69.9% of retail investor accounts lose money when trading CFDs with this provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

Do reviews by traders influence the Squared Financial rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Squared Financial you need to go to the broker's profile.

How to leave a review about Squared Financial on the Traders Union website?

To leave a review about Squared Financial, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Squared Financial on a non-Traders Union client?

Anyone can leave feedback about Squared Financial on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.