Importance Of Understanding Temperament In Trading

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Here’s how traders with different temperaments can manage their risks while trading:

- Sanguine traders - Use automated trading systems to enforce strict risk management and avoid impulsive decisions

- Choleric traders - Develop and adhere to a comprehensive trading set-up checklist to counteract impatience during trades

- Phlegmatic traders - Set up alerts and automated triggers to ensure timely responses to market opportunities

- Melancholic traders - Rely on data-driven strategies and predefined criteria to prevent overanalysis and delays

Temperament significantly influences trading behavior by affecting decision-making styles, risk tolerance, and emotional reactions to market changes. It refers to the inherent personality traits that influence how individuals respond to various situations. This article explores the four primary temperaments — sanguine, choleric, phlegmatic, and melancholic — and how they influence trading behaviors and strategies. More importantly, it also discusses how you can manage risks across the different types of temperaments.

Overview of temperament types and their influence on trading

Each temperament has unique traits that impact decision-making, risk tolerance, and emotional responses to market changes. We have compared them in the table below:

| Temperament | Characteristics | Strengths | Weaknesses | Trading Strategies |

|---|---|---|---|---|

| Sanguine | Social, enthusiastic, risk-takers | High energy, quick decision-making | Impulsivity, overconfidence | Short-term trading, high-frequency trading |

| Choleric | Dominant, decisive, competitive | Decisiveness, goal-oriented | Impatience, risk of burnout | Aggressive trading, focus on long-term goals |

| Phlegmatic | Calm, methodical, risk-averse | Patience, thoroughness | Slow decision-making, risk aversion | Long-term investments, detailed analysis |

| Melancholic | Analytical, detail-oriented, cautious | Analytical skills, attention to detail | Overthinking, fear of failure | Conservative trading, data-driven decision-making |

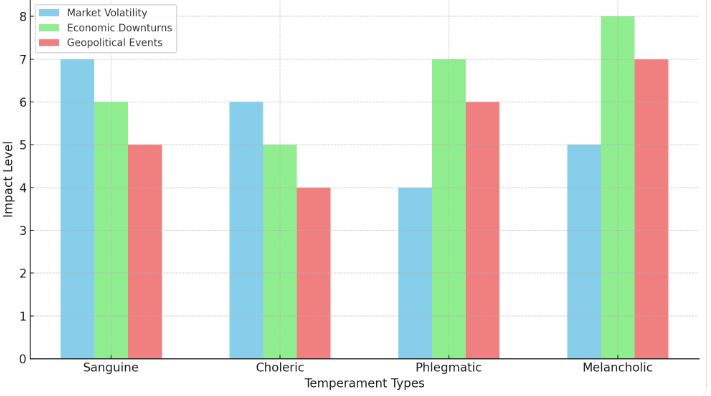

Impact of external factors on trading behavior

Impact of external factors on trading behavior

Impact of external factors on trading behaviorDifferent temperaments react uniquely to market conditions and external stressors, which can significantly impact trading outcomes. We have examined these influences and provided guidance on adapting trading strategies accordingly:

Sanguine traders. Typically, sanguine traders might become overly optimistic during bullish markets, potentially taking on excessive risks. During bearish markets, their enthusiasm may wane, leading to impulsive decision-making and potential losses.

Strategy: Implement strict risk management rules and set predefined stop-loss limits to avoid impulsive decisions;

Action: Use automated trading systems to enforce discipline and manage emotional highs and lows effectively.

Choleric traders. Choleric traders are likely to remain focused and determined, even in volatile conditions. However, their impatience might lead them to make hasty decisions without fully analyzing the situation, especially under stress.

Strategy: Incorporate comprehensive analysis and review processes to counteract impatience;

Action: Develop a checklist to ensure all critical factors are considered before executing trades, particularly during volatile periods.

Phlegmatic traders. These traders may become overly cautious during volatile markets, possibly missing out on profitable opportunities. Their methodical approach might slow down their response to sudden market changes, leading to suboptimal outcomes.

Strategy: Create a decision-making framework that balances caution with agility;

Action: Use alerts and automated triggers to act swiftly when predefined market conditions are met, ensuring timely responses to opportunities.

