What is the Most Accurate Trading Strategy?

There is a connection between profitable strategies and significant losses incurred by most traders due to price action. In this article, I will discuss 5 strategies:

-

Stop Loss Hunting. Most traders lose money placing stop losses at obvious levels.

-

Testing the Value Area. Most traders cannot determine the fair value after a trend movement.

-

Parallel Channels. This pattern brings losses to both trend traders and counter-trend traders.

-

Cup with Handle. Most people make mistakes when trading in calm markets.

-

Rounding Top. Most people make mistakes trusting trend reversals.

If you have tried trading on an exchange, you have probably had situations when the price would go against you after you opened a position or come your way after you closed a position (usually through a stop loss). In such cases, you feel like accusing the broker of manipulating the price to make you lose money. But when you take a closer look, it turns out that the giant market is indifferent to your positions. The price simply takes the trajectory of least resistance, thereby causing maximum damage to most market participants, including you if you act trivially.

In this article, I will share my experience and ideas on how to build a strategy that brings you success while others incur losses.

-

Is there a 100% reliable trading strategy?

No, completely reliable training strategies don’t exist, as every strategy carries risks. Since the future is unknown, traders make decisions under uncertainty.

-

What is the most successful form of trading?

Everyone would give you a different answer. Buffett became one of the world’s richest people by investing in stocks for the long term. And you can find success by scalping cryptocurrencies 1-2 hours a day. It depends on the person.

-

What is the number 1 rule of trading?

The most important thing is not to lose money. To follow this rule, you must clearly understand which trading advantage helps you survive day by day under tough competition. Base your trading strategy on this advantage and use it persistently.

-

How do you structure a trading strategy?

Understand at what moments traders lose money and what you should do to avoid losses. Determine your entry and exit criteria, develop risk management parameters, and backtest your strategy.

What is the most successful trading strategy?

It was in the early 2010s. One of the first strategies I tried – it had the word “tiger” in its name – was based on trend trading. You had to find three moving averages positioned in a certain order. Then you had to use the Relative Strength Index (RSI) for trend scalping. I also clearly remember that, as a beginner, I tried the Woodies CCI strategy that was based on the Commodity Channel Index (CCI) patterns.

There were also other strategies, but I couldn’t earn steady profits with any of them. It seemed their probability of success was about 50%, which meant that constant use of such strategies on Forex would lead to a gradual loss of my deposits due to spreads and fees.

My conclusion is that oscillators and many other moving averages are not informative enough. They are only price movement derivatives that do not reflect the causes of market trends.

Best Forex brokers

Then what should you rely on?

I know for sure that most market participants lose money. Therefore, my point is that you should look for success right where most other traders fail. And naturally, this has nothing to do with popular technical indicators.

Below, I will consider 5 strategies with which my idea can be used to succeed in trading.

-

Testing the Value Area

-

Cup with Handle

-

Rounding Top

In my further insights, I will avoid explaining obvious things that can be unclear only to those who are starting from scratch.

Stop Loss Hunting

In this strategy, you should consider buying when buyers’ positions are being massively liquidated by stop losses. Respectively, when the price enters a zone with a lot of sellers’ stop losses, get ready to open a short position.

How do you know that a massive liquidation of positions by stop losses is happening?

It’s not difficult in the crypto market, where you can look at liquidation charts.

Chart with a liquidation indicator

This chart illustrates an idea for building a successful strategy that includes 2 steps:

-

Wait until a downtrend is established (shown by the arrow).

-

Open short positions when other participants’ short positions are being liquidated on a bullish candlestick (circled on the liquidation indicator).

This is the reason why earning from trend trading is sometimes difficult. And as a result of corrections, traders who are gaining profits are left out of the trend.

How to identify a liquidation NOT in cryptocurrencies?

For example, by round levels. Note that in the above example, liquidations happened after the price broke a psychological level of $70,000, and psychological levels work in all markets.

Another option is to use the Delta indicator and common logic.

Look at this example from the S&P-500 futures market:

S&P-500 futures market

The numbers show:

-

An established downtrend.

-

Buys suddenly surge. What does it mean?

-

It presumably indicates the triggering of stop losses above the preceding high, which was noticed by too many participants. That is why many traders placed their stop losses there.

So, the first signs of a price decline after the green Delta surge could mean that the liquidation is over and the market is ready to continue moving down.

Testing the Value Area

As you know, the market has 2 states:

-

Flat. It’s when buyers and sellers agree that the current price reflects an asset’s fair value.

