According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Thinkorswim

- FINRA

- SIPC

- CFTC

- NFA

- 1999

Our Evaluation of Thinkorswim

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Thinkorswim is a moderate-risk broker with the TU Overall Score of 6.14 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Thinkorswim clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Thinkorswim is a professional stock market broker for US residents. Only traders with a capital of $10 thousand dollars will be interested.

Brief Look at Thinkorswim

TD Ameritrade’s Thinkorswim broker is a result of the unification of Thinkorswim and TD Ameritrade, the developers of the best platform for stock trading in the US. Its main focus is trading securities, the OTC securities market, spot instruments, and retail foreign exchange trading in the US. The company was nominated for: "Best Platforms and Tools", "Best Application for Traders", for being among the Top 5 in the ratings, "Best Innovative Developments", and "Best Broker for Options Trading". Since 2009, the company’s reliability has been confirmed by the licenses from two of the most stringent regulators in the world, FINRA (CRD#: 7870/SEC#: 801-60469,8-23395), and SIPC.

- Access to stock exchange markets with hundreds of instruments, including indices. Derivatives trading, entry into the OTC market, legal services of currency trading in Forex.

- One of the most functional platforms in the world for trading securities with multi-level complex chart analyses.

- Two of the world's best regulators license it.

- Optimal trading conditions for individual assets.

- Segregated accounts.

- The broker works only with traders from the USA.

- The platform is difficult for novice traders.

- There is no membership in the FDIC (Federal Deposit Insurance Corporation, which would ensure traders' money up to $250 thousand).

- A limited number of deposit/withdrawal options.

- High entry threshold.

TU Expert Advice

Financial expert and analyst at Traders Union

TD Ameritrade’s Thinkorswim is a licensed broker that is fundamentally different from classic brokers in Europe. Forex is strictly monitored in the USA and TD Ameritrade’s Thinkorswim is authorized to provide currency pair trading services. The company also offers direct access to the American stock exchanges. Its emphases are on trading in securities, futures, options, and other derivatives, and securities of ETF funds. A separate area is the withdrawal of OTC assets, the OTC stocks, and the bond market. The OTC market differs from CFDs and the usual Forex trades are in the absolute control of the regulator.

Thinkorswim is a unique proprietary platform that is considered the best in its class. Advanced analysis of securities yields, FRED charting, tools for identifying dozens of candlestick patterns, and market sentiment analysis are only a small part of its capabilities. It does not have MetaTrader 4 or QUIK. It will be a mammoth task to deal with it intuitively by typing. There are 400 technical indicators built into the Thinkorswim terminal.

Many of the offered Thinkorswim tools, like the platform itself, is unfamiliar to CIS traders. And it will not be easy for traders to connect to a broker. The broker works only with US residents. Nevertheless, the company deserves attention and, perhaps, acquaintance with it will open up new investment horizons for traders. The reliability of the company is beyond doubt. Therefore it is rightfully included in the Traders Union Forex broker ratings.

- You want a diverse selection of tradable assets. TD Ameritrade provides access to stocks, ETFs, options, futures, forex, and mutual funds, offering ample diversification opportunities.

- You prefer advanced trading tools and features. The thinkorswim platform, offered by TD Ameritrade, is robust and popular, providing advanced charting, technical analysis tools, paper trading, and algorithmic trading capabilities.

- You want a broad selection of payment systems. This broker offers a limited selection of payment systems for deposits and withdrawals.

- You prefer high leverage. TD Ameritrade provides leverage only up to 1:2, which may not be suitable for traders seeking higher leverage ratios.