Melancholic traders. Melancholic traders might experience heightened anxiety during market downturns, causing them to overanalyze and delay decisions. Their cautious nature, while beneficial in stable markets, can hinder their performance in rapidly changing environments.

Strategy: Focus on data-driven strategies and avoid overanalyzing;

Action: Set specific criteria for decision-making and adhere to them strictly to prevent analysis paralysis.

How temperament affects trading behavior

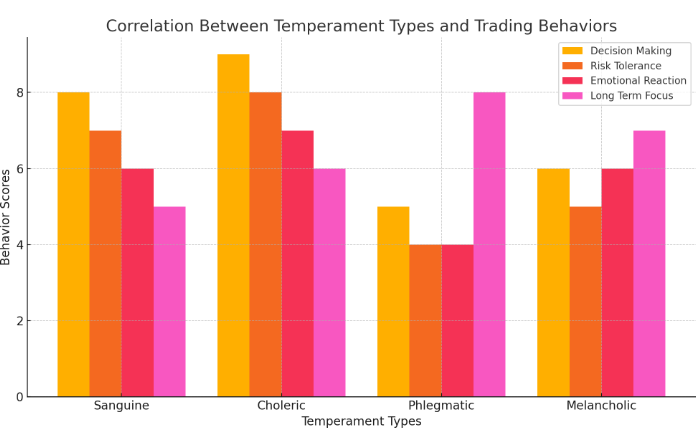

Correlation between temperament types and trading behaviors

Correlation between temperament types and trading behaviorsTemperament influences trading behavior in several key ways:

Decision-making styles. Sanguine and choleric traders are more likely to make quick decisions, while phlegmatic and melancholic traders take a more delayed approach;

Risk tolerance and management. Sanguine and choleric traders typically have a higher risk tolerance, whereas phlegmatic and melancholic traders prefer conservative strategies;

Emotional reactions to market changes. Sanguine and choleric traders may react more emotionally to market fluctuations, while phlegmatic and melancholic traders remain more composed;

Long-Term vs. Short-Term investment strategies. Sanguine and choleric traders often prefer short-term gains, while phlegmatic and melancholic traders focus on long-term investments.

To learn more about trading strategies you could in our article “What is the Most Accurate Trading Strategy?”

Step-by-step guide to assessing your temperament

If you’re not sure about the specific trading temperament you carry, this simple step-by-step guide can help you introspect on the same:

Identifying your primary temperament: Start by reflecting on your typical reactions and decision-making processes in various situations. Consider how you respond to stress, uncertainty, and pressure. Ask yourself the following questions:

Do you tend to make quick decisions or take your time to analyze all options?

Are you comfortable with taking risks, or do you prefer to avoid them?

How do you react to unexpected changes or market volatility?

Do you rely more on data and analysis, or do you follow your instincts and emotions?

Self-assessment tools and quizzes: Try online assessments to gain insights into your temperament. Here are some popular online assessments you can use:

Myers-Briggs type indicator (MBTI): Although not specifically focused on trading, MBTI provides valuable insights into your personality type, which can influence your trading style;

Keirsey temperament sorter: This assessment categorizes individuals into one of four temperaments and offers detailed descriptions of each type;

16Personalities: This free online quiz provides a comprehensive analysis of your personality traits and how they impact various aspects of your life, including decision-making and risk tolerance.

Consulting with a psychologist or trading coach: Seek professional guidance to understand how your temperament influences your trading style.

Find a professional: Look for psychologists or trading coaches who specialize in behavioral finance or personality psychology. You can find these professionals through referrals, online directories, or trading communities.

Schedule a consultation: Set up an appointment to discuss your trading experiences, challenges, and goals. Be prepared to share your self-reflection insights and assessment results.

Develop a personalized plan: Work with the professional to develop a customized trading plan that leverages your strengths and addresses your weaknesses. They can also provide ongoing support and feedback to help you stay on track.