-

Trend. It’s when either supply or demand is weak.

If you use a profile indicator, it will form a Gaussian distribution when the market is flat. And when there is a trend, the profile will be narrow.

The transition from a trend to a balance is an interesting moment that gives you a chance to open a position.

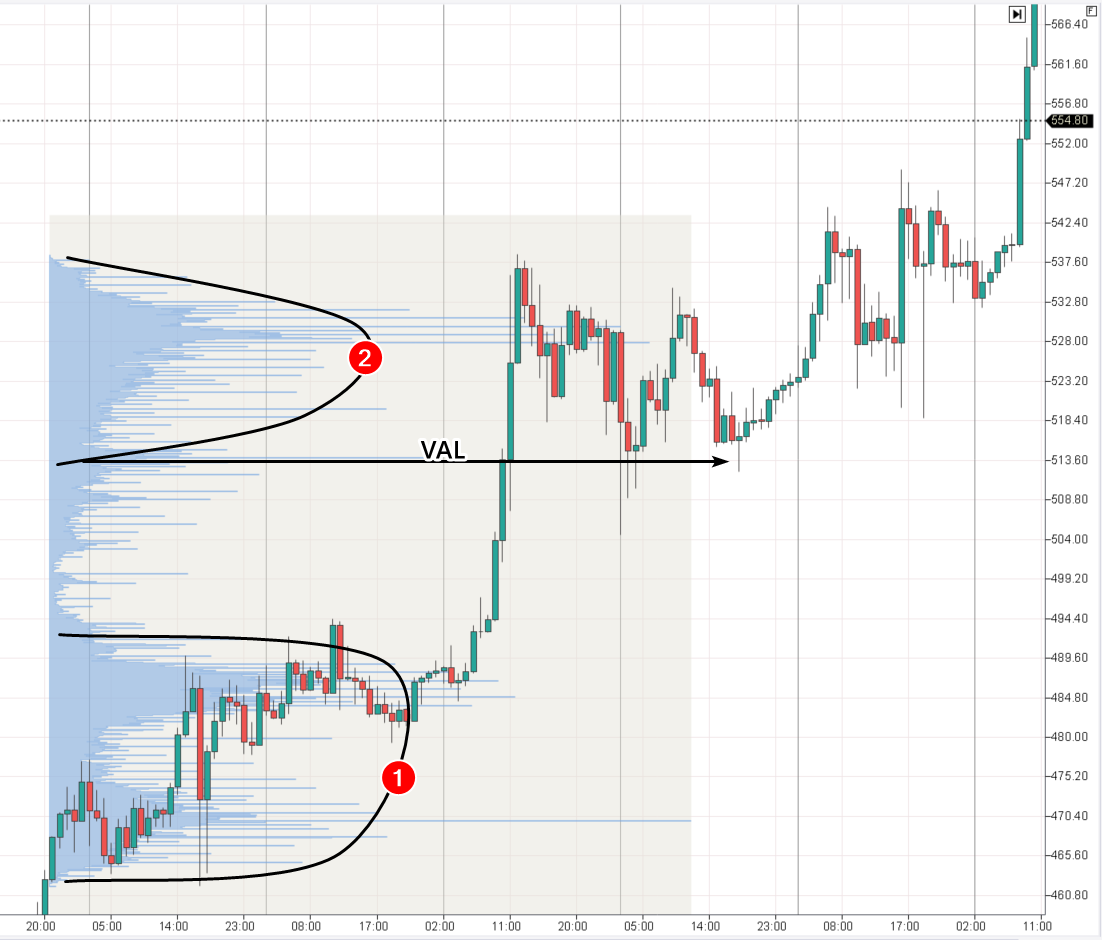

An example of BNB/USDT:

Two interim balance stages in an uptrend

The numbers show:

-

There was a temporary balance noticeable by a bulge in the profile, where BNB price was equally influenced by buyers and sellers. But then the balance was tilted upwards.

-

After a steep rise, a second balance formed, also noticeable by a bulge in the profile, indicating a new configuration of the opinions of buyers and sellers.

Value Area is a zone that encompasses most trades within a selected balance period. Practice shows that the Value Area Low – the lower boundary of the price zone (shown by the arrow) – can be a good entry point in terms of the risk/reward ratio if the preceding trend continues.