Thinkorswim Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | Thinkorswim |

|---|---|

| 📊 Accounts: | Standard Forex (account for trading currency pairs, other assets are not considered in this review) |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Electronic bank deposit, wire transfer, checks, transfer of assets from one brokerage company to TD Ameritrade’s Thinkorswim, physical certificates of shares |

| 🚀 Minimum deposit: | From $0 (from $2,000 to activate margin trading opportunities) |

| ⚖️ Leverage: | Floating |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.1 |

| 💱 EUR/USD spread: | 0,12 pips |

| 🔧 Instruments: | Over 70 currency pairs |

| 💹 Margin Call / Stop Out: | Stop out - 25% |

| 🏛 Liquidity provider: | n/a |

| 📱 Mobile trading: | available |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Instant execution, Market execution |

| ⭐ Trading features: | There is cryptocurrency trading |

| 🎁 Contests and bonuses: | no |

TD Ameritrade’s Thinkorswim trading conditions are competitive for the US Forex market but relatively uncomfortable for non-residents. This is due to the legal standards of trading in the American foreign exchange market like commission fees, taxation, and other issues.

Thinkorswim Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Before opening an account, register on the Traders Union rebate service website and go to the broker's website using the partner link. It will allow you to save on commission costs in the future.

How to register on the TD Ameritrade’s Thinkorswim website:

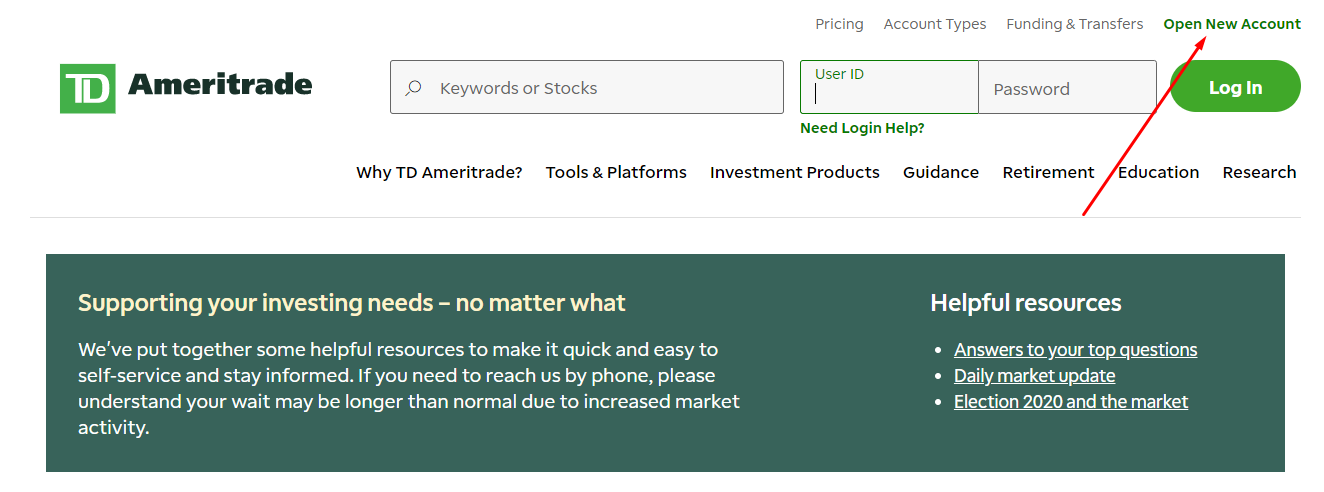

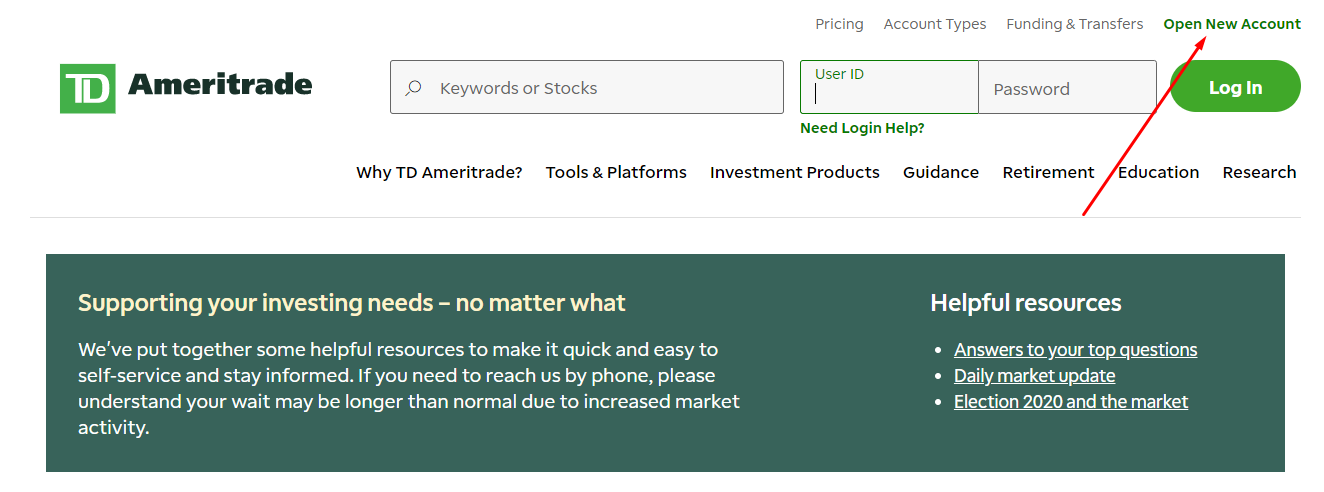

On the main page of the broker's website, click the button "Open a new account" in the top menu tab.

Fill in all data. Registration automatically doubles as verification. Therefore you need to indicate all documents, including payment cards and tax details. Also, here you need to select the type of account to open.

The following functions are available in TD Ameritrade’s Thinkorswim personal account:

-

Management of all open accounts.

-

Full access to the platform’s functionalities.

There are also many other useful functions and features like:

-

Trading account management and statistics on deposits/withdrawals.

-

Access to a think tank and online courses.

-

Chatting with the Support Service.

Regulation and safety

Thinkorswim has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 26 years

- Strict requirements and extensive documentation to open an account

Thinkorswim Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

NFA NFA |

National Futures Association | United States | No specific fund | Tier-1 |

CFTC CFTC |

Commodity Futures Trading Commission | United States | No specific fund | Tier-1 |

SEC SEC |

Securities and Exchange Commission | United States | Up to $500,000 for SIPA members | Tier-1 |

FINRA FINRA |

Financial Industry Regulatory Authority | United States | No specific fund | Tier-1 |

Thinkorswim Security Factors

| Foundation date | 1999 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Thinkorswim have been analyzed and rated as Low with a fees score of 9/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No deposit fee

- No withdrawal fee

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Thinkorswim with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Thinkorswim’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Thinkorswim Standard spreads

| Thinkorswim | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,4 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Thinkorswim RAW/ECN spreads

| Thinkorswim | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,12 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,18 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Thinkorswim. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Thinkorswim Non-Trading Fees

| Thinkorswim | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0-10 | 0 | 0-15 |

| Inactivity fee ($, per month) | 20 | 0 | 0 |

Account types

Thinkorswim offers a standard universal account. A trader needs to open an individual account from which he can trade using most assets, including currency pairs.

Account types:

Deposit and withdrawal

Thinkorswim received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

Thinkorswim offers limited payment options and accessibility, which may impact its competitiveness.

- Low minimum withdrawal requirement

- Bank card deposits and withdrawals

- No withdrawal fee

- Bank wire transfers available

- Wise not supported

- Only major base currencies available

- Limited deposit and withdrawal flexibility, leading to higher costs

What are Thinkorswim deposit and withdrawal options?

Thinkorswim offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire. This limitation may restrict flexibility for users, making Thinkorswim less competitive for those seeking diverse payment options.

Thinkorswim Deposit and Withdrawal Methods vs Competitors

| Thinkorswim | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Thinkorswim base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Thinkorswim supports the following base account currencies:

What are Thinkorswim's minimum deposit and withdrawal amounts?

The minimum deposit on Thinkorswim is $2000, while the minimum withdrawal amount is $0. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Thinkorswim’s support team.