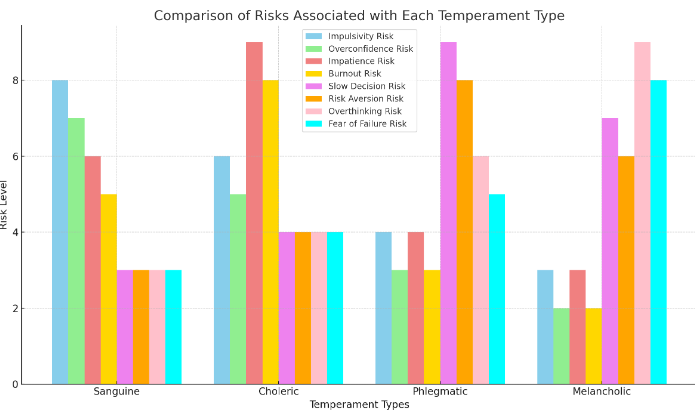

Understanding risks associated with different temperaments

Each temperament type comes with its own set of potential pitfalls. Identifying these risks and employing strategies to mitigate them is essential for successful trading.

Comparison of risks associated with each temperament type

Comparison of risks associated with each temperament typeHere’s how you can tackle some of the risks discussed:

Overtrading - develop and stick to a trading plan with clear entry and exit rules;

Emotional trading - practice emotional control techniques, use automated systems;

Ignoring market signals - stay informed and incorporate flexible strategies;

Lack of discipline - Keep a trading journal, regularly review and adjust your plan.

How to remain calm and collected

Based on my experience, understanding the influence of temperament on trading can significantly impact the effectiveness of your trading strategy.

Most importantly, I recommend you to practice emotional intelligence as it would enable you to manage your emotions, handle stress, and make rational decisions. Building this skill will help you:

remain calm under pressure, making well-considered decisions rather than emotional reactions;

better handle losses and setbacks, maintaining a long-term perspective.

You can try the following techniques that are proven to assist in building emotional intelligence:

Mindfulness practices. Regular meditation and mindfulness exercises can help traders stay present and focused, reducing the impact of stress and anxiety;

Stress-relief techniques. Activities such as yoga, deep breathing exercises, and physical exercise can help manage stress levels and improve overall well-being;

Cognitive behavioral therapy (CBT). Engaging in CBT can help traders recognize and change negative thought patterns, enhancing emotional regulation and decision-making.

Conclusion

Different personality types—like outgoing, determined, calm, and cautious—affect how you make decisions, handle risks, and react to changes. By knowing these traits, traders can adjust their methods to use their strengths and work on their weaknesses. For example, outgoing traders can use automated systems to avoid impulsive moves, determined traders can follow checklists to avoid impatience, calm traders can use alerts to make timely decisions, and cautious traders can stick to data-driven rules to avoid overthinking. To be successful in trading, you need to match your strategy with your personality, which helps you make better and more disciplined decisions. Additionally, practicing techniques to manage emotions, like mindfulness and stress-relief exercises, can help traders stay calm and make sensible choices under pressure.

FAQs

What is the importance of understanding temperament in trading?

By knowing your temperament, you can tailor your trading strategies to leverage your strengths and mitigate your weaknesses, leading to more effective and consistent trading performance.

What are the main risks associated with different temperaments in trading?

Each temperament faces unique risks. Sanguine traders may struggle with impulsivity and overconfidence, choleric traders with impatience and burnout, phlegmatic traders with slow decision-making and risk aversion, and melancholic traders with overthinking and fear of failure.

What are some common trading pitfalls and how can I avoid them?

Common trading pitfalls include overtrading, emotional trading, ignoring market signals, and lack of discipline. To avoid these pitfalls, develop a comprehensive trading plan with clear rules, practice emotional control techniques, stay informed about market trends, and maintain a trading journal to track and review your performance.

How can I improve my emotional intelligence for better trading?

Improving emotional intelligence involves practicing mindfulness, stress-relief techniques, and cognitive behavioral therapy (CBT).

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Overtrading is a phenomenon where a trader executes too many transactions in the market, surpassing their strategy and trading more frequently than planned. It's a common mistake that can lead to financial losses.

Working orders, also known as pending orders, are a type of order that allows traders to specify the price and time conditions for entering or exiting a trade. They help traders execute their trading strategies more effectively, reduce the need for constant market monitoring, and improve risk management.