Parallel Channels

Parallel Channels are a simple, but effective tool. Here is how they can be used to build a successful trend trading strategy:

S&P-500 futures market

Suppose we have an uptrend where the price rises from point 1 to point 2. The trend channels are shown by the black lines.

Then, there is a pullback to point 3 – the lower boundary of the parallel channel – from where the price continues rising. It happens frequently because the price drop to point 3, as I see it, is equally unfavorable for both buyers and sellers:

-

the buyers, who assessed the 1→2 growth as positive, saw that their positions became either losing or significantly less profitable;

-

the sellers, who decided to go short when they saw the 2→3 descent, couldn’t make enough profit from the descent.

Disappointment befalls both parties when the market reverses at point 3, and this is why it can be a rational trading strategy. I know it from experience.

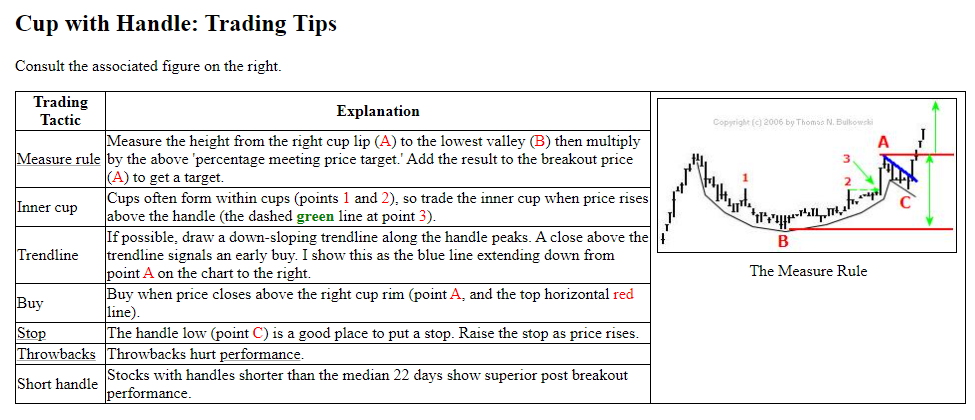

Cup with Handle

Thomas Bulkowski, an internationally known expert on patterns, believes that the Cup with Handle pattern has a high probability of success. According to his calculations, the price goes below the breakeven level in only 5% of cases. It was tested on 913 stock market setups.

Cup with Handle description

Cup with Handle is one of the patterns I do NOT take skeptically. I think it makes sense and can be used as a basis of a successful trend trading strategy.

For example:

Day chart of NVDA stock price

The numbers show:

-

An uptrend that stopped at a psychological mark of $500 per share.

-

Formation of a cup.

-

Formation of a handle.

As a rule – and in this case as well – the handle pattern aims to send as many traders as possible in the wrong direction. While a downward impulse can start quickly, it also ends quickly because the market lacks active sellers, thereby showing its readiness to break resistance.