Markets and tradable assets

Thinkorswim offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 82 Forex pairs.

- Crypto trading

- Commodity futures are available

- Copy trading platform

- Bonds not available

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by Thinkorswim with its competitors, making it easier for you to find the perfect fit.

| Thinkorswim by TD Ameritrade | Plus500 | Pepperstone | |

| Currency pairs | 82 | 60 | 90 |

| Total tradable assets | 2800 | 1200 | |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Thinkorswim offers for beginner traders and investors who prefer not to engage in active trading.

| Thinkorswim by TD Ameritrade | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Information

TD Ameritrade’s Thinkorswim support team is ready to provide assistance 24 hours a day, five days a week.

Advantages

- Fast response to any requests

- Round-the-clock support

Disadvantages

- US customers only

There are several ways to contact support:

-

by phone, as indicated on its website;

-

using a teletypewriter (for people with hearing impairments);

-

by visiting the company's offices in the United States;

-

through social networks;

-

by fax;

-

by email; and

-

using the feedback form.

Contacts

| Foundation date | 1999 |

|---|---|

| Registration address | 200 S 108th Ave, Omaha, NE |

| Regulation | FINRA, SIPC, CFTC, NFA |

| Official site | tdameritrade.com |

Education

Information

There is a separate section for training on the TD Ameritrade’s Thinkorswim website. It explains stock markets, derivatives, and OTC markets, the essence of financial planning, and analyzes investment programs.

Comparison of Thinkorswim with other Brokers

| Thinkorswim | Eightcap | XM Group | RoboForex | Vantage Markets | NPBFX | |

| Trading platform |

Thinkorswim | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, TradingView, ProTrader, Vantage App | MT4 |

| Min deposit | $2000 | $100 | $5 | $10 | $50 | $10 |

| Leverage |

From 1:1 to 1:1 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:200 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0.4 points |

| Level of margin call / stop out |

No / 25% | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 50% | No / 30% |

| Order Execution | Instant Execution, Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed Review of Thinkorswim

TD Ameritrade’s Thinkorswim is a US-licensed broker that combines an investment fund and intermediary financial functions. For private clients, the company offers savings deposits for different categories of people ranging from children to pensioners. For passive investors, there is a service for forming investment portfolios with varying levels of risk. There are exits from the exchange and OTC markets for active traders, trading assets — such as stocks, futures, and options. TD Ameritrade’s Thinkorswim is one of the few US-licensed brokers that provides Forex trading services.

A few figures about Thinkorswim that might be of interest to potential traders:

-

$0.00 commission for Forex trading.

-

From $0.00 initial deposit (from $2000 for margin trading).

-

More than 12 years of experience in the CIS market.

Thinkorswim’s reliability and functionality in one platform

CFD trading in the USA has strict restrictions. TD Ameritrade’s Thinkorswim broker is one of the few companies that allows traders to earn on currency quotes. The broker has more than 70 different currency pairs in its arsenal, which are traded in increments of 10,000 base units (0.1 lot). The broker does not charge a commission, but there is a trade value expressed in the spread. The market spread is from 0.00 pips (percentage in points) depending on the current volatility and liquidity of the currency pair.

The Thinkorswim platform is full-featured with multi-level market and trade statistics analysis tools. Most of it is not needed for Forex, but Forex's access is possible only through this platform. One of its drawbacks is that it will be challenging to implement classical algorithmic strategies from MT4.

Useful features of the Thinkorswim platform:

-

On-Demand is a debugging strategy based on historical data with tracking quotes in real-time.

-

Control of Level 2 market depth, and fast rewinding when testing strategies.

-

Built-in screener for stocks and options and options board. It can be used to analyze co-related instruments and the corresponding forecast for currency pairs.

Advantages:

The TD Ameritrade’s Thinkorswim platform’s functionality is, in many ways, superior to the classic MT4.

Market exchange real spreads without markup, commissions, and other brokerage margins.

Scalping and algorithmic trading are allowed but regulatory restrictions may apply to hedging and high-risk tactics.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i