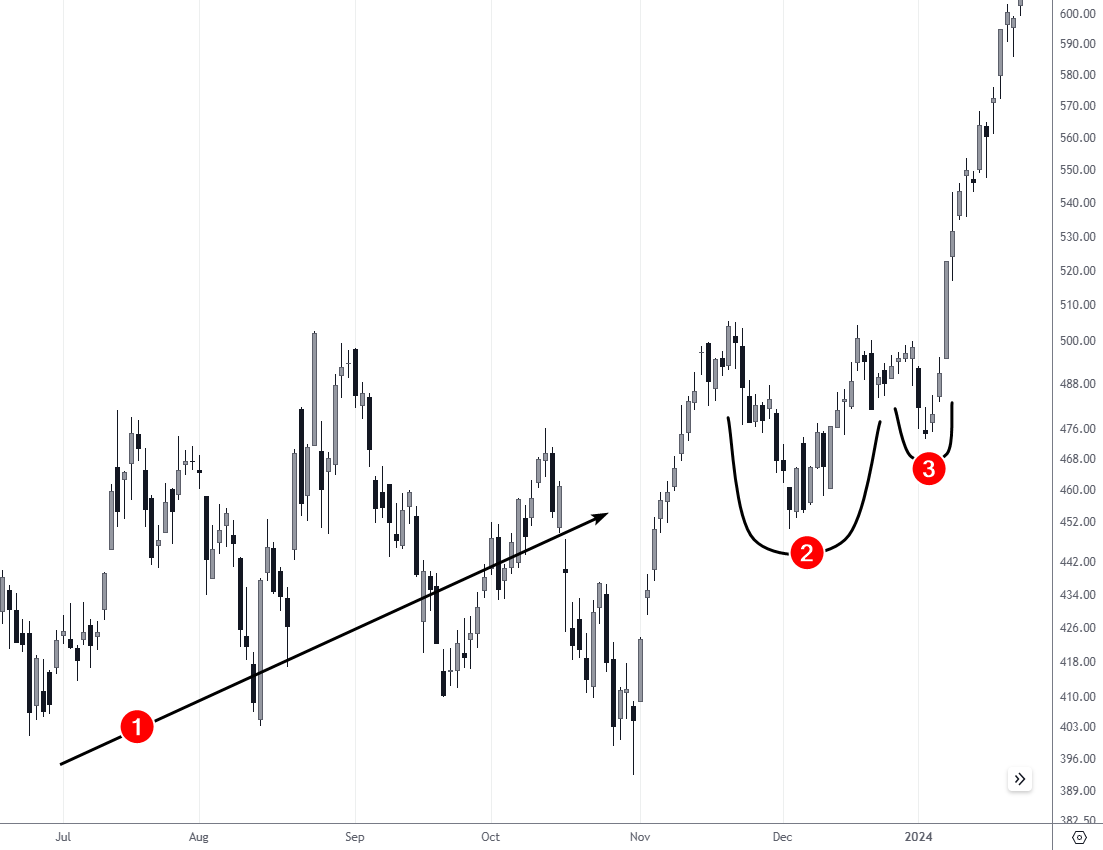

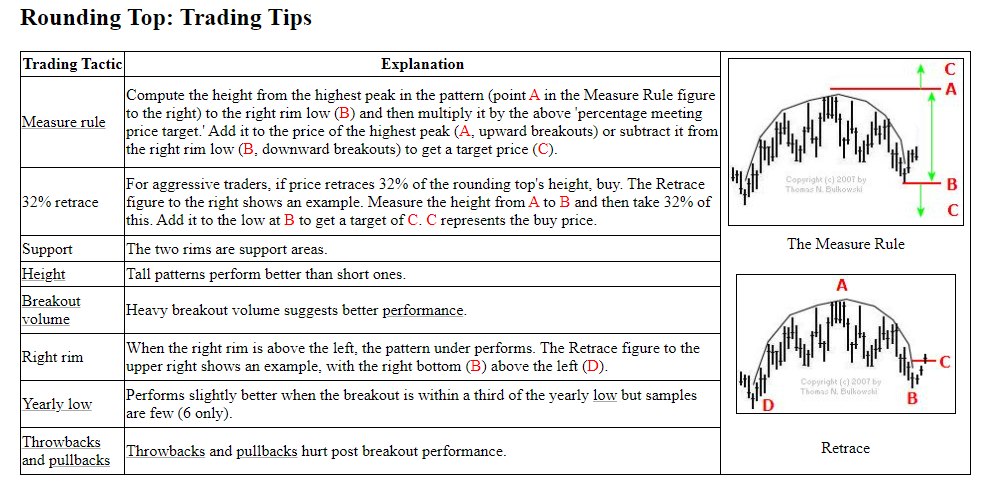

Rounding Top

This is another pattern that confirms its effectiveness, according to Bulkowski’s research. The price drops lower than the buy level in only 9% of cases.

Rounding Top pattern

This pattern matters to me because I clearly see a lot of traders get on the wrong side of the market.

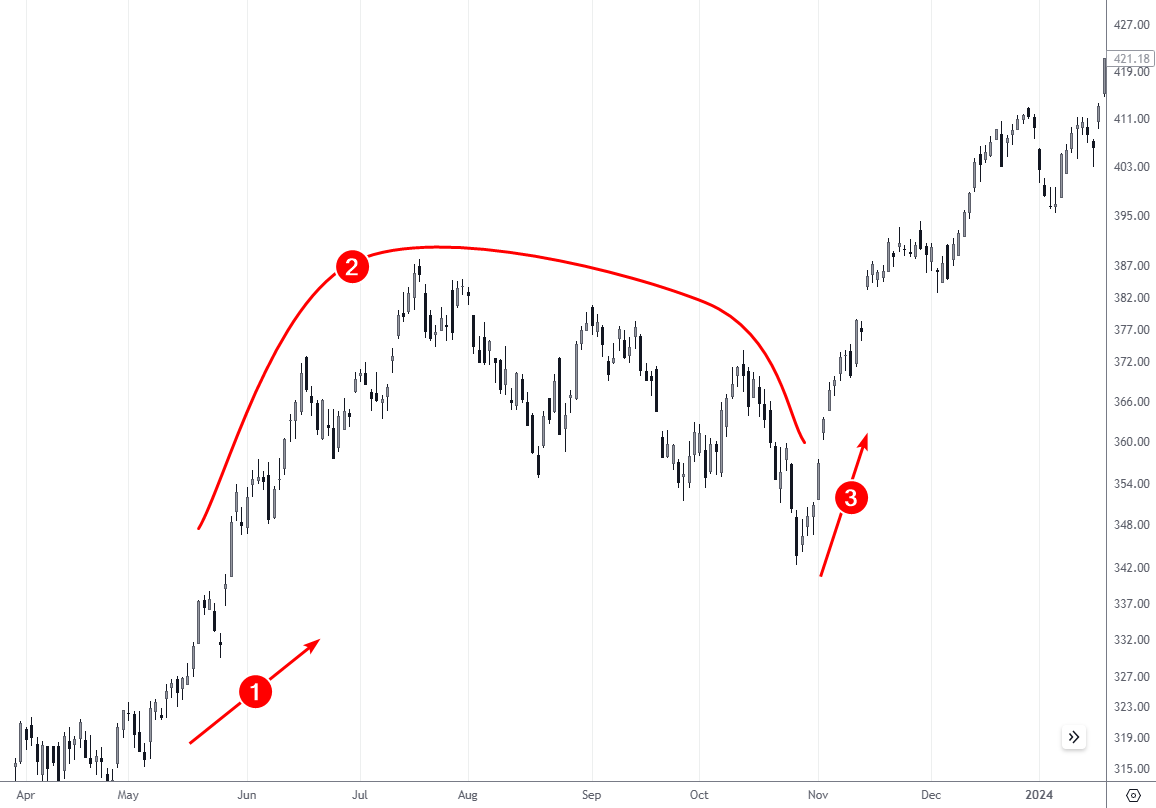

Here is an example from 2023-2024:

QQQ price chart, ETFs on technology stocks

The numbers show:

-

An uptrend caused by AI-related excitement.

-

Rounding Top pattern.

-

Pattern breakout.

When a rounding top is forming, many moving averages and MACD - like indicators give bearish interpretations. Having seen a series of lower lows, investors start doubting that the uptrend is still relevant and may decide to close their long positions.

However, a rounding line breakout will prove them wrong. Note that as the breakout forms (3), the price opens with gaps and does not provide a psychologically convenient moment to enter a long trade again.

Which strategy is best for trading?

I have described 5 strategies. All of them:

-

are based on the understanding that most traders lose money;

-

can be applied to any timeframe and asset class – crypto, stocks, Forex, etc.;

-

do not use classic technical indicators that, in my opinion, do not offer any advantage;

-

provide enough freedom to adjust the rules to your view of the market.

Now your task is to decide which strategy is best for you.

To that end, you have to:

-

Create a trading plan, i.e, establish the rules for entering trades and placing stop-loss and take-profit orders. You can combine strategies or add elements of fundamental analysis. Use what you really believe in.

-

Test and optimize your strategy on a history and/or a demo account.

-

Evaluate the results.

Summary

Experiment with the strategies offered, combine them with your own ideas, and use the results for further improvement. To succeed in trading, you must be ready to constantly develop and adapt to the ever-changing world of financial markets.

There is no perfect trading strategy that would be best for everyone without expedition. It’s rather risky to do nothing, but it’s even riskier to trade without a strategy, advantage, or deep understanding of the market’s nature.

Glossary for novice traders

-

1

Scalping

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

-

2

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

3

Take-Profit

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.

-

4

Supply and Demand Zones

In trading, a supply and demand zone refers to specific price levels on a chart where there is an imbalance between buyers (demand) and sellers (supply). A demand zone represents a price area where buying interest is strong, potentially leading to price increases, while a supply zone indicates an area where selling interest is significant, possibly resulting in price declines.

-

5

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Team that worked on the article

For over 15 years, Oleg worked as a copywriter and journalist at advertising and marketing agencies, as well as radio and television companies. His writing style is aimed at using simple terms to explain only those things that matter to the reader – benefits, risks, and realizable ideas. During the 2008 financial crisis, Oleg got interested in the stock and Forex markets and thoroughly explored price action to start working as an independent expert in 2018.